TechCrunch |

- Danish startups Responsibly raises $2M to benchmark supply chains on climate, diversity

- PayEm comes out of stealth with $27M and its answer to the expense report

- “Autonomous accounting” platform Vic.ai raises $50M round led by ICONIQ Growth

- Vector design tool Vectornator raises $20M round led by EQT Ventures

- CoachHub raises $80M in Series “B2” round, as coaching goes digital in the pandemic

- Trustshare runs escrow infrastructure as a service to facilitate online sales

- Oviva grabs $80M for app-delivered healthy eating programs

- VanMoof raises $128 million to become the world’s leading e-bike brand

- Reframe your Metaphors, and other lessons from Y Combinator S21 Day 1

- Sanas aims to convert one accent to another in real time for smoother customer service calls

- Our favorite startups from YC’s Summer 21 Demo Day, Part 1

- Olsam raises $165M to buy up and scale consumer and B2B Amazon Marketplace sellers

- Tribe and Arkam back Jar app to help millions in India start their savings journey

- Here are all the companies from Y Combinator’s Summer 2021 Demo Day, Part 1

- Daily Crunch: Databricks reaches $38B billion valuation with $1.6B Series H

- Yandex buys out Uber’s stake in Yandex Self-Driving Group, Eats, Lavka and Delivery for $1B

- CryptoPunks creator inks representation deal with major Hollywood talent agency

- LinkedIn is scrapping its Stories feature to work on short-form video

- Cheeterz Club wants to make reading glasses hip

- A popular smart home security system can be remotely disarmed, researchers say

| Danish startups Responsibly raises $2M to benchmark supply chains on climate, diversity Posted: 01 Sep 2021 04:26 AM PDT If the world is to reach NetZero, and avoid climate disaster it needs to make every product sustainable and that means every purchase. But to do that you need a lot more transparency, so that means more data on suppliers to improve sourcing and benchmarking companies. While companies are often doing their best, the problem with issues like CO2 emissions lies in the supply chain. Danish startup Responsibly, reckons it has the answers in providing retailers, builders, and others with a supply network a scorecard against this supply chain of providers. Thus, a company can check if any level of its supply chain is involved in deforestation, water pollution, as well as human rights violations or gender pay gap issues. It's now raised a $2 million pre-seed investment round led by Flash Ventures. Also participating is Pirate Impact (the family-office of Fabian & Ferry Heilemann) and Michael Wax, Founder and CEO of Planetly Benedikt Franke. The startup will now soft-launch the first version of its platform which will look at the supplier data of more than 10,000 suppliers for pilot customers. Responsibly's co-Founder and CEO Thomas Buch Andersson said: “If we can make it as easy for purchasers to evaluate how their suppliers compare on a planetary agenda, as it is to compare them on price, then we think we can unlock the huge force for change that’s sitting in the world’s procurement departments." Being developed with Google's Startup Advisor: Sustainable Development Goals Program, Responsibly Johann Nordhus Westarp, Founding Partner at Flash Ventures said: "The timing is perfect, and companies will fundamentally change the way they procure in the next couple of years. Price- or value-driven procurement will give way to impact-driven procurement. Companies are acting somewhat blindly today, treading-water to solve the 'problem of the day'. Responsibly helps them finally get visibility into their procurement footprints and make forward-thinking decisions for all the right reasons." According to CDP, some 40% of global GHG emissions are driven or influenced companies through their purchases and the products they sell. Meanwhile, Gartner found that 23% of supply chain leaders expect to have a digital ecosystem by 2025, up from only 1% today. Speaking to me over a call Buch Andersson said: “The space for responsible sourcing has really evolved quite a lot over the past 20 years. We are building a layer on top of all of the different data providers to essentially allow the procurement team to flexibly read any information, interpret it and then use it for sourcing decision making." Responsibly competes with EcoVadis and Integrity Next. |

| PayEm comes out of stealth with $27M and its answer to the expense report Posted: 01 Sep 2021 04:00 AM PDT Itamar Jobani was a software developer working for a medical company and "hated that time of the month" when he had to use the company's chosen reimbursement tool. "It was full of friction and as part of the company's wellness team, I felt an urge to take care of the employee experience and find a better tool," Jobani told TechCrunch. "I looked for something, but didn't find it, so I tried to build it myself." What resulted was PayEm, an Israeli company he founded with Omer Rimoch in 2019 to be a spend and procurement platform for high-growth and multinational organizations. Today, it announced $27 million in funding that includes $7 million in seed funding, led by Pitango First and NFX, with participation by LocalGlobe and Fresh Fund, as well as $20 million in Series A funding led by Glilot+. The company's technology automates the reimbursement, procurement, accounts payable and credit card workflows to manage all of the requests and invoices, while also creating bills and sending payments to over 200 territories in 130 currencies. It gives company finance teams a real-time look at what items employees are asking for funds to buy, and what is actually being spent. For example, teams can submit a request and go through an approval flow that can be customized with purchasing codes tied to a description of the transaction. At the same time, all transactions are continuously reconciled versus having to spend hours at the end of the month going through paperwork. "Organizations are running in a more democratized way with teams buying things on behalf of the organization," Jobani said. "We built a platform to cater to those needs, so it's like a disbursement platform instead of a finance team always being in charge." The global B2B payments market is valued at $120 trillion annually and is expected to reach $200 trillion by 2028, according to payment industry newsletter Nilson Report. PayEm is among many B2B payments startups attracting venture capital — for example, last month, Nium announced a $200 million in Series D funding at a $1 billion valuation. Paystand raised $50 million in Series C funding to make B2B payments cashless, while Dwolla raised $21 million for its API that allows companies to build and facilitate fast payments. Meanwhile, PayEm itself saw accelerated growth in the second quarter of 2021, including increasing its transaction volume by four times over the previous quarter and generating millions of dollars in revenue. It now boasts a list of hundreds of customers like Fiverr, JFrog and Next Insurance. It also launched new features like the ability to create corporate cards. The company, which also has an office in New York, has 40 employees currently, and the new funds will enable the company to triple its headcount, focusing on hiring in the United States, and to bring additional features and payment capabilities to market. "Each person can have a budget and a time frame for making the purchase, while accounting still feels in control," Jobani added. "Everyone now has the full context and the right budget line item." |

| “Autonomous accounting” platform Vic.ai raises $50M round led by ICONIQ Growth Posted: 01 Sep 2021 03:35 AM PDT Vic.ai, a startup that has built an AI-based platform it claims can 'automate’ enterprise accounting, has raised a $50M Series B round led by ICONIQ Growth, with participation from existing investors GGV Capital, Cowboy Ventures and Costanoa Ventures, bringing total capital raised to $63 million. The company's customers include HSB (Sweden's largest real-estate management company), Intercom Inc. and HireQuest Inc., as well as accounting firms KPMG, PwC, BDO, and Armanino LLP. Vic.ai says its platform has processed more than 535 million invoices with 95 percent accuracy. Vic.ai says it can do this by learning from historical data and existing processes to deliver more automation in accounting processes thus saving time, reducing errors and duplicates. Alexander Hagerup, CEO of Vic.ai (launched in 2017) said: "It's 2021, and it's high time for finance and accounting teams to embrace AI technology. Accounting work is tedious and repetitive, but it no longer needs to be. Our AI platform delivers both autonomy and intelligence for finance and accounting teams." Will Griffith, founding partner at ICONIQ Growth said Vic.ai team "demonstrates the same passion, product focus and customer-first mentality that we see in other exceptional founders." |

| Vector design tool Vectornator raises $20M round led by EQT Ventures Posted: 01 Sep 2021 03:05 AM PDT It's an age-old tech industry story: company comes up with a tool to solve its own problem, then realizes the tool is actually worth more than the existing company. Something similar happened to Linearity. Its 17-year-old founder, Vladimir Danila, came up with the Vectornator tool to make vector design easier in 2017. It's now used by Apple, Disney, Wacom and Microsoft. Disney uses Vectornator to create artwork for hotels in Disneyland, in fact. The vector-focused platform has now raised a $20 million funding round led by EQT Ventures together with 468 Capital. It's been joined by Angels including Bradley Horowitz (VP Product, Google), Jonathan Rochelle (Co-Founder Google Docs, Google Spreadsheets, Google Slides, Google Drive), Charles Songhurst (Ex. Corporate Strategy, Microsoft) and Lutz Finger (Group Product Manager, Google). Ted Persson, Partner at EQT Ventures commented: "For me, there were two clear sides to joining forces with the Linearity team. Vladimir is a very clear-cut founder who has built an outstanding product. Design tools are some of the hardest tools to build, but Vladimir and his team have shown that anything is possible." Investor interest in design tools has exploded since the success of Canva, which is now valued at $15 billion. |

| CoachHub raises $80M in Series “B2” round, as coaching goes digital in the pandemic Posted: 01 Sep 2021 02:24 AM PDT The world of professional coaching has grown over the years as coaches realised they could easily counsel people remotely and clients realized digital coaching was far more efficient. But, equally, a problem arose in how to sift the wheat from the chaff. At the same time corporates realised that their own staff could benefit – but faced the same sifting problem. In a classic Internet play, CoachHub came along three years ago and applied AI to a marketplace to do the sifting. All well and good, but with training and personal development going almost completely digital due to the pandemic, the market has exploded. Berlin-based CoachHub has now raised $80m in a Series “B2” funding, increasing its total Series B capital to $110m. Investors Draper Esprit, RTP Global, HV Capital, Signals Venture Capital, Partech, and Speedinvest all participated bringing the total funds raised to $130m, since 2019. Last year it raised a $30 million Series B round, also led by Draper Esprit, alongside existing investors HV Capital, Partech, Speedinvest, signals Venture Capital, and RTP Global. The startup competes with other aggregators such as AceUp out of Boston, which has raised $2.3M. |

| Trustshare runs escrow infrastructure as a service to facilitate online sales Posted: 01 Sep 2021 12:43 AM PDT Meet Trustshare, a London-based startup that is working on escrow infrastructure for online classified, B2B marketplaces, trade directories and more. It's a white-label platform that can be integrated with online marketplaces in just a few lines of code. If you've ever tried to sell something expensive on the web, you know that it's hard to know for sure that you're not getting scammed. For instance, that person that is trying to buy your old phone from you — should you send the phone first or ask the buyer to send the money first? If a marketplace relies on Trustshare for payments, buyers first have to checkout and leave money into a dedicated transaction-based account. Trustshare can also handle identity verification steps, such as KYC and AML checks (Know Your Customer and Anti-Money Laundering). The seller can check the status of the funds. Once the buyer has received the product, they can release funds to the seller. Behind the scenes, Trustshare generates a dedicated IBAN per transaction. Customers can deposit money using bank transfers or cards. In the U.K. and Europe, Trustshare takes advantage of open banking regulation so that users can connect to their bank account from the checkout flow. If you don't want to tweak your site's code, you can also use Trustshare for offline sales and transactions that happen over email or messaging apps. The company lets you generate QR codes or payment links to initiate a payment. The startup has raised an angel round from several business angels, such as Cazoo and Zoopla founder Alex Chesterman and Carwow founder James Hind. After that, Trustshare raised a $3.2 million seed round (£2.3 million) led by Nauta Capital. Many companies could leverage Trustshare to launch their own marketplace as escrow payment is one of the biggest pain points. For instance, you can imagine luxury brands launching their own marketplaces of handbags and watches, new car marketplaces focused on one type of cars in particular, etc. "Our 5 lines of code branded escrow checkout is taking many marketplaces, brands that consumers know and trust, transactional. Really, this is just the start. Our borderless escrow infrastructure is incredibly powerful, and we plan to launch new products including instant pay-throughs, baskets and projects to make payments as quick and easy as sending an email," co-founder and CEO Nick Fulton said in a statement. Trustshare is built on top of existing payment infrastructure. That's why it supports 180 countries and 30 currencies already. The company's initial clients include Watchcollecting, Bookabuilder and U.K. trade body FENSA's Deposit Protection service. |

| Oviva grabs $80M for app-delivered healthy eating programs Posted: 31 Aug 2021 11:15 PM PDT UK startup Oviva, which sells a digital support offering, including for Type 2 diabetes treatment, dispensing personalized diet and lifestyle advice via apps to allow more people to be able to access support, has closed $80 million in Series C funding — bringing its total raised to date to $115M. The raise, which Oviva says will be used to scale up after a “fantastic year” of growth for the health tech business, is co-led by Sofina and Temasek, alongside existing investors AlbionVC, Earlybird, Eight Roads Ventures, F-Prime Capital, MTIP, plus several angels. Underpinning that growth is the fact wealthy Western nations continue to see rising rates of obesity and other health conditions like Type 2 diabetes (which can be linked to poor diet and lack of exercise). While more attention is generally being paid to the notion of preventative — rather than reactive — healthcare, to manage the rising costs of service delivery. Lifestyle management to help control weight and linked health conditions (like diabetes) is where Oviva comes in: It’s built a blended support offering that combines personalized care (provided by healthcare professionals) with digital tools for patients that help them do things like track what they’re eating, access support and chart their progress towards individual health goals. It can point to 23 peer-reviewed publications to back up its approach — saying key results show an average of 6.8% weight loss at 6 months for those living with obesity; while, in its specialist programs, it says 53% of patients achieve remission of their type 2 diabetes at 12 months. Oviva typically sells its digitally delivered support programs direct to health insurance companies (or publicly funded health services) — who then provide (or refer) the service to their customers/patients. Its programs are currently available in the UK, Germany, Switzerland and France — but expanding access is one of the goals for the Series C. “We will expand to European markets where the health system reimburses the diet and lifestyle change we offer, especially those with specific pathways for digital reimbursement,” Oviva tells TechCrunch. “Encouragingly, more healthcare systems have been opening up specific routes for such digital reimbursement, e.g., Germany for DiGAs or Belgium just in the last months.” So far, the startup has treated 200,000 people but the addressable market is clearly huge — not least as European populations age — with Oviva suggesting more than 300 million people live with “health challenges” that are either triggered by poor diet or can be optimised through personalised dietary changes. Moreover, it suggests, only “a small fraction” is currently being offered digital care. To date, Oviva has built up 5,000+ partnerships with health systems, insurers and doctors as it looks to push for further scale by making its technology more accessible to a wider range of people. In the past year it says it’s “more than doubled” both people treated and revenue earned. Its goal is for the Series C funding is to reach “millions” of people across Europe who need support because they’re suffering from poor health linked to diet and lifestyle. As part of the scale up plan it will also be growing its team to 800 by the end of 2022, it adds. On digital vs face-to-face care — setting aside the potential cost savings associated with digital delivery — it says studies show the “most striking outcome benefits” are around uptake and completion rates, noting: “We have consistently shown uptake rates above 70% and high completion rates of around 80%, even in groups considered harder to reach such as working age populations or minority ethnic groups. This compares to uptake and completion rates of less than 50% for most face-to-face services.” Asked about competition, Oviva names Liva Healthcare and Second Nature as its closest competitors in the region. “WW (formally Weight Watchers) also competes with a digital solution in some markets where they can access reimbursement,” it adds. “There are many others that try to access this group with new methods, but are not reimbursed or are wellness solutions. Noom competes as a solution for self-paying consumers in Europe, as many other apps. But, in our view, that is a separate market from the reimbursed medical one.” As well as using the Series C funding to bolster its presence in existing markets and target and scale into new ones, Oviva says it may look to further grow the business via M&A opportunities. “In expanding to new countries, we are open to both building new organisations from the ground up or acquiring existing businesses with a strong medical network where we see that our technology can be leveraged for better patient care and value creation,” it told us on that.

|

| VanMoof raises $128 million to become the world’s leading e-bike brand Posted: 31 Aug 2021 09:00 PM PDT Amsterdam-based startup VanMoof has raised a $128 million Series C funding round. The company designs and sells electric bikes that are quite popular in some markets. It now wants to become the world's leading e-bike brand by iterating at a faster pace. Asia-based private equity firm Hillhouse Investment is leading the round, with Gillian Tans, the former CEO of Booking.com, also participating. Some existing investors also put some more money on the table, such as Norwest Venture Partners, Felix Capital, Balderton Capital and TriplePoint Capital. Today's Series C represents a big jump compared to the company's Series B. Last year, VanMoof raised a $40 million Series B. Overall, if you add it all up, the startup has raised $182 million in total. If you're not familiar with VanMoof's e-bikes, TechCrunch reviewed both the most recent S3 and X3 models. On paper, they are identical. The VanMoof X3 features a smaller frame and smaller wheels. What makes VanMoof different from your average e-bike manufacturer is that the company tries to control everything from the supply chain to the customer experience. VanMoof e-bikes are premium e-bikes that are primarily designed for city rides. The most recent models currently cost $2,298 or €2,198. They feature an electric motor paired with an electronic gear shifting system. It has four gears and you don't have to change gears yourself. All you have to do is jump on the bike and start pedaling. Recognizable by their iconic triangular-shaped futuristic-looking frames, the S3 and X3 also come with hydraulic brakes, integrated lights and some smart features. There's an integrated motion detector combined with an alarm, a GPS chip and cellular connectivity. If you declare your bike as stolen, the GPS and cellular chips go live and you can track your bike in the VanMoof app. The company's bikes are now also compatible with Apple's Find My app. Instead of relying exclusively on off-the-shelf parts, the company works with a small set of suppliers to manufacture custom components. This way, it can cut out as many middleperson as possible to bring costs down. It's also a good competitive advantage. Growing a company like VanMoof is a capital-intensive business. The company has opened retail stores and service hubs in 50 different cities around the world. While the company started in Europe, the U.S. is now the fastest growth market for VanMoof. With today's funding round, the startup plans to double-down on its current strategy. You can expect updated bikes with refined designs and more custom parts. You can expect more stores and service hubs around the world. And you can probably expect more online sales as well. "It will help us get 10 million people on our bikes in the next five years," co-founder and CEO Taco Carlier said in a statement. So far, there are 150,000 people using VanMoof bikes. Today's investment shouldn't come as a surprise. The coronavirus pandemic has accelerated plans to transform European cities — and prioritize bikes over cars. Last year, TechCrunch's Natasha Lomas and I wrote a comprehensive overview of key policy developments in four major cities — Paris, Barcelona, London and Milan. VanMoof is now benefiting from these policy shifts. |

| Reframe your Metaphors, and other lessons from Y Combinator S21 Day 1 Posted: 31 Aug 2021 04:47 PM PDT After a 17-hour marathon through nearly 200 startup pitches, the Equity team was fired up to get back on Twitter and chat through some early trends and favorites from the first day of Y Combinator’s demo party. We’ll be back on the air tomorrow, so make sure you’re following the show on Twitter so you don’t miss out. What did Natasha and Alex chat about? The following:

TechCrunch has extensive coverage of the day on the site, so there’s lots to dig into if you are in the mood. More tomorrow! Equity drops every Monday at 7:00 a.m. PDT, Wednesday, and Friday at 6:00 a.m. PDT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts! |

| Sanas aims to convert one accent to another in real time for smoother customer service calls Posted: 31 Aug 2021 04:23 PM PDT In the customer service industry, your accent dictates many aspects of your job. It shouldn’t be the case that there’s a “better” or “worse” accent, but in today’s global economy (though who knows about tomorrow’s) it’s valuable to sound American or British. While many undergo accent neutralization training, Sanas is a startup with another approach (and a $5.5 million seed round): using speech recognition and synthesis to change the speaker’s accent in near real time. The company has trained a machine learning algorithm to quickly and locally (that is, without using the cloud) recognize a person’s speech on one end and, on the other, output the same words with an accent chosen from a list or automatically detected from the other person’s speech. It slots right into the OS’s sound stack so it works out of the box with pretty much any audio or video calling tool. Right now the company is operating a pilot program with thousands of people in locations from the U.S. and U.K. to the Philippines, India, Latin America and others. Accents supported will include American, Spanish, British, Indian, Filipino and Australian by the end of the year. To tell the truth, the idea of Sanas kind of bothered me at first. It felt like a concession to bigoted people who consider their accent superior and think others below them. Tech will fix it … by accommodating the bigots. Great! But while I still have a little bit of that feeling, I can see there’s more to it than this. Fundamentally speaking, it is easier to understand someone when they speak in an accent similar to your own. But customer service and tech support is a huge industry and one primarily performed by people outside the countries where the customers are. This basic disconnect can be remedied in a way that puts the onus of responsibility on the entry-level worker, or one that puts it on technology. Either way the difficulty of making oneself understood remains and must be addressed — an automated system just lets it be done more easily and allows more people to do their job. It’s not magic — as you can tell in this clip, the character and cadence of the person’s voice is only partly retained and the result is considerably more artificial sounding: But the technology is improving and like any speech engine, the more it’s used, the better it gets. And for someone not used to the original speaker’s accent, the American-accented version may very well be more easily understood. For the person in the support role, this likely means better outcomes for their calls — everyone wins. Sanas told me that the pilots are just starting so there are no numbers available from this deployment yet, but testing has suggested a considerable reduction of error rates and increase in call efficiency. It’s good enough at any rate to attract a $5.5 million seed round, with participation from Human Capital, General Catalyst, Quiet Capital and DN Capital. “Sanas is striving to make communication easy and free from friction, so people can speak confidently and understand each other, wherever they are and whoever they are trying to communicate with,” CEO Maxim Serebryakov said in the press release announcing the funding. It’s hard to disagree with that mission. While the cultural and ethical questions of accents and power differentials are unlikely to ever go away, Sanas is trying something new that may be a powerful tool for the many people who must communicate professionally and find their speech patterns are an obstacle to that. It’s an approach worth exploring and discussing even if in a perfect world we would simply understand one another better. |

| Our favorite startups from YC’s Summer 21 Demo Day, Part 1 Posted: 31 Aug 2021 04:11 PM PDT Y Combinator kicked off its fourth-ever virtual Demo Day today, revealing the first half of its nearly 400-company batch. The presentation, YC's biggest yet, offers a snapshot into where innovation is heading, from not-so-simple seaweed to a Clearco for creators. The TechCrunch team stuck to its tradition of covering every single company live (but, you know, from home) so you'll find all of the Day One companies here. For those who want a sampling of standouts, however, we're also bringing you a host of our favorites from today's one-minute pitch-off extravaganza. As reporters, we're constantly inundated with hundreds of pitches on a daily basis. The startups below caught our picky attention for a whole host of reasons, but that doesn't mean other startups weren't compelling or potential unicorns as well. Instead, consider the below to be a data point on which startups made us do a double take, be it due to the size of the market opportunity, the ambition exhibited by the founding team or an idea that was just too clever to pass up. GeneiGenei is, dare I say, a refreshing mashup between robots and writers. The startup has a simple goal: Automatically summarize background reading so content creators can grab the top facts, attribute and move onto the next graf. Writing is innately an art, so I find Genei’s positioning as a tool for writers instead of a replacement out to take their jobs as smart. Better yet, it’s launching by targeting some of the hardest workers in our industry: freelance writers. These folks often have to balance consistent pitches, diverse assignments and tight deadlines for their livelihood, so I’d presume a sidekick can’t hurt. Down the road, I could totally see this startup playing the same role as a Grammarly: a helpful extension of workflows that optimizes the way people who write for a living, write. — Natasha |

| Olsam raises $165M to buy up and scale consumer and B2B Amazon Marketplace sellers Posted: 31 Aug 2021 04:00 PM PDT On the heels of Heroes announcing a $200 million raise earlier today, to double down on buying and scaling third-party Amazon Marketplace sellers, another startup out of London aiming to do the same is announcing some significant funding of its own. Olsam, a roll-up play that is buying up both consumer and B2B merchants selling on Amazon by way of Amazon’s FBA fulfillment program, has closed $165 million — a combination of equity and debt that it will be using to fuel its M&A strategy, as well as continue building out its tech platform and to hire more talent. Apeiron Investment Group — an investment firm started by German entrepreneur Christian Angermayer (known first for biopharmaceuticals, then investing and crypto, including playing a role in SoftBank investing in Wirecard) — led the Series A equity round, with Elevat3 Capital (another Angermayer firm that has a strategic partnership with Founders Fund and Peter Thiel) also participating. North Wall Capital was behind the debt portion of the deal. This appears to be the first significant funding of any kind announced by the company since it launched in October 2020. We have asked for more details about how the $165 million breaks down between equity and debt, and Olsam said it is only disclosing the full amount raised. Valuation is also not being disclosed. Being an Amazon roll-up startup from London that happens to be announcing a fundraise today are not the only two things that Olsam has in common with Heroes. Like Heroes, Olsam is also founded by brothers with track records that lend themselves to diving into becoming Marketplace consolidators. Sam Horbye previously spent years working at Amazon, including building and managing the company’s Business Marketplace in the UK (the B2B version of the consumer Marketplace). Co-founder Ollie Horbye had years of experience in strategic consulting and financial services. Between them, they had also quietly built and sold previous marketplace businesses, and they believe that this collective experience gives Olsam — a portmanteau of their names, “Ollie” and “Sam” — a leg up in areas like building relationships with merchants; identifying quality products amid the vast sea of search results that often feel like they are selling the same inexpensive junk as each other; understanding merchants’ challenges and opportunities; and critically building relationships with Amazon and understanding how the merchant ecosystem fits into the e-commerce giant’s wider strategy. Olsam is also taking a slightly different approach when it comes to target companies. Yes, it is focusing on the usual consumer play you hear about from consolidators — home & garden, sporting, baby and children products, and beauty are typical categories. But alongside that, it is also building out a strategy to sell those products, and others, on Amazon’s B2B portal — the one Sam helped build when he worked at Amazon. B2B selling includes items like office furniture and office supplies, but also electronics, automotive parts and accessories, kitchenware, and, actually, anything that is potentially sold on the consumer marketplace. The exception is that with business customers — as you get with members’ only stores in the physical retail world — they may get discounts for bulk purchases, tax breaks, and perhaps a slightly different mix of products more tailored to running their enterprises. B2B is currently one of the fastest-growing segments in Amazon’s Marketplace, and it is also one of the most overlooked.”It’s flying under the radar,” Ollie said. “The B2B opportunity is very exciting,” Sam added. “A growing number of merchants are selling office supplies or more random products to the B2B customer.” Estimates vary pretty wildly when it comes to how many merchants there are selling on Amazon’s Marketplace globally. I’ve seen estimates of 6 million and nearly 10 million. But altogether, those merchants generated $300 million in sales (gross merchandise value) last year, and that figure is growing by 50% each year at the moment. Amazon itself notes that online B2B sales as a category — beyond, but also including, on Amazon itself — is about 2.3 times bigger than its B2C counterpart. Combined with that opportunity, consolidating sellers — in order to achieve better economies of scale around supply chains, marketing tools and analytics, and more — is also big business. Olsam estimates that some $7 billion has been spent cumulatively on acquiring these businesses, and there are more out there: Olsam estimates that there are some 3,000 businesses in the UK alone making more than $1 million each in sales on Amazon’s platform. And to be clear, there are a number of other roll-up startups beyond Heroes also eyeing up that opportunity. Raising hundreds of millions of dollars in aggregate, others have made moves this year include Suma Brands ($150 million); Elevate Brands ($250 million); Perch ($775 million); factory14 ($200 million); Thrasio (currently probably the biggest of them all in terms of reach and money raised and ambitions), Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group (X2), Benitago, Latin America's Valoreo and Rainforest and Una Brands out of Asia. Sure, there may be room for all of these, and many more, to move into the roll-up opportunity, but it’s a more complicated equation in the longer run. That is one reason why so many of these companies also emphasize their organizational, M&A, and marketplace expertise: at the end of the day, the technology these well-capitalized startups build will only be as good as the merchants they manage to buy, and the business plans they subsequently execute around their conglomerations. “The senior team behind Olsam is what makes this business truly unique,” said Angermayer in a statement. "Having all been successful in building and selling their own brands within the market and having worked for Amazon in their marketplace team – their understanding of this space is exceptional.” |

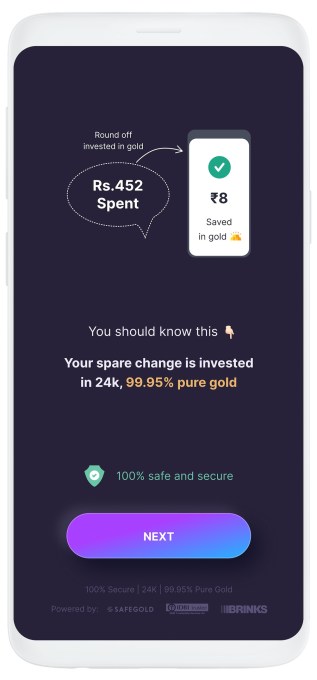

| Tribe and Arkam back Jar app to help millions in India start their savings journey Posted: 31 Aug 2021 03:51 PM PDT Even as hundreds of millions of people in India have a bank account, only a tiny fraction of this population invests in any financial instrument. Fewer than 30 million people invest in mutual funds or stocks, for instance. In recent years, a handful of startups have made it easier for users — especially the millennials — to invest, but the figure has largely remained stagnant. Now, an Indian startup believes that it has found the solution to tackle this challenge — and is already seeing good early traction. Nishchay AG, former director of mobility startup Bounce, and Misbah Ashraf, co-founder of Marsplay (sold to Foxy), founded Jar earlier this year. The startup's eponymous three-month-old Android app enables users to start their savings journey for as little as 1 Indian rupee. Users on Jar can invest in multiple ways and get started within seconds. The app works with Paytm (PhonePe support is in the works) to set up a recurring payment. (The startup is the first to use UPI 2.0's recurring payment support.) They can set up any amount between 1 Indian rupee to 500 for daily investments. The Jar app can also glean users' text messages and save a tiny amount based on each monetary transaction they do. So, for instance, if a user has spent 31 rupees in a transaction, the Jar app rounds that up to the nearest tenth figure (40, in this case) and saves nine rupees. Users can also manually open the app and spend any amount they wish to invest. Once users have saved some money in Jar, the app then invests that into digital gold. The startup is using gold investment because people in the South Asian market already have an immense trust in this asset class. India has a unique fascination for gold. From rural farmers to urban working class, nearly everyone stashes the yellow metal and flaunts jewelry at weddings. Indian households are estimated to have a stash of over 25,000 tons of the precious metal whose value today is about half of the country's nominal GDP. Such is the demand for gold in India that the South Asian nation is also one of the world's largest importers of this precious metal.  Jar’s Android app (Image Credits: Jar) "When you're thinking about bringing the next 500 million people to institutional savings and investments, the onus is on us to educate them on the efficacies of the other instruments that are in the market," said Nishchay. "We want to give them the instrument they trust the most, which is gold," he said. The startup plans to eventually offer several more investment opportunities, he said. The founders met several years ago when they were exploring if MarsPlay and Bounce could have any synergies. They stayed in touch and, last year during one of their many conversations, realized that neither of them knew much about investments. “That’s when the dots started to connect,” said Misbah, drawing stories from his childhood. “I come from a small town in Bihar called Bihar Sharif. During my childhood days, I saw my family deeply troubled with debt because of poor financial decisions and no savings,” he said. “We both understand what a typical middle class family goes through. Someone who comes from this background never had any means in the past but their aspirations are never-ending. So when you start earning, you immediately start to spend it all,” said Nishchay. “The market needs products that will help them get started,” he said. That idea, which is similar to Acorn and Stash’s play in the U.S. market, is beginning to make inroads. The app has already amassed about half a million downloads, the founders said. Investors have taken notice, too. On Wednesday, Jar announced it has raised $4.5 million from a clutch of high-profile investors, including Arkam Ventures, Tribe Capital, WEH Ventures, and angels including Kunal Shah (founder of CRED), Shaan Puri (formerly with Twitch), Ali Moiz (founder of Stonks), Howard Lindzon (founder of Social Leverage), Vivekananda Hallekere (co-founder of Bounce), Alvin Tse (of Xiaomi) and Kunal Khattar (managing partner at AdvantEdge). “Over 400 million Indians are about to embrace digital financial services for the first time in their lives. Jar has built an app that is poised to help them — with several intuitive ways including gamification — start their investment journey. We love the speed at which the team has been executing and how fast they are growing each week,” said Arjun Sethi, co-founder of Tribe Capital, in a statement. Transactions and AUM on the Jar app are surging 350% each month, said Nishchay. The startup plans to broaden its product offerings in the coming days, he said. |