TechCrunch |

- Early bird extension gives you more time to save on passes to TC Early Stage 2021: Marketing and Fundraising

- Extra Crunch roundup: Fintech stays hot, Brex doubles, and startup IRR is up all over

- Analytics as a service: Why more enterprises should consider outsourcing

- Daily Crunch: Europe charges Apple with antitrust breach

- What3Words sends legal threat to a security researcher for sharing an open-source alternative

- How UK-based Lendable is powering fintechs across emerging markets

- Basecamp sees mass employee exodus after CEO bans political discussions

- How to attract large investors to your direct investing platform

- Facebook is buying the developer behind VR shooter ‘Onward’

- Amid the IPO gold rush, how should we value fintech startups?

- Roc Nation’s VC Neil Sirni lays out his investment strategy

- Y Combinator-backed Uiflow wants to accelerate no-code enterprise app creation

- Pitch your startup to seasoned tech leaders, and a live audience, on Extra Crunch Live

- ByteDance CFO assumes role as new TikTok CEO

- Riot Games updates its privacy notice to start developing voice comms moderation

- Cloud gaming service Shadow taken over by OVHcloud founder

- Sequoia’s Mike Vernal will share how to iterate with tempo at TC Early Stage in July

- Optimism reigns at consumer trading services as fintech VC spikes and Robinhood IPO looms

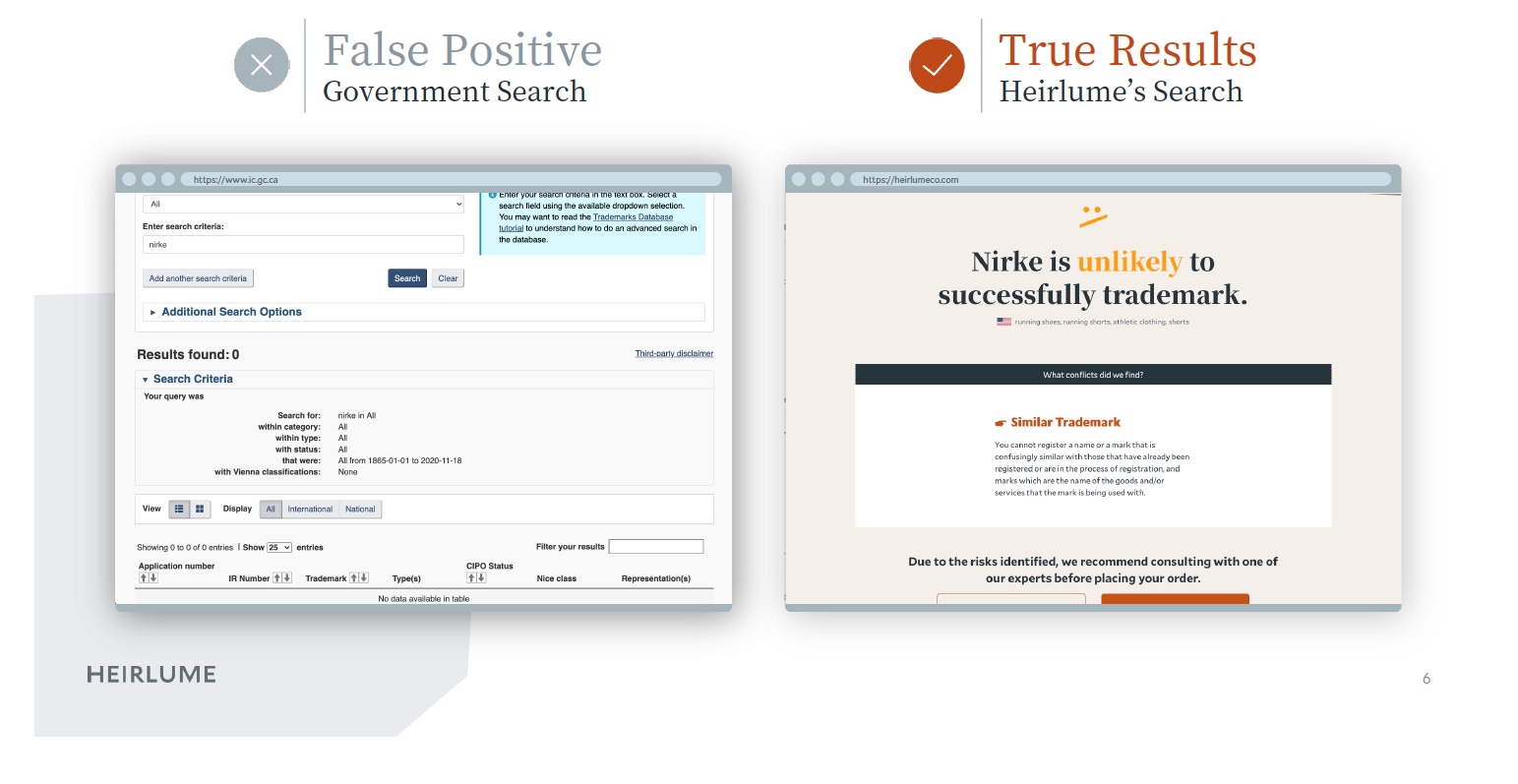

- Heirlume raises $1.38M to remove the barriers of trademark registration for small businesses

- Early-bird price ends tonight: Buy your pass to TC Early Stage 2021 and save $100

| Posted: 30 Apr 2021 05:25 PM PDT Startup life, especially in the early innings, is nothing short of hectic. Who wouldn't love a clone or two to help get everything done? Well, we can't clone you, but we can give you more time to sign up and save on a pass to TC Early Stage 2021: Marketing and Fundraising on July 8-9. We're extending the early bird deadline to Friday, June 4 at 11:59 pm (PT). Sweet! That should help calm the cray-cray and save you $100 on admission to our virtual two-day bootcamp experience. Of course, you don't need to wait. Buy your pass now while it's top-of-mind and feel the joy of having one less task on your to-do list. Not familiar with TC Early Stage? It's specifically designed to help new startup founders learn essential entrepreneurial skills to build a successful startup. We tap the very best experts in the startup ecosystem, and they deliver actionable insights you can put in place now, when you need them most. At TC Early Stage 2021, top-tier investors, veteran founders and respected subject-matter experts will lead highly interactive sessions on topics ranging from fundraising and marketplace positioning to growth marketing and content development. Get answers to your burning questions. Here's just one example. Rebecca Reeve Henderson, founder and CEO of Rsquared Communication, will hold forth on how to create an effective earned media strategy for your startup. Talk about an essential skill. Want more examples?

We're announcing more speakers every week, and we'll share the event agenda soon, so stay tuned. TC Early Stage 2021: Marketing and Fundraising takes place on July 8-9, and now you have an extra month to save $100. Calm the cray-cray and take one important, business-building task of your to-do list. Buy your early-bird pass to TC Early Stage 2021 before June 4. We can't wait to see you there! Is your company interested in sponsoring or exhibiting at Early Stage 2021 – Marketing & Fundraising? Contact our sponsorship sales team by filling out this form.

