TechCrunch |

- Joni Mitchell joins Neil Young, pulls her music from Spotify over vaccine misinformation

- The return of the lean, green startup

- This Week in Apps: iPhone payments, App Store upgrades, Snapchat’s AR shopping

- Frozen giants, and why everyone is competing with everyone regardless of what they say

- Please make a dumb car

- Lessons from a fintech founder: Solving for C by going B2B

| Joni Mitchell joins Neil Young, pulls her music from Spotify over vaccine misinformation Posted: 29 Jan 2022 12:17 PM PST Spotify’s Joe Rogan headache is about to get a lot worse. Earlier this week, musician Neil Young announced that he would pull his music from the streaming service to protest Spotify’s relationship with Joe Rogan, who the company brought under its wing in an exclusive $100 million deal two years ago. In a post to her website on Friday, Joni Mitchell announced that she would “stand with Neil Young” and remove her catalogue from the streaming platform. “I’ve decided to remove all my music from Spotify. Irresponsible people are spreading lies that are costing people their lives,” Mitchell wrote. “I stand in solidarity with Neil Young and the global scientific and medical communities on this issue.” As one of the world’s most famous and most well-respected living musicians, Mitchell’s decision to abandon Spotify over Rogan is bound to turn some heads. And unlike Young, she didn’t have an existing beef with the service over its stream quality. Rogan’s podcast, the Joe Rogan Experience, is no stranger to controversy. In recent years, Rogan and a number of his featured guests have openly expressed transphobia, discouraged his listeners from wearing face masks to reduce Covid-19 transmission because masks are “for bitches,” and broadly spread doubt about vaccines to his massive audience. Rogan’s show also happens to be the world’s most popular podcast, bringing in more than an estimated 11 million listeners per episode, with multiple episodes hitting Spotify each week. Rogan regularly spotlights guests who peddle misinformation and makes no effort to fact-check their claims. His decision to host Dr. Robert Malone, a virologist banned from Twitter for spreading misinformation about COVID-19, prompted hundreds of medical professionals to sign onto an open letter slamming Spotify for profiting off of putting lives at risk as the pandemic rages on. The letter inspired Young to leave the service this week and Mitchell also linked to it in her own message. “Dr. Malone used the JRE platform to further promote numerous baseless claims, including several falsehoods about COVID-19 vaccines and an unfounded theory that societal leaders have ‘hypnotized’ the public,” that letter reads. “Many of these statements have already been discredited. Notably, Dr. Malone is one of two recent JRE guests who has compared pandemic policies to the Holocaust. These actions are not only objectionable and offensive, but also medically and culturally dangerous.” |

| The return of the lean, green startup Posted: 29 Jan 2022 11:00 AM PST Welcome to Startups Weekly, a fresh human-first take on this week's startup news and trends. To get this in your inbox, subscribe here. The market is down. The party is over. And Peloton of X startups aren't too happy right now. As tech stocks take a hit, the big question on my mind is how a dip in market performance impacts early-stage startups. There's the obvious argument here that startups have been preparing for a re-correction, and that market highs were knowingly unsustainable, but just because expectations exist doesn't mean that ripple effects float away. Despite investor's outward rationalization, the red, or millennial pink, flags are not going unnoticed, with some firms lowering revenue expectations even at the earliest stages. On Equity this week, Alex and I interviewed Bessemer growth partner Mary D’Onofrio, who admitted that her expectations for exit multiples have changed, and that the IPO window is mostly closed. The stocks may be sane, but that's still kind of sad, right? D'Onofrio is seeing rounds taking longer, VCs asking more questions and the return of full due diligence (which, for anyone who has been reading this newsletter, is music to my paranoid ears). My take, after speaking to a handful of venture investors and founders, is that we're going to see the return of the lean, green startup. In the past, stock market dips may have caused a retraction in venture capital dollars, leaving startups to crumble under lack of capitalization. In today's market however, there's never been more capital in the venture world. A venture-backed early-stage startup has an elusive line to toe, because a decline in valuations isn't a decline in capital. I expect to see founders with cash in the bank take on a leaner mindset, maybe spending more conservatively or thinking about runway again. Vernacular will change: If becoming the “Amazon of X” isn’t the smartest target, founders could instead focus on building out key capabilities that will help them survive an even bigger slowdown. It may be a while before a founder tells me that their capital is offensive, not defensive. The return to normalcy feels foreign, but that's because we've been in wonky times for an extended period of time. Going forward, I am paying attention to how startups speak about growth in the coming months. You're raising money, but is it to hire, develop, acquire or just be able to exist? For my full take on this topic, check out my latest TechCrunch+ column: 3 views: How should founders prepare for a decline in startup valuations and investor interest? I'd also love to know how you're reacting to the news, so tweet me @nmasc_ and change my mind. In the rest of this newsletter, we'll get into education's emotional pivot, fintech proactiveness and some insidery buzz in the VC and startup world. Education's inevitable pivot to emotionI wrote a TechCrunch+ story about edtech's inevitable pivot to emotion-based learning. In the story, I explore how three venture-backed companies — Wayfinder, Empowerly and Learnfully — are navigating the longstanding challenges of personalized education with fresh takes. Here's why it's important: For education enthusiasts, personalized learning isn't a new phenomenon, it's simply a rebranding of adaptive learning. What's fresh, then, is that newly venture-backed startups are cooking up products that look at students beyond their grades and scores. Edtech entrepreneurs are betting that the future of learning depends on understanding the more subjective traits of learners, which feels hard to argue with. The tension ahead, though, is how to apply a venture-like mindset to something as hard to scale as a sense of belonging. Other lessons:

Image Credits: Dual Dual (opens in a new window) / Getty Images Deal of the weekParthean recently raised $1.1 million at $12 million valuation to build a personal finance company that educates users, and helps them track their finances at the same time. The big vision behind it, per co-founder and CEO Arman Hezarkhani, is the idea of pro-active learning. "Anyone who tells you that people want to learn, largely they are wrong," he said. "[Founders] want to believe in the best of humanity and that people are going to dedicate time to wanting to learn something, but we always come back to this vitamin versus painkiller problem." A big area where this exists prominently is in finance, he argues, leaving consumers in a spot where they need a financial platform that helps them when they have a fever (overspend) instead of when they're feeling ambitious (after their New Year's resolution). Here's why it's important: By combining edtech and fintech, Parthean has an opportunity to track a metric that traditional education companies are unable to measure: connection rates. Part of Parthean's progress is measured by whether users, after they complete a crypto course, end up doing the action item that's tacked onto the end of the lesson, whether it's setting up a crypto wallet on Coinbase or growing a credit score. It can only do that because it has your spending information, but that sort of integration could lead to fascinating outcomes. It's less about consumption, and more about creation. Honorable mentions:

Image Credits: Peshkova (opens in a new window) / Getty Images In the DMs

Across the weekEquity, the tech news podcast I co-host alongside Alex Wilhelm and Mary Ann Azevedo, is going live! Join us for a virtual, live recording of our show on February 10th — tickets are free, puns will come at the cost of our producers' sanity. Seen on TechCrunch How one founder is putting the power of home ownership back in the hands of actual homeowners 10,000 subscribers later, This Week in Fintech has a venture fund Joby Aviation wants to conduct dramatic eVTOL flights over San Francisco Bay Seen on TechCrunch+ Why Robinhood is getting hammered today Hard cash and soft skills: How to successfully manage an acquisition How our SaaS startup broke into the Japanese market without a physical presence Dear Sophie: 3 questions about immigration and naturalization Crypto pioneer David Chaum says web3 is 'computing with a conscience' Until next time, |

