TechCrunch |

- Dyson is betting you’ll want to strap an air purifier to your face

- The tech inside the new Lotus Eletre EV hints at autonomous driving ambitions

- The 25 crypto startups that Y Combinator is backing in its W22 batch

- Everything you need to know about YC Winter 2022 Demo Day, part 1

- AR glasses maker Nreal nabs $200M funding in 12 months

- Our favorite startups from YC’s Winter 2022 Demo Day, Part 1

| Dyson is betting you’ll want to strap an air purifier to your face Posted: 29 Mar 2022 10:00 PM PDT Air. I love it, you love it. We're all out here walking around in it all day, filling our lungs and blood with the stuff. We can't get enough of it. But that beautiful, wonderful, life-saving air that you, me and your pet chinchilla all need is bad sometimes. That's right. The same air we rely on is sometimes filled with bad, tiny things. Things that would love nothing more than to fly into your nose and wreak havoc on your soft, unprotected insides. Over the past two years, air purifiers have seen a massive spike in sales here in the U.S., starting with a 57% increase in 2020. The pandemic, coupled with phenomenon like the California wildfires, has driven many to install filters in their homes and offices. All the while, the engineers at Dyson have been asking themselves one important question: What if we found a way to stick the purifier on people's faces? In a world where mask wearing has become the status quo, maybe it's not the most out-there question? Maybe.  Image Credits: Dyson The Dyson Zone is a beast. It has many of the hallmarks of Dyson's much-loved product design, with the decided (and not insignificant) difference that it's designed to be strapped onto the wearer's face. Or, more precisely, I suppose, strapped to a pair of headphones and worn in front of their mouth. Honestly, the basic form factor most closely resembles a football helmet. The final product arrives after 500 prototypes over six years, according to the company. Says Dyson:

Image Credits: Dyson The removable visor shoots a pair of filtered air streams at the user's mouth and nose without coming in direct contact with the face. It's designed to filter out allergens, pollutants and other particulates. Dyson isn't making any claims here about the Zone's ability to filter out contagions like COVID. Instead, the product comes with an attachment that allows a user to wear a face covering in addition to the product. The headphones feature three noise-canceling modes, and the front piece has four air purification settings. Exact pricing and availability are not yet available — which is too bad, because I really want to know how much this thing is going to run. Broadly, it's arriving in select markets at some point this fall. More information on all of that is promised in the coming months. |

| The tech inside the new Lotus Eletre EV hints at autonomous driving ambitions Posted: 29 Mar 2022 06:10 PM PDT Lotus unveiled Tuesday a battery-electric “hyper” SUV called the Eletre — the first of a trio of EVs Lotus plans to launch over the next four years. The upshot? The Eletre, which means “coming to life,” is the British brand’s first utility vehicle and a crucial play for the anticipated boom in demand for battery-electric luxury SUVs. The vehicle’s design and luxury interior features are notable. But it’s some of the vehicle’s tech, including a whopping four lidar sensors that pop out when needed, that provides the best glimpse of what Lotus has in store for the future. First the basics. The company, which is owned by Geely Automotive and Malaysian conglomerate Etika Automotive, is packing in the power, torque and some decent battery range. The Eletre has an 800-volt electric architecture, allowing for fast charging without battery degradation. There are two electric motors, one on each axle, that produce a minimum of 600 horsepower and allow the SUV to rocket from 0 to 60 mph in less than three seconds. Lotus says its battery pack, which will have more than 100-kilowatts of storage, will allow the Eletre to travel 373 miles on a full charge under the European WLTP cycle. A 350-kilowatt charger can add 248 miles in 20 minutes. The Eletre comes with four drive modes, including one for off road, which adjusts the steering, damper settings, powertrain and accelerator pedal response. Other hardware and features can be added, such as optional 23-inch wheels, active ride height, active rear-axle steering, an active anti-roll bar and torque vectoring via braking. The vehicle will go into production at Lotus’ new facility in Wuhan, China, later this year. As Lotus’ first SUV and EV, the new model “heralds a momentous point in our history and a clear signal of our ongoing desire to transform our business,” according to Lotus Cars managing director Matt Windle. The aim, of course, is for this momentous point in history to turn into momentous future profits. Lotus did not share pricing information for the Eletre, making it difficult to precisely pinpoint its competitors. Depending on its price, it may compete with Tesla Model X or some of the more upscale SUVs that register as top-sellers for luxury brands, from Lamborghini to Aston Martin. There’s a growing list of potential competitors. Maserati announced last week plans to launch two all-electric SUVs: a battery-powered version of its Levante midsize SUV and an all-new compact crossover called the Grecale. Ferrari’s first SUV, the $300,000 Purosangue, is expected later this year. Notably, Lotus has “future proofed” the Eletre with sensors and other hardware that can be activated via over-the-air software updates to improve or add features to its advanced driver assistance system. Lidar, the light detection and ranging sensor that is commonly viewed as the key to safely deploying autonomous vehicles, is starting to be adopted by automakers like Mercedes-Benz, Volvo and now, Lotus. These automakers see lidar as a necessary sensor to provide redundancy for specific and limited autonomous driving features, not full autonomy. At least not yet. This seems to be how Lotus intends to use lidar in the Eletre. Lotus plans to use four lidar sensors, which can be “deployed” or pop out when needed. Lotus said the lidar sensors are hidden when not required, “only emerging from the top of the windscreen, the top of the rear glass, and from the front wheel arches as required.” This lidar sensor system will eventually allow the vehicle to enter and exit parking spots via smartphone app. But comments from Maximilian Szwaj, vice president of Lotus Technology and managing director of the Lotus Tech Innovation Center in Germany, show the company is thinking beyond parking. “ADAS technologies such as LIDAR sensors and cameras will become increasingly common on new cars as we move into a more autonomous era,” he said in a statement, adding that the car has tech for today and also for tomorrow. The vehicle will also include a camera-based mirror system, which current U.S. regulations prohibit. The three different cameras are for the rear-view mirror, a second to create a 360-degree view of the car from above to aid parking and a third used for its advanced driver assistance system. Lotus said the cameras work in tandem with the lidar system to deliver “autonomous driving capability.” Lotus doesn’t provide more detail about what “autonomous driving capability” means beyond its aspirations for parking. Though the hardware Lotus describes is state of the art, there are many challenges to overcome — including a system with the compute power and software as well as an intuitive user experience — before a vehicle can have effective and safe autonomous driving features. But four lidar sensors and three cameras suggests the company’s aspirations extend to other limited or conditional autonomous driving features. Other innovations include what the company calls porosity, the principle of air flowing through the car as well as under, over and around it for better aerodynamics, range and efficiency. Lotus leaned into porosity when it designed the Evija hypercar and the Emira. Now, the Eletre has it, which suggests that this design innovation is here to stay. Some of the more obvious examples of these air channels can be seen at the lower grille, front fenders and near the taillights. The grille is particularly interesting, and includes a network of interconnecting triangular petals that stay shut when the car is not moving or if there’s a need to reduce drag during driving. They open to feed air into the radiator, allowing the Eletre to “breathe” when cooling of the electric motors, battery pack and front brakes is required, according to Lotus. |

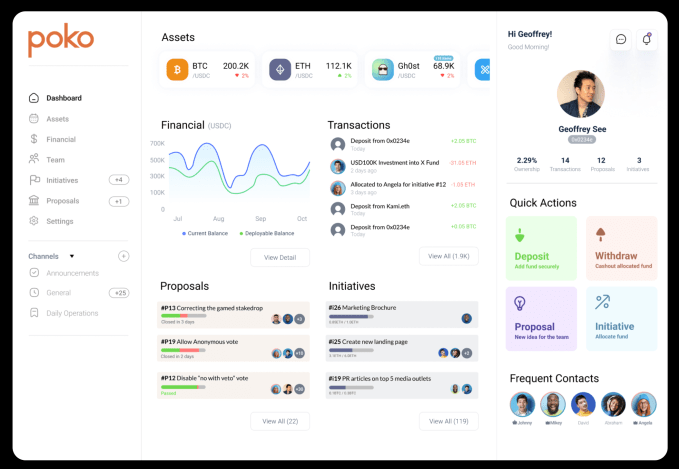

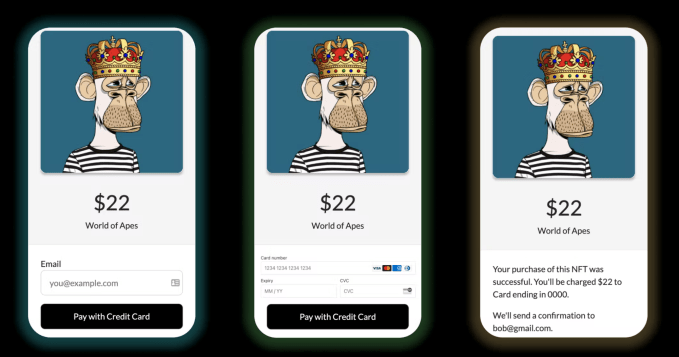

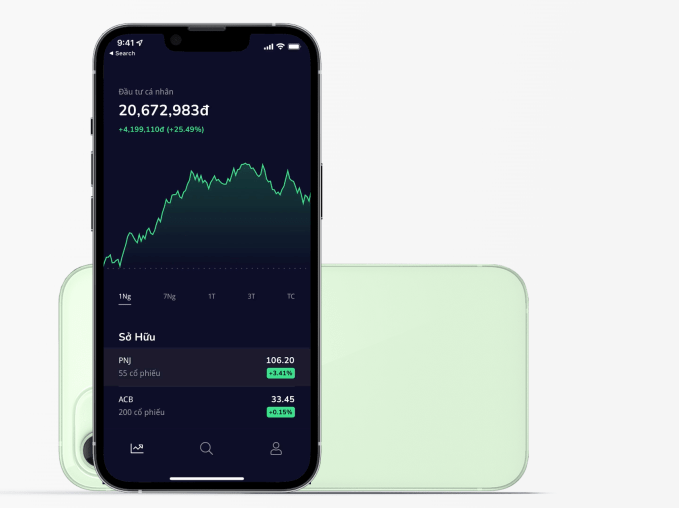

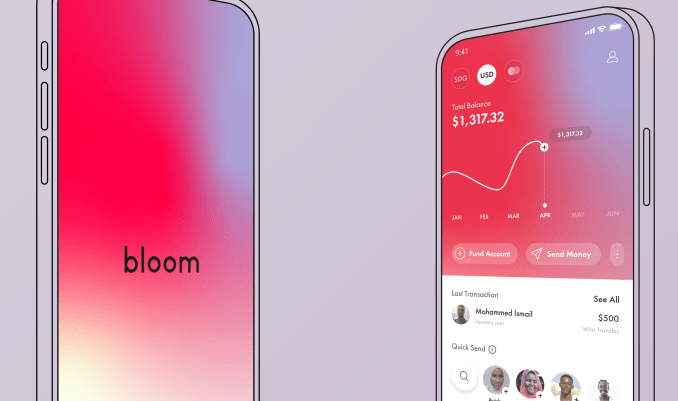

| The 25 crypto startups that Y Combinator is backing in its W22 batch Posted: 29 Mar 2022 05:58 PM PDT Crypto was big at YC this batch. Y Combinator Demo Days returned yet again with another ballooning heap of startups. In the old days, a gaggle of TechCrunch reporters would go to the Demo Day in person, write up the presentations of each startup and hobnob with VCs during the breaks, but in a post-pandemic bloat, YC has gotten just so massive that one comprehensive list of startups is neither feasible nor particularly useful to readers. That said, this was a massive year for crypto and I wanted to make sure that we profiled each and every crypto startup that publicly launched at Demo Days this batch. The list of 25 companies unsurprisingly spans NFTs, DeFi, web3 services and crypto investing. A couple of notes on these descriptions… These are listed in the seemingly random order in which they appeared on the YC Demo Days site. The “What it says it does:” sections are also taken from that site, while the “Founders:” section is largely based on info from the LinkedIn profiles of the co-founders of each startup. I have not personally fact-checked any of the information that was self-reported by the founders themselves. The “Quick thoughts:” section is made up entirely of my own insightful thoughts, though I also cannot guarantee that they are always all that insightful. Now, onto the startups… But wait! While I have you, please do me a favor and subscribe to TechCrunch’s new crypto-focused podcast and newsletter Chain Reaction which is launching in April — hosted by myself and my colleague Anita Ramaswamy. Okay, now, onto the startups!! SimpleHashWhat it says it does: “SimpleHash allows web3 developers to query all NFT data from a single API. We index multiple blockchains, take care of edge cases, provide a rapid media CDN, and can be integrated in a few lines of code.” NFTScoringWhat it says it does: “NFTScoring is the place for you to discover, analyze and trade NFTs. We give you the superpowers to understand the NFT market in any given moment, make the best decisions, and take faster actions.” Remi LabsWhat it says it does: “Launching an NFT collection can seem tantalizing for brands, however, when executed poorly can create long-lasting negative implications. We take the cringe out of NFTs.”  Image Credits: Poko PokoWhat it says it does: “We are building Slack for Web3. We aim to replace LLCs with DAOs in emerging market cross border collaborations. We will take costly multi-step months-long company registration and setups down to $50 a month and with the ease of opening a Slack channel.” GoSatsWhat it says it does: “GoSats is a bitcoin rewards app. We help people accumulate free bitcoin as cashbacks and rewards every time they shop in India.” CashmereWhat it says it does: “Cashmere is a crypto wallet for web3 startups to manage their digital assets on Solana. Instead of running their business from one person's wallet, startups can use our wallet to collaboratively manage their funds.” ChaingrepWhat it says it does: “Chaingrep is a search engine for on-chain interactions and digital assets. You can think of it as a new kind of block explorer. We think that current block explorers like Etherscan are too complicated to use for regular users, and that abstracting a lot of their functionalities and filtering out all the noise can dramatically improve the experience of finding on-chain information.”  Image Credits: Winter WinterWhat it says it does: “Winter offers an embeddable widget to help your consumers buy an NFT with a credit card or bank account! We also help custody & manage a user’s NFT if they don’t have a wallet.” DecentWhat it says it does: “Decent enables musicians to monetize their work directly through their fans, aligning artist & fan incentives to reinvent funding, IP protection, and discovery. We do this through a marketplace and infrastructure that enables musicians to issue NFTs collateralized by their royalties.” YatimaWhat it says it does: “Yatima is a Substrate blockchain which uses on-chain formal verification and zero-knowledge proofs to radically improve the safety and scalability of smart contracts, and other deterministic computations.”  Image Credits: CypherD CypherD WalletWhat it says it does: “Existing Crypto Wallets are too geeky for mainstream users. We are building a multi-chain crypto wallet simplifying user experience for the mainstream users along with a crypto card.” CourtyardWhat it says it does: “Courtyard stores physical collectibles (trading cards, sneakers, watches, etc.) in secured vaults, creates a 3D representation of the asset and mints it as an NFT on the blockchain. We've partnered with one of the largest security companies in the world to store collectibles.” PayourseWhat it says it does: “We build the tools and infrastructure that make it easier, faster and cheaper for anyone in Africa easy, fast and cheap access to crypto and web3.” ArgoWhat it says it does: “Argo is on a mission to empower Film and TV makers worldwide. It's the easiest way to upload and monetize your content. Argo provides the technology and the ecosystem for the Filmmakers to monetize their film and tv work through advertising, subscription and NFT sales.” FinntWhat it says it does: “Finnt is the first DeFi app for families. We provide multi-user, high yield saving accounts, which make it easy to save with crypto for your children or family members.”  Image Credits: Tradezi TradeziWhat it says it does: “Tradezi is the Robinhood for Southeast Asia. We aim to help everyone invest in stocks, crypto, and other alternative assets all in one place.” BotinWhat it says it does: “Botin a mobile app where people in Latin America can invest in US Stocks, Crypto and more.” earnJarvisWhat it says it does: “earnJARVIS is a crypto investment platform that helps retail investors (i.e, you) and businesses intelligently invest across the crypto-economy.” MagnaWhat it says it does: “We’re bring universally needed tools to crypto companies to help them manage their token distributions, tokenholder onboarding/offboarding, and other critical tools.” SoonWhat it says it does: “With Soon you can invest without the stress of speculating. Our fully automated sweep account attaches to your bank and uses routine spending activity to signal market trades. By investing on a schedule and selling available gains when you spend, Soon automates investing from beginning to end.” LiquiFiWhat it says it does: “LiquiFi (“Carta for crypto”) helps companies and DAOs automate their token vesting, management, and distribution to employees, investors, partners, and community members. Secure, audