TechCrunch |

- EVage raises $28M to be a driving force in India’s commercial EV revolution

- House committee investigating Jan. 6 subpoenas Meta, YouTube, Twitter and Reddit

- UK class action lodged against Meta seeks $3.1B for breach of competition law

- Vangst ropes in $19 million more to place employees with work in the growing cannabis industry

- Daily Crunch: Banking app Current amps up its savings rate to 4.00% APY

- Second Life’s creator is returning to advise the original metaverse company

- 5 essential factors for attracting angel investment

- Google’s loss to Sonos settles it: Big Tech has an IP piracy problem

- Software stocks give up even more ground

- Row, row, row your phone, gently, ’till it’s charged

- Fortnite is coming back to iOS, but not on the App Store

- Dear VCs: If you want startup prices to come down, stop paying higher prices

- GoFundMe gets Classy (literally) with acquisition of nonprofit giving platform

- Meta shuts down its experimental video speed-dating service, Sparked

- Here’s why CNET co-founder Halsey Minor is bullish on NFTs

- The year of living autonomously

- Meet the 13 startups in IndieBio’s SF cohort, and discover what about each swayed investors

- The M11 is Leica’s new flagship rangefinder

- Yahaha Studios, a platform for building no-code, immersive games, raised $50M in 3 rounds ahead of its launch this year

- Has Y Combinator’s new deal changed the early-stage investing game?

| EVage raises $28M to be a driving force in India’s commercial EV revolution Posted: 13 Jan 2022 09:27 PM PST A congruence of factors in India — notably, climate change policies, fuel costs and skyrocketing demand for e-commerce — has set up ideal conditions for startups like all-electric commercial vehicle startup EVage. The startup, which has already supplied five EV trucks to Amazon India’s Delivery Service Partner and plans to provide “in the thousands” more by the end of the year, according to one investor, has just raised a $28 million seed round, led by new U.S.-based VC RedBlue Capital. EVage will use the funds to complete its production-ready factory outside of Delhi in first quarter of 2022 and scale up production to meet growing demand. EVage’s flagship vehicle is a one-tonne (2,000 pound) truck that was designed for India’s commercial delivery market using feedback from its partnership with Amazon. The truck is developed on EVage’s industry-ready EV platform that the company says allows it to build multiple different types of high quality vehicle at a far lower cost than other OEMs. The startup plans to manufacture vehicles in “Modular Micro Manufacturing” factories, similar to Arrival’s microfactories, which should have smaller carbon footprints and require less capital to produce vehicles than traditional OEMs. The upshot: EVage aims to pass those savings onto customers. Finding a way to make production cheaper is vital for scaling, and the opportunity and demand for scaling EVs in India is massive. India’s Transport Minister Nitin Gadkari, whom Olaf Sakkers, general partner at RedBlue Capital and future EVage board member, says has had a high-level hand in the announcement of EVage’s deal with Amazon, has set a target for the country to have 30% private cars, 40% buses, 80% two and three-wheelers and 70% commercial vehicles electric by 2030. A series of incentives like the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles schemes (FAME-I and FAME-II) help by providing subsidies to electric two-wheelers and commercial or transit-related four-wheelers. FAME-II subsidies only apply if OEMs source 50% of components from local manufacturers, which helps boost the supply side, as well. Two and three-wheelers are already well on their way to that target, particularly so with companies like Ola Electric setting up a massive factory for e-scooters and Hero MotorCorp, one of the country’s largest micro-EV manufacturers, penning a deal with Taiwanese battery swapping company Gogoro to build a battery swapping network in India. Four-wheelers are a bit slower to market, in part because the average commuter isn’t buying electric cars. The path to electric four-wheeler adoption, therefore, is more likely to occur through commercial roads, Sakkers said. India’s e-commerce market is exploding, especially as global companies increase their presence in the country and the mobile-first nation full of smartphone users gets extra comfortable with easy digital transactions. Amazon has invested $6.5 billion in India since it entered the country in 2013, and Walmart entered the South Asian nation through a $16 billion acquisition of the startup Flipkart. Those companies, alongside national and local delivery companies, are looking to partner with Indian OEMs that can meet the unique demands of an Indian market. “There are some electric vehicles that work in developed markets like the U.S. and Europe, and you see companies like Rivian selling to logistics fleets for those use cases, but the needs of Indian logistics in an Indian market more broadly is very different,” Sakkers told TechCrunch. “It requires solving different problems, and so we see a pretty big opportunity to create custom-built vehicles for these kinds of use cases. Sakkers noted that from a pure engineering perspective, for example, EVage’s vehicles don’t have to meet the same standards of the west in terms of being certified to drive at highway speeds, because rarely in India do vehicles go above 40 miles per hour. That means everything from motor requirements to battery size and types of materials you need to build are different, and potentially much cheaper, added Sakkers. “The total cost of ownership savings for the customers is quite significant,” said Sakkers. “They’re not only doing this for optic reasons, they’re also doing it for pure economic reasons. In India, you can’t operate at certain times of day in cities if you produce a certain amount of emissions, so it also improves your ability to operate a logistics fleet if you’re operating electric vehicles.” “There aren’t many startups that fit into this mold so thats why we’re putting so much capital into EVage,” said Sakkers. “The demand for this segment of vehicles is half a million per year in India. Scaling production to the hundreds of thousands is going to be a challenge for the company, but also a huge opportunity.” |

| House committee investigating Jan. 6 subpoenas Meta, YouTube, Twitter and Reddit Posted: 13 Jan 2022 04:11 PM PST The House committee leading the investigation into the January 6, 2021 insurrection at the U.S. Capitol issued subpoenas to four major tech companies Thursday. January 6 select committee chairman Bennie G. Thompson (D-MS) sent letters to YouTube parent company Alphabet, Facebook and Instagram parent company Meta, Reddit and Twitter demanding for those companies to provide additional information on how those platforms were used to organize the day’s violent events. In the announcement, the committee accused each company of hosting content related to planning the attack on the U.S. Capitol. “Meta platforms were reportedly used to share messages of hatred, violence, and incitement; to spread misinformation, disinformation, and conspiracy theories around the election; and to coordinate or attempt to coordinate the Stop the Steal movement,” the committee stated, noting that it believes Facebook’s since-disbanded Civic Integrity team held information relevant to the investigation. As TechCrunch reported at the time, Facebook was a major hub of the Stop the Steal movement as the platform failed to control the spread of content denying the legitimate results of the 2020 U.S. presidential election. Facebook was also previously the organizing platform of choice for some extremist and militia-like organizations that went on to play a role in the Capitol attack, including the Proud Boys and the Three Percenters. The committee’s complaint with Reddit appears to be focused on r/The_Donald, a notorious subreddit that migrated to its own domain after being banned over hate speech in late January 2020. The committee also noted that YouTube was used to livestream the events and Twitter users “reportedly used the platform for communications regarding the planning and execution of the assault.” The committee first requested relevant records from 15 different platforms in August of last year, though that round of letter also demanded information from extremist-friendly sites including 4chan, 8kun, Gab, Parler and theDonald.win in addition to more traditional social media apps like Snapchat, Twitch and TikTok. The committee is revisiting its previous demands from the four mainstream social platforms after those companies failed to provide sufficiently detailed information “despite repeated and specific requests,” this time with a deadline set for January 27.

|

| UK class action lodged against Meta seeks $3.1B for breach of competition law Posted: 13 Jan 2022 04:01 PM PST A competition legal expert, backed by a powerful litigation fund, is set to mount a multibillion-dollar class action suit against Facebook/Meta for breach of competition law on the basis that it abused its dominance of social networking in the U.K. for several years. If successful, the action would see Facebook having to pay $3.1 billion (£2.3 billion) in damages to Facebook U.K. users. The class action lawsuit was lodged against Meta, Facebook's parent company, yesterday with the U.K.’s Competition Appeal Tribunal in London. The unusual approach claims Facebook should pay its 44 million U.K. users compensation for the exploitation of their data between 2015 and 2019. Effectively, it's saying Facebook took all the personal and private data of its users — who, due to Facebook's dominance, had no other viable social platform — and in return all its users got, in effect, was the ability to post pictures of babies and kittens to their friends and families. The action is being mounted by international competition law expert Dr Liza Lovdahl Gormsen (pictured above) who has made submissions before the U.K.'s Parliament regarding Facebook's market dominance, as well as written academic legal papers about it. Dr Lovdahl Gormsen's case rests on the idea that Facebook (recently renamed Meta) set an “unfair price” for U.K. Facebook users. The "price" set for granting access to the social network was the surrender of U.K. users' highly valuable personal data, who in return simply got "free" access to Facebook's social networking platform, no financial compensation, all while Facebook generated billions in revenues. Key to the case's argument is that Facebook “surrounded” its U.K. users not just by locking them and their data into its platform, but also by tracking them via the Facebook pixel, on other websites, thus generating deep "social graph" data about its users. Germain to Dr Lovdahl Gormsen's argument is that user profiles resurfaced time and again in controversies, such as during the Cambridge Analytica scandal, further illustrating their market exploitation. Dr Lovdahl Gormsen's lawyers, Quinn Emanuel Urquhart & Sullivan, LLP, have written to Meta to notify them of the claim. Dr Lovdahl Gormsen will represent the class of people affected — that is, all people domiciled in the U.K. who used Facebook at least once during 1 October 2015 – 31 December 2019. The “opt-out” class action is the first of its kind against Meta in England and Wales. As an opt-out case, Facebook's 4 million U.K. users will not need to actively join the case to seek damages, but will be part of the claim unless they decide to opt-out from it. Financial backing for the case is coming from Innsworth, one of the largest litigation funders in the world. Quinn Emanuel and Innsworth have previous history in bringing consumer class action claims of this kind. The wider context to this is that Meta is also facing a consumer class action in the U.S., regulatory action around the world and an antitrust suit from the FTC in the U.S. that could break it up from the Instagram and WhatsApp platforms. In a statement, Dr Lovdahl Gormsen said: "In the 17 years since it was created, Facebook became the sole social network in the UK where you could be sure to connect with friends and family in one place. Yet, there was a dark side to Facebook; it abused its market dominance to impose unfair terms and conditions on ordinary Britons giving it the power to exploit their personal data. I’m launching this case to secure billions of pounds of damages for the 44 million Britons who had their data exploited by Facebook." Speaking to me over a call, I asked Dr Lovdahl Gormsen if Facebook could argue that there were other social networks available, such as Twitter or Myspace? "I don’t think people can connect to their family and friends in the same way on Twitter, and Snapchat and all these other places. Facebook is quite unique in the way they’re doing it," she said. The action is also based on the ubiquity of the Facebook pixel on other websites. What is the significance of that to the case, I asked? "Imagine yourself as a Facebook user," said Dr Lovdahl Gormsen. "You may be aware that your data will be used by Facebook.com. But what the pixels are doing is when you use a third-party website, that of course has nothing to do with Facebook. That means Facebook has created many, many, many more data points on you that you actually knew you'd signed up to." She argues that although it's possible for a user to remove themselves from Facebook's platform, deep down in the Settings, in practice the vast majority of users have no idea how to do this or even know it's possible. Dr Lovdahl Gormsen is a Senior Research Fellow at the British Institute of International and Comparative Law (BIICL), the director of the Competition Law Forum, a Non-Governmental Advisor to the International Competition Network and sits on the advisory board of the Journal of Antitrust Enforcement (OUP). TechCrunch reached out to Facebook asking for comment but had received no reply at the time of publication. |

| Vangst ropes in $19 million more to place employees with work in the growing cannabis industry Posted: 13 Jan 2022 03:33 PM PST In a tight labor market, so-called vertical labor marketplaces that zoom in on one industry, like nursing or hospitality, are drawing funding. Trusted Health, a healthcare staffing platform, raised $149 million in funding in November, for example. Seasoned, a hiring platform for restaurant workers, closed on nearly $19 million at roughly the same time. Investors are similarly betting there is plenty of upside in a hiring platform focused entirely on the fast-growing cannabis industry, in which an estimated 320,000 people were already working as of last fall, a 32% increase from the year earlier. Indeed, an investor syndicate led by Level One Fund just plugged $19 million in Series B funding into Vangst, a six-year-old, Denver-based outfit that pairs both short-term workers and full-time employees with job openings at cannabis companies around the U.S. It’s no surprise, given the traction the outfit is seeing, along with the variety of revenue streams it has built. According to founder and CEO Karson Humiston — who launched the company while an undergraduate student at St. Lawrence University — Vangst currently features 500 “gigs” per week that the platform takes on average 48 hours to fill. (Vangst treats these individuals as W-2 employees, and pays them through its own payroll.) It also right now features nearly 2,000 full-time positions that represent $85 million in gross salaries. It can start to add up financially. Vangst charges its customers 50% more than it pays its part-time employees, so paying $15 per hour, it might charge a client $22.50 for that employee’s time. As for full-time roles, in exchange for vetting talent that it connects with companies, Vangst takes a percentage of each candidate’s first-year salary. Vangst also charges employers both monthly and yearly subscriptions for the privilege of posting as many openings as they need to fill and, more recently, it began to build out a content business that includes modules about retail roles and other positions in the cannabis industry that those new to the industry might not understand. (Not everyone knows what a trimmer does.) It hasn’t all been a bed of rosettes for Humiston and her team. Though Vangst had gained momentum following its Series A round, which closed with $10 million in 2019, like a lot of other hiring businesses, it was hard hit by the immediate ripple effects of the coronavirus. In March of 2020, Humiston says, Vangst was forced to lay off half its then 70-person team as its customers shrank their own payrolls and began operating at 50% of their previous capacity. In fact, it was because of Vangst’s dwindling revenue that it decided to jump into the business of placing full-time salaried candidates in roles. Think accounting managers, product managers and software engineers. “That was sort of our COVID strategy,” she says. Gradually, when business bounced back, Vangst had built up an entirely new book of business, says Humiston. Now the challenge is no longer demand but supply. Like nearly every other employer in the U.S., Vangst, which has 56 employees, is working hard to find people to fill the roles on its platform, including by attending trade shows and spending money on SEO services. Part of its new funding round will be used to build up its small marketing team, unsurprisingly. Vangst’s own customers are meanwhile having to sweeten their terms in many cases in order to secure help. As Humiston tells it, “We encourage them to pay above minimum wage” and to “show their mission and values and the perks that they offer.” The good news: Many more new jobs are expected to come online to fill, which should bode well for Vangst when the labor market finds its footing again. The state of New York, for example, legalized recreational cannabis use last September, and though it is still in the process of doling out retail licenses, that decision is expected to open up 60,000 new jobs, according to former New York Governor Andrew Cuomo. Last fall, New Jersey also signed into law three bills that permit and regulate the use of recreational marijuana, and businesses are already opening up there. That’s saying nothing of Michigan, which is “growing extremely quickly right now” as a market, Humiston says. (Vangst also has clients in Colorado, California, Nevada and Arizona, among other places to have already embraced recreational marijuana. There are currently 18 states altogether where it’s legal.) Eventually, says Humiston, Vangst also hopes to go international. Toward that end, it has upcoming plans to spend time in Barcelona with one of its investors, Casa Verde Capital, which is investing more money in European startups these days. The team has much to master first, she offers. “As here [in the U.S.], where we had to do a lot of learning about business needs and regulatory stuff, we’re eager to learn about international markets. We’re starting that exploration process this spring.” |

| Daily Crunch: Banking app Current amps up its savings rate to 4.00% APY Posted: 13 Jan 2022 03:17 PM PST To get a roundup of TechCrunch's biggest and most important stories delivered to your inbox every day at 3 p.m. PST, subscribe here. Hello and welcome to Daily Crunch for January 13, 2022! Somehow it is already the close of Thursday, which is odd, as it was minutes ago Monday morning. Such is the pace of 2022! There is some hope in the market that things will slow down (and get cheaper), but that doesn't seem super likely at the moment. More on that shortly, along with news that Facebook's dating app is kaput? To which we can heartily reply: Facebook is still building dating apps? – Alex The TechCrunch Top 3

Startups/VCWe have lots and lots to talk about today, so let's dive right in:

And so, so much more. This startup thinks it can offer a 4% savings rate, which is wild. This startup is building super cute sidewalk robots. Shield raised $15 million for communications compliance software, while Fintech Farm wants to build neobanks for different emerging markets. Setting up high-conversion lead magnets that deliver value Magnet drawing people It's one thing to get a prospective customer to visit your site, but convincing them to reach for their wallet or share their phone number is a stretch. As consumers gain greater control over their privacy, Aleksandra Korczynska, CMO of GetResponse, says marketers who align lead generation with the goals of prospective customers will gain a significant advantage. "The key is building a foot-in-the-door technique for continuous engagement — lead magnets," she says. (TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.) Big Tech Inc.

TechCrunch Experts Image Credits: SEAN GLADWELL / Getty Images TechCrunch wants you to recommend software consultants who have expertise in UI/UX, website development, mobile development and more! If you're a software consultant, pass this survey along to your clients; we'd like to hear about why they loved working with you. |

| Second Life’s creator is returning to advise the original metaverse company Posted: 13 Jan 2022 02:31 PM PST The creator of one of the earliest and most enduringly iconic virtual worlds is returning to his roots. Second Life’s founder Philip Rosedale will rejoin the company he founded in 1999 as a strategic advisor after High Fidelity, the spatial audio company Rosedale co-founded in 2013, invested in Second Life’s developer Linden Lab. The deal includes an unspecified cash investment, relevant patents and some members of its development team. “No one has come close to building a virtual world like Second Life,” Rosedale said in a press release. “Big Tech giving away VR headsets and building a metaverse on their ad-driven, behavior-modification platforms isn't going to create a magical, single digital utopia for everyone. Second Life has managed to create both a positive, enriching experience for its residents — with room for millions more to join — and built a thriving subscription-based business at the same time. Virtual worlds don't need to be dystopias.” As companies like Meta launch their own visions for the metaverse, Rosedale has remained a vocal critic of some of the dynamics that underpin the current era of online life, from ad-based social networks to the environmental impact of energy generated by Bitcoin mining operations. While few Roblox users are old enough to have more than a passing familiarity with Second Life, if that, Rosedale’s virtual social platform pioneered many of the concepts that have only very recently been hyped under the umbrella of the “metaverse.” Second Life explored notions of digital identity, virtual real estate, digital economies and online multiplayer ecosystems in the early 2000s, back when Facebook only existed to connect students at elite universities. Rosedale is already regularly in communication with executive chairman of Linden Lab, Brad Oberwager, according to the company, but will significantly deepen his involvement in the platform’s product plans in the new advisory role. And High Fidelity’s current work remains extremely relevant to Second Life’s second life: A number of social platforms recently added spatial audio to create more immersive experiences, and some of them, like Clubhouse, are licensing High Fidelity’s code to pull it off. “Since Philip started Second Life in 1999, its visionary approach has not only stood the test of time, but positioned it for the future,” Oberwager said. “He and the High Fidelity team have unmatched experience and I can't wait to capitalize on the vast opportunity in front of us.” With Rosedale back in the fold, it sounds like Linden Lab is interested in tapping into that early mover magic. But Second Life has a long way to go to claw its way back to relevance. Fortnite-maker Epic, Roblox, Meta and myriad other major companies are betting big on a near future (or arguably the present, depending on who you ask) of virtual worlds populated by digital identities with endless lucrative virtual goods on offer. Rosedale’s own perspective isn’t likely to imitate the glimpses into the metaverse that some platforms offer now, so it will be interesting to see how someone who has been thinking about these issues for 20 years envisions the virtual worlds that companies are suddenly so keen on all of us moving into.

|

| 5 essential factors for attracting angel investment Posted: 13 Jan 2022 02:14 PM PST In more than two decades as an angel investor and early-stage company scout, I've met with hundreds of entrepreneurs seeking funds and sat through an equal number of slide deck pitches. You could say I've seen it all. From my point of view as an angel investor and former entrepreneur, here are five essential factors I look for when considering my next investment. Offer a game-changer that stands outTo attract the right angel investor, make sure to present a compelling technology or product offering that solves a critical customer problem. Be sure to showcase your unique competitive advantage — an incremental improvement over the competition is not a winning formula for attracting investment. Include key market metrics such as TAM, SAM and SOM. TAM (total addressable market) is the total revenue possible if a product or service were to achieve 100% market share. TAM answers the question of who would theoretically buy your product or service. It describes the total revenues a company could make if it had an all-encompassing monopoly with total market share for its product or service. The TAM for the non-alcoholic beverage category, among the many categories where I invest, takes in the total worldwide non-alcoholic beverage market, looks at all revenues from beverage purchases, imagines sales in all countries in the world, and assumes no competition except tap water. SAM (service addressable market) is the TAM segment within geographical reach that you can target with your products or services. Lastly, SOM would be the share of the market that a company could capture over time. Present solid financialsWhen presenting to angels, it's critical to show proof of concept, traction with regards product/service development, and revenues. Knowing your company's financial condition and presenting your numbers to investors is paramount, as is making sure the past and current numbers you present are accurate. Investors want to see top line, gross margin and net profit margin. Don't be tempted to overstate or hide trouble spots; it's a huge red flag that investors will see through, sinking your prospects of attaining investment.

Founders have a tendency to peg a much higher valuation to their company in a good economy. Resist the temptation! Marjorie Radlo-Zandi Case in point: Two venture capital groups recently pulled out of a game-changing SaaS company investment because the founder radically inflated financials and misrepresented the product development stage. Have a realistic five-year projection that includes profit and loss – a mid-level projection that isn't too optimistic or too conservative is best. These financial projections give investors a look into the future of your business sales, cost of goods, operating expenses and bottom line income. They become a collection of estimations and forecasts that give a data-backed view of your company’s financial future. |

| Google’s loss to Sonos settles it: Big Tech has an IP piracy problem Posted: 13 Jan 2022 01:53 PM PST The U.S. International Trade Commission ruled on January 6 that Google infringed Sonos' patented innovations in wireless speaker technology. This may sound like an obscure legal ruling about a complicated fight over intellectual property. But it confirms a problem that threatens America’s innovation economy and its international economic competitiveness. The problem? Intellectual property theft. Years ago, Big Tech companies like Google decided that they profit more by stealing smaller companies' intellectual property than buying or licensing it. Google, Apple, Samsung and others — with cash reserves in the tens, even hundreds, of billions of dollars — do not sweat legal fees, court costs or even damages they might have to pay for this theft. Google has a reported $142 billion in cash in the bank. This is far beyond what most companies make in total annual profits. Big Tech thus takes what it wants. It then uses scorched-earth litigation tactics to beat up on complaining IP owners. It drags out litigation over many years and imposes massive litigation costs on IP owners seeking justice. Many IP owners don't even file a lawsuit. They know it is ruinous and self-defeating to try to protect what is rightfully theirs. Simply put, Big Tech benefits from stealing IP. The legal costs and potential damages, if ever issued after years of litigation, are paltry by comparison. A few companies have fought back, and the results confirm this predatory infringement practice. The story of Google's abuse of Sonos is one of the more telling ones. Sonos is a classic American success story, and Google's piracy of its technology is a tragedy. Sonos began as a disruptive startup in 2005 with its groundbreaking patented innovation in wireless speakers. It secured a licensing deal with Google in 2013, when Google agreed to make its music service, Google Play Music, work with Sonos speakers.

Simply put, Big Tech benefits from stealing IP. The legal costs and potential damages, if ever issued after years of litigation, are paltry by comparison. Adam Mossoff But Google merely used this deal to gain access to Sonos' technology. It soon began making its own devices with Sonos' technology, including speakers and other audio equipment that competed directly with Sonos' speakers and other products in the marketplace. Google did not have Sonos' development costs to cover, and it could subsidize its new products and services with its massive profits from its search engine business. Thus, Google undercut Sonos' prices — a common commercial practice by patent pirates. Sonos first attempted to negotiate a deal with Google, asking Google to simply pay for a license for the technologies it pirated from Sonos. Google held out for years, dragging out negotiations while its profits ballooned and Sonos lost more and more money. Seven years later, Sonos was left with no choice but to defend its rights in court. Sonos sued Google in 2020. Sonos also sued Google at the International Trade Commission. This special court can move faster than regular courts in prohibiting infringing imports. But it can't reward damages. This past August, a judge at the International Trade Commission ruled that Google had indeed infringed five of Sonos’ patents. Last week, the commission reaffirmed this decision. Google still calls Sonos' claims "frivolous" and promises to keep fighting. This is just one prominent example of Big Tech's illicit use of other people's patented technologies. It is so common it now has a name: predatory infringement. Legal scholars and policy wonks call it “efficient infringement.” In plain English, this is piracy. Unfortunately, Big Tech has been attacking America’s patent system to further support its piracy. Google and other companies have spent millions over the years lobbying Congress and regulators to weaken and eliminate patents, rigging the system against innovators. For instance, they created the “patent troll” boogeyman to smear patent owners who sue them for infringement — as if the problem was not their own theft, but their victims’ gall in fighting back. Washington must act to protect the innovators and creators who rely on patents as a key driver of the U.S. innovation economy. Congress should reintroduce and enact the bipartisan STRONGER Patents Act. This law would bring balance back to the patent system by reforming some of the legal rules and institutions that Big Tech lobbied to create and that are key to its predatory infringement tactics practices. Sonos' legal victory over Google confirms what policy wonks and lawyers have been talking about for years: Big Tech's predatory infringement is 21st-century piracy, and Sonos is just one of many victims. Washington can and should help end this piracy. |

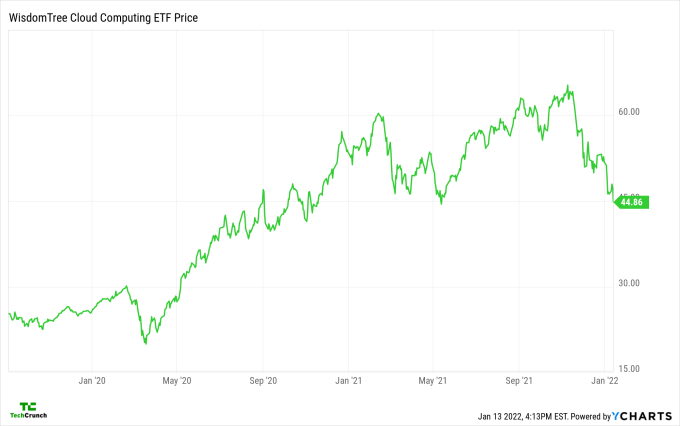

| Software stocks give up even more ground Posted: 13 Jan 2022 01:48 PM PST Quick blog here to update you on some pretty important movements in the market. Today, in a nasty day for stocks generally, shares of software and cloud companies took a pounding. In numerical terms, the Nasdaq Composite lost 2.51%, per CNBC data. That’s a very bad day for a huge, critical category of publicly traded wealth. And then the Bessemer Cloud Index, our favorite method of tracking a more targeted basket of modern software concerns, tanked 5.45% during regular trading. That’s a lot of deleted value in a single day. But because the declines come after the startup-critical index already endured sharp drops recently, it was insult to injury. Here’s the chart:  Image Credits: YCharts You need to glean two things from this collection of graphed data:

So things are not great, but also not terrible, for modren public software companies. The issue that TechCrunch continues to track is how quickly — if at all — the declines shown above begin to trickle into startup valuations. We’re seeing some chop in the private-public market divide, where IPOs and direct listings try to carry companies from one shore to the other. But in terms of sheer startup fundraising momentum, you wouldn’t know that revenue multiples are taking a huge cut on the public markets. For most startups, it’s still heady days. |

| Row, row, row your phone, gently, ’till it’s charged Posted: 13 Jan 2022 01:35 PM PST Against a backdrop of a pandemic that has shredded supply chains and gym memberships alike, it was mildly surreal to see professional-grade gym machine company SportsArt launch a rowing machine that can pump energy back into the grid. Like a wind turbine or a solar panel, except powered by pecs, deltoids and trapeziuses. The rower uses a micro-inverter that enables you to put your back into charging your phone, one stroke at a time. The company estimates that to fully charge a depleted iPhone will take about two hours of rowing. That wasn’t the example the company would have given, but for a hot minute, I was excited by using a low-battery phone as a motivator to get on an exercise machine. The handlebar grip has fingertip controls to increase the resistance on the rower and — as you might expect — the heavier the resistance, the more power you generate. The company showed off its G260 rower at CES in Las Vegas last week, claiming that the machine converts around 74% of the energy you exert into usable electricity. I had a chance to talk with the company’s COO this week, to figure out why it makes sense to use human power to power things. “In an hour of working out, you could kind of generate up to the same kind of consumption as your fridge — or about 220 watts per hour,” explains Carina Kuo, COO at SportsArt — but she admits that you’re not going to be rowing to charge your Tesla quite yet. Also, that isn’t quite the point: “A traditional treadmill consumes about one kilowatt per hour. The idea is that in addition to working out, you’re helping offset your power consumption of the workout.” As a company, SportsArt has been around for 40+ years. It’s headquartered in Taiwan, with its U.S. operations based in Seattle. In addition, the company has offices in Germany and Switzerland, with 300 employees scattered around the world, and sales operations in 80 countries. It is primarily targeted at gyms and robust rehabilitation facilities, but is also evaluating the home market at the moment. In the shorter term, Kuo suggests that perhaps shared gyms for apartment buildings etc. are a better fit for the company “Especially in the fitness industry the gyms not being able to be open [due to COVID-19] definitely caused this huge uptick in residential sales. That’s an area where it can be really difficult to compete because a lot of times people are thinking about cheaper, but not necessarily looking at the quality. That’s not the area that we’re trying to compete in. We believe in quality,” Kuo explains, and says that the company still maintains exercise equipment that was sold 10-15 years ago, and is still going strong in gyms and medical contexts. “We believe in using the best components, and we cover everything with the best warranty in the industry. I do think being able to have that kind of differentiator in that market is important.” The focus on commercial machines means it makes slightly more sense for the machines to be power-generating rather than a rower that sits in the corner of your gym, unused, 95% of the time: With more substantial use, the machines can put a dent in the power bill at the gym. “We’re not saying that we are going to go into residential — we’re trying to find where our sweet spots would be,” explains Kuo, eager to highlight the company’s green and recyclability credentials over the past 40 years. “It make a difference in gyms in particular, because they are able to have a message of sustainability.” |

| Fortnite is coming back to iOS, but not on the App Store Posted: 13 Jan 2022 12:32 PM PST Fortnite is back on iOS — well, kind of. Through Nvidia’s streaming game service GeForce Now, mobile users on iOS and Android will be able to play a touch-control version of Fortnite through cloud gaming. Players can now register to join the closed beta test for Fortnite’s new mobile work-around — you don’t need to have a paid account to play, and paying won’t give you priority for getting off the waitlist. But if you want to play Fortnite on mobile for longer than an hour, you might be driven to upgrade. Fortnite hasn’t been playable on iOS devices since August 2020, when it was kicked off the App Store for trying to skirt Apple’s 30% commission on in-app purchases. Then, Fortnite developer Epic Games sued Apple, alleging that the tech company is a monopoly that violates antitrust laws. In September, the California court ruled that Apple cannot prohibit developers from adding links for alternative payments outside the App Store. But Apple ultimately had the upper hand in the ruling: the court said the tech giant was not acting as a monopoly like Epic claimed. But neither Apple nor Epic was happy with the ruling, so both parties appealed it. Apple also convinced the appeals court to grant it more time before the injunction goes into effect. That means it didn’t have to make the court-ordered App Store changes dictated by the original ruling. Epic Games CEO Tim Sweeney has remained a vocal dissident of Apple, so it’s up in the air if we’d ever see a Fortnite iOS app any time soon, even if the two entities come to an agreement. |

| Dear VCs: If you want startup prices to come down, stop paying higher prices Posted: 13 Jan 2022 12:27 PM PST That the venture capital market is incredibly exuberant at the moment is not news. Data from 2021 paints the picture of a startup fundraising game at peak velocity, with more capital, unicorns and nine-figure deals than ever. And let me tell you, some venture capitalists are tired of it. PitchBook has a post up detailing how startup prices are too high from the viewpoint of investors. That startup investment and resulting valuations may have gotten out of hand is not an unpopular perspective. Reuters’ prediction series for the new year included the idea that startups “seeking to raise capital in 2022 may [have] to sell shares at a lower valuation than before,” to flag another example. But missing from the discussion of the prices that venture capitalists and other private-market investors are paying for startup shares is the fact that they are still doing it. This, of course, is a choice. Venture capitalists have the ability to stop writing checks. They can hit the brakes — and quickly. We saw this in 2020 when, for several weeks while early-COVID uncertainty reigned, venture capitalists around the world started to circle the wagons around their existing portfolio companies. So, it is possible for investors to just, well, not for a bit. If a bunch of venture investors decided to effectively go on strike, it would have an impact. And that impact would be to lessen competition, perhaps leading to lower overall startup valuations in the near term. Will that happen? Hell no. Venture capitalists are putting capital to work at revenue multiples that even they know are elevated past reason. They are doing so because they think it is the best move from where they currently sit in the market. The game here is pretty simple: Invest the current fund, enjoy paper markups from other investors, raise an even bigger fund, repeat until your AUM makes you feel important. This is why the complaints — and I do not mean to single out any particular investor here; most are only content to whine while off the record, I’ve noticed, so points to investors saying out loud what others are thinking — are somewhat silly to me. It’s investors complaining about their own activity.

For founders that can access more capital than ever at lower prices, godspeed. May you never find yourself in a valuation trap. But will I feel bad for the investing class? Never. |

| GoFundMe gets Classy (literally) with acquisition of nonprofit giving platform Posted: 13 Jan 2022 12:26 PM PST GoFundMe announced today that it will acquire Classy, a nonprofit fundraising software company. This is an all equity deal, though the company did not disclose the financials. Anyone can make a GoFundMe, from a local food pantry to a community member in need. But Classy is more specialized, working directly with nonprofits. Since its 2010 seed round, Classy has raised $183.5 million in venture capital, which most recently included a $118 million Series D in April 2021, led by Norwest Venture Partners. The Public Benefit Corporation employs a team of 200 and will become a subsidiary of GoFundMe, operating as a separate entity under GoFundMe CEO Tim Cadogan’s leadership. “While we are proud of the combined $20 billion the GoFundMe and Classy communities have raised for people and organizations, we recognize the unique opportunity we have to make an even bigger impact — both in the U.S. and around the world — if we do this together,” Cadogan wrote in a blog post. Cadogan hopes that the acquisition will help connect individual donors with nonprofit giving opportunities. “This could mean that someone who makes a donation to an individual seeking relief from a natural disaster, could then be connected to a nonprofit that focuses on addressing the underlying causes of climate change,” he wrote. The company said that $5 billion was raised on GoFundMe and Classy combined in 2021. GoFundMe doesn’t charge a platform fee from fundraisers (aside from standard transaction fees), but when people donate to a campaign, they can add an optional tip that helps keep GoFundMe running. By default, the tip is set to 15% of the donation amount. |

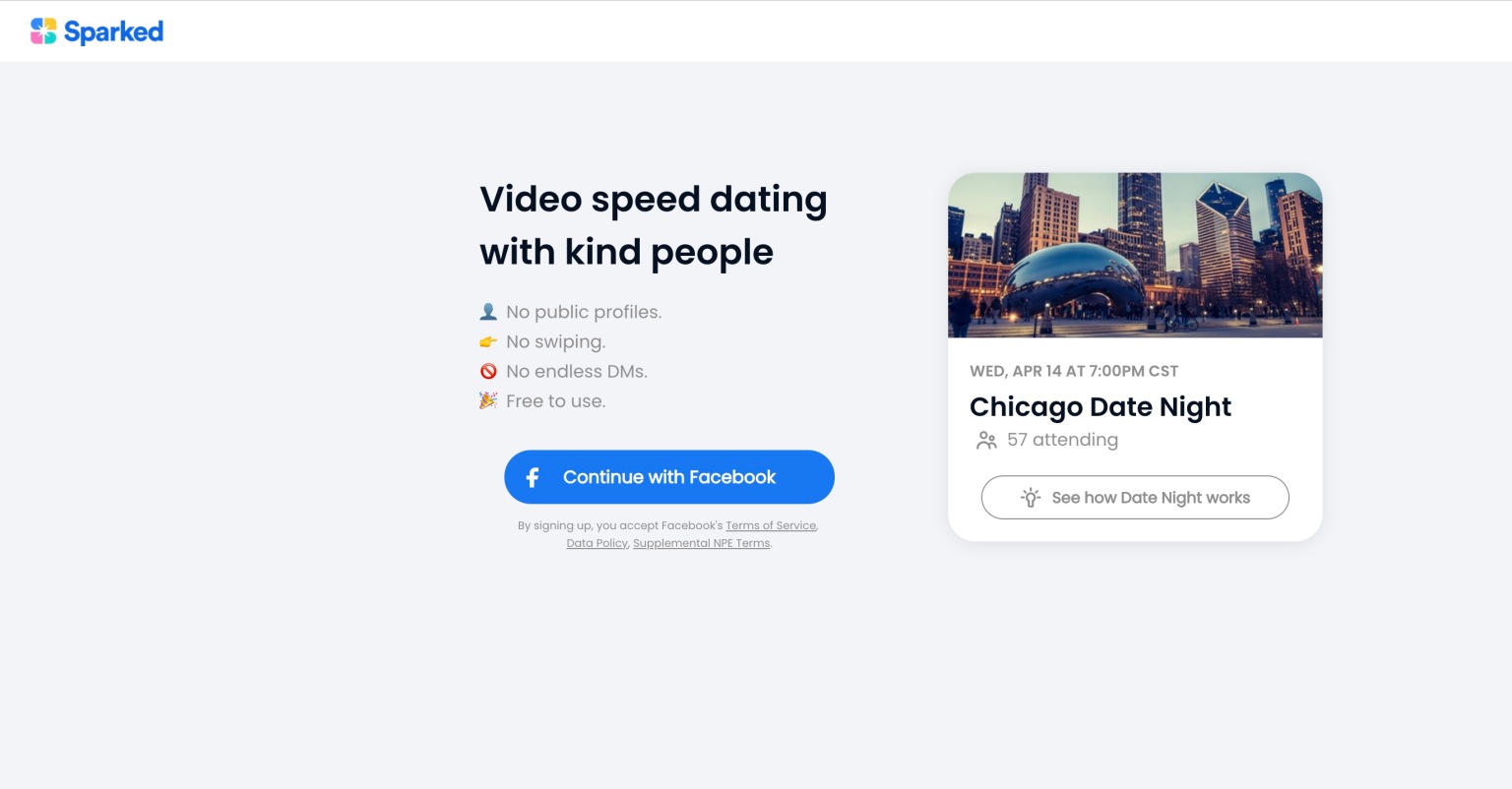

| Meta shuts down its experimental video speed-dating service, Sparked Posted: 13 Jan 2022 12:24 PM PST Meta is shutting down a video speed-dating service it had tested over a good part of last year, the company informed the service’s users via a recent email. Last April, the company formerly known as Facebook confirmed it was testing a new dating service called Sparked, which was developed by its in-house incubator, the NPE team. Unlike modern dating apps where users swipe on profiles to generate matches, Sparked’s premise was to bring the serendipity associated with in-person speed dating to an online service. With Sparked, daters would cycle through a series of short “video dates” during a preplanned event with other locals in their area. The team had tested the service in select markets, including Chicago, and had also hosted several “global” date nights throughout the year, as well as dedicated events for LGBTQ users or other demographics, like certain age groups.  Image Credits: Meta Initially, Sparked users would chat in short, four-minute video dates, which they could then follow up with a 10-minute date, if all went well. They could also choose to share their contact information with a match, like their phone number, email or Instagram handle. Meta, at the time, described Sparked as “a small, external beta” test designed to generate insights about how video dating could work. However, Sparked last summer began experimenting with a different sort of online dating that didn’t include video chat: audio dating. The service hosted several “audio only” date nights where users could chat with one another, but not appear on video. Not coincidentally, Facebook’s larger dating service, Facebook Dating, soon thereafter launched a new feature called Audio Dates which similarly gave users a way to start an audio chat with their match. Now Sparked is closing up shop. The company informed its testers via email that the service will officially close on January 20, 2022. “We started building Sparked in late 2020 to help people find love through an experience rooted in kindness. Since then, thanks to regular input and feedback from you, we improved where we could, learned a ton, and made connections between people,” the email read. “Like many good ideas, some take off and others, like Sparked, must come to an end.” The email seems to imply Sparked is not among the “many good ideas” that “take off.” In other words, it didn’t find traction. Reached for comment, a Meta spokesperson didn’t have anything more to add beyond what had already been shared in the email to Sparked users. The company is giving users a way to download their information from Sparked’s website before the final shutdown. After January 20, however, all user accounts will be deleted. It’s not surprising that Meta is closing down this experiment. Few of the NPE team’s projects have found a permanent home at Meta as standalone apps, despite a wide smattering of tests that have included things like calling apps, meme-makers and even variations on popular social apps like TikTok, Twitter and Clubhouse. Currently, only three NPE projects are still live on the U.S. App Store: BARS, a TikTok-like app focused on rap music; Collab, a collaborative music-making app (which is also shutting down soon); and Tuned, an app for couples. Meanwhile, Facebook’s broader efforts in dating haven’t proven all that successful when compared with incumbents. An analysis of Meta’s own Facebook Dating ads by The Verge last spring indicated Facebook was struggling to convert its millions of users in various cities to Facebook Dating users — even though the feature is available directly in the Facebook app itself. And Meta can’t necessarily blame the pandemic for this. Top dating apps saw surges of usage during the pandemic as people embraced virtual dating, which continued into 2021. Facebook doesn’t publicly share figures for its Facebook Dating product, and it’s not possible to determine its traction in other ways, as it’s a built-in feature inside Facebook. In addition to not likely meeting the bar for continued investment, Sparked also doesn’t quite fit into the NPE team’s new vision as an organization focused more on emerging markets, not just new consumer social experiences. The group set up offices in Lagos, Nigeria, and is staffing another in Asia. It’s also planning to look externally for new ideas, including by making seed-stage investments in small, entrepreneurial teams, it recently said. |

| Here’s why CNET co-founder Halsey Minor is bullish on NFTs Posted: 13 Jan 2022 11:59 AM PST Halsey Minor has lived many lives. One of the founders of CNET, Minor entered tech media at a time when the closest thing most of us had to the web was a spider spinning cobwebs on an old NES. Born in Charlottesville, Virginia, Minor worked for Merrill Lynch during the rise of the internet in the early 1990s and, in the words of Wayne Gretzky, has been skating to where the puck is going ever since. Since his initial foray into media, Minor has taken to cryptocurrency and blockchain in a big way. In 2014, he started an exchange, Bitreserve, which morphed into Uphold, a money transfer product that supported over 30 currencies, including crypto. Over the last few years, he built Live Planet, a video service, and VideoCoin, a token that rewards idle data centers for serving up video content. Now he's expanded into NFTs and sees the space as wide open yet in need of serious change. We spoke to Minor about his view of the current NFT market and what needs to be done to turn today's technology into tomorrow's CNET.

NFTs are one of those ubiquitous technologies that will touch virtually everything we do, from e-commerce to marketing and entertainment. In three years, everyone will be interacting with NFTs every day. Halsey Minor These days, Minor is building startups – and running Zoom calls. "I've spent the pandemic educating five children — with two dogs and a cat," Minor said. "It's been incredibly hard if you have a lot of children because of all the added work that comes from Zoom-based homeschooling. I've been extraordinarily lucky to be able to work from home." "With five children in school it leaves very little time for anything other than around-the-clock work," he said. "People honestly don't talk about this enough probably because it's not a sexy story." TechCrunch: You’ve gone all-in on crypto and NFTs after a career in content. Why? Halsey Minor: Much like I recognized the massive explosion of the internet many years ago, I see crypto and NFTs as the technology of the future. As NFTs become more accessible and mainstream, the creator economy will continue to migrate to the blockchain and, I believe, will eventually overtake traditional platforms. I am all-in on video NFTs with Vivid Labs because we believe video is the next great bulwark for NFTs and has the potential to spread into various verticals, from gaming to art to traditional entertainment. Video has always been one of the most compelling, engaging and empathetic mediums across all swaths of entertainment, and we don't expect NFTs to be immune to that. What advice do you have for new founders right now? What's the best route to raising capital? When I started my first company CNET, 26 years ago, I had no track record. Everything I did was to build credibility. I hired a former head of programming and marketing at Fox and the head of multimedia from Bell Labs with extensive internet experience (rare skill in 1995). You need to sell great people on your vision to build great things. These people helped turn CNET into a NASDAQ 100 company in four years. |

| The year of living autonomously Posted: 13 Jan 2022 11:30 AM PST Even in the era of the virtual event, it tends to take me a few days to recover from the whirlwind of CES. Frontloading the year's big hardware news is a bit less than ideal, but perhaps the changing nature of the big tech event will bring adjustments to the news cycle, as well. For this reason, I'm frankly a bit relieved that it has been a slow week on the robotics news front — even if that means this is going to be a shorter newsletter. Having nearly a week's distance from the show does, however, bring some added perspective on its emerging trends. From where I sit, here are the key things the robotics world can take away from CES 2022. Automotive is going to continue to be a key driver. What started as interest in manufacturing has grown into the world of autonomous vehicles — and beyond. Hyundai had, by far, the biggest headline-grabbing news, though the carmakers' announcements were a little all over the place. The company's PnD (Plug and Drive Module) continued the broad concepts around autonomous mobility, which could eventually reach into the world of mass transit. Its concepts for Boston Dynamics' Spot system, on the other hand, ran the gamut from the practical to shooting the robot into space, so Earthlings can interact with the metaverse on the actual surface of Mars. That sounds fine, but there's still plenty of practical work to be done in the meantime, and I go back and forth on how useful these big conceptual pitches are — particularly in an age where we're actually seeing a lot of robots work alongside us.  Image Credits: LG By and large, I think consumer electronics firms were less reliant on robotics as a kind of shorthand way of demonstrating that they're thinking about the future. The big caveat to this is LG, which announced UL certification for its CLOi ServeBot. The differentiator here is that LG does, in fact, appear to be taking robotics more seriously than others. That means, in part, focusing on near-term practical applications, rather than showcasing videos about how the homes of 2050 might look with their robots around. We touched on UV disinfecting robots last week (including one from LG) as an easy and practical near-term use for indoor-navigating robots. It's something people are increasingly concerned with a few years into this pandemic and ultimately it makes a lot of sense. ServeBot, as the name implies, is looking to take on systems like those by Bear Robotics — offering, in effect, a second set of arms for servers. Like Bear, restaurants are on the list of clients, along with hotels and stores. The system is capable of carrying around up to 66 pounds for up to 11 hours on a charge. LG's Jeffrey Weiland says, "As the first commercial service robot to receive UL certification for safe operation in consumer environments, the CLOi ServeBot’s semi-autonomous operation offers businesses an effective means to provide enhanced service, while freeing staff to focus on customer relations and build relationships that encourage repeat visits." No firm date, but the system will roll out to select clients before being offered nationwide.  Image Credits: Naïo Agtech continues to be one of the major categories to watch here. John Deere made the biggest waves with its fully autonomous tractor. Naïo's vineyard robot got a little bit of love, as well. Ultimately, CES is decidedly not an agricultural show, but it's pretty clear we're merely scratching the surface here, in terms of how these robots can help out on the farm. More babysteps for home robotics. Observers have been waiting around for the next Roomba for a number of years now, but thus far it's been largely fruitless trying to find the right balance between pricing and functionality for a home setting. Contrast Amazon's Astro robot with Labrador's Retriever. The first is currently firmly in the category of solutions looking for problems, while the latter is addressing the very real desire for those who need assistance to continue living on their own. It's not a mainstream product exactly, and the market, sizing and pricing will likely keep it there. But eldercare is a very real concern, and robotics have some immediately available solutions. Speaking of assisted living, a cool project out of Cornell just earned a $1.5 million grant from the National Science Foundation's National Robotics Initiative. Assistant professor Tapomayukh Bhattacharjee says he's ready to take his team's research to the next level, stating, "I started chatting a lot with the stakeholders — people with mobility limitations, the caregivers who are helping them, and occupational therapists — and I felt like robotics can truly make a difference in their lives, when it's ready to be deployed." As always, some news out of the last-mile delivery side of things. Magna this week announced that it has bought up IP and assets from Boston-based Optimus Ride, along with 120 of its employees. Here's Magna's president, John O'Hara on the matter:

Image Credits: Nuro Extremely well-funded Nuro, meanwhile, showed off its new road-ready ‘bot. The system doubles its predecessor's cargo, has a slew of new safety sensors and features and has its own exterior airbag, which deploys on contact with a person or object. No word yet on when it plans to actually deploy the systems in the street. Shenzhen-based Hai Robotics, which announced a $200 million raise back in September, has broken ground on a "demo center" in the SF Bay Area — specifically my hometown of Fremont. The area will be primarily devoted to showcasing the company's warehouse automation, as it looks to further expand its reach within the U.S. market.  Image Credits: Bryce Durbin/TechCrunch New year, new newsletter. Subscribe to Actuator! |

| Meet the 13 startups in IndieBio’s SF cohort, and discover what about each swayed investors Posted: 13 Jan 2022 11:00 AM PST It's been a big two years for biotech investors. But if you ask Po Bronson, a partner at SOSV's IndieBio, this trend was probably a long time coming. "Often, the implication is that everything must be overpriced," he tells TechCrunch. "But I think more of it is that some major theses in the markets are being proven out," he says. Those theses, which range from the future necessity of climate and agriculture solutions to the promise of programmable biology are reflected in IndieBio San Francisco’s new cohort of companies. We spoke to Bronson about what big scientific ideas unite these companies, and finally, what key elements sealed the deal for IndieBio. Below you'll find a quick rundown of each company, and one "clincher" factor that set it apart. (Note: This cohort represents IndieBio's San Francisco-based cohort. The New York-based cohort will debut on January 27). The CohortSoliome – Soliome wants to reinvent the way we develop sunscreen. The team is working on a protein engineering-based procedure to manufacture sunscreen out of basic ingredients, like plant proteins. This new approach, ideally, would help the market pivot away from sunscreens that have been shown to harm the environment, particularly coral reefs and other marine life. The Clincher: Bronson says he was impressed with the scalability of this business. The complex sunscreen molecules could be made quickly and easily. The $18 billion sunscreen industry isn't massive, but the ability to scale quickly in that space was a big plus. Pyrone Systems – Pyrone Systems is using scalable, biology-based techniques to create a new-age biopesticide. Specifically, one that doesn't kill, but selectively stuns pests like mosquitos. The biopesticide itself is currently being "fast tracked" by the EPA, per IndieBio's website. The process itself can also be used to make as many as seven other products, per IndieBio, which opens up $40 billion in other markets. The Clincher: Founder-market fit. Pyrone's founders are seasoned entrepreneurs, and their team includes people with deep biopesticide expertise. Solid Ox Motors – Solid Ox is building "range extender" chargers for commercial-scale electric vehicles, which have less time to charge and are more sensitive to fuel prices than private vehicles. At the moment, these chargers are able to cut refueling time in half, at a cheaper price point, per IndieBio's website. The Clincher: The idea of low-cost energy and market fit was important for Solid Ox. But it was CEO Jared Moore and his background in engineering that swayed the team. Puna Bio – Puna Bio specializes in growing microbial extremists — organisms that have been on earth for billions of years. Specifically, this team has managed to grow microbes only found in the La Puna desert (an area described as “Mars on Earth”), where they've managed to sustain plant life. Puna is using these microbes to both revitalize degraded soil and increase yields in fertile soil. The Clincher: Bronson describes these extremophiles as "programs with the ability to transform matter" — an idea he's been excited about for a while. But what officially sealed the deal was the fact that Puna is poised to tap into both agricultural and land markets. Restoring fertile possibility to unfarmable land can literally change the value of land itself.  Image Credits: Getty Images / Juan Carlos Munoz Grand Bio – Growth factors are proteins that help stimulate the growth of tissues. They're a major part of the cell-based meat market, but we're still learning about them. Grand Bio is looking to help cells produce their own growth factors more efficiently. The company sells growth-factor enhancing supplements for the media in which cells live and grow. The Clincher: Grand Bio presented a fresh take on a well-known problem. "I love the counterintuitiveness of everybody’s trying to bring down the cost of growth factors, making them in all sorts of systems. And they’re just like, No, we’ll just make the cells run longer on a little bit of growth factors," he said. Sea & Believe – Sea & Believe founder Jennifer O'Brien has toured Ireland's beaches, looking for the best tasting seaweed she could find. She found it on an Irish beach and has now started growing it into a scalable food source. Sea & Believe already has partnerships with Wageningen University, The University of Limerick and Clextral. The Clincher: O'Brien has a solid and compelling founder story says Bronson. But she also has a plan to scale a seaweed-based food business that has a specific niche: a strain of seaweed that is known for its flavor. Capturing that supply chain, he says, was of interest. (Full disclosure, he has yet to give the seaweed a try himself, but has plans to when a forthcoming shipment arrives.) Matagene – Matagene has focused on engineering a single enzyme with the power to change how efficiently crops use critical resources, like starch. Ultimately, the product can alter how plants use starch to increase crop yields by 90% in potatoes, 41% in canola, and 24% in sorghum, per IndieBio. The Clincher: Bronson notes many investors overlook the potential in agricultural innovation. Instead, he looks at the sector similar to pharma: "If you make one big, mega crop, it’s like a blockbuster drug," he says. Matagene's technology is also applicable to many crops (so you're not pinned down with just one), and, he says, can be applied in food, industrial and carbon markets. Veloz Bio – Veloz Bio has developed a rapid protein production system (think animal proteins that are grown in crops). The company can scale up and grow new proteins in less than six months, without the use of a bioreactor. The Clincher: These founders have an expertise in critical aspects of protein production: supercritical fluid extraction and membrane purification. They've also run large-scale businesses before in the Mexican food system. "I wanted industry pros coming at it with the point of view and real ability to scale and extract," says Bronson. Prothegen – There are two primary routes that cells follow toward death. One of them is called ferroptosis, a process in which the cell defense mechanisms fail, and they're overwhelmed by rogue molecules. Prothegen aims to develop drugs that can control that death cycle — applying it to some cells and restraining it in others. The Clincher: Bronson said Prothegen was able to demonstrate a high level of expertise in the ferroptosis area. “The part that put us over the top was spending time with professor Scott Dixon [a discoverer of ferroptosis],” he says. The specific challenges associated with manipulating this process were robust, and Prothegen demonstrated the ability to meet that high bar.  Image Credits: Getty Images / koto_feja Wayfinder Biosciences – Wayfinder Bio is using RNA-based biosensors to control editing molecules (like CRISPR). This allows once-permanent changes created to respond to an environment — for instance, imagine switching certain genes "on" and "off" in response to changing conditions in the body. Wayfinder is a spinout from the Center for Synthetic Biology at the University of Washington. The Clincher: Wayfinder was an example of "programmable" logic in biology. Fine tuning biological systems with precision, says Bronson, is a key idea. Cellens – Cellens has developed a urine-based bladder cancer test that goes beyond screening. The test also monitors cell surfaces to help determine stage and aggressiveness of cancer. At the moment, the test can detect bladder cancer with 94% accuracy, and in pre-clinical trials at Dartmouth, Dana Farber Cancer Institute and the University of Washington. The Clincher: Both Cellens and ProtonIntel (see below) speak to one of IndieBio's theses: "A lot of where the money being spent is in ongoing long-term patient monitoring," says Bronson. "And a lot of the pain in the ass for the patient is that they need not just a screening test, they need a true biological marker." Cellens is built around measuring patient progression in enough detail to drive clinical decisions, rather than simply screen for a disease. ProtonIntel – ProtonIntel is developing a rapid, continuous potassium monitor. Potassium is a critical element that drives the heart's electrical signals, and, in people with kidney failure, potassium levels can spiral out of control. ProtonIntel is designed to measure those potassium levels before problems, like heart attacks, arise. The Clincher: Bronson says that ProtonIntel has taken on an especially difficult scientific problem: measuring potassium in the body. But previous experience in this market has suggested that this service is truly needed, and could further disrupt the dialysis industry (which, after decades of stagnation, is already seeing changes). Unlocked Labs – Unlocked labs is a consumer probiotic company whose first products focus on reducing oxalic acid and uric acid — two products in the body responsible for kidney stones and gout, respectively. The company is aimed at improving microbiome health, and harnessing that system to reduce toxins in the body. The Clincher: The first generation of microbiome products, says Bronson, were centered around balancing that colony of microbes. The next generation, he argues, is to provide "specific and targeted benefits." Unlocked Labs he says, fits in that niche.

*An earlier version of this article miscounted the amount of startups in this cohort. There are 13.

|

| The M11 is Leica’s new flagship rangefinder Posted: 13 Jan 2022 10:42 AM PST Leica’s a strange one. It only puts out a handful of cameras every year, and most of them are remixes or minor iterations on previous models. Since 2017 its flagship has been the solid but still somewhat archaic M10, but now the company has revealed its successor: the even more solid and also still somewhat archaic M11. Leica really defined the rangefinder style in cameras, and its film models are legendary. In the digital era they are known more for their prices than anything else. While the build and image quality of the M10, Q2 and other cameras was unimpeachable, you could get a lot more camera for considerably less money elsewhere. That won’t change with the M11, but at least the new model brings some much-needed modern features. Perhaps the most important is the switch to a backside-illuminated sensor. This misleading term refers to putting the light-sensitive part of the sensor toward the aperture rather than letting it sit behind wiring and other components. BSI sensors usually outperform their traditional predecessors by quite a lot, and Leica generally has a good sensor game to begin with. Interestingly, they seem to have chosen a non-Bayer sub-pixel layout with an eye toward superior pixel binning. The new full-frame, 60-megapixel BSI sensor can be shot at full resolution, of course, but hardly anyone needs that these days. The 36MP and 18MP options sample the entire sensor rather than just lines or regions, reducing noise and artifacts. If I got one of these I’d switch it to 36MP and never look back. There are also 1.3x and 1.8x crop modes for those who enjoy them. There are now three easily reassignable function buttons. The rear touchscreen has twice the resolution of the old M10, though if you’re a real Leica fan you’ll probably have your eye to the optical finder. Interestingly, but controversially, the M11 uses its full sensor at all times for exposure purposes. Having the camera essentially always in “live view” mode means accurate exposures, but according to DPReview’s initial review, it leads to longish startup times — and Leicas are generally quick as lightning to turn on and shoot with. There’s a USB-C port that charges the camera’s new and much larger battery, or to pull shots off the card or 64-gig internal memory — or to suck them directly onto your phone and a companion app (another reason not to shoot full rez). Leica’s M series is unique and definitely not an option for more hobby photographers, who will rightfully balk at the $8,995 price for the M11 body — the M10 debuted at $6,600 in 2017, and even adjusting for inflation the new price is eye-popping. And of course that’s before you get any lenses! But the point is not to recommend this camera specifically — more to note that Leica is still making technically interesting and quite competent cameras, the technology of which occasionally dips down to prices that mere mortals like you and I might be able to afford (after living on ramen for a month or two, anyway). Expect to see more variants of the M11 over the years, but also some of the design lessons on display here applied to something more affordable. Not affordable affordable, but “less than a used car” affordable. |

| Posted: 13 Jan 2022 09:18 AM PST The success of Roblox and other user-created gaming experiences like Overwolf have democratized the concept of making games and have taken it into the mainstream. Now, a startup founded by veterans from Unity, Microsoft and EA that is building a new platform for creators to build immersive games, and related communities around like-minded people, is gearing up to launch later this year. Ahead of that, it is disclosing a healthy $50 million in funding. Yahaha Studios, an Espoo, Finland-based startup with R&D based in Shanghai, has yet to launch a commercial product. But it describes what it is building as a no-code “metaverse for games”, where people can come together in communities to build and play games combining virtual and real-world elements. The $50 million that it has raised, to be clear, is not new funding: it was pulled together in a period of six months, across three rounds, nearly two years ago, all in 2020. The company tells me that “round 1” was led by 5Y Capital; “round 2” was led by HillHouse, and “round 3” was led by Coatue. Early investors participated in subsequent rounds, and other backers include ZhenFund, Bertelsmann Asia Investments, BiliBili and Xiaomi. The funding, we’ve confirmed, values Yahaha in the range of $300 million to $500 million (“few hundred millions” is the phrase that was used when we asked). While Yahaha Studios may still be months from launch, in the meantime it has been quietly running a Discord community with a small group (around 220) of early users. The company tells me that an alpha version of the product will be launching in Q2 of this year. It is not planning to raise any more funding ahead of that, a spokesperson tells me. “Metaverse” has very quickly become a very over-used word, and a number of companies claim to be blazing trails into this nebulous space, with its promises of combining augmented and virtual reality technologies to create entirely new kinds of digital experiences, gaming and otherwise. It looks like Yahaha has managed to stand apart from the crowd, and found investor attention early on, for a couple of reasons. First of all, there are the company’s founders — Chris Zhu (CEO), Pengfei Zhang (COO) and Hao Min (CTO) — who all worked together as engineers at cross-platform gaming engine Unity, and have years of experience behind them. Zhang has been living in Finland for the last 15 years, and this is how the company got started there, but that is not the only reason for basing Yahaha in Espoo: with companies like Supercell also originating in the Helsinki suburb, there is a strong ecosystem in the region for building teams and tapping into new gaming innovations. The company has confirmed that the Yahaha platform was built in partnership with Unity, a link that in turn will help onboard more creators and more cross-platform gameplay and communities. Second of all, there is the concept behind Yahaha itself, which focuses on two popular themes in tech at the moment: user-generated content and no-code development. UGC has been a popular part of online entertainment for decades at this point, but platforms like TikTok and Instagram have really given rise to a new focus on “creators”, people building huge audiences and businesses around the content that they are generating. While platforms like Twitch and Discord have made celebrities out of game players, we haven’t really yet had much in the way of platforms that make it easy for creators to build massive communities around actual games (Roblox partly addresses this but doesn’t feel like a social platform). This is what Yahaha seems to hope to become, and if it works, it could be on to something very interesting. Building the platform on a “no-code” framework, meanwhile, is what will help make Yahaha potentially used by more people. While a lot of the application of no-code has been in the area of enterprise IT (where people can, for example, easily build integrations between CRMs and accounting software), it’s interesting to see more of it making its way into consumer-focused services, specifically to serve creator communities. "Achieving an investment of $50 million is incredibly exciting for us,” said CEO Chris Zhu in a statement. “Yahaha Studios has a key part to play in ushering in the next generation of entertainment as the metaverse continues to grow. Connecting users around the world through virtual entertainment, YAHAHA offers a unique creative and social experience to game developers and gamers alike. Through YAHAHA we are empowering creators at all levels, from established developers to those making their first game. Everyone can be a creator in our virtual world. We're really looking forward to fully launching this year, growing our team and bringing the first stage of our vision for the future of content creation to life." |

| Has Y Combinator’s new deal changed the early-stage investing game? Posted: 13 Jan 2022 09:11 AM PST Y Combinator's newly announced plan to invest more capital into startups that take part in its accelerator program is more controversial than many first assumed. By raising its so-called "standard deal" to include an additional $375,000, the U.S. program and investing group with hundreds of companies in each of its accelerator classes may have materially changed the earliest stage of investing. Professional early-stage investors around the world may see their offers lose luster, possibly changing how the youngest startups that take part in Y Combinator interact with external capital. The Exchange explores startups, markets and money. Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday. Prior to the change, Y Combinator offered $125,000 to its accelerator participants in the form of a simple agreement for future equity, or SAFE, that reserves 7% of participating startups' equity on a post-money basis. The new $375,000 SAFE, now part of YC’s regular transaction, is uncapped – meaning that the dollar amount will not convert into an automatic percentage stake of the company in question. Stacked up against today's myriad mega-rounds — those nine-figure checks that seem to touch down at every hour of the day — and the huge unicorn horde waiting by the private-market exits, an extra $375,000 may not seem like a big deal.