TechCrunch |

- Dogs aren’t just a vibe, they’re a lifestyle, and Fable built a brand to match

- U.S. fintech Current introduces high-yield savings where customers earn a 4.00% APY

- A bill to ban geofence and keyword search warrants in New York gains traction

- Stoïk combines cyber insurance products with active security monitoring

- Meet Paysail, the startup making B2B payments faster using crypto

- Databricks launches its first industry-specific lakehouse

- Serve Robotics’ new autonomous sidewalk delivery robots don’t require human assist

- Germany’s SoSafe raises $73M Series B led by Highland to address human error in cyber

- Swell takes in $20M to develop more adaptable headless commerce infrastructure

- Tiger Global backs Accrue Savings’ ‘save now, pay later’ approach to consumer purchases

- Seel secures $17M round to infuse AI in customer product returns

- Shield bags $15M Series A to address surging demand for its AI-powered communication compliance platform

- Crypto API provider Conduit wants to be the Stripe of decentralized finance

- Tencent invests in Easy Transfer to amp up cross-border payments ambition

- Give users genuine control over ad targeting, MEPs urged

- HeyCharge’s underground charging solution raises $4.7M Seed led by BMW i Ventures

- Global Processing Services adds $100M to its coffers to grow its embedded finance and API payments platform

- Fintech Farm nabs $7.4M to launch neobanks in Nigeria and other emerging markets

- Kenyan BNPL startup Lipa Later eyes more African markets after raising $12 million

- MycoWorks, making leather from fungi, closes $125M to scale production

| Dogs aren’t just a vibe, they’re a lifestyle, and Fable built a brand to match Posted: 13 Jan 2022 07:18 AM PST The way that recent generations of consumers treat(!) their dogs is vastly different than those who have come before. It’s gotten to the point that it’s memeable. There are a handful of new pet veterinary services out there, such as Bond Vet and Small Door, and pet food companies have gotten into the mix in a real way, including Farmer’s Dog and Spot & Tango to name a few. Fable, on the other hand, is thinking about the accessories a pup parent needs to stay sane in an urban environment, including collars, leashes, crates, and toys. The company just raised $9 million in Series A, led by 14W, with participation from Female Founders Fund and Slow Ventures. And that fresh cash shows that its plan to build dog accessories that work together as an ecosystem is a smart one. The New York-based startup is riding the waves of both pandemic-fueled puppy purchasing and the trend in how millennials take care of their pets. Like, you know, living breathing companions. But rather than focus solely on the pets themselves, Fable also makes a conscious effort to think of the pet parent, as well. Fables products are all designed to make caring for a pet easier and more aesthetically pleasing, to boot. The company launched with a collar and a leash, and then evolved to a new kind of hands-free leash called the Magic Link. Anyone who has tried to multitask getting coffee and walking the dog at the same time can quickly realize the value in a hands-free leash.  Image Credits: Fable Pets Fable then expanded to other use-cases around caring for a dog, including a crate that can double as an side table by the bed, a dog bowl, a poop bag dispenser (that is durable enough to not need replacing after a few months) and, importantly, toys. In fact, Fable’s best selling product is a game aptly called The Game. I have one for my puppy that has been an actual godsend. The Game has a weighted bottom and a silicon frame wherein you can put up to a cup of kibble or treats. Inside, there is a sliding mechanism that lets you set the difficulty for your dog. From there, the pup activates both their play and their prey drive and can stay occupied for quite some time. I’ve had other treat-dispensing toys for my puppy, including puzzles and balls, that are either too easy for him (earns me five minutes) or are cheap and super loud. The Game seems to solve for those two problems. Fable also released a toy called the Falcon, which dispenses treats through a small slot that the puppy has to squeeze to make open. Falcon is good on its own, but you can chain together multiple Falcons to create different, more difficult games for your little gal or guy. All of these products are designed to look good in a small space, with matching earth and jewel tone coloring. This is where the real genius of Fable lies. One product leads to another. Once you’ve purchased the essentials — a collar and leash — it makes sense to buy a matching toy or poop bag dispenser from a now-trusted brand. If your dog loves The Game, why not buy the Falcon? Why not buy two? And if you have a Falcon, did you know it can hang down on the inside of the Crate so your dog can stay busy and stimulated in there? And while you’re at it, why not get a matching bowl? But Fable isn’t resting there. The company is thinking not only of new use cases to add into the portfolio, but ways to enhance existing products. For example, sibling founders Jeremy Canade and Sophie Bakalar, described plans to sell an add-on to the Crate. (Right now, it has no drawer or compartment for storing human stuff.)  Image Credits: Fable Pets Canade also hinted at a different insert for The Game that would change the difficulty of the toy for the dog. Planned obsolescence isn’t part of the strategy here, but rather, what else can the company offer to enhance existing products while releasing new ones? The startup has had quite a bit of success using this strategy. In 2021, there have been more than 20,000 people on the waitlist for the Crate, and Fable sold a unit of The Game every five to ten minutes over the holidays. Overall, the business grew approximately 3x year over year, according to the team. It doesn’t hurt, either, that people naturally love sharing content around their dogs. The organic marketing around products like the Magic Link and The Game has helped spread the word tremendously, according to Canade and Bakalar. Fable’s price point leans more toward the premium end of the Spectrum. The Crate stands out specifically at $395 — you can pick up a crate on Amazon or PetCo for $40. But Bakalar explained that the pricing depends on how you benchmark the products themselves. The Crate, for example, is also a bedside table, so when comparing it to prices at West Elm or Restoration Hardware, it’s much more in line. The Game is $55, the Magic Link is $65, and the Waste Bag Holder is $35, to give you some idea of the range for pricing. “Those [competing] products are designed to be thrown away in the short term and to be remodeled,” said Canade. “We’re trying to actually rethink the products from scratch and make things that are both for the animal and the human. They’re meant to live in both those worlds simultaneously. Nobody is doing that. Everybody is either designing only for the human, with a quality grade that is not meant to stand up to the wear and tear of a dog, or only for a dog, [that doesn’t fit into the use cases of a human].” (The audio on my transcript was terrible for the end of this quote. Waiting on clarification from Canade and will update when I hear back.) |

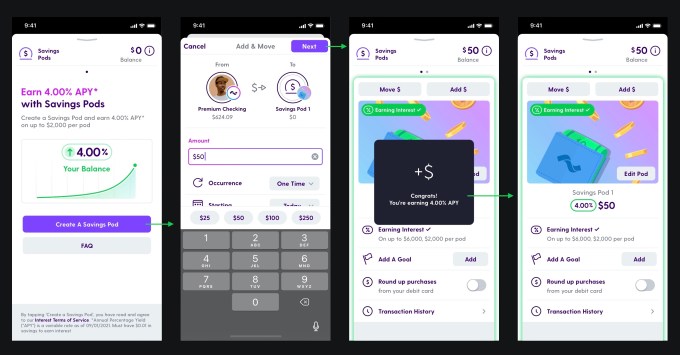

| U.S. fintech Current introduces high-yield savings where customers earn a 4.00% APY Posted: 13 Jan 2022 07:04 AM PST As competition amid digital banks heats up, U.S. fintech Current is rolling out a new product designed to make its banking service more appealing. The company announced this morning it’s launching a new high-yield offering called “Interest” that allows any Current account holder to earn a 4.00% Annual Percentage Yield (APY) — a rate that’s 60x higher than the national average, it notes. The Interest offering will be made available to all Current users, including those on Current’s free Basic plan as well as Premium users who pay to access upgraded features. (The latter group also likely helps Current be able to afford to boost its APY, in fact, as Premium subscribers pay $4.99 per month for Current’s expanded service.) While it’s common for neobanks to offer a higher APY than traditional banks, many banking services require users to jump through hoops to reach the higher rate. For example, One Finance offers a 1.00% APY in its “Save” product on funds up to $5,000, but to get its higher 3.00% rate, you have to set up the auto-savings feature. Aspiration and Varo also offer a 3.00% APY, but have their own requirements around spending, balances, total direct deposits, and more. Current’s new offering, however, pays out on funds up to a total of $6,000 annually, the company says. It also notes there is no minimum balance required and no direct deposit or spending requirement. However, what makes its product different is that all members will be able to earn interest on their funds on a daily basis. (Typically, banks pay the interest monthly.) Plus, the catch on Current’s product is that the $6,000 total has to be spread across its Savings Pods. So the APY is earned on up to $2,000 per pod. That makes it more of a viable choice for customers just starting to save and who want to organize their money into different groupings, rather than someone looking to park a larger balance.  Image Credits: Current Current tells TechCrunch it’s not introducing this high-yield product at a higher rate which it aims to bring down later, over time. “We’re not approaching this as a promotional rate,” explains Current VP of Product, Josh Stephens. “We’re approaching it as something that’s available for the all the foreseeable future…I think, certainly, you see promotional rates from other folks out there with a lot of bells and whistles attached to it. But this is something that’s available for anyone, with no balance minimum, no fees,” he says. The company also sees the rate as a way to better promote its banking service in a crowded landscape. Current, which got its start as a teen banking service, expanded over the years to offer a more competitive product for adults — including those without kids. Like many digital banking services, Current offers perks like fee-free overdrafts, cashback, fee-free ATMs, faster direct deposits, automated savings, money management tools, and more. With Interest’s launch, it’s now responding to customer demands for better savings products, as well. “Inflation has been rising at one of the highest rates in 40 years over the last couple of months. [The Consumer Price Index] has been rising at the fastest pace since the early 80s,” says Stephens. “And for our members — and for a lot of Americans — this meant their money just isn’t going as far as they need. That means they’re paying more for the same goods and services. It’s making it harder to put money aside.” Meanwhile, Current believes the existing options on the market make it difficult for banking customers to meaningfully grow their money. The change could encourage some banking customers who have their funds parked in savings elsewhere to move over to Current’s service instead. Over time, they may upgrade to premium Current products and services, making the higher APY worth it from a business perspective. Today, Current has over 3 million members, free and paid, with an average age of 27 among its member base — younger than many competitors. Longer-term, the company plans to roll out more offerings to help these customers further grow their money. It’s planning to enter the crypto space, having last year announced a partnership with Acala to create a new category of “hybrid finance” which will combine the benefits of traditional banking and decentralized finance. Consumer lending is also on its roadmap. Current’s new Interest product will begin to roll out today across iOS and Android. |

| A bill to ban geofence and keyword search warrants in New York gains traction Posted: 13 Jan 2022 07:02 AM PST A New York bill that would ban state law enforcement from obtaining residents’ private user data from tech giants through the use of controversial search warrants will get another chance, two years after it was first introduced. The Reverse Location Search Prohibition Act was reintroduced to the New York Assembly and Senate last year by a group of Democratic lawmakers after the bill previously failed to pass. Last week, the bill was referred to committee, the first major hurdle before it can be considered for a floor vote. The bill, if passed, would be the first state law in the U.S. to end the use of geofence warrants and keyword search warrants, which rely on asking technology companies to turn over data about users who were near the scene of a crime or searched for particular keywords at a specific point in time. For geofence warrants — also known as “reverse location” warrants — law enforcement asks a judge to order Google, which collects and stores billions of location data points from its users’ phones and apps, to turn over records on whose phones were in a certain geographical radius at the time of a crime to help identify possible suspects. Geofence warrants are a uniquely Google problem; law enforcement knows to tap Google’s databases of location data, which the search giant uses to drive its ads business, last year netting the company close to $150 billion in revenue. It’s a similar process for Google searches; law enforcement asks a judge for a warrant to demand that Google turns over who searched for certain keywords during a particular window of time. Although less publicly known, keyword search warrants are in growing use and aren’t limited to just Google; Microsoft and Yahoo (which owns TechCrunch) have also been tapped for user data using this kind of legal process. The use of these warrants has been called “fishing expeditions” by internet rights groups like the Electronic Frontier Foundation, which recently lent its support to the New York bill, along with the ACLU. Critics say these kinds of warrants are unconstitutionally broad and invasive because they invariably collect data on nearby innocent people with no connection to the crime. TechCrunch reported last year that Minneapolis police used a geofence warrant to identify protesters accused of sparking violence in the wake of the police killing of George Floyd in 2020. Similar encounters reported by NBC News and The Guardian revealed how entirely innocent people have been tacitly accused of criminality simply for being close to the scene of the crime. According to data published by Google, geofence warrants make up about one-quarter of all U.S. legal demands it receives. Since Google became widely known among law enforcement as a source for connecting location data and search terms to real-world suspects, Google processed more than 11,500 geofence warrants in 2020, up from less than a thousand in 2018 when the practice was still in its relative infancy. New York state accounted for about 2-3 percent of all geofence warrants, amounting to hundreds of warrants in total. Zellnor Myrie, a New York state senator who represents central Brooklyn and sponsored the senate bill, told TechCrunch: “In dense, urban communities like the ones I represent in Brooklyn, hundreds or thousands of innocent people who merely live or walk near a crime scene could be ensnared by a geofence warrant that would turn over their private location data. And keyword search warrants would identify users who have searched for a specific term, name or location. Our bill would ban these types of warrants and protect New Yorkers’ privacy.” |

| Stoïk combines cyber insurance products with active security monitoring Posted: 13 Jan 2022 06:24 AM PST Meet Stoïk, a new French startup that wants to protect small and medium companies against cybersecurity incidents. The company offers an insurance product as well as a service that monitors your attack surface. The startup recently raised a $4.3 million (€3.8 million) seed round from Alven Capital, Anthemis Group, Kima Ventures as well as several business angels, such as Raphaël Vullierme, Emmanuel Schalit and Henry Kravis. Stoïk targets SMEs specifically as they are quite vulnerable when it comes to ransomware and other cyber attacks. And yet, small companies often aren't doing enough to protect their software infrastructure. "We're going to insure you and protect you," co-founder and CEO Jules Veyrat told me. "But what we're going to sell is the insurance product. If you get attacked, you have a phone number that you can call 24/7 and all the cost implications are insured." At the same time, Stoïk is going to offer monitoring tools so that small companies can fix vulnerabilities in their infrastructure. In that case, incentives between Stoïk and Stoïk's clients remain aligned. The team of 15 have already signed partnerships with insurance companies to design the insurance products. Stoïk sells insurance products and charges its clients directly — it takes a cut on each contract. It works with a third-party company called Inquest to handle crisis management. Stoïk works a bit like Coalition in the U.S., except that it doesn't partner with brokers to distribute its insurance product. The French startup wants to build a direct relationship with its customers. As for the tech product, when you sign up to the service, you enter your domain name and start a scan. Stoïk looks at DNS records, finds IP addresses and scans online databases for password leaks associated with this domain name. You get a score and several tips to improve that score. For instance, Stoïk can tell you that some services are externally exposed even though they shouldn’t be. If your score is above a certain threshold and if you generate less than €50 million in annual revenue, you can subscribe to the insurance product. The company is currently in the pre-launch phase with contracts that range from €50 to €400 per month. Up next, it plans to add more features to its monitoring service. For instance, Stoïk wants to scan internal accounts. You could imagine scanning your Amazon Web Services configuration to spot some vulnerabilities. And that should also help when it comes to closing new contracts with potential customers. |

| Meet Paysail, the startup making B2B payments faster using crypto Posted: 13 Jan 2022 06:00 AM PST Companies use invoices to pay for many of their major costs, ranging from materials to contract work. Most still rely on solutions built on top of bank transfers or credit cards to complete cross-border payments, which typically take 2-5 days to complete and represent a $130 trillion global market. Enterprise payments startup Paysail just raised seed funding to build a tool that shortens the cross-border payment process to less than five seconds, the company says. Its solution leverages stablecoins, which it describes as "cryptocurrencies designed to have a stable price because they are pegged to a commodity or currency." Using stablecoins to pay invoices also reduces transaction fees for businesses by removing third-party intermediaries, according to Paysail. Other startups in the space using traditional banking infrastructure to make payments more efficient have hit a ceiling on how fast and cheap they can offer payments because fees charged by these intermediaries, particularly between countries that don't transact as regularly, Paysail cofounder Nicole Alonso told TechCrunch in an interview.  Paysail cofounders Nicole Alonso and Liam Brennan-Burke. Image Credits: Paysail "There have been enormous strides in making payments between, let’s say, the US and Canada, significantly cheaper and quicker. But if you’re sending a payment from the US to [a country in] Africa, it could still be really difficult and cost exorbitant fees," Alonso said. The cost of making a cross-border payment using legacy systems like Bill.com usually includes a transaction fee charged by the third-party intermediary as well as a currency exchange fee. A transfer done through Paysail, in contrast, costs only a "gas fee" it takes for the transaction to be validated on the blockchain, currently less than one-tenth of a cent, Alonso said. Paysail is currently using Celo's CUSD stablecoin, which tracks the price of the U.S. dollar, to enable payments and plans to expand to other stablecoins backed by different countries' fiat currencies as it grows. It is also evaluating a transaction fee of around 0.9% to generate revenue for the business, which Alonso said could be structured as a tiered offering based on each company's transaction volume and will ideally "significantly undercut any existing competitors in the non-crypto space" on price. The company announced its $4 million seed round today led by Uncork Capital, with support from Tribe Capital, Pear VC and Mischief Capital. Angel investors Nik Milanović, head of business development and strategy at Google Pay, and Juan Manuel Fernández Lobato, founder and CEO of Ebury, also participated in the round. Paysail's current users comprise "a small cohort" of companies, most of which are already transacting in cryptocurrency or are familiar with the space, Alonso co-founder Liam Brennan-Burke told TechCrunch. The company wants to fine-tune its solution for crypto-native customers before expanding to those that have no prior crypto experience, Brennan-Burke added. Alonso and Brennan-Burke, who launched Paysail after meeting as students at Claremont McKenna College last year, are Paysail's only full-time employees today. They plan to use their funding to hire a full-time engineering team, as well as legal counsel and eventually a sales team. Paysail is building its tech to allow users who don't have an existing crypto wallet to start transacting on its platform by generating a noncustodial wallet on users' behalf through a third-party wallet provider. It aims to eventually bring this functionality in-house and add new features within the Paysail wallet like allowing users to earn yield on their stablecoin holdings, Brennan-Burke said. In countries like Nigeria, where local fiat currency depreciation poses a significant risk, companies may prefer to hold their wealth in stablecoins pegged to less volatile currencies and transfer it into local fiat on their own timeline, he added. "The goal ultimately with the platform is to continue making cryptocurrency payments really digestible and easy to use, and not so daunting for those businesses and individuals who don’t have any prior experience with it," Brennan-Burke said. |

| Databricks launches its first industry-specific lakehouse Posted: 13 Jan 2022 06:00 AM PST As cloud infrastructure projects grow increasingly complex, there’s been a trend in the industry to launch pre-packaged solutions for specific verticals. Today, the well-funded data analytics firm Databricks is joining the fray with its first vertical-specific solution: Lakehouse for Retail. The promise here is to offer a fully integrated platform that can help retailers extract value from the vast volumes of data they generate, be that through traditional analytics or by leveraging Databricks’ AI tools. “This is an important milestone on our journey to help organizations operate in real-time, deliver more accurate analysis, and leverage all of their customer data to uncover valuable insights,” said Databricks CEO and co-founder Ali Ghodsi. “Lakehouse for Retail will empower data-driven collaboration and sharing across businesses and partners in the retail industry.” Some of the early adopters for the platform include the likes of Walgreens, Columbia and H&M Group. These users get access to the full Databricks platform, but also — and most importantly — a set of Lakehouse for Retail Solution Accelerators that offer what Databricks calls a “blueprint of data analytics and machine learning use cases and best practices” which can ideally save new users months of development time. These include templates for real-time streaming data ingestion, demand forecasting, recommendation engines and tools for measuring customer lifetime value. It’s worth noting that Databricks previously offered similar blueprints, but customers had to assemble these for themselves instead of Databricks offering them as part of an integrated solution. “With hundreds of millions of prescriptions processed by Walgreens each year, Databricks' Lakehouse for Retail allows us to unify all of this data and store it in one place for a full range of analytics and ML workloads,” said Luigi Guadagno, Vice President, Pharmacy and HealthCare Platform Technology at Walgreens. “By eliminating complex and costly legacy data silos, we've enabled cross-domain collaboration with an intelligent, unified data platform that gives us the flexibility to adapt, scale and better serve our customers and patients.” Over the course of the last few years, Databricks has been trying to popularize the concept of the ‘lakehouse.’ which combines the best of data warehouses for analytics and data lakes for storing vast amounts of raw data that has yet to be operationalized. |

| Serve Robotics’ new autonomous sidewalk delivery robots don’t require human assist Posted: 13 Jan 2022 06:00 AM PST Serve Robotics, an Uber spinout that builds sidewalk delivery robots, is deploying its next generation of robots that are capable of completing some commercial deliveries without a human in the loop, according to the startup. That means in certain operational design domains, or geofenced areas, Serve won’t be relying on remote operators to teleassist robots or followers to trail behind the robots for safety. Most companies in the industry, like Coco, Starship Technologies and Kiwibot, lean on remote operators to monitor autonomous deliveries and take over driving in case the robot stops or needs help, so Serve’s milestone is indeed a step toward progress in robotic deliveries. “The problem we have solved is that relying on teleoperation for safety means you must count on 100% reliable LTE networks and 100% mistake-free operators, both of which are impossible to achieve consistently,” Ali Kashani, co-founder and CEO of Serve, told TechCrunch. “Consider what happens when a safety situation requires human attention, but the video is delayed or the connection has dropped? With Level 4 robots, humans are not needed to be in the loop to ensure safety.” Serve began rolling out its next generation of robots in December and says it recently completed its first delivery at Level 4 autonomy, which SAE defines as a system that can drive autonomously as long as certain conditions are met and will not require a human to take over driving. The startup’s robots currently have L4 capabilities in some neighborhoods in Los Angeles, such as Hollywood, where Serve has been operating since 2018, Kashani said. “When the robot is in a given area where Level 4 is enabled, the remote video feed turns off and the robot continues navigating autonomously without requiring a human in the loop,” Kashani told TechCrunch. “The robots can always request assistance if in need of one, say if they come across something unexpected. They also turn video on while crossing intersections. But for the majority of the time they operate autonomously.” Until autonomous vehicles reach Level 5 capability, under which the system can operate in all conditions without a human, there will always be a long tail of edge cases that robots are unfamiliar with. Relying on humans for those makes sense from both a safety and commercialization perspective, said Kashani. Serve’s new robots are equipped with a range of active sensors, like ultrasonics and lidar sensors from Ouster, and passive sensors like cameras to help navigate busy sidewalks. The startup has developed specific capabilities for its bots, like automatic crash prevention, vehicle collision avoidance and fail-safe emergency braking, according to the company. The computations needed to produce those capabilities in real-time are powered by chip-maker Nvidia’s Jetson platform, which is designed specifically for robots and other autonomous machines. The company raised a $13 million expanded seed round last month, which it said would be used to fund accelerated expansion plans into new customer segments and geographic areas. In line with those stated goals, Kashani said Serve’s next steps are to deploy its next-gen robots in more areas, starting with expanding in Los Angeles. |