| This Week in Apps: iPhone payments, App Store upgrades, Snapchat’s AR shopping Posted: 29 Jan 2022 10:30 AM PST Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. App Annie says global spending across iOS, Google Play and third-party Android app stores in China grew 19% in 2021 to reach $170 billion. Downloads of apps also grew by 5% reaching 230 billion in 2021 and mobile ad spend grew 23% year-over-year to reach $295 billion. In addition, consumers are spending more time in apps than ever before — even topping the time they spend watching TV, in some cases. The average American watches 3.1 hours of TV per day, for example, but in 2021, they spent 4.1 hours on their mobile device. And they're not even the world's heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed five hours per day in mobile apps in 2021. Apps aren’t just a way to pass idle hours, either. They can grow to become huge businesses. In 2021, 233 apps and games generated more than $100 million in consumer spend, and 13 topped $1 billion in revenue, App Annie noted. This was up 20% from 2020, when 193 apps and games topped $100 million in annual consumer spend, and just eight apps topped $1 billion. This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps and games to try, too. Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters Top StoriesThe App Store’s bad press cycleThere was a time when developers were too scared to say anything bad about Apple’s App Store for fear of repercussions to their own apps. That time has long since passed. Apple is under regulatory scrutiny, facing investigations and engaged in lawsuits over its App Store and its alleged antitrust practices, according to some authorities. Meanwhile, because more are open to pointing out when the App Store makes mistakes, it seems as if those issues are more common and frequent. In reality, Apple may have made just as many mistakes in the past, but they were only discussed in backchannels, not publicly on the web and social media. For the developer community, the stories that emerge from this closer look into the day-to-day goings-on of the App Store can be disheartening. Every week, it’s something new. This week, for example, one story highlighted how Apple approved what was described as a shameless clone of the popular game “Unpacking,” even allowing the clone (“Unpacking Master”) to reach the top of the App Store’s free charts before its removal. The developer has since apologized, but this latest event comes only days after a number of developers tried to game the App Store with clones of the popular web game Wordle. These incidents seem to convey a message to the community that if you don’t have an iOS version of your app or game, you’re going to get knocked off — and your brand could suffer. Elsewhere, another developer called Fanhouse decided that it would now punish its own iOS users by jacking up subscription prices by 50% in order to cover its App Store commissions. An outspoken critic of the commission structure, the company, of course, wants to collect fees through its own website, but isn’t allowed to point to that option on iOS. This is also the type of incident that would have never been heard of in such a public fashion years ago. The changing regulatory climate has allowed smaller developers to speak out about how they want altogether different rules, not just a price cut for registering as a small business. Apple’s new plan for contactless paymentsIs Apple preparing to more directly take on Square and other companies that help small businesses process payments? That’s the latest report from Bloomberg this week, which claims Apple has been working on a new feature since 2020 (following its Mobeewave acquisition) that would turn the iPhone itself into a payment terminal. The feature would involve NFC technology — meaning customers could tap their credit card to the iPhone to pay, instead of using an additional piece of hardware, like a payment terminal or simpler card reader. There are questions as to how this feature would operate. If Apple were to allow third parties to tap into the feature via an API, for example, it could boost the entire iOS mobile payments ecosystem. If, however, Apple decides these payments must only flow through Apple Pay, then it will be setting itself up as a competitor to existing payment providers and businesses serving the small business market — but at the risk of further regulation. Apple didn’t respond to comments, Bloomberg’s report noted — and of course, we won’t know anything for sure until it’s officially announced. The timing is ripe for such a shift, as the pandemic has prompted increased adoption of contactless mobile payments in markets that had been slow to make the transition, such as the U.S. App Store UpgradesThe App Store got a number of notable updates this week to APIs and Search Ads and more (see below). But one new feature stands out as a much bigger improvement: Apple has launched a new App Store feature that will allow developers to distribute “unlisted” apps within the App Store. To be clear, this is not really meant for distributing betas for testing purposes, which will continue on TestFlight. Nor is it meant for widescale enterprise distribution of apps to an employee base. Instead, the feature can be used to publish unlisted apps, including consumer-facing apps, that are meant for more limited distribution. This could include those apps intended for a limited audience, says Apple, like those for “specific organizations, special events, or research studies.” The feature could also be used to distribute apps to employee-owned devices that can’t be managed through Apple’s School Manager or Business Manager platforms, which would aid organizations that have BYOD policies or lack enterprise distribution infrastructure. Unlike public apps, the unlisted apps won’t appear on the App Store in category listings, recommendations, charts, search results, or, really, anywhere. Instead, the only way to get to the app’s download page will be with a direct link. It will be interesting to see how this feature ends up being used by businesses and other organizations, and how strict Apple will be when determining whether or not an app is eligible for unlisted distribution — a process that requires approval. There are many cases where developers want to test an app with a wider audience but bump up against TestFlight’s limit of 10,000 external testers. Will Apple finally allow these broader tests to have App Store distribution, too? Time will tell. Weekly NewsPlatforms: Apple Image Credits: Apple

Platforms: Google

Augmented Reality Image Credits: Snap

Fintech

Social

Photos

Messaging

Dating

Streaming & Entertainment

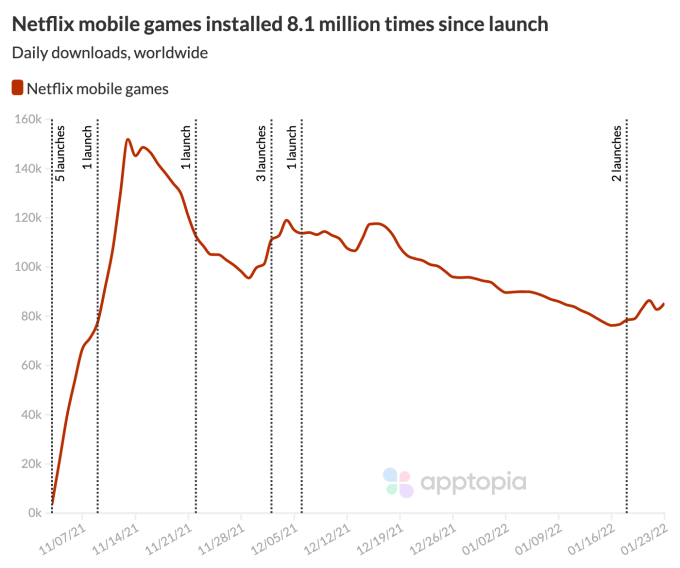

Gaming

Image Credits: Apptopia Productivity/Utilities

Government & Policy

Funding and M&A

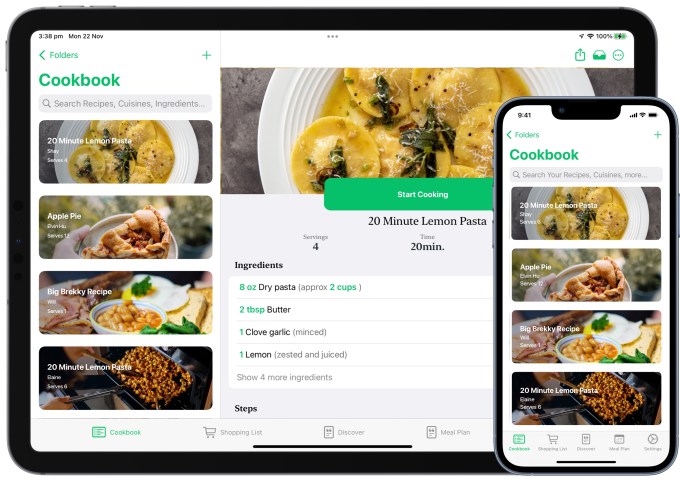

DownloadsPestle Image Credits: Pestle A newly launched recipe app called Pestle aims to do more than provide a place to save and organize your favorite recipes. The app, from indie developer Will Bishop, also helps you plan meals, create shopping lists, keep up with new recipes from creators and even cook hands-free or with friends and family remotely over Apple's SharePlay feature for FaceTime. The result is a well-built recipe app that provides a better experience for the end user, and one which tries to respect the creator content it organizes by offering source links, tools to discover more recipes from the same creator as they're published and a feature that encourages repeat visits to recipe sites. However, there are issues with the food publishers’ links not being quite as visible as they should be, which may cause concerns. But from the end user’s perspective, the app is handy, with features like automatically organized folders, a guided cooking experience where you can move through recipes step-by-step, hands-free voice controls, built-in shopping lists with Reminders integration and more. (Read more here on TechCrunch.) Podcastle Image Credits: Podcastle Podcastle’s audio creation app has grown to 200,000 users in less than a year, backed by now $9 million in funding. The app allows users to schedule podcast interviews, invite guests, record podcasts in HD sound and access the final master files from the guest’s phone. Files are offered in locally uncompressed lossless WAV format. In addition to the support for a remote multitrack interview, the app also supports background noise removal, a text-to-speech converter, transcription features and A.I. technology to improve the sound of your voice, among other features. Projects can also be edited on the company’s web platform. The result is a podcast studio and rival to Spotify’s Anchor. The iOS app is a free download. |

| Frozen giants, and why everyone is competing with everyone regardless of what they say Posted: 29 Jan 2022 10:01 AM PST Welcome to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It's inspired by the daily TechCrunch+ column where it gets its name. Want it in your inbox every Saturday? Sign up here. Hello my dear friends, here's hoping that you are warm, safe, and happy today. Welcome to the weekend. Today's Exchange note is somewhat brief, and, I hope, good fun. We're talking gaming and competition, two of my very favorite things. Notes on the gaming worldWhile the venture capital world loses its mind over crypto-based video games bringing fiscally focused activity to the "gaming" space, some builders are sticking to more traditional models. One such company is Frost Giant, which announced a Series A this week worth $25 million, and is building a de novo RTS game. As a longtime fan of the genre, I am incredibly excited about this. As a business and technology journalist, I am curious as well. I got on the phone the other day with its founders – the Two Tims – to chat through what they are building. Details are somewhat sparse at the moment because the company is still a ways from releasing its title. But! It will be a real-time strategy (RTS) game, a genre made famous by beloved entries like Age of Empires and Starcraft. It should feature, we learned, a campaign and multiplayer capabilities. And the group is talking to esports players as well so that it works out of the box for more competitive battles. Per the company, it's being built to be a game as a service of sorts, with a long shelf life. That's a big goal. And to do so with new IP as the core is a big gamble. In a good way, I think; this is what venture capital is for – venturing into the unknown. Not just building more B2B SaaS. For now, Frost Giant is staying mum on setting and anything more substantial about the game's core elements, so we'll be keeping an eye on what it's building. In a more nuts/bolts sense, Frost Giant raised a $4.7 million seed round after being founded in 2020, later adding another $5 million to that round. Kakao Games, a South Korean game developer, led the company's Series A, which should provide its team of 25 full-timers and 12 contractors plenty of breathing room to get the game right. And speaking of taking time to get the game right, let's talk about Paradox. Paradox is a gaming studio based in Sweden, is the maker of so-called grand strategy games. They are real-time in a sense, but different from the traditional RTS genre in their complexity and length of play. You can K.O. someone in Starcraft 2 in 15 minutes if you know what you are doing. A play-through of Paradox title Crusader Kings 3 (CK3) could take you days and days of plugging away. Not that I am intimately aware of that fact or anything. Anyhoo, Paradox is executing a natural experiment before our eyes with its first major expansion to CK3, called Royal Court. The company announced it ages ago, only telling fans last October that it would come out this February. The news was a bit of a surprise, but after some hiccups in expansions for some of its other titles, the CK3 player base appeared mostly cool with the later-than-anticipated launch, provided that the new code came out the gate solid as a rock. February 8, the launch date for Royal Court, is just around the corner, and as Paradox is a public company, we'll be able to see if its wager that making gamers wait – and perhaps lose interest? – for a big update pays out. I, for one, am buying the expansion, but don't want to over-index on my own experiences. In related CK3 news, Paradox just announced that it is bringing the title to consoles this week. I actually got invited to a press event with the company, and the studio it hired to help bring the game to a handset-powered environment. Why folks don't just buy a damn gaming PC is beyond me, but I will say that I learned quite a lot about how games get ported to other platforms. It's a lot of work to make a PC game work in a non keyboard/mouse environment, it turns out. Everyone is fighting everyoneWrapping on a tiny note, did you catch this story in The Information? At one point, Databricks (soon to be public, worth a bajillion dollars) and Snowflake (public, worth a bajillion dollars) were kinda friends. And if you asked, say, Databricks, about the other company, it might tell you that they were operating in different areas. And maybe that was true for a while, but as The Information notes, it's no longer the case. Why do I bring this up? Simply to make another public request for the Databricks S-1 document? Well, yes, but more to note that startups of all sizes love to talk about how they aren't really competing with one company or another. But as they grow, they tend to overlap more and more with a greater swath of the market. So the next time a startup says that they aren't competing with a similar entity or a major firm in their space, just set a timer. And wait. |

| Posted: 29 Jan 2022 08:02 AM PST Today’s cars are dumb where they should be smart, and smart where they should be dumb. Enough already. Make a car that’s pretty much all dumb and watch it sell — because what automakers are giving people is so bad, they’ll pay more to have less of it. Cars now are like budget smartphones with wheels: loaded with bloatware, unintuitive and slow to operate. Carmakers have always struggled with user interfaces, but until recently the biggest problem we had was “too many knobs.” How I long for those days! The proliferation of touchscreens and LCDs has made every car feel like a karaoke booth. Animations show reclaimed energy from braking, the speedometer changes color as you approach the limit, the fan speed and direction is under three menus. And besides being non-functional, these interfaces are even ugly! The type, the layouts, and animations scream “designed by committee and approved by someone who doesn’t have to use it.” Not to mention the privacy and security concerns. I was dubious the first time I saw a GPS in a car, my mom’s old RX300, about 20 years ago. “Yeah… that’s how they get you,” I thought. And now, Teslas with missed payments drive themselves to be impounded. Welcome to the future — your car is a narc now! The final indignity is that these features are being sold as upscale, not downmarket, options. Screens are so cheap that you can buy a few million and use them everywhere, for everything, and tell buyers “enjoy the next generation of mobility!” But in reality it’s a cost-saving measure that cuts down on part numbers and lets your dashboard team kick the can down the road as often as they want. You know this for sure because high-end models are going back to knobs and dials for that “premium feel.” So here’s what I would like: a dumb car. This is what I think that looks like. Dare to be stupidFirst of all: no screens whatsoever. This is for a couple reasons, both practical and aesthetic. Practically speaking, nearly all of what these screens do is already performed by smartphones. There’s no need for a deeply outdated, laggy, manufacturer-branded Spotify or Apple Music app, your phone does it perfectly already. Navigation, similarly, is handled perfectly by the phone. Both of these, I need hardly add, already work fine with voice commands, too. Not having GPS or data (or hidden microphones or cameras) also makes your vehicle feel more private, obviously. Sure, they can still get your phone, but at least they’ll need to put a GPS package on your undercarriage like the old days if they want to track your movements beyond that. For media, an aux input does it all. Doubles as a charging cable, and you could easily swap it out for different and new devices. Include a bit of smart cable routing and your phone can conveniently be mounted in a number of places around the cockpit — not that you should be looking at it or touching it (use your words). If you want Bluetooth, I’ve got a dongle for you. The only thing the car should have is a volume dial, maybe a three-button basic playback control cluster on the wheel. As for the climate controls on those big center LCDs, a couple knobs will do it. No one really believes these “zone” things work, right? No car is big enough to have zones in it. A blue-to-red dial, blower select, and A/C and recirculate toggles get it done just fine. In the instrument cluster, we can have ordinary needle gauges. Speed, fuel, oil, temperature, and the usual idiot lights: check engine, low tire pressure, etc. Aesthetically, the digital versions of these have always bothered me. Drivers are meant to be focused on the road, but these clusters often have distracting, bright information that’s constantly changing. The difference between 69 and 70 on a gauge is an eighth of an inch, just like the difference between 67 and 68, and 68 and 69. That continuous, predictable variation is intuitive and precise enough for pretty much any driving purpose. On a digital display the numbers are blinky and big, constantly drawing your eye as they dip from 71 to 69, numbers that look completely different and you can’t really check out of the corner of your eye. Keep it simple, keep it safeLosing the media and navigation means we can do without a lot of the computation capability that goes into a modern car, but we don’t want to go without it entirely. There are safety features introduced in the last few years that ought to be included on every new car, smart or dumb. Traction control, blind spot and lane exit warnings, and even automatic emergency braking require a certain amount of CPU power and they should get it, because they save lives. Backup cameras are one thing people may not want to go without — but you’d be surprised how informative a basic proximity beeper is. The engine itself is also far more computerized than in the old days. Unlike the computerization of the cabin, however, this has many positive effects, such as improved mileage, lower emissions, better reliability, and easier diagnosis for servicing. The exact level of electronics required for safe, responsive pedals and steering are probably a matter of some debate, but we can leave that to the experts. I’m tempted to ask for manual window knobs and door locks, but that would put us over the line into affectation (if indeed we have not already left that line far behind). We’re not trying to recreate vintage cars but to make a modern one stripped of superfluous technology. Power seat adjustment, though, that’s a luxury even today. Use the lever. Note that nothing I’ve proposed is specific to gas-powered cars; electric vehicles are just as prone to these bad decisions as the rest. This isn’t about nostalgia but rather abandoning a pernicious yet universally followed design philosophy. (…Okay, it is a little about nostalgia, but only a little.) Of course what I’m describing, despite its seeming simplicity, probably amounts to something like a luxury vehicle, in that it’s not aiming at minimizing cost. Nearly every existing car line is designed with the “latest” tech in mind and to do away with that is a major departure from existing molds, assembly work, QA, and so on. Plus while I think the concept would attract many, it still wouldn’t outsell much. It’s a niche vehicle for sure, and the price would reflect that. Still, all I want is a car that isn’t as overbearing as all the rest of the devices I already own, sending me notifications, dinging, reporting errors, asking permissions, needing updates — my god! Leaving aside the whole spurious “back in my day” argument, there simply isn’t much point to these features now, certainly not enough to justify their prominence or poor quality. Let’s see what it’s like to make a car that focuses on letting the driver drive, and accommodating rather than trying to replace the supercomputers we all carry around in our pockets. |

| Lessons from a fintech founder: Solving for C by going B2B Posted: 29 Jan 2022 06:42 AM PST Fintech founders that set out to solve big problems for consumers almost always begin with the best intentions — they want to help people. But they often miss that mark by a country mile, which spurs questions about how effective other fintech founders can be at helping consumers. Trust me, when you name your for-profit, venture-backed fintech startup "Altruist," a certain amount of healthy skepticism follows you around. That skepticism is understandable because, in many ways, the world of fintech is built on a foundation of internal conflict. The vast majority of fintech founders deeply appreciate the power and value of hyper-profitable business models in accomplishing less clearly profitable goals. Many come from finance backgrounds, giving them an insider's advantage at identifying the ways financial tools and institutions do not benefit — and sometimes exploit — consumers. Founders quickly identify the problems and have the skills to fix them, so they lock in and start building a solution to help people. Their intentions are, by and large, altruistic. This is where things start to get more complicated for fintech founders. The same industry know-how and business understanding that helped them identify problems to solve will drive many down a path that abandons their initial mission. So where do altruistic fintech founders lose their way? What market forces turn their "disruption" into the same archaic business models? And, most importantly, how can they be avoided? Avoiding the exploitative pathThe first step that any fintech founder must take is to right-size their addressable market, and this doesn't just mean identifying a widespread need. "We want to help people begin saving" is a great mission statement, but any founder must be realistic about how to deliver on this need. If your business model means that you have to generate revenue equal to 200+ basis points from your addressable market, it may cost too much money for the people you set out to help. In short, you have to get the math right. The unit economics of your business are such that it costs too much money to acquire customers based on the assets of that customer. To make the math work, you have to generate an enormous amount of LTV, and because the customers you want to help don't have enough money, you have to charge massive fees. If you really look at the business models of many consumer fintechs, particularly savings products, their fees are often effectively 5% a year. That's not far removed from predatory lending. In effect, they're saying, "We're going to get you to use our product and charge you on such small transactions that you don't notice that you're never really getting ahead." Worse, a lot of founders travel down this exploitative path without ever realizing it. Getting the math right should be your first step, but there's no wrong time to sit down and give it another hard look to see if there's another path. Venture pressure and shiny objectsIf you find yourself on the wrong side of the addressable market "math," you leave yourself open to the next, dangerous, fintech founder trap: the "get big quick" scheme. The venture markets have made it so frothy to be in fintech, and there are huge pressures to use the same playbook to scale up an organization to raise a lot of money. Unfortunately, this approach often leaves the customer hanging out to dry. For example, one major fintech company that automates investing, buying and spending has a noble mission and has also publicly said that it expects to earn 1% across all assets. That's a high fee and almost twice as much as many non-digital platforms. But if you really do the math and charge a truly "disruptive" quarter of a percent, $5 billion in assets is only a $12 million business. Investors don't want to create small companies, and $12 million is a small company. At 1%, suddenly, you're a unicorn with the ability to change the world. Getting big quickly like that can lead to overpriced products that hold consumers back and "mission creep." The founder that sets out to help people save money may turn into the founder who tacks a high-fee crypto investment service onto their product. Why? Because crypto offered a faster path to growth and funding at that time. That eagerness to raise funding is another quick path to losing your way. When founders do a bunch of rapid funding rounds (safe notes or traditional preferred equity raises), they often find themselves owning a de minimis percentage of their own company. At that point, you're locked into "growth at all costs" and have to build a monster to see any benefit. Solving for C by going B2BOf course, some of the founders reading this column are likely already mid-flight. You sized-up your addressable market as best you could, you took the funding you needed and chose your investors. There may be very little you can do to manage the risks already laid out above. That said, there's still one too-often-ignored path for an altruistic founder to help consumers — addressing the root cause rather than the end result. There are few more complex and personal problems than a consumer’s relationship with their money. Too many companies think they can carve out one consumer pain point to somehow create systemic change, and a better financial life for someone — they identify a consumer problem and think that the solution must be a direct-to-consumer play. Whether it’s solving saving, budgeting or investing, all of these solutions are well-meaning and well-executed, but are the finance equivalent of “solving” insomnia with bedding. I don’t mean you need to ignore consumers’ problems, but you might help them most by focusing your vision beyond what the average person deals with in their day-to-day lives. The difficulties people face in saving money can be solved by developing new banking systems. The challenges people have in making it to payday can be solved by working with employers and improving their payroll solutions. The struggles of wealth management can be eased by giving advisers better technology to help their clients. Best of all — solving business problems means you can better avoid the other fintech founder traps. Right-sizing the addressable market of a B2B solution is far less prone to delusions of grandeur. There are far fewer distracting shiny objects and "fast growth" tricks in the B2B world. The investors backing B2B fintechs tend to be more patient and reasonable in their expectations for runway and ARR. You may still find yourself releasing a consumer product eventually, but you’ll have achieved the proper stability and scale to serve consumers effectively by that time. In many ways, the best path to help consumers is looking beyond them. |

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Weather forecast company and popular app maker AccuWeather

Weather forecast company and popular app maker AccuWeather  Singapore-based mental health startup Intellect

Singapore-based mental health startup Intellect

No comments:

Post a Comment