TechCrunch |

- Grab to go public in the US following $40 billion SPAC deal

- Elder tech company, Papa, raises $60M Led by Tiger Global

- On-demand pediatrics app Biloba adds prescriptions and raises $1.7 million

- MFS Africa leads $2.3M seed round in Ugandan fintech startup Numida

- With two new funds, LocalGlobe has more latitude than ever

- African crypto usage spurs Luno as customers reach 7M

- Berlin Brands Group raises $240M to buy and scale up third-party Amazon Marketplace brands

- Pine Labs acquires Southeast Asian startup Fave for $45 million

- Putting Gdańsk, Wroclaw, Krakow, Poznan on the TechCrunch map — TechCrunch’s Cities Survey

- Grover raises $71M to grow its consumer electronics subscription business

- Reminder: Student, non-profit, and government discounts available for Extra Crunch

- Vietnamese electric motorbike startup Dat Bike raises $2.6M led by Jungle Ventures

- Binance Labs leads $1.6M seed round in DeFi startup MOUND, the developer of Pancake Bunny

- Battery Resourcers raises $20M to commercialize its recycling-plus-manufacturing operations

- Daily Crunch: Microsoft acquires Nuance for $19.7B

- Another milestone for in-space servicing as Northrop Grumman gives aging satellite new life

- From pickup basketball to market domination: My wild ride with Coupang

- Blue Origin will run an ‘astronaut rehearsal’ during a launch this week to prep for human spaceflight

- Tiger Global leads $100 million investment in Indian social commerce DealShare

- Chinese autonomous vehicle startup WeRide scores permit to test driverless cars in San Jose

| Grab to go public in the US following $40 billion SPAC deal Posted: 13 Apr 2021 04:30 AM PDT Ride-hailing and delivery company Grab has announced plans to go public in the U.S. Based in Singapore, the company has evolved from a ride-hailing app to a Southeast Asian super app that offers several consumer services, including food delivery, financial services, such as an e-wallet so that you can send and receive money. It operates in Singapore, Malaysia, Cambodia, Indonesia, Myanmar, Philippines, Thailand and Vietnam. According to Crunchbase, the company has raised over $10 billion, including from SoftBank's Vision Fund. In order to go public, Grab has chosen to merge with a SPAC named Altimeter Growth Corp. A SPAC is a publicly-traded blank-check company based in the U.S. Going public through this process should be much easier for Grab — especially because it's a foreign company. If the deal goes through, it would be the world's largest SPAC merger. Grab would be listed on NASDAQ under the symbol 'GRAB'. A part of the announcement, Grab has shared some metrics and some big numbers. In 2020, the company managed to generate around $12.5 billion in gross merchandise value (GMV). The merger would value Grab at $39.6 billion and the company would keep $4.5 billion in cash. The company thinks there's still a lot of room to grow when it comes to food delivery and on-demand mobility in Southeast Asia. It expects to see the total addressable market jump from $52 billion to $180 billion by 2025. "This is a milestone in our journey to open up access for everyone to benefit from the digital economy. This is even more critical as our region recovers from COVID-19. It was very challenging for us too, but it taught us immensely about the resiliency of our business," Grab co-founder and CEO Anthony Tan said in the announcement. "Our diversified superapp strategy helped our driver-partners pivot to deliveries, and enabled us to deliver growth while improving profitability. As we become a publicly-traded company, we'll work even harder to create economic empowerment for our communities, because when Southeast Asia succeeds, Grab succeeds," he added. Altimeter has agreed to a three-year lockup period for its sponsor shares, which means that Altimeter should remain committed to the company for a while. |

| Elder tech company, Papa, raises $60M Led by Tiger Global Posted: 13 Apr 2021 04:00 AM PDT Papa, the elder tech company that offers care and companionship to seniors, today announced a $60 million Series C led by Tiger Global Management, bringing its total raised to date to $91 million. The money will be used to propel the company's growth this year, building on 600% year-over-year growth as of the start of 2021, the company said in a statement. Andrew Parker, the company’s founder and CEO, launched Papa as a consumer product in 2017. Seniors signed up for the service and a college student, called a Papa Pal, would show up at their door to help with anything from taking them to doctor appointments, helping around the house, providing tech support and offering companionship. The idea was always to spend about six months collecting data and feedback and to then approach insurance companies. The Miami-based company has since partnered with 80 insurance providers who offer Papa nationwide as a benefit to their members. Employers can also offer Papa as a benefit. And while individuals can still sign up for the service, it is largely available through insurance. "We have about 1 million eligible members on the platform, and about 15% use Papa every month," Parker told TechCrunch. The company expects there to be between 5-6 million members on the platform starting January 2022.

"We've been able to prove that we improve the lives and health outcomes of older adults and families," Parker said. "Most of all they're trying to reduce loneliness and isolation to seniors.” The pandemic has only exacerbated loneliness and so Papa started offering virtual services, too. The company has expanded its core offering to also include Papa Health, a suite of benefits that includes care navigation, virtual primary care and chronic care management, all of which are offered through the Papa platform. Additionally, the company's services are now offered to families through Medicaid Managed Care, Parker said. "For example, maybe there's a single mother with children who is trying to get a job – a Papa pal can help her out," he added. The idea for Papa came from a personal need within the Parker family. "I started Papa originally to help my grandfather – who we called Papa – who came from Argentina. He needed support and help and companionship, but he didn't need bathing and toileting," Parker said. To get help for his grandfather, Parker put an ad on Facebook asking, "Who wants to be a pal to my Papa?"  A virtual Papa visit

"We wanted someone young and energetic who would also benefit from my grandfather's life experiences," Parker said. While the company originally focused on students, it now works with anyone from the age of 18-45, though Parker reinforced that the company is stringent in who it accepts and has an acceptance rate below 10%. The company gets about 20,000 applications per month from people wanting to be pals. For those who do work with Papa, Parker said their main role is to provide a sense of, "Hey, I'm here, and I care about you, and I'm here to support you." "There's so much nuance to older adults' lives, and 50% of older adults consider themselves lonely," Parker added.

|

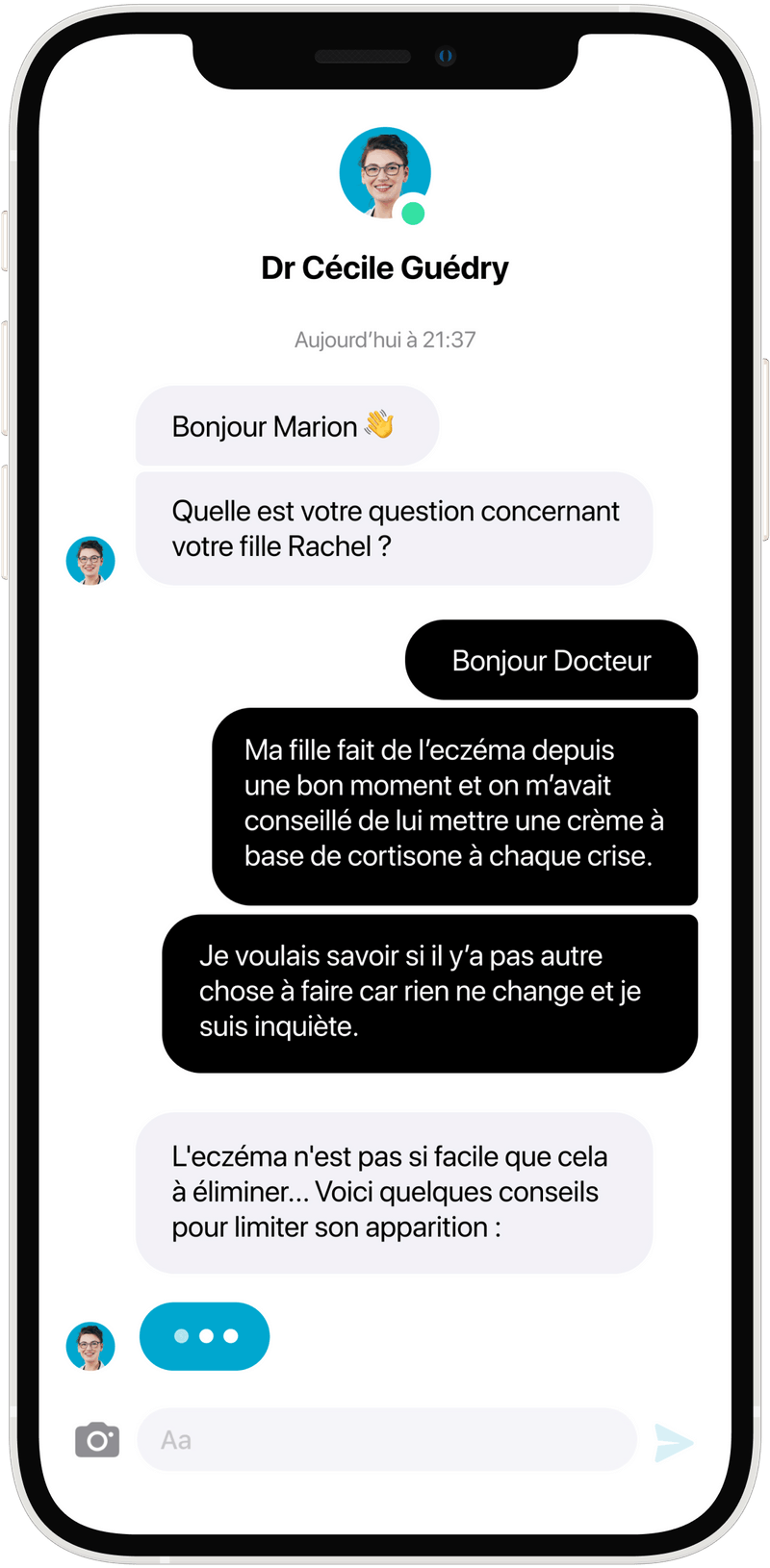

| On-demand pediatrics app Biloba adds prescriptions and raises $1.7 million Posted: 13 Apr 2021 03:55 AM PDT French startup Biloba has raised a $1.7 million funding round (€1.4 million) a few months after launching its pediatrics app that lets you chat with a doctor whenever you have a question. In addition to raising some money, the startup also recently added in-app prescriptions. Biloba's concept is surprisingly simple. It's a mobile app that lets you reach a general practitioner and a nurse whenever you have a medical question about your child. The service is available from 8 AM to 10 PM. When you start a conversation, it looks like a messaging app. You can send and receive messages but also send photos and videos. There's no real-time video conversation, no appointment. The company says that you usually get an answer in less than 10 minutes. Last year, Biloba raised a €1.2 million pre-seed round. This year's €1.4 million's seed round is led by Aglaé Ventures and ID4. Existing investors Calm/Storm Ventures, Inventures, Acequia Capital and several business angels are also participating once again. A text conversation will never replace a visit to the pediatrician. And there are many medical interactions and milestones after a baby is born. But you may have questions and you don't want to wait for the next appointment. And if it's a relatively harmless issue that doesn't need an in-person appointment, Biloba can now issue prescriptions. You receive the prescriptions in the app and it is accepted in all French pharmacies. The startup uses Ordoclic for that feature. Biloba thinks people shouldn't pay per consultation — even though people are particularly well covered by the French national healthcare system and private health insurance. Instead, the startup has opted for a subscription model. Parents pay €12.99 per month, €24.99 for a three-month subscription or €79.99 per year. After that, you can start as many conversations as you want. Biloba subscriptions aren't covered by the French national healthcare system. Basically, if you can afford a subscription, Biloba can increase the frequency of interactions with doctors, which should lead to better medical advice.  Image Credits: Biloba |

| MFS Africa leads $2.3M seed round in Ugandan fintech startup Numida Posted: 13 Apr 2021 03:52 AM PDT Small businesses in Africa need digital banking services including plenty of credit. Although these businesses drive economic growth and contribute up to one-third of the continent's GDP, they are often financially excluded from credit and other financial services due to their size and informality. One such company tackling this challenge in the eastern part of Africa is Ugandan fintech startup Numida. And today, the company is announcing the close of its $2.3 million seed round. Mina Shahid, Catherine Denis and Ben Best founded Numida in 2017 and capitalized on the opportunity to build one of East Africa’s first digital fintechs targeting semi-formal micro and small businesses. Typically, these businesses access credit from family, loan sharks and informal money lenders that offer poorly designed consumer credit. They can also get loans from a traditional microfinance institution, although with ridiculous interest rates. But the founders didn’t set out to offer credit to businesses when they first started. An initial pilot in 2016 was centered around a bookkeeping tool that enabled traditional microfinance institutions (MFIs) to provide unsecured credit to semi-formal businesses. “One of the major reasons why financial institutions don’t give loans to these businesses is because they don’t have good financial track records and cash flow history,” Shahid said to TechCrunch. “That was the problem we set out to solve — to create the mechanisms to get that cashflow data and present it in a form that can be used and incorporated into the underwriting processes.” The founders thought that these microfinance institutions would begin to use the data obtained from months of bookkeeping to serve these businesses. But they didn’t envisage what happened after nine months. Shahid stated that even though the MFIs claimed to love the data that Numida could bring out, they were unwilling to adjust their underwriting practices. In turn, they rejected all Numida’s customers who applied for loans on the platform because they lacked collateral. “So we thought among ourselves that if our mission is to unlock access to resources that these mom and pop shops need in order to grow their businesses, we’re not going to do that by partnering with these traditional MFIs; we had to do that ourselves,” he continued. Via a proprietary credit score, Numida offers risk-based pricing on an applicant’s first loan. After that, businesses can access unsecured working capital loans of up to $3,500 in less than two hours, according to the company.  Numida business owners From May 2017, when it pivoted to September 2019, Numida kept its outstanding portfolio very small and iterated on its underwriting process and credit risk algorithm. After making several iterations, the company went full on to the market in October 2019, and the CEO says the company has grown 6x in lending volumes. To date, it has provided more than $2 million in unsecured credit to 3,000 micro and small businesses in Uganda, disbursing around $250,000 per month. This is with outstanding collections, repayment rates and client retention, the CEO added. Although the consumer digital lending space in East Africa has seen an abundance of transactions in recent years, the same cannot be said for startups targeting the micro and small business segment. As one of the few facing this segment, the business has faced issues around getting relevant data to improve its model but doesn’t collate data it thinks isn’t necessary (social media activities, SMS or mobile money transactions) for the sake of aggregating data. “We look at the business fundamentals, the cash flow of the business, and some demographic data about the applicants. We’ve had to build our own data set because there are no readily available cashflow data on semi-formal, micro and small businesses in Africa,” remarked Shadid. Its underwriting model was built off 15,000 loans, which took a long time to execute, and this timing puts some strain on how fast it can onboard customers and serve them. However, the pandemic helped in accelerating this model, and with this new investment, Numida is poised to grow further. Pan-African payments company MFS Africa led the seed round. There was also participation from firms like DRK Foundation, Equilibria Capital and Segal Family Foundation alongside angel investors. The last time MFS Africa was in the news regarding an investment dates back to June 2020, when it acquired Ugandan fintech startup Beyonic for an undisclosed amount. Numida is another Ugandan fintech, and a similar play might be in the cards. According to Shahid, the most obvious acquisition path for any successful lending startup to small businesses in Africa is a payments platform. His reason? Because credit is one of the core financial products that will create loyalty and retention to a specific payments platform. He adds that MFS is a strategic investor in Numida and not the typical VC. He sees the Pan-African company as owning infrastructure, which his company can ride on as a solid foundation for scale. “That’s an opportunity we see in the future. We were concerned about scaling across the continent and who would be the best partner for this. We thought MFS has a lot of expertise and footprint on the continent that will allow us to scale moving forward.” With this new financing, Numida plans to expand aggressively in Uganda and pilot in a new market, preferably in West Africa. There are some parallels between Uganda and Ghana, Numida’s primary choice in the region. They both have similar mobile money penetration, issues with traditional financial service providers and similar businesses that Shahid says make an enticing market. Per plans, Numida will introduce additional financial services like payments, micro-insurance and deposits to its customers. |

| With two new funds, LocalGlobe has more latitude than ever Posted: 13 Apr 2021 03:00 AM PDT "You wanted me to record this?" asks Saul Klein, LocalGlobe founding partner. "Just in case you say anything interesting," I quip back. "I won’t be doing most of the talking, so maybe someone will say something interesting,” Klein replies poker-faced, before grinning. Once again, I’ve agreed to an ensemble-style interview with multiple members of the LocalGlobe investment team: Klein, George Henry, Suzanne Ashman, Julia Hawkins, Mish Mashkautsan and Remus Brett. Unlike in 2015, however, when I visited the early-stage VC’s then offices in Tileyard Studios, the interview is taking place over Zoom, rather than the firm’s new Phoenix Court premises in the King’s Cross area of London. Also in contrast to last time, when I wanted to scoop LocalGlobe’s latest fundraise and Klein rather I didn’t, this time it’s the other way round: I’ve been invited to write a piece partly anchored on news of two new funds that were quietly raised last year. LocalGlobe, the entity that invests at seed stage, has an additional $150 million of capital to deploy in the U.K. and Europe (and further afield). Running alongside is Latitude, a growth-stage fund now with $220 million more to invest, which allows the LocalGlobe team to take a fresh look at breakout portfolio companies that have proven their growth potential or to back other scale-ups, which, for myriad reasons, didn’t take or weren’t offered LocalGlobe’s cash earlier. "Latitude was born out of the idea of building continuity," says LocalGlobe general partner George Henry. “When it comes to existing LocalGlobe companies, Latitude is very much building on top of what we’ve done. It’s giving us the capital to continue to invest more into those companies". However, the firm doesn't think of Latitude as follow-on funding, in the classic sense. Not only is it able to back companies that LocalGlobe hasn’t previously invested in, but even for those it has, the LocalGlobe team, including Julian Rowe, who heads up Latitude, uses the opportunity to take a fresh look before writing a Latitude cheque. "I think 80% of Latitude companies have at least one LocalGlobe partner fully engaged," says Klein. Internally, whichever fund the firm is investing from and at what stage, LocalGlobe frames its strategy as “insights and access”. Though no one explicitly explains what this means, I interpret it as having the expertise in the team (and wider LocalGlobe network) to understand a problem space and its addressable market, and having the access to see and then get in on a deal, should it want to. “Of course, it’s easier to have insight and access when you’ve already been inside the company from pre-seed or seed," explains Henry. "But we’ve [also] seen opportunities where we feel we had the insight and access because we know the founders already, we know the theme, we know the market [and] we know the investors really well. And then it puts us in a position where we feel confident to participate at Series B or beyond”. LocalGlobe isn’t the only European early-stage VC firm to launch a separate later-stage fund, either to avoid too much dilution for the most promising portfolio companies or to opportunistically back companies later when there’s arguably less risk. Yet I can’t help wonder what the conversation is like when Latitude wants to invest in a company that LocalGlobe previously turned down. One example is Monzo, the popular U.K.-based bank with its instantly recognisable hot coral pink-coloured debit card. “We were very aware of Monzo from the earliest days,” says Klein. “We weren’t big believers at the time in consumer neobanks. We thought the neobank was something that would work for SMEs or for business banking, where the incumbents were really not focused… but also it’s kind of typically a better business than consumer retail banking. And we took the view that consumer neobanks weren’t going to be a thing". Instead, LocalGlobe invested in Cleo, a financial assistant chatbot and app that runs on top of consumer bank accounts, and Tide, a business bank account for SMEs. "And it turns out, you know, we were wrong," admits Klein, before revealing that LocalGlobe general partner Suzanne Ashman was the outlier in the team. After becoming an early customer of Monzo, she backed the challenger bank's equity crowd fund in a personal capacity. "When we had an opportunity later on through Latitude to get involved with Monzo, we felt it’s an exceptional company," continues Klein. "We love the investors, we work very closely with General Catalyst, and they were getting involved with the business at the time, and with Accel. And we thought it was a great opportunity to enter". Another example of missing out first time around is Cazoo, the used car retailer founded by Alex Chesterman. Klein and Chesterman go way back to their time at Lovefilm, and LocalGlobe was an early investor in Zoopla, the proptech company Chesterman took all the way to IPO. Access, therefore, wasn’t a problem. Instead, a perceived conflict of interest was. LocalGlobe had invested in Motorway (curiously, as had Chesterman), which at the time looked like a potential Cazoo competitor. No longer deemed as such, Latitude would go on to write a later-stage (and more expensive) check. Then, last month, Cazoo announced plans to SPAC its way to going public with a valuation of $7 billion, proving that conflicts of interest can be costly. These near misses are the exception, says Klein, underlining that Latitude’s core thesis is to be able to support LocalGlobe portfolio breakouts. “LocalGlobe is about that startup phase of pre-seed and seed. Latitude is the breakout phase where things are really starting to hit an inflection point,” he says. That is, of course, true, but it can also be argued that having a later stage fund does provide additional optionality and I posit that this could make LocalGlobe less risk-taking. With Latitude potentially able to mop up deals that didn’t happen at seed, LocalGlobe can take a wait and see approach for investments where early insights are less forthcoming. Henry shakes his head ferociously, prompting Klein to suggest he takes this question. “You want to get in as early as possible, because that’s the way you build the relationship… There’s nothing that gives you more credit than to be the first believer in a team," says Henry. “Also, in the market we’re in, you don’t want to make a bet on something that looks exciting, but you’re not sure and say, 'it’s okay, we’ll get into Series B'. Because the reality is, the more you wait, the harder it gets to get into a great company". In LocalGlobe’s own (interesting) words…On capital going into private markets“The amount of capital that is now in the private markets looking to invest in tech, it’s not just extraordinary, but, arguably, it’s necessary and important, because this is where growth comes from and this is where innovation comes from. I’ve been doing this for 20-25 years, and it took 20 years to get to the starting line. Now it gets interesting.” — Saul Klein. On investing in regulated industries“Opportunities in the highly regulated industries are just massive. And they were largely untouched by wave one of VC, and even five years ago, we tended not to see that many founders building in heavily regulated spaces. So it feels to me that, yes, while the base of capital has gotten much larger, the opportunity in all of these segments is now much larger.” — Suzanne Ashman On healthcare opportunities“We think overall, obviously, healthcare is one of the largest markets, and we are very, very bullish on that, on the opportunity at large. We’ve doubled down on specific themes within healthcare. So, for example, developing communication rails for healthcare, improving how patients get connected with hospital systems… Mental health is another enormous market and opportunity, not just in terms of market, but in terms of impact.” — Julia Hawkins On successful exits“You’re just the supporting cast, and obviously, you are delighted for them. But you’re never the main show. What’s lovely about being a seed investor, and then supporting with Latitude, is it is not a quick journey, and you get to know people over time, you get to know their friends, their partners. And honestly, it’s just a privilege to sit on the sidelines.” — Suzanne Ashman On fintech’s longevity“Over the next five years, on all dimensions, from payments to core banking to insurance, you know, we’re going to see many more interesting companies. Just when you think the market map is pretty clear, and the winners are emerging, you’ll still see these companies that emerge and completely destroy the market.” — Remus Brett On frontier tech need for more capital“Proper frontier tech, and foundational tech, requires even more patience and focus on what’s beyond the horizon… The available capital for proper frontier tech startups is much more limited than startups in general. And that’s something we all know and feel daily.” — Mish Mashkautsan |

| African crypto usage spurs Luno as customers reach 7M Posted: 13 Apr 2021 01:30 AM PDT The crypto industry as a whole has seen a momentous year of growth, heavily spurred on by the entrance of institutional investors adopting bitcoin due to its store of value properties. The 2020 spike bitcoin experienced was also accelerated by its global adoption as the number of global cryptocurrency users surpassed 100 million in Q3 2020. For Luno, a U.K.-based crypto company founded by Marcus Swanepoel and Timothy Stranex in 2013, it grew to 6 million customers from January 2020 to January 2021. However, that number has since gone up to 7 million. Today the company, headquartered in London, has nearly 400 employees across London, South Africa, Malaysia, Indonesia, Nigeria and Singapore, with customers in 40 countries globally. According to CEO Swanepoel, Luno’s numbers have been increasing month-on-month over the last seven years. However, this is the first time it is observing an acceleration of this magnitude. There are a couple of reasons for Luno’s surge in numbers (like any other crypto exchange startup). Generally, despite talks of bitcoin being used in everyday life by crypto enthusiasts and interests from institutional entrants like BNY Mellon, Mastercard and Tesla, it is a long shot before becoming mainstream. For now, crypto mainly serves investment purposes. This singular factor has particularly made it very popular with Africans — a demographic that has been a major part of Luno’s growth and the huge traction it is witnessing. Last year, the company surveyed the markets in which it currently operates. It featured 15,000 respondents from South Africa, U.K., France, Italy, Indonesia, Malaysia and Nigeria; the answers helped Luno understand how the pandemic influenced attitudes towards the current financial system. According to the survey, 54% of Africans were ready to adopt a single global digital currency, compared to 41% for Asia and 35% for Europe. Africa’s dominance also shows in its numbers. Out of the 7 million customers it has globally, 4.7 million people are in Africa. This number was 2.3 million in January 2020. Luno’s app installs across the continent have increased by 271% within this time frame, and trading volumes skyrocketed 12x, from $555 million to $7 billion. For context, Luno did $8.3 billion in total trading volume. But a large part of this growth is down to Luno’s early play in the market. Over the last few years, infrastructure in parts of the world that could not previously support the crypto market has improved substantially. Luno has played a vital role as one of the first platforms to improve the crypto marketplace experience by including local currencies. It also helped to lay the groundwork for educating people on digital currencies. “The last time bitcoin went up as it did during the past year was in 2017 and 2018, and it was mostly driven by retail, but it was still very difficult to buy crypto. There were trust issues; it would take days to get your account verified and even set up a wallet,” Swanepoel told TechCrunch. “Now, over the last three years, companies like ours, especially in Africa, have built up this infrastructure, KYCs, new payment methods, customer experience and support. The experience is much better and education levels are a lot higher. To me, I think that’s played a large role in crypto adoption in the continent.” In September last year, Luno got acquired by Digital Currency Group (DCG), an investment firm that builds, buys and invests in blockchain companies. Some of its portfolio companies include Coindesk, Genesis and Grayscale Investments. Before acquiring Luno, BCG first invested in the company’s seed round in 2014. Then last year, Swanepoel said he saw the opportunity to take Luno to a larger scale after noticing the immense growth and adoption on its platform. “The first five to six years for us was on a small scale and now, we want to go big. So it helps to have a global platform like DCG to do it from because they have large amounts of capital and are committed to investing in Africa as well as outside the continent,” he remarked. The CEO adds that DCG has more visibility on the crypto industry and trends. The acquisition was simply for Luno to leverage DCG’s insights and stay ahead of the curve, which looks to have paid off. Since the acquisition, Luno has seen the number of active users increase by 167%. As of January, the average user held more than $7,000 in their wallet, up 56% from December 2020. Nothing lasts forever, but if the crypto market bull run is anything to go by, crypto isn’t the fad people once thought it was. In Q1 2021, companies like Coinbase (going public Wednesday) and Robinhood experienced monster numbers showing strong growth projections. For Luno, it expects to continue growing exponentially, a trajectory that sets the company on track to reach 1 billion customers by 2030. |

| Berlin Brands Group raises $240M to buy and scale up third-party Amazon Marketplace brands Posted: 13 Apr 2021 01:13 AM PDT The race is on for companies building e-commerce empires by rolling up smaller, promising businesses that sell via Amazon and other marketplaces and growing by using some economies of scale to operate them as one. In the latest development, Berlin Brands Group has raised $240 million that it says it will be using to acquire smaller but promising enterprises in Europe and North America — specifically the U.S. — that are already making between $1 million and $100 million in sales via marketplaces like Amazon. The funding is coming in the form of debt, not equity, and it is coming specifically from UniCredit, Deutsche Bank and Commerzbank, BBG founder and CEO Peter Chaljawski said in an interview. BBG is profitable and earlier this year it committed more than $300 million off its balance sheet for buying up and operating companies, and so with this debt round (which we reported earlier this year was in the works), it now has $540 million for that purpose. “We’re in a wonderful situation with a proven business model, and this is the cheapest money you could get,” he said of the decision to go for debt, a choice often made by startups that are in capital-intensive modes but either reluctant or do not need to give up equity to raise capital to scale if they are generating cash. In the case of BBG it’s the latter, since the company is profitable. “This is better than equity. BBG does not have any debt as of 2020, and we had cash on hand for our first acquisitions, 20 brands that we bought in cash from our balance sheet. Now we want to accelerate that even more.” Chaljawski said that BBG may well tap an equity round in the near future to bring on investors to shape its own growth and set a valuation for the company. (For a point of comparison, competitors like Thrasio are now valued in the multiple billions of dollars.) BBG has to date mostly built its business around starting up and scaling its own in-house brands that sell on Amazon and elsewhere — starting first with home audio equipment, coming out of Chaljawski’s own interests in sound technology from a previous life as a budding dance music DJ. Its brands include Klarstein (kitchen appliances), auna (home electronics and music equipment), Capital Sports (home fitness) and blumfeldt (garden). In a big move to scale and build out what it’s established itself, last year BBG shifted over to the roll-up model: leveraging a more buying power to cut better deals with manufacturers and other suppliers, consolidating some of the other functions like marketing, and providing a more comprehensive set of analytics around what is selling best, who is buying, how best to market an item, and more. It says it has 1.3 million square feet of warehouse space in Europe, Asia and the U.S. and is one of the biggest Amazon sellers in Europe today. The basic idea of rolling up businesses that sell on the Amazon platform with FBA (Fulfillment by Amazon) has been around for years in fact, but the notable and more recent shift is that it has taken on a startup profile in part because of how some of the latest entrants are leveraging big data analytics, the latest innovations in manufacturing and logistics technology and a founder-led, e-commerce ethos to grow the model. “Without data, you would go nowhere in this business,” Chaljawski said. “But on top of that, there is something you can't pull from market data — a toolbox of manufacturing and engineering expertise that we use to evaluate products.” He says that BBG’s data scientists build algorithms that millions of products, and hundreds of thousands of sellers, to produce the data that it uses both to source potential acquisitions and to run the business. U.S. players like Thrasio — which itself closed a $1.2 billion Series C for the same purposes: rolling up and scaling — have led the charge. But in recent months we’ve seen a number of others also move into the space, buoyed by hundreds of millions of dollars in funding from investors very keen to ride the e-commerce wave and the vision of tapping into some of the economies of scale and the marketplace model that have been such a juggernaut for Amazon. It’s a two-sided marketplace, and Amazon has focused primarily on earning money from operating the marketplace itself and sales to consumers, so that leaves a huge opportunity on the table for someone else (or as it happens, many others) to tackle the opportunity to address the needs and services of the other side of that marketplace: the sellers. In addition to BBG and Thrasio, others in the same space include Branded, which launched its own roll-up business on $150 million in funding earlier this year; SellerX, Heyday, Heroes, Perch, among several others. Even removing the very-highly capitalized Thrasio and BBG from the equation, these companies have collectively raised or committed from their own balance sheets hundreds of millions of dollars to buy up small but promising third-party merchants. If that sounds like a crowded market, well, it probably is. These are also startups, after all, and so the chances that some of these roll-up consolidators will not be that skilled at running multiple companies — with their disparate supply chains, customer bases, replacement cycles and marketing strategies — are as risky as in any other area of e-commerce startup interest. On the other hand, though, there are a lot of opportunities to play for here. By one estimate, there are about 5 million third-party sellers on Amazon today, a number that appears to be growing exponentially, with more than 1 million sellers joining the platform in 2020 alone. Out of those, Thrasio estimates that there are probably 50,000 businesses selling on the Amazon platform with FBA (Fulfillment by Amazon) that are making $1 million or more per year in revenues. We have pointed out before that within that bigger number of merchants, there are a huge amount of clones and companies of questionable quality. What is interesting is that there are distinct companies, built around more originality and flair, swimming in that sea: some of them have broken through and floated, while others that have not. So for a company like BBG, the opportunity lies in the fact that for many of these smaller but promising merchants, they have not been built with longer-term growth visions in place. The merchants might not be prepared for the kind of scaling, investment or operational commitment that would need to be made to keep their businesses going, or they simply don’t have the appetite for it. BBG’s selling point — as it is with others in this space — is that they do. And BBG’s added pitch is that they can help open another door, to Europe. In the region, Amazon on average has about a 10% market share of marketplaces, BBG estimates, with regional players accounting for more marketplace activity than in the U.S. BBG not only has the links into selling on these other marketplaces, but the promise is that it can help improve how a brand will sell on Amazon itself in the region, given its traction in the market already. Conversely, it hopes to do the same for European brands by giving them a better window into selling in the U.S. Chaljawski is however realistic about the profusion of companies like his, and is “sure” there will be some casualties down the road. He also believes that we may start to see some emerge around specific verticals as an alternative. “Yes, I’m sure consolidation will happen, but I also think that we’ll see some specialization, with roll-ups focusing on one vertical or another. I think it will be a mix,” he said. |

| Pine Labs acquires Southeast Asian startup Fave for $45 million Posted: 13 Apr 2021 01:07 AM PDT Pine Labs said on Tuesday it has acquired Southeast Asian startup Fave in a deal valued at $45 million as the Indian firm looks to strengthen its consumer-focused offerings in the domestic and international markets. Fave helps an offline merchant connect and retain customers by using gift cards and vouchers. The startup allows merchants to accept digital payments by having a customer scan a QR code. Once the payment is made, the customer automatically receives a cashback / loyalty point through the Fave app that can only be redeemed at that specific business during future transactions. "Customers love us because they get safe money, cashback and rewards for being on the platform. And merchants love us because they get a lot of new and repeat customers," explained Joel Neoh, co-founder and chief executive of Fave, which like Pine Labs, is backed by Sequoia Capital India. Five-year-old Fave, which started as a fitness subscription service, raised over $32 million prior to being acquired. This offering has especially proven useful to merchants in the pandemic as they scramble for ways to drive sales from existing customers, said Amrish Rau, chief executive of Pine Labs, in an interview. "Consumers, too, were looking for ways of cost-savings or ways to optimize their purchases." Pine Labs — which offers businesses payments terminals, invoicing tools, and working capital, and acquired a gift cards solution provider Qwikcilver in 2019 — made its first investment in Fave last year.  Amrish Rau, who ran PayU business in India, joined Pine Labs last year. Mastercard and PayPal have backed Pine Labs, which is now valued at $2 billion. Rau drew comparisons between Fave and Honey, saying the Southeast Asian startup is doing to offline businesses what the PayPal-owned business has achieved in the online world. "For the first time with QR, what I realized was you can do a wonderful job when it comes to loyalty, rewards, and the redemption in the offline world," said Rau. Leadership of Fave will continue to work at the startup post the acquisition and Rau said the team is working to bring Fave’s offering to customers in 3,700 Indian cities. (This is one of the rare times when a Southeast Asian startup is launching its offering in India.) Neoh said in the interview that Fave, which will be hiring an additional 100 employees, also plans to launch a buy now and pay later product in the next one to two months. “India has the digital advantage with young demography, growing aspirational middle class with rising disposable income and increasing digital savviness. We are confident that the APAC e-payments landscape will continue to achieve exponential growth in the coming decade. Together, we will be stronger, faster and better,” said Neoh. Within the next 30 days, Fave Pay will launch in India with QR code transactions, and then Rau said, the team will work with Pine Labs’ merchants community to deliver rewards, coupons, and redemption programs to Indian consumers. “After looking at the business for nine-ten months, I thought it was time for us to do something more important and strategic,” said Rau, who added that the acquisition will help Pine Labs make further inroads in the consumer space. Rau said Pine Labs is exploring more merger and acquisition opportunities and broadly focusing on two themes: Bridging the gap between offline and online payments, and business applications where Pine Labs’ prepaid cards offerings could be leveraged. |

| Putting Gdańsk, Wroclaw, Krakow, Poznan on the TechCrunch map — TechCrunch’s Cities Survey Posted: 13 Apr 2021 01:00 AM PDT TechCrunch is embarking on a major new project to survey European founders and investors in cities outside the larger European capitals. Over the next few weeks, we will ask entrepreneurs in these cities to talk about their ecosystems, in their own words. This is your chance to put Gdańsk, Wroclaw, Krakow and Poznan on the Techcrunch Map! If you are a tech startup founder or investor in the city please fill out the survey form here. We are particularly interested in hearing from women founders and investors. This is the follow-up to the huge survey of investors (see also below) we've done over the last six or more months, largely in capital cities. These formed part of a broader series of surveys we're doing regularly for ExtraCrunch, our subscription service that unpacks key issues for startups and investors. In the first wave of surveys, the cities we wrote about were largely capitals. You can see them listed here. This time, we will be surveying founders and investors in Europe's other cities to capture how European hubs are growing, from the perspective of the people on the ground. We'd like to know how your city's startup scene is evolving, how the tech sector is being impacted by COVID-19, and generally how your city will evolve. We leave submissions mostly unedited and are generally looking for at least one or two paragraphs in answers to the questions. So if you are a tech startup founder or investor in one of these cities please fill out our survey form here. Thank you for participating. If you have questions you can email mike@techcrunch.com and/or reply on Twitter to @mikebutcher. |

| Grover raises $71M to grow its consumer electronics subscription business Posted: 12 Apr 2021 11:32 PM PDT A startup tapping into the concept of the circular economy, where people don’t buy items outright but pay an incremental amount to use them temporarily, has raised some funding to scale its business in Europe and beyond. Grover, a Berlin-based startup that runs a subscription model where people can rent out consumer electronics like computers, smart phones, games consoles and scooters for set fees, has picked up €60 million ($71 million). The funding is coming in the form of €45 million in equity and €15 million in venture debt. The company, which as of September last year had 100,000 subscriptions and now has around 150,000, said it aims to triple its active users by the end of this year to 450,000 by the end of 2021. It will be using the funds both to expand to more markets: both to grow its business in Germany, Austria and the Netherlands (where it’s already operating) and to launch in Spain and the US, and to add in more product categories into the mix, including health and fitness devices, consumer robots and smart appliances. And, it plans to invest in more innovation around its rental services. These have seen a new wave of interest in particular in the past year of pandemic life, which has put a strain on many people’s finances; definitely made it harder to plan for anything, including what gadgets you might need one week or the next; and turned the focus for many people on consuming less, and getting more mileage out of what they and others already have. “Now more than ever, consumers value convenience, flexibility and sustainability when they shop for and use products. This is especially true when it comes to technology and all of the possibilities that it has to offer — whether that's productivity, fun, or staying in touch with our loved ones,” said Michael Cassau, CEO and founder of Grover, in a statement. "The fresh funding allows us to bring these possibilities to even more people across the world. It enables us to double down on creating an unparalleled customer experience for our subscribers, and to push the boundaries of the most innovative ways for people and businesses to access and enjoy technology. The strong support from our investors confirms not only the important value our service brings to people, but also Grover's vast growth potential. We're still just scratching the surface of a €1 trillion global market." JMS Capital-Everglen led the Series B equity round, with participation also from Viola Fintech, Assurant Growth, existing investors coparion, Augmentum Fintech, Circularity Capital, Seedcamp and Samsung Next, and unnamed founders and angel investors from Europe and North America, among others. Kreos Capital issued the debt. Samsung is a strategic investor: together with Grover it launched a subscription service in December that currently covers select models from its S21 series. “Samsung powered by Grover,” as it’s called, has started out out in Germany, so one plan may be to use some of this investment to roll that out to other markets. The funding is coming on the heels of a year when Berlin-based Grover said its business grew 2.5x (that is, 150%). Its most recent annual report noted that it had 100,000 active users as of September of last year, renting out 18,000 smartphones, 6,000 pairs of AirPods and over 1,300 electric scooters in that period. It also said that in the most recent fiscal year, it posted net revenues of about $43 million, with $71 million in annual recurring revenue, and tipping into profitability on an Ebitda basis. It raised €250 million ($297 million) in debt just before the start of the pandemic, and previously to that also raised a Series A of $44 million in 2018, and $48 million in 2019 in a combination of equity and debt in a pre-Series B. It’s not disclosing its valuation. The company’s service falls into a wider category of startups building services around the subscription economy model, which has touched asset-intensive categories like cars, but also much lighter, internet-only consumables like music and video streaming. Indeed, Grover has been regularly referred to as the “Netflix for gadgets,” in part a reference to the latter company’s history starting out by sending out physical DVDs to people’s homes (which they returned when finished to get other films under a subscription model). Similar to cars and films, there is definitely an argument to be made for owning gadgets on a subscription. The pricier that items become — and the more of them that there are battling for a share of consumer’s wallets against many of the other things that they can spend money to own or use — the less likely it is that people will be completely happy to fork out money or build in financing to own them, not least because the value of a gadget typically depreciates the minute a consumer does make the purchase. At the same time, more consumers are subscribing, and often paying electronically, to services that they use regularly: whether it’s a Prime subscription, or Spotify, the idea with Grover — and others that are building subscriptions around physical assets — is to adopt the friction-light model of subscribing to a service, and apply it to physical goods. And for retailers, it’s another alternative to offer customers — alongside buying outright, using credit, or offering by-now-pay-later or other kinds of financing, in order to close a deal. Shopping cart abandonment, and competition for shoppers online, are very real prospects, so anything to catch incremental wins, is a win. And if they are working in a premium (cost-per-month of use, say) to give customers possession of the gadget in question, if they manage to secure enough business this way, it actually might prove to be even more lucrative than outright sales, especially if the maintenance of those goods is offloaded to a third party like Grover. Although some people have regularly been wary of the idea of used consumer electronics, or other used goods, that has been shifting. There have been a number of companies seeing strong growth in the last year on the back of helping consumers resell their own items. This has been helped in part by buyers being more focused on spending less (and sellers maybe earning back some money in the process), but also being keen to reduce their own footprints in the world by using items that are already out in circulation. In Europe alone, last week, Brighton-based MPB raised nearly $70 million for its used-camera equipment marketplace. Other recent deals have included used-goods marketplace Wallapop in Spain raising $191 million and clothing-focused Vestiaire Collective raising $216 million. What is interesting here is — whether it’s a sign of the times, or because Grover might have cracked the subscription model for gadgets — the company seems to be progressing in an area that has definitely seen some fits and bumps over the years. Lumoid out of the U.S. also focused on renting out tech gear but despite finding some traction and inking a deal with big box retailer Best Buy, it failed to raise the funding it needed to run its service and eventually shut down. It’s also not alone in trying to tackle the market. Others in the same space include Tryatec and Wonder, which seems to be focused more on trying out technology from startups. The big question indeed is not just whether Grover will find more of a market for its rental/subscription model, but also whether it has cracked those economics around all of the supply chain management, shipping and receiving goods, reconditioning or repairing when needed, and simply keeping strong customer service throughout all of that. As we’ve seen many times, a good idea on one level can prove extremely challenging to execute on another. |

| Reminder: Student, non-profit, and government discounts available for Extra Crunch Posted: 12 Apr 2021 08:15 PM PDT Students, government employees, and members of non-profit organizations can get access to Extra Crunch at a discounted rate of $50/year (plus tax). That's 50% off our annual price point. You'll also be grandfathered in at the discounted price for future years until you cancel. How to claim the discount:

If you are part of a student group like an entrepreneurial club and interested in getting access for a large number of users, reach out to travis@techcrunch.com to learn more about custom discounts on large groups. What is Extra Crunch? Extra Crunch is a members-only community from TechCrunch focused on helping startup teams and founders get ahead. Membership features thousands of articles, including investor surveys, market analysis, late-stage company deep dives, and how-tos and interviews on fundraising, growth, monetization and other work topics. You also can browse and use TechCrunch.com more efficiently without the distraction of banner ads, and stay up-to-date through our Extra Crunch members-only newsletters. Another benefit of Extra Crunch is discounts on events. If you have interest in attending TechCrunch events, you can save 20% on tickets. Once you join, reach out to our customer service team with the event name to receive a discount code for any TechCrunch event. For questions about this offer, reach out to customer support at extracrunch@techcrunch.com. |

| Vietnamese electric motorbike startup Dat Bike raises $2.6M led by Jungle Ventures Posted: 12 Apr 2021 06:00 PM PDT Dat Bike, a Vietnamese startup with ambitions to become the top electric motorbike company in Southeast Asia, has raised $2.6 million in pre-Series A funding led by Jungle Ventures. Made in Vietnam with mostly domestic parts, Dat Bike's selling point is its ability to compete with gas motorbikes in terms of pricing and performance. Its new funding is the first time Jungle Ventures has invested in the mobility sector and included participation from Wavemaker Partners, Hustle Fund and iSeed Ventures. Founder and chief executive officer Son Nguyen began learning how to build bikes from scrap parts while working as a software engineer in Silicon Valley. In 2018, he moved back to Vietnam and launched Dat Bike. More than 80% of households in Indonesia, Malaysia, Thailand and Vietnam own two-wheeled vehicles, but the majority are fueled by gas. Nguyen told TechCrunch that many people want to switch to electric motorbikes, but a major obstacle is performance. Nguyen said that Dat Bike offers three times the performance (5 kW versus 1.5 kW) and 2 times the range (100 km versus 50 km) of most electric motorbikes in the market, at the same price point. The company's flagship motorbike, called Weaver, was created to compete against gas motorbikes. It seats two people, which Nguyen noted is an important selling point in Southeast Asian countries, and has a 5000W motor that accelerates from 0 to 50 km per hour in three seconds. The Weaver can be fully charged at a standard electric outlet in about three hours, and reach up to 100 km on one charge (the motorbike's next iteration will go up to 200 km on one charge). Dat Bike's opened its first physical store in Ho Chi Minh City last December. Nguyen said the company "has shipped a few hundred motorbikes so far and still have a backlog of orders." He added that it saw a 35% month-over-month growth in new orders after the Ho Chi Minh City store opened. At 39.9 million dong, or about $1,700 USD, Weaver's pricing is also comparable to the median price of gas motorbikes. Dat Bike partners with banks and financial institutions to offer consumers twelve-month payment plans with no interest. "These guys are competing with each other to put the emerging middle class of Vietnam on the digital financial market for the first time ever and as a result, we get a very favorable rate," he said. While Vietnam's government hasn't implemented subsidies for electric motorbikes yet, the Ministry of Transportation has proposed new regulations mandating electric infrastructure at parking lots and bike stations, which Nguyen said will increase the adoption of electric vehicles. Other Vietnamese companies making electric two-wheeled vehicles include VinFast and PEGA. One of Dat Bike’s advantages is that its bikes are developed in house, with locally-sourced parts. Nguyen said the benefits of manufacturing in Vietnam, instead of sourcing from China and other countries, include streamlined logistics and a more efficient supply chain, since most of Dat Bike's suppliers are also domestic. "There are also huge tax advantages for being local, as import tax for bikes is 45% and for bike parts ranging from 15% to 30%," said Nguyen. "Trade within Southeast Asia is tariff-free though, which means that we have a competitive advantage to expand to the region, compare to foreign imported bikes." Dat Bike plans to expand by building its supply chain in Southeast Asia over the next two to three years, with the help of investors like Jungle Ventures. In a statement, Jungle Ventures founding partner Amit Anand said, "The $25 billion two-wheeler industry in Southeast Asia in particular is ripe for reaping benefits of new developments in electric vehicles and automation. We believe that Dat Bike will lead this charge and create a new benchmark not just in the region but potentially globally for what the next generation of two-wheeler electric vehicles will look and perform like." |

| Binance Labs leads $1.6M seed round in DeFi startup MOUND, the developer of Pancake Bunny Posted: 12 Apr 2021 05:00 PM PDT Decentralized finance startup MOUND, known for its yield farming aggregator Pancake Bunny, has raised $1.6 million in seed funding led by Binance Labs. Other participants included IDEO CoLab, SparkLabs Korea and Handshake co-founder Andrew Lee. Built on Binance Smart Chain, a blockchain for developing high-performance DeFi apps, MOUND says Pancake Bunny now has more than 30,000 daily average users, and has accumulated more than $2.1 billion in total value locked (TVL) since its launch in December 2020. The new funding will be used to expand Pancake Bunny and develop new products. MOUND recently launched Smart Vaults and plans to unveil Cross-Chain Collateralization in about a month, bringing the startup closer to its goal of covering a wide range of DeFi use cases, including farming, lending and swapping. Smart Vaults are for farming single asset yields on leveraged lending products. It also automatically checks if the cost of leveraging may be more than anticipated returns and can actively lend assets for MOUND's cross-chain farming. Cross-Chain Collateralization is cross-chain yield farming that lets users keep original assets on their native blockchain instead of relying on a bridge token. The user's original assets serve as collateral when the Bunny protocol borrows assets on the Binance Smart Chain for yield farming. This allows users to keep assets on native blockchains while giving them liquidity to generate returns on the Binance Smart Chain. In a statement, Wei Zhou, Binance chief financial officer, and head of Binance Labs and M&A's, said “Pancake Bunny's growth and MOUND's commitment to execution are impressive. Team MOUND's expertise in live product design and service was a key factor in our decision to invest. We look forward to expanding the horizons of Defi together with MOUND.” |

| Battery Resourcers raises $20M to commercialize its recycling-plus-manufacturing operations Posted: 12 Apr 2021 03:22 PM PDT  Equipment at Battery Resourcers’ new cathode sintering and analysis facility in Novi, Michigan. (Photo: Battery Resourcers) As a greater share of the transportation market becomes electrified, companies have started to grapple with how to dispose of the thousands of tons of used electric vehicle batteries that are expected to come off the roads by the end of the decade. Battery Resourcers proposes a seemingly simple solution: recycle them. But the company doesn't stop there. It's engineered a "closed loop" process to turn that recycled material into nickel-manganese-cobalt cathodes to sell back to battery manufacturers. It is also developing a process to recover and purify graphite, a material used in anodes, to battery-grade. Battery Resourcers' business model has attracted another round of investor attention, this time with a $20 million Series B equity round led by Orbia Ventures, with injections from At One Ventures, TDK Ventures, TRUMPF Venture, Doral Energy-Tech Ventures and InMotion Ventures. Battery Resourcers CEO Mike O'Kronley declined to disclose the company's new valuation. The cathode and anode, along with the electrolyte, are major components of battery architecture, and O'Kronley told TechCrunch it is this recycling-plus-manufacturing process that distinguishes the company from other recyclers. "When we say that we’re on the verge of revolutionizing this industry, what we are doing is we are making the cathode active material — we're not just recovering the metals that are in the battery, which a lot of other recyclers are doing," he said. "We’re recovering those materials, and formulating brand new cathode active material, and also recovering and purifying the graphite active material. So those two active materials will be sold to a battery manufacturer and go right back into the new battery." "Other recycling companies, they're focused on recovering just the metals that are in [batteries]: there’s copper, there’s aluminum, there’s nickel, there’s cobalt. They’re focused on recovering those metals and selling them back as commodities into whatever industry needs those metals," he added. "And they may or may not go back into a battery." The company says its approach could reduce the battery industry's reliance on mined metals — a reliance that's only anticipated to grow in the coming decades. A study published last December found that demand for cobalt could increase by a factor of 17 and nickel by a factor of 28, depending on the size of EV uptake and advances in battery chemistries. Thus far, the company's been operating a demonstration-scale facility in Worcester, Massachusetts, and has expanded into a facility in Novi, Michigan, where it does analytical testing and material characterization. Between the two sites, the company can make around 15 tons of cathode materials a year. This latest funding round will help facilitate the development of a commercial-scale facility, which Battery Resourcers said in a statement will boost its capacity to process 10,000 tons of batteries per year, or batteries from around 20,000 EVs. Another major piece of its proprietary recycling process is the ability to take in both old and new EV batteries, process them and formulate the newest kind of cathodes used in today's batteries. "So they can take in 10-year-old batteries from a Chevy Volt and reformulate the metals to make the high-Ni cathode active materials in use today," a company spokesman explained to TechCrunch. Battery Resourcers is already receiving inquiries from automakers and consumer electronics companies, O'Kronley said, though he did not provide additional details. But InMotion Ventures, the venture capital arm of Jaguar Land Rover, said in a statement its participation in the round as a "significant investment." "[Battery Resourcers'] proprietary end-to-end recycling process supports Jaguar Land Rover's journey to become a net zero carbon business by 2039," InMotion managing director Sebastian Peck said. Battery Resourcers was founded in 2015 after being spun out from Massachusetts' Worcester Polytechnic Institute. The company has previously received support from the National Science Foundation and the U.S. Advanced Battery Consortium, a collaboration between General Motors, Ford Motor Company and Fiat Chrysler Automobiles. |

| Daily Crunch: Microsoft acquires Nuance for $19.7B Posted: 12 Apr 2021 03:16 PM PDT Microsoft makes a big healthcare tech acquisition, Twitter is building a presence in Africa and Apple may be cooking up some new smart home products. This is your Daily Crunch for April 12, 2021. The big story: Microsoft acquires Nuance for $19.7B Microsoft announced this morning that it’s acquiring speech-to-text company Nuance Communications for $19.7 billion. It seems like the real focus here is on healthcare — Microsoft announced a Cloud for Healthcare last year, while Nuance’s industry products include Dragon Ambient eXperience, Dragon Medical One and PowerScribe One for radiology reporting. "Today's acquisition announcement represents the latest step in Microsoft's industry-specific cloud strategy,” the company said in a blog post. Analysts told us that this could help Microsoft fill in crucial gaps when it comes to both speech recognition and health data. The tech giants Apple and Google will both attend Senate hearing on app store competition — After it looked like Apple might no-show, the company has committed to sending a representative to a Senate antitrust hearing on app store competition later this month. Twitter to set up its first African presence in Ghana — In a statement, Twitter said it is now actively building a team in Ghana "to be more immersed in the rich and vibrant communities that drive the conversations taking place every day across the continent." Apple said to be developing Apple TV/HomePod combo and iPad-like smart speaker display — Apple is reportedly working on a couple of new options for a renewed entry into the smart home, according to Bloomberg. Startups, funding and venture capital Austin's newest unicorn: The Zebra raises $150M after doubling revenue in 2020 — The Zebra started out as a site for people looking for auto insurance via its real-time quote comparison tool, and has added homeowners insurance as well. Hardware is still hard in the Motor City — Astrohaus co-founder Adam Leeb describes the ups and downs of launching a hardware startup in Detroit. EcoCart raises $3M for a Honey-like browser extension to offset shoppers' carbon emissions — Brands pay the company a commission to drive traffic to their websites under a standard affiliate marketing model and EcoCart uses a portion of the proceeds to offset a shopper's carbon emissions. Advice and analysis from Extra Crunch How to choose and deploy industry-specific AI models — Organizations that seek the most accurate results from their AI projects will simply have to turn to industry-specific models. UiPath's first IPO pricing could be a warning to late-stage investors — The company's first IPO price range failed to value the company where its final private backers expected it to. Ride-hailing's profitability promise is in its final countdown — The Exchange is back! (Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.) Everything else Biden's cybersecurity dream team takes shape — President Biden has named two former National Security Agency veterans to senior government cybersecurity positions, including the first national cyber director. Tech and auto execs tackle global chip shortage at White House summit — A collection of tech and auto industry executives met with the White House to discuss solutions for the worldwide chip shortage today. How one founder identified a huge healthcare gap and acquired the skills necessary to address it — We’ve already been telling you about TechCrunch’s new podcast Found, but now we’ve got the very first episode for your listening pleasure. The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here. |

| Another milestone for in-space servicing as Northrop Grumman gives aging satellite new life Posted: 12 Apr 2021 02:21 PM PDT Northrop Grumman hit a new milestone in extending the life of active spacecraft as a purpose-built spacecraft, MEV-2, docked with Intelsat’s IS-10-02 satellite to give it another five years of life. It’s a strong demonstration of the possibilities in a growing field of orbital servicing operations. MEV-2 launched in August and matched the orbit of Intelsat’s 18-year-old satellite, which would have soon been due for decommissioning, having exceeded its original mission by some five years. But it’s precisely this type of situation that the new “on-orbit service, assembly and manufacturing,” or OSAM, industry intends to target, allowing such satellites to live longer — likely saving their operators millions. In today’s operation, the MEV-2 spacecraft slowly approached IS-10-02 and docked with it, essentially adding itself as a spare engine with a full tank. It will stay attached this way for five years, after which it will move on to its next mission — another end-of-life satellite, probably. “You can think of MEV-2 as a jetpack for the 10-02 satellite,” said a Northrop Grumman representative. The docking process is really more of a clamping-on than a docking, since while there’s a mechanical fit between the MEV-2’s probe and the IS-10-02’s engine cone, it’s not like they’re making a seal and exchanging fluids or power. The representative explained:

Last year the MEV-1 mission performed a similar operation, docking with Intelsat’s IS-901 and changing its orbit. But in that case, the satellite was inactive and not in the correct orbit to return to service. MEV-1 therefore had a bit more latitude in how it approached the first part of the mission. In the case of MEV-2, the IS-10-02 satellite was in active use in its accustomed orbit, meaning the servicing spacecraft had to coordinate an approach that ran no risk of disrupting the target craft’s operations. Being able to service working satellites, of course, is a major step up from only working with dead ones. And naturally the goal is to have spacecraft that could dock and refuel another satellite without hanging onto it for a few years, or service a malfunctioning part so that a craft that’s 99% functional can stay in orbit rather than be allowed to burn up. Startups like Orbit Fab aim to build and standardize the parts and ports needed to make this a reality, and Northrop Grumman is planning a robotic servicing mission for its next trick, expected to launch in 2024.

|

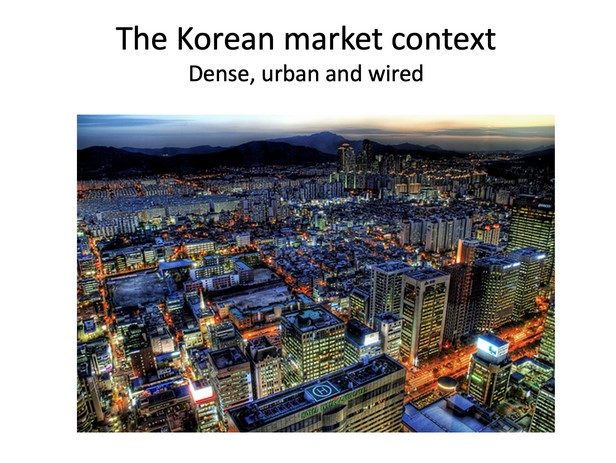

| From pickup basketball to market domination: My wild ride with Coupang Posted: 12 Apr 2021 02:01 PM PDT A month ago, Coupang arrived on Wall Street with a bang. The South Korean e-commerce giant — buoyed by $12 billion in 2020 revenue — raised $4.55 billion in its IPO and hit a valuation as high as $109 billion. It is the biggest U.S. IPO of the year so far, and the largest from an Asian company since Alibaba's. But long before founder Bom Kim rang the bell, I knew him as a fellow founder on the hunt for a good idea. We stayed in touch as he formed his vision for what would become Coupang, and I built it alongside him as an investor and board member. As a board member, I've observed a brief quiet period following the IPO. But now I want to share how exactly our paths intersected, largely because Bom exemplifies what founders should aspire to and should seek: big risks, dogged determination and obsessive responsiveness to the market. Bom fearlessly turned down an acquisition offer from then-market-leader Groupon, ferociously learned what he didn't know, made a daring pivot even after becoming a billion-dollar company, and iteratively built a vision for end-to-end market dominance. Why I like talking to founders earlyIn 2008, I met Bom while playing a weekend game of pickup basketball at Stuyvesant High School. We realized we had a mutual acquaintance through my recently sold startup, Community Connect Inc. He told me about the magazine he had sold and his search for a next move. So we agreed to meet up for lunch and go over some of his ideas. To be honest, I don't remember any of those early ideas, probably because they weren't very good. But I really liked Bom. Even as I was crapping on his ideas, I could tell he was sharp from how he processed my feedback. It was obvious he was super smart and definitely worth keeping in touch with, which we continued to do even after he relocated to go to HBS. I soon began investing in and incubating businesses, starting mostly with my own capital. When I got a call from an executive recruiter working for a company in Chicago called Groupon — who told me they were at a $50 million run rate in only a few months — I became fascinated with their model and started talking to some of the investors, former employees and merchants. Inspired, and as a new parent, I decided to launch a similar daily-deal business for families: Instead of skydiving and go-kart racing, we offered deals on kids' music classes and birthday party venues. While I was working on this idea, John Ason, an angel investor in Diapers.com, said I should meet with the founder and CEO Marc Lore. By the end of the meeting, Marc and I etched a partnership to launch DoodleDeals.com co-branded with Diapers.com. The first deal did over $70,000 — great start.

I've observed a brief quiet period following the IPO. But now I want to share how exactly our paths intersected, largely because Bom exemplifies what founders should aspire to and should seek: big risks, dogged determination, and obsessive responsiveness to the market. All that time, I kept in touch with Bom. In February 2010, we were catching up over lunch at the Union Square Ippudo, and he asked if I had heard of Buywithme, a Boston-based Groupon clone. He hadn't yet heard about Groupon, so I explained the business model and shared the numbers. He thought something similar might transfer well to South Korea, where he was born and where his parents still lived. This kind of conversation is exactly why I love working with founders early, even before the idea forms: You learn a lot about them as they explore, wrestle with uncertainty and eventually build conviction on a business they plan to spend the next decade-plus building. Ultimately, success comes down to founders' belief in themselves; when you develop the same belief in them as an investor, it is pretty magical. I was starting to really believe in Bom. The idea gets real — and moves fast I’m not Korean — I am ethnically Chinese — so Bom put together slides on the Korean market and why it was perfect for the daily-deal model. In short: a very dense population that's incredibly online. Image Credits: Ben Sun I told Bom he should drop out of business school and do this. He said, "You don't think I can wait until I graduate?" I responded, "No way! It will be over by then!" First-mover advantage is real in a business like this, and it didn't take Bom long to see that. He raised a small $1.3 million seed round. I invested, joined the board. Because of my knowledge of the deals market and my entrepreneurial experience, Bom asked me to get hands-on in Korea — not at all typical for an investor or even a board member, but I think of myself as a builder and not just a backer, and this is how I wanted to operate as an investor. Once he realized time was of the essence, Bom was heads down. For context, he was engaged to his longtime girlfriend, Nancy, who also went to Harvard undergrad and was a successful lawyer. Imagine telling your fiancée, "Honey, I am dropping out of business school, moving to Korea to start a company. I will be back for the wedding. Not sure if I will ever be coming back to the U.S." I emailed Bom, saying: "Bom — honestly as a friend. Enjoy your wedding. It is a real blessing that your fiancée is being so supportive of you doing this. Launching a site a few weeks before the wedding is going to be way too distracting and she won’t feel like your heart is in it. Launching a few weeks later is not going to make or break this business. Trust me." Bom didn't listen. He launched Coupang in August 2010, two weeks before the wedding. He flew back to Boston, got married and — running on basically no sleep — sneaked out for a 20-minute nap in the middle of his reception. Right after the wedding, he flew back to Seoul. Nancy has to be one of the most supportive and understanding partners I have ever seen. They are still married and now have two kids. Jumping on new distribution, turning down an acquisition offer |

| Posted: 12 Apr 2021 01:37 PM PDT Blue Origin is making progress toward its goal of flying human astronauts aboard its spacecraft, with a plan to run an “astronaut rehearsal” during a launch it has planned for Wednesday, April 14. The launch of Blue Origin’s New Shepard suborbital, reusable rocket will be a key step in verifying the vehicle for paying human passengers. What does the rehearsal entail? Basically everything except for the actual spaceflight, including boarding and going through preflight operations, the returning to the capsule once it has landed and going through a staged version of an actual capsule exit post-mission. It’s what would happen during a Blue Origin launch with private astronauts on board, with the exception that the Blue Origin personnel standing in for those customers will get out of the capsule before actual engine ignition and launch, and then be transported to the capsule landing site where they’ll get back in and behave as though they’ve been there all along. There will be one passenger on board the spacecraft during its actual flight: Mannequin Skywalker, a test dummy used by Blue Origin to measure data about what the launch would be like for people. Mannequin has flown previously, but this is the first time it’s playing a sort of human spaceflight relay with the simulation crew doing the ground operations rehearsal portions of the mission. Blue Origin launched its first New Shepard rocket of 2021 back in January, and that mission included a test of improved capsule cabin crew features, like better acoustics and temperature management system, and new display and communications equipment for the eventual crew. The company expects to begin flying people on board the rocket at some point this year, as of the most recently disclosed timelines. This week’s launch is set for a take-off time of 8 a.m. CDT (9 a.m. EDT/6 a.m. PDT), and will take place from the company’s launch site in West Texas. A live feed will kick off an hour ahead of the opening of the launch window, and Blue Origin also plans to include footage of the astronaut rehearsal activities, which will be the best look we’ve gotten yet at what its tourist flights might look like. |