TechCrunch |

- Hear NVP’s Priti Choksi and Birdies founder Bianca Gates explain how to land early-stage funding

- Northrop Grumman leads team to design an astronaut transportation vehicle for the lunar surface

- Facet raises $13M to add photo editing features Photoshop can only dream of

- Gooder Foods brings in $6.4M to offer its take on a more grown up mac n’ cheese

- Runway raises $2M seed, launches its ‘air traffic control’ system for mobile app releases

- Meadow launches Dynamic Delivery to bring mobile cannabis dispensaries to California

- CatalyzeX grabs $1.64M seed to help developers find right machine learning model

- Medium acquires Knowable to bring audio to the platform

- Contra partners with TikTok to add a little LinkedIn flavor to the social video app

- Pinterest launches TwoTwenty, its own in-house incubator for new projects

- Jumia posts revenue and order gains, but compounding losses drag its stock lower

- Huge deals are pushing more AI startups into IPO territory

- Threat intel startup SnapAttack lands $8M Series A following Booz Allen spinout

- South Africa’s NFTfi raises $5M so people can use their NFTs as collateral for loans

- Heyday raises $555M to buy up and scale more D2C brands in the Amazon marketplace universe

- UK opens in-depth probe of Nvidia-ARM deal, citing national security and competition concerns

- EasySend raises $55.5M for a no-code platform to build online interactions with customers

- Real estate marketing software provider Luxury Presence raises $25.9M in a Bessemer-led Series B

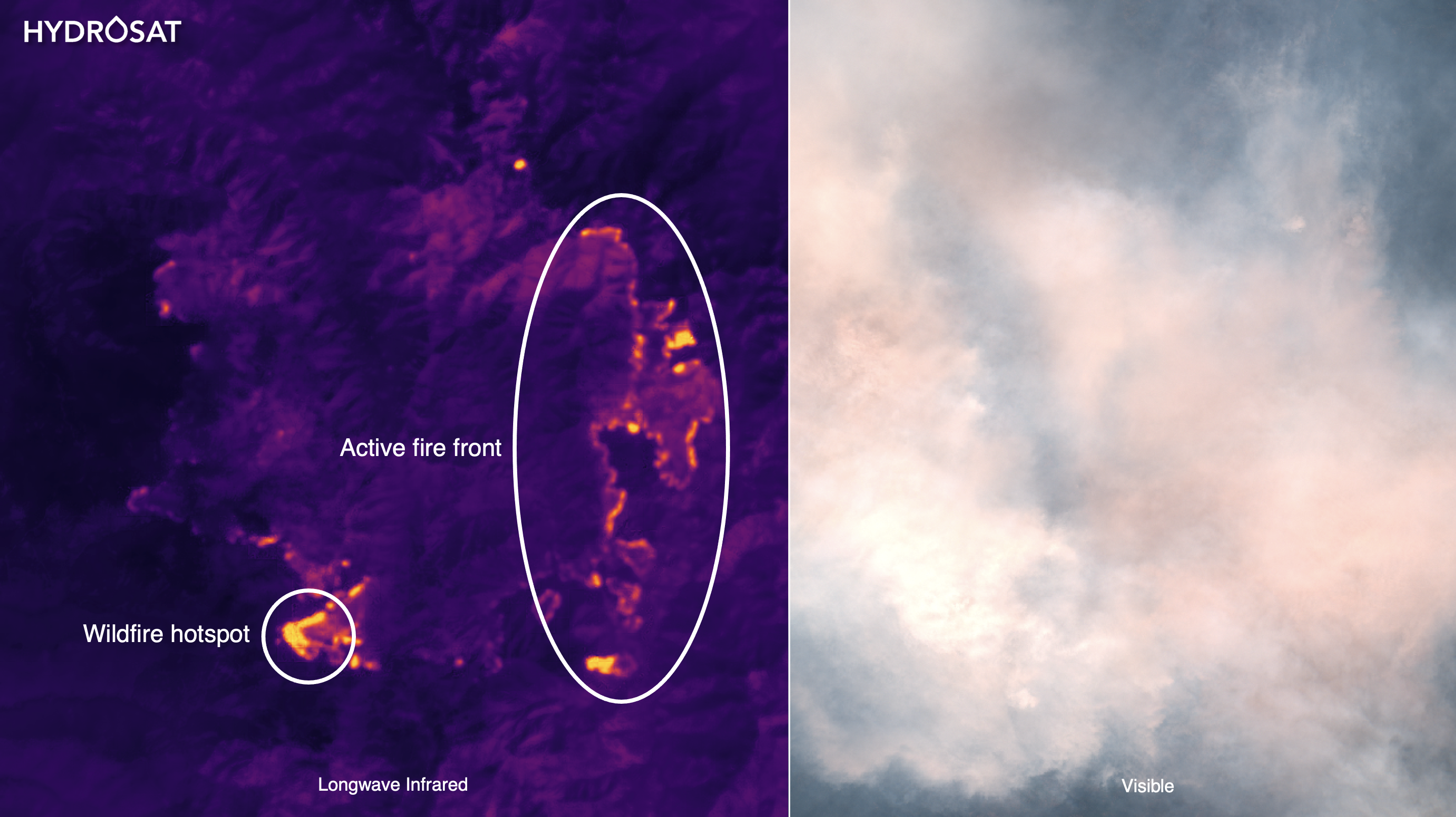

- Hydrosat closes another $10M in funding for ground temperature analytics product

- Slack wants to make it easier to build workflows with developer building blocks

| Hear NVP’s Priti Choksi and Birdies founder Bianca Gates explain how to land early-stage funding Posted: 16 Nov 2021 09:30 AM PST Priti Choksi, partner at Norwest Venture Partners, has a portfolio that includes Bright, Lumosity, Citcon, UPSIDE Foods and Birdies. But before she ever entered the world of VC, she was an operator at companies like Facebook and Google. She managed business development teams and ran M&A and has vast experience in the world of growing and scaling companies. So, it should go without saying, we’re absolutely amped to have Choksi join us on November 17 at 12 p.m. PST/3 p.m. EST for an episode of TechCrunch Live. Choksi will be joined by founder Bianca Gates of Birdies. TechCrunch Live is all about helping founders build better venture-backed businesses. The first step in that, usually, is getting some funding. We’ll talk to Choksi and Gates about how they first met, what drew Choksi to invest in Birdies and how they’ve worked together since. We’ll also take a look through Birdies’ early pitch deck and hear what really sang for NVP and other investors. Founders, this is a great opportunity to learn what makes VCs tick and refine your fundraising process accordingly. This episode of TechCrunch Live will also feature the TCL pitch-off, where founders in the audience can come on our virtual stage and pitch their products to our esteemed guests, who will give their live feedback. TechCrunch Live is accessible to anyone who is available on Wednesdays at noon PST/3 p.m. EST, but the full library of on-demand TechCrunch Live content is reserved exclusively for TechCrunch+ members. It’s but one of the many reasons to subscribe. If you haven’t yet, you can do that here. Registration and episode info can be found below. Click here to join us on November 17 at 12 p.m. PST/3 p.m. EST! See you soon! |

| Northrop Grumman leads team to design an astronaut transportation vehicle for the lunar surface Posted: 16 Nov 2021 09:09 AM PST Aerospace prime Northrop Grumman is leading a team that includes AVL, Intuitive Machines, Lunar Outpost, and Michelin, to design a vehicle to transport Artemis astronauts around the moon. The Lunar Terrain Vehicle (LTV) will be key to exploration of the lunar south pole region, an area that has no human has ever visited before. Northrop will lead systems integration and spacecraft design, and the rest of the team bring together a wide range of capabilities that point to the LTV design areas they'll likely focus on: AVL develops and tests vehicle powertrains and advanced driver assistance and autonomous systems; Intuitive Machines has experience in payload delivery with its Nova-D spacecraft; Lunar Outpost is developing off-world unmanned rovers; and multinational French company Michelin has worked with NASA before on tires for previous lunar rovers. The team will almost certainly submit the design as part of a forthcoming request for proposals from NASA, similar to the process the agency used to select the lunar lander under the Human Landing System contract. Although NASA has not yet released an RFP for the LTV, Northrop Grumman is anticipating it early next year, a spokesperson told TechCrunch. But even though the contract solicitation doesn't exist yet, the space agency has already started requesting information from industry to inform the development of the vehicle. In documents related to the project, NASA provided some details as to what it might be looking for in a winning bid: a vehicle that can traverse up to 20 kilometers on the lunar surface without needing to recharge; that can potentially survive an extended lunar night; and that is capable of transporting a minimum of 800 kilograms. NASA said it anticipates launching the vehicle around 2027, which suggests it would only be sent to the moon once the Artemis program is up and running. Last week, NASA representatives confirmed that the first crewed mission under the program — which aims to return humans to the moon for the first time in decades — would be pushed back to 2025. |

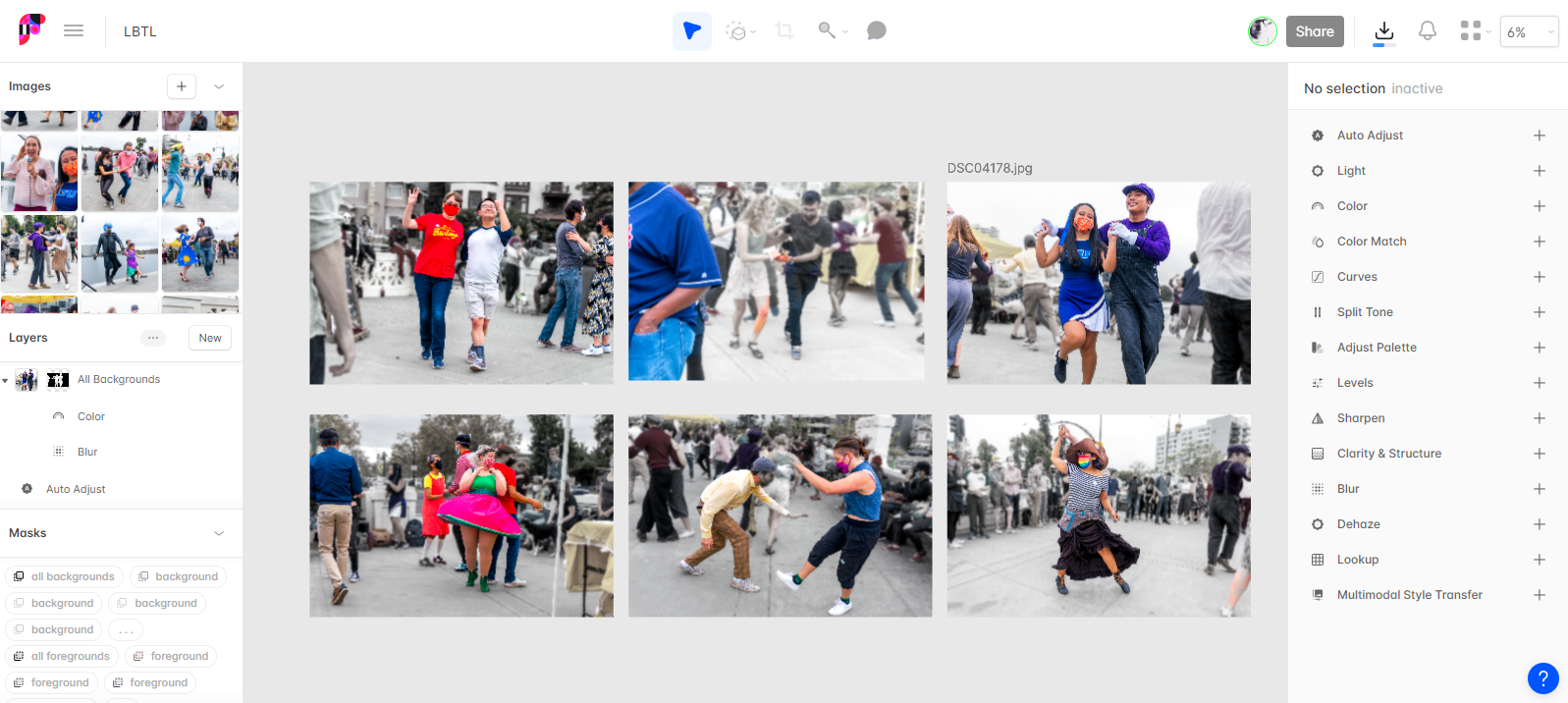

| Facet raises $13M to add photo editing features Photoshop can only dream of Posted: 16 Nov 2021 09:05 AM PST In a nutshell, the company has created an AI-powered photo editing tool that can be accessed using APIs. This means that you can do extremely powerful batch photo editing that is kind of like a mash-up between Snapchat’s photo filters, Adobe Lightroom’s batch editing features, Photoshop’s flexibility and the collaborative powers of Figma and the like. And yet, the tool is able to do things that haven’t been seen in the photo editing space so far. Facet just raised $13 million from Two Sigma Ventures with participation from Accel, Basis Set Ventures, Slow Ventures and South Park Commons. To say that I’m more than averagely interested in photography is a bit of an understatement — I used to be a professional photographer, and have written 20-ish books about photography. So when Facet reached out to me to say they had something brand new in the photo editing space, I got pretty excited, followed by “extremely confused.” Even after talking to the company’s founders and investors for an hour, I still couldn’t wrap my head around exactly what the tool is, nor who it is for. It all became a lot clearer when I got a chance to play with the tool for myself. I uploaded a gallery of dance photos I shot at a recent Lindy by the Lake dance event in Oakland, and let Facet do its thing. The web-based editor has a profoundly steep learning curve — a learning wall, if you will — but I was very quickly able to do some editing that would have been hard, if not impossible, in Photoshop. One filter I created was “Detect background, then blur and desaturate the background.” The foreground/background detection on the images wasn’t perfect, but for the photos where it worked, it was an extremely fast way to make the photos pop — without having to open and edit each individual image in a photo editing suite.  The image on the left had the background desaturated and blurred automatically by Facet. The original is on the right. The result isn’t perfect, but Facet was able to do this to 200 photos in a matter of minutes — an incredibly impressive feat of AI image editing. Photos by Haje Kamps, editing by Facet’s AI. Facet is particularly aimed at commercial-grade image editing where you need to prepare and present huge quantities of photos, but — as with Photoshop — it can be used in dozens of different ways, limited only by the image-makers’ creativity. “As you edit an image and layer on those changes, we analyze every edit and we figure out how to transfer that across a much larger content library, building you your presets automatically. This is very powerful for maintaining brand consistency across a campaign for making sure that all your product, photographs, are consistent,” explains Joe Reisinger, CEO and co-founder at Facet. “One example is someone like Spotify. You’ll probably have seen the duotone effect they are so famous for when it comes to album covers. We can create that and give you a reusable image editing pipeline with an API endpoint, so you can process thousands of photos very quickly.” The company’s selection and filtering tools are powerful and infinitely scalable. The company does have a consumer-grade platform that hobby photographers could use, but where the company really shines is when the tool is used by creative software developers to use the APIs. “Instead of trying to adapt old, print-centric software to the internet age, we're building the tools creatives need from the ground up with a content-aware image editing platform,” Reisinger said.  An example of the Facet interface. In this screen shot, I’ve asked the tool to desaturate and blur the backgrounds. When it works, it is incredible, and something I’ve wished Lightroom had been able to do for years. When it doesn’t work (see the middle two photos, where only the woman’s leg is in color, or where the tool failed to detect the dancer’s face as the foreground), it is a little disappointing. Having said that, it’s possible to download the images as layered Photoshop files, so it would be trivial to tidy that up — and the time saved in the batch editing process would be enormous. Image: Screenshot from the Facet tool “One aspect I really like about Facet is that it enables asynchronous collaboration. You can define the style of a photo, and designers can use the same style on lots of different photos without having to manually edit each of the photos. You can encode the look and feel of a photo programmatically, and copy them across from one image to another,” said Dan Abelon, partner at Two Sigma Ventures, the lead investor in Facet’s round. “You start to get into the more community side — if you like someone’s style, you can apply it to your own images, which opens up a whole world of real-time collaboration.” “This isn’t just about making money. Facet is about to have a big impact on the creative community and the wider web. I can tell that they want to make a mark on the web as a whole, and that’s something we were really attracted to as well,” said Abelon. The company will be using its recently expanded war chest to do the obvious next couple of steps after a Series A: expand the team, find more traction and build out a go-to-market strategy. You can sign up for a free trial at Facet to kick the tires, and plans start at $24 per month for professional users, and $50 per month for high-end team users with API requirements. |

| Gooder Foods brings in $6.4M to offer its take on a more grown up mac n’ cheese Posted: 16 Nov 2021 09:01 AM PST New macaroni and cheese brand Goodles launched Tuesday after its parent company, Gooder Foods, raised $6.4 million to carve out a niche in the $4.4 billion dry noodles category. The food is high on the list of comfort foods, but has been advertised specifically to children for decades, despite the fact that 59% of adults eat at least one noodle dish each week, Gooder Foods co-founder and CEO Jennifer Zeszut told TechCrunch. "There is product and branding innovation here, too," she added. "One important part is that existing competitors in mac and cheese think it is for kids, and our experience and data shows that everyone likes it. We see product differentiation and other flavors targeting adults. It has been a fun opportunity to disrupt everything." This is Zeszut's fourth time at the helm, and she gathered an impressive founding team that includes Annie's co-founder and former president Deb Churchill Luster; Paul Earle, former Kraft brand executive, founder of Earle & Co and faculty member at Northwestern’s Kellogg School of Management; and actress Gal Gadot. Zeszut and Gadot met three years ago and bonded over Gadot's love for mac and cheese. When Zeszut was putting the company together, she reached out about getting involved. Goodles is going after the two oldest incumbents in the space, Kraft and Annie's, to provide a healthy alternative that tackles both better taste and nutrition. Goodles is high in protein and fiber and has 21 nutrients from organic vegetables. "One is 83 years old and the other one is over 30 years old," Zeszut said. "What has happened in food since then is leaps and bounds better. Mac and cheese is that universal thing, but more people are thinking of food as performance and are worried about what they put in their bodies. There was so much lack of innovation, and we are taking a fresh look at the category." Normally, the company would have staged a bunch of taste tests, but due to the pandemic, Gooder Foods created an online community, shipping out thousands of small bags of noodles for people to try. In fact, the company developed more than 1,000 versions of noodles to get the right one. Not all tried all 1,000 versions, but to build a mass brand, taste was important, she added.  Gooder Foods team. Image Credits: Gooder Foods Some of the research found that 92% of people would switch to Goodles, which Zeszut believed was one of the highest she had ever seen in food, saying, "we think we are onto something huge, which is what we print on the back of the boxes." The brand launches today with four SKUs: a cacio e pepe-inspired mac called Mover & Shaker; Cheddy Mac, what Zeszut considers similar to the original flavor of mac and cheese; Shella Good, which is going head-to-head with Annie's; and Twist My Parm, an asiago and creamy parmesan blend. The $6.4 million investment combines a seed round and convertible note and will be poured into efforts to launch direct to consumers, inventory, branding and marketing. Though the focus is on DTC, Zeszut does have plans for national distribution via other channels. Investors backing the company include Springdale Ventures, Willow Growth Partners, Third Craft, Gingerbread Capital, Purple Arch Ventures and First Course Capital, along with a group of individual investors. Genevieve Gilbreath, co-founder and general partner at early-stage consumer investment firm Springdale Ventures, said though her firm doesn't usually invest in pre-revenue companies, like where Gooder Foods is now, she felt the company was unusual in that it already had product market fit and liked what the company had done during pandemic to create the community, which provided thousands of built-in taste-testers. Following what food tech is doing, she said the technical areas, like cellular meats, are interesting, but where Gilbreath sees a bigger impact is from brands using real food, with improved nutrition and taste. That's what she says Goodles is doing. "As a leader, Jen's persistence, passion, experience and ability to lead a team came across super well," Gilbreath added. "What really impressed us was her research into the market, the consumer need and the way they are tracking data." |

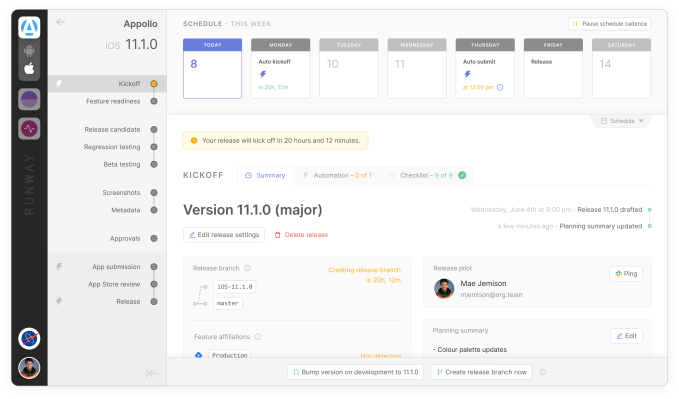

| Runway raises $2M seed, launches its ‘air traffic control’ system for mobile app releases Posted: 16 Nov 2021 08:45 AM PST Runway, a startup that emerged from the challenges that faced Rent the Runway’s first iOS team, is now exiting beta and launching its service that simplifies the mobile app release cycle — or, as the team describes it, offers “air traffic control” for mobile releases. The company has additionally raised a $2 million round of seed funding for its product, led by Bedrock Capital. Other investors include Array Ventures, Chapter One, Breakpoint Capital, Liquid 2 Ventures, Four Cities, Harvard Management Seed Capital, SoftBank Opportunity Fund, and various angels. The idea for Runway comes from co-founders Gabriel Savit, Isabel Barrera, David Filion, and Matt Varghese, who had all worked together on the first mobile app team at Rent the Runway. While there, they learned that getting an app release out the door involves a lot of overhead in terms of time spent and wasted, and a lot of back-and-forth on internal communication apps like Slack. Interdisciplinary teams consisting of engineers, product, marketing, design, QA, and more all have to keep each other updated on their own part of the app’s release process — something that’s still often done using things like shared documents and spreadsheets. Runway instead offers an alternative with its dedicated software specifically designed for managing the various parts of the app’s release cycle. The system integrates with a company’s existing tools, like GitHub, JIRA, Trello, Bitrise, CircleCI and others, to automatically update teams as to what’s been done and what action items still remain. Since launching into beta this spring, Runway has doubled the number of supported integrations, which also now include tools like Linear, Pivotal Tracker, Jenkins, GitHub Actions, GitLab CI, Travis CI, Slack, Bugsnag, Sentry, TestRail, and more, with others on the way soon.  Image Credits: Runway During its test period, Runway has been used by a handful of early customers, including ClassPass, Kickstarter, Capsule and others, who, as of this March, had pushed out over 40 app releases via its platform. Since its beta, it’s grown its client base 10x, which now includes Gusto, NTWRK, Brex, and Chick-fil-A as customers, as well as some bigger names in at the enterprise end of the scale, the company notes. (One is a “favorite food delivery app,” we understand). Several of these customers have also contributed statements of support for using Runway over their old methods. For instance, ClassPass’s Mobile Lead Sanjay Thakur said the system results in “less confusion” and less time spent on releases. “Our engineers tell me their load during sprints in the release manager role has shrunk,” Thakur said. Kickstarter’s Senior iOS engineer Hari Singh noted that “things are easier now” with Runway, and remarked, “it’s nice to have all of our team members looking at the same thing, all the time. There’s no subjective opinion of what’s happening,” he said. “Runway has not only made releases faster, but mental stress around releases is something we don’t have to worry about anymore,” noted Senior Software Engineer Dave Cowart of NTWRK. “We used to be hesitant to release as often as we would have liked. Now, we know it’s going to go smoothly, and we know it’s going to require minimal effort.” As of today, Runway says its early adopters have since pushed out 60x app releases through its platform since March, totaling over 700. It has also made a number of key product changes and updates since its beta in March.  Image Credits: Runway These include the addition of many more automations for tasks that would have otherwise been handled manually or other chores like automatically pausing unstable phased releases, automatically accelerating stable phased releases, adding in default Release Notes for the app stores’ “What’s New” section, support for rollouts with automatically increasing staged percentage (including Android), selecting the latest build in the app stores, submitting new builds for beta review on iOS, tagging release at the end fo the release cycle, autogenerating changelogs, attaching artifacts, adding missing labels or fix versions to tickets in project management tools, and more. Runway also added support for quicker hotfix releases, an approvals feature that loops in external stakeholders, a screenshot viewer and approval gate, build artifact downloads directly from the CI pipeline, regression testing integrations, stability monitoring integrations, TestFlight and Play Store beta track testing integrations, additional capabilities for frequent releases like bumping the version number in code, and support for roles, permissions, and access control lists, among other things. It’s also attained SOC 2 certification. One area it’s still working on is simplifying the onboarding of new customers. Because it’s designed to be a broad platform, the initial setup process where a customer connects Runway to its many apps and services can take time. However, Runway believes that ultimately, its ability to adapt to many teams’ different tools and processes will be a selling point, not an obstacle to its adoption. As it goes to launch, Runway continues to charge $400 per month per app for its standard tier but has now added on custom, enterprise pricing for larger businesses, as it has more companies on the high-end in the pipeline. It may add new pricing for indie teams in the future, we’re told. Runway says it will apply the new funds to hiring, including the hire of multiple full-stack engineers (particularly ex-mobile engineers), and a full-time employee to help with growth and marketing. It has already made its first full-time hire with the addition of a former senior mobile engineer. |

| Meadow launches Dynamic Delivery to bring mobile cannabis dispensaries to California Posted: 16 Nov 2021 08:32 AM PST Meadow’s new Dynamic Delivery helped Cannable cut delivery times from hours to 20 minutes. How? The delivery vehicle is stocked with $3,000 worth of pot, and customers can order directly from the car in their neighborhood. Think of it like an ice cream truck with a modern online ordering system. But, instead of serving gelato treats and creamsicles, these mobile dispensaries are slinging eighths of Gelato and Creamsicle. “Now we’re able to put inventory in a car trunk,” David Tuel of Cannable told TechCrunch. He’s the Director of Strategy & Technology at Cannable, a dispensary store-front, and cannabis delivery service in Parlier, CA. “We can have inventory stored in the vehicles, rather than stored in one conglomerate ecommerce location,” he said. “When customers order, they are ordering based on the vehicle that is in their location, rather than ordering from the primary menu at our home base — and they can still order from our main menu, too.” Meadow built Dynamic Delivery to give dispensaries the tools needed to operate such retail locations. Meadow’s solution wraps up the handful of tools dispensaries have to use to offer similar services. For example, it automatically dispatches drivers and includes real-time inventory reporting. It features geo-targeted SMS marketing, too, which allows for precise, targeted advertisement. Meadow was once called the Amazon of weed. Its platform, like AWS, serves a large part of the cannabis retail industry. Now Meadow is pushing the retail platform forward with Dynamic Delivery. Weed delivery is quickly growing. More consumers are opting to have their pot delivered rather than going to a dispensary. In 2021 60% of retail cannabis transactions were delivered, up from 50% in 2020, according to a report published today by Weedmaps. In addition, delivery among Gen Z users increased 125% year over year. Most dispensaries operate delivery like mail carriers. Stores receive orders, which are then loaded into a vehicle and sent to the customer. Called ‘hub and spoke,’ this delivery method is reliable and low-cost, but often slow, much to the frustration of the store and consumer alike. There’s a large untapped market in California. The state legalized recreational marijuana in 2016, but it’s only sold in 35% of the state. The remaining 65% do not have access to a dispensary. This could be for several reasons, including lack of resources to develop regulations or a legal prohibition on the sale of cannabis in retail stores. However, in a 2020 ruling, a Fresno, CA judge affirmed the right to deliver to these areas by dismissing a lawsuit by 24 California cities seeking to ban deliveries. While there are strict limits and regulations to mobile dispensaries, there are significant benefits for the dealer and consumer. Delivery times are usually slashed, and it allows for some novel retail use cases. Meadow founder David Hua gave the example of a mobile dispensary at a Giant’s baseball game. With this platform, a retailer could set a geofence around the stadium and offer delivery only in that region. Since the driver has the product in the vehicle, deliveries happen in minutes rather than hours. And each time there’s a sale, Meadow’s platform tracks the inventory, processes the cash payment, and allows the driver to stay compliant with Metrc, the widely-used cannabis regulatory system. Hua says with just a vehicle, driver, and a few clicks, operators can set up mobile dispensaries anywhere in California and even operate in cities and areas that do not have brick and mortar dispensaries. “Imagine Golden Gate Park,” Hua said. “We just had the Outside Lands Music and Arts Festival. You could draw an area around there and have a drop zone. Another option is to do a farmer’s market model where there are little kiosks.” “There are a lot of things here I think we can play with — or at least the dispensaries can play with — to reach their customers more expeditiously without having to waste time going back and forth from the dispensary.” California allows operators to work out of a vehicle with $3,000 worth of inventory and $5,000 if the merchandise includes pre-orders. There are legislative efforts to increase the in-vehicle inventory size to $10,000 – $25,000 which is where Meadow’s comprehensive solution would become critical. Dispensaries do not need Meadow’s Dynamic Delivery tools to offer mobile services. Such services are already legal under California law. However, operating a mobile dispensary often requires multiple platforms. It can turn into an administrative mess that relies on texting, 3rd party payment integration (made harder by cash-only transactions), and human error. Meadow’s David Hua explained the pain points Dynamic Delivery addresses. For one, he says, human error can inadvertently result in drivers carrier more than the legal limit. In addition, without automatic inventory management, retailers can run into compliance reconciliation issues, and online menus can quickly become inaccurate. “Communication with the customer can become an issue,” Hua said. “If there’s something in the menu that isn’t updated, they have to call the customer and that’s an issue. “What’s interesting about our system is retailers can create zones that have one driver in it. Then, any order that comes to that menu gets automatically dispatched to that driver, so it’s taking the labor down significantly,” Hua said. Meadow’s new platform allows operators to set regions for the delivery vehicles. Each vehicle can be its own inventory hub, allowing one van to serve a certain region quickly. “We have a use case where you can say, ‘Hey, driver, go to your area and cover that territory, and we’ll load you with a handful of brands,'” Hua said. “I’ll push a notification to my past customers and tell them you’re in the area. I’ll give them a discount code for the next 15 minutes.” Hua considers this feature a serious marketing effort that can operate at scale. He explains that in test runs, inner-city dispensaries can reach previous customers who are working from home. “What we’ve seen in San Francisco and other areas, people are working remote and not coming back in the city, but they’re still customers. So now dispensaries can push out into those territories by putting a car out there.” Meadow started building these features as delivery became critical in the early days of the COVID-19 pandemic. Then, as the pandemic dragged into 2021, the company started building out in earnest. Meadow is launching this feature first in California and is exploriing bringing it to Michigan, Massachusetts, and New York. |

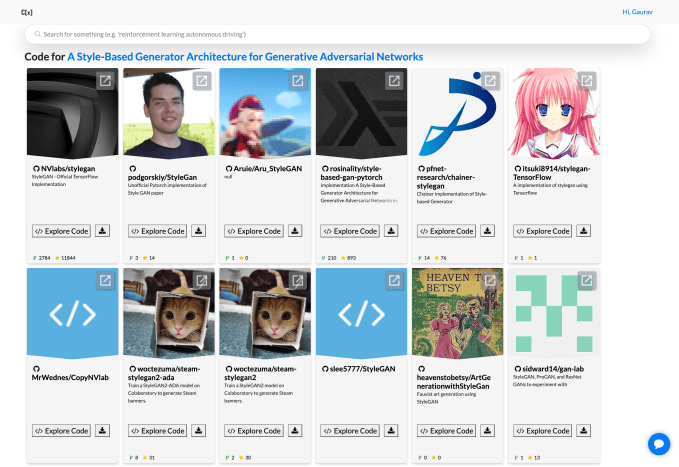

| CatalyzeX grabs $1.64M seed to help developers find right machine learning model Posted: 16 Nov 2021 08:13 AM PST Machine learning is exploding, and so are the number of models out there for developers to choose from. While Google can help, it’s not really designed as a model search engine. That’s where CatalyzeX comes in: It not only helps developers find the most appropriate model for their data, it provides a direct link to the code in a simple interface. Today, the early-stage startup announced a $1.64 million seed round from Unshackled Ventures, Kepler Ventures, On Deck, Basecamp Fund, Abstraction Capital, Unpopular Ventures, Darling Ventures and a number of industry angels. The company co-founders, brothers Gaurav Ragtah and Himanshu Ragtah, saw that there was so much research being done and wanted to build a tool to make it easier for developers to find the most applicable models for their use case. “We’ve built a platform that lets you easily search for all the various techniques and models available for a certain use case and jump to the code in one click, saving you a lot of friction by going from ‘there’s a good technique’ to ‘here’s the code that actually implements it’ and go on from there,” CEO Gaurav Ragtah told me.  CatalyzeX search results page. Image Credits: CatalyzeX While this could apply to any type of research, as a young startup, they are concentrating on machine learning, which is broadly applicable across fields. By building a platform like this, they can learn what types of research apply to a given use case and automatically surface the most relevant ones for the user. While they have 30,000 weekly active users today, they recognize they will need a critical mass to get to the point where they can more precisely identify the right model for the right research, so for now, they are taking advantage of the technology they have built into the tool, like crawlers and aggregators, to jump-start that process. The brothers grew up in New Delhi in an area that was originally for refugees from when the British split India and Pakistan in the late 1940s. Their grandparents settled there, originally living in tents, before building a home. Gaurav came to the United States on scholarship in 2009 and Himanshu followed later. Both eventually got jobs at tech companies in the U.S. working on machine learning projects, where they saw the kinds of research challenges they are attempting to fix with CatalyzeX. For now, the company is just the two of them, but they hope the idea will take off so they can hire more people to help build out the tool. Given their backgrounds, they believe strongly in looking at underrepresented people. “We’ve always made efforts to get to know people from various backgrounds of all kinds, but also when we talk about opportunities, [we plan to] actively tap into a recruiting pipeline to see if there are enough applicants from different backgrounds because fundamentally, I believe if we don’t find the best people across all backgrounds, we are unnecessarily disadvantaging ourselves,” he said. Users can access the tool on the company website or through browser extensions on Chrome and Firefox. |

| Medium acquires Knowable to bring audio to the platform Posted: 16 Nov 2021 08:00 AM PST Medium announced today its third and final acquisition of the year: Knowable, an audio-based learning platform featuring podcast-like courses from experts like Reddit co-founder Alexis Ohanian, NASA astronaut Scott Kelly and food journalist Mark Bittman. Medium’s other acquisitions this year include Projector, a browser-based graphic design tool, and Glose, a social book-reading app. As the podcasting and live audio industries expand, Knowable will help Medium cater to people seeking audio education. Warren Shaeffer, co-founder of Knowable, will join Medium as the vice president of Audio, and the rest of the Knowable team will follow. Shaeffer told TechCrunch that the Medium and Knowable teams have already begun working together on complementary initiatives and will share more details in early 2022. “Publishing on Knowable gives experts and thought leaders — including those already on Medium — an easy way to add a new, monetizable format to share their work,” Shaeffer told TechCrunch. “Knowable lessons sit between social audio, which is largely ephemeral and non-monetizable, and podcasts and audiobooks, which are far more labor-intensive. Knowable handles the heavy lifting on the production side to help its creators sound great, even if they're audio newbies.”  Image Credits: Knowable Knowable launched in 2019 with funding from Andreessen Horowitz, Upfront, First Round and Initialized — the platform charged $9.99 per month for access to more than 100 courses, though in celebration of the acquisition, its prices have dropped to $25 annually through the end of the year. Per the acquisition, Knowable will remain a standalone platform, but Knowable might be included in future Medium subscription bundles. “The number one reason that people say they listen to podcasts is to learn new things, and Knowable and Medium are pioneering a new audio experience to better serve this need, for both creators and listeners alike,” Shaeffer said. Knowable takes applications from experts and thought leaders to build a course — if accepted, the Knowable team works with them to develop a course. Knowable shares 30% of quarterly revenue and 30% of all referred memberships with published creators. |

| Contra partners with TikTok to add a little LinkedIn flavor to the social video app Posted: 16 Nov 2021 08:00 AM PST Contra, a professional network for freelance workers, is partnering with TikTok to allow users to showcase their resumes and portfolios on TikTok Jump, the social media service’s third-party integration tool. The new partnership will allow creators to link their Contra profile to their TikTok videos to showcase their professional portfolios. With this new integration, creators can now add a “View My Portfolio” link to their TikTok content. Viewers will then be able to tap the link and see the creator's Contra profile, check out their services and send a request to collaborate. Contra says the integration makes it easier to share professional work and get new client leads. It plans to launch another Jump integration that will allow companies that are hiring to post TikTok content with a link to apply to the job directly with the viewer’s Contra profile. The company says the partnership allows independent workers to replace traditional resumes with more engaging methods to showcase their work. "TikTok has become one of the leading places for people to get career advice and find out about amazing roles, so it only makes sense that creators should also be able to showcase their amazing professional work on the platform,” said Contra founder and CEO Ben Huffman in a statement. Earlier this year, Contra raised a $14.5 million Series A led by Unusual Ventures, with participation from Cowboy Ventures and Li Jin's recently announced Atelier Ventures. Two weeks ago, the company brought in $30 million in Series B funding, led by NEA, with participation from Unusual Ventures and Cowboy Ventures. The platform wants professionals to create profiles that show project-based identities, versus a role-based identity that one would show on LinkedIn. Contra’s goal is to help independent workers create high-signal referral networks so they can land new opportunities. Unlike LinkedIn, where you can add anyone you meet and they become a "connection," Contra requires you to have work experience with your network. The company’s partnership with TikTok allows it to reach more millennial and Gen Z users and possibly help them land new opportunities. Since launching TikTok Jump in June, the social media giant has partnered with many companies, such as Quizlet, Wikipedia, BuzzFeed and Jumprope, to allow them to create their own integrations within its app. |

| Pinterest launches TwoTwenty, its own in-house incubator for new projects Posted: 16 Nov 2021 07:32 AM PST Pinterest today announced a new initiative designed to help the company increase its pace of innovation. The company is introducing an in-house, experimental products team called TwoTwenty — named after the address of Pinterest’s first office. The team is comprised of engineers, designers and other product experts who will research, prototype and test new features and ideas, then identify those that gain traction. Successful products will be then handed off to other teams within the company to take to scale. The team has already had its hand in some of Pinterest’s latest launches, the company notes. Its first exploration was with the livestreamed creator events, which later evolved to include features like the ability to rewatch livestreams and support for shopping product recommendations. These became a part of Pinterest’s recently announced product, “Pinterest TV,” a live shopping feature on the app that aims to compete with rival services from Facebook, Instagram, TikTok and other dedicated livestream shopping platforms. The Pinterest TV lineup includes a host of “shows” from creators, where fans can interact and ask questions while participating in the live shopping event. And it offers a virtual studio to creators, which was also an idea that emerged from TwoTwenty’s work, Pinterest says. The idea to create an in-house team now dedicated to new project ideas comes at a time when Pinterest is trying to reinvent itself for the modern era of online social, which is more focused on formats like video and livestreaming amid a maturing creator economy. In that light, the launch of Pinterest TV represented a significant pivot away from Pinterest’s original idea of an online image pinboard where users research and discover new ideas, which sometimes translate into an online purchase. With video and live shopping, Pinterest aims to better attract a younger demographic who has grown up with social apps like Instagram and TikTok, where video and live content is core to the experience. If it fails to successfully make this shift, it could be on its way out as a top social platform. (In fact, reports that Pinterest was discussing an exit by way of PayPal have been circulating, but PayPal said it’s not pursuing an acquisition at this time.) Pinterest explained its new incubation team will field ideas from an online submission portal called the “Idea Factory” as well as from its companywide “Makeathons” (hackathon events). The team will then further experiment with the ideas and prototypes to see if any gain traction. At any time, there will be one to two projects underway — some of which will see the light of day, and others which will be pulled back if not successful — more like how a startup would experiment. Initially, the team includes Product Lead David Temple, who’s been heading up creator products; early engineer Ryan Probasco; Content Lead Meredith Arthur, previously of CBS; Albert Pereta, who joined Pinterest by way of its 2014 Iceberg acquisition; and others. In total there are 15 people working full-time on the team now and it’s actively recruiting new members. Other large tech companies also formalize their efforts to drive innovation through dedicated teams. Facebook, for instance, launched its “NPE Team” in 2019 to test new ideas and features, to see how users would react. But over the years, none have scaled to become their own, new Facebook (now Meta) brand — they’ve instead informed the development of other Facebook and Instagram features. Meanwhile, Google had been allowing its more entrepreneurial-minded employees to experiment within its Area 120 in-house incubator. By comparison, this group has launched a number of successful products that have exited to other areas of Google’s business, like Search, Shopping, Commerce and Cloud. That team has now been elevated with the recent reorg that sees it under new leadership and paired alongside other long-term-focused innovations, like the holographic videoconferencing project known as Project Starline. “With TwoTwenty, we prioritize a collaborative approach and accelerate ideas from employees around the company,” said Temple, in an announcement. “With the resources of an established brand, we're able to explore and invest in new solutions to help people find inspiration to live a life they love,” he added. |

| Jumia posts revenue and order gains, but compounding losses drag its stock lower Posted: 16 Nov 2021 07:22 AM PST Pan-African e-commerce company Jumia released its third-quarter financial performance today, detailing a mix of expected and surprising results. When TechCrunch discussed the company's Q2 2020 financials, Jumia had a market cap of a little over $2.1 billion, based on a per-share price of $22. Since then, Jumia has lost value, trading at just $17.52 per share before the opening bell today. Let's talk about what the company disclosed and how its new results are impacting its value. Jumia's third quarterBefore we dive into Jumia's third-quarter results, recall that Jumia changed the default currency in its report from euros to the American dollar in Q2 2021; it will remain this way in the foreseeable future, according to the company. Jumia Q3 financials highlight "accelerating usage growth" as its core theme, disclosing impressive percentage bumps in usage KPIs — orders, annual active customers and gross merchandise volume (GMV). Orders made on Jumia reached an all-time quarterly high of 8.5 million, representing a 28% year-over-year growth. Co-CEOs Jeremy Hodara and Sacha Poignonnec say that's the fastest growth witnessed by Jumia in the past seven quarters. In Q2 2021, for reference, the number of orders made on the platform totaled 7.6 million. The pan-African e-commerce company saw most orders from fast-moving consumer goods (FMCGs) and food delivery. According to Jumia, the former category saw its "highest ever volume number," while the latter posted its highest-ever quarterly volume with more than 2 million orders made. Annual active customers grew by 8.1% year-over-year to 7.3 million from Q3 2020, the report said. Gross Merchandise Value (GMV) — the total amount of goods sold over in the quarter — gained 8.1% from Q2 2021 to $238 million. These numbers stood at 7 million and $223.5 million in Q2 2021. The co-CEOs say their company's growth acceleration strategy, embraced at the end of Q2 2021, is behind the improving results across its three usage KPIs. Jumia also stated that it made bets in sales and advertising and technology arms to "support consumer acquisition and retention." Another key factor in its quarterly performance, the company said, was the expansion of its grocery category within “everyday products” to cover an estimated 15,000-20,000 SKUs. To execute this, Jumia had to change from a marketplace model to a retail one for the FMCG brands that largely contributed to the platform's growth. Jumia also rolled out more dark stores to meet increasing demand. JumiaPay diversificationJumia — with online goods and service verticals in 11 African countries — posted third-quarter revenue growth of 8.5%, from $39.3 million to $42.7 million, beating the consensus of $40.2 million. In Q2 2021, Jumia's falling GMV led to decreasing total payment volume (TPV) at payment arm JumiaPay. In the third quarter, rising GMV drove increased usage, pushing up the platform's TPV 15% year-over-year to $64.5 million. JumiaPay transactions reached 3 million, up 34% year-over-year. Jumia says that is its fastest transactions growth rate in the last five quarters, adding that increase in volume, especially in areas such as food delivery, provided fuel to the digital payment's growth. The digital payment arm also contributed to 35.7% of the orders placed on Jumia this quarter compared to 34.1% in Q3 2020. From the report, we noticed that Jumia is extending JumiaPay services to new sets of customers outside its core e-commerce market. For one, Nigerian users can book bus tickets via the app, while users in Egypt (students in particular) can pay tuition fees online. Signs of profitability still elude the e-commerce company. Maybe JumiaPay's diversification — which will surely bring more growth to its numbers — is a means to an end to achieve that. Compounding lossesBut that road remains long for Jumia as losses compound even more in this quarter. Jumia's adjusted EBITDA and operating losses in Q3 2021 went up by 94% and 93% year-over-year, respectively, to $52.5 million and $64 million. Major factors behind this wild growth in losses are due to the company's ramp-up in sales and advertising, and technology departments. Sales and advertising expenses reached $24.0 million, up 228% year-over-year, while technology and content expenses increased by 27% to $9.4 million, the company noted in the report. Just as last quarter, the huge gain in sales and advertising spending indicates that "the company is back to its old method of executing aggressive advertising, which initially slowed during the pandemic," as we wrote before. The e-tailer finished Q3 2021 (ending September 30) with $583.6 million — $185 million in cash and cash equivalents; (it was $637.7 million in Q2 2021) and $399 million of financial assets. At the opening bell, Jumia shares fell 7.13%, trading at $17.20 and further down at $15.73 per share when this report went live. |

| Huge deals are pushing more AI startups into IPO territory Posted: 16 Nov 2021 07:22 AM PST Venture investors are betting that AI-focused startups are ready for the public markets, making more, larger, earlier bets on such companies. It's a great time to raise capital if your startup is building with — or on top of — artificial intelligence, regardless of how far along you are toward an exit. While many startup niches have seen their funding tallies rise in 2021, AI startups appear to be enjoying strong gains across younger and older cohorts, implying a broad base of customer demand. The Exchange explores startups, markets and money. Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday. New data from CB Insights details a global AI funding market replete with activity, sharply divided by geography. This morning, we're making sense of the numbers with help from Sapphire Ventures partner Jai Das and Glasswing Venture partners Rudina Seseri, two of our regular check-ins when it comes to AI investing.

Record venture demandIn the third quarter of 2021, investors poured $17.9 billion into global AI startups, CB Insights reports. The amount of money raised by the cohort of companies has risen every quarter since Q1 2020, when AI startups raised a local minimum of $6.3 billion. But what makes Q3 2021 more than just another quarter of strong fundraising results from AI startups is a dramatic rise in deal volume. |

| Threat intel startup SnapAttack lands $8M Series A following Booz Allen spinout Posted: 16 Nov 2021 07:00 AM PST SnapAttack, a threat hunting startup that was this week spun out from IT consulting firm Booz Allen Hamilton, has secured $8 million in Series A funding. The startup, which claims to hold the “largest library of labeled threat data in the world,” was created within Booz Allen DarkLabs, a team of researchers, threat hunters, analysts and data scientists that focuses on preventing cyberattacks. At its core, SnapAttack is a cloud-based software solution that brings together actionable threat intelligence and hacker detection. However, the startup says it brings both offensive and defensive tradecraft together in an integrated workflow that enables community collaboration around threat intelligence, attack emulation and behavioral analytics. This, in turn, helps organizations proactively identify potential security flaws, risks and gaps in their infrastructure before an incident occurs, the company says. "SnapAttack is poised to empower a new level of collaboration among the next generation of ethical hackers, threat hunters and security researchers providing advanced insights to stop attackers in their tracks," said Fred Frey, CTO and founding member of the SnapAttack team. "While many of our competitors focus on a single stage of the workflow and most often from a specific offensive or a defensive lens; SnapAttack provides a space to merge both." The startup's Series A funding round was led by Volition Capital, a growth equity fund, with participation from Strategic Cyber Ventures (SCV) and Booz Allen Hamilton, which is retaining a "significant" minority stake in the standalone company. The investment was completed in connection with SnapAttack's recently announced spinout from Booz Allen Hamilton, which the startup tells TechCrunch has been in the works over the last few months. "It was important to ensure the spinout and employees joining the team were set up for success, so the funding and spinout process were aligned to ensure that both the corporate entity was properly established, and funding was secured to ensure adequate runway for operations," the company said. SnapAttack will use the funding to accelerate platform development to further integrate across security operations processes, manage the entire lifecycle of detection analytics and enhance reporting. It also plans to expand its team (SnapAttack currently has 15 employees, with plans to double over the next 12 months) and grow its customer base across federal and commercial markets. |

| South Africa’s NFTfi raises $5M so people can use their NFTs as collateral for loans Posted: 16 Nov 2021 06:30 AM PST Once regarded as a fad (for some, it still is), NFTs, digital assets that depict real-world objects, are becoming increasingly popular within and outside the crypto world. But with large amounts of capital locked into illiquid NFTs, more people are looking for ways to unlock liquidity without selling their NFTs. This market is one South African company NFTfi targets and has raised a seed round of $5 million to continue pioneering the financialization of NFTs. Early-stage crypto fund 1kx led the round, with Ashton Kutcher’s Sound Ventures, Maven 11, Scalar Capital, Kleiner Perkins and others participating. Founded by Stephen Young in February 2020, NFTfi acts as a marketplace where users can get a cryptocurrency loan on their NFTs and offer loans to borrowers against their NFTs. In other words, users can use their NFTs as collateral to get loans from other users on the decentralized and peer-to-peer system. For example, if a user comes to the platform to borrow $10,000, different lenders would propose to the borrower offers with varying interest rates and payments terms, from which the borrower could then select. Meanwhile, the borrower will need to submit an NFT as part of the transaction. When the transaction is made, the NFT gets transferred into NFTfi’s smart contract (no one, including the NFTfi team, will have access to it) while the borrower receives the money. Once the loan gets paid with interest to the lender, the NFT returns to the borrower’s wallet. If the loan is not repaid during the allocated time, the lender receives the NFT. NFTfi users apply a common practice in the traditional art world where banks, big galleries or auction houses offer loans to artists to determine if an NFT is worth a loan or not. Typically, in the traditional market, loans are roughly 50% of the artwork’s value. On NFTfi’s platform, lenders make evaluations and give borrowers up to 50% of their NFT value as the loan principal. So, if an NFT is worth $20,000 at the point a borrower needs money, lenders are likely to offer not more than $10,000 as a loan. The interest rates, however, vary depending on the lender and assets. NTFfi takes a 5% cut of the interest earned on every loan by lenders, but it doesn’t make anything on a default. Risk exists on both sides, though. Borrowers have a set time to repay their loans before lenders take their NFTs, and since NFTs are volatile due to public demand and perception, lenders can eventually take lesser-priced NFTs. “That’s why lenders want to have some room between the price of the asset and how much they lend,” Young said on the dynamics in pricing between lenders and borrowers on NTFfi. “This is because in the case where somebody defaults, they need to be able to sell it for less than market value, and the price might have dropped in between. So that’s why they need such a big buffer between the loan value and the value of the actual asset.” Currently, roughly 20% of loans on the platform get defaulted on, but according to Young, most are lower-value loans. The reason behind this is that high-value NFTs are pretty exclusive and hard to come by, so users fund loans that they hope will default as a way to acquire the NFTs. “A lot of lenders actually don’t mind a default because often they’ll only lend on assets that they would like to add to their collection anyway. So when they get a default, they’ll keep the assets or list them on the market for 75% of the total value and might actually end up making more profits on defaults than on the actual loan.” While it appears that NFTfi serves as an advantage to lenders, Young says that’s not the case. However, the platform is working to address that speculation by including features that allow term negotiations and extensions for borrowers. The top NFT loans on NFTfi span across popular digital collectibles on the Ethereum blockchain — Art Blocks, Bored Ape Yacht Club, Cryptopunks, Autoglyphs, Meebits and VeeFriends. NFTfi transacted its first loan in May 2020, and since then, more than 1,500 have taken place on the platform. Young claims NFTfi has been growing at 80% month-on-month in terms of loan volume and the company has totalled more than $26.5 million in value. The company says lenders have earned over $500,000 in interest. Before launching NFTfi during the early stages of the COVID-19 pandemic as digital assets became more prominent, Young was the co-founder and chief product officer at Coindirect, a cryptocurrency exchange and OTC desk. He raised $890,000 as seed money for NTFfi last year, assembling a team in South Africa to build and launch the product. Most of the group still reside in the African country; however, the company is now incorporated in the British Virgin Islands for compliance and regulatory reasons, according to Young. With the new cash infusion, NFTfi plans to grow its team, launch new product features, roll out the platform on other blockchains, invest in its community and fund its decentralization. What started from a bunch of friends using their NFTs as collateralized loans between themselves — with blind trust and some spreadsheet document — has taken flight to become a fully decentralized platform, one Young hopes will have a more significant impact in the NFT world. “Our main focus is that we want to do for NFTs what DeFi did for cryptocurrencies. As soon as you brought DeFi into cryptocurrencies, you also had this explosion of activity and liquidity in the market. And really, we want to act as that catalyst for the NFT market, unlocking some of the value in these NF T’s so they can then be ploughed back into the NFT community and market to help develop the space further.” |

| Heyday raises $555M to buy up and scale more D2C brands in the Amazon marketplace universe Posted: 16 Nov 2021 06:22 AM PST Consolidation to have better economies of scale is one of the biggest themes in the world of e-commerce, and today a player in the world of online retail is announcing a large round of funding to double down on its approach to the concept. San Francisco-based Heyday — which buys up and then grows direct-to-consumer merchants and brands that have found initial traction, leveraging the Amazon marketplace — has raised $555 million, a Series C that it will be using to continue expanding its technology, investing in business development, and to buy up more assets. Specifically, it will also be deepening its engagement in Asia (with a seventh office in China); hiring more brand management experts and other talent; investing in more product development; and building out its marketing, supply chain, data science and M&A tech stacks. The Raine Group and Premji Invest co-led this round, with previous backers General Catalyst, Victory Park Capital and Khosla Ventures also participating. Heyday competes against a large field of startups also raising huge amounts of money to follow their own Amazon marketplace roll-up strategies. Other big names out of the U.S. include Thrasio (which picked up a cool $1 billion in October) and Perch ($775 million in May). Heyday has been moving at a fast clip to keep up since being founded in 2020. This latest round comes on the heels of a $70 million Series B that was raised only in May of this year, with the total capital raised by Heyday at $800 million, a mix of equity and debt (Heyday did not specify the proportions of equity and debt in this latest Series C). “Our pace is insane,” said Sebastian Rymarz, Heyday’s co-founder and CEO, in an interview. “We were born 16 months ago and are already crossing $200 million in revenues.” (That’s an annual run rate figure.) The company said its brands are currently growing at a rate of 64% year-on-year compared to the broader e-commerce market. Heyday has never disclosed its valuation, and Rymarz would only say that this latest round was made at “a very good valuation.” That lack of detail is intentional. “I don't want the team thinking or me getting into my head that 'we've won,'” he continued. “We're only 16 months in to what we think will be a multi-decade journey. I don't want to celebrate valuations at this stage.” Sources say it’s over $1 billion, although that is still fairly vague, not least because we don’t know how much equity it’s raised to date. As a point of reference, Thrasio is now valued at about $5 billion; Razor Group out of Berlin was valued at over $1 billion last week; and Perch also is now in the nine-figure range. As with all of these, Heyday is also profitable on an EBITDA basis, Rymarz confirmed to me. There are millions of third-party sellers using Amazon as their primary route to market, and Heyday and others like it have seized on a prime opportunity to target them: Often, these merchants lack the capital or appetite to take their businesses to the next level of growth. At the same time, as Amazon and other marketplaces mature, there are more sophisticated ways and more technology that could be used in aid of improving how to leverage them to find more buyers for products, amid a pool of me-too brands that are also finding ways to game Amazon’s algorithms. The pitch that Heyday makes is that it has built technology that evaluates this sea of merchants to identify the most interesting of them all. Rymarz said that for every 100 merchants it looks at, it might consider buying just one. When Heyday buys these companies, and their intellectual property, the idea is that it reaps the rewards of doing that scaling itself. It does so by integrating the business into a larger platform to manage marketing and sales analytics, production and distribution, and retail channels; and by following the company’s initial trajectory to continue developing more products to take along on that journey. Given the number of third-party merchants and the gating factors for them scaling, this has become an area ripe for consolidation, and so, unsurprisingly, it has also become an area ripe for competition among consolidators. In addition to Thrasio, Razor Group and Perch, others that have recently raised both equity and debt for the same ends include Heroes, which raised $200 million in August; Olsam with $165 million; Suma Brands ($150 million); Elevate Brands ($250 million); factory14 ($200 million); as well as Branded, SellerX, Berlin Brands Group (X2), Benitago, Latin America's Valoreo and Rainforest, and Una Brands out of Asia. There are dozens more. How Heyday differs from these others is that, at least up to now, it has focused not on quantity of merchants, but quality. Rymarz said that Heyday currently has only 15 brands in its stable, compared to, say, 200+ for Thrasio and 150+ for Razor Group. Again, this is also intentional: “We have much larger brands, with five of them making up over 70% of our revenues.” He positively bristles when Heyday is described as a rollup play. “Amazon is a launchpad, and we are not an aggregator,” he said. For competitive reasons, Heyday has never publicly disclosed any of the names of the brands that it owns, but they are products in categories like home and lifestyle. And the bigger strategy is not just to build up their profiles on Amazon but to extend to a variety of other channels, including placement in household-name brick and mortar chains. (Rymarz showed me several brands under the condition that I would not publish their names, but just so that I could get a better idea of what it owned. At least two of them are gearing up to sell in stores like Target.) Heyday’s pitch these days typically does not bring on any of the teams involved with the brands that it buys up (there are sometimes exceptions to that, Rymarz said), but it has been bringing on more people with extensive e-commerce experience into the team to build out its wider operation. In addition to hiring more branding and retailing teams, it has included adding a number of new executives, including a CFO (Navid Veiseh, previously at Amazon and Coupang); a CMO (Reema Batta, formerly of Opendoor and Expedia), and a chief administrative officer (Todd Heeter, formerly of Doma and Anixter). It’s been interesting to see how so many investors have piled into the opportunity in the last couple of years. (Other big names that have been backing Amazon marketplace consolidators include SoftBank, BlackRock, Silver Lake, Target Global, Tiger Global and more.) Part of the appeal is that it gives investors a look into some of the massive e-commerce growth that we’ve seen over the last decade, in a landscape that has otherwise been dominated not by startups, but by big players like Amazon. That, of course, has become an even more acute opportunity in the last two years with the rise of COVID-19 and the accelerated shift we’ve seen to more people shopping online than ever before. "We have been exceptionally impressed with Sebastian and his team, their vision, and commitment to operational excellence for the next generation of consumer brands," said Jake Vachal, managing director at The Raine Group, in a statement. "Heyday’s innovative approach to growing and incubating brands provides entrepreneurs access to leading technology, as well as deep-rooted expertise spanning operations and marketing. We are excited to be partnering with this team as they continue building a differentiated platform for quality, digital-first brands." Investors in this round said that Heyday’s particular approach was also a factor. "Heyday's differentiated strategy and world-class team stand-out in what is playing out to be one of the most explosive new industries," said Sandesh Patnam, managing partner Premji Invest, in a statement. "We are excited to partner with the leadership team to help Heyday leave a mark on the e-commerce space." |

| UK opens in-depth probe of Nvidia-ARM deal, citing national security and competition concerns Posted: 16 Nov 2021 06:16 AM PST Chipmaker Nvidia’s planned $40 billion purchase of U.K.-based chip designer ARM will face an in-depth probe by the U.K.’s competition regulator after the government ordered the Competition and Markets Authority (CMA) to take a closer look at the proposed transaction. The U.K.’s digital secretary, Nadine Dorries, said today that she has written to the CMA instructing it to carry out a phase two investigation — citing competition and national security concerns. Back in August, the government published details of the CMA’s preliminary probe which raised a number of competition concerns attached to the acquisition — saying it could lead to a "substantial lessening of competition” in markets for data centres, Internet of Things, the automotive sector and gaming applications. The CMA’s phase one report, which recommended a deeper probe on competition grounds — but did not make a decision on the national security issue — has been published in full today. Back in April, the government issued an intervention notice on national security grounds — asking the CMA to prepare a report on the implications of the transaction to help it decide whether a deeper probe is required. Today Dorries said national security interests remain “relevant” — and “should be subject to further investigation”. Under the Enterprise Act 2002, the digital secretary has statutory powers that allow her to make a quasi-judicial decision to intervene in mergers under a handful of public interest considerations, including for matters of national security. Commenting in a statement, she said: "I have carefully considered the Competition and Market Authority's 'Phase One' report into NVIDIA's proposed takeover of Arm and have decided to ask them to undertake a further in-depth 'Phase Two' investigation. "Arm has a unique place in the global technology supply chain and we must make sure the implications of this transaction are fully considered. The CMA will now report to me on competition and national security grounds and provide advice on the next steps. "The government's commitment to our thriving tech sector is unwavering and we welcome foreign investment, but it is right that we fully consider the implications of this transaction". Nvidia has been contacted for comment on the phase two referral. The CMA will have 24 weeks (with a possible eight-week extension) to conduct the phase two probe and report its findings to the government — meaning, at the very least, Nvidia’s acquisition of ARM faces months more delay before the transaction could be cleared. The digital secretary will need to take a decision on whether to make an “adverse public interest finding” — in relation to the acquisition on national security and/or competition grounds — which, if she does make such a finding, could lead to the acquisition being blocked on public interest grounds. A final decision on the national security issue lies with the U.K. secretary of state — who has 30 days after receiving the CMA’s final report to make the call. If Dorries finds no adverse public interest grounds for intervention she would refer the case back to the CMA — which could still advise against it on competition grounds — and/or impose conditions in order to remedy concerns so it may go ahead. So there are substantial barriers to clearance — with the potential for the acquisition to be blocked on both national security and competition grounds, or on one of either ground. Although it could also ultimately be cleared on both grounds (albeit that seems unlikely on the competition front, given the CMA’s phase one probe raised significant concerns). The deal could also be approved subject to remedies (aka conditions and/or restrictions intended to address specific concerns). Growing concernsNvidia’s plan to buy ARM faced instant domestic opposition, with one of the original co-founders of the company starting a campaign to “save ARM” from being snapped up by the U.S. giant. The global chip crunch has only likely heightened concerns about supply chain stability in the semiconductor arena (though ARM develops and licenses IP, rather than making chips itself). And the EU recently announced a plan to legislate with a Chips Act that’s intended to strengthen regional sovereignty around semiconductor supply. The European Union is also examining the Nvidia-ARM deal directly — announcing its own in-depth investigation late last month and throwing up another road-block for the U.S. giant to scoop up the U.K. chip designer. In a similar finding to the CMA’s phase one probe, the Commission said its preliminary analysis of the Nvidia-ARM deal raised a raft of competition concerns. “The Commission is concerned that the merged entity would have the ability and incentive to restrict access by NVIDIA’s rivals to Arm’s technology and that the proposed transaction could lead to higher prices, less choice and reduced innovation in the semiconductor industry,” the EU’s executive wrote last month. “Whilst Arm and NVIDIA do not directly compete, Arm’s IP is an important input in products competing with those of NVIDIA, for example in datacentres, automotive and in Internet of Things,” added competition chief Margrethe Vestager in a statement. “Our analysis shows that the acquisition of Arm by NVIDIA could lead to restricted or degraded access to Arm’s IP, with distortive effects in many markets where semiconductors are used. Our investigation aims to ensure that companies active in Europe continue having effective access to the technology that is necessary to produce state-of-the-art semiconductor products at competitive prices.” The EU has until March 15, 2022 to decide whether or not to clear the acquisition. According to a Reuters report last month, the Commission was not swayed by concessions offered earlier by Nvidia as it sought to avoid an in-depth EU probe. |

| EasySend raises $55.5M for a no-code platform to build online interactions with customers Posted: 16 Nov 2021 06:00 AM PST No-code continues to permeate the many layers of enterprise IT, where traditionally non-technical workers have had to rely on technical experts to get things done, and startups building these tools are raising a lot of money as they see a surge of business. In the latest development, EasySend — a Tel Aviv startup that has built a platform for people to build customer interactions using drag-and-drop interfaces that do not require knowing any coding languages — has raised $55.5 million, a Series B that it will be using to continue building out more templates for its platform and to hire more talent, as well as for business development. Oak HC/FT is leading the round, with previous backers Vertex IL, Intel Capital and Hanaco Venture also participating. EasySend said it separately also secured $5 million in venture debt from Silicon Valley Bank. Tal Daskal — the company’s CEO who co-founded the startup with COO Omer Shirazi and CTO Eran Shirazi — would not disclose EasySend’s valuation, but said it was five times bigger than its previous valuation. For some context on that earlier number, PitchBook estimated that the startup was valued at $31.4 million in its last round, which would make this current valuation about $157 million, if that figure is accurate. In any case, the company has seen a big boost of business, specifically out of the U.S., where revenues grew 10-fold. EasySend has some 100 enterprise customers today, spanning areas like education, government, financial services and insurance. The latter two are particularly strong verticals for EasySend, with Cincinnati Insurance, NJM Insurance Group, PSCU, Sompo and Petplan among its customers. The startup has raised $71.5 million to date. The opportunity in the market that EasySend has been targeting is that typically a lot of businesses produce and use paper-based forms to gather information about customers, and the people who often formulate those materials are not technical. But as companies started to make a bigger and bigger shift toward virtual environments for customer service, they needed to move away from all of those paper-based processes. Daskal and the team saw an opportunity, he said, to “help the business digital customer journeys from scratch.” The company started out first in traditional banking, but quickly saw the same problem and potential solution in a lot of adjacent markets. That development, meanwhile, has been also caught up in the currents of COVID-19: As more companies push for so-called “digital transformation” they have sped up the move away from paper-based and offline activity. That has also driven more business to EasySend, as one way for companies to help more of their staff engage with and use digital tools to get their work done. And, as is often the case, the digital tools replacing the analogue ones are giving their users more functionality: One area where EasySend has built out tech and will be doing more is in the area of analytics, where users can track engagement around the interactions that they have built. That will soon become augmented with AI insights to provide more trending and forecasting data, Daskal told TechCrunch. The plan is to continue investing not just in addressing more “customer journey” use cases, but to bring in more technology like RPA to make the process even more integrated with the rest of the business. Adding newer services like ID verification, e-signatures and other technology from third parties will potentially open the door to handling a more complex and wider array of interactions. "Today, more than ever, companies need to create exceptional customer experiences to have a competitive edge. EasySend has transformed the way businesses deliver a digital experience to their customers in a quick and efficient way," said Dan Petrozzo, partner at Oak HC/FT, in a statement. "Our investment is a reflection of our belief that EasySend is in a unique position to lead enterprises into the digital era, and we see significant growth opportunities ahead." |

| Real estate marketing software provider Luxury Presence raises $25.9M in a Bessemer-led Series B Posted: 16 Nov 2021 06:00 AM PST Luxury Presence, a startup selling marketing software to real estate brokerages, announced today it has raised $25.9 million for its Series B round. Bessemer Venture Partners led the round alongside fellow existing investors Toba Capital and Switch Ventures. Dallas Mavericks basketball player Dirk Nowitzki also participated in the round along with other angel investors, making his first-ever institutional investment. The Los Angeles-based company, which last raised in January 2020, has amassed a total of $33.3 million since its launch in 2016. Luxury Presence's product has evolved over this period from a website building tool to a more holistic real estate content management system that now includes a customized home search tool for agents as well as marketing, social media, and lead generation support. The company serves 3,700 customers, including individual and multi-agent real estate teams. Its customers are concentrated in high-end metropolitan areas across the US and Canada, founder and CEO Malte Kramer told TechCrunch in an interview. Luxury Presence will use the funds to build new sales products for agents, some of which it expects to announce later this year, as well as to continue iterating the platform's design and user experience. It will also invest in launching networks similar to its new Global Collective, which helps its 30 member agents, who all have at least $1 billion in individual sales, connect and share opportunities. The company doubled its headcount in the past year to over 130 employees today, and plans to double it again in 2022, Kramer said. One major growth area for new hires is its 25-person sales team, many of whom will likely be based in the company's second office in Austin that opened earlier this year. Kramer said that the recent surge of individuals moving to new states and regions during the pandemic has opened up opportunities for collaboration between agents. Surging demand for second homes has also catalyzed the luxury real estate segment in the past year. Kramer noted the importance of integration to real estate agents, who he said have not historically embraced new technology solutions. Most agents are "hiring different specialists for different tasks," Kramer said. "They might have different point solutions and software tools. They might have a marketing assistant on a team, they might have a brother-in-law who does their SEO. It takes a lot of time for them to do all those things, and they’re not very well integrated," he added. Luxury Presence's cost-efficient customer acquisition and high retention rates attracted Bessemer, which has backed prominent SaaS companies like Toast and Shopify, to invest, partner Byron Deeter told TechCrunch in an email. "We watched the pattern recognition closely to see the signs of customer love really taking hold for [Luxury Presence]," Deeter wrote. |