|

| Extra Crunch roundup: Fintech stays hot, Brex doubles, and startup IRR is up all over Posted: 30 Apr 2021 04:30 PM PDT Tech companies in Silicon Valley, the geography, have had an incredible year. But one indicator points to longer-term changes. The internal rate of return (IRR) for companies in other startup hub cities has been even better. A big new analysis by AngelList showed aggregate IRR of 19.4% per year on syndicated deals elsewhere versus 17.5% locally. A separate measure, of total value of paid-in investment, revealed 1.67x returns for other hubs versus 1.60x in the main Silicon Valley and Bay Area tech cities. The data is based on a sample of 2,500 companies that have used AngelList to syndicate deals from 2013 through 2020. Which is just one snapshot, but a relevant one given how hard it can be to produce accurate early-stage startup market analysis at this scale. I believe we’ll see more and more data confirming the trends in the coming years, especially as more of the startup world acclimates to remote-first and distributed offices. You can increasingly do a startup from anywhere and make it a success. Not that Silicon Valley is lacking optimism, as you’ll see in a number of the other stories in the roundup below! Eric Eldon (Subbing in for Walter today as he’s enjoying a well-deserved break and definitely not still checking the site.) Optimism reigns at consumer trading services as fintech VC spikes and Robinhood IPO looms Image Credits: Nigel Sussman (opens in a new window) With the Coinbase direct listing behind us and the Robinhood IPO ahead, it's a heady time for consumer-focused trading apps. Mix in the impending SPAC-led debut of eToro, general bullishness in the cryptocurrency space, record highs for some equities markets, and recent rounds from Public.com, M1 Finance and U.K.-based Freetrade, and you could be excused for expecting the boom in consumer asset trading to keep going up and to the right. But will it? There are data in both directions. After going public, once-hot startups are riding a valuation roller coaster Image Credits: Nigel Sussman (opens in a new window) A short meditation on value, or, more precisely, how assets are valued in today's markets. Long story short: This is why I only buy index funds. No one knows what anything (interesting) is worth. Should you give an anchor investor a stake in your fund's management company? Image Credits: Matthias Kulka (opens in a new window) / Getty Images Raising capital for a new fund is always hard. But should you give preferential economics or other benefits to a seed anchor investor who makes a material commitment to the fund? Let’s break down the pros and cons. 2021 should be a banner year for biotech startups that make smart choices early Image Credits: TEK IMAGE/SCIENCE PHOTO LIBRARY / Getty Images Last year was a record 12 months for venture-backed biotech and pharma companies, with deal activity rising to $28.5 billion from $17.8 billion in 2019. As vaccines roll out, drug development pipelines return to normal, and next-generation therapies continue to hold investor interest, 2021 is on pace to be another blockbuster year. But founder missteps early in the fundraising journey can result in severe consequences. In this exciting moment, when younger founders will likely receive more attention, capital and control than ever, it's crucial to avoid certain pitfalls. Two investors weigh in: Is your SPAC just a PIPE dream? Image Credits: Maxime Robeyns/EyeEm (opens in a new window) / Getty Images The fundamental thing to remember about the SPAC process is that the result is a publicly traded company open to the regulatory environment of the SEC and the scrutiny of public shareholders. In today's fast-paced IPO world, going public can seem like simply a marker of success, a box to check. But are you ready to be a public company? There is no cybersecurity skills gap, but CISOs must think creatively Image Credits: Westend61 (opens in a new window) / Getty Images Those of us who read a lot of tech and business publications have heard for years about the cybersecurity skills gap. Studies often claim that millions of jobs are going unfilled because there aren't enough qualified candidates available for hire. Don’t buy it. The basic laws of supply and demand mean there will always be people in the workforce willing to move into well-paid security jobs. The problem is not that these folks don't exist. It's that CIOs or CISOs typically look right past them if their resumes don't have a very specific list of qualifications. In many cases, hiring managers expect applicants to be fully trained on all the technologies their organization currently uses. That not only makes it harder to find qualified candidates, but it also reduces the diversity of experience within security teams — which, ultimately, may weaken the company's security capabilities and its talent pool. To be frank, we do not know how to value Honest Company Image Credits: Nigel Sussman (opens in a new window) We do not know how to value Honest Company. It's outside our normal remit, but that the company is getting out the door at what appears to be a workable price gain to its final private round implies that investors earlier in its cap table are set to do just fine in its debut. Snowflake it is not, but at its current IPO price interval, it is hard to not call Honest a success of sorts — though we also anticipate that its investors had higher hopes. Returning to our question, do we expect the company to reprice higher? No, but if it did, The Exchange crew would not fall over in shock. How Brex more than doubled its valuation in a year Image Credits: TechCrunch Brex, a fintech company that provides corporate cards and spend-management software to businesses, announced Monday that it closed a $425 million Series D round of capital at a valuation of around $7.4 billion. The new capital came less than a year after Brex raised $150 million at a $2.9 billion pre-money valuation. So, how did the company manage to so rapidly boost its valuation and raise its largest round to date? TechCrunch spoke with Brex CEO Henrique Dubugras after his company's news broke. We dug into the how and why of its new investment and riffed on what going remote-first has done for the company, as well as its ability to attract culture-aligned and more diverse talent. Founders who don't properly vet VCs set up both parties for failure Image Credits: Flashpop (opens in a new window) / Getty Images There's a disconnect between reality and the added value investors are promising entrepreneurs. Three in five founders who were promised added value by their VCs felt duped by their negative experience. While this feels like a letdown by investors, in reality, it shows fault on both sides. Due diligence isn't a one-way street, and founders must do their homework to make sure they're not jumping into deals with VCs who are only paying lip service to their value-add. Looking into an investor's past, reputation and connections isn't about finding the perfect VC, it's about knowing what shaking certain hands will entail — and either being ready for it or walking away. Fifth Wall's Brendan Wallace and Hippo's Assaf Wand discuss proptech's biggest opportunities Image Credits: Jeff Newton / Hippo What is the biggest opportunity for proptech founders? How should they think about competition, strategic investment versus top-tier VC firms and how to build their board? What about navigating regulation? We sat down with Brendan Wallace, co-founder and general manager of Fifth Wall, and Hippo CEO Assaf Wand for an episode of Extra Crunch Live to discuss all of the above. SaaS subscriptions may be short-serving your customers Image Credits: emyerson (opens in a new window) / Getty Images Software as a service (SaaS) has perhaps become a bit too interchangeable with subscription models. Every software company now looks to sell by subscription ASAP, but the model itself might not fit all industries or, more importantly, align with customer needs, especially early on. What can the OKR software sector tell us about startup growth more generally?In the never-ending stream of venture capital funding rounds, from time to time, a group of startups working on the same problem will raise money nearly in unison. So it was with OKR-focused startups toward the start of 2020. How were so many OKR-focused tech upstarts able to raise capital at the same time? And was there really space in the market for so many different startups building software to help other companies manage their goal-setting? OKRs, or "objectives and key results," a corporate planning method, are no longer a niche concept. But surely, over time, there would be M&A in the group, right?  Image Credits: Nigel Sussman (opens in a new window) Internal rates of return in emerging US tech hubs are starting to overtake Silicon Valley Image Credits: petdcat (opens in a new window) / Getty Images Tech innovation is becoming more widely distributed across the United States. Among the five startups launched in 2020 that raised the most financing, four were based outside the Bay Area. The number of syndicated deals on AngelList in emerging markets from Austin to Seattle to Pittsburgh has increased 144% over the last five years. And the number of startups in these emerging markets is growing fast — and increasingly getting a bigger piece of the VC pie. Fund managers can leverage ESG-related data to generate insights Image Credits: Guido Mieth (opens in a new window)/ Getty Images Almost two centuries ago, gold prospectors in California set off one of the greatest rushes for wealth in history. Proponents of socially conscious investing claim fund managers will start a similar stampede when they discover that environmental, social and governance (ESG) insights can yield treasure in the form of alternative data that promise big payoffs — if only they knew how to mine it. ESG data is everywhere. Learning how to understand it promises big payoffs.

Dear Sophie: What's the latest on DACA? Image Credits: Bryce Durbin/TechCrunch Dear Sophie, My company is looking to hire a very talented data infrastructure engineer who is undocumented. She has never applied for DACA before. What is the latest on DACA? What can we do to support her? —Multicultural in Milpitas Zomato juice: Indian unicorn's proposed IPO could drive regional startup liquidity Image Credits: Nigel Sussman (opens in a new window) The IPO parade continued this week as India-based food-delivery unicorn Zomato filed to go public. The Zomato IPO is incredibly important. As our own Manish Singh reported when the company's numbers became public, a "successful listing [could be] poised to encourage nearly a dozen other unicorn Indian startups to accelerate their efforts to tap the public markets." So, Zomato's debut is not only notable because its impending listing gives us a look into its economics, but because it could lead to a liquidity rush in the country if its flotation goes well. Investment in construction automation is essential to rebuilding US infrastructure Image Credits: Donald Iain Smith (opens in a new window) / Getty Images With the United States moving all-in on massive infrastructure investment, much of the discussion has focused on jobs and building new green industries for the 21st century. While the Biden administration's plan will certainly expand the workforce, it also provides a massive opportunity for the adoption of automation technologies within the construction industry. Despite the common narrative of automating away human jobs, the two are not nearly as much in conflict, especially with new investments creating space for new roles and work. In fact, one of the greatest problems facing the construction industry remains a lack of labor, making automation a necessity for moving forward with these ambitious projects. How to fundraise over Zoom more effectively Image Credits: fourSage (opens in a new window)/ Getty Images Even though in-person drinks and coffee walks are on the horizon, virtual fundraising isn't going away. Now, it's imperative to ensure your virtual pitch is as effective as your IRL one. Not only is it more efficient — no expensive trips to San Francisco or trouble fitting investor meetings into one day — virtual fundraising helps democratize access to venture capital. Hacking my way into analytics: A creative's journey to design with data Image Credits: Xuanyu Han (opens in a new window) / Getty Images There’s a growing need for basic data literacy in the tech industry, and it's only getting more taxing by the year. Words like "data-driven," "data-informed" and "data-powered" increasingly litter every tech organization's product briefs. But where does this data come from? Who has access to it? How might I start digging into it myself? How might I leverage this data in my day-to-day design once I get my hands on it? Fintech startups set VC records as the 2021 fundraising market continues to impress Image Credits: Nigel Sussman (opens in a new window) The first three months of the year were the most valuable period for fintech investing, ever. Where did the fintech venture capital market push the most money in Q1, and why? Let’s dig in. Healthcare is the next wave of data liberation Image Credits: PM Images (opens in a new window)/ Getty Images Why can we see all our bank, credit card and brokerage data on our phones instantaneously in one app, yet walk into a doctor's office blind to our healthcare records, diagnoses and prescriptions? Our health status should be as accessible as our checking account balance. The liberation of healthcare data is beginning to happen, and it will have a profound impact on society — it will save and extend lives. What private tech companies should consider before going public via a SPAC Image Credits: cnythzl (opens in a new window) / Getty Images The red-hot market for special purpose acquisition companies, or SPACs, has "screeched to a halt.” As the SPAC market grew in the past six months, it seemed that everyone was getting into the game. But shareholder lawsuits, huge value fluctuations and warnings from the U.S. Securities and Exchange Commission have all thrown the brakes on the SPAC market, at least temporarily. So what do privately held tech companies that are considering going public need to know about the SPAC process and market? The era of the European insurtech IPO will soon be upon us Image Credits: Image Source (opens in a new window) / Getty Images Once the uncool sibling of a flourishing fintech sector, insurtech is now one of the hottest areas of a buoyant venture market. Zego's $150 million round at unicorn valuation in March, a rumored giant incoming round for WeFox, and a slew of IPOs and SPACs in the U.S. are all testament to this. It's not difficult to see why. The insurance market is enormous, but the sector has suffered from notoriously poor customer experience, and major incumbents have been slow to adapt. Fintech has set a precedent for the explosive growth that can be achieved with superior customer experience underpinned by modern technology. And the pandemic has cast the spotlight on high-potential categories, including health, mobility and cybersecurity. This has begun to brew a perfect storm of conditions for big European insurtech exits. The health data transparency movement is birthing a new generation of startups Image Credits: Busakorn Pongparnit (opens in a new window) / Getty Images The recent movement toward data transparency is bringing about a new era of innovation and startups. Those who follow the space closely may have noticed that there are twin struggles taking place: a push for more transparency on provider and payer data, including anonymous patient data, and another for strict privacy protection for personal patient data. What's the main difference, and how can startups solve these problems?

|

| Analytics as a service: Why more enterprises should consider outsourcing Posted: 30 Apr 2021 04:00 PM PDT With an increasing number of enterprise systems, growing teams, a rising proliferation of the web and multiple digital initiatives, companies of all sizes are creating loads of data every day. This data contains excellent business insights and immense opportunities, but it has become impossible for companies to derive actionable insights from this data consistently due to its sheer volume. According to Verified Market Research, the analytics-as-a-service (AaaS) market is expected to grow to $101.29 billion by 2026. Organizations that have not started on their analytics journey or are spending scarce data engineer resources to resolve issues with analytics implementations are not identifying actionable data insights. Through AaaS, managed services providers (MSPs) can help organizations get started on their analytics journey immediately without extravagant capital investment. MSPs can take ownership of the company’s immediate data analytics needs, resolve ongoing challenges and integrate new data sources to manage dashboard visualizations, reporting and predictive modeling — enabling companies to make data-driven decisions every day. AaaS could come bundled with multiple business-intelligence-related services. Primarily, the service includes (1) services for data warehouses; (2) services for visualizations and reports; and (3) services for predictive analytics, artificial intelligence (AI) and machine learning (ML). When a company partners with an MSP for analytics as a service, organizations are able to tap into business intelligence easily, instantly and at a lower cost of ownership than doing it in-house. This empowers the enterprise to focus on delivering better customer experiences, be unencumbered with decision-making and build data-driven strategies.

Organizations that have not started on their analytics journey or are spending scarce data engineer resources to resolve issues with analytics implementations are not identifying actionable data insights. In today’s world, where customers value experiences over transactions, AaaS helps businesses dig deeper into their psyche and tap insights to build long-term winning strategies. It also enables enterprises to forecast and predict business trends by looking at their data and allows employees at every level to make informed decisions. |

| Daily Crunch: Europe charges Apple with antitrust breach Posted: 30 Apr 2021 03:33 PM PDT Apple faces an antitrust complaint in Europe, TikTok has a new CEO and YouTube TV disappears from Roku. This is your Daily Crunch for April 30, 2021. Also, this is my last day at TechCrunch, and therefore my last day writing The Daily Crunch. It’s been a blast rounding up the news for all of you, and thank you to everyone who took the time to tell me they enjoyed the newsletter. On Monday, TechCrunch will be debuting a more collaborative approach to The Daily Crunch — stay tuned! The big story: Europe charges Apple with antitrust breach The European Commission has filed preliminary charges against Apple, focusing on complaints by Spotify that Apple’s App Store policies — particularly its requirements around in-app purchase — are anti-competitive. “The Commission takes issue with the mandatory use of Apple's own in-app purchase mechanism imposed on music streaming app developers to distribute their apps via Apple's App Store," it wrote. "The Commission is also concerned that Apple applies certain restrictions on app developers preventing them from informing iPhone and iPad users of alternative, cheaper purchasing possibilities." Apple has 12 weeks to respond to the charges. The tech giants ByteDance CFO assumes role as new TikTok CEO — Eight months after former TikTok CEO Kevin Mayer quit in the midst of a full-court press from the Trump administration, TikTok finally has a new permanent leader. Roku removes YouTube TV from its channel store following failed negotiations — Earlier this week, Roku warned customers that the YouTube TV app may be removed from its streaming media players and TVs, and it alleged that Google was leveraging its monopoly power during contract negotiations to ask for unfair terms. Computer vision inches toward 'common sense' with Facebook's latest research — One development Facebook has pursued in particular is what's called "semi-supervised learning." Startups, funding and venture capital Developer-focused video platform Mux achieves unicorn status with $105M funding — "I think video's eating software, the same way software was eating the world 10 years ago." As concerns rise over forest carbon offsets, Pachama's verified offset marketplace gets $15M — The startup is building a marketplace for forest carbon credits that it says is more transparent and verifiable thanks to its use of satellite imagery and machine learning technologies. Heirlume raises $1.38M to remove the barriers of trademark registration for small businesses — Heirlume’s machine-powered trademark registration platform turns the process into a self-serve affair that won't break the budget. Advice and analysis from Extra Crunch Optimism reigns at consumer trading services as fintech VC spikes and Robinhood IPO looms — But services that help consumers trade might need to retool their models over time to ensure long-term income. Amid the IPO gold rush, how should we value fintech startups? — If there has ever been a golden age for fintech, it surely must be now. The health data transparency movement is birthing a new generation of startups — Twin struggles seem to be taking place: a push for more transparency on provider and payer data, and another for strict privacy protection for personal patient data. (Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.) Everything else Cloud infrastructure market keeps rolling in Q1 with almost $40B in revenue — That's up $2 billion from last quarter and up 37% over the same period last year. The second shot is kicking in — A new episode of the Webby-nominated Equity podcast. Pitch your startup to seasoned tech leaders, and a live audience, on Extra Crunch Live — We’re bringing the pitch-off format to Extra Crunch Live. The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here. |