| Germany’s SoSafe raises $73M Series B led by Highland to address human error in cyber Posted: 13 Jan 2022 05:53 AM PST As we've learned in the last few years, 'human error'-led cyber security breaches are the ones companies often find it hardest to guard against. Surveys suggest some 85% of attacks can be traced back to the human factor. Thus startups built to alleviate this gap — such as the UK's Cybsafe which raises $7-9m last year — are proliferating. Addressing human behavior is clearly one of the hottest new areas for cyber. The latest to scale up in this space is SoSafe. The Cologne-based cybersecurity awareness and testing platform has now raised a $73 million Series B funding round led by growth-capital fund Highland Europe. Existing investors Acton Capital and Global Founders Capital were joined by SAP Hybris founder and Celonis Advisory Board member Carsten Thoma together with La Famiglia as well as Adjust founder Christian Henschel as participants. SoSafe competes with platforms like Knowbe4 (that went public in 2021) and Cofense which has raised $58M to date. SoSafe says it takes a user-centered approach to cyber security, using insights from behavioral science to nudge users in the right, and safer, direction, using gamified methods to teach end-users what to look out for in a cyber-attack. It now has over 1,500 customers including Aldi, Ceconomy AG, Taylor Wessing, Vattenfall and Valtech. Dr. Niklas Hellemann, co-founder and managing director of SoSafe, said: "Challenging the existing paradigms in security awareness and human risk management, we have seen tremendous adoption of our platform and extraordinary growth." Lead investor Highland Europe has previously backed security companies such as Malwarebytes, Cobalt, and ActiveFence. Gajan Rajanathan, partner at Highland Europe, said: "SoSafe's founders have built a trusted cybersecurity awareness and testing platform, underpinned by behavioral analytics and human risk scoring that sustainably protects the most important threat surface in cybersecurity – human security breaches. They have rapidly emerged as one of the leading software scale-ups, experiencing incredible momentum in a short period of time." |

| Swell takes in $20M to develop more adaptable headless commerce infrastructure Posted: 13 Jan 2022 05:01 AM PST Starting an e-commerce business on one of the large marketplaces, for example, Shopify, can be an easy process, but what the team at Swell began to notice was that the model could only take a business so far. Swell is working in "headless" commerce, which means it is disconnecting the front end of a website, aka the storefront, from the back end, where all of the data lives, to create a better shopping experience and so that anything on the back end can be updated and maintained without disturbing the front end. The remote-first company offers APIs, storefronts and a dashboard, all tools that can grow with any sized company. The first version of Swell was a pure API for developers, but it wasn't enabling businesses to get up-and-running quickly, so businesses were turning to marketplaces like Shopify, CEO Eric Ingram told TechCrunch. "The key is getting started quickly, which Shopify is awesome at, but you realize you are stuck when you try to do more than the basic model," Ingram said. "We needed to build something that was as easy as Shopify, but enabled you to grow. Most people can't afford to build their own back end, so we also wanted to provide something people could do without spending millions of dollars." Swell was an idea Ingram had about a decade ago that stemmed from his experience at e-commerce company Digital River and then building a few of his own businesses, including a clothing company. He and his team got things off the ground in 2021, raising $3.4 million in a seed round. Nearly a year later, the company is back again with $20 million in Series A funding, led by VMG Catalyst and Headline, with participation from Bonfire Ventures, Willow Growth, Commerce Ventures and Red Antler. Individual investors include Attentive CEO Brian Long, Gorgias CEO Romain Lapeyre, Remote First Capital and former CTO of Product Hunt Andreas Klinger, Fast.co CEO Domm Holland and Warby Parker's Brian Magida. The opportunity for additional funding was somewhat unexpected, according to Ingram, but he feels like Swell's focus on small and mid-market companies, while building an ecosystem and community, separates it from competitors like Commercetools and Fabric that are targeting larger companies.  Swell’s founding team, from left, Dave Loneragan, Eric Ingram, Stefan Kende, Mark Regal and Joshua Voydik. Image Credits: Swell "To solve the problem, it has to be something accessible to everyone rather than just big companies with big budgets," Ingram added. "Some of the platforms are only good at one thing, but there are hundreds of other models out there." In the past year, Swell grew five times in revenue and grew its customer base to over 1,000 at the end of 2021 after starting the year with 30 customers. It also created a free community plan, where customers begin paying when they start selling, to go with the standard and enterprise options. Ingram expects to use the new funding to grow Swell's team of 30 to 100 in the next 12 months and in product development, including building an app ecosystem. Plans include building out a framework for third parties to build the apps and also for customers to be able to own their own data on the back end and do more with it, something that is difficult for businesses building on marketplaces to do, he said. "A core feature will be a configurable database that could adapt to new use cases," he added. "The market is moving fast with integrations and building apps and the community will require 10 times more people to get to the next level." |

| Tiger Global backs Accrue Savings’ ‘save now, pay later’ approach to consumer purchases Posted: 13 Jan 2022 05:00 AM PST Buy now, pay later has grown to be an alternative to credit cards, with the trend generating $100 billion in sales last year, more than four times 2020. However, even with the spread out payments, debt accumulation is not easing, causing the Consumer Financial Protection Bureau to now look into the practice. Accrue Savings, founded in June 2021 by CEO Michael Hershfield, aims to get people saving again with its merchant-embedded shopping experience that rewards consumers for saving up for the things they want to buy. After raising $4.7 million, the company launched in late 2021 with its product that enables merchants to provide additional payment options. Hershfield told TechCrunch that he isn't out to replace buy now, pay later (BNPL), but be a way for brands to help people save up for items while also attracting and retaining customers.  Michael Hershfield, CEO of Accrue Savings. Image Credits: Accrue Savings "Brands have tremendous influence, and while there is a deep misnomer that Americans don't save, our own research shows that people were actually saving more during the pandemic," he added. "How Americans save can now be tied to a brand. We, as a society, need to offer better savings tools, and it needs to be on a merchant's website." Accrue Savings embeds the savings feature on a retailer's website, enabling merchants to also put the feature in targeted email or SMS campaigns. When the consumer opens an account and hits savings milestones, they can receive FDIC-insured cash contributions from brands. Because saving can take time, Hershfield felt it was too early to disclose growth metrics, but said that in its short existence, the company has racked up a customer list that includes Allbirds, Casper, Poly & Bark, Smile Direct Club and Tire Agent. It initially went live with 15 customers, and he teased that the list is expected to double in the coming months. Today, Accrue Savings announced $25 million in a Series A funding round led by Tiger Global, with participation from Aglaé Ventures and Maple VC, existing investors Twelve Below, Box Group, Red Sea Ventures, Ground Up Ventures, Good Friends and Silas Capital Ventures, and a group of individual investors, including UPS CEO Carol Tomé, Fanatics CEO Michael Rubin. "Accrue Savings helps brands reach more customers and gives consumers a responsible purchasing option. It's a win-win," said Alex Cook, partner of Tiger Global, in a written statement. "Michael and the Accrue Savings team are building a unique platform and we're thrilled to partner with them on the next stage of the journey." The new capital infusion brings the company's total funding to nearly $30 million to date. Hershfield plans to expand retail partnerships and add employees across all departments, including engineering, sales and marketing. It has 14 employees right now, and he is looking to be around 65 employees by the end of the year. |

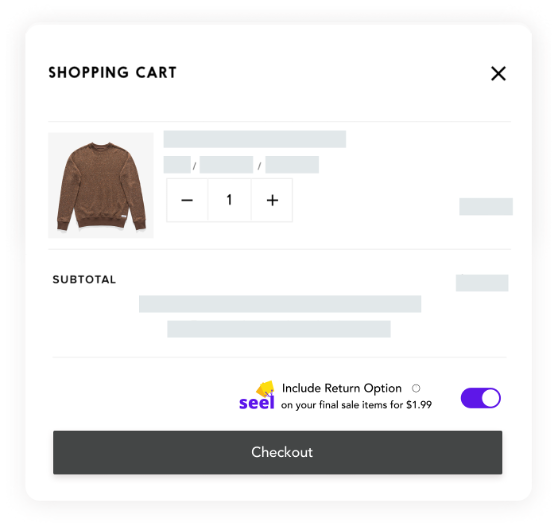

| Seel secures $17M round to infuse AI in customer product returns Posted: 13 Jan 2022 05:00 AM PST Product returns remain a headache for many e-commerce companies. Some have gotten creative in how they approach it — for example, Amazon formed relationships with Kohl's and Stein Mart for in-person returns, while PayPal acquired returns provider Happy Returns.  Seel’s return option example. Image Credits: Seel Aiming to give merchants more control over this, Seel, which focuses on underwriting e-commerce returns, is leveraging artificial intelligence to build proprietary underwriting software that uses hundreds of signals to predict the probability of return as soon as an order is placed, co-founder Zack Peng told TechCrunch via email. After an order is sold, merchants can add "return assurance" to that order and transfer the liability of return to Seel. If the order is returned in the next 30 days, Seel, instead of the merchant, will pay for the refunds, he said. Shoppers themselves can add the assurance for a small fee at checkout to make items, like ones the merchant isn't offering the service, returnable. "Merchants typically won't know their true revenue until the return window expires six to eight weeks after an order is sold," he said. "That means they often have to reconcile refunds, correct financials and adjust marketing plans for orders sold weeks ago. Instead, they can pay a variable return assurance fee when an order is sold, and instantly lock in the net revenue and streamline a significant amount of revenue operations." With the U.S. e-commerce market poised to be a $1 trillion industry by the end of this year, Peng says between 10% and 30% of merchandise is returned, with merchants continuing to take on the financial risk of managing the logistics. He believes with an industry growing that big Seel could one day underwrite over $100 billion in returns and refunds annually. The company has been around for two years, and while its private beta started five months ago, Peng said Seel has close to 200 merchants using its software, ranging from boutiques to marketplaces. It is also seeing 20% of shoppers adding the assurance to their orders, which translates to a 5% conversion lift for merchants, he added.  Seel’s team. Image Credits: Seel It is now launching its Shopify app, buoyed by $17 million in Series A funding led by Lightspeed Venture Partners. Existing investors participating include Foundation Capital, Afore Capital and West Loop Ventures. "Seel sits at the intersection between fintech and e-commerce, and both markets are growing rapidly with strong secular trends," Peng said. "With Lightspeed being an early and committed investor in Affirm and Justin (Overdorff)'s background from Stripe, the round was a perfect fit. Seel wants to build a strong fintech brand in underwriting the way that Stripe is in payments and Affirm is in credit." The new capital will be used to grow the team, strengthen the product and build out its go-to-market strategy. Seel has raised $24 million to date, he added. Peng said the company grew from five to 25 employees in 2021, and is on track to double that in the coming quarters. While the company is focused on e-commerce, Peng envisions creating a new category of risk underwriting for everyday consumer activities, for example shopping, working and playing online. "We believe high-frequency, low-severity risks will become the next big category in underwriting, and Seel is the leader in building toward that future," he added. |

| Posted: 13 Jan 2022 05:00 AM PST Over the past two years, since the pandemic hit, there has been a sharp rise in financial crime compliance costs, nearing $50 billion in 2021, up 58% compared to 2019, in the U.S. and Canada. Shield, a Tel Aviv-based startup, built a compliance surveillance platform to enable regulated financial institutions to detect market abuse, gain behavioral analysis, mitigate toxic workplace culture and automate surveillance over employee communication channels. Today, the company announced it has closed a $15 million Series A round co-led by Macquarie Capital and OurCrowd, with participation from Mindset Ventures. The startup will use the funding to significantly expand its U.S. presence with a New York City office while further establishing itself in markets throughout Europe, the Middle East, Africa and Asia. It will also ramp up the development of its communication compliance platform. As remote and hybrid work environments become more permanent, global banks have come to rely upon compliance platforms, co-founder and chief executive officer of Shield Shiran Weitzman said. The capital infusion comes at a time when the industry is actively seeking cloud-based solutions – evidenced by Shield's recent signing of a tier-one global bank as a client. Its tailored platform applies advanced artificial intelligence and natural language processing (NLP) capabilities through rigorous data enrichment, powerful analytics, enhanced search tools, and proactive surveillance, according to the company. Shield allows organizations of any size and across industries to mitigate risks, escape time-consuming data silos, improve operational efficiency and reduce compliance costs. "The ability to access and understand new and evolving communication channels is increasingly becoming a pain point for organizations, no matter the industry, and this funding round is well-timed as it will empower us to scale our technology and enhance our already robust platform that addresses compliance concerns that enterprises deal with daily," Weitzman said. "As a bootstrapped company, we've already proven that our AI platform is unquestionably valuable to banks and financial institutions." Financial regulations obligate financial institutions to capture every communication channel used for regulated employees such as traders, back-office employees, and others Weitzman told TechCrunch. The employees know that the financial institution monitors specific channels, Weitzman added. Shield takes extra measures to maintain privacy with its proprietary privacy content recognition (PCR) engine that automatically masks personal identifiable information from the communications via emails, chats, fin-chats, and voice recordings. Shield is currently monitoring more than 150,000 regulated employees and analyzes over 53 million interactions in a day, Weitzman said, adding that it has been more than tripling its revenue year to year since established in 2018. Weitzman noted that the company has a year-over-year growth of 200% in customers. According to Polaris Market Research, the global market for enterprise governance, risk & compliance is projected to reach almost $97 billion by 2028. "In order to support hybrid working, better manage to change compliance and regulatory requirements and the need to be cloud-native Shield has adopted a new architectural approach to software development. Shield's leading edged software platform, agile development philosophy and ability to rapidly implement its solution to deliver more immediate benefits to customers positions Shield to be a new market leader" said David Standen, Co-Head Venture Capital Group, Macquarie Capital. "We are excited to be the lead investor and support the aspirations of the very talented team at Shield." |

| Crypto API provider Conduit wants to be the Stripe of decentralized finance Posted: 13 Jan 2022 05:00 AM PST Financial institutions continue to search for ways to pile into the crypto market, and decentralized finance (DeFi) products are one mechanism that could help them capture share. Investors in DeFi products can earn yield on their capital by lending out their cryptocurrency in exchange for interest. But DeFi lending is far riskier than traditional lending, in part because of the volatility of the asset class. Just as "high-yield" bonds compensate investors with more cash for betting on riskier-than-average companies, DeFi lending can offer far higher interest rates than the traditional savings account wherein customers essentially lend their money to a bank. Conduit is building a set of APIs that developers can use to build platforms that provide access to DeFi products. As VP of product at crypto wallet BRD, which Coinbase acquired in November last year, Conduit CEO and cofounder Kirill Gertman experienced firsthand the challenges of finding vendors that would provide the backend tools that his team needed to build its user-facing product. After a stint at Arrival Bank and half a year as product head at consumer fintech Eco, Gertman created Conduit to be the backend solution he was looking for but couldn't find.  Conduit’s team on a video call Image Credits: Conduit "When you look at the fintech side of things, there’s already a huge stack that’s been built right to support that. You have Stripe, you have Marqeta if you want to issue cards – any use case you can come up with, you have somebody with an API that’s ready to give it to you," Gertman told TechCrunch in an interview. Conduit aims to be a one-stop shop for neobanks and financial institutions to plug their own products into the DeFi ecosystem, which Gertman said is made easier because Conduit itself is regulated and compliant, taking the compliance burden off of companies using its tools. For consumers to earn DeFi yields, their fiat currency is first converted into stablecoins, a type of cryptocurrency pegged to the fiat currency's value, so it can be invested into various crypto protocols like Compound and AAVE. Conduit offers two solutions to help companies access these yields. The first is its growth earnings account, which neobanks offer to customers so they can invest their fiat currency in DeFi. The second is Conduit's corporate treasury solution, which offers high-yield DeFi accounts to companies. "We do the ledgering, and we do a lot of stuff that basically creates a very simple bundle for [our clients], so they don’t have to worry about the complexities," like how to convert dollars to stablecoins or how to calculate rates, Gertman said. Gertman declined to name specific Conduit customers, but said they fall into two categories – neobanks and small cryptocurrency exchanges, particularly in regions like Latin America. Its largest clients are in Canada, where its product first launched, and Brazil, and it is looking to expand into markets including the US and Europe next, Gertman said. Gertman sees two types of benefits from the expansion of DeFi products, he said. The first is access – DeFi protocols are permissionless, allowing any user to lend and borrow funds without needing to provide a credit score, identity verification, or collateral. The second is that DeFi connects users globally, allowing investors in countries with extremely low or negative interest rates to earn higher yield, and making it easier for companies to borrow money at favorable rates by drawing from a global liquidity pool, Gertman added. Conduit says it plans to triple its headcount, which is fully remote, during the next year across the North America and LatAm regions by hiring engineering, sales, and compliance professionals with localized knowledge. Regulation has played a role in which countries Conduit has targeted, he added, saying that a lack of regulatory clarity from the Securities and Exchange Commission (SEC) has slowed Conduit's entry into the US. To fuel its global expansion, Conduit raised a $17M seed round led by Portage Ventures, with support from Diagram Ventures, FinVC, Gemini Frontier Fund, Gradient Ventures and Jump Capital, the company announced today. A number of fintech executives also participated in the round, from firms including PayPal, Coinbase, Google Pay, and others. Conduit bears high legal expenses to ensure it is compliant in all its markets, so Gertman decided the company needed to raise a "larger-than-average seed round," he said. "Obviously, the market conditions helped us, and we took advantage of that, and I’m not going to hide that…Even if there will be a crypto winter or something like that, we can survive that," Gertman said. |

| Tencent invests in Easy Transfer to amp up cross-border payments ambition Posted: 13 Jan 2022 04:45 AM PST Tencent has invested in Easy Transfer, a startup that aims to make tuition payments less stressful for hundreds of thousands of overseas Chinese students. Tencent declined to comment for the story, but Tony Gao, founder and CEO of Easy Transfer, told TechCrunch that the internet giant now owns about 5% of his company. The investment, which closed in December, is the first tranche of Easy Transfer’s ongoing Series C funding round. IDG Capital and ZhenFund are early investors in the startup. Easy Transfer itself doesn’t handle transactions directly; instead, it works with financial institutions with cross-border payments licenses in China. The startup’s value-add, Gao said in a previous interview, is to make remittance hassle-free. In the old practice, parents and students would need to visit a bank, fill out a stack of forms, double-check the routing information is correct, and nervously wait for the tuition to deposit in time into the university’s account. With Easy Transfer, users fill out a straightforward form online and the startup takes care of the rest for a fee of up to 200 yuan ($31). Through Tencent’s strategic investment, Easy Transfer hopes to further streamline its user experience. The partners have jointly developed a WeChat-based tuition remittance service called WeRemit. Unlike the millions of third-party lite apps inside WeChat’s ecosystem, WeRemit is partly operated by WeChat with deep support from the messaging giant. “From anti-money laundering, identity verification, to information security, WeChat makes cross-border payment transactions much more secure,” said Gao. “The gargantuan amount of user data owned by WeChat allows it to build a robust risk management system that even banks can’t match.” Before moving money around, WeRemit will ask to scan users’ faces to confirm their identity and collect their personal information, data that is already stored on WeChat. Internet platforms in China are required to verify people’s true identity before enabling core features like mobile payments and content posting. WeChat’s AI-based financial compliance system is also at work. Machine learning is used to identify and comprehend documents submitted to WeRemit, like tuition bills, offer letters, and visa information. The system can also flag high-risk transactions for manual review and compare billed amounts to the due numbers to avoid overpayment. Undergirding WeRemit’s service is Tenpay, Tencent’s online payments arm that also powers WeChat Pay, the messenger’s digital wallet. Upon receiving transactions from users, Tenpay, which holds a cross-border transact-on license, sends the money to one of the 2,000 universities that accepts Easy Transfer. Teaming up with WeChat, which has a ubiquitous presence in China, could greatly amplify Easy Transfer’s reach. The startup served 120,000 students in the past year and processed over $2 billion in transactions, according to Gao. It’s now targeting the 500,000 users that WeChat tags as “overseas students.” In all, around 700,000 Chinese students studied overseas in 2019, according to the Ministry of Education. For Tencent, a partnership with Easy Transfer could help diversify its breadth of cross-border fintech services beyond targeting outbound tourists. Gao wants to replicate Easy Transfer’s model in the rest of Asia, especially South and Southeast Asia. The plan is to capture the growing population of overseas students in countries like India, Nepal and Vietnam. Families in these countries have the same pain points in tuition transfer and are even more price sensitive, said the founder. Overseas expansion has proven challenging for Tencent, and the firm has largely relied on strategic investments to extend its influence abroad. Case in point is its massive portfolio of video games companies. Tencent had backed multiple fintech service providers across Asia including Grab. Tencent could hook Easy Transfer with the right local partner with the necessary license for sending money overseas, said Gao, and Easy Transfer will focus on building a local team and an easy-to-use product like WeRemit. |

| Give users genuine control over ad targeting, MEPs urged Posted: 13 Jan 2022 03:44 AM PST Over 30 civil society organizations, pro-privacy tech businesses and European startups are making a last ditch pitch to try to convince EU lawmakers to put stricter limits on surveillance advertising as a major vote looms on an update to the bloc’s digital rules. The European Parliament will vote shortly to confirm its negotiating position on the Digital Services Act (DSA) — and the 30 signatories to the joint statement on “surveillance-based advertising” are urging MEPs to back amendments to the DSA to tighten the rules on how people’s data can be used for targeting ads. In a nutshell they argue that inferred personal data (aka what a platform can learn/guess about you by snooping on your digital activity) should be out of bounds for ad targeting — and that advertisers should only be able to use information that has been consciously provided to them for targeting their marketing by the individuals in question. An example of how that could work might be that a platform periodically asking a user to select a few categories of goods/interests for which they’re happy to receive marketing offers — such as, say, beauty products, hiking/outdoors gear, holidays, or culture/art. They would then only be able to use such signals for ad targeting, making it contextual, rather than creepy. This is not so very radical a suggestion. Regulators in the region have in fact been warning that tracking based ads are on borrowed time for years, given systemic breaches of EU privacy laws. Though actual regulator enforcement against adtech has been harder to spot. Most recently the outgoing UK data protection commissioner urged the industry to reform — and move away from the current paradigm of tracking and profiling — saying the future must be about providing Internet users with a genuine choice over how they are targeted with marketing messages. The signatories to the statement calling for parliamentarians to get behind this kind of ad targeting reform argue it would have major benefits — preventing problems associated with the covert surveillance of web users which can lead to abusive ads that manipulate and exploit. The theories of harm around microtargeted ads have been much discussed in recent years — with risks of behavioral targeting being linked to discrimination, exploitation of vulnerable people/groups, and democracy-denting election interference, to name a few. Surveillance advertising’s problem is that it can’t be publicly accountability because it lacks genuine transparency. Yet there are other ways to target ads that don’t require creepy snooping and behavioral profiling. “We are convinced that targeted digital ads can be delivered effectively and with respect for users' choice and privacy (i.e. without covert surveillance practices), provided that exclusively data specifically provided by users for that purpose is processed, in a transparent and accountable manner,” the signatories write. The statement dubs the use of “inferred data, which reveals users' vulnerabilities and, by definition, is collected or generated without their awareness and control” as “a particularly problematic practice in digital advertising”, arguing: “It is time to end this practice as it causes significant harm on an individual and societal level, as evidenced by extensive academic research and recent revelations including the Facebook Files and the whistleblower Frances Haugen's testimony or Mozilla's YouTube Regrets study.” “It is in the best interest of companies engaging in digital advertising to respect users' choice, autonomy, and expressed (not inferred) preferences,” they go on, pointing to survey results which found that 75% of social media users in France and Germany are not comfortable when their behavioural data is used to target them with advertising. “While small and medium-sized businesses legitimately use online advertising to reach their clients, they do not need to rely on intrusive surveillance as a means to that end,” they further argue. The statement suggests that the main beneficiaries of current adtech’s ‘surveillance free-for-all’ — and the pervasive, covert massive tracking of Internet users — are likely to be US tech giants. While progressive European startups — which have been trying for years to scale alternative, privacy respecting approaches for ad targeting — are being competitively disadvantaged by the rights-violating data abuses of US giants. “The only actors who benefit from exploitation of users' vulnerabilities and cross-site tracking are US-based large online platforms, with an interest to preserve their dominant position in the digital advertising market,” the statement argues, calling for “regulatory incentives” so that “progressive” privacy-focused startups can scale their rights-respecting services and make them more accessible for small brands. “Putting an end to the most invasive practices will strengthen small European brands and GDPR [General Data Protection Regulation] compliant digital services, as well as local media as it would promote fair competition in digital advertising and reinstate the power of quality.” It’s an argument that should — in theory — play well with Europeans elected representatives in the parliament. However in recent years US tech giants — led by Google and Facebook — have been pouring millions into lobbying efforts in Brussels in a bid to steer lawmakers away from policies that could damage their surveillance-based business models. So this is in no way a fair fight. Key among the tech giant lobbying claims has been the suggestion that tougher rules on targeting will hit Europe’s small businesses. Indeed, Facebook (now Meta) has gone so far as to claim that banning surveillance ads would decimate the bloc’s economy. But of course they would say that, wouldn’t they…

The 17 civil society organizations signing the joint statement are: the Panoptykon Foundation, Access Now, Alliance4Europe, Amnesty International, Article 19, Bits of Freedom, Civil Liberties Union for Europe (Liberties), Defend Democracy, Fair Vote, Global Witness, Irish Council for Civil Liberties, #jesuisla, The Norwegian Consumer Council, Ranking Digital Rights (RDR), The Signals Network, SumOfUs and Uplift. While the 14 business representatives backing the call for a ban on use of inferred data for ad targeting are:

An earlier push by a number of MEPs towards the end of last year to get an outright ban on surveillance-based ad targeting included in the DSA did not prevail. Although a parliamentary committee did back tightening restrictions on tracking-based advertising in another draft package of EU legislation that will apply to the most powerful Internet gatekeepers (so plenty of US giants), aka the Digital Markets Act (DMA) — by beefing up consent requirements for ad targeting and adding a complete prohibition on behavioral targeting of minors. But the 31 signatories to today’s statement argue that the IMCO tweaks do not go far enough against the data industrial surveillance complex, writing: “We urge Members of the European Parliament to support plenary amendments to Article 24 of the DSA which go beyond the existing IMCO compromise and rule out surveillance practices in digital advertising — such as the use of inferred data — while supporting users' genuine choice.” Karolina Iwańska, a lawyer and policy analyst for the Panoptykon Foundation, also told us: “Unfortunately the compromise around ads in the IMCO committee is very weak and largely maintaining status quo” — adding that: “Big tech’s ‘SME’ lobbying was very successful.” “We believe that a true compromise between a full ban on the use of personal data (unrealistic at this point) and status quo (everything allowed if consent is collected) is possible — but has sadly been ignored in the parliament,” she added, saying the anti-surveillance campaigners are now hoping to convince MEPs to back reform of personalized ads by limiting targeting to expressed preferences — which they believe will give Internet users “genuine control”. The effort will need to work fast if it’s to achieve its aim. Per Iwańska, the campaigners have drafted an amendment — but have yet to get backing from MEPs to submit it so that the parliament as a whole would be able to vote on it at the plenary. Clearly it’ll be crunch time for this push over the next few days. Under the EU’s co-legislative process the Commission proposes legislation and that’s then followed by a process of wider negotiations between Member States and the European Parliament on the policy detail — with the chance for upcoming EU rules to be reworked and reshaped before they’re finally adopted. Both the DSA and the DMA were proposed at the end of 2020 by the European Commission, with the DSA aimed at updating the bloc’s ecommerce rules and dialling up accountability on digital businesses by widening requirements to define areas of additional responsibility around content. While the DMA targets the competition- and consumer-crushing market power of Internet giants, with a set of ex ante rules aimed at preventing abusive practices. Trilogue negotiations on the DSA are due to start soon — once the parliament confirms its position in next week’s plenary vote. And — ultimately — there will need to be another plenary vote in the parliament on the final text. So campaigners against surveillance advertising may have other points in the process to try to push strategic amendments. One thing is clear: The lobbying will continue throughout this year. Any restrictions on ad targeting in the EU will still also have to wait for the legislation to be adopted and come into force — with EU lawmakers set to apply a grace period for digital businesses to come into compliance. So any rule changes won’t bite for many months more at least. While the DMA — which appears to be moving pretty speedily through the co-legislative process — could get up and running relatively quickly, perhaps in 2023, the DSA looks likely to take longer before it comes into force; perhaps not until 2024. In the meanwhile, the tracking and targeting continues… |

| HeyCharge’s underground charging solution raises $4.7M Seed led by BMW i Ventures Posted: 13 Jan 2022 02:41 AM PST EV charging continues to be a high-growth business, for obvious reasons. Since 2007, one of the largest players has been ChargePoint, the floated US company which with a widespread EV charging network. But plenty of startups are snapping at its heels. One of them is Germany-based HeyCharge, which realised there was a problem with how EVs could be charged in underground carparks, where roughly 80% of all EV charging activity generally happens. The problem is that normal smart charging infrastructure needs an internet connection, but underground that's not possible. So HeyCharge has a solution… This is no doubt why it's now raised a $4.7m Seed round led by BMW i Ventures (also a an early investor in Chargepoint and Chargemaster), the venture capital arm of BMW Group. Also participating was Statkraft Ventures, the venture capital arm of Statkraft, a large European generator of renewable energy. We covered HeyCharge when it was part of YC's 2021 batch. HeyCharge's solution is aimed at apartment buildings, offices, hotels and other underground infrastructure for EVs. Its SecureCharge technology doesn't require an on-site internet connection, connecting over Bluetooth instead, in a plug-and-play setup. Chris Carde, CEO of HeyCharge, said: "With 40% of Europeans and 37% of US renters living in apartment buildings, there is a large section of the population for whom going electric is too difficult because they can't charge at home. HeyCharge's solution makes EV charging not just scalable but also more cost-effective and accessible so that you can EV charge wherever you live or work." Kasper Sage, Managing Partner, BMW i Ventures, said: "The rapid growth of the electric vehicle market in coming years will necessitate greater infrastructure build-out of charging solutions around the globe. HeyCharge is the first company to enable EV-charging without internet connection, which is a key enabler to cover untapped white-spots." HeyCharge was founded by Chris Carde and Dr. Robert Lasowski in March 2020, who previously worked at Mercedes-Benz, Google, BMW and SIXT. |

| Posted: 13 Jan 2022 01:54 AM PST Embedded finance continues to be the engine driving the growth of fintech, with one group of companies building core banking, payments and other financial technology, and a much bigger group tapping that technology through APIs to build customer-facing businesses. Today, one of the bigger players on the core technology side — Global Processing Services — is announcing $100 million in funding, a sign not just of how popular embedded finance remains as a business, but also GPS’s traction in the space. Singapore investor Temasek and US firm MissionOG are the two investors in this latest tranche of funding, which is coming in the form of an extension of a $300 million investment that GPS announced back in October 2021, closing out the full round at $400 million. Advent International and Viking Global Investors co-led that previous round, which gave them a controlling stake in GPS. Other investors in the company include Visa. As with the earlier part of the round, GPS — which is based in London, England — is not disclosing its valuation today. "This is not something on which we wish to be drawn, but what we can say is that we continue to aspire to be one of the largest paytech companies in the world, mirroring the success of providers on the acquiring side of payments, such as Adyen, Stripe and Checkout.com, and Marqeta on the issuing side,” said a spokesperson in response to the valuation question. “We believe we have built a special platform. This injection of capital by the world's leading experts in payments and next generation technology will enable us to bring financial empowerment and enable more of our fintech clients around the world on their journey to unicorn status." The funding will be used to continue growing GPS’s business — which includes a range of fintech services such as payments, direct debits, and standing orders; virtual cards; mobile wallets; fraud prevention; expense management; cryptocurrency management; BNPL and more (these are sold under the GPS Apex brand). Specifically, the company wants to expand further in Europe and Asia Pacific, as well as in more emerging markets across the Middle East and Africa; and it wants to bring on new products. (Notably, there are no loan products in the mix right now, so that could be one area it explores; insurance could be another, and so could solutions tailored for specific verticals.) The reason for the investment and investor attention is that GPS, and the space it’s active in, have both seen a big surge of activity. One one hand, neobanking services among consumers and businesses have been rising in popularity (and credibility); on the other, we’ve seen an ever-expanding range of non-fintech businesses (such as telcos and retailers) that are tapping the concept of embedded finance to add new features and revenue streams into their own platforms. More generally, consumers and businesses made a big shift to carrying out all of their financial activities online as the Covid-19 pandemic took hold of the world, and even as/if that abates, it looks like they will not completely go back to their analogue ways. That has had a knock-on effect on venture funding for the whole fintech industry. It was just yesterday that another big player in fintech, the payments startup Checkout, raised a whopping $1 billion at a $40 billion valuation. GPS itself focuses mainly on those working more directly in fintech, with its its customers including Revolut, Starling, Curve, Zilch, and Paidy. Its said its services are being used today in 48 countries and that last year it processed more than 1.3 billion transactions, with 190 million cards now issued to date. "GPS is an innovative technology company, and we believe their unique position at the heart of the global payments ecosystem ideally positions them to power the next generation of financial services,” said Gene Lockhart, the general partner at MissionOG, in a statement. “With the deep network and experience MissionOG brings to the table, we look forward to being a trusted and valued partner of Joanne and the entire team." Notably, Lockhart is taking on a role as chair at GPS with this investment. "The upsizing of this latest round of investment is an important step forward for the company and a strong endorsement of our strategy,” added Joanne Dewar, GPS’s CEO. “We are a company that has grown rapidly in recent years, driven by our commitment to innovation and the delivery of a single scalable technology platform. The expertise that our new partners bring to GPS will be invaluable as we enter our next phase of geographic expansion and technology innovation." Updated with response on valuation from company and to note that GPS is based in London, not the Isle of Man. |

| Fintech Farm nabs $7.4M to launch neobanks in Nigeria and other emerging markets Posted: 13 Jan 2022 01:06 AM PST Fintech Farm, a newly launched fintech startup based in the U.K. that creates digital banks in emerging markets, confirmed to TechCrunch today that it has raised $7.4 million in seed funding. The company said it plans to use the investment to launch neobanks in eight countries over the next 24 months. Flyer One Ventures and Solid led the seed round. TA Ventures, Jiji, u.ventures and AVentures Capital also participated. Digital banks, neobanks, challenger banks or whatever you may call them, are among the biggest recipients of VC investments in fintech. Globally, hundreds have sprung forth the past few years to challenge incumbents in their respective markets. In Eastern Europe, for instance, Ukrainian neobank Monobank, in just the years of operations, has amassed over 4.5 million customers and more than $100 million in operating income, as claimed by the company last year. After helping to scale Monobank in Europe, Dmytro Dubilet, one of its co-founders, aims to do the same in emerging markets via his new company. He started Fintech Farm with Nick Bezkrovnyy, a former director at KPMG U.K. and Middleware founder and CEO Alexander Vityaz. In November 2021, Fintech Farm launched in its first market, Azerbaijan. It took a credit-led neobank approach by providing loans to customers with thin credit histories via cards and a mobile app. On a call with TechCrunch, Dubilet said Fintech Farm's operational model in Azerbaijan and prospective markets is to launch its app via partnerships with local banks. "Usually, it's 50-50 partnership with a local bank," he remarked when asked how this partnership works. According to him, Fintech Farm is responsible for the business side of things — the app and credit decision making processes. The partner bank holds local knowledge, license and capital as both parties co-invest in the business equally. As a U.K.-based fintech, Fintech Farm takes a different approach from the conventional model used by neobanks in the country (Monzo, Starling Bank, Revolut) who prefer to hold their banking license and offer the full range of financial services themselves. But considering its operational approach, that is, providing financial services to emerging markets, it makes sense to have a different business model. Fintech Farm uses a different name in each country it launches, but the same design and mascot — a funny-looking lion with a lilac mane. Three months into its launch in Azerbaijan as Leobank, Fintech Farm has issued over 100,000 cards; by the end of the year, it hopes to get this number up to a million. And in the next two years, Fintech Farm plans to enter eight emerging markets spread across Africa and Asia, the first of which is Nigeria. "We have a plan to launch similar businesses in around eight other markets that are slightly bigger than Azerbaijan, of course," said Dubilet. "Our next market is going to be Nigeria, we have visited Nigeria a couple of times already and it is one of our favourite countries," said Dubilet, adding that the launch will likely take place in the first quarter of 2022. Meanwhile, despite its original plan to use partner banks, Fintech Farm has done the opposite in Nigeria so far. Right now, the company says it has gotten a "co-operative license." Should Fintech Farm acquire up to 200,000 customers, the founders said it would partner with a bank to scale further. According to Bezkrovnyy, a determining factor for choosing a partner bank, asides from licensing and infrastructural support, will be how fast they can move to capture millions of customers and issue hundreds of millions (dollars) in loans. Fintech Farm's key product is a card that functions as a debit card where users can withdraw funds from deposits and a credit card with a loan facility attached in the customer's name. A savings account, deposits and transfers are some of the app's features. Nigeria's population is hungry for credit. Fintech Farm's credit-led approach will serve to meet the demand (most of its revenues comes from offering loans) companies such as FairMoney and Carbon have done for years. However, unlike these indigenous neobanks, Fintech Farm wants to use credit cards to provide cheaper and more accessible credit. "In terms of the credit product, we see an opportunity for a "mass credit card" in Nigeria. Currently, credit cards issued by traditional banks are limited to the upper-middle class," Bezkrovnyy said in a statement. "At the same time, APRs of credit offerings from neobanks and alternative lenders may well be over 100%. We are going to fill this gap and accept those customers neglected by traditional banks and offer them fair interest rates." Unlike most developed countries, the West African nation lacks an advanced credit bureau system to detail people's credit histories, so there's some scepticism to how Fintech Farm will use credit cards to operate. But Dubilet is pretty confident; he cites the company's data science teams which he describes "as one of the best in the world", to work some magic. As part of this financing round, Vladimir Mnogoletniy, co-founder of Genesis, the parent company of African online classifieds platform Jiji, will join Fintech Farm's board. He is also a partner at co-lead investor Flyer One. The founders believe the expertise and understanding of Mnogoletniy and his Jiji team will be pivotal to Fintech Farm's growth. In a statement, Mnogoletniy said Jiji, having built one of the largest e-commerce platforms on a GMV basis, was looking for the right partner to enter the neobanking space. Investing in Fintech Farm was a strategic investment to that end. As Fintech Farm carries out its expansion plans, it also intends to spend heavily on marketing and hiring talent, especially engineers and data scientists. |