TechCrunch |

- Scratchpad nabs $33M Series B to continue building sales workspace

- YouTube is considering NFTs, CEO’s letter suggests

- Refract raises $8.5M SGD funding, announces new game development division

- Okta’s 8th ‘Businesses at Work’ cloud usage report shows increasing heterogeneity

- Dyspatch helps companies create emails you’ll actually want to open

- Bokksu bags $22M Series A at a $100M valuation to deliver traditional Asian groceries to your home

- Collaboration platform CloudApp raises $9.3M to enhance workplace productivity

- Hunters raises $68M Series C for its security operations platform

- Dremio raises $160M Series E for its data lake platform

- Startup Battlefield Winner Cellino grabs $80M Series A

- Google kills off FLoC, replaces it with Topics

- Archive aims to put clothing brands in control of their secondhand sales

- Columbus-based Tribevest bags $3M for its collaborative investing platform

- Woflow structures merchant data so food ordering can be more accurate

- Report suggests NVIDIA is preparing to walk away from its ARM acquisition

- Brazilian fintech Creditas lands $4.8B valuation and Fidelity as an investor after revenue jumps in 2021

- Twitter’s experimental ‘Flock’ feature will let you share tweets with your closest friends

- Tunisian enterprise AI startup InstaDeep raises $100M from AI Capital, BioNTech, Google

- Wandelbots raises another $84 million to teach robots without code

- What Kai-Fu Lee-backed AInnovation tells us about China’s smart manufacturing

| Scratchpad nabs $33M Series B to continue building sales workspace Posted: 25 Jan 2022 06:55 AM PST Scratchpad, a startup that is building a tool to make it easier for salespeople to enter data into Salesforce, has expanded that mission to give access to the information it’s collecting to the whole revenue team. Apparently, investors were pleased with that expanded approach, and the company announced a $33 million Series B today. Previous investor Craft Ventures led the round with participation from Accel. The round follows the company’s $13 million A round a year ago and a $3 million seed in Fall 2020, bringing the total raised to almost $50 million. Company co-founder and CEO Pouyan Salehi says that the funding is directly related to the product expansion, which has resulted in increased usage and sales. “The interesting part was it really evolved from just this single player tool if you will, or a single player mode, where an individual salesperson sees a lot of benefit to all of a sudden that benefit being felt and being visible across the entire revenue team,” he told me. That has resulted in better penetration inside customer companies and larger deals. “This idea of a revenue team workspace that was really just a nugget of an idea a year ago, seems to have really started to take hold across these revenue teams,” he said. The end result is this product expansion has become core to the company’s growth strategy. The startup is continuing to employ a bottoms-up sales approach, where they use a free product to attract sales people, who then act as brand ambassadors spreading the product inside the organization. The approach appears to be working with Salehi reporting tens of thousands of users inside thousands of companies using the product. “These organizations have adopted Scratchpad for managing their sales pipeline, taking and sharing notes, working their to-dos, forecasting with their managers, making handoffs between teams easier and collaborating with their revenue teams more effectively,” according to the company’s description of the product. As the number of users has grown, the company has grown from around 10 employees to close to 50 today with plans to add more over this year as growth allows. One big way the company looks for diverse candidates is by looking at competencies and motivations, rather than experience that correlates directly to a tech startup. “What this has done is open the door to hiring folks that traditionally may not have looked like they were a fit on paper. And that’s worked out incredibly well for us because we’ve been able to hire folks that have no experience in software, no experience in technology, no experience in sales, but have still come from backgrounds or experiences like retail, hospitality or therapy, that on paper is a big jump to technology, but we’ve been able to unpack what makes somebody successful here,” he said. Among the companies using the product today include Allstate, Twilio, Pitchbook and Talkdesk. |

| YouTube is considering NFTs, CEO’s letter suggests Posted: 25 Jan 2022 06:48 AM PST In a letter published today by YouTube CEO Susan Wojcicki, the executive suggests the video-sharing platform may embrace Web3 technologies, including NFTs — or non-fungible tokens, a way to certify digital assets stored on the blockchain — as a means of helping YouTube creators make money. While no concrete plans were shared, nor any sense as to when YouTube may begin testing NFTs on its site, Wojcicki referred to the innovations taking place in the Web3 world as a “source of inspiration to continue innovating on YouTube.” “The past year in the world of crypto, nonfungible tokens (NFTs), and even decentralized autonomous organizations (DAOs) has highlighted a previously unimaginable opportunity to grow the connection between creators and their fans,” she wrote. “We're always focused on expanding the YouTube ecosystem to help creators capitalize on emerging technologies, including things like NFTs, while continuing to strengthen and enhance the experiences creators and fans have on YouTube.” Reached for comment, a YouTube spokesperson was unable to further elaborate on what YouTube may have in store, in terms of supporting NFTs. YouTube, however, already has a number of ways it could allow creators to showcase their NFTs, if it desired. The video platform today offers a “merch shelf” option that can appear underneath a creator’s video, for example, where they can feature products, like apparel, collectibles, plushies, vinyl records, and more, through a growing number of supported retail partners. It would seem feasible that YouTube could partner with NFT platforms and integrate crypto wallet technologies, in order to allow digital creators to feature their NFT art here as well. Or YouTube could choose to more deeply integrate NFT support on creators’ profiles in other ways, or build tools designed for creators working in this space to network with one other and share their work. It’s not surprising to see YouTube considering a move into the NFT space, as other social media platforms are now doing the same. Twitter just last week launched its first NFT feature, by adding support for NFT Profile Pictures. The feature lets creators set an NFT they own as a hexa-shaped profile picture which, when clicked, will allow others to learn more about the art. Instagram, too, has publicly said it was exploring NFTs. And Facebook may be building an NFT marketplace, a report from The Financial Times recently said. In addition to the news that YouTube may be open to building out Web3 support in the future, Wojcicki offered a few more notable updates amid a comprehensive look back over the last year on YouTube. She hinted, too, that YouTube would be expanding the “remix” feature on its TikTok rival called YouTube Shorts, which today supports remixing only audio content from other public videos. Though YouTube also couldn’t share more details on this feature, it’s likely that the company is looking into adding support for remixing video, as Instagram has now done. The CEO noted that YouTube Shorts has hit 5 trillion all-time views, which is a less interesting metric than how many creators it’s managed to onboard — a number it did not share. And it noted that over 40% of creators who received payouts from its YouTube Shorts Fund were those who weren’t already established creators in the company’s YouTube Partner Program — suggesting that Shorts was allowing a new type of creator to make money on YouTube. The letter touches on other initiatives and investments YouTube has underway, including in gaming, creator monetization, music, shopping, education, and more, as well as its stance on various regulatory issues. Wojcicki said the number of channels around the world making more than $10,000 a year is up 40% year over year, and YouTube Channel Memberships and paid digital goods were purchased or renewed more than 110 million times. YouTube's ecosystem also supported more than 800,000 jobs in 2020 in the United States, Japan, South Korea, Canada, Brazil, Australia, and the EU combined. Much of the rest of the creator-directed missive touched on things YouTube had already announced, like its plans to partner with Shopify, to launch Gifted Memberships, to double the number of users engaging with educational content, to stop recommending borderline content, improve YouTube Kids, and more. Wojcicki also acknowledged the pushback over YouTube’s decision to remove the Dislike button, but reasserted why the removal was necessary. |

| Refract raises $8.5M SGD funding, announces new game development division Posted: 25 Jan 2022 06:01 AM PST Refract, a Singapore-based extended reality (XR) startup, announced today it has closed approximately $8.5million SGD (approximately $6million) Series A led by Sea Limited along with international family offices and individual investors. The latest funding will be used to intensify R&D for AXIS, a wearable and game-oriented full-body motion capture solution. The startup also plans to expand its team in preparation for the commercialization of AXIS later this year to cater to the rapidly growing market of gamers, tech adopters, content creators and fitness enthusiasts. The Series A round brings Refract's total raised to $9 million. In 2018, three co-founders of Refract, Chong Geng Ng, Michael Chng and Eugene Koh, worked on a gaming-related project and encountered a problem statement: How would one bridge the gap between gaming and physical activity? CEO of Refract Chng told TechCrunch that the solution they found out was to allow players to use their bodies as game controllers. After poring over documents and articles of cutting-edge technological innovations in gaming and applications in other industries, the three co-founders identified a gap in the market and set up Refract. "Refract's goal has always been to become a key player in AR and XR gaming, and this funding enables us to accelerate this process," said Chng.  AXIS The funding announcement comes on the heels of the successful completion of crowdfunding campaign on Kickstarter for AXIS and its XR game publishing division set up via Deep Dive Studio acquisition. Unlike full-body motion tracking systems like Perception Neuron, Rokoko and Xsens, AXIS is for real-time gaming and entertainment use. AXIS also allows users the flexibility of using between 7-10 nodes for gaming or up to the industry standard of 17 for higher-precision motion tracking. AXIS doesn't need a base station but still requires wifi to connect to the user's computer. "AXIS will be fully untethered and wireless, requiring no external base stations or setups. Everything is on the body, with proprietary inside-out tracking capability. This addresses common issues like occlusion and space requirements of systems such as HTC Vive," Chng told TechCrunch. Refract will continue delivering immersive and engaging XR and VR experiences to a growing market of 2.9 billion gamers through its games and technology, such as the wearable AXIS. Its Deep Dive Studio enables Refract to create more immersive titles to supplement its roster of offerings, such as the FreeStriker fighting game, which is currently in development and will be available free for all AXIS customers. To make it accessible to game developers and content creators, Refract's software suite is compatible with platforms like OpenVR, OpenXR, Unity and Unreal engines, and existing VR systems and applications. AXIS can also work with popular VR headsets like the Oculus Quest 2, Chng said. Refract is eyeing more vertical and horizontal integrations in the sector. Refract has already secured strategic relationships with the likes of World Taekwondo as part of its virtual sports program, working with the federation to make Virtual Taekwondo a medal event in the near future. The partnership came about when World Taekwondo saw an opportunity to gamify the sport and reach out to a broader, tech-savvy audience by creating a new discipline, Chng told TechCrunch. Refract also plans to feature AXIS at the 2022 Global Esports Gems in Istanbul, Turkey.  Refract "AXIS represents a huge step forward in bringing high fidelity motion tracking and capture technology to a broader audience; innovating within the space and delivering even more immersive gaming experiences," said Chong Geng Ng, executive director of Refract. “Our investment reflects the strong belief Sea and our other investors have in our vision and creativity as well as the huge untapped potential of the XR gaming market.” "It's exciting to see a Singaporean company like Refract driving the development of innovative technologies in XR and VR," said Jason NG, vice president of strategic partnerships, at Sea's digital entertainment arm, Garena. “We are pleased to support their growth and the development of the overall innovation ecosystem in Singapore.” "Sea and our other investors recognized the talent at Refract as well as the enormous potential of AXIS. The successful completion of the AXIS Kickstarter campaign proves that there is a dedicated community of gamers who share this vision, and we look forward to delivering AXIS and FreeStriker to them in 2022,” Chng said. |

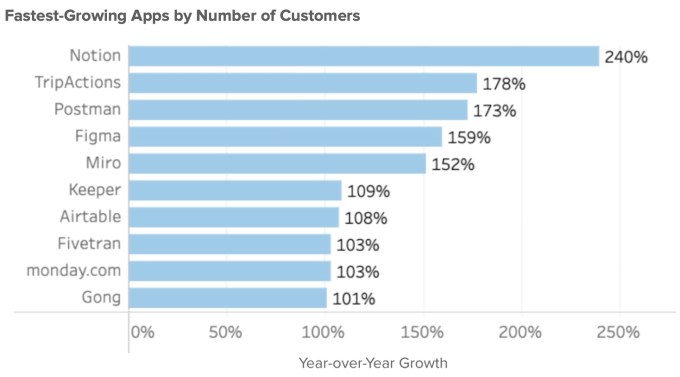

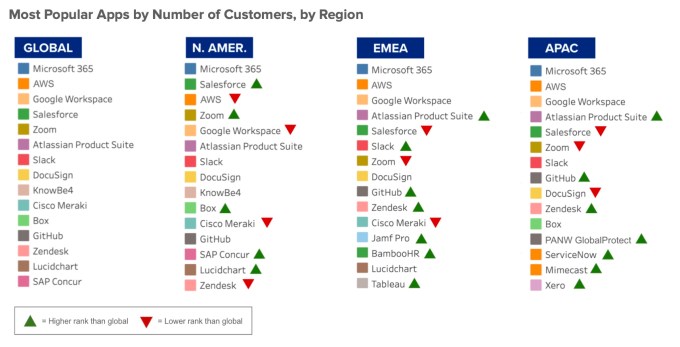

| Okta’s 8th ‘Businesses at Work’ cloud usage report shows increasing heterogeneity Posted: 25 Jan 2022 06:00 AM PST Okta released its eighth annual ‘Business at Work’ report today, looking at which apps and cloud services on the Okta identity platform were the most popular from November 1, 2020, to October 31, 2021. The report found that for the most part, Okta users tend to favor best-of-breed over the single-vendor approach of the past. Microsoft Office 365 remains the most popular service, with AWS second and Google Workspace third, moving up fast with 38% year-over-year growth. In an interesting twist, though, showing a desire to avoid that single vendor lock-in, 38% of companies using Office 365 also used Google Workspace, while 45% also used Zoom and 33% also used Slack. Considering that Microsoft has Teams, which also handles the video meeting functionality of Zoom and the internal communications capability of Slack, and Google Workspace competes directly with Office 365, it shows that even when Microsoft has similar tooling, companies will still go with a competing offering when it makes sense for them (at least Okta users will). Still, the report reflects trends we have been hearing about in the market for some time, especially around multi-cloud usage and a move away from vendor hegemony. That could explain why a number of the fastest-growing tools made their Business at Work report debut — Notion, TripActions, Postman, Keeper, Airtable, Fivetran and Gong. It’s worth noting that Fivetran raised $565 million on a $5.6 billion valuation in September; Gong raised $250 million last June at a $7.5 billion valuation; and Airtable raised $270 million last March at a $5.7 billion valuation, showing that these companies are starting to go mainstream (at least in Okta’s world) at the same time their value is skyrocketing in the eyes of investors. Seems hard to imagine this is a coincidence.  Image Credits: Okta Just as we see AWS leading the way in the cloud infrastructure market, it’s the clear leader in Okta’s data as well. In fact, AWS usage at 32% pretty much matches its market share, which has held steady at around one-third over the last several years. And as the cloud market shows a shift to multi-cloud usage, so does the Okta report, with 14% of users implementing a multi-cloud infrastructure vendor approach, a number that feels a bit low compared to the real world. That number is up from 8% in 2017. Surprisingly, the most popular infrastructure vendor pairing for Okta users is AWS and GCP, which is still pretty tiny at 2.6%. The cloud isn’t just a U.S.phenomenon, of course. We are seeing increasing use of a broad range of apps in Europe, Asia, Africa and the Middle East, according to the report. The biggest winners: Google Workspace grew 68% year over year in APAC, while Slack and Zoom grew 49% and 45%, respectively, in EMEA, according to the report.  Image Credits: Okta The report looks at data culled from Okta’s 14,000 customers and 7,000 cloud, mobile and web app integration for the period from November 1, 2020, to October 31, 2021. As the report itself points out, this data reflects the usage by Okta customers and may not be representative of cloud usage as a whole — only how Okta customers tend to use it. Regardless, it provides a useful set of data points for anyone looking at how companies use the cloud today. Okta CEO Todd McKinnon explained that the company has a small team devoted to pulling this data into a coherent set of results in this report. “There are probably like five or six people, including a couple of data warehouse folks doing the queries, a few analysts, some iteration with me and the content and PR team to figure out what is interesting. And then, of course, we talk to our partners because all these companies are partners of ours [and they are interested in hearing about the data, too],” McKinnon told me. |

| Dyspatch helps companies create emails you’ll actually want to open Posted: 25 Jan 2022 06:00 AM PST Some marketers believe that to make more money, you have to send more emails, which Matt Harris, founder and CEO of Dyspatch, refers to as the "law of email." "All of those emails are leading to a decline in open engagement rates," he told TechCrunch. "In addition, there is a new generation entering the workforce that isn't email centric, and is having to learn how to email." Most marketers don't take courses on email marketing, rather it's a skill learned on-the-job, Harris added. As time goes on, people get to a point where they create their own designs and copy and paste lines of code into whatever email system they are using. With the advent of multiple tools and resources for sending out email, it has become a challenge as people have to learn how to use different ones and the code they relied on doesn't always work. Harris started off with a solution called Sendwithus in 2018 that was a developer product in the email space. Later on, he and his team identified email production as a big problem and pivoted to become Dyspatch to bring a more drag-and-drop approach to designing emails. The company's email production tool essentially takes the tips and tricks from people designing email well and makes it widely accessible. Dyspatch is leveraging Google's AMP for Email to launch its interactive email product, called Apps in Email, last year that makes implementing the AMP email elements simpler for non-technical users. The tool is now being used by more than 300 customers, including Canva, which uses AMP emails to boost engagement with comment reply notifications. “Dyspatch has massively reduced the hours our team spends on creating emails, which has allowed us to really scale our content production," said Megan Walsh, global head of lifecycle marketing at Canva, in a written statement. "We’re producing over 20 emails a week, and the platform ensures every single one is on-brand, localized and responsive, without any engineering effort. It’s also allowed us to implement interactivity with AMP comment reply emails. The Dyspatch team was so supportive and collaborative on that project, and it’s been a huge success with our users.”  Dyspatch’s booking demo. Image Credits: Dyspatch Dyspatch is already able to prove out that brands see a 500% increase in email engagement and 300% increase in email conversions after developing fully functional interactive AMP email campaigns, Harris said. The company is now at the point where it is scaling its go-to-market and technology teams to support new customer growth, and raised $6 million in seed funding to help. Gradient Ventures led the round, with participation from Initialized Capital, Baseline Ventures, Blue Run Ventures, Scott Banister and VanEdge Partners. This is Dypatch's first round of funding, but together with its previous company, they raised $11 million in total. Dyspatch also plans to use this round of funding to further integrate with email service providers, like Oracle Eloqua and Salesforce Marketing Cloud, to make sure that users will be able to facilitate a seamless email workflow no matter which resources they use to send email. The company focuses on how many people are using the app, and its customer base more than doubled in the past year. One of the repeated patterns Harris is seeing are customers coming back each year and adding more users. For example, one of its marquee customers initially bought 10 user seats in the first year of the contract, but within six months grew that by 10 times. Next up, the company is taking steps to open up its technology to third parties and to build some of the features customers have been asking for, like calendar booking in email. "Today we are building out the building blocks for apps, surveys and approval apps, but our DNA is an engineering company, so we want to build a marketplace so that third parties can build apps on our marketplace," Harris added. |

| Bokksu bags $22M Series A at a $100M valuation to deliver traditional Asian groceries to your home Posted: 25 Jan 2022 06:00 AM PST Bokksu CEO Danny Taing has always been passionate about Japanese food and culture, so he moved to Tokyo after college and lived there for four years. When Taing moved back to NYC, he brought a suitcase full of his favorite Japanese snacks and shared it with his friends. Taing realized other Americans also loved Japanese snacks, but they didn't have a way to discover and buy them in the U.S. Taing founded Bokksu in 2015 and launched a Japanese snack subscription service in 2016. After delivering over one million subscription boxes of Japanese snacks to customers in more than 100 countries, Bokksu launched a digital marketplace for premium Japanese lifestyle products, Bokksu Market, in 2018. It also opened an online grocery store, Bokksu Grocery, in 2021, making it easier for everyone to discover and buy authentic Asian food products. "One million [subscription] boxes later, seeing how much our customers love discovering and eating foods they otherwise may never have tried, I've been inspired to find more ways to help authentic Asian makers reach a wider audience," Tiang said. Today, the New York and Tokyo-based startup announced a $22 million Series A at a $100 million valuation to bridge cultures by helping traditional Asian products reach a global audience. The funding was led by Valor Siren Ventures, with participation from Company Ventures, St. Cousair, World Innovation Lab (WiL), Headline Asia and Gaingels. "This funding capitalizes Bokksu at a level far beyond our bootstrapped early days, and it will facilitate a rapid increase of our product offerings and improvement of our delivery times, as well as allow us to grow our team," Taing said. The fresh capital will also enable Bokksu to accelerate its primary business lines: subscription, market and grocery. Bokksu ships its grocery products to the U.S. and Canada, but delivers its subscription and market services to more than 100 countries, including the U.S., Canada, the U.K, Australia, Germany, Singapore, Sweden and Netherlands, Taing said. Bokksu has seen consecutive 100% year-on-year growth since 2018 and expects to see continued growth in the coming years, Taing told TechCrunch.  Image Credits: Bokksu What sets Bokksu apart from competitors is that it is committed to telling the stories of its snack makers, which have been producing in Japan for decades, Taing said. It also has exclusive partnerships with more than 100 snack makers, meaning that customers will find the snacks on Bokksu's platform that they can't find anywhere else. Taing also said when he first started Bokksu, his goal was to help Japan's traditional snack makers share their craft with the world. His experience of having lived in both the U.S. and Asia helped him realize that many Americans had a relatively surface-level understanding of Japan that only included geisha, Pokémon and sushi. He wanted more people to learn about Japan's rich culture and history through Bokksu. Bokksu's grocery service competes with Umamicart and Weee! and traditional grocers like HMart and Sunrise Mart. Bokksu Grocery offers both nationwide shipping and fair pricing, Taing said. "What I'm most excited about is our recent launch of Bokksu Grocery, which makes the Asian grocery experience more accessible for all Americans, regardless of their ethnicity, location or how much they know about Asian food," Tiang said. "Unlike its competitors that mainly focus on metropolitan areas, Bokksu delivers authentic Asian products and experiences to a wide range of fans through nationwide shipping," said Gen Isayama, general partner and CEO of World Innovation Lab. "While most Asian e-grocery platforms are used mainly by Asians, the majority of Bokksu's loyal customer base are non-Asians who are hungry to learn more about Asian cuisines, and this gives Bokksu a potentially larger addressable market." The online grocery space has been growing and drawing major investments for the past few years. Isayama told TechCrunch: “The e-grocery market has focused on making grocery shopping less of a chore with a focus on speed and convenience. In the future, we expect e-grocery companies to increasingly help customers explore new things, for example, snacks and flavors, and accomplish individualized nutritional needs through food.” "We are thrilled to partner with Bokksu as they scale their business," said Jon Shulkin, partner and fund manager of Valor Siren Ventures. "In a short period of time, the Bokksu team has built an authentic and purpose-driven brand. Thanks to their success in bringing curated products and gourmet experiences from Japan to the world, we believe Bokksu has the potential to build a disruptive direct-to-consumer (D2C) grocery platform that will become the premier destination for Asian food products." Bokksu's subscription fee costs $49.95/month, offering free shipping for orders in most countries such as the U.S. There is also an option to pre-pay for multiple months for added savings. Its three-month and six-month plans cost $44.95 and $42.95 per month, respectively, while a 12-month plan costs $39.95. |

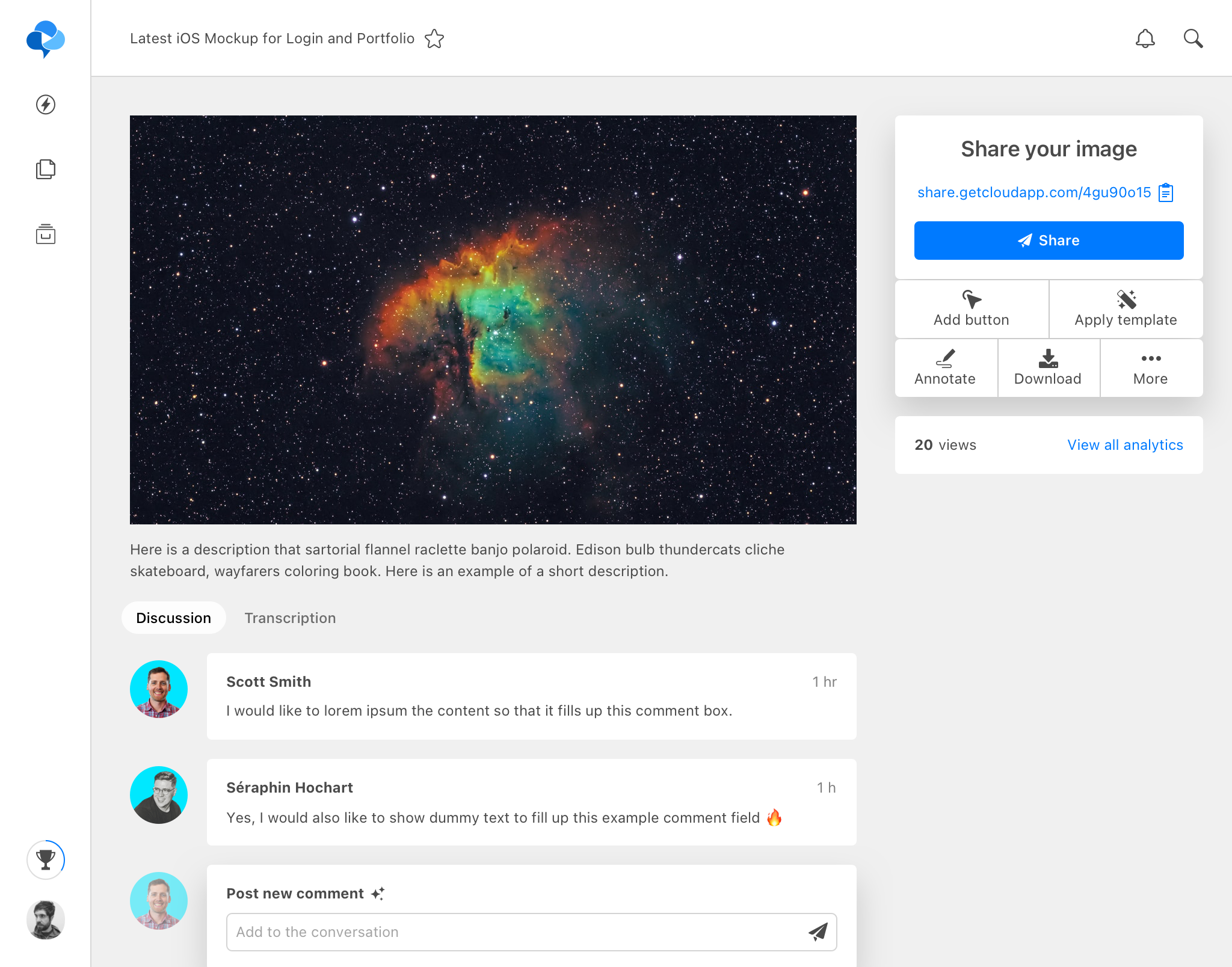

| Collaboration platform CloudApp raises $9.3M to enhance workplace productivity Posted: 25 Jan 2022 06:00 AM PST Visual work communication tool CloudApp has raised $9.3 million in Series A funding led by Grayhawk Capital and Nordic Eye. The round also includes previous investors Kickstart Fund, Cervin Ventures, New Ground Ventures, Bloomberg Beta and new entrants Peninsula Ventures & Forward VC. It also features CloudApp customers Peter Kazanjy, the CRO of Atrium, and Derek Andersen, the CEO of Startup Grind and Bevy. Founded in 2015, CloudApp aims to help teams share information faster through instantly shareable videos, gifs and screenshots. The tool is an all-in-one screen recording software that captures and embeds HD video, marked-up images and more into workflows. Every file users create is securely stored in the cloud, and accessible via CloudApp’s native Mac and Windows Apps, or shareable on the web through secure password-protected links. The goal of the company is to help teams avoid having to schedule extra calls or emails and instead communicate their message through simple shareable videos. CloudApp sees itself as a visual voicemail that can be read at any time without disrupting workflows. The tool supports dozens of integrations including Slack, Atlassian, Trello, Zendesk and Asana. Since its launch, CloudApp has garnered more than four million total users. Notable CloudApp clients include Adobe, Uber, Zendesk and Salesforce. CloudApp CEO Scott Smith told TechCrunch in an email that the company will use this latest investment to make the tool faster, more deeply integrated and secure. The startup also wants to help more teams discover and use CloudApp to enhance their workplace productivity.  Image Credits: CloudApp “To accomplish those goals, we need some more of what we already have: awesome people,” Smith said. “We plan to build out our product and engineering teams to continue increasing our speed and user experience. Marketing will be another key focus, as we work towards making sure every workplace has CloudApp as an indispensable part of its workflow. We'll continue scaling our successful sales team to bring CloudApp right to the teams that need it the most.” In terms of the future, Smith says CloudApp envisions a world where employee and customer interactions will become instantly more searchable and shareable than ever. He noted that artificial intelligence can help surface the most relevant and significant content, which makes CloudApp’s vision possible. “We see CloudApp initially as an incredibly easy and fast way to capture what you need to share. Knowledge is power, so teams can then build out repositories of content and quick-help videos that can be used throughout workflows and integrations to help all parts of an organization: sales, support, product, engineering teams, etc,” Smith wrote. “Asynchronous work is the future, and CloudApp can help every team member become a more productive, superhuman version of themselves.” CloudApp’s Series A funding follows its $4.3 million seed investment announced in May 2019. The round was led by Kickstart Seed Fund and also included previous investors Cervin Ventures, Bloomberg Beta and Kyle York, who was the vice president of strategy at Oracle, at the time. |

| Hunters raises $68M Series C for its security operations platform Posted: 25 Jan 2022 06:00 AM PST Cybersecurity startup Hunters today announced that it has raised a $68 million Series C round led by Stripes. New investors DTCP, Cisco Investments and Databricks also invested in this round, together with existing investors YL Ventures, Bessemer Venture Partners, Microsoft's venture fund M12, U.S. Venture Partners, Blumberg Capital and Snowflake Ventures. This new round brings Hunters’ total funding to date to $118 million, including last August’s $30 million Series B. As Hunters co-founder and CEO Uri May told me, since its Series B round, the team doubled down on helping enterprises replace traditional Security and Information Event Management (SIEM) solutions with its own tools. “We found the courage to go after complicated projects, like SIEM replacements,” he told me. “Since our [Series B], our confidence in that grew significantly and obviously, the results followed — because when you’re going after something with confidence, usually, if it’s the right thing, it’s working out.” And things are working out for Hunters, which according to May saw its revenue grow 5x in 2021. It’s this wave of replacements that is currently washing through the enterprise that is also providing Hunters with an opportunity, May believes. “We’re in this wave of awakening where a lot of security operations centers and enterprises around the world understand that they’re not really equipped to cope with the sophistication of the threat, the shortage of the talent, the magnitude and scale of the data, the amount of security product that they have — and they recognize all of those challenges and see the current solutions — usually technologies from vendors that have been around for the last 10 or 15 years — they understand that there’s a big gap from where they want to be and where they are today,” he said. Since all of this creates quite a bit of urgency in the market, it’s no surprise that investors want to back companies like Hunters and that Hunters needs this funding to aggressively pursue this opportunity before this window closes. That’s also likely why we’re seeing so many strategic investors in Hunters, with Databricks and Cisco Ventures in this round and Snowflake Ventures in the previous one. As May noted, the plan here, especially with Databricks, is to build a sales motion similar to its partnership with Snowflake. “For over three years, Hunter's cloud-native architecture and automation have enabled security teams to adopt the security data lake model,” said Stefan Williams, head of Corporate Development at Snowflake. “Hunters, a Powered By Snowflake partner, is a great example of how investing in best-in-class solutions built using Snowflake extends our ability to mobilize data and contributes to the powerful network effects of Snowflake's Data Cloud.” |

| Dremio raises $160M Series E for its data lake platform Posted: 25 Jan 2022 05:45 AM PST Data lake platform Dremio today announced that it has raised a $160 million Series E funding round led by Adams Street Partners. Existing investors Sapphire Ventures (which also led the company’s $135 million Series D round last year), Insight Partners, Lightspeed Venture Partners, Norwest Venture Partners, and Cisco Investments also participated in this round. The company says this preemptive round now brings Dremio’s valuation to $2 billion, up from $1 billion when it raised its Series D round just over a year ago. “We live in what’s called the SQL lakehouse world,” explained Dremio CEO Bill Bosworth, who joined the company almost exactly a year ago, after eight years as Datastax’s CEO. “What we do is provide technology that allows end-users to access their data in their data lakes directly via SQL — and they can do this in a way that delivers mission-critical BI. What that means is [we’re] giving you the performance that you need to run things like mission-critical dashboards that have sub-second response time capabilities. You can have thousands of analysts hitting the same datasets at the same time with no performance penalty, we call that high concurrency throughput. This is the area that Dremio has been focused on for some time now. We’re going to continue to take that position to the future with a lot of exciting new growth and capabilities in the coming year.” Dremio — as well as competitors like Databricks — is playing in a newly invigorated market. While data lakes and data warehouses, for the longest time, looked like they would remain useful for a set of relatively limited use cases, the idea of the lakehouse — which was first popularized by Databricks — is meant to signal that this new class of technologies now allows enterprises to do far more with this data. “The technology has advanced so much that we felt like there was a need to sort of shift people’s thinking in what those capabilities could be,” Bosworth said. “So by using the term lake house, really, it’s just a connotation that says, ‘oh, so what you’re suggesting is that things that I could do previously only in my data warehouse, are now made possible on data lakes.'” Unlike Databricks, Dremio’s focus is squarely on SQL workloads, business analysts and mission-critical business intelligence. There is some overlap there with the competition, but Dremio’s mission is quite a bit more focused right now. “A top priority for every business leader today is to become a data-driven company,” said Brian Dudley, Partner at Adams Street Partners. “But data teams are being asked to do the impossible: provide faster time to insights, make all data consumers more self-sufficient, ensure data governance and security, and promote an open architecture to avoid vendor lock-in, all while reducing infrastructure complexity and costs. We believe Dremio is leading the way to empower companies to become data-driven, and we couldn't be more excited to partner with Billy and the Dremio team on its mission!” This new funding, of course, gives Dremio a lot of room to aggressively pursue this mission. In addition to expanding its engineering team, the plan is to triple the company’s sales capacity and Bosworth specifically noted that the team plans to greatly expand its go-to-market in Europe this year. But he also noted that having raised this much capital, the company now has the runway to weather any potential headwinds in the global markets for quite some time. “I think everybody who studies this even for five minutes understands that there are some questions ahead in terms of inflation and what that’s going to do to tech valuations,” he noted. “Nobody knows the answer. The best economists I listened to seem to be all over the map, but the good news is, for us, with this kind of the balance sheet, we can execute independently of whatever inflationary winds might hit the markets in the coming years.” |

| Startup Battlefield Winner Cellino grabs $80M Series A Posted: 25 Jan 2022 05:00 AM PST Cellino Bio's founder Nabiha Saklayen didn't initially intend to enter TechCrunch Disrupt 2021's Startup Battlefield – it was her PR advisor who threw the startup's name in the ring as a wildcard entry. But after a busy weekend for the team, Cellino walked away with the prize anyway. Just a few months later, Cellino has more momentum in the form of a $80 million Series A. Cellino is looking to automate the process we use to create human cells, most specifically, induced pluripotent stem cells (iPSCs). IPSCs are made from other cell types, like blood cells, and transformed back into stem cells, which can eventually differentiate into many different cell types. TechCrunch's Sarah Perez covered Cellino Bio's initial pitch and overview here, but in short, their autonomous process would allow scientists to produce large quantities of high-quality iPSCs and scale-up studies in the regenerative medicine space. That's a novel area of medicine in which new cell-based therapies help the body regrow tissues damaged by disease and aging. This series A was led by Leaps by Bayer, 8VC and Humboldt Fund. The round also includes Felicis Ventures, other unnamed investors and existing investors The Engine and Khosla Ventures. Cellino's total funding is $96 million to date, per a company press release. There are some scientific areas where regenerative medicine is showing interesting progress. For instance, embryonic stem-cell derived islet cells have been able to restore insulin producing capabilities to one man with diabetes, per a clinical trial conducted by Vertex Pharmaceuticals. But iPSCs, which are not derived from embryos, have also made remarkable progress. For instance, scientists have implanted iPSCs into one patient with Parkinson's. So far, there haven't been signs of immune rejection and scientists reported that certain Parkinson's symptoms had improved – but there was no control group for this study, so these findings are extremely premature. Meanwhile, at the National Eye Institute, a team of scientists led by Kapil Bharti have been manufacturing induced pluripotent stem cells from patient blood samples, and have shown, in animal studies, that these cells can integrate with the retina. That suggests they may be able to restore certain types of vision loss that currently have no treatment. But, there's still a problem that seems to dominate the regenerative cell research landscape: where do you actually get the cells? Cellino is looking to massively scale-up the way that iPSCs are made. Manufacturing a few cells by hand for animal or even early stage human studies is one thing. But as larger Phase III trials near, researchers will need methods to make many of these cells in a reliable way. Cellino's key invention is a laser-based cell-editing system that can help eliminate cells that aren't up to the task of regenerating tissues, or deliver biological cargo needed to advance manufacturing. Meanwhile, the company is developing machine learning algorithms with the ability to pick out subpar cells. All together, Cellino is looking to create a closed-loop system that can manufacture IPSCs, and eliminate the unusable – all without human intervention. The dream is to build a truly autonomous human cell foundry by 2025. "You're really running into a manufacturing bottleneck," Saklayen tells TechCrunch. "So as we were engaging with investors – a lot of them were passionate about the iPSC space and have invested in other companies working in the space – what drew them to Cellino was our ability to automate these complex processes." Since Disrupt, Cellino has been working on a collaboration with Bharti's project at the National Eye Institute. It represents the first clinical trial intended to transplant personalized iPSCs into patient retinas, with the hopes of treating age-related macular degeneration. Cellino will be manufacturing the iPSCs for this upcoming trial, and Bharti's group will test those IPSCs to ensure they meet FDA safety requirements. In the long term, Cellino is aiming towards developing a iPSC-derived retinal pigment epithelium product. (Bharti is also a part of Cellino's scientific advisory board, says Saklayen). As of now Cellino is "in the process of getting this collaboration formalized,” she says. As for the Series A, Saklayen articulates clear goals when it comes to hiring. She'll plan to to expand the machine learning capacity of the platform – a key part of making Cellino's platform truly autonomous. On the science side, the company will measure its progress by creating a robust dataset comparing its stem cells to those derived from existing, but slower techniques. "We will be doing head-on-comparisons of ourselves with the [cell] lines that are already going into clinical trials," said Saklayen. "So it’s really a comparability data set that we’re going for to show that the cells coming off of a single platform are safe and high quality." Cellino founder and CEO Nabiha Saklayen joined our ‘Found’ podcast recently, be sure to check it out to learn more about her and the company. |

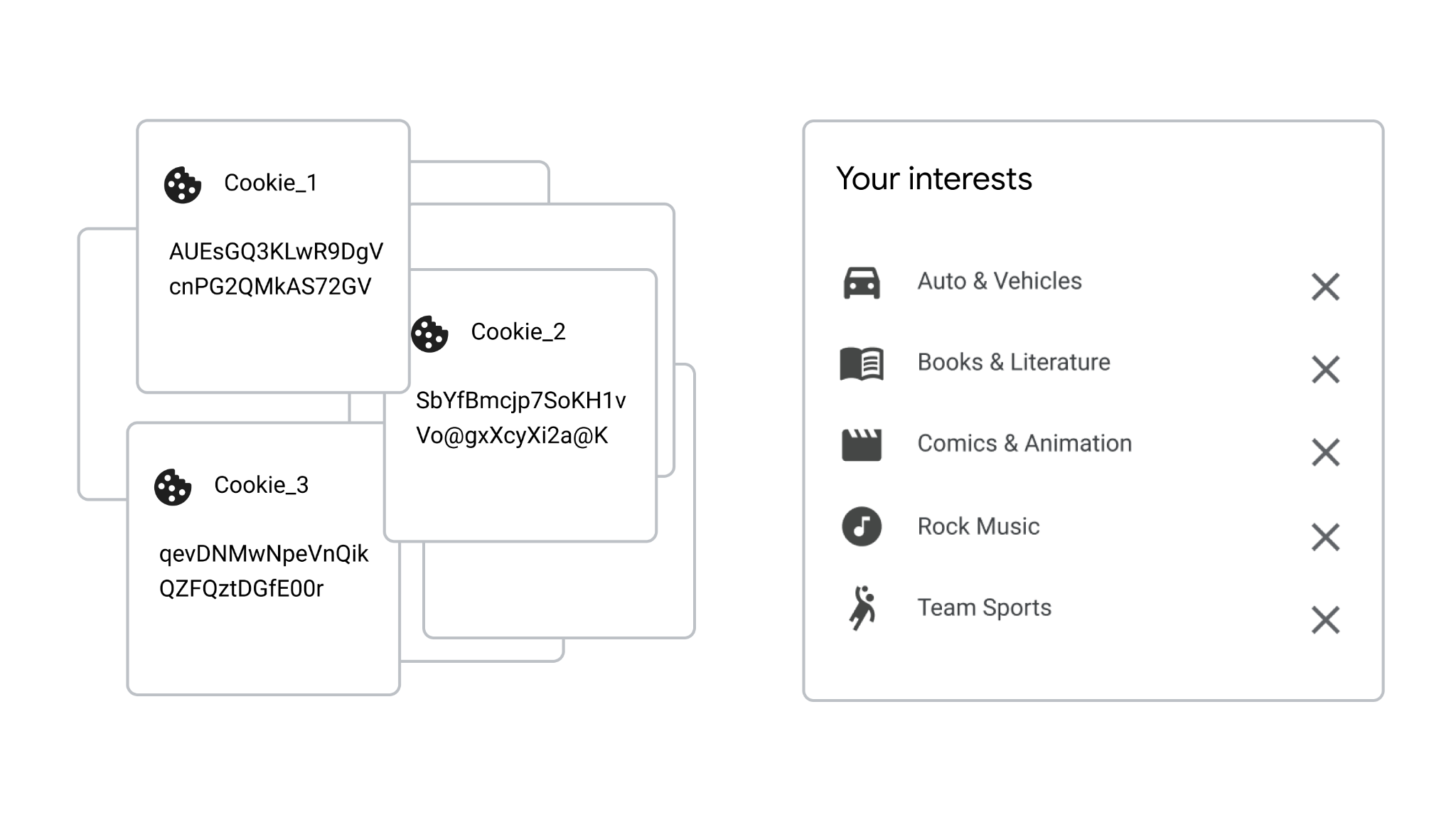

| Google kills off FLoC, replaces it with Topics Posted: 25 Jan 2022 05:00 AM PST FLoC (Federated Learning of Cohorts), Google’s controversial project for replacing cookies for interest-based advertising by instead grouping users into groups of users with comparable interests, is dead. In its place, Google today announced a new proposal: Topics. The idea here is that your browser will learn about your interests as you move around the web. It’ll keep data for the last three weeks of your browsing history and as of now, Google is restricting the number of topics to 300, with plans to extend this over time. Google notes that these topics will not include any sensitive categories like gender or race. To figure out your interests, Google categorizes the sites you visit based on one of these 300 topics. For sites that it hasn’t categorized before, a lightweight machine learning algorithm in the browser will take over and provide an estimated topic based on the name of the domain. When you hit upon a site that supports the Topics API for ad purposes, the browser will share three topics you are interested in — one for each of the three last weeks — selected randomly from your top five topics of each week. The site can then share this with its advertising partners to decide which ads to show you. Ideally, this would make for a more private method of deciding which ad to show you — and Google notes that it also provides users with far greater control and transparency than what’s currently the standard. Users will be able to review and remove topics from their lists — and turn off the entire Topics API, too. “The design of topics was informed by our learnings from the earlier FLoC trials,” Google’s Privacy Sandbox lead Ben Galbraith said in a press briefing ahead of today’s announcement. “And this resulted in a bunch of great feedback from the community, as I’m sure you know. As such, Topics replaces our FLoC proposal and I want to emphasize that this whole process of sharing a proposal, doing a trial, gathering feedback and then iterating on the designs — this is the whole open development process that we wanted for the Sandbox and really shows the process working as intended.” Galbraith noted that Google has spoken to a number of parties to gather feedback for this new proposal, but today marks the start of the company’s process of collaborating with the ecosystem. It’ll remain to be seen if other browser vendors will be interested in adding the Topics API. Since they all quickly turned a cold shoulder to FLoC, I’m somewhat skeptical that they will want to adopt the Topics API, but it’ll be interesting to watch how the ecosystem reacts. It’s also worth noting that, for advertisers, Topics is only one potential signal to decide which ad to show to a given user. In some ways, it just becomes another signal for them that can be augmented with data about the article a user is currently reading, for example, or other contextual data about the user. The plan is to start trialing the Topics API at the end of this quarter, but to get the ball rolling, Google also today published a technical explainer that delves a bit deeper into the details of the proposal. |

| Archive aims to put clothing brands in control of their secondhand sales Posted: 25 Jan 2022 05:00 AM PST It turns out the fashion industry is quite a wasteful industry, contributing an estimated 13 million tons of textile to landfills per year. One of the ways some startups have helped is making the resale of clothing easier by moving it online. However, Emily Gittins and Ryan Rowe, co-founders of Archive, saw some clothing brands being left out of the action. They launched their company in February 2021 to not only decrease the amount of clothing that finds its way into landfills, but also to power the next generation of resale that puts the brands themselves in charge. Buoyed by $8 million in new funding, the company's resale technology builds customized marketplaces for brands to incorporate a secondhand component into their businesses. Via a favorite brand's marketplaces, consumers can buy and sell secondhand merchandise alongside the existing retail experience. "It feels like there is a huge opportunity for brands to improve how they plan buying to reduce the waste in the supply chain," CEO Gittins told TechCrunch. "In my mind is an even bigger opportunity to unlock all of the inventory that is sitting in people’s closets in their houses." One of the drivers for Gittins and Rowe to start Archive was seeing the shift of resale from the early days of consignment stores to moving online with companies like Poshmark, ThredUp and The RealReal. Gittins explained that as all of these generations of resale moved online, buyers and sellers could be matched by common interests; now the third generation will be brands taking back ownership of that and actually driving it themselves. They designed Archive to be a kind of a peer-to-peer, white-labeled product that brands could release that had the same look and feel of their existing retail channels, Rowe, CTO, said. Items are sold directly from a seller to a buyer, so there isn't much to deal with in terms of inventory or logistics. "It also builds community and gives an outlet for these fanatics of the brand," he added. "We realized that retail strategies are much bigger than this, so we’ve started to build out capabilities to help our brands do things like list their additional inventory that was maybe returned or damaged." Over the past year, brands were accelerating the conversations around resale, but weren't taking steps to do it. However while preparing for 2022, Gittins says brands began coming to them with resale as one of their top priorities for the year. It was then that she and Rowe discussed taking additional venture capital to scale their team and operations to service the number of inbound requests. Archive went live with five brands: Dagne Dover (Almost Vintage), Filippa K. (Preowned), M.M. LaFleur (Second Act), The North Face (Renewed Marketplace) and Oscar de la Renta (Encore). The company now has a pipeline of 100 brands looking to work with them, Gittins said. The round brings Archive's total funding to nearly $10 million. It was co-led by Lightspeed Venture Partners and Bain Capital Ventures, with participation from Firstmark and a group of angel investors, including Oscar de la Renta CEO Alex Bolen, Zola co-founder Shan Lyn-Ma, former Credo Beauty CEO Dawn Dobras, designer Steven Alan and former Saks Fifth Avenue president Marigay McKee. The bulk of the funding is earmarked for scaling the company, but also in technology and product development, as Archive aims to build out customized and unique experiences for each brand and their customers. The company did not disclose growth metrics, but Gittins did say that after launching with the first few brands in 2021, the company has seen "incredible traction and is making a dent in taking care of the resale market." Alex Taussig, partner at Lightspeed, said secondhand retail is estimated to be a $100 billion category and will be driven by the brands adopting resale through companies like Archive. He has been watching market play out over the last decade and thinks Archive is the first company to build resale tools tailored toward the brand’s experience. "We were very impressed with the quality of brands and the breadth," Taussig said. "It was not just one type of brand, but all the brands they got on board in such an early timeframe. If you’re the kind of person who really likes Oscar de la Renta, and you just want to be an Oscar de la Renta seller or buyer, you get really deep in that community, but this is the site." |

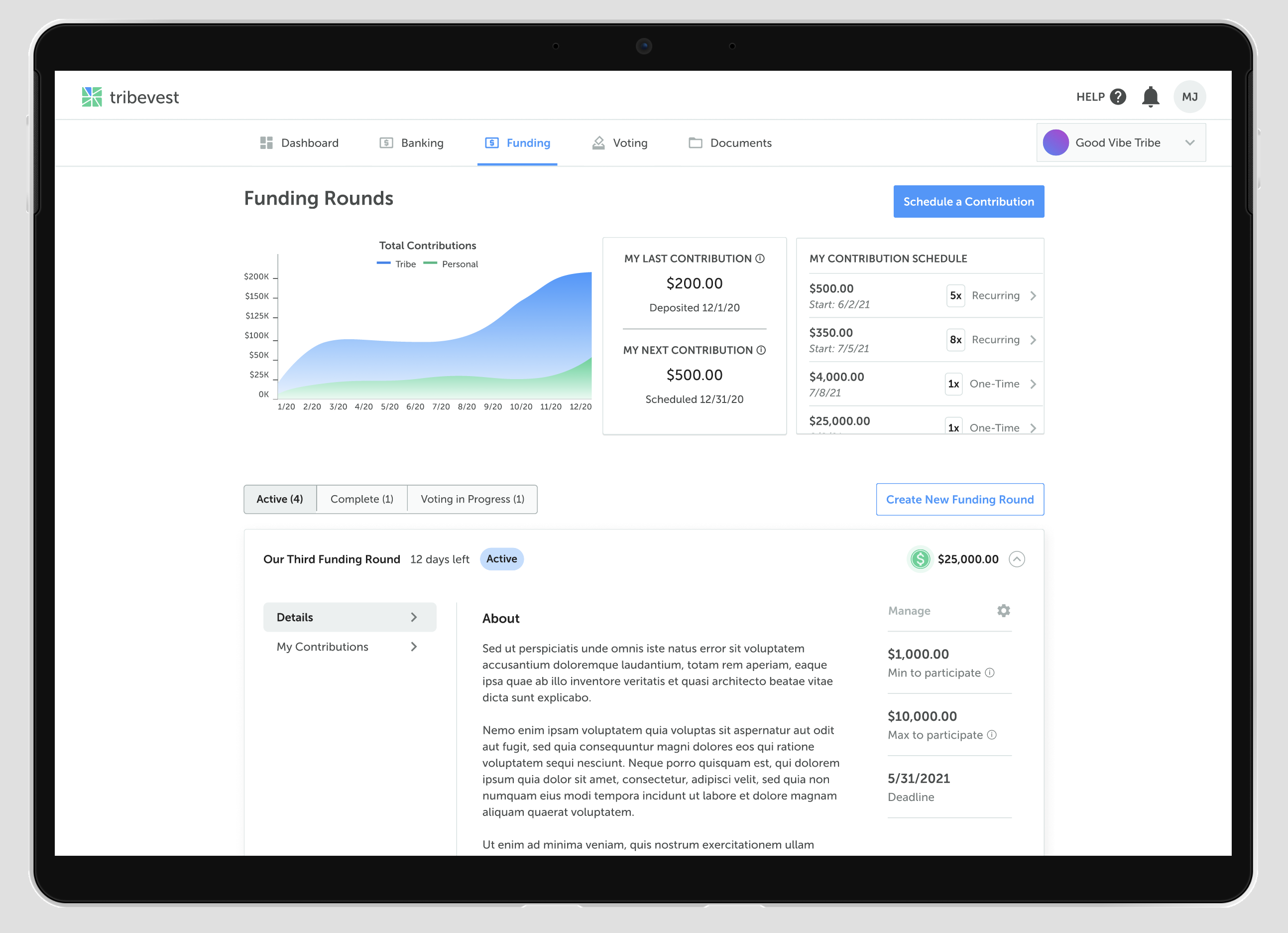

| Columbus-based Tribevest bags $3M for its collaborative investing platform Posted: 25 Jan 2022 05:00 AM PST Tribevest founder Travis Smith went on a fishing trip with his brothers in 2008 that he says they couldn't afford. It was then that he realized their "good jobs with 401ks" would never be enough for them, he told TechCrunch. The brothers had dreams of finding their own financial freedom through investing in real estate, but didn't have enough individual capital to go into business alone. "On that trip, we had our breakthrough, and we realized that together, we can start to pool our capital," Smith said. Smith and his brothers started by making monthly contributions of $500 each, putting down more and more money over time until they were finally able to make their first real estate investment. One deal led to another, Smith said, and the wealth the group created eventually gave him the financial freedom to launch his own company, Tribevest, in 2018.  Tribevest’s chief storyteller Julian McClurkin, co-founder and COO Josh Wilson, founder and CEO Travis Smith, and co-founder and CTO Zach Bowers (left to right) Image Credits: Tribevest When Smith's friends heard about his venture with his brothers, they started asking him if he could help them form their own investor groups, and Smith reflected on the logistical difficulties he and his brothers had faced when they were getting started. "We really had to look at the market and think about what we would have done differently. And the truth was, we would have done everything differently. There just isn’t any platform out there that helps you piece all these things together," Smith said. Tribevest wants to be that platform. It allows investor groups, which it calls "tribes," to form LLCs, create operating documents, establish FDIC-insured bank accounts, and vote to make investment decisions, Smith said. It also offers tools including a business ledger for groups to track their investment performance. Tribevest users leverage the LLC structure for decision-making, giving members executive roles and proposing and voting on group rules — all actions that are recorded on Tribevest's platform. The groups source their own investment opportunities through personal networks or external platforms, as Tribevest is "investment-agnostic," according to Smith. Through their business bank account on Tribevest, provided by Blue Ridge Bank, "tribes" can transact both digitally and offline through checks and wire payments. The company's goal is to become "the collaborative banking layer of the investment world," Smith said. The Columbus, Ohio-based company just raised $3 million in seed funding to scale its business, a spokesperson for the company told TechCrunch. Investors in the round include I2BF Global Ventures, Mucker Capital, Gaingels, Vibe Capital, and singer-songwriter Ryan Leslie. Leslie participated in the round as part of an investor group formed on the Tribevest platform alongside personal finance podcasters Rashad Bilal and Troy Millings, according to the company.  The Tribevest dashboard Image Credits: Tribevest Tribevest previously raised half a million dollars in a pre-seed round and exceeded its goals for customer acquisition in 2020 and 2021, Smith said. Over 1,000 "tribes" have launched on the platform, over 570 of which are actively transacting, usually across multiple asset classes, according to Smith. On average, "tribes" are composed of four to five members, though some are as small as two or as large as fifty members. Over half of Tribevest's customers are people of color, Smith said. He sees increasing access to wealth for marginalized groups as core to the company's mission, and thinks Tribevest can serve as a tool to help individuals learn the "best practices" of wealth-building that successful investors have employed for decades. Tribevest enables its users to break into private markets like real estate and startups, which can often require prohibitively large upfront investments, through pooling their money, Smith said. While some groups invest in public company stock, nearly 80 percent of Tribevest users are invested in the private markets, he added. Beyond needing capital, Smith said he and his brothers "didn’t have the guts" to invest in real estate on their own before they formed a group. Investing in "tribes" is a way for groups to access new asset classes while also spreading their risk, Smith said. Tribevest plans to use some of the proceeds from its seed round to launch formal partnerships with investment platforms similar to Roofstock, which will allow users on those platforms to make investments directly through their Tribevest account at checkout, Smith said, though he declined to name any specific platforms the company plans to partner with. Until now, the company has been focused on building out and streamlining its core functionalities like launching and managing LLCs and making transactions, Smith said. Now, the 8-person team is doubling down on making engineering and product management hires as well as investing in marketing ahead of an expected Series A fundraise. Tribevest plans to launch a mobile app in the first half of 2022, which Smith said reflects its forward-looking focus on "community, communications, and collaboration." |

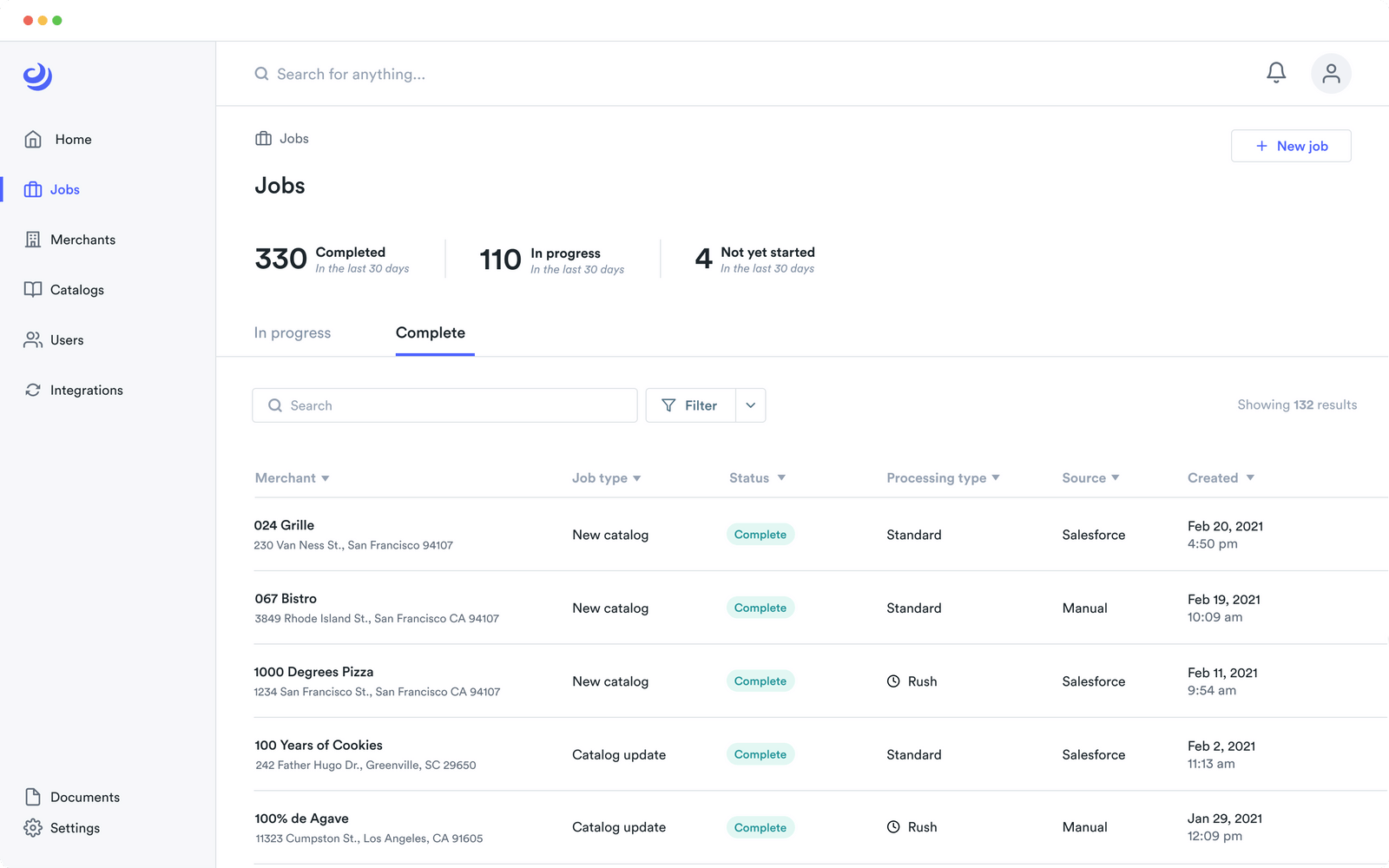

| Woflow structures merchant data so food ordering can be more accurate Posted: 25 Jan 2022 05:00 AM PST Woflow, a data infrastructure company, raised $7.3 million in Series A funding to continue developing its automated approach to bring offline data online. The company helps customers with antiquated inventory systems power their merchant onboarding data, like restaurant menus and images, with APIs to structure data in a way that when someone's food order requests "no mustard," it is recognized properly, Woflow co-founder and CEO Jordan Nemrow told TechCrunch. Nemrow and Will Bewley founded the San Francisco-based company in 2017. "In the background, machine learning models and artificial intelligence-powered humans in the loop do the structuring for our customers, which include food delivery, e-commerce and point-of-sale," Nemrow added. "Restaurants usually deal with having offline data, but time equals money, and if there is incorrect data, there can be some financial reimbursement. We are the de facto solution for that." The round comes nearly a year after the company launched its merchant data tool with $3.5 million in funding led by Craft Ventures. We touched on it briefly at the time, with my colleague Alex Wilhelm remarking on Woflow's early traction with food delivery giants like DoorDash, Deliveroo, Wolt and Popmenu.  Example of Woflow’s merchant data. Image Credits: Woflow Craft Ventures is back for the second round, this time in a participatory role with a group of angel investors, with Base10 Partners and Construct Capital co-leading the Series A. Woflow's co-founders decided to go after an additional round of capital when they saw how quickly they were ramping up and adding new enterprise clients, Bewley, COO, said. After launching last year, the company saw its revenue doubling every couple of months and then in the last six months it was doubling every month, a trend he said is planned to occur through 2022. "We thought it was a good time to start fundraising when we started getting traction, seeing the expansion, and thought about doing things in parallel that we wouldn't be able to do if we were watching our pennies," he added. The new funding gives Woflow about $11 million in total funding to date. It will be deployed into accelerating product development, recruiting on the engineering team and developing new language considerations so the company can move into new markets. Bewley went on to say that Woflow is going to be careful about its next expansion. Restaurant menus are the company's "bread and butter," and they are approaching 1 million merchants onboarded, which Bewley believes means that approach is scaling well. The company is in 10 countries right now, with five languages, and aims to add another 10 languages in coming years as it expands into Latin America and Asia. They are already looking at the next horizontal markets, like grocery stores and convenience stores. Both of those stores "are a totally different beast," Nemrow said. However, there will be some trade-offs: restaurants have 50 or 60 items with a complexity of ordering options, while grocery and convenience stores could have 50,000 items, but will be less complex, and SKUs can be mapped out and reused across vendors. As part of the investment, Rexhi Dollaku, partner at Base10 Partners, joins the Woflow board of directors. Base10 often invests in the digitization of the food supply chain, and Dollaku said one of the biggest trends he is seeing here is ease of use of food apps and buying digitally. "Part of what's driving the trend is back office systems that aren't connected to front systems," he added. "The consumer-facing part has transformed in the past decade, so you can do things now you could not before. Part of the reason I was excited by Woflow is that they are providing the critical infrastructure for the food category, starting with restaurants, which is a highly overlooked part of the ecosystem. People aren't spending time thinking about back and front integration, especially for businesses that are not as tech savvy." |

| Report suggests NVIDIA is preparing to walk away from its ARM acquisition Posted: 25 Jan 2022 04:42 AM PST NVIDIA has reportedly made little to no progress in gaining regulatory approval for its $40 billion purchase of ARM and is privately preparing to abandon the deal, according to Bloomberg‘s sources. Meanwhile, current ARM owner SoftBank is reportedly advancing a program to take ARM public as an alternative to the acquisition, said another person familiar with the matter. NVIDIA announced the deal in September 2020, with CEO Jensen Huang proclaiming it would “create a company fabulously positioned for the age of AI.” ARM’s designs are used under license almost universally in smartphones and other mobile devices by companies like Apple, Qualcomm, Microsoft, Samsung, Intel and Amazon. A backlash began soon after the announcement. The UK, where ARM is based, launched an antitrust investigation into the acquisition in January 2021, and another security probe last November. In the US, the FTC recently sued to block the purchase over concerns it would “stifle” competition in industries like data centers and car manufacturing. China would also reportedly block the transaction if other regulators don’t, Bloomberg‘s sources say.

Companies like Intel, Amazon and Microsoft have reportedly given regulators enough information to kill the deal, the sources say. They previously argued that NVIDIA can’t preserve ARM’s independence because it’s an ARM client itself. As such, it could also potentially become both a supplier and competitor to ARM licensees. Despite the stiff headwinds, both companies maintain that they’re still pushing forward. “We continue to hold the views… that this transaction provides an opportunity to accelerate ARM and boost competition and innovation,” NVIDIA spokesman Bob Sherbin told Bloomberg. “We remain hopeful that the transaction will be approved,” a SoftBank spokesperson added in a statement. Despite the latter comment, factions at Softbank are reportedly pushing for an ARM IPO as an alternative to the acquisition, particularly while the semiconductor industry is so hot. Others in the company want to continue pursuing the transaction given that NVIDIA’s stock price has nearly doubled since it was announced, effectively increasing the transaction price. The initial agreement expires on September 13th, 2022, but will automatically renew if approvals take longer. NVIDIA predicted that the transaction would close in approximately 18 months — a deadline that now seems unrealistic. Editor’s note: This article originally appeared on Engadget. |

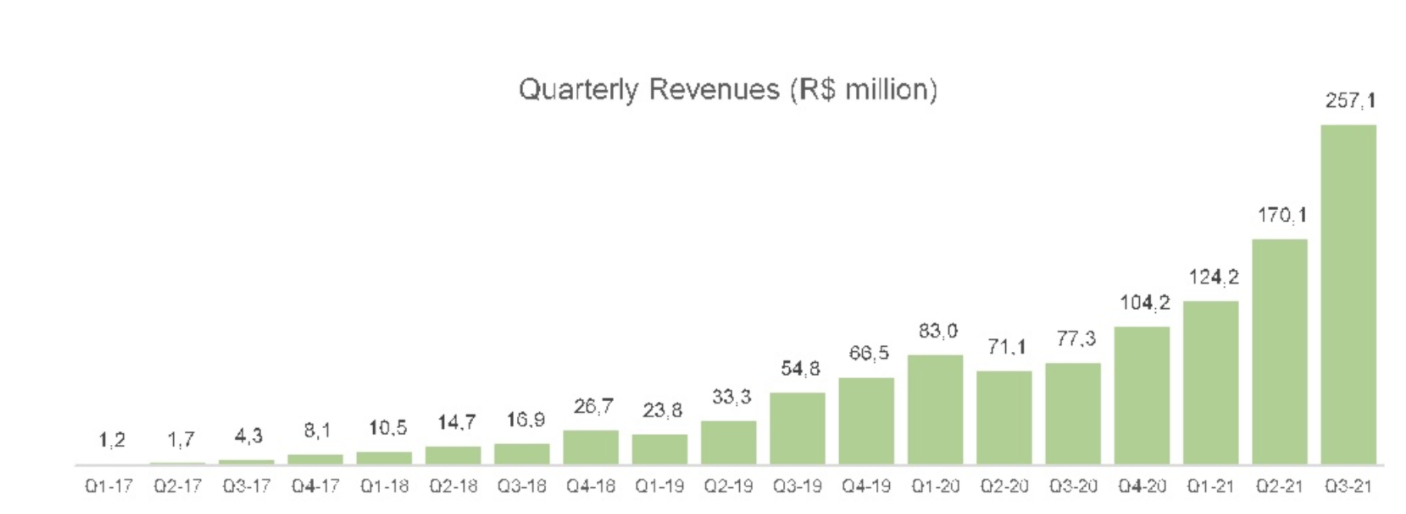

| Posted: 25 Jan 2022 04:30 AM PST Brazilian lender Creditas announced today that it has raised $260 million in a Series F funding that values the company at $4.8 billion. That's up from the fintech's $1.75 billion valuation at the time of its $255 million raise in December 2020. With the latest financing, São Paulo-based Creditas has now raised more than $829 million in funding over six rounds, with the bulk of that capital ($745 million) coming in over the last three years. It's a robust start to a new year that follows one which saw venture investments into fintech startups in Latin America skyrocket — to over $13.2 billion in 2021 compared to $2.3 billion in 2020. Notably, Fidelity Management & Research LLC led Creditas's latest investment, which also included participation from other new investors Spanish fintech fund Actyus and Greentrail Capital. Existing backers also put money in the Series F round, including QED Investors, VEF, SoftBank Vision Fund 1, SoftBank Latin America Fund, Kaszek Ventures, Lightock, Headline, Wellington Management and Advent International, via affiliate Sunley House Capital. Creditas is one of those rare and refreshing startups that gives us a glimpse into their financials. Such transparency is not common and has the benefit of preparing the company well for its eventual path to the public markets. In the third quarter of 2021, Creditas notched US$46.8 million in revenue – up 233% from $14 million in the 2020 third quarter. At the same time, as it has been investing in its growth, the company's net loss widened to $14.8 million compared to $8.25 million. Founder and CEO Sergio Furio projects annualized revenue of about $200 million for 2021. Such rapid revenue growth is more often seen in younger startups. A company that is now 10 years old seeing that kind of revenue growth is quite impressive.  Image Credits: Creditas As of the 2021 third quarter, the company's credit portfolio under management had reached $532 million — up from $189.3 million in the third quarter of 2020. Creditas began its life in 2012 as a collateralized lender operating via a marketplace model. It partnered with banks to deliver collateralized lending at rates that were significantly lower than compared to traditional interest rates (around 30% APR compared to 85% APR). In 2016, the company essentially took the bank out of the equation and built its own platform so that instead of the banks, Creditas was the entity securing funds for loans. Then in 2019, the company evolved into more of an ecosystem around its customers. Say, if a customer owned a car and wanted cash, Creditas would take the car as collateral, deliver a "very low" rate for the loan and then say a few years later if that customer wanted to get another car, they could do that through Creditas' marketplace. It also could provide insurance for that new car. "Today, we are a fintech company that uses those assets to deliver cheaper financing," founder and CEO Sergio Furio told TechCrunch. "Beyond that, we also deliver protection and a marketplace for other verticals beyond cars." Or in other words, Creditas is working toward being "a one-stop solution for those seeking a digital-first experience in everything related to their house, car, motorcycles, and salary-based benefits." For example, it operates a car marketplace called Creditas Auto. It also runs Creditas Store, an e-commerce platform with a payroll-deductible buy now, paylater model and Voltz, a manufacturer of electric motorcycles in Brazil (and after its strategic investment in Voltz Motors, next-generation EV motorcycles and scooters). And it's building financial software for all those operations. Eighteen months ago, Creditas expanded out of its home market of Brazil into Mexico. The country, Furio said, "has proven to be a strategic engine for growth." "We believe Creditas can become a true disruptor in the Mexican market being able to democratize access to financial products and consumer solutions alike," he added. "We plan to continue growing by nurturing and expanding our ecosystem, such as providing financial solutions to our marketplace customers, launching new products, extending our geographic reach — including our recent successful entry into Mexico and the expansion of our tech hub in Valencia, Spain — and selectively pursuing strategic M&A opportunities," Furio said.  Image Credits: Founder and CEO Sergio Furio / Creditas The company also has a tech hub in Spain (Furio's home country), where about 20% of the company's tech team is based. Presently, Credit has more than 4,200 employees, and plans to, naturally, continue to hire with its new capital. While its headcount doubled over the past year, Furio envisions a slower pace of hiring (no more than 50% growth) over the next 12 months. "This funding round will help us increase our tech, marketing and operations teams but the speed of growth from an employee perspective will probably slow down," he told TechCrunch. The company also plans to continue investing in acquisitions. In 2021, it acquired four companies. Part of the proceeds from the round will go toward "adding specialty products or niches" that it does not currently operate in. Its investors are, naturally, bullish on the company's continued potential. Will Pruett, managing director of Fidelity, described Creditas as "the rare fintech that actually builds deep relationships with their customers, drastically lowering the cost of credit and improving the quality of life of those they serve." QED Managing Partner Bill Cilluffo notes that his firm first invested in Creditas at the time of its Series A in 2015. "By broadening its strategy away from being purely a finance company, Creditas can now leverage a number of end-to-end solutions from insurance to car sales to support more customers than ever before," he said. "Creditas is one of those special fintech assets given its ability to marry hyper-growth with high revenue economics into an ever-growing TAM. We continue to back them harder and see shareholders like Fidelity and Wellington in the cap table as reinforcement of our thesis that Creditas is a successful listed company in the making," said David Nangle, CEO of VEF. As to timing of going public, Furio said the company is "continuously monitoring the market to see when it's due time for that." |

| Twitter’s experimental ‘Flock’ feature will let you share tweets with your closest friends Posted: 25 Jan 2022 04:13 AM PST Twitter is still working on a feature that will give you a way to blast tweets that can only be seen by the friends you choose. In July last year, the social network revealed that it’s considering letting you designate “trusted friends” so some tweets would only be visible to them. Now, developer and reverse engineer Alessandro Paluzzi has unearthed evidence that the feature is currently in development and that Twitter now calls it “Flock.” It might be called differently if it gets a wider release, though — the company told The Verge that “Flock” is just a placeholder name. Based on the explanation that Paluzzi found, its current iteration will let you add up to 150 users to your list, and they’ll be the only ones who can see and respond to tweets you send to the group. Any tweet you send to your Flock will be come with a notice telling your audience that they can see it because you’ve added them to the group. You can edit the group anytime, though, and Twitter says it won’t notify anyone you remove. |

| Tunisian enterprise AI startup InstaDeep raises $100M from AI Capital, BioNTech, Google Posted: 25 Jan 2022 04:03 AM PST A recent survey carried out by CNBC reported that 81% of executives worldwide say AI will play a prominent and critical role in how their businesses operate this year. Companies are phasing from the first generation of AI, which deals with pattern, text and image recognition, to decision-making AI, which helps them make timely decisions in complex spaces. InstaDeep, a Tunis and London-based enterprise AI startup that creates decision-making systems for solving real-world problems, has raised $100 million in Series B financing led by Alpha Intelligence Capital and CDIB. BioNTech (the company behind Pfizer's COVID-19 vaccine), Chimera Abu Dhabi, Deutsche Bahn's DB Digital Ventures, Google, G42 and Synergie participated in the round. InstaDeep was founded by Karim Beguir and Zohra Slim in 2014. The Tunisian startup, headquartered in London with offices in Paris, Tunis, Lagos, Dubai and Cape Town, uses advanced machine learning techniques to bring AI to applications within an enterprise environment. Beguir, the chief executive officer, on a call with TechCrunch, said the eight-year-old company's AI and machine learning solves an array of challenges. They can range from a large shipping company finding ways to efficiently transport thousands of containers to a railway station, with more than 30,000 kilometres of railway, trying to automate scheduling for 10,000 trains. Other examples are the design of advanced therapeutics with silicon and routing components on a printed circuit board. These types of problems, though in different verticals, have similarities. InstaDeep uses reinforcement learning, a kind of machine learning that helps design optimization strategies and tackles them simultaneously. In a statement, the company said it is currently working on a moonshot product to automate railway scheduling with Deutsche Bahn. The rail operator is the largest in Europe. Two years ago, InstaDeep formed a multi-year strategic collaboration with BioNTech to launch a joint AI innovation lab. The lab's mandate was to deploy the latest advances in AI and ML to develop novel immunotherapies. One of its best efforts came in late November when it created an early warning system (EWS) for detecting high-risk SARS-CoV-2 variants. Per a report by FT, this EWS identified more than 90% of World Health Organization (WHO) designated variants on average two months ahead of time and detected Omicron three days before it was classified as a variant of concern by the WHO. InstaDeep also collaborates with Google's AI research divisions to create an early detection system for desert locust outbreaks in Africa; it has worked on AI initiatives and has published joint research with DeepMind and Google Research. A common theme with these partnerships is that all three organizations are investors in InstaDeep's new financing round. "With them being our partners and customers, they've been able to see firsthand what InstaDeep platform and the team can achieve," said Beguir. "So we see it as a significant milestone and also sort of a vote of confidence in our capabilities and products that they are investing having worked very closely with us on difficult problems for years."  Karim Beguir (InstaDeep CEO) Beguir and Slim bootstrapped InstaDeep from 2014 to 2018, pumping revenue from clients back into the business acquiring new talent and expanding. In 2019, the Tunisian startup raised a $7 million Series A round from pan-African private equity firm AfricInvest and New York-based Endeavor Catalyst to scale its systems. InstaDeep has established itself as a global company using AI to solve complex problems with significant monetary value. For example, building one kilometre of railway costs hundreds of millions of dollars. So, providing an intelligent system — which is one of InstaDeep's applications — that can optimize train traffic, and manage constraints better, is highly marketable. With the new funding, the enterprise AI company plans to accelerate the launch of disruptive AI products across biotech, logistics, transportation and electronics manufacturing. Advancing its computing infrastructure, expanding into the U.S. and hiring more talent is also in its use of funds strategy. InstaDeep currently has over 170 employees. More than 130 are in AI research, engineering, ML and DevOps departments, while half of the team is based in its African offices: South Africa, Nigeria and Tunisia. When InstaDeep launched, Africa wasn't in the picture detailing AI's contribution to global economic growth. And while that picture hasn't changed so much, InstaDeep is one of the few African companies, including South Africa's Aerobotics and hearX Group, trying to change that status quo and give Africa have a say in shaping the future of AI. "We've managed to build a culture of high standards and prove that the talents in Africa are capable of being competitive, working and collaborating with the very best," said Beguir. "That's the story we've been able to nurture. And today, we're proud to have a team which is now over multiple countries in Europe, Middle East and Africa, but has some very passionate African AI researchers, engineers making a tangible contribution." Beguir mentioned on the call that at the time InstaDeep started with "two laptops, $2,000 and a lot of enthusiasm," many investors and onlookers within the African tech and AI space doubted the company's goal to collaborate with the likes of DeepMind and Google. But if technology has taught us anything, location doesn't pose a barrier in getting global customers. And this holds more true for AI and deep tech technology as long as companies have access to knowledge, talent with experience and an open AI community. Beguir, half Tunisian and half French, grew up in the North African country but studied engineering and mathematics in France and the U.S. After a classical career background, Beguir said he started InstaDeep to prove that African talent could be competitive, make a difference in deep tech and collaborate and compete with the best in the world. "It is possible to create a globally competitive company with strong African roots, but also well integrated into the world working on genuine deep-tech innovation, and doing things that haven't been done before," the CEO said. "That's been our story so far, and we can't wait to take it to the next level with our investors and partners and try to have a positive impact on the ecosystems in which we operate and all the partners with whom we work." |

| Wandelbots raises another $84 million to teach robots without code Posted: 25 Jan 2022 04:00 AM PST Dresden, Germany-based Wandelbots has raised a healthy sum in the years since it appeared on our Disrupt Berlin stage, way back in 2017. The following year, the no-code robotic software firm raised $6.8 million, followed by another $30 million in June 2020, as excitement around automation continued to build as COVID slowed manufacturing to a crawl. Today the firm returns with a healthy $84 million Series C, putting its funding well north of $100 million to date. This latest round was led by Insight Partners and featured a slate of existing investors, including 83North, Microsoft, Next47, Paua, Atlantic Labs and EQT. Wandelbots' mission is a deceptively simple one, and something a number of firms are pushing to solve in the space. Can a robotic software layer lower the barrier of entry for deploying robotics in a factory setting? Specifically, how can a firm deploy a robotic army without the need for a lot of outside help, significant sums of money and/or robotic coding know-how? The company's solution involves a "Trace Pen," which an instructor uses to mimic a motion and train the robot in the process. The motion can then be fine-tuned on the software without coding.  Image Credits: Wandelbots "I'm very proud to see Wandelbots mission become a reality," co-founder and CEO Christian Piechnick said in a release. "Our platform will help to accelerate human-centered robotics solutions in the industry." This latest funding finds the company working to build a developer community around its robotic instructing software. Specifically, developers are invited to create their own teaching applications on the Wandelbots platform. The company says it's also working to bring interoperability to a wider range of systems, a list that currently includes Universal Robots and Yaskawa, powering robots for clients like BMW and VW. Wandelbots is also set to do additional hiring and expand global operations into markets like the United States and Asia. |