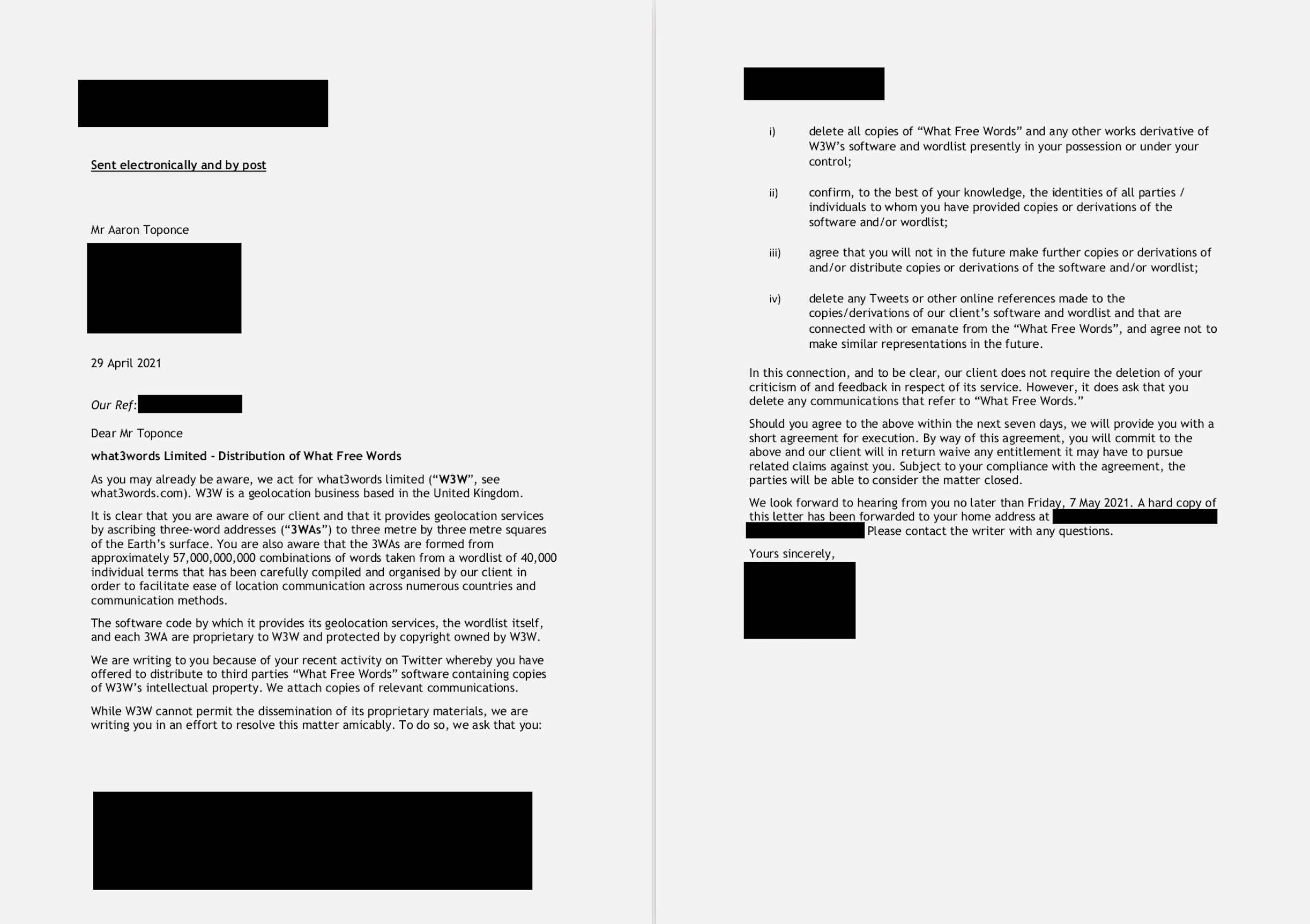

| What3Words sends legal threat to a security researcher for sharing an open-source alternative Posted: 30 Apr 2021 02:41 PM PDT A U.K. company behind digital addressing system What3Words has sent a legal threat to a security researcher for offering to share an open-source software project with other researchers, which What3Words claims violate its copyright. Aaron Toponce, a systems administrator at XMission, received a letter on Thursday from a law firm representing What3Words, requesting that he delete tweets related to the open-source alternative, WhatFreeWords. The letter also demands that he disclose to the law firm the identity of the person or people with whom he had shared a copy of the software, agree that he would not make any further copies of the software and to delete any copies of the software he had in his possession. The letter gave him until May 7 to agree, after which What3Words would “waive any entitlement it may have to pursue related claims against you,” a thinly-veiled threat of legal action. “This is not a battle worth fighting,” he said in a tweet. Toponce told TechCrunch that he has complied with the demands, fearing legal repercussions if he didn’t. He has also asked the law firm twice for links to the tweets they want deleting but has not heard back. “Depending on the tweet, I may or may not comply. Depends on its content,” he said.  The legal threat sent to Aaron Toponce. (Image: supplied) U.K.-based What3Words divides the entire world into three-meter squares and labels each with a unique three-word phrase. The idea is that sharing three words is easier to share on the phone in an emergency than having to find and read out their precise geographic coordinates. But security researcher Andrew Tierney recently discovered that What3Words would sometimes have two similarly-named squares less than a mile apart, potentially causing confusion about a person’s true whereabouts. In a later write-up, Tierney said What3Words was not adequate for use in safety-critical cases. It’s not the only downside. Critics have long argued that What3Words’ proprietary geocoding technology, which it bills as “life-saving,” makes it harder to examine it for problems or security vulnerabilities. Concerns about its lack of openness in part led to the creation of the WhatFreeWords. A copy of the project’s website, which does not contain the code itself, said the open-source alternative was developed by reverse-engineering What3Words. “Once we found out how it worked, we coded implementations for it for JavaScript and Go,” the website said. “To ensure that we did not violate the What3Words company’s copyright, we did not include any of their code, and we only included the bare minimum data required for interoperability.” But the project’s website was nevertheless subjected to a copyright takedown request filed by What3Words’ counsel. Even tweets that pointed to cached or backup copies of the code were removed by Twitter at the lawyers’ requests. Toponce — a security researcher on the side — contributed to Tierney’s research, who was tweeting out his findings as he went. Toponce said that he offered to share a copy of the WhatFreeWords code with other researchers to help Tierney with his ongoing research into What3Words. Toponce told TechCrunch that receiving the legal threat may have been a combination of offering to share the code and also finding problems with What3Words. In its letter to Toponce, What3Words argues that WhatFreeWords contains its intellectual property and that the company “cannot permit the dissemination” of the software. Regardless, several websites still retain copies of the code and are easily searchable through Google, and TechCrunch has seen several tweets linking to the WhatFreeWords code since Toponce went public with the legal threat. Tierney, who did not use WhatFreeWords as part of his research, said in a tweet that What3Words’ reaction was “totally unreasonable given the ease with which you can find versions online.” We asked What3Words if the company could point to a case where a judicial court has asserted that WhatFreeWords has violated its copyright. What3Words spokesperson Miriam Frank did not respond to multiple requests for comment. |

| How UK-based Lendable is powering fintechs across emerging markets Posted: 30 Apr 2021 01:42 PM PDT What moves the needle for digital lenders is serving loans to their respective customers. But where does this money come from? The pool is usually equity or debt. While some lenders use the former, it can be seen as folly because, over time, the founders tend to lose ownership of their businesses after giving out too much equity to raise capital for loans. Hence the reason why most lending companies secure debt facilities. TechCrunch has recently reported on two prominent digital lenders (also digital banks in their own rights) gaining steam in Africa — Carbon and FairMoney. In 2019, Carbon secured $5 million in debt financing and the following year, FairMoney did the same but raised a higher sum, $13 million. Enter Lendable, the UK-based firm responsible for supplying both lenders with debt finance. The company with offices in Nairobi, New York, and Singapore advances loans to fintechs across eight markets in Africa, Southeast Asia, and Latin America. Since launching in 2014, the company has disbursed over $125 million to these fintechs — SME lenders, payment platforms, asset lenders, marketplaces, and consumer lenders. In a phone conversation with TechCrunch, Samuel Eyob, a principal at the firm, said the company is raising almost $180 million to continue its investment efforts across the three continents. “We want to raise more than $180 million and we have investors that have committed cash to us,” he said. “Right now, we’re already investing out of that amount because we’ve already closed on a bunch of it. Ideally, the goal is to invest that amount over this year.” Lendable was founded by Daniel Goldfarb and Dylan Friend. It was based on an insight that they had while Daniel was a partner at Greenstart, a venture capital firm focused on data, finance and energy. That insight was that the poorest people in the world pay the most for goods and services, so if capital markets could provide a path to ownership, that could help individuals build assets. So the pair set out to solve this by providing capital to fintechs catering to the needs of these people. Eyob, a first-generation American from Ethiopia, knows what a lack of access to fair finance does to people and countries. Given the millions of people and businesses not effectively served by banks and MFIs, Eyob joined the team to drive financial inclusion in these markets. “Over a billion people still lack access to financial services and multiple reports indicate that the financing gap for micro and small businesses is trillions of dollars and growing. We believe this is a massive opportunity. So, whilst we started in Africa, the lack of access to fair financing solutions is a problem across all emerging markets, which we want to address,” he said.  Samuel Eyob (Principal, Lendable) So in 2014, Lendable started as a SaaS platform to democratize access to African capital markets by providing risk and analytics software. “We hoped to do this by bringing the securitization market from the Global North into Africa,” Eyob added. The company built an analytics platform to analyze loans and used machine learning to predict loan portfolio cashflows. In addition to that, they created an automated investment platform helping ventures to raise nondilutive (not equity) capital to help scale their businesses. After sufficiently proving out its tech, the firm made a pivot. According to Eyob, the previous model wasn’t experiencing enough growth and was incurring unsustainable costs. So the company began raising capital based on its own analytics in 2016. It had only raised $600,000 and was focused on East African startups with SME financing and Pay-Go solar home models. That number has since increased to over $125 million across Africa, Southeast Asia and Latin America. So why do these companies actually need debt financing? Here’s a clearer picture of the instance used at the beginning of this piece. Imagine a VC-backed startup whose ultimate goal is to help scale up female-founded SMEs with one-year loans. The startup could easily use its equity to provide the capital for all the one-year loans. The payoff from the loans, after one year, would be the interest due to them. Or, it could put that capital into hiring developers, build a go-to-market strategy, hire a CTO, all of which would likely have payoffs that are up to a 100x multiple of the interest they would have made on the single SME loan that is tied up for an entire year. So ultimately, debt would be an ideal source of nondilutive capital for the startup as they wouldn't have to tie up equity for one year. Therefore, debt would be a much cheaper source of capital to scale up their operations, especially if it has scaled up to having tens of thousands of one-year loans. If it were equity, they would have to raise an endless amount with constant dilution as they scale. In its five years of official operations, Lendable has given debt facilities to more than 20 startups. While the stage at which Lendable gives money differs, it is particular about startups that are post Series A. Apart from Carbon and FairMoney, some startups to have raised debt from Lendable include Tugende, Uploan, KoinWorks, Planet42, TerraPay, Watu Credit, Trella, Amartha, Payjoy, Solar Panda, Cars45 and MFS Africa. Collectively, Eyob said, Lendable has reached 1.2 million end borrowers through its partners and helped finance up to 290,000 SMEs. Of the $125 million disbursed so far as debt, Eyob said the company has a default rate of about 0.01%. The reason behind this low number, Eyob reckons, is because Lendable ensures to be in constant conversation with the companies offering help, advice or connections when necessary. “We view lending as a partnership and typically when both parties act in good faith, there are ways to solve problems,” Eyob said. The debt facilities start at $2 million but can go up to over $15 million, Eyob said. But while the global standard at which lenders pay back their debt investments is typically 4 to 6 years, Lendable expects the companies it gives cash to do so in 3 to 4 years. Eyob pushes that founders in emerging markets should be willing to take more debt financing to scale their startups. These days, startups tend to be high on giving out equity instead of weighing options on effectively using debt in critical points when scaling. Equity could be used to help attract the best talent or expand into new markets. Still, debt proves essential when scaling up capital-intensive operations like working capital or pre-funding activities. More often than not, debt and equity are complementary to one another, and Lendable is hoping to use the new funds it’s raising to push that notion. “I think, just like everywhere else in the world, debt and equity are tools that should be used to support one another, supporting the venture’s ultimate mission. We have lasting relationships with multiple VC teams across emerging markets that we work with to ultimately support one another's partner investees.”

|

| Basecamp sees mass employee exodus after CEO bans political discussions Posted: 30 Apr 2021 01:38 PM PDT Following a controversial ban on political discussions earlier this week, Basecamp employees are heading for the exits. The company employs around 60 people, and roughly a third of the company appears to have accepted buyouts to leave, many citing new company policies. On Monday, Basecamp CEO Jason Fried anounced in a blog post that employees would no longer be allowed to openly share their “societal and political discussions” at work. “Every discussion remotely related to politics, advocacy or society at large quickly spins away from pleasant,” Fried wrote. “You shouldn't have to wonder if staying out of it means you're complicit, or wading into it means you're a target.” Basecamp’s departures are significant. According to Twitter posts, Basecamp’s head of design, head of marketing and head of customer support will all depart. The company’s iOS team also appears to have quit en masse and many departing employees have been with the company for years. The no-politics rule at Basecamp follows a similar stance that Coinbase CEO Brian Armstrong staked out late last year. Armstrong also denounced debates around “causes or political candidates” arguing that such discussions distracted from the company’s core work. About 60 members of Coinbase’s 1,200 person staff took buyouts in light of the internal policy change — a ratio that makes the exodus at Basecamp look even more dramatic. Like Coinbase, Basecamp was immediately criticized for muzzling its employees over important issues, many of which disproportionately impact marginalized employees. Drawing the line on “political” topics becomes murky very quickly for any non-white or LGBTQ employees, for whom many issues that might be seen as political in nature in some circles — the Black Lives Matter movement, for instance — are inextricably and deeply personal. It’s not a coincidence these grand stands against divisive “politics” at work issue down from white male tech executives. “If you’re in doubt as to whether your choice of forum or topic for a discussion is appropriate, please ask before posting,” Basecamp CTO David Heinemeier Hansson wrote in his own blog post, echoing Fried. According to Platformer, Fried’s missive didn’t tell the whole story. Basecamp employees instead said the tension arose from internal conversations about the company itself and its commitment to DEI work, not free-floating arguments about political candidates. Fried’s blog post does mention one particular source of tension in a roundabout way, referencing an employee-led DEI initiative that would be disbanded. “We make project management, team communication, and email software,” Fried wrote. “We are not a social impact company.”

|

| How to attract large investors to your direct investing platform Posted: 30 Apr 2021 01:30 PM PDT Many fintech startups have tried to become a market-maker between investors and investment opportunities. However, the challenge with this two-sided market is: How do you get the investors to show up? It's hard enough to get retail investors, but family offices and other large check writers are even more challenging to lure. I've been meeting lately with an increasing number of family offices interested in investing directly into companies in lieu of via funds. As a result, I've started investigating some of the online platforms that enable direct investing. For instance, those focused on:

Tim Friedman, the founder of PE Stack, observes that the interest in direct access to alternatives has been so strong that "platforms like Delio have emerged, which provide technology to allow institutions that already have relationships with buy- and sell-sides to quickly launch robust private investment platforms. Delio built an ESG-focused direct private investment platform for Barclays' wealth management division, for example." Note that I’m specifically excluding from this analysis firms that help investors access investment funds, for instance: CAIS, Context365, iCapital Network, OurCrowd, Palico, PrimeAlpha and Trusted Insight. Investors there are outsourcing the decision-making about individual investments to the general partners. |

| Facebook is buying the developer behind VR shooter ‘Onward’ Posted: 30 Apr 2021 01:15 PM PDT After a steady stream of studio acquisitions in late 2019 and early 2020, Facebook has been a little quieter in recent months when its came to bulking up its VR content arm. Today, the social media giant breaks that stream, announcing their acquisition of Downpour Interactive, the developer of the popular VR first-person shooter Onward. The title, which is available on the company’s Rift and Quest platforms, as well as through Valve’s Steam store, has been among virtual reality’s top sellers in recent years. Facebook says that the title will continue to be available on non-Facebook VR hardware going forward. It’s an interesting deal, particularly after the company’s recent attempt to create an ambitious first-person shooter of its own, partnering with Apex Legends developer Respawn Entertainment and dumping millions into a Medal of Honor VR title that was tepidly received among reviewers after its release this past December. Facebook didn’t share terms of the Downpour deal, though they noted that the entire team will be joining Oculus Studios. In a blog post detailing the deal, Mike Verdu, Facebook’s VP of AR/VR Content, called Onward a “multiplayer masterpiece.” |

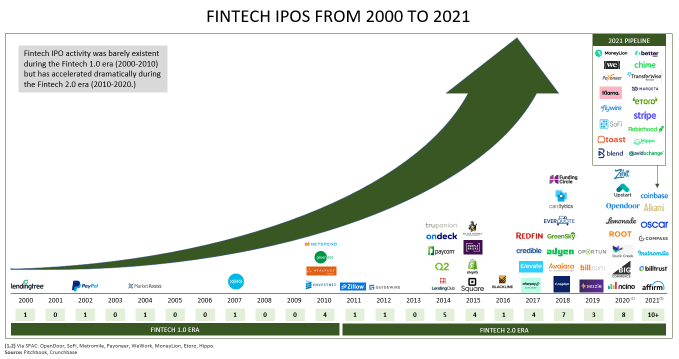

| Amid the IPO gold rush, how should we value fintech startups? Posted: 30 Apr 2021 12:13 PM PDT If there has ever been a golden age for fintech, it surely must be now. As of Q1 2021, the number of fintech startups in the U.S. crossed 10,000 for the first time ever — well more than double that if you include EMEA and APAC. There are now three fintech companies worth more than $100 billion (Paypal, Square and Shopify) with another three in the $50 billion-$100 billion club (Stripe, Adyen and Coinbase). Yet, as fintech companies have begun to go public, there has been a fair amount of uncertainty as to how these companies will be valued on the public markets. This is a result of fintechs being relatively new to the IPO scene compared to their consumer internet or enterprise software counterparts. In addition, fintechs employ a wide variety of business models: Some are transactional, others are recurring or have hybrid business models. In addition, fintechs now have a multitude of options in terms of how they choose to go public. They can take the traditional IPO route, pursue a direct listing or merge with a SPAC. Given the multitude of variables at play, valuing these companies and then predicting public market performance is anything but straightforward.

It is important to note that fintech is a complex category with many different types of players, and not all fintech is created equal. The fintech gold rush has arrivedFor much of the past two decades, fintech as a category has been very quiet on the public markets. But that began to change considerably by the mid-2010s. Fintech had clearly arrived by 2015, with both Square and Shopify going public that year. Last year was a record one with eight fintech IPOs, and there has been no slowdown in 2021 — the first four months have already produced seven IPOs. By our estimates, there are more than 15 additional fintech companies that could IPO this year. The current record will almost certainly be shattered well before the end of the year.  Image Credits: Oak HC/FT |

| Roc Nation’s VC Neil Sirni lays out his investment strategy Posted: 30 Apr 2021 11:35 AM PDT Jay-Z’s Roc Nation announced in 2017 that it was forming a venture investment arm called Arrive. And the firm has been busy since then — co-founder and president Neil Sirni said Arrive has made 29 investments thus far. At the same time, Sirni hasn’t really said much about those investments publicly, or about the broader strategy. So he reached out to me a few months ago, suggesting that he was ready to provide more details about Arrive. “We're now three years, 29 investments in and expanding — so it felt like the right time to start opening up a bit,” he said. Over the course of a few back-and-forth emails, we discussed how Arrive fits into the larger aims of Roc Nation, how Sirni (a former Goldman Sachs executive) makes investment decisions and where he’s focusing next. (Spoiler: Southeast Asia is a big part of that answer.) He was also eager to provide testimonials from Arrive’s portfolio companies — for example, Outlier.org founder Aaron Rasmussen said that “when Arrive commits to your mission, they commit,” while Helm co-founder and CEO Giri Sreenivas said that the firm “brings something that I don't see in traditional institutional investors — legitimate operational expertise around brand and marketing.” You can read our email Q&A, lightly edited for length and style, below. What is Arrive and how does it fit into the larger Roc Nation umbrella? Arrive is Roc Nation's venture platform. Roc Nation is a full-service music and sports management, music publishing and entertainment company founded by Jay-Z. Roc Nation and its affiliated companies have built a diversified business that employs several hundred people. These businesses include artist and athlete representation, a portfolio of spirit brands, an apparel line, a philanthropy division that manages four charitable organizations, a content streaming service, a digital team that oversees social media accounts with over 1.4 billion followers, a sales and marketing division that works on countless partnerships with Fortune 500 companies, communications, video production and live event production, among others. The Roc Nation infrastructure can add value to many different types of businesses across various stages, which is why we created Arrive. For consumer-facing businesses, Arrive leverages the Roc Nation infrastructure to help companies with branding, creative, marketing, communications and other services. For enterprise, we use our broad network of B2B relationships to help with business development. Being a strategic venture investor on the cap table of a portfolio company is not only about the investment but also how much human capital a fund can deploy to drive long-term, real and unique value for entrepreneurs and their businesses. So, we're leveraging the broader Roc Nation platform to help portfolio companies and, in turn, receiving access to great entrepreneurs. What kinds of investments do you normally make — types of companies, size of investment, etc.? We're relatively sector and stage agnostic. We have dedicated capital in an early-stage fund that tends to focus on Series A to Series C, but we've also started SPV growth and pre-IPO investments as we lay the foundation for a dedicated growth vehicle later this year. How do you make investment decisions? Is Jay-Z involved in the process? We gravitate toward companies that we can provide meaningful assistance to but that are outside of Roc Nation's core industries of music and traditional sports. Thanks to our platform, that is an extremely broad opportunity set. To date, we've made 29 investments under the Arrive umbrella in everything from fintech, insurtech, edtech, health & wellness, social and gaming. Geographically, we're investing roughly 80% in North America, primarily the U.S., and 20% across Southeast Asia, namely, Singapore, Indonesia and Vietnam. As a strategic investor, we never lead deals and always co-invest. Our long-term focus is on driving real and unique value for our portfolio companies. If we remain hyper-focused on this mission, we believe we have the opportunity to build an enduring brand as a top-tier strategic investor. Jay-Z approves every Arrive opportunity; he, Juan Perez and Desiree Perez are overwhelmingly supportive of Arrive and what we're collectively trying to accomplish. What’s your biggest success story so far? I'm very proud of being co-founder of Arrive and what it took to get here. In the grand scheme of things, we're just getting started, but I've been an entrepreneur — after leaving a large public company — for over 10 years now. It's been a roller coaster with many sacrifices, but I can understand and relate to our founders and their journey, which makes this experience even more rewarding. The founders of Roc Nation have built their businesses brick by brick as well, so the entire organization is united by this entrepreneurial mindset. I still consider myself a founder and operator first, whose business happens to be making investments.  NEW YORK, NY – OCTOBER 20: Jay-Z performs during Tidal X: 1020 at Barclays Center on October 20, 2015 in the Brooklyn borough of New York City. (Photo by Taylor Hill/FilmMagic) Given that Arrive has been around for a few years, what made you feel like this is the time to start talking more openly about the fund? When Arrive launched a few years ago, I hated the idea of talking about what we're going to do. Instead, we wanted to quietly actually go do it; learn, improve, build and, in the process, demonstrate that we're not, and never will be, tourists in the venture ecosystem. We're now three years, 29 investments in and expanding — so it felt like the right time to start opening up a bit. What’s an example of an investment where working with Arrive/Roc Nation led to gains beyond the financial investment? Arrive functions like many other investors in that we spend time understanding a company's vision and then try to provide them meaningful levers to pull to help drive their success. Our toolkit is unique thanks to the Roc Nation platform and network. We've found that both our portfolio companies and their other investors, typically traditional venture funds, find those levers complementary and additive to the cap table. Arrive typically works with portfolio companies across three main areas. The first is creative and brand marketing. The second is business development and partnerships. The third is communications. Communications efforts are generally focused on driving short-term or immediate awareness. Many of our portfolio companies receive broader press coverage when we invest in them. That initial attention typically dies down within a week or two, although those news stories remain as searchable assets that the company might not otherwise have. While this can be of some value, especially for consumer businesses, we believe it's at the bottom of the list compared to the long-term benefits that can be derived from Roc Nation's underlying infrastructure in brand marketing and business development. In terms of creative and brand marketing, we've likely saved our earlier-stage portfolio, in aggregate, over a million dollars by providing brand and agency work at no cost. Examples of this include campaign ideation, graphic design, video production, hosting live events and product integrations, among other activities. For business development and partnerships support, we have leveraged our network to help portfolio companies launch their own internal philanthropic platforms, leveraged our B2B relationships to introduce new partners and customers, brought in other strategic investors in a targeted way, helped companies navigate endorsement deals and recruited non-technical executive talent to join their companies. We don't pretend to be a magic bullet, no investor can be, but we're focused on continuously improving and building on the services that we provide to our portfolio companies. The founder journey is never a straight line and we pride ourselves on being willing to do whatever we can on their behalf. Stephen Francis, SVP at Arrive, and I are accessible to our portfolio companies any day and time. Do you see these investments as primarily strategic for Roc Nation, or are you focused on financial returns? 'Strategic' investor, in the context of Arrive, refers to the strategic value that we bring to the cap table of a portfolio company. We leverage that strategic value to get into deals and form relationships with entrepreneurs in whom we have high conviction. Our ultimate goal is financial return and Arrive's investments are not meant to be strategic in nature for Roc Nation as an operating company. Instead, an investment from Arrive is meant to be strategic for the portfolio company. You said you’re stage agnostic with capital devoted to different stages. Can you say anything more about what the breakdown is in terms of early-stage versus later-growth deals, and how that might change with the new growth fund? Of our 29 investments, I would classify 25 as early-stage and four as growth. In regards to percentage of capital, the four growth investments account for a little over 35% of total capital deployed. When we do have a dedicated growth fund, I expect the volume of growth investments to pick up to roughly three-six per year. What are your priorities for 2021? At a high level our priorities are to build out a larger team to ensure that we're staying very engaged with the portfolio as we scale and to continue being aggressive in deploying more capital to back great companies. On a more granular level I'm looking forward to physically getting back to Southeast Asia, namely Singapore, Indonesia and Vietnam, on a regular basis. We're really bullish on the region and believe it's only a matter of time before more venture funds deploy significant capital there. We started to invest a lot of time there in 2019 as part of our plan to deploy roughly 30% of our early-stage fund in the region. That expansion has been hindered by COVID-19. However, I'll make quarterly trips once travel normalizes. There is nothing like in-person interaction to build relationships and trust, especially internationally. |

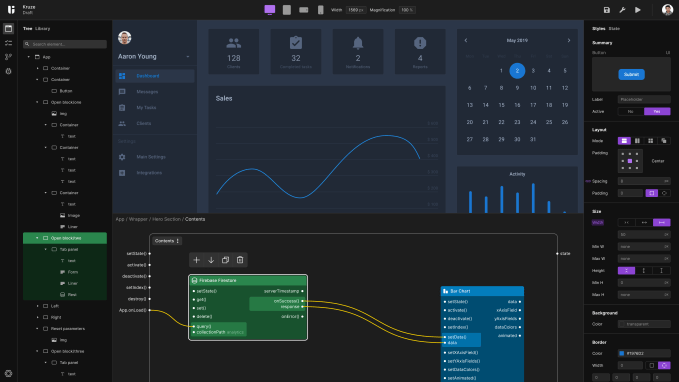

| Y Combinator-backed Uiflow wants to accelerate no-code enterprise app creation Posted: 30 Apr 2021 11:34 AM PDT TechCrunch recently caught up with recent Y Combinator graduate Uiflow, a startup that is building a no-code enterprise app creation service. If you are thinking wait, don’t a number of companies already do that?, the answer is yes. But what Quickbase, Smartsheet and others are working on isn’t quite the same thing, at least from the startup’s perspective. Uiflow, a Bay Area-based concern that has been alive for far less than a year, has built an app creation tool that works with whatever backend a large company currently employs, and helps its development team build apps collaboratively. As the startup explained in a public posting, customer developers can import Figma files while their engineers can use existing UI libraries, and product managers can quickly vet an app’s logic. The service is akin to a “cross between Unity and Figma,” Uiflow says. Here’s what its own user interface looks like, per a screenshot the company provided to TechCrunch after an interview:

Per Y Combinator, the company has closed a pre-seed round of more than $500,000. The company told TechCrunch that it has been talking to investors lately — as essentially every Y Combinator-backed startup does after their public unveiling — but appears to be holding off raising more capital until it fully launches self-service of its product; the company may also accelerate its hiring efforts once its self-serve GTM motion is more broadly available. The startup told TechCrunch that after its Product Hunt launch it picked up around 1,200 signups. It’s vetting the group and letting in some as pilot customers. Those customers currently pay the company, so it has revenue, although the startup is more product-focused at the moment than centered around boosting its short-term revenues. Uiflow thinks that its target customers are companies with 250 or more workers, the scale at which a company begins to start thinking about its own UI elements. However, Uiflow is talking to companies with 100 to 1,000 customers, it said. The five-person team is building a service in a market that is more than active at the moment. As TechCrunch has explored, private-market investors are bullish on the no-code space, especially after the COVID-19 pandemic bolstered the pace at which companies large and small moved toward digital solutions. No-code and low-code services came into greater demand as accelerating digital transformation efforts met the market’s general dearth of available developer talent. TechCrunch has covered the no-code space extensively in recent quarters, given both rising market demand for its products and what seemed to be growing investor demand for shares in startups pursuing the model. All that’s to say that there’s a reasonable chance that we’ll hear from Uiflow soon regarding a fresh capital raise. Let’s see how long that takes. In the meantime, here’s a photo of the Uiflow team. In 2021-style, it’s a Zoom shot:  From upper left, clockwise: Michael Tildahl, Eric Rowell (CTO and co-founder), Brian Lichliter, Rocco Cataldo and D. Sol Eun (CEO and co-founder). Via the company.

|

| Pitch your startup to seasoned tech leaders, and a live audience, on Extra Crunch Live Posted: 30 Apr 2021 10:54 AM PDT TechCrunch is known for its pitch-offs. We’ve had them in cities all over the world, and heard from hundreds of startups who have shared the story of their company on our stages. We’re excited to be bringing the pitch-off to Extra Crunch Live. Anyone in the audience on an episode of Extra Crunch Live can virtually “raise their hand” to be selected to pitch in front of the audience and get feedback from our all-star guests. On ECL, pitch-off startups will have two minutes to tell us about their company. This is the equivalent of an elevator pitch — imagine running into a VC or potential customer at a tech conference like Disrupt or bumping into them at a park. As such, no visual aids are allowed, including decks, videos, demoes, etc. Essentially, what can you convey with your words, in a short time frame, to get people to both understand your startup and be excited about it? This is a critical skill, and we’re creating the space for founders to practice and improve. I’m amped to have Firstmark’s Rick Heitzmann and Orchard founder Court Cunningham as guests on Extra Crunch Live on May 5. This founder/investor duo know exactly what it takes to deliver a great pitch. Do you have what it takes? You can register here for free! To be selected for the pitch-off, you must be present in the audience during the live show. Instructions on how to raise your hand will come at the top of the show, so don’t be late! See you on Wednesday! |

| ByteDance CFO assumes role as new TikTok CEO Posted: 30 Apr 2021 10:06 AM PDT Eight months after former TikTok CEO Kevin Mayer quit in the midst of a full-court press from the Trump administration against the Chinese-owned social media giant, TikTok finally has a new permanent leader. ByteDance’s recently hired CFO Shouzi Chew will be assuming the role as TikTok CEO while still holding the CFO role at its parent organization, the company announced Friday morning. It’s a bold move, likely signaling that the company believes that the worst of its tussles with the U.S. executive branch are over as President Biden has seemed uninterested in picking up former President Trump’s pet project. Vanessa Pappas, who was serving as interim CEO, will take the role of COO going forward. “The leadership team of Shou and Vanessa sets the stage for sustained growth,” ByteDance CEO Yiming Zhang said in a press release. “Shou brings deep knowledge of the company and industry, having led a team that was among our earliest investors, and having worked in the technology sector for a decade. He will add depth to the team, focusing on areas including corporate governance and long-term business initiatives.” Prior to joining ByteDance earlier this year, Chew was an executive at Xiaomi, with stints at DST and Goldman Sachs earlier in his career.

|

| Riot Games updates its privacy notice to start developing voice comms moderation Posted: 30 Apr 2021 10:02 AM PDT Anyone who has played a video game with voice chat in the past decade knows that there is some risk involved. You might be greeted by friendly teammates, but you may also hear some of the most toxic language you’ve ever heard in your life. Riot Games, the game developer behind ultra popular titles like League of Legends and Valorant, is thinking hard about this. And taking action. The developer is today announcing changes to its privacy notice that allow for it to capture and evaluate voice comms when a report is submitted around disruptive behavior. The changes to the policy are Riot-wide, meaning that all players across all games will need to accept those changes. However, the only game that is scheduled to utilize these new abilities is Valorant, as it is the most voice chat-heavy game from Riot. The plan here is to store relevant audio data in the account’s registered region and evaluate it to see if the behavior agreement was violated. This process is triggered by a report being submitted, and is not an always-on system. If a violation has occurred, the data will be made available to the player in violation and will ultimately be deleted once there is no further need for it following reviews. If no violation is detected, the data will be deleted. Before we go any further, let me just say that this is a big fucking deal. Publishers and developers have long known that toxicity in gaming is not only a terrible user experience, but it’s actively preventing large swaths of potential gamers from dedicating themselves to it. “Players are experiencing a lot of pain in voice comms and that pain takes the form of all kinds of different disruption in behavior and it can be pretty harmful,” said Head of Players Dynamics Weszt Hart. “We recognize that, and we have made a promise to players that we will do everything that we could in this space.” Voice chat often makes games much richer and more fun. Particularly during the pandemic, people are craving more human connection. But in a tense environment like competitive games, that connection can turn sour. As a gamer myself, I can safely say that some of the most hurtful experiences of my life have been while playing video games with strangers. To be clear, Riot isn’t getting specific with how exactly this voice chat moderation will work. The first step is the update to its privacy notice, which gives players a heads up and gives the company the right to start evaluating voice comms. It’s incredibly difficult to police voice comms. Not only do you need to be transparent with users and update any legal documents (which is arguably the easiest step, and the one Riot is taking today), but you must develop the right technology to do this, all while protecting player privacy. I spoke with Hart and Data Protection Officer and CISO Chris Hymes about the changes. The duo said that the actual system for detecting behavior violations within voice comms is still under development. It may focus on automated voice-to-text transcription, and go through the same system as text chat moderation, or it may rely more heavily on machine learning to actually detect an infringement via voice alone. “We’re looking at the technologies and we’re trying to land on the one that we want to launch with,” said Hart. “We’ve been putting a lot of time and effort into space and we have a pretty good idea of the direction that we’re going to take. But what we want to do is to have some audio to work with, to better understand if any other approaches that we’re looking at are going to be the best. To do this, we need to be able to process something real, and not just make a good guess.” To get to that answer as quickly as possible, he added, the first step of updating the privacy notice had to go into effect. Hart and Hymes also said that some layer of human moderation will be involved to ensure that whatever system is being developed is working properly and can ultimately be rolled out to other languages and other titles, as the system is initially being developed for Valorant in North America. Advances in machine learning and natural language processing are making that development easier than it was 10, or even two, years ago. But even in a world where a machine learning algorithm could accurately detect hate speech, with all its nuances, there is yet another hurdle. Gamers, even from one title to the next, have their own language. There is a whole lexicon of words and terms used by gamers that aren’t used in every day life. This adds yet another complication to the process of developing this system. Still, this is a critical step in ensuring that Riot Games titles, and hopefully other titles as well, become an inclusive environment where anyone who wants to game feels safe and able to do so. And Riot is careful to understand that developing games is a holistic endeavor. Everything from game design to anti-cheating measures to behavior guidelines and moderation have an effect on the overall experience of the player. Alongside this announcement, the company is also introducing an update to its terms of service with an updated global refund policy and new language around anti-cheat software for current and future Riot titles. |

| Cloud gaming service Shadow taken over by OVHcloud founder Posted: 30 Apr 2021 09:40 AM PDT Blade, the French startup behind cloud gaming service Shadow, has been acquired by Octave Klaba's fund following a commercial court order. Klaba is better known as the founder of OVHcloud, a French cloud hosting company. He's acquiring Blade (and Shadow) through his investment fund Jezby Ventures — not OVHcloud. Shadow is a cloud computing service for gamers. People can pay a monthly subscription fee and gain access to a gaming PC in a data center. You can connect to this PC from your computer, a smartphone, a tablet or a smart TV. You can see a video stream of what's happening on the screen and your actions are relayed to the server. Unlike Google Stadia, Amazon Luna or even Nvidia GeForce Now, you can install whatever you want on your server. You get a full Windows 10 instance so it supports anything from Steam to Photoshop and Excel. While the French startup has raised more than $100 million across multiple funding rounds, the company couldn't keep up with pre-orders, didn't generate enough revenue to be self-sustainable and couldn't find cash to expand its service. Despite attracting 100,000 paid users, Next INpact reported that the company had no choice but to go into administration with the commercial court. Several companies and a group of people submitted takeover bids. In particular, Blade CTO Jean-Baptiste Kempf teamed up with other employees, while Octave Klaba submitted his own offer. Klaba plans to keep all employees except Jean-Baptiste Kempf. Now, it's going to be interesting to see how the service changes over the coming weeks. Subscriptions currently start at €12.99 per month in Europe or $11.99 per month in the U.S. It's unclear whether Shadow will remain available at this price point, how specifications are going to evolve and if the company is going to spin up more servers to attract new clients.

|

| Sequoia’s Mike Vernal will share how to iterate with tempo at TC Early Stage in July Posted: 30 Apr 2021 09:28 AM PDT TC Early Stage is back in July and we have a fantastic lineup in store that’s laser-focused on marketing and fundraising. That includes, but is not limited to, Sequoia’s Mike Vernal, whose portfolio companies include Citizen, PicsArt, Whisper, Threads, Houseparty and more. Vernal will be leading a discussion on tempo and product-market fit. The chat stems from Vernal’s experience as an investor, sharing the lesser-known keys to success to not only secure early investment, but to use it to secure a later-stage investment. In essence, tempo is everything. At the earliest stage, investors are looking more at the team than the product, knowing that the likelihood of the product changing and evolving is high. That means that the ability to adapt — including the systems in place to collect feedback and willingness to continue iterating — are incredibly important factors. Vernal will not only stress the importance of tempo and product iteration (and how it relates to fundraising success), he’ll also share how both enterprise and consumer companies should go about creating these feedback loops with customers and how to iterate quickly. Vernal joined Sequoia as a partner in 2016. He currently sits on the boards of Citizen, Jumpstart, rideOS, PicsArt, Rockset, Threads and Whisper. Before Sequoia, Mike was VP at Facebook, where he led a variety of product and engineering teams. He co-created Facebook Login and the Graph API. In other words, he’s seen and participated in success, and has done the work of product iteration himself. Vernal joins a stellar lineup of speakers at TC Early Stage in July, including Norwest Venture Partners’ Lisa Wu, Greylock’s Mike Duboe and Cleo Capital’s Sarah Kunst, among many others that are soon to be announced. One of the great things about TC Early Stage is that the show is designed around breakout sessions, with each speaker leading a chat around a specific startup core competency (like fundraising, designing a brand, mastering the art of PR and more). Moreover, there is plenty of time for audience Q&A in each session. Pick up your ticket for the event, which goes down July 8 and 9, right here. And if you do it before the end of the day today, you’ll save a cool $100 off of your registration.

|

| Optimism reigns at consumer trading services as fintech VC spikes and Robinhood IPO looms Posted: 30 Apr 2021 09:08 AM PDT With the Coinbase direct listing behind us and the Robinhood IPO ahead, it's a heady time for consumer-focused trading apps. Mix in the impending SPAC-led debut of eToro, general bullishness in the cryptocurrency space, record highs for some equities markets and recent rounds from Public.com, M1 Finance and U.K.-based Freetrade, and you could be excused for expecting the boom in consumer asset trading to keep going up and to the right. But will it? There are data in both directions. While recent information could indicate that some of the most lucrative trading activity at companies like Robinhood could be slowing, there's also encouraging app download information that paints a more bullish picture regarding the durability of the boom in consumer interest regarding savings and investing, which The Exchange has had an eye on for some time. The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday. Our question today is this: How bullish are companies in the space about continued consumer interest in equities and other asset trading? And why? We'll also put similar questions to their backers.

We'll start with a short look at some data to help ground ourselves regarding where consumer trading demand appears to be today, then consider what the companies in the ring and their backers are thinking. We'll close with a synthesis of all the perspectives to come up with hype-adjusted expectations for the rest of 2021. Bullish data, bearish dataCoinbase executed its direct listing on the back of one of the most impressive quarters we've ever seen in the realm of business results, meaning it began to trade when it looked just about as good as a company can. Will the same hold true for Robinhood and company? |