TechCrunch |

- How to recruit when your software startup is in stealth mode

- Meta adds ‘personal boundaries’ to Horizon Worlds and Venues to fight harassment

- Circular takes on Oura with a $259 smart ring

- Collaborate with the founder community at TechCrunch Early Stage 2022

- Why 2022 insurtech investment could surprise you

- Spotify CEO hints HiFi tier delay is related to licensing issues

- We’re building a social+ world, but how will we moderate it?

- Numeral wants to turn bank accounts into microservices

- Unit CEO Itai Damti and Flourish’s Emmalyn Shaw to explain fundraising strategies on TechCrunch Live

- Cloud infrastructure market soared to $178B in 2021, growing $49B in one year

- Taxing crypto only makes it stronger

- Artisanal Ventures closes $62M fund, takes ‘connected capital’ approach to investment

- Apple to charge 27% fee for Dutch dating apps using alternative payment options

- BharatPe founder asks for the removal of CEO from board

- In Ford’s transition to EVs, cost-cutting takes center stage

- Marathon Venture Capital adds to its newest fund to back Greek founders around the globe

| How to recruit when your software startup is in stealth mode Posted: 04 Feb 2022 10:01 AM PST A company's most valuable asset is its people, especially for organizations still in their infancy. A startup's founding team can be the difference between an industry-changing unicorn and just another failed venture, making early recruitment one of the most critical processes in a company’s first year. But the war for tech talent has rarely been so brutal. Large technology companies are growing at amazing rates and startup funding is at an all-time high. Great candidates have more choices than ever, and hiring them is harder than ever before. By taking a unique approach, we achieved a near 100% acceptance rate with almost 100 employees while we were in stealth mode. With the right strategy, founders can find and hire people whose passion aligns with their vision. Recruiting while in stealth mode

Humility is an invaluable trait when you’re hiring a founding team or fostering the company’s culture. Working in stealth mode for over a year required me and co-founder Dan Amiga to take a highly personalized approach to recruitment. Similar to a football draft, we listed everyone in our network that we thought were absolute rock stars. Some of these people had startup experience, but we didn't let that limit our search. We were looking for nothing short of the best — people who we personally knew or who came with referrals from trusted parties. Our targets included people who we either couldn't wait to work with again or who we couldn't believe we hadn't worked with already. We knew that a list based on our own network would always outperform individuals found through a blind recruitment process. We also considered each candidate's personal journey. Would our company be a good fit for them? Did the timing, lifestyle requirements and the early stage of the organization make sense? Based on this pool, we identified the skills that we felt were critical for making our company a success. Next, we cross-referenced these two lists. This final headcount gave us a good "draft prospect" list with which to start our recruitment process. In our company's early stages, we had to find a way to turn interviewees into believers without actually divulging the details of what we were working on until the very last minute, meaning most of the interview process happened without sharing a glimpse or description of the product. Yet we achieved a near 100% acceptance rate.

Instead of relying on a demo to attract recruits, we sold them on the leadership team we were creating, the investors we had already engaged and the opportunity to build a new category of software. We emphasized the goal: to change the industry and make a real impression, not just another version of an existing solution. |

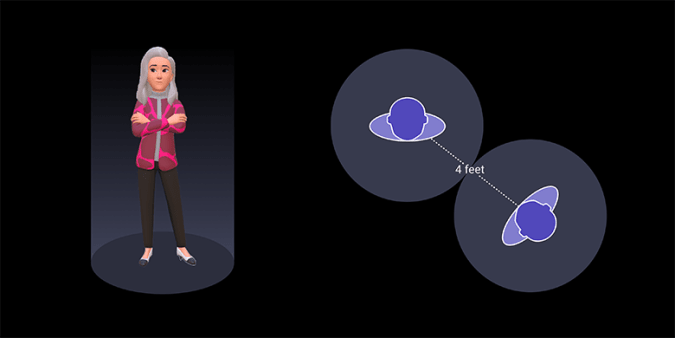

| Meta adds ‘personal boundaries’ to Horizon Worlds and Venues to fight harassment Posted: 04 Feb 2022 09:57 AM PST Meta is rolling out a feature called Personal Boundary in its Horizon Worlds and Horizon Venues virtual reality spaces to combat harassment. Each avatar will have a bubble with a radius of two virtual feet, so they won’t be able to come within around four feet of each other.  Meta If someone tries to move into your personal space, their forward motion will halt when they get too close. However, Meta told The Verge that avatars will still be able to move past each other, so users won’t get trapped in a corner or doorway. The Personal Boundary feature, which users won’t be able to disable, builds on previous measures Meta added to tackle harassment, such as making an avatar’s hands vanish when they enter someone else’s personal space. Shortly before Meta opened Horizon Worlds to everyone aged 18 or older in the US and Canada in December, a beta tester said her avatar was groped by a stranger. Eventually, you may be able to change the radius of your Personal Boundary. Users can still high-five and fist bump other avatars, but they need to extend their arms to do so. Editor’s note: This article originally appeared on Engadget. |

| Circular takes on Oura with a $259 smart ring Posted: 04 Feb 2022 09:49 AM PST Oura wasn't the first smart ring to market, but over the course of its life, the device has had surprisingly little competition. In general, it's proven difficult for consumer hardware companies to find a toehold beyond the wrist. Though the brand's relative success has no doubt raised hope that the fitness band/smartwatch isn't necessarily the end-all-be-all for the category. CES has never been a huge show for wearables, but the event that gave us our first glimpse at what seemed to be the first viable smart ring delivered two more this year. There's Movano, which we highlighted late year. The company said it's shooting for a second-half launch. Also notable is Circular. The French startup offered a sneak preview — but not much more — at the show. Today, the company announced its titular ring will open for preorder on February 27, priced at $259. That's $50 less than the latest Oura (gen 3), and Circular's not yet discussing a monthly subscription plan for its promise of "not […] just raw data but personal insights." Let's be frank though — everyone appears to be on a steady march in that direction these days, regardless. The company's got a wide time frame for the actual delivery of the product — between April and June. To some degree, that's to be expected for a relatively young and small firm, particularly as we're in the throes of ongoing chip and supply chain constraints. The ring sports a number of different sensors for things like heart and respirator rate and body temperature. From that standpoint, at least, we're operating in the general Oura territory, creating actionable insights based on a number of vitals in a bid to "democratize personal health," per the marketing material. That's coupled with a "personal assistant" in the app. The battery should last up to four days and charges in around 45 minutes. From the sound of things, consumer is the first step for a still-small hardware startup. Moving forward, the company is looking to hit the B2C market via insurance and health companies. That's probably where the real money is for a product like this, but it's a longer runway with more regulatory red tape. The ring is launching in Europe (France, Germany, Italy and the U.K.), along with the U.S., Hong Kong, Singapore and Australia. |

| Collaborate with the founder community at TechCrunch Early Stage 2022 Posted: 04 Feb 2022 09:38 AM PST Ready to get serious about launching a startup? Aspiring and newly minted entrepreneurs will find all the essential building blocks they need to create a solid foundation for startup success at TechCrunch Early Stage 2022. This live, in-person event takes place on April 14 in San Francisco, California. The day-long founder summit offers three concurrent tracks featuring an all-encompassing range of topics that the earliest of early-stage founders Need-To-Know. What's more, you'll hear from successful founders who share their experiences — warts and all — so you'll get a real sense of what you might encounter. No hype — just the facts and the reassurance that comes from knowing you are not alone. Here's what Chloe Leaaetoa, the founder of Socicraft, told us about her experience at TC Early Stage:

Join your early-stage community: Buy a Founder Launch Pass ($199) before they sell out, and you'll save $350. Make an informed decision and read our COVID vaccination policy before you buy your pass. Okay, enough with the housekeeping and back to the good stuff. What will you learn at TC Early Stage? Short answer: plenty. Expert-led workshops and smaller roundtable sessions address vital topics. Here's just a sample of what you can expect:

No FOMO: You can't attend every session, but never fear. You'll receive access to videos of all the sessions when the event ends. You won't miss a thing! We're limiting the number of overall attendees to keep this event intimate. You'll have time to talk with the session experts, VCs and founders — and each other. And you'll have access to CrunchMatch, our AI-powered system that lets you find people who align with your business goals and set up 1:1 meetings on site. Don't underestimate the power of networking with other like-minded, early-stage entrepreneurs. You might meet someone who'd make the perfect co-founder or an engineer who can help you turn your idea into a viable product. TechCrunch Early Stage 2022 takes place on April 14 in San Francisco. Some of the best teachers are the people who've paved the way and want to help you benefit from their experience. Buy your ticket to TC Early Stage, join your community and get ready to grow your startup. Is your company interested in showcasing your expertise at TC Early Stage 2022? Contact our sponsorship sales team by filling out this form.

|

| Why 2022 insurtech investment could surprise you Posted: 04 Feb 2022 09:07 AM PST There were two markets for insurtech startups in 2021: one welcoming and one dismissive. Private market investors poured capital into promising insurtech startups, while the public markets sent the value of recently public insurtech companies down — and then further down as the year progressed. The decline in the value of public insurtech unicorns was a theme that The Exchange covered throughout last year, noting rising damage as valuations fell from low to lower. And yet when CB Insights dropped its 2021 fintech data collection, it noted that global insurtech venture activity hit a new high in the year. In 2021, insurtech funding reached 566 deals (an all-time record and a 21% gain over 2020) and $15.4 billion in capital (again, an all-time record, and a 90% gain over 2020.) TechCrunch has discussed the growing gap between public and private tech valuations in recent weeks, as an exuberant venture capital market seemed to move further apart from a late-2021 decline in the value of many technology companies. Much of the losses persisted or worsened in early 2022. And yet the insurtech market is an even more extreme example of the decoupling we're seeing more broadly in startup land. How so? Root, which raised a $350 million Series E in 2019 at a valuation of around $3.6 billion, per Crunchbase data, traded as high as $22.91 per share after going public. Today it's worth $1.82 per share, or $460 million, about half the money it raised while private. The Exchange explores startups, markets and money. Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday. Other examples are at hand. MetroMile was valued at $540 million during its final private round in 2018, per PitchBook data. The company's SPAC-led public debut valued the company at around $1.3 billion. Today, after seeing its stock crest the $20 per share mark, MetroMile is worth $1.52 per share and awaiting a new home inside Lemonade, another recent insurtech IPO. Lemonade has seen its value fall from an all-time high of $171.56 per share to $28.92 as of this morning. The company went public at $29 per share. For insurtech startups, the public-market mess that some of their peers have endured is bad news. Florian Graillot, a seed-stage investor in Europe who puts capital to work in the insurtech space through Astorya.vc, told The Exchange that “there is a growing gap between valuations of these startups and M&A deals done recently in the insurance industry,” citing the recent sale of Aviva France for $3.9 billion. The company had, per Reuters, "3 million customers and 7.8 billion euros in revenue." (The deal cleared regulators.) Revenue multiples of less than one don't get founders' hearts racing. And there are startups in the business of writing insurance products for which such a low multiple would be akin to a death sentence, from a valuation perspective. Falling share prices for insurtech startups and worrying acquisition prices for insurance companies could prove a sticky wicket for the companies in the sector that raised so much money last year. But that doesn't mean that all the news is bad. |

| Spotify CEO hints HiFi tier delay is related to licensing issues Posted: 04 Feb 2022 09:06 AM PST Spotify CEO Daniel Ek has hinted that the delay of the streaming service’s HiFi subscription tier is related to licensing issues. Speaking to analysts and investors during Spotify’s quarterly and annual earnings release on Wednesday, Ek stated that the company doesn’t have much to share about its plans for the HiFi tier, but noted discussions were ongoing. In response to a direct question over Spotify’s failure to bring the HiFi service to the public as promised, Ek only provided a vague answer before moving on. “Many of the features that we talk about and especially that's related to music ends up into licensing,” Ek told investors. “So I can't really announce any specifics on this other than to say that we're in constant dialogue with our partners to bring this to market.” Last February, Spotify announced plans to roll out the new high-end subscription service. The company had said Spotify HiFi would launch sometime in 2021 and give Spotify Premium subscribers the option to listen to music in “CD-quality, lossless audio format." Spotify also said the HiFi service would work across devices, including on Spotify Connect-enabled speakers. The company didn’t provide any further information, such as details about pricing or which markets will support the new subscription. But the service was going to be offered as a Premium “add-on,” meaning it would cost more than the usual Premium subscription. This plan could have been complicated by changes in the competitive landscape. Ek’s comments about the delayed feature follow those left by a Spotify representative on the company’s community forum last month, after a thread about the feature blew up into hundreds of pages of angry posts. “We know that HiFi quality audio is important to you,” the comment reads. “We feel the same, and we're excited to deliver a Spotify HiFi experience to Premium users in the future. But we don't have timing details to share yet. We will of course update you here when we can.” It’s worth noting that rumors of Spotify’s lossless subscription tier date back to 2017, when it was revealed that the streaming service was thinking about introducing a new paid option called Spotify Hi-Fi. At that time, it was rumored that the feature would cost an additional $5-$10 per month. Spotify’s delays with its HiFi tier come as both Apple Music and Amazon Music have released high fidelity streaming features for their customers. Last June, Apple launched lossless audio streaming and Spatial Audio with support for Dolby Atmos to its Apple Music subscription at no extra charge. Apple Music’s entire catalog of 75+ million songs supports lossless audio. The lossless tier begins at CD quality — 16 bit at 44.1 kHz, and goes up to 24 bit at 48 kHz. Audiophiles can also opt for the high-resolution lossless that goes up to 24 bit at 192 kHz. Meanwhile, Amazon launched its Amazon Music HD subscription tier with lossless audio streaming in 2019 for an additional $5 per month. Last May, the company made Amazon Music HD available to all eligible Amazon Music Unlimited subscribers at no extra cost. Amazon HD streams songs with a bit depth of 16 bits and a sample rate of 44.1kHz (around CD-quality). Some songs stream in Ultra HD, or 24-bit, with a sample rate of up to 192kHz (or better than CD quality). The launch of high-fidelity streaming is seen as a way to counteract the threat from music streaming service Tidal, which has been catering to audiophiles with higher quality streams. Although Tidal hasn't exactly been able to compete with industry-leading music streaming services in terms of subscriber numbers, its continued existence indicates there's a demand out there for better quality music. |

| We’re building a social+ world, but how will we moderate it? Posted: 04 Feb 2022 08:50 AM PST Social is not just what you do on Facebook anymore; it’s what you do in every single app you use. Think of the experience on Venmo, Strava, Duolingo or even Sephora. Companies that implement social components into their apps and services, known as social+ companies, are thriving because they can establish connections and enable interactions with users. Andreessen Horowitz's D'Arcy Coolican explained the appeal of social+ companies, writing:

Social+ will soon permeate all aspects of our lives, accelerating at breakneck pace in the months ahead. I would wager adoption will continue to the point of utility – where every company is a social company. This is very exciting, but only if we plan accordingly. As we've seen with social's influence in the past, it's amazing … until it's not. What's incredibly additive to the user experience today could become an absolute nightmare if apps invoking social don’t find religion on sound moderation practices and invest the necessary resources into ensuring they build the right tech and processes from the start. Learning from FacebookAs the OG social pioneer, Facebook redefined how society functions. In doing so, it endured some very painful lessons. Notably, it must bear the burden of monitoring individual, group and organization posts from 1.93 billion daily active users– all while trying to cultivate a sense of community without censorship and driving platform adoption, engagement and profits. While social+ companies are not likely to see this kind of volume, at least in the near-term, they will still have to contend with the same issues – only they no longer have the excuse of not being able to foresee that such things could happen.

If Facebook and its army of developers, moderators and AI technology struggle, what kind of chance do you have if you don't make moderation and community guidelines a priority from the start? Let's look at a few areas where Facebook stumbled on moderation:

All of these issues should be considered carefully by companies planning to incorporate a social component into their app or service. The next generation of social appsSocial engagement is key to sales, adoption and much more, but we must not forget that humans are flawed. Trolling, spam, pornography, phishing, and money scams are as much a part of the internet as browsers and shopping carts. They can wipe out and destroy a community. Consider: If Facebook and its army of developers, moderators and AI technology struggle, what kind of chance do you have if you don't make moderation and community guidelines a priority from the start? Companies must build moderation features – or partner with companies that provide robust solutions – that can scale with the company, especially as services go global. This cannot be overstated. It is fundamental to the long-term success and viability of a platform– and to the future of the social+ movement. For moderation tools to do their part, however, companies must create clearly defined codes of conduct for communities, ones that minimize the gray areas and that are written clearly and concisely so that all users understand the expectations. Transparency is vital. Companies should also have a structure in place for how they handle inappropriate conduct – what are the processes for removing posts or blocking users? How long will they be locked out of accounts? Can they appeal? And then the big test – companies must enforce these rules from the beginning with consistency. Any time there is ambiguity or a comparison between instances, the company loses. Organizations must also define their stance on their ethical responsibility when it comes to objectionable content. Companies have to decide for themselves how they will manage user privacy and content, particularly that which could be of interest to law enforcement. This is a messy problem, and the way for social companies to keep their hands clean is to clearly articulate the company's privacy stance rather than hide from it, trotting it out only when a problem arises. Social models are getting baked into every app from fintech to healthcare to food delivery to make our digital lives more engaging and fun. At the same time, mistakes are unavoidable as companies carve out an entirely new way of communicating with their users and customers. What's important now is for social+ companies to learn from pioneers like Facebook in order to create safer, more cooperative online worlds. It just requires some forethought and commitment. |

| Numeral wants to turn bank accounts into microservices Posted: 04 Feb 2022 08:41 AM PST Meet Numeral, a French startup that wants to upgrade corporate bank accounts. While clients interact with Numeral using a modern application programming interface (API), the startup connects directly to bank servers to upload payment files and interact with outdated information systems. By abstracting that layer of complexity, you can treat your bank accounts like another microservice in your architecture. Last month, Numeral announced that it raised a $14.8 million (€13 million) funding round led by Balderton Capital. Alexandre Prot, Tom Blomfield, Guillaume Princen and Kima Ventures also participated. The Numeral team originally started working on the project within Logic Founders, a startup studio created by eFounders. The best way to describe Numeral is by describing what it isn't. Numeral isn't an open banking aggregator for consumer apps. It doesn't compete with Tink, TrueLayer or Yapily. Numeral isn't a banking-as-a-service provider either. The company doesn't offer bank accounts, doesn't generate IBANs and doesn't issue cards. "We are a payment automation platform for tech companies," co-founder and CEO Édouard Mandon told me. "We let tech companies connect to their bank account to automate payment operations." While retail banks are just starting to offer APIs, corporate banks opened their banking platform many years ago. But don't expect a REST API with documentation pages. Many banks expect you to upload a text file to an SFTP server. The file is supposed to be formatted in a very specific way as well. Numeral sells its product to fintech, insurtech or real estate companies that rely heavily on bank transfers. For instance, the company's first clients are Spendesk and Swile. Numeral has created integrations for its first clients so that Spendesk and Swile can interact with their bank accounts using an API. By the end of 2022, Numeral plans to offer coverage for a dozen different banks. "Right now, half of our customers discover our service through a French bank that describes Numeral as the APIs they don't offer," Mandon said. Once the integration is done, Numeral customers can integrate payment capabilities and features in their apps. The startup also offers a web app for non-technical staff. This way, they can reconcile payments and accounts without having to use the legacy web app offered by corporate banks. Numeral can then add some additional features on top of its API. For instance, you can imagine setting up an approval workflow, a notification system, etc. The startup is also thinking about orchestration capabilities. If a customer has multiple bank accounts, they could route payments to the right account depending on several rules. Numeral could also be used to actively manage cash balances across multiple accounts. That could be particularly useful for global customers with accounts in multiple countries. Mandon worked for iBanFirst before starting Numeral, so he knows a thing or two about having several partner banks spread across multiple countries. With the funding round, Numeral plans to grow to a team of 30 to 40 people. In addition to new integrations with French banks, the company plans to expand its coverage and customer base to other European countries, such as Germany, the U.K., Spain and Italy. |

| Unit CEO Itai Damti and Flourish’s Emmalyn Shaw to explain fundraising strategies on TechCrunch Live Posted: 04 Feb 2022 08:00 AM PST Itai Damti co-founded Unit in 2019 to help businesses integrate banking services into their consumer products. In 2020, Emmalyn Shaw, as Flourish’s managing partner, invested in Unit’s Series A round, and later, in the company’s B round. We’re excited to host both of them on an episode of TechCrunch Live taking place on February 16 at 12pm PT / 3pm ET, where we’ll talk about how the two connected and what makes Flourish a good partner for Unit. Click here to register for free! TechCrunch Live is all about helping startups build better venture-backed businesses. Founders and the investors who finance them sit down to talk about how they met, what kept them interested in one another and, ultimately, how they sealed the deal. We also discuss the relationship that they share in working together through scaling. Plus, this episode of TechCrunch Live also includes the TCL Pitch-Off. Folks in the audience can come on to our virtual stage to pitch their startup to our esteemed guests and get their live feedback. TechCrunch Live is free to attend and goes down every Wednesday at 3 pm EDT/noon PDT. However, only TechCrunch+ members get access to the on-demand version of the episode, as well as the complete library of TechCrunch Live content. In other words, bite the bullet and subscribe to TechCrunch+. Smash this link to register for TechCrunch Live with Unit and Flourish Ventures! |

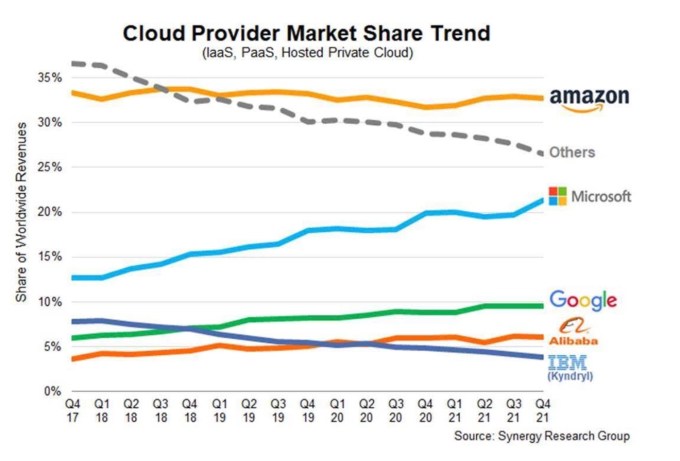

| Cloud infrastructure market soared to $178B in 2021, growing $49B in one year Posted: 04 Feb 2022 07:49 AM PST It’s kind of a broken record at this point, but the cloud infrastructure market continues to grow at an astonishing rate. Over the last year, it added almost $50 billion in business, growing from $129 billion in 2020 to $178 billion last year, according to Synergy Research data. Canalys reports similar numbers. As for the quarter, Synergy reports the market reached $50 billion, up 36% over the prior year. The big three — Amazon, Microsoft and Google — continue to grow at a remarkable rate, even as the market matures, taking advantage of that growth with their market strength. Microsoft and Google are growing faster at similar rates, around 45% for the quarter, while Amazon is growing at just under 40%. The quarterly revenue numbers worked out to around $17 billion for Amazon, $10 billion for Microsoft and $5 billion for Google, all healthy and growing businesses. The market breakdown by percentage hasn’t changed a ton over the last year, with Amazon leading the way with 33%, followed by Microsoft with 21% and Google with 10%. It’s worth noting that Amazon’s market share has been stubbornly persistent for several years, while Google and Microsoft continue to grow steadily over time, but of course, the market continues to expand and Amazon revenue continues to grow at a decent rate. In fact, Synergy reports that Microsoft, which was at just 11% share 4.5 years ago, has doubled its position in 18 quarters, an impressive rise. Synergy principal analyst John Dinsdale said that he isn’t too concerned, though, that Amazon’s position hasn’t changed in a while. He calls it a nice problem to have. “Well, controlling a third of a huge and rapidly growing market is a very nice ‘rut’ to be in,” Dinsdale said. And while he isn’t about to predict the future, he noted it’s hard to keep growing consistently at a rapid rate. “As a matter of principle, we never project or comment on likely future market share performance — that's a rubicon that analysts like us should never cross. I will say that math is a powerful force, and the bigger you are, the more difficult it is to maintain aggressive growth. That is just a fact of (corporate) life.”  Image Credits: Synergy Research Canalys data was pretty darn close to Synergy’s, with the firm reporting just over $53 billion for the quarter, up 34%. For the year, Canalys set the market at $191.7 billion, up 35% year over year from $142 billion in 2020. For the quarter, it broke down as Amazon with 33%, Microsoft with 22% and Google with 9%. Again, these numbers are close enough to Synergy’s to call it a draw. Both define the market similarly, so it shouldn’t come as a huge surprise. Canalys looks at service and platform as a service, either on dedicated hosted private infrastructure or shared infrastructure. For Synergy, it’s infrastructure and platform services. Both companies leave out SaaS, which is counted as a separate category. The fact is that the market continues to grow at a rapid rate, and if analysts and prognosticators are correct, there is still a ton of room for growth in the cloud. We’re certainly seeing that quarter after quarter in recent years, as the largest players, in particular, reap the benefits of this growth with gaudy revenue numbers. Even at the bottom of the market, there is still plenty of money to be made. While it might not meet the level of Microsoft, Amazon or Google, it can still add up to multibillion-dollar businesses. Chances are, in the coming years,we will continue to see continuing rapid growth. When we reach a point where we don’t, that’ll be the “man bites dog” news event. |

| Taxing crypto only makes it stronger Posted: 04 Feb 2022 07:00 AM PST Hello and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines. We had the full crew aboard today, headed by our killer production team Grace and Chris, and hosting crew Mary Ann, Natasha and Alex. Last week we promised Cute Farming Robots, and this week we delivered, along with a lot more. But first, the Equity team along with our sister podcast Found are doing live recordings starting soon. You can find out more here, but Equity will be live-taped on Hopin next Thursday. Come hang out, it should be fun! Now, the show rundown:

So far, 2022 is feeling good. Along with our soon to be standing live show circuit, we’re working hard on making the show more focused on tension and nuance, while still sticking to our love for numbers and nerdy networks. Let’s annoy some people this year, and teach you something in the meantime. Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts. |

| Artisanal Ventures closes $62M fund, takes ‘connected capital’ approach to investment Posted: 04 Feb 2022 05:00 AM PST Cloud is the big buzzword these days, with people talking about why it's a smart move for companies, and lots of venture-backed startups developing easy ways for companies to make the shift. Artisanal Ventures, a Bay Area venture capital firm investing in B2B cloud startups, closed on its first fund, the oversubscribed $62 million Artisanal Ventures I. The inaugural fund is backed by more than 50 founders and senior executives from companies like Square, Atlassian, CrowdStrike, AppDynamics, Snowflake, Splunk, UiPath and MuleSoft. The firm is led by Andy Price, general partner, and also founder of cloud-focused executive search firm Artisanal Talent. He has brought in Andrew Van Nest as a partner. Van Nest was previously a venture investor at Blumberg Capital. “We sit in a unique spot in the B2B software landscape as both investors and recruiters,” Van Nest said. “Our lens into the flow of great talent allows us to monitor and invest in spaces that are truly at the cutting edge. We’ve been focused on ML/NLP, cloud security and automation. We’re excited to be supporting companies leading the charge.” Meanwhile, Price expects most of the check sizes to be between $500,000 and $1.5 million for early-stage companies and $2 million to $3.5 million in later-stage companies. Rather than compete with the VC ecosystem, Price's strategy is to complement the biggest VC firms by building companies with them, he said. That includes combining the expertise of the firm's limited partners with Artisanal Talent's executive search capabilities to help portfolio companies build best-in-class teams. "Much of the success of these ventures has to do with the dynamics of the people supporting the founders," he added. "If that dynamic works, and you know that you’re a part of that group that has a constructive approach, lots of intellectual value to bring to the table, a track record and a bunch of brand power, it makes company building so much easier. That’s really our formula and what we already have been doing intentionally." For every company like Meta, there are 5 million "flameouts" in the consumer landscape. However, with B2B, the win rate is a lot higher, he said. That's why he likes investing in cases that correlate to public markets, a strategy he doesn't think many venture capitalists think about — how Wall Street is ultimately going to embrace or not embrace what a company is doing. So far that strategy has worked in Artisanal Ventures' favor. The firm has invested in 14 companies so far, and Price says the fund has won allocation in over 90% of deals it has pursued. Among the portfolio of companies, the firm has invested in email security company Abnormal Security, which raised $50 million back in 2020; biotech software developer Benchling, which raised $100 million in Series F funding last November; and Transmit Security, which took in a $543 million Series A last year on a pre-money valuation of $2.2 billion to rid the world of passwords. Price started fundraising for the fund early last year, and while his vision for a second fund will be going after about $200 million, he is not yet ready to go for a second fund. "We’ll likely do it in the next two to three years, but for the next 12 months, we are singularly focused on deploying capital intelligently, as the market is getting utterly destroyed in the public markets," he added. "What’s happening is that is starting to correlate with startups, and we’re waiting to see how that affects the pricing dynamics of private companies. Before going into another big batch of investments, we will play a wait-and-see approach and tap the brakes to see if we can’t get more great assets at more fairer prices." |

| Apple to charge 27% fee for Dutch dating apps using alternative payment options Posted: 04 Feb 2022 04:13 AM PST Following a court order, developers working on dating apps don't have to use Apple's in-app purchase system in the Netherlands. And because those purchases aren't handled by Apple, the company doesn't take its usual 30% cut on digital purchases. But developers who use a third-party payment system still have to pay a commission. And Apple plans to charge a… 27% commission. If you haven't kept track of the Dutch antitrust saga, the Netherlands Authority for Consumers and Markets originally said that Apple was in breach of national competition rules on a very specific case — digital content sold by dating app developers, such as superlikes and boosts. This represents yet another threat for Apple's in-app payment system. In South Korea, Apple agreed to allow third-party payment systems following a new law on digital payments. There are also several ongoing cases in the U.S. and Europe. As for the Netherlands, Apple has appealed the antitrust ruling, saying that allowing external payments wasn’t in the users' best interests. "Because we do not believe these orders are in our users' best interests, we have appealed the ACM's decision to a higher court. We're concerned these changes could compromise the user experience, and create new threats to user privacy and data security. In the meantime, we are obligated to make the mandated changes which we're launching today and we will provide further information shortly," the company said last month. The company doesn't have much of a choice, as the Netherlands' competition authority already fined Apple €5 million ($5.7 million) because it missed the first deadline to comply with the court order. Earlier today, Apple updated its documentation page that explains how developers of dating apps can take advantage of alternative payment systems in the Netherlands. It's a fairly technical document that explains how developers can offer an alternative payment option. But it also says that Apple plans to charge a commission to app developers. Essentially, developers get a three percentage point cut on the App Store commission as Apple doesn't handle transactions. But the company still thinks it's fare to charge a 27% commission for the various services that it offers:

Every month, app developers will have to send a report of digital sales related to apps hosted on the App Store. After that, Apple will send an invoice related to its 27% commission. In other words, developers aren't going to generate a ton of extra revenue by bypassing Apple's payment system. But that's not all. There is also some technical overhead with third-party payment systems. If you're an app developer with users in multiple countries, which is pretty common with dating apps, you can't submit the same app binary. Development teams will have to compile and submit two different binaries — a Dutch app and a non-Dutch app. Apple wants to make it as difficult and expensive as possible to use a third-party payment system. Chances are most developers will just keep using Apple's in-app purchase API. "Developers of dating apps who want to continue using Apple's in-app purchase system may do so and no further action is needed," Apple writes. But it feels like Apple is just buying time. The App Store remains under close antitrust scrutiny across various jurisdictions. Apple will find ways to circumvent the first court orders and pro-competition reforms. But regulators will likely get smarter if they really want to lower Apple's commission on app developers. |

| BharatPe founder asks for the removal of CEO from board Posted: 04 Feb 2022 12:04 AM PST BharatPe co-founder and managing director Ashneer Grover has asked the board for the removal of chief executive Suhail Sameer from the board in the latest of a series of remarkable turn of events at the Tiger Global-backed Indian fintech startup. Grover, who is subject to an ongoing investigation whose preliminary finding has suggested fraud, wrote in a letter to board members on Wednesday asking for the removal of Sameer from the board, though he did not offer an explanation. "I, now, in exercise of the power vested in me by Clause 3.7 of the SHA and Clause 91.7 of the AoA do hereby withdraw, my nomination of Suhail Sameer as a Director nominated by me to the Board of Directors of the Company." "In light thereof, I, Ashneer Grover request the Board of Directors of the Company to complete the necessary processes to record the cessation of the Directorship of Suhail Sameer as a Director of the Company," the letter reads, the contents of which were reviewed by TechCrunch. BharatPe did not immediately return a request for comment. Indian newspaper Economic Times first reported about the letter. Earlier this week, the paper separately reported that Grover was seeking legal counsel to protect his shareholding and position at the firm. The 39-year-old Grover said last month that he was going on a two-month leave of absence after an alleged audio clip surfaced on Twitter of a man hurling abusive and life threatening statements over a phone call to a Kotak Bank representative over not getting financing to buy shares in fashion e-commerce Nykaa’s IPO. The clip, coupled with BharatPe’s long-track record of abusive work culture, created enough pressure on the startup’s board that it announced an investigation into, among other things, financial irregularities charges levelled against Grover and his wife, who serves as the startup’s head of controls. Grover rubbished the audio clip in a tweet, which he has since deleted. A preliminary investigation by Alvarez and Marsal (A&M) commissioned by BharatPe's board found fraudulent transactions, including payments to non-existent vendors as well as irregularities of invoices being produced to substantiate spends, Economic Times reported. Indian newspaper Mint on Friday shared more details about the "egregious instances of fraud" findings at the firm. The Wednesday letter to the board members escalates the tension between Grover and Sameer, who took over the chief executive role from Grover last year. Mint has also reported that the board has decided to remove Grover from the firm. The relationship between Grover and Sameer has soured in recent months. The two stopped seeing eye to eye several months ago, according to a person familiar with the matter. "I am happy to appoint Suhail Sameer as the CEO in recognition of stupendous business growth he has delivered during the last 1 year and his ability to lead from the front," Grover had said at the time of Sameer’s appointment. In an interview this week to Indian outlet MoneyControl, Grover said the firm’s investors “arm-twisted” him to go on a leave and claimed that Sameer was the “board’s puppet.” “Anyone who will say anything unsubstantiated against me, I will get their house, car and everything they ever built. I'm very clear about that. Be clear of the repercussions if you say something without any modicum of truth,” he told the outlet. “Founder is a guy who has the spine to raise money from someone and tell them I’m not here to dance to your tunes. I am here to give you a return on your money and give you a higher return on your money than anyone else has given till date. Anyone who’s not doing that is an employee,” Grover posted on his LinkedIn Friday. BharatPe, valued at $2.85 billion and which was until recently attempting to raise a new funding round at $4.5 billion valuation, is one of the fastest growing fintech startups in India. The firm helps offline merchants accept digital payments and secure working capital. |

| In Ford’s transition to EVs, cost-cutting takes center stage Posted: 03 Feb 2022 05:28 PM PST Ford has made cost-cutting a key piece of its EV strategy as the company works to improve profit margins while meeting what CEO Jim Farley has called “incredible demand” of its new electric vehicle models. During the company’s fourth-quarter and full-year earnings call on Thursday, Farley said Ford has set up a task force dedicated to lowering the bill of materials for its battery-electric vehicles (BEV) “above and beyond just the usual declines in material costs.” “For example, on the Mustang Mach-E in just the last month, our team found $1,000 of opportunity per vehicle, and that’s deliberate through design simplification, vertical integration and leveraging our scale with supply chain as we ramp up production,” Farley said. “And that team is just getting started.” Notably, Ford isn’t waiting for a second generation vehicle to make changes that will lead to cost reductions or better efficiency. Through the process of producing Mach-E’s, Farley said the company has learned how to source profit opportunities by better integrating its engineering, supply chain and manufacturing segments. For example, Farley noted that the Mach-E’s cooling system has four motors when it probably only needs to have two; it has 60 or 70 hoses, when it can probably function well on a third of that. “Those are the opportunities we’re going after and we are not going to wait for next year,” he said. “We’re not going to wait for a minor change. We are going to reengineer that vehicle now and then use that expertise for the Lightning and the E-Transit and of course, all our electric platforms.” Ford CFO John Lawler noted that the company’s BEV margins need to improve. “We have an opportunity but we need to do that through scaling them,” Lawler said. “We’re going to want to have a strong lineup where we can lean into it with key vehicles in high-volume segments like we are today with Mustang Mach-E and the Lightning, and in our commercial vehicles, with the E-Transit, we’re going to reduce complexity.” The Ford F-150 Lightning truck and the E-Transit van are not yet out to market, although deliveries of the van are expected to begin later this month. For now, Ford’s BEV portfolio consists of one vehicle: the Mustang Mach-E. Sales of the crossover EV has accelerated since it came to market last year. In January alone, the Mach-E sold 2,370 units, as opposed to 238 in the same month the previous year. Scaling operations is one obvious way to lower costs, but that can come with a lot of upfront investment. Ford and battery manufacturer SK Innovation plan to spend $11.4 billion to build two campuses in Tennessee and Kentucky that will produce batteries as well as the next generation of electric F-Series trucks — a project the companies said will create 11,000 new jobs. Ford is contributing $7 billion to the project, the largest single manufacturing investment in its 118-year history. The investment is part of Ford’s previously announced plan to put $30 billion toward electric vehicles by 2025. Ford is prioritizing bringing down costs in its internal combustion engine vehicle business, as well, which Farley distinguished as a separate business from the company’s blossoming EV business, despite having models like the Transit van that will span both fuel segments. This is an important distinction to make, as Ford’s profitability still mainly comes from its ICE models. “On the ICE business, we're gonna leverage the compute on the vehicles to really lower manufacturing costs and leverage that compute to simplify what we do coming down the line and bring that down to the bottom line of the vehicle,” said Lawler, noting that the company is also investigating ways to work with partners to lower distribution costs with manufacturers. The stated goal behind continuing to invest in a healthy ICE business is to fuel the growth of a healthy BEV business, said Farley, noting that the future manufacturing of ICE vehicles has a main focus in optimizing cash returns that can then be injected back into the electrification of Ford. Ford reported a net income $12.3 billion in the fourth quarter, a reversal from the $2.8 billion loss it reported in the period in 2020. Ford’s profit included $8.2 billion in gains from its investment in EV startup Rivian, which went public in November. Once the gains from its Rivian holdings were removed, the company had an adjusted profit of $2 billion in the fourth quarter. Revenue for the fourth quarter rose 5%, to $37.7 billion. For the full year, Ford reported a net income of $17.9 billion, up from a $1.27 billion loss in 2020. Ford shares are down 4.37% in after-hours trading because the company’s results did not meet analyst expectations. |

| Marathon Venture Capital adds to its newest fund to back Greek founders around the globe Posted: 03 Feb 2022 05:22 PM PST Marathon Venture Capital, an Athens, Greece-based venture firm co-founded in 2017 by two stalwarts of the Greek startup scene, has added €30 million in capital commitments to its second fund roughly a year after completing a first close with €40 million. Backers of the vehicle, which is more than twice the outfit’s €32 million debut effort, include the European Investment Fund, the Hellenic Development Bank of Investments (which really upped its investment, we’re told) and the European Bank for Reconstruction and Development. We traded emails yesterday with one of the outfit’s co-founders, George Tziralis, who said that he, co-founder Panos Papadopoulos and the rest of the team have been writing seed-state checks of between €1 million to €1.5 million into a wide variety of startups in exchange for a targeted 15% to 20% ownership stake. He made it sound from the exchange like the startup ecosystem in Greece is more active than ever, but far from frothy as in many regions around the world. Part of that exchange follows. TC: Are you exclusively backing Greek founders, no matter where they are in the world? Do they have to be natives of the country or do Greek Americans, for example, or Greek Australians interest you? GT: No, absolutely not [they don’t have to be born in Greece]. If you are an ambitious Greek founder, we want to talk no matter where you’re based. How many women founders have you backed? Are you talking with many female founders of Greek ancestry? Like many other countries, Greece long had a very paternalistic culture, so I wonder what you’ve observed on this front. We have invested in 14 companies so far, and only two had female founders. There is an increasing number of female founders starting up in our broader community, and some of them have been quite successful. Still, obviously, we have lots to do on this front and we started by tracking related figures. [Specifically], we recently released a compensation report for tech roles in startups based in Greece in which we also studied gender ratios. The results further highlighted the underlying gender gap, especially in leadership roles. On the flip side, product and QA/testing roles proved to be more balanced, and we hope they can serve as an example. What percentage of your founders are based in Greece versus elsewhere? I’d say roughly half. We’ve invested in founders starting from Nicosia to Munich to Berlin to Stockholm to London, all the way to San Fransisco, and we’re increasingly getting access to more opportunities across Europe and the U.S. At the same time, our domestic market has been growing really fast. The next generation of Greeks want to build a career in startups rather than anything else. It’s also interesting to highlight that an increasing part of Greek founders based internationally maintain part of their operations in the country. Culture, quality and compensation-wise, this is becoming appealing to more and more companies. You and Panos are the firm’s two general partners, yet you have investments across a lot of areas: climate, health, security, infrastructure, finance, education, real estate, productivity, AI, crypto. Who specializes in what at Marathon? We all focus on company building — from setting up shop, recruiting a team, perfecting the product, nailing marketing and sales, then raising the next round, and so forth. These functions are largely sector agnostic in our experience. We believe founders know better when it comes to their domain of expertise. From where does your deal flow come? What kind of outbound work do you do to ensure you’re talking with the right founders? We started doing meet-ups in Greece 15 years ago. I actually was running Open Coffee meet-ups in Athens every month from 2007 until COVID. We built a vibrant startup community, but there was no investor around and someone had to do it. This is how I got started with venture capital. Since we launched Marathon in 2017, we’ve expanded our event footprint to destinations across Europe and the U.S., hosting a sizeable pool of Greeks doing startups and working in tech. We’ve been to Zurich, Munich, Berlin, Stockholm, Amsterdam, Paris, Barcelona, London, New York, Boston, Chicago and San Francisco, gathering hundreds of attendees and bringing together a global community accumulating experience and enthusiasm about startups. We are on a mission to find every Greek entrepreneur around the world. What can you tell me about the size of the market you’re tracking? It has become sizeable, fast. It actually grew 2.4x to $4.5 billion last year. You can see our latest report here, using CB Insights data, to find every Greek founder who raised money last year, or who sold their company. What is your biggest exit to date, and what are some of your most valuable portfolio companies? We’ve done ten investments with our first fund, and had our first exit already. Data streaming platform Lenses.io was acquired by Celonis, one a fast-growing enterprise software company with a decacorn valuation. Last year alone, half of our Fund I portfolio companies raised a Series A. More specifically: LearnWorlds raised $32 million led by by Insight Partners; Causaly raised $17 million led by Index Ventures; Hack The Box raised $11 million led by Paladin Capital Group; Augmenta raised $8 million led by CNH Industrial; and Cube RM raised $8 million led by Runa Capital. Have you raised any side vehicles so that you and your limited partners can get a bigger stake in a promising portfolio company (or you can at least maintain your pro rata)? If so, have those vehicles been registered in the U.S.? We participate in Series A and B rounds, maintaining our pro-rata with our existing funds. The second closing of Fund II we are announcing today is providing us with more firepower toward that goal. SPVs are reserved for later stages. A significant number of our LPs are based in the U.S., and participate using various kinds of vehicles. Are you seeing more foreign investors checking out startups in Greece than you were when you co-founded Marathon? Absolutely. The names from our portfolio speak for themselves. Are you seeing many more funds formed in Greece? Yes, activity has been increasing and we believe there is space for more of it. Venturefriends announced a fund of similar size a few weeks ago. Genesis Ventures also recently launched a €20 million pre-seed fund. And there has been a bunch of funds originally started at the 2018 vintage that should follow with new funds soon. What’s your newest deal and why did you do it? We led the seed of Ariadne Maps, a Munich-based pioneer of real-time commercial real estate analytics. It’s actually a pretty slick case. Its service tracks in real time the position and trajectories of visitors in an area without requiring an app download, WiFi login or using cameras. Its adoption by large retailers, shopping malls, transport operators, etc. has been spreading fast with landmark customers, including IKEA globally. |

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment