TechCrunch |

- Walmart expands its home services offerings via new partnership with Angi

- Citrix to be acquired by Vista and Evergreen/Elliott in a $16.5B all-cash deal, will be merged with Tibco to create SaaS powerhouse

- Gandeeva Therapeutics raises $40m zoom in on biomolecules – and create new drugs in the process

- AllSpice thinks hardware developers lack their own ‘GitHub,’ so it is building one

- Sunday competitor Qlub emerges with $17M Seed round from Cherry and Point Nine

- TCV, looking to bond with younger startups, has raised a new $460 million fund to back them

- The Station: Waymo sues to protect trade secrets, Wisk lands more Boeing capital and a chat with Toyota’s chief scientist

- Berlin’s Tilo raises seed round to tackle unstructured data sets with a serverless platform

- Tiger Global and Greycroft back Nigerian investment app Bamboo in $15M round

- Egyptian social commerce startup Brimore raises $25M led by IFC and Endure Capital

- Pennylane wants to overhaul the accounting tech stack in France

- Norrsken, VCs and 30 unicorn founders set up $200M fund to back growth-stage startups in Africa

- Fintech Roundup: Better.com workers leaving in ‘droves’ in wake of CEO Vishal Garg’s return

| Walmart expands its home services offerings via new partnership with Angi Posted: 31 Jan 2022 06:34 AM PST Walmart is expanding into home services. The retailer today announced a new partnership with Angi (previously Angie’s List), which will make service professionals available to Walmart customers in nearly 4,000 stores across all 50 states. When Walmart customers shop in-store or online, they’ll be able to also book an Angi professional for any of 150 common home projects, including flooring, painting, fence installation as well as smaller jobs like furniture assembly or mounting a big-screen TV. In 2018, Walmart had taken its initial further steps into the home services market when it teamed up with Handy to sell in-home installation and assembly services in over 2,000 stores, and then later online. The idea was that when customers were purchasing items, like furniture, they could also immediately purchase an installation appointment to help them get the new item set up in their home. The move had followed rival Amazon’s own entry into home services, which had included the launch of a dedicated Home Services hub on its retail website in 2015. Shortly after Walmart announced its partnership with Handy, the company was acquired by Angi Homeservices. And last year, Handy co-founder Oisin Hanrahan became the CEO of the combined organization. It was expected that Walmart could also capitalize on this arrangement by later expanding its own deal to include Handy’s full range of home services at some point, given the potential market. Walmart today explains that now Angi, not Handy, will become its home services partner. This will allow the retailer to link its customers to Angi’s network of over 250,000 professionals. Handy will no longer have its brand showcased on Walmart’s website as a result, Walmart told TechCrunch. Instead, only Angi’s branding will be found both in-store and online. This also builds on Angi’s rebrand and launch in 2021, when the company decided that “Angie’s List” no longer accurately described its offerings as it was no longer just “a list” but rather a site where customers could research, book, schedule and pay service pros and other home contractors.  Image Credits: Walmart In comparison with the Handy partnership, Walmart’s new deal with Angi will see a much broader number of SKUs than the previous integration, correlating to the larger number of services offered. Handy’s partnership had primarily focused on in-home installation and assembly services on smaller-scale projects, like TV or furniture installation, which start at $45 and $79, respectively. But the Angi partnership goes further to include new and more complex services like painting, flooring and fencing. And it’s working to expand into additional, complex services as well, Walmart says. Walmart declined to share the details about the financial nature of the partnership nor its impact on revenues, when asked. It wouldn’t disclose, for example, what sort of commission it may take on the Angi services booked through its site. However, Walmart will be Angi’s first, limited-time exclusive retailer to offer its services.  Image Credits: Walmart Customers will be able to book Angi’s services both online and in-store alongside any eligible item or from Angi’s dedicated landing page at Walmart.com, which goes live in mid-February. (The URL itself has yet to be finalized, we’re told). After purchase, Angi will reach out to coordinate the booking. For larger services, a dedicated project advisor provides the customer with a custom quote, finds a pro, and handles the work to make sure the project is successful. “We could not be more excited to launch Angi with Walmart, a leading global retailer, as our first retail integration,” Angi CEO Oisin Hanrahan, in a statement about the launch. "Since the start of the pandemic, the home is in focus and people across the U.S. are doing more home improvement, maintenance and repair work and they are often turning to Walmart to find the tools and materials needed to start those projects. Things like sprucing up an entertaining space by installing a new smart TV, painting a nursery for a family addition, and transforming an outdoor space and adding a patio are now projects that Walmart customers can get done seamlessly with the help of an Angi pro as part of the Walmart shopping experience,” he said. “Angi brings experience and highly-rated pros to our customers to help them get jobs done around the home,” added Darryl Spinks, Senior Director of Retail Services at Walmart. “We're thrilled to bring the convenience and ease of Angi's services to our customers.” |

| Posted: 31 Jan 2022 05:49 AM PST More consolidation is afoot in the world of IT to meet a new demand from enterprises for “one-stop shops” covering a wide range of needs in our hybrid world of work. Citrix, the long-in-the-tooth virtualization giant that had been making a slow transition into cloud computing, is being acquired by PE firms Vista Equity Partners and Evergreen Coast Capital (an affiliate of Elliott Investment Management) for $16.5 billion. Vista plans to combine Citrix with Tibco, which it acquired in 2014 for $4.3 billion. The all-cash deal will include the assumption of Citrix’s debt, the companies say. The deal comes after a long period of speculation over the company — Citrix has been looking at strategic options for at least the last five months — which culminated in the last month with reports that Vista and Elliott, with the most recent speculation being that they would acquire the company for $13 billion. Citrix is currently traded on Nasdaq and the deal will see the company go private. Citrix shareholders, the companyt said, will receive $104.00 in cash per share, a premium of 24% over the closing price on December 20, 2021, “the last trading day prior to media reports regarding a potential bid from Vista and Evergreen.” Evergreen, it should be noted, was already an investor in Citrix prior to this deal. PE firms, similar to VCs, are sitting on massive funds at the moment that they need to invest. One obvious move to address that is to scoop up large technology businesses that are in need of restructuring and consolidating. Bringing Citrix together with Tibco could see analytics from the latter cross-sold with virtualization and cloud computing services from the former, at a time when many buyers — that is, enterprises — are looking for more simplified supplier partnerships and better financial around IT services for increasingly-remote workforces in the wake of the Covid-19 pandemic. It also gives the combined company a hefty business from day one: it will have 400,000 customers, including 98% of the Fortune 500, Citrix said, in total with 100 million users in 100 countries. "Over the past three decades, Citrix has established itself as the clear leader in secure hybrid work. Our market-leading platform provides secure and reliable access to all of the applications and information employees need to get work done, wherever it needs to get done. By combining with TIBCO, we will expand this platform and the outcomes our customers achieve," said Bob Calderoni, Chair of the Citrix Board of Directors and Interim Chief Executive Officer and President, in a statement. "Together with TIBCO, we will be able to operate with greater scale and provide a larger customer base with a broader range of solutions to accelerate their digital transformations and enable them to deliver the future of hybrid work. As a private company, we will have increased financial and strategic flexibility to invest in high-growth opportunities, such as DaaS, and accelerate its ongoing cloud transition." Vista and Citrix have had something of a revolving door prior to this deal: the company paid $2.25 billion to acquire project management platform Wrike from the PE firm a year ago. Tibco had also been the subject of sell-off speculation itself, although it seems that Vista decided to take another route: combining it with Citrix could be a more interesting use of the asset that speaks to how enterprises are evaluating and buying IT today. "There has never been a better time to be in the business of connected intelligent analytics, and we're thrilled to bring our industry-leading solutions to Citrix's global customers,” said Dan Streetman, CEO of TIBCO, in a statement. “The workplace has changed forever, and companies everywhere will require real-time access to faster, smarter insights from the increasingly large volumes of data available to them, their employees, and their ecosystems. I couldn't be more excited about our combined vision and look forward to a strong partnership." "We have always viewed Citrix as a true technology pioneer, building and defining so many categories that have changed the landscape of the industry," said Monti Saroya, Co-Head of Vista's Flagship Fund and Senior Managing Director, in a statement. "As a private company, Citrix will have access to additional resources and support, as well as more flexibility to take advantage of strong secular tailwinds with trends supporting modern and secure remote hybrid work to serve the combined customer base and invest in high growth markets." More to come. |

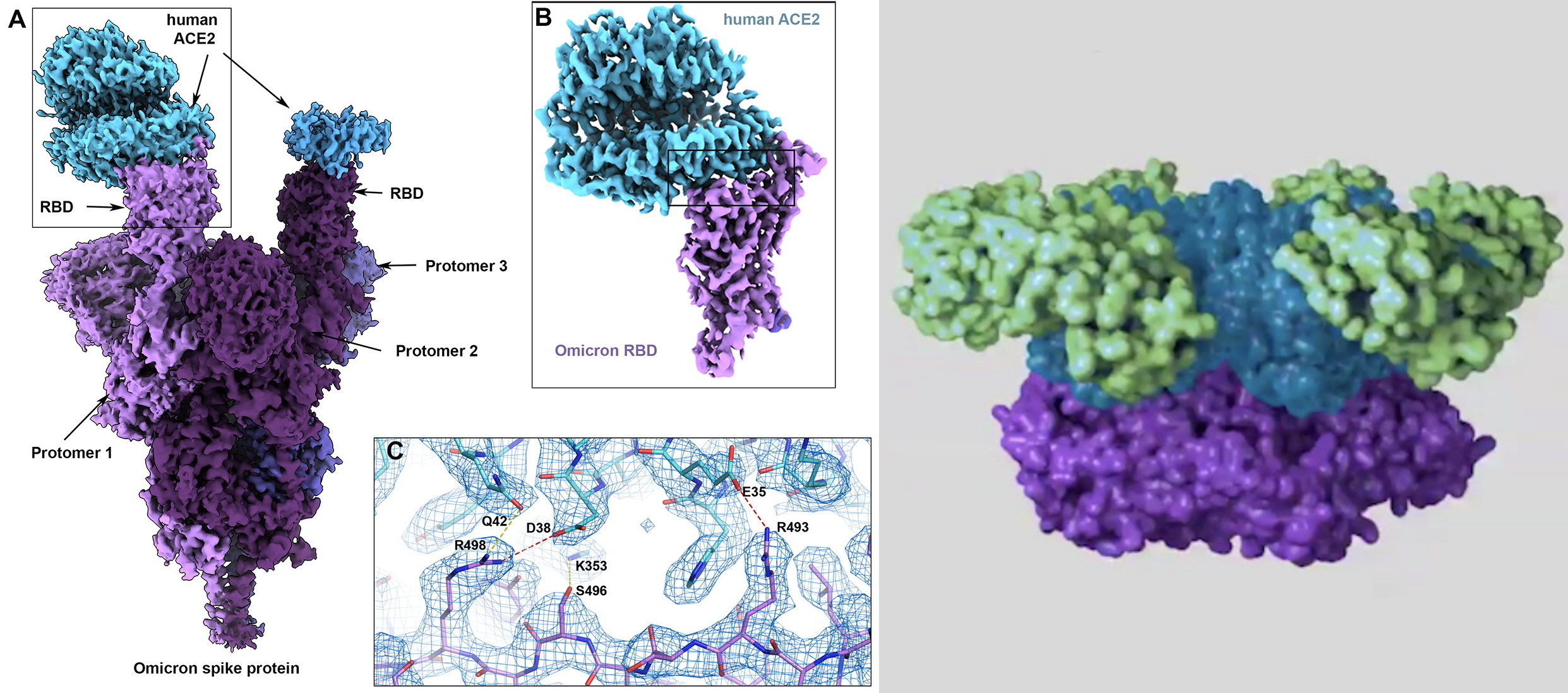

| Gandeeva Therapeutics raises $40m zoom in on biomolecules – and create new drugs in the process Posted: 31 Jan 2022 05:02 AM PST The field scientists once jokingly called "blobography" has come a long way. Cryogenic electron microscopy was formerly known for delivering amorphous images of biomolecules. Now it has become one of the highest fidelity methods available for viewing the body's smallest building blocks. It's also a key pillar of Gandeeva, a new biotech company that emerged from stealth on Monday with a $40 million Series A round. The company plans to combine this high resolution imagery with a suite of machine learning tools to speed up the process of drug discovery. "It took about 15 years of dedicated effort to achieve this dream we had when we started: to literally visualize proteins in an electron microscope at atomic resolution. Once we and others showed this could be done, it was clear to me that this was the critical tool needed to transform and revolutionize drug discovery," co-founder and CEO Sriram Subramaniam told TechCrunch. Gandeeva's thesis, he continues, is about creating a platform that can actually learn from the current advances in cryo-Em. The idea is that these high resolution images can help reveal previously unseen pockets for drugs to bind to, if, we can find drugs that fit the bill "Having the tool to dig for gold is one thing, but you need to know what to do with that – what product to convert it into. And in our case that's medicines for patients," he said. There are lots of companies tackling the mammoth problem of drug discovery at the moment. Gandeeva's approach, put extremely bluntly, is that seeing is believing when it comes to finding druggable targets in the body. Countless scientific breakthroughs have been achieved by simply observing the world around us. But when it comes to the body's building blocks, this is impossible without specific microscope techniques. The leading technique in this field for decades has been X-ray crystallography, in which a scientist literally packs proteins or molecules together into a crystal and shoots X-rays at it, approximating its shape, size and orientation. The issue with X-ray crystallography was the crystallization bit – this process is arduous and time consuming. The upside of cryo-Em is that it doesn’t require crystallization. Instead, the molecules are flash frozen, creating a 2D sheet, that’s then shot with an electron gun. This sheet protects the biomolecule from the electrons and allows for the capture of detailed images. That sheet also allows for scientists to capture the motion of biomolecules, a process that’s not possible with a crystal-encased structure. For example, it's possible to obtain images of structures as small as two ångströms across – that's one tenth of a nanometer. (For reference, the width of one human hair is about 1 million ångströms). There's some evidence that cryo-EM is in the midst of a boom. As Nature reported in February 2020, some scientists have predicted that more protein structures will be determined by cryo-EM than X-ray crystallography by 2024. It's becoming a bigger part of the scientific toolkit – despite the sometimes prohibitively expensive costs of microscopes and equipment needed to perform the technique – because resolution has vastly improved.  Left: A Cryo-EM-based map of Omicron’s spike protein (originally published in Science). Meanwhile, there are other developments in structural biology working in Gandeeva’s favor. For one, advances in machine learning have made it possible to predict exactly how proteins fold. Specifically, we've seen the development of two AI engines capable of predicting how proteins fold: AlphaFold, developed by Alphabet-owned AI outfit DeepMind, and RoseTTAFold, developed at the University of Washington. While it used to take hours of lab work to determine protein structures, RoseTTAFold claims to be able to predict that structure in ten minutes, on a regular gaming computer. Subramaniam has argued that these tools provide an unprecedented level of insight into protein structure and function, but that there will still be gaps to fill (for instance, there are some elements of the AI predictions that are lower confidence than others). Cryo-EM, he notes, allows scientists to zoom in on specific areas of a protein, or capture images of proteins in many different conformational states (think wiggles), perhaps filling those gaps. "We have this whole new revolution happening in AI, and I think everyone is wondering: what does this all mean? This combination of AI and cryo-EM, which was always Gandeeva's thesis, is really the ticket because it's not just experimental alone or prediction alone," he said. "You can [use] these AI-based understandings of structural biology and interactions and combine that with precision imaging at the highest speed at the right throughput." So far, Gandeeva is aiming to prove that cryo-EM can actually be done quickly and easily outside of a government or university sponsored context. That’s important, because much of Subramaniam’s work in this field has come in those environments. Subramaniam spent the bulk of his career at the NIH, where he was chief of the biophysics section at the National Cancer Institute. From there he went on to found the the National Cryo-EM facility, a government-run lab. At the NIH, he hoped to get moving on Gandeeva's cryo-EM based drug discovery platform, and realized that developing the lab alone would cost billions. At that time, "VCs had no interest in that kind of approach," he said. But the University of British Columbia did. He left the NIH to become Chair of Cancer Drug Design at the University. "In the last few years that I’ve been here, I set up this essentially to show that I could repeat what we did at the NIH. So at UBC, I was able to create a prototype and that’s really what persuaded investors this could be done at speed," he said. His proof-of-concept came in the form of a rapidly-produced cryo-EM image of the Omicron variant’s spike protein, published in Science. Ultimately, though, Gandeeva isn't just packaging cryo-EM in hopes of taking pretty biological pictures – it's a research platform aimed to cut down the time it takes to create new drugs. "We do think that we can shave a lot of time off simply because of the power of looking at exactly where the drug binds, and what protein surfaces it targets. That kind of information is extremely powerful because it prevents you from following dead end pathways," Subramaniam said. The company will have to prove that it can perform this techniques at industrial speed and scale, and glean information that can’t be found elsewhere. Gandeeva has a six-year lease on a facility outside of Vancouver, where Subramaniam plans to build out the functionality of his platform. Internally, the goal is to advance a few programs to prove that they can identify potential drug targets. Subramaniam said that if he had to guess, he's likely start applying Gandeeva's platform to oncology – but that's not set in stone. This round was led by Lux Capital and LEAPS by Bayer. The round includes participation from Obvious Ventures, Amgen Ventures, Amplitude Ventures and Air Street Capital. The company has raised $40 million to date. |

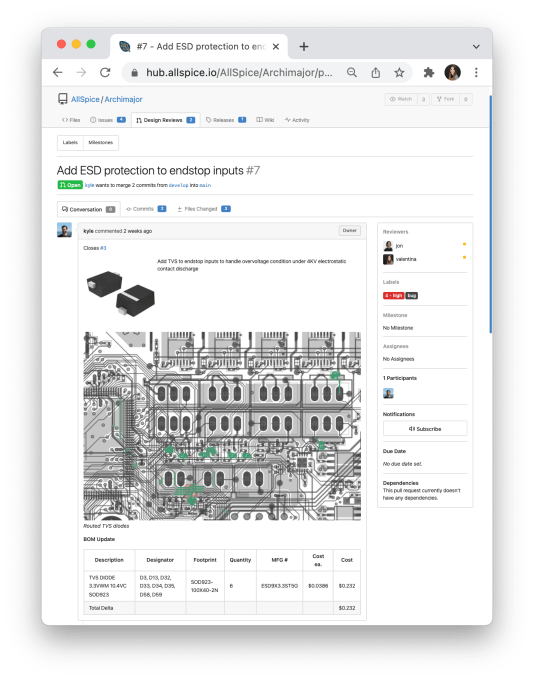

| AllSpice thinks hardware developers lack their own ‘GitHub,’ so it is building one Posted: 31 Jan 2022 05:00 AM PST AllSpice, a collaborative hub designed for hardware development, came out of private beta on a mission to build a DevOps ecosystem inspired by GitHub. Founders Valentina Ratner (formerly Toll Villagra) and Kyle Dumont met at Harvard while both were getting a joint engineering master's and MBA in 2019. They bonded over frustrations at their respective jobs in what seemed like a hardware industry left behind to rely on PDFs and email to get things done versus software development. "It felt like the software industry was off and running with good developer tools with strong collaboration and strong automation," Dumont told TechCrunch. "When I met Valentina, we started brainstorming how we could fix the space and what kind of impact we could have on the size of the market." There are many tasks still being performed manually, with engineers spending a good chunk of time on paperwork and spreadsheets, so the idea behind the company was to get engineers back to spending the majority of their time designing and building hardware products, Ratner said.  AllSpice’s design review function. Image Credits: AllSpice Remote work and the recent chip shortage are driving AllSpice and other companies to think a "GitHub for hardware" is in order. Wikifactory, which is building a collaboration tool enabling someone to build almost anything remotely, announced $3 million in funding at the end of 2020. Flux, which raised $12 million last October, is developing a browser-based hardware design tool. AllSpice's tool allows engineering-driven people to manage their projects and collaborate with stakeholders within their teams, Dumont said. AllSpice is compatible with tools like GitHub, GitLab and Bitbucket and serves as a home base of sorts for hardware teams to control revisions, reviews and releases from one place. The company raised a pre-seed round in 2020 and recently closed on a $3.2 million seed round co-led by Bowery Capital and Root Ventures, with participation from Flybridge and angel investors. In total, the company has brought in $3.8 million. Last year, the company saw "incredible adoption" from people: hundreds of user comments for companies, over 30 projects and hundreds of project repositories made, Ratner said. To keep that momentum going, the new capital will be deployed into new engineering and marketing hires for continuous integration and continuous delivery. "We take a very developer-driven approach which is something that's been very established in the software industry for a while, but in hardware, it’s still pretty sales heavy," Ratner said. "Some of the sales practices haven’t caught up in the industry yet so we make sure that our product is helpful for the engineer first." Ratner and Dumont say AllSpice is tool agnostic and so their plan is to bring on additional CAD tools for integrations so it can appeal to a wide range of companies and help hardware teams react quickly to changes in the environment as more things are digital and asynchronous. Meanwhile, Loren Straub, general partner at Bowery Capital, said the firm was looking at product-lead growth approaches when she was introduced to AllSpice. What she saw most often had to do with supply chain, manufacturing and automation, which also included hardware. What attracted Straub to the company was the founders' combined software and hardware engineering experience and how they had both seen and experienced how challenging and antiquated hardware development was. "When we went through our diligence process, the frustration levels were like nothing I’ve ever seen. People even said they tried to force their workflows into some of the software tools because they heard about how creative the experience was, but it didn't work," she added. "Valentina and Kyle had a deep understanding of how much better it could be if the right tools were built for hardware," “Before becoming a VC, I spent over a decade in hardware engineering," added Chrissy Meyer, partner at Root Ventures, via email. "The thing that big companies like Apple had in common with startups was that we still did design reviews using screenshots. I've seen hardware engineers cobble together software tools like GitHub and JIRA, but those tools are made for code, not CAD. When I first met Valentina and Kyle, I immediately got excited because they were describing the tool I always wish I had.” |

| Sunday competitor Qlub emerges with $17M Seed round from Cherry and Point Nine Posted: 31 Jan 2022 04:48 AM PST Our behavior at restaurants and venues has changed massively in the last two years because of the pandemic, but many of us have realized the huge advantages of being able to order via phones from the table, or even pay, instead of the usual ‘credit card dance’. French startup Sunday, which didn't even exist in 2020, has raised large sums to allow people to easily pay and share the bill, freeing up wiring staff and increasing turnover in restaurants. Other startups have jumped on these kinds of trends, among them Toast and GoodEats. Now Qlub is emerging from a period of stealth to tackle a similar area, but aiming at markets outside the USA. The payment solution for consumers in restaurants has now raised $17 million in seed financing in a round co-led by Berlin’s Cherry Ventures and Point Nine Capital of Germany. Also participating were other VCs including STV, Raed Ventures, Heartcore, Shorooq Partners, and FinTech Collective as well as numerous entrepreneurs-turned-angels. Similar to the Sunday startup, Qlub enables customers to pay their bills in restaurants quickly by scanning a QR code with their phone. No app or registration is required. Customers can split the bill with their friends and pay the bill with Apple Pay, Credit Card or in instalments in a similar manner to BNPL. The benefit for restaurants includes a higher potential turnover of tables, more possibility of tips for wait staff, and returning customers who enjoy the simple experience. Qlub also says that the ease of use tends to lead to restaurants getting higher ratings on review sites. Obviously, there is also less contact with wait staff, which is useful in the pandemic, and for general public health. Co-founder Eyad Alkassar, a former Co-Founder and Managing Director for Rocket Internet Middle East, said: "Having built multiple food delivery startups, I was baffled by how little the dine-in experience has improved by technology within the last two decades. Since the advent of credit cards, little to nothing has changed. By combining two mega-trends driven by the pandemic — QRs in restaurants and cashless payments — we are creating the payment function of the future." The founding team of Qlub consists of Arun Sharma, Eyad Alkassar, Filiberto Pavan, Gizem Bodur, Jeff Matsuda, Jianggan Li, John Mady, Mahmoud Fouz, Oscar Bedoya and Ramy Omar. The team variously founded and scaled companies like Lazada, Namshi and Snapp. Filip Dames, founding partner at Cherry Ventures, Said: "Adapting to a self-checkout solution is a no-brainer for restaurants as offline payments remain a barrier to turnover." Ricardo Sequerra Amram, partner at Point Nine, said: "Qlub is building a win-win offering for consumers who want the freedom of cashless payments and the convenience of self-checkout as well as restaurant owners who, in a post-pandemic world, are even more mindful of compressing their fixed costs and allocating staff to revenue-generating activities." Qlub has so far launched in UAE, KSA and India with additional international markets, set to follow in the weeks and months ahead. |

| TCV, looking to bond with younger startups, has raised a new $460 million fund to back them Posted: 31 Jan 2022 04:30 AM PST Over the last decade, late-stage and crossover funds have faced sharper elbows from a wider number of non-traditional market participants that write checks to maturing but still-private companies. A lot of these firms have done well as their portfolio companies begin to to trade publicly or get acquired. Still, it’s harder every year to stand out from the pack. That kind of heated competition may explain in part why Technology Crossover Ventures, which closed on a $4 billion fund in January of last year, just raised a separate, $460 million fund that will focus exclusively on Series A, B, and C-stage companies. Called its Velocity fund, the idea is to “help founders of innovative companies as they shift from product-market fit to scaling up,” says the now 27-year-old firm. The apparent thinking: maybe it improves the firm’s odds of backing the best later-stage companies if it can start working with them a little earlier. “We wanted to make sure companies have a full-stack approach,” as General Partner Matt Brennan, who co-leads the fund with another general partner, Gautam Gupta, explains it. “Now they can get early capital through a dedicated team effort fund and LP base, but at the same time, as they grow, they have a product that grows with them.” Already, the Velocity fund — which aims to invest checks of between $10 million and $30 million into rounds that are between $15 million and $50 million in size — has invested in two companies: BenchSci, a company that’s using artificial intelligence in an effort to increase the speed and quality of biomedical research, and Passport, an international shipping carrier built for e-commerce brands and marketplaces. BenchSci recently raised $63 million in Series C funding co-led by TCV and Inovia Capital; meanwhile, TCV led Passport’s $39 million Series B round just last week. The investing team, which also includes three other investors who have joined TCV in the past year from venture growth firms, intends to invest the fund in both consumer and enterprise startups and maybe even lead TCV into its first crypto deal. Says Gupta — who joined TCV last year and who long led his own startup, the subscription snack company NatureBox — “We’re earlier in the learning curve on crypto than crypto native funds certainly, but we’re absolutely spending a lot of time looking at opportunities across both consumer and B2B.” TCV has “backed a lot of the great web 2.0 companies,” he adds, “so I think the approach we’re taking is [asking], ‘Where are the amazing value propositions being built in a web3 world, and how can we leverage our resources and what we’ve learned in web 2.0 to help those companies accelerate?'” TCV has been on a roll. In 2021, 14 of its portfolio companies became publicly traded, including through IPOs, direct listings, and mergers with blank-check companies. Among the best known of TCV’s deals over the years — and it has now invested in roughly 350 companies altogether — are Airbnb, EA, Peloton, Netflix, Spotify, Facebook, and Zillow. According to a recent report in the WSJ, in addition to this new fund, TCV is already already out raising another flagship fund as as follow-up to the $4 billion vehicle it raised last year, which was its biggest ever. This time, according to the report, TCV is looking to raise up to $5.5 billion in capital commitments. |

| Posted: 31 Jan 2022 04:00 AM PST The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox. Hello readers: Welcome to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B. As always, you can email me at kirsten.korosec@techcrunch.com to share thoughts, criticisms, opinions or tips. You also can send a direct message to me at Twitter — @kirstenkorosec Before we jump in, I wanted to bring your attention to a plea by TechCrunch editor Devin Coldewey to “Please make a dumb car.” That might sound silly coming from a media outlet focused on technology — and the people investing and building it. But technology for technology’s sake can lead us down some tricky paths. Just look at some of tech-laden vehicles on roads today. This doesn’t just lead to a poor user experience, a point that Coldewey makes. This feature bloat has also helped fuel the chip shortage, as Jim Motavalli wrote a few weeks ago. One final note to all those builders out there. The fourth round of the Transit Tech Lab has launched and is looking for technologists to submit ideas on ways to restore customer confidence in public transportation, improve resilience to weather extremes, and further reduce the region’s carbon footprint. (That’s one big task.) The Metropolitan Transportation Authority, Port Authority of New York and New Jersey, NJ TRANSIT, NYC Department of Transportation and the Partnership for New York City are behind the Transit Tech Lab. Applications for the Recovery Challenge and Sustainability Challenge are due March 25 and are accessible here. Is driverless vehicle data a trade secret?In case you missed it, Waymo filed a lawsuit against the California Department of Motor Vehicles in an effort to protect certain data from its driverless vehicle operations from being shared with the public. (The Los Angeles Times was the first to report on the lawsuit) The end result of this lawsuit, which was filed in the Superior Court of California, Sacramento, could end up having broad implications for the rest of the industry — at least in that state. Here’s the gist of the lawsuit. Waymo, along with every other autonomous vehicle developer that wants to test and deploy in California, must receive a permit from the California DMV. (There are actually multiple permits required at different stages to be able to deploy a commercial, driverless vehicle service like a robotaxi). Waymo shared information about its safety practices and technology as part of the application process. The DMV asked Waymo some specific questions, which the company answered. Problems arose after a person made public record request to the DMV to disclose the documents that the company had sent. Waymo contends that its initial application and follow-up response should be redacted if disclosed to the public because they include trade secrets. The company wants to protect details about how its AVs identify and navigate through certain conditions, its emergency backup system, internal processes for assessing and, if necessary, remediating the circumstances that were deemed to have led to certain collisions. Here is Waymo’s official response, which a spokesperson emailed to me: “Every autonomous vehicle company has an obligation to demonstrate the safety of its technology, which is why we've transparently and consistently shared data on our safety readiness with the public. We will continue to work with the DMV to determine what is appropriate for us to share publicly and hope to find a resolution soon.” I reached out to a few experts to get their take and one of the more interesting ones was from Matthew Wansley, former general counsel of nuTonomy (which Aptiv acquired) and a law professor at Yeshiva University’s Cardozo School of Law in New York. While he said it’s certainly possible that some of this information is not widely known or readily ascertainable and could be economically valuable to competitors, he doubts that all of that information would qualify as a trade secret. (It is of course hard to know if these sections that Waymo has redacted are actually trade secrets without seeing behind the redactions, he noted) He did propose a solution that I will post below.

Deal of the weekInvestment activity in aviation — specifically air taxis — continues to ramp up as illustrated by Boeing. The company announced it invested $450 million into Wisk, a startup trying to develop and commercialize electric, self-flying air taxis. Wisk has been pursuing its eVTOL game plan for nearly 12 years now. The company launched in 2010 as Zee Aero and then merged with Kitty Hawk Corporation. The fifth-generation aircraft — and the team working on it — were spun out of Kitty Hawk under the name Wisk. Boeing helped fund Wisk’s initial launch as a separate company. Not all eVTOL companies are aiming for autonomous flight. Wisk’s focus on autonomous flight is one of the factors that attracted Boeing. This new capital will be used to fund the development of the company’s sixth-generation electric vertical takeoff and landing (eVTOL) aircraft. Wisk is aiming to bring this sixth-gen aircraft through the lengthy U.S. certification process. Wisk said the funds are also going to be used for what it describes as an “intensive growth phase” over the next year. For the company, that means preparing to ramp up manufacturing operations and its go-to-market efforts. That doesn’t mean Wisk will be headed to market or producing its eVTOL aircraft in large volumes this year. However, the company is bullish on its trajectory, going so far as to make a bold forecast that it will achieve 14 million annual flights within five years of its certification. Other deals that got my attention … ABB acquired a controlling stake in electric vehicle commercial charging infrastructure company InCharge Energy. ABB initially acquired a 10% stake through its investment in the Series A venture capital funding round in 2020 and has now increased its interest to approximately 60% of InCharge Energy’s issued share capital. Accell Group, the maker of bicycle brands Batavus, Raleigh and Sparta, was acquired by a consortium led by KKR, Reuters reported. The deal values the bike manufacturer at 1.56 billion euros ($1.77 billion). BasicBlock Inc., a financial technology company focused on the trucking industry, raised $78 million in debt and equity raise. Autotech Ventures, Clear Haven Capital Management, Emergent Ventures, and Nelnet invested in the company. Existing investors Revolution’s Rise of the Rest Seed Fund, SaaS Ventures and TNT Ventures also joined. Cowboy, the Brussels-based ebike and services startup, raised $80 million in a Series C round of funding co-led by Exor, HCVC and Siam Capital. Tiger Global, Index Ventures, Eothen, Isomer Opportunities Fund, Future Positive Capital and Triple Point Capital also participated. Cowboy, which has raised $120 million to date, did not disclose its valuation or any sales numbers, but did say that it’s on track to reach 100,000 riders by 2023. Gopuff, the delivery startup, is reportedly working with banks including Goldman Sachs Group Inc. for an initial public offering in the second half of the year, Bloomberg reported. Gorillas Technologies is reportedly in talks to buy French delivery firm Frichti, Bloomberg reported. Hozon New Energy Automobile Co., the Chinese electric vehicle startup, is trying to raise about $500 million before a potential listing in Hong Kong this year, Bloomberg reported. Jidu, an electric automaker founded by Baidu and Chinese auto partner Geely in 2021, raised $400 million in a Series A round. The funding came from Baidu and Geely and will be used to speed up the automaker’s R&D and mass production process and allow it to showcase its first concept "robocar" — which it classifies as an automotive robot rather than a car — at the Beijing auto show in April. Laka, the London-based insurer for bike and e-bike owners, raised $12 million in Series A round led by Autotech Ventures with participation from Ponooc, ABN AMRO Ventures, Creandum, LocalGlobe, angel investor Eric Min, and Elkstone Partners. Mayd, a Berlin-based startup that’s building an on-demand medicine delivery platform in Europe, raised a €30 million (~$34 million) Series A funding round led by U.S. investor Lightspeed Venture Partners. Previous investors Target Global, 468 Capital and Earlybird Venture Capital also participated. May Mobility, the autonomous shuttle startup, raised $83 million in a Series C investment led by Mirai Creation Fund II, which is managed by Sparx Group Co. New investors Tokio Marine and Toyota Tsusho also participated along with returning backers Toyota Ventures, Millennium Technology Value Partners, Cyrus Capital Partners, 1843 Capital, BMW i Ventures and Bay Lake Ventures. May Mobility has now raised $166 million to date. The new funds will be used to work on future platforms and public deployments of the Toyota Sienna Autono-MaaS equipped with May’s autonomous driving kit by 2023. Ola Electric raised $200 million in a new financing round that included Tekne Private Ventures, Alpine Opportunity Fund and Edelweiss. The company, which has struggled to deliver its maiden electric scooter to customers, is now valued at $5 billion. Owl Autonomous Imaging, a company developing monocular 3D thermal imaging and ranging solutions for automotive active safety systems, raised $15 million in Series A funding round led by State Farm Ventures. Excell Partners, Luminate NY Accelerator, Empire State Development, MHNW Consortium, Dr. Sanjay Jha, (the former CEO of both GlobalFoundries and Motorola Mobility), as well as other investors also participated. Paack, an e-commerce delivery platform that integrates with robotics used in logistics, raised €200 million ($225 million) in a Series D funding round led by SoftBank Vision Fund 2. New investors Infravia Capital Partners, First Bridge Ventures and Endeavor Catalyst and returning backers Unbound, Kibo Ventures, Big Sur Ventures, RPS Ventures, Fuse Partners, Rider Global, Castel Capital and Iñaki Berenguer also participated. Starship Technologies, the autonomous sidewalk delivery bot startup, raised €50 million (just under $57 million based on exchange rates on January 25) from the European Investment Bank, the funding arm of the European Union. Starship Technologies is describing this as a “quasi-equity facility”, meaning there is a venture loan involved in the mix. Sibros, a connected vehicle platform company, raised $70 million in a Series B funding round led by Energy Impact Partners with participation from Fontinalis Partners, Google, Iron Pillar, Qualcomm Ventures and existing investors Nexus Venture Partners and Moneta Ventures. Swiggy, India’s top food delivery startup, raised $700 million in a new financing round, just six months after securing $1.25 billion, as it aggressively expands its offerings, including the instant-delivery service in the South Asian market. Invesco led the Series K round, which according to a source familiar with the matter values the seven-year-old startup at $10.7 billion. Vecna Robotics, Massachusetts-based startup developing autonomous forklifts, raised $65 million led by Tiger Global Management with participation from existing investors Blackhorn Ventures, Highland Capital Partners, Tectonic Ventures, Drive Capital and Fontinalis Partners. New investors Lineage Logistics, Proficio Capital Partners and Impulse also joined. Zapp, the London-based instant grocery delivery startup, raised $200 million as it tries to compete with Getir, Gopuff, Jiffy, Deliveroo and others hungry for a share of the on-demand convenience market. The Series B round was co-led by Lightspeed, 468 Capital and BroadLight Capital, with Atomico, Burda and Vorwerk Ventures — all previous backers — also participating, alongside Sir Lewis Hamilton, the Formula One champion. Checking in with Toyota’s chief scientistI recently had a chat with Dr. Gill Pratt, who is CEO of Toyota Research Institute in the United States and now the chief scientist for Toyota Motor Corporation. In his newish chief scientist role, Pratt gives advice to the company from a “scientific point of view” and tries to educate the public and policy makers about issues that are of concern to Toyota. His focus these days: the environment and climate change, and trying to come up with policies that truly drives down co2 emissions. For instance, they’re using AI to accelerate the work of material scientists and engineers to help them develop new materials and new structures for the way things are built — like batteries and fuel cells. Over at TRI, Pratt said they’re spending a lot of time on behavioral science and what he described as human centered AI. Specifically he talked about work on “machine aided cognition,” the idea being that AI is an assistant, or partner, for a person. This partnership between the person and the machine makes the pair much stronger than either one could be by themselves, he noted. He stressed that the aim is to use robots to amplify people, not replace them. Cool stuff. Ok, one more tidbit. I asked Pratt: what do you wish people talked about more in terms of climate change and how it relates to transportation and what what is ignored? Pratt: I think what’s ignored is that there’s not a silver bullet, and one size doesn’t fit all. You know, there was fantastic phrase when I was younger in the environmental movement: think globally, act locally. And people fail to do that now. The reality is it’s going to take some time for the infrastructure for EVs to be rolled out. And it’s not only the chargers in the grid, but it’s the conversion of power stations as well to put out low co2 power. You have to think about it from a complete system point of view from the the amount of co2 that’s put out into the air during the manufacturing of all the components that go into the car and look at the total lifetime co2 that’s going to come out. That’s part of what our tool tries to do (reference to the AI tools they’re developing). And so what I would want people to do is to kind of open the aperture and think more globally and before they decide what local thing they want to push for to realize that the world is a very diverse place. In different parts of the world, the way the power is made is quite varied and even within a particular part of the world like in the United States different people have different needs and different constraints. Notable reads and other tidbitsThis newsletter is already looonnnnngggg, so here are just a few more items worth noting this week. Bentley Motors announced it will spend 2.5 billion pounds ($3.4 billion) over the next decade to become a fully electric luxury brand by 2030, CNBC reported. Bloomberg CityLab looks at five cities where bike commuting is booming. Ford has started production of its electric E-Transit cargo vans at its factory in Kansas City, Missouri with the first deliveries expected in the next several weeks, Ford Pro North America general manager Tim Baughman told TechCrunch. (I was out in California for a Ford Pro event when I learned of this milestone along with a few other insights that I’ll share this coming week.) General Motors said it will invest more than $7 billion in four Michigan factories focused on battery cell and electric truck manufacturing, including a third plant with partner LG Energy Solutions. The funding plans, which GM says will create 4,000 new jobs and the retention of 1,000 others, includes investment into two previously announced sites: the Ultium Cells battery cell plant in Lansing, Michigan and the conversion of GM’s assembly plant in Orion Township, Michigan. Joby Aviation is seeking permission for a series of high-profile air taxi flights over San Francisco Bay, according to documents filed with the FCC and obtained by TechCrunch. The tests of the startup’s second-generation pre-production prototype, called the S4, would be the first in full view of the public and among the first in an urban environment. Mercedes-Benz reached an agreement with solid-state battery company ProLogium to develop next-generation battery cells. The first Mercedes-Benz test vehicles equipped with solid-state batteries co-developed with ProLogium are expected to be introduced in the coming years, according to the automaker. |

| Berlin’s Tilo raises seed round to tackle unstructured data sets with a serverless platform Posted: 31 Jan 2022 03:54 AM PST As is commonly the case, datasets used inside companies almost always come from diverse sources and in different, unstructured formats. Connecting them up can lead to a be a very large headache. But if it can be done, there are all sorts of benefits, especially in finance, such as fraud detection, KYC/AML checks etc. This is a problem particularly faced by financial firms, but it could also be useful in the areas of Covid contact tracing or general business intelligence. The main platforms used at this point include Neo4j, Senzing, or Neptune from AWS. Alternatively, companies try to build their own solutions using Elasticsearch. But it remains a big problem to solve. Now a new Berlin startup, which has tested its theories after being spun out from a larger corporate, is poised to tackle this thorny problem. Tilo's data infrastructure tool TiloRes says it helps companies match data points from different sources and formats, by being both serverless and doing it in near real-time and at scale, claims the company. Tilo has now raised €1,200,000 in pre-Seed funding led by European VC Peak Capital which put in €640,000). The funding round was joined by Berlin-based Tiny VC (Philipp Moehring), First Momentum Ventures, Enduring Ventures and Angel Investors including the founder of Algolia and the former CMO of Contentful to name a few. Peak's investments include global auction marketplace Catawiki, headless content management system GraphCMS, and omnichannel communications platform Trengo. As well as applications for KYC/AML, Tilo plans to offer its solution for free to anybody working in Covid contact tracing. Founded in November 2021, Tilo has started pilot projects together corporates and startups. As its business model, Tilo charges a license fee based on the volume of data companies are processing through TiloRes. Because its serverless, the costs scale with the usage, making it cheaper than server-based solutions. The market Tilo is taking on is large, and worth approximately $65 Billion according to Gartner. Tilo's founding team, Renwick (CEO), Hendrik Nehnes (CTO), and Stefan Berkner (Chief Development Officer), were formerly the technology team at Regis24, a German consumer credit bureau. However, Regis24 agreed to spin out their solution and take a strategic stake in the startup. Madeline Lawrence, Head of DACH Peak commented: "To be really honest, I didn't grasp what Tilo was solving at first. Then I realized: we struggle with data matching ourselves. If CRM duplicates and spelling differences cause us such a headache, imagine the pain when the stakes are higher, the need is real-time, and the data in question is an order of magnitude larger." |

| Tiger Global and Greycroft back Nigerian investment app Bamboo in $15M round Posted: 31 Jan 2022 01:03 AM PST To buy a share in Amazon, you'd have to fork out almost $3,000. It's a luxury very few can afford and despite the prospects of the trillion-dollar company or returns from its share price, it'll take some contemplating to pay that full price for those who can afford to. But with fractional investing, pioneered by Robinhood, access to these securities are democratized and people can own smaller shares in big companies. There are many Robinhood-esque platforms globally because of a growing need to invest in U.S. stocks in different parts of the world. Bamboo, launched in January 2020, is one of such in Nigeria. Following two years of significant growth and raising $2.4 million to facilitate it, the investment firm is announcing that it has raised $15 million in a new financing round. U.S.-based Greycroft and Tiger Global co-led the Series A round (it's the second Tiger Global-led investment announced this month after Ghanaian fintech Float). Motley Fool Ventures, Saison Capital, Chrysalis Capital and Y-Combinator CEO Michael Seibel are some of the other investors in Bamboo's round, per a statement seen by TechCrunch. The average Nigerian only has a handful of ways to save and invest. The nation's currency, the naira, experiences devaluation every other year against the dollar and currently runs on an almost 16% inflation rate. Building a portfolio of stocks, particularly U.S. stocks, is one way they can hedge against inflation and currency devaluation. The S&P 500, for instance, has an average annualized return of 10.5% from 1957 through 2021. But Nigerians that could access such services, up until a few years ago, were HNIs with resources to open brokerage accounts and consult asset managers. For the average Nigerian, it's an expensive and tedious process that takes weeks. But Bamboo simplifies all that. As a brokerage and retail investment app via its partnership with DriveWealth LLC, it lets Nigerians set up an account in minutes and buy and trade U.S. stocks in real-time. "What we essentially want to do is to make investing in the global stock market easy for Africans," said Richmond Bassey, who founded the company with COO Yanmo Omorogbe. "In accessing investment options, especially in capital markets, both locally and globally, we want to make that easy for Africans because we're driven to help Africans create and preserve wealth by owning shares in the world's most successful companies." Stock investing is relatively nascent in Nigeria, but Bamboo has managed to rack up impressive numbers quickly, showing expertise in user acquisition and retention. The company said it has more than 300,000 users; of that number, about 20% are active daily traders, while 75% never traded stocks before using the platform. In 2021, repeat depositors made up 85% of deposits on the Bamboo platform. These users are charged a commission of 1.5% per transaction and about ₦45 (~$0.1) to $45 withdrawals for users with naira or dollar bank accounts, respectively. Bamboo has competitors in the Nigerian retail investment space such as Chaka, Rise and Trove. They differ in the type and class of securities they offer; for instance, Bamboo gives access to U.S. stocks, ETFs and ADRs, while Chaka deals with stocks and ETFs trading on local and foreign capital markets, but all have collectively been subjected to regulatory issues at home. Last April, Nigeria's capital market regulator SEC declared the activities of these investment firms as illegal and warned capital market operators to stop working with them. Then in August, the Central Bank of Nigeria (CBN) accused them of operating without licenses as asset management companies and "utilizing F.X. sourced from the Nigerian F.X. market for purchasing foreign bonds/shares." A court order to freeze their accounts for six months pending CBN's investigation followed. According to findings released by the CBN, the four fintechs had a total of ₦15 billion (~$30 million) turnover from January 2019 to April 2021. It's unclear where Bamboo stands with the first directive, but Bassey confirmed to TechCrunch that the company received a court order to unfreeze its accounts. Operating in a tight regulatory space has somewhat stood in the way of other features Robinhood and other investment platforms offer freely, yet Bamboo cannot, for now, such as crypto. "Stocks and selling stocks is a regulated business and currently, we are only live in Nigeria. Working very closely with regulators in Nigeria, we have to work within the ambit of what they are comfortable with and what they allow. "That's the extent to which we are offering our services. Perhaps if we launched in other markets and regulators there have a different relationship with a certain asset class, we would also work within the ambit of what they are comfortable with," said the CEO. He also stated that Bamboo is waiting for approvals from regulators to start offering Nigerian stocks before Q2 this year so Africans and those in the diaspora can tap into investment opportunities on the continent. The next market for Bamboo is Ghana. Over 50,000 users have joined its waitlist since it announced intentions to launch in the neighbouring West African country, the company said. Similarly, there has been some demand from Kenya and South Africa, so Bamboo will look to move into those countries soon with this new funding. Part of the funding will be used to scale the company's tech infrastructure for smoother processes and faster withdrawals. The company also intends to introduce new offerings to add to its B2B product, allowing asset managers and fintech companies to integrate Bamboo into their offerings for their customers and trademark stock-trading product. Bamboo's round at this stage is akin to Robinhood's Series A eight years ago, in terms of size. It'll be unfair to assume that Bamboo can replicate the U.S. fintech giant's growth trajectory over the years. Still, there's no denying that with the backing of Tiger Global and Greycroft, who have backed successful retail platforms over the years (Robinhood and Public, respectively), the two-year-old Nigerian company is poised to reach mass scale across Africa in the following couple of years. "These are very early days. If you think about it with the kind of technology that we've put together, the kind of brand that we've created, the access that we do both locally and globally, then we've come far, we are a unique team that incept a vision to say we want to get 1 million or 2 million Africans to invest in over the next 18 months and have a great shot at making it happen. We're one of the few teams that can do that on the continent today, so the future is bright for us," the chief executive remarked. |

| Egyptian social commerce startup Brimore raises $25M led by IFC and Endure Capital Posted: 30 Jan 2022 10:03 PM PST The Egyptian social e-commerce market will be worth over $14.8 billion by 2024. The opportunity in the market can be attributed to the growth in online social sellers in the country, over 1.25 million them, helping little-known brands sell and distribute their goods via different networks. Brimore–a market leader in the country and, to an extent, Africa–off the back of witnessing impressive growth in the last three years, has raised $25 million in a Series A round. The company was founded by Mohamed Abdulaziz and Ahmed Sheikha in 2017. While working in the FMCG business, both founders witnessed how difficult it was for emerging brands to get their products to the mass market due to the dominance of established brands, who, for the most part, had built distribution infrastructure for themselves over the years. On the other end, thousands of individuals, particularly women and stay-at-home moms, wanted to start their e-commerce shops but had no clue how to go about it, nor did they have products to sell. "We started working on Brimore with the mindset of actually manufacturing products ourselves. However, producing our products wasn't the wisest decision at that time as it was a very asset-heavy model," said CEO Abdulaziz to TechCrunch in an interview. "So we started scaling with listing different products. And at the same time, it was very insightful to see how the network formed on the other side. From a seller perspective, we started onboarding more and more sellers. Most of them happen to be women." Brimore connects both worlds via an app as an omnichannel social commerce platform. So, small and medium-sized suppliers could give these individuals–who double as sellers and word-of-mouth marketers–access to these emerging products. This way, these manufacturers have advertising and marketing on lock while these sellers start their e-commerce businesses and earn extra cash.  Image Credits: Brimore Over the past three years, Brimore claims to have grown around 400x in revenue. More than 300 suppliers with approximately 8,000 different SKUs from packaged foods, personal care, and household goods are on the platform. The social commerce platform has also built a network of 75,000 sellers (74% of them are women) covering 27 cities, primarily rural and remote areas, in Egypt. Brimore, in a statement, said it uses "its unique infrastructure–which is an ecosystem of supply, demand, logistics and finance– and proprietary technology to avail market penetration opportunities to emerging brands owners." "We are building a smart and reliable infrastructure and a full ecosystem that enable masses to do commerce. So anyone– with a shop or a stay at home mom–can do commerce business with Brimore either online or offline," said Ahmed Sheikha, the company's chief business and investment officer. When sellers register on the platform, they see various product images from different manufacturers. They share these pictures on their socials: Facebook, Instagram, WhatsApp, Telegram, generate orders and place them on the app. Once Brimore confirms, its delivery process depends on where the sellers want their products delivered: to them or their end consumers. The founders say that while sellers often want the products at their doorsteps, the availability and flexibility of both options differentiate Brimore from similar social commerce platforms such as Taager. Brimore gets a margin from the difference between the suppliers and sellers' prices. The company runs its warehousing and last-mile and fulfilment infrastructure through a spin-off called Milezmore; before last year, third-party logistics handled those operations. Abdulaziz, highlighting how beneficial Brimore has been to its sellers, said that 24% of them report signal 'significant improvement' in their lifestyle and 88% report an increase in income since they began using the platform. The next phase for Brimore would be to "grow in Egypt by 50x within the next couple of years," the chief executive said in a statement. Other use of funds entails expanding its logistics and operational infrastructure, doubling its staff size, triple product catalogues and quadrupling its sellers and suppliers network. Abdulaziz, on the call, also mentioned Brimore's plans to introduce financial products, particularly credit and replicate its Egyptian efforts across other African markets. "We want to crack the concept of go to market in Africa. We know that Africa is like 54 different markets with distinct dynamics of every market," he said. "Our vision is if we crack the concept of go-to-market through people and reaching the online and offline and the component of trust all together, towards the new age of commerce, the cross border trade will be our next thing. Anyone can produce anything can sell anywhere because we enable the hard part about market access." The International Finance Corporation (IFC) and Endure Capital led the new financing round. Walid Labadi, IFC's country manager for Egypt, said this is the corporation's largest direct investment in the social commerce space globally. Other investors include fintech giant Fawry, Flourish, Endeavor Catalyst Fund. Existing investors who participated in its $800,000 seed round and $3.5 million Series A, such as Algebra Ventures (led both rounds), Disruptech and Vision Ventures, participated. |

| Pennylane wants to overhaul the accounting tech stack in France Posted: 30 Jan 2022 09:45 PM PST French startup Pennylane has raised a $57 million Series B round (€50 million) from existing investors, such as Sequoia Capital (leading the round), Global Founders Capital and Partech. The startup wants to replace legacy accounting solutions in France — and in Europe. If you're an accountant, you might be familiar with tools like Cegid and Sage. Essentially, Pennylane wants to overhaul these tools and modernize the tech stack of accounting firms. Pennylane connects directly with third-party services that hold valuable information. For instance, you can get banking statements in the Pennylane interface, import receipts from Dropbox and get billing information from Stripe. And because it's an online platform, accounting firms can use Pennylane collaboratively. Clients can also access the platform to centralize receipts, create invoices and automate some tasks. Instead of sending information back and forth with spreadsheets and photo attachments, both clients and accounting firms can interact directly on the platform. Right now, there are 300 accounting firms that are using Pennylane. Some of them have started using the product with a few clients, others have completely switched to the new tool. Interestingly, Pennylane clients want to use the platform more and more, which means that they bring new clients to the platform. "Nine months ago, 90% of our clients reached out to us directly and 10% of them became clients through accounting firms. Nine months later, that trend has changed. 81% of our clients come from accounting firms," co-founder and CEO Arthur Waller told me. While the startup didn't want to share revenue numbers, Waller told me that the startup has been growing by 20% month over month since this summer. Since 2020, Pennylane has raised $96 million. If you take a step back, Pennylane has a significant market opportunity ahead. In the U.K., the U.S. and other more mature markets, companies have been using QuickBooks, Xero and other software-as-a-service solutions. But accounting is a fragmented industry with each country using their own software solution. In some countries, such as France, there’s no definitive SaaS solution for accounting. "In France, there are roughly 12,000 accounting firms. Today we work with 300," Waller said. "Our goal is that in 4 or 5 years we work with 1.5 million small and medium companies," he added. There are some geographic expansion opportunities ahead, but also some product opportunities. Pennylane could become the central hub for everything related to financial management. For instance, the company has started beta-testing corporate cards with Swan to facilitate payments. You could imagine a sort of revenue-sharing deal with accounting firms for the interchange fees generated by those corporate cards. With today’s fundraising, the company thinks it can iterate on its product as there are still a lot of things to do just for the French market. The company plans to reach 500 employees by the end of the year. As Pennylane thinks tech and product remain the most important areas for the startup, most hires will be in these categories. Essentially, Pennylanes wants to create a product that is a no-brainer for new accountants getting started. |

| Norrsken, VCs and 30 unicorn founders set up $200M fund to back growth-stage startups in Africa Posted: 30 Jan 2022 03:01 PM PST Niklas Adalberth's Norrsken Foundation is in the news again barely two months after opening its Norrsken House in Kigali, Rwanda, which plans to accommodate thousands of entrepreneurs by next year. This time, the foundation has teamed up with thirty unicorn founders and a couple of seasoned venture capital and private equity investors to launch a $200 million fund targeted at African startups. The fund, dubbed the Norrsken22 African Tech Growth Fund, has reached its first close of $110 million, per a statement seen by TechCrunch. It's the latest fund launched by Norrsken after closing €125 million impact fund for European startups last March. Hans Otterling, a partner at Northzone, a U.K.-based early VC firm that led the investment in Adalberth's previous company Klarna, is Norrsken's founding partner alongside the Klarna co-founder. Making up the firm's investment are the general partners Natalie Kolbe, the ex-global head of private equity at Actis, a private equity fund investing in emerging markets; her colleague, Ngetha Waithaka; and Lexi Novitske, the ex-managing partner at Acuity Ventures Platform. Novitske told TechCrunch on a call that the firm is speaking to a few DFIs to reach a final close later this year. Before Acuity, Novitske was principal at Singularity Investments. Portfolio companies across both firms include API fintechs such as Mono and OnePipe; and exited companies like Flutterwave, Paystack and mPharma. Africa VC funding reached an all-time high in 2021 at over $4 billion, more than what startups in the continent raised in the two previous years combined. Growth and late-stage deals such as $100 million-plus rounds from unicorns Andela, Flutterwave, Chipper Cash, OPay and Wave and other companies largely propelled this growth. Nevertheless, they were relatively fewer than early-stage deals, per insights from Briter Bridges and The Big Deal. There's another issue besides the shortage of growth and late-stage checks. Most of these large deals are often financed by international VCs as local investors tend to focus on pre-seed to Series A rounds with micro to medium-sized funds. "What's happening is, and we've seen this in our Acuity portfolio, is that our founders, as they grow and want to scale, have to take time away from their business and spend it with Silicon Valley-based investors who they have to educate on the Africa growth story," said Novitske on a call with TechCrunch. "These investors are coming with their capital, which is valuable, of course, but they're not coming with the local knowledge to help those companies scale across the continent. And that's the missing middle that we're looking to unlock with this fund." According to her, Norrsken22 intends to be that growth-stage local-based firm that will enable startups to unlock significant partnerships to grow revenue, find the best talent and facilitate expansion plans across Nigeria, Kenya and South Africa. The firm, with offices in the countries above, is the latest big-sized Africa-focused VC fund that includes the likes of TLcom Capital which recently closed nearly half of its new $150 million fund; Novastar Ventures, a $200 million fund; and Partech Ventures, a $143 million fund. While the others seldomly invest above Series B rounds, Norrsken22 is willing to go beyond that stage. Waithaka, speaking on the fund's strategy, said Norrsken22 plans to invest 40% of its capital, about $80 million in Series A and B companies and the rest in follow-on rounds from Series C up until exit. The firm will make 20 investments at an average ticket size of $10 million and may go as high as $16 million, including follow-on rounds in some portfolio companies, he continued. "I think that reserve capital pool is really important because we do want to have the ability to support companies through their entire lifecycle," said Kolbe picking up from where Waithaka left off in the conversation. "Innovation is uncertain, and it doesn't happen overnight, so we want to be sure to be able to support the top winners in the company so they can be the champions in the tech ecosystem." Per sectors, Norrsken22 will rely on its general partners' years of experience and investment philosophies to back startups in fintech, medtech, edtech and market-enabling solutions such as B2B marketplaces and inventory management businesses. Kolbe, whose previous firm Actis backed Egyptian fintech giant Fawry in 2019 as it prepared to go public, said Norrsken would look at Egypt' opportunistically.' Deals from the country that may be of interest to the firm will be those planning an expansion into the four markets Norrsken22 is keen on right now: Nigeria, Ghana, Kenya and South Africa. Of the $110 million first close reached by Norrsken22, $65 million comes from a group of unicorn founders globally. Some of them include Flutterwave co-founder Olugbenga ‘GB’ Agboola; Skype co-founder Niklas Zennström; iZettle co-founder, Jacob de Geer; Delivery Hero co-founder Niklas Östberg. Others include Carl Manneh, co-founder Mojang; Sebastian Knutsson, co-founder King; and Willard Ahdritz, founder of Kobalt Music. Asides from the capital, the unicorn founders will help founders understand what it takes to bring their companies from series A to billion-dollar companies, said the founding partners. The Norrsken22 African Tech Growth Fund is also supported by a local advisory council board, which according to the partners, will help portfolio startups navigate business challenges across the continent. Nonkululeko Nyembezi, the chairman of the Johannesburg Stock Exchange (JSE), is a member of this board. Arnold Ekpe, the ex-group chief executive at pan-African bank Ecobank; Phuthuma Nhleko, an ex-chief executive at telecoms giant MTN; and Shingai Mutasa, founder and chief executive at Harare-based investment firm Masawara are the others. As an anchor shareholder, the Norrsken Foundation intends to re-invest all of its carry into projects across the continent, including the Kigali House. |

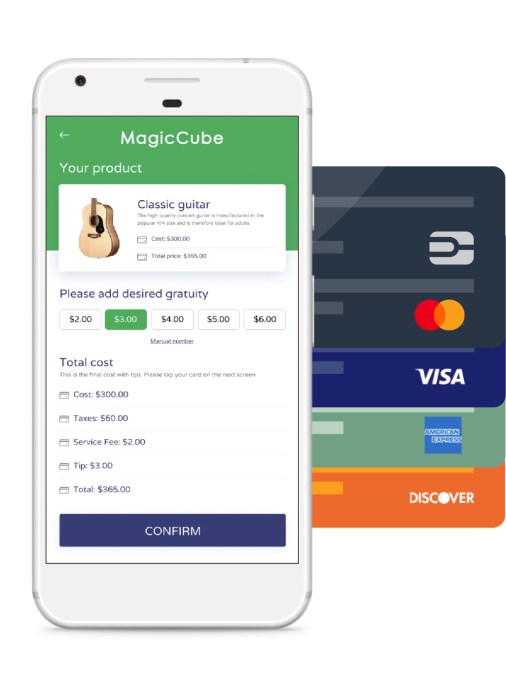

| Fintech Roundup: Better.com workers leaving in ‘droves’ in wake of CEO Vishal Garg’s return Posted: 30 Jan 2022 07:03 AM PST Welcome to my new weekly fintech-focused column. It's an incredible time to be a financial technology journalist. Besides the fact that over 20% of all venture dollars last year went into fintech startups, I am particularly excited about the many ways that this technology is helping boost inclusion all over the world. While this pandemic has sucked on 100 different levels, one good thing to have come out of it is that consumers and businesses have forced more fintech to exist, and that's a good thing. I'll be publishing this every Sunday, so in between posts, be sure to listen to the Equity podcast and hear Alex Wilhelm, Natasha Mascarenhas and I riff on all things startups! There has been plenty of drama at online mortgage lender Better.com over the last couple of months and it appears that just because its infamous CEO Vishal Garg is back at the helm, there is still no shortage of controversy surrounding the company. Earlier this week, Axios' Dan Primack revealed that investor SoftBank, "in its apparent zeal to back the company," promised to give Garg the 1.9% voting rights tied to its original investment, “contingent on the final settlement of certain legal proceedings (which has not yet occurred).” For those who haven't been following this saga, Garg has received a ton of negative press for his unfeeling way of laying off 900 people over Zoom, berating his own investors over email and accusing employees of being "lazy" and "dumb dolphins." We've all been wondering how this man can still be running the show and perhaps SoftBank's conditions help explain it. Meanwhile, one former staffer tells me that Better employees are so upset that Garg is back, that they are leaving the company in droves. Reportedly, employees at every level – from loan officers to senior executives (some of whom are believed to be leaving potentially millions of dollars in equity on the table). As the employee told me, "It's an astonishing fall from grace. It would not be a stretch to say that the top talent and hundreds from every department have fled in the wake of Zoomgate."  Image Credits: Better.com CEO Vishal Garg / LinkedIn But that's not all. Now that Garg is back, he is apparently paranoid about things being leaked to the media and according to one employee, he and the rest of the execs still there "have put everything on lockdown." For example, engineering managers were said to have had an AMA (Ask Me Anything) with Garg and only in-person workers were allowed to attend. Those employees had to sign NDAs and place phones in paper bags, and there were even metal detectors to make sure no one had recording devices. Also, the company has reportedly disabled sharing of Google documents internally and they've blocked access to all companywide dashboards – likely because business has probably suffered dramatically. As the employee put it: "There's no transparency into anything. Vishal doesn't trust anyone." Now let’s talk about paymentsSmall businesses might soon be able to accept payments using their iPhones without the need for extra hardware, according to this piece, which cites Bloomberg. This is interesting because if true, Apple could be viewed as taking on Square in the contactless payments space. I found all this particularly intriguing because in October, I wrote about a startup named MagicCube – which is backed by the likes of Visa – that is building technology that will impact Android users.  Image Credits: MagicCube That company's software-based tech gives merchants a way to accept card payments on any consumer device with no reader or extra hardware required. CEO and co-founder Sam Shawki told me in October that he believed his startup "will be the dominant party on the Android side, which is 85% of the universe." Last week, Shawki told me he has an even greater vision when it comes to contactless payments:

The fact that more companies are making it easier to pay without contact is not surprising and welcome as that spells security and convenience for users. It will be exciting to watch how this all plays out. Notable rounds and a new fundOur Nigeria-based startups reporter, Tage Kene-Okafore last week wrote about Esusu, a New York-based fintech company that targets immigrant and minority groups and provides rent reporting and data solutions for credit building, that raised $130 million in a Series B round led by SoftBank Vision Fund 2. The investment gave four-year-old Esusu a valuation of $1 billion, making it one of the very few black-owned unicorns in the U.S. and globally (love to see this list growing!). Esusu co-founders and co-CEOs Nigerian-born American Abbey Wemimo and Indian American Samir Goel come from immigrant homes and say they experienced firsthand financial exclusion. That led them to start Esusu in 2018 in an effort to build the credit scores of immigrants and African-Americans and "leverage data to bridge the racial wealth gap" via rental payments.  Esusu Tage also covered NALA, a Tanzanian cross-border payments company that recently pivoted from local to international money transfers, and its recent $10 million seed raise. The startup's mission is to build the "Revolut for Africa." You can read all about it here. Besides Esusu, last week saw yet another fintech unicorn being born. CaptivateIQ, which claims to automate commission workflows using AI, raised its third round in 20 months. Less than 10 months after raising its $46 million Series B, CaptivateIQ raised $100 million in a Series C round at a $1.25 billion valuation. The San Francisco-based startup, which has developed a no-code SaaS platform to help companies design customized sales commission plans, says it "more than tripled" its revenue compared to the year prior, although it declined to provide hard revenue figures. A trio of firms co-led CaptivateIQ's latest investment, including ICONIQ Growth and existing backers Sequoia and Accel. In M&A activity, investment banking firm UBS picked up financial robot-advisor Wealthfront for $1.4 billion in an all-cash deal. Alex unpacked the deal for us here. Unsurprisingly, Latin America continues to be a hotbed of fintech activity. I covered Brazilian lender Creditas's $260 million Series F funding that valued the company at $4.8 billion. That's up from the fintech's $1.75 billion valuation at the time of its $255 million raise in December 2020. Fidelity Management led the latest round. One of the most interesting things about this company, besides all the cool services it provides (including offering Latin Americans a way to borrow money at a MUCH lower interest rate than traditional banks offer) is share all its financials! Seriously, the extent at which this company shares the details of its finances is something to be admired and we wish all startups would follow suit.  Image Credits: Creditas Impressively, in the third quarter of 2021, Creditas says it notched US$46.8 million in revenue – up 233% from $14 million in the 2020 third quarter. It has been focused on growth, so it is still reporting a loss. But founder and CEO Sergio Furio told me that he projects annualized revenue of about $200 million for 2021. Not bad at all! I'm excited to watch this one keep growing. I also covered a new fintech fund started by a true fintech influencer and all-around nice person, Nik Milanović. For over two years, Nik has been putting out a newsletter called This Week In Fintech, working at Google Pay and angel investing. Most importantly, he's been building a true community of fintech enthusiasts all around the world. Now he's putting his money where his mouth is and launching his own venture fund, called simply The Fintech Fund. Nik is trying to raise $10 million for his fund, which has a bunch of cool LPs including investors who put money in fintech startups through other vehicles (such as Bain Capital, Better Tomorrow Ventures and Cowboy Ventures' Jillian Williams) and a several founders including NerdWallet co-founder Jake Gibson and The Block's Mike Dudas. Also, I love the fact that the fund has an explicit target of over 25% or more of its dollars and total number of investments going to founders from underrepresented backgrounds. I mentioned inclusion up top and it's worth noting that Nik is big on it too. GO NIK!  Image Credits: Founder Nik Milanovic / The Fintech Fund That's it for now. I hope you had as much fun reading this as I did writing it. Now, go enjoy what's left of this weekend! |

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment