StartupNation |

- An SOC 2 Audit: Why Your Business Should Get One

- Small-Scale Manufacturing is the Secret Sauce to Revive Downtowns

- How Venture Capitalist Diane Yoo Chooses Her Startup Investments

- WJR Business Beat: Equity Crowdfunding Plays Key Role in Funding Startups (Episode 320)

| An SOC 2 Audit: Why Your Business Should Get One Posted: 15 Nov 2021 09:00 PM PST Information security is more important than ever, and part of that includes conducting SOC 2 audits. SOC 2 stands for System and Organization Control 2 report. Simply put, an SOC 2 report is designed to instill confidence in business owners and stakeholders by proving that all operations are happening in a secure manner. However, there’s more to SOC 2 audits than that. Below we will cover this topic in more detail and explore why an SOC 2 audit is beneficial for your business. What is it?As mentioned, an SOC 2 audit is an examination that’s carried out by a CPA firm to determine if the service provided by your business or organization has enough security measures in place. The investigation is performed according to the general criteria set by the American Institute of Certified Public Accountants (AICPA). When you hire an auditor from a CPA firm, they will first look at the controls you already have in place to minimize risks to your business’ services. If there are any areas for improvement, the auditor will bring them up during this exercise. For instance, you may have to implement new controls or revamp existing controls to meet the applicable criteria. Once everything is in place, a CPA firm will perform the examination and prepare a report that describes your organization's system and the controls that support that system. In addition, depending on whether the report is a Type I or Type II, will include an opinion on certain aspects of your organization's control environment. A Type I SOC 2 indicates that these controls are designed effectively as of a point in time. In contrast, a Type II SOC 2 indicates that the controls not only have the correct design but have been shown to operate effectively within a specified period. What criteria is used?SOC 2 reports are guided by common criteria. More specifically, your service organization can choose from five SOC 2 Trust Services Criteria (TSC). Keep in mind that some TSCs may not apply to your business, so there’s no point in including them. In a nutshell, here are the five TSCs. SecurityThe security criteria look at whether your business system and infrastructure are adequately protected against physical and logical access from unauthorized persons. It checks security controls like physical security measures, firewalls, password protection and others to determine the level of protection. This security criteria is required; however, the other criteria are optional. AvailabilityThis criteria analyzes your system for availability. Meeting this criterion involves showing your plan and procedures for maintaining the flow of business operations in the event of unforeseen disruptions. Therefore, it’s necessary to back up your business system regularly as well as have a robust recovery plan. ConfidentialityIf your business has an agreement with another business to limit access to confidential and sensitive information, then this criteria might apply to you. PrivacyThe privacy criteria differ from the confidentiality criteria in that it concerns service organizations that gather confidential information and interact with data subjects directly. Processing integrityProcessing integrity verifies that your system is whole, and that there are measures in place to recognize and rectify errors. This TSC is usually applicable to businesses that deal with a lot of transactions. What’s included?An SOC 2 report includes the following information:

What are the benefits for your business?There are many benefits associated with SOC 2 reports. For starters, it’s important that you provide evidence to key stakeholders that they can rely on the security and reliability of your services. Your stakeholders need to know about the controls you have put in place and whether they are effective. SOC 2 audits enable you to reassure your stakeholders with one audit. In addition, the resulting SOC 2 report is one that everyone can trust. Otherwise, things can get expensive and hectic if all clients demand multiple audits on their own terms. It’s important for your business to be SOC 2 compliant, especially in a time where data breaches and hacks are the norm. Fortunately, SOC 2 audits are rarely complicated and will assure you and your clients of the effectiveness of your security controls. Related: How to Conduct a Small Business AuditThe post An SOC 2 Audit: Why Your Business Should Get One appeared first on StartupNation. |

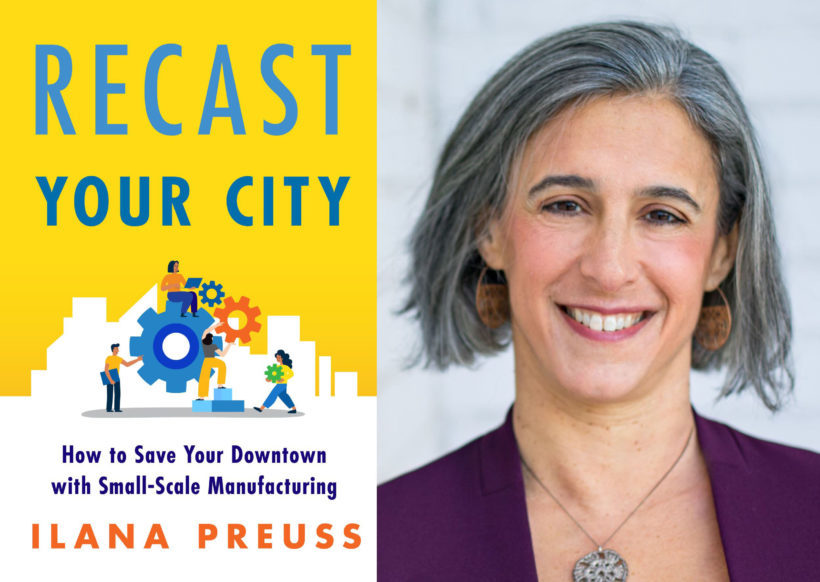

| Small-Scale Manufacturing is the Secret Sauce to Revive Downtowns Posted: 15 Nov 2021 09:00 PM PST

Excerpt from Recast Your City: How to Save Your Downtown with Small-Scale Manufacturing by Ilana Preuss .Copyright © 2021 Ilana Preuss. Reproduced by permission of Island Press, Washington, D.C. The Secret Sauce: Small-Scale ManufacturingSmall-scale manufacturing businesses create a tangible product—in any material—that can be replicated or packaged; my catch all is "hot sauce, handbags, and hardware." The business can be all about technology (for example, a supply chain business that uses 3D printers to supply parts for the Department of Defense) or can be artisan (for example, a consumer-facing business that handcrafts leather handbags). It can be food-based (beer or chocolate anyone?), or it can be food material-based (all-natural lotions). It can sell direct to consumers, sell wholesale to retailers, or sell into business-to-business supply chains. Such businesses are considered small scale because of their number of employees and the amount of space they need. Small-scale manufacturing businesses have fewer than fifty employees; most of the time, they have fewer than twenty. Their space needs are smaller, too; they generally need less than 5,000 square feet of space, and most need less than 1,000 to 2,000 square feet. They can operate in storefronts and smaller spaces that are not considered "manufacturing," and in general large, distant, industrial spaces don't serve their needs because of their small space requirements. In addition, these businesses are modern manufacturing and are most often quiet, clean, and great neighbors. Small-scale manufacturing businesses help us create thriving places, with business ownership opportunities and good-paying jobs that other business types cannot fulfill. They are the hidden gems in the economic development strategy and downtown reinvestment efforts of every place (yes, I really mean every place).

You already have some type of small-scale manufacturing business in your community, and as you learn more about these businesses in this book, you may start to notice them. One example is Katie Stack's shop, Stitch & Rivet in Northeast Washington, DC. There, you can walk in and see three employees busy at their sewing machines. Little pieces of leather are neatly piled in the table corners, and the sound of the machines makes the air hum with activity. The front of the small shop is filled with Stack's leather and waxed canvas bags alongside items from complementary producers—some jewelry, funny gift cards, and other small items that round out the shop. It is easy to see all the activity because this business is in an 800-square-foot micro-storefront alongside other small producers in a real estate development project called the Art Walk at Monroe Street Market, NE. Stitch & Rivet is one of a few dozen shops along this walkway. These businesses are an essential part of what makes this project work: they fill a pedestrian walkway with active storefronts that you can't find anywhere else in the city. These kinds of product businesses—called small-scale manufacturing—are a critical part of what makes local real estate and economic development work. I often call them hidden gems because they are in every community. The owners are working hard, with their heads down, and are rarely brought into discussions about downtown and business development opportunities, yet they are essential engines to local economies. Community wealth building Today, the power and energy behind local small business are more important than ever. Local efforts to buy from small businesses exploded during the COVID-19 shutdowns, bringing more and more people to focus on the importance of these businesses as the backbone of our local economies. Small-scale manufacturing businesses expand this opportunity. Residents are proud to see these businesses create and sell products. The product businesses can access a strong local market alongside a global market through the internet. As more people gravitate toward unique and custom products online, artisan businesses grow in power, and dollars spent on them are increasing. The power to build community wealth pairs with the national interest in unique products, allowing these business owners to bring revenue into the community from far away. Local residents can use their skills, be business owners, build community wealth, and retain what is special about the neighborhood's culture with these businesses. More economic opportunity Small-scale manufacturing businesses can make a major difference to help more people create economic opportunities, regardless of education or background. This business sector often includes many people who have been excluded from opportunities in the past. Someone who has an entrepreneurial spirit and the ability to make something can become a business owner; they just need the right support and the right space in town to become a thriving addition to the business community. Small-scale manufacturing businesses are found in every part of our communities and include people across racial, ethnic, immigrant, and income types. This kind of entrepreneurship can help families create economic opportunity for themselves and the people around them. Small-scale manufacturing businesses often hire from within the community and on average pay 50 to 100 percent more than retail or service jobs. Verizon Small Business Digital Ready: Learn basic business skills, the latest digital technology and more. |

| How Venture Capitalist Diane Yoo Chooses Her Startup Investments Posted: 15 Nov 2021 09:00 PM PST

With so many entrepreneurs and startup ventures seeking investment opportunities, it's crucial that venture capitalists (VCs) create a list of criteria they want their potential investments to meet. Of course, every VC dreams of investing in a business that can grow into a billion-dollar unicorn company, but these instances are few and far between. As such, VCs have to consider a number of factors when choosing which companies or entrepreneurs in whom to invest. With more than 15 years of experience coaching, mentoring and investing in hundreds of different companies and the entrepreneurial minds behind them, I myself am no stranger to stringently analyzing the management team, operating model, market opportunities and risk factors of the businesses that I ultimately choose to invest in. If you are an entrepreneur, startup founder or business owner wondering how you can best structure your pitch to acquire a VC investment, I offer some insight as to what my own process looks like when selecting a particular company or entrepreneur. A proven track record of successLike most other VCs and investors, one of the most important qualities I look for in any investment is the potential. That means the potential of the business' core team as a whole and as individuals. I have to ask myself, "Do the company's core leadership team and the individual people on it have the track record of success that can carry this company forward?" Likewise, if the company's CEO, in particular, doesn't have a proven track record as an entrepreneur, it's far less likely that they'll receive an investment. Both the potential and proven past successes of a venture's core team are a huge factor in determining whether they will receive investment capital. However, that does not necessarily mean that I refuse to invest in a company or team that is taking its first dive into the world of entrepreneurship. If a company's CEO or executive team possess the soft skills necessary to be a true leader — such as empathy, compassion, humility and a hunger to continue learning — this tells me that they would be a good candidate for mentorship, even if they aren't presently the best candidate to receive an investment. I always tell others to beware of uncoachable founders. Those sorts of entrepreneurs can land a fund or board in deep water if they aren't willing or able to change. Also by Diane Yoo: The Venture Capital Diversity Gap |

| WJR Business Beat: Equity Crowdfunding Plays Key Role in Funding Startups (Episode 320) Posted: 15 Nov 2021 08:55 AM PST

On today’s Business Beat, Jeff reveals the results of a Kings Crowd study on how online equity crowdfunding is changing the landscape for startups. Tune in to the Business Beat, below, to learn more about where the shifts in crowdfunding are changing:Tune in to News/Talk 760 AM WJR weekday mornings at 7:11 a.m. for the WJR Business Beat. Listeners outside of the Detroit area can listen live HERE. Are you an entrepreneur with a great story to share? If so, contact us at editor@startupnation.com and we'll feature you on an upcoming segment of the WJR Business Beat! Good morning, Paul! Well, it used to be that if you wanted to create and grow a fast-growth startup, the marching orders were go west. You better base yourself in Silicon Valley, but my how times are changing. As we’ve reported here on the Beat previously, there are many more deals getting done and startups getting financed across the country, including right here in the Midwest, like never before. Now, contributing to this positive change in part has been the success in getting startups funded through online equity crowdfunding. These platforms provide for the investment by qualified investors directly into startup companies through what’s known as a regulation offering, and given the decentralized nature of online startup investing platforms, you might guess that startups have become less localized to specific regions. The idea is that founders from anywhere in the country should be able to launch their companies anywhere in the country. That’s the idea anyway. Well Kings Crowd, one of these equity crowdfunding platforms, analyzed the state of origin for all equity crowdfunding raises from January 2018 through October 2021, to see if indeed certain areas of the country still dominate the launch of startups. And while online startup investing has made location less strict for companies, their research shows that in fact, we still see that certain regions dominate the country and startups. And where else but California? They’re the leader far and away. In fact, out of more than 3,000 companies in the database study by Kings Crowd, 868 of them, nearly one-third of the total, were launched in California. Following California in the top spots were New York, Florida, Texas and Massachusetts, which pretty much mirrors the historical trends. However, there was some interesting shuffling of the deck going on, namely that startups launched with online crowdfunding based in the South surpass the Northeast and the number of startups for the first time. So these figures seem to indicate that the decentralization of startups maybe is really starting to happen. I’m Jeff Sloan, founder and CEO of startupnation.com, and that’s today’s Business Beat on the Great Voice of the Great Lakes, WJR. The post WJR Business Beat: Equity Crowdfunding Plays Key Role in Funding Startups (Episode 320) appeared first on StartupNation. |

| You are subscribed to email updates from StartupNation. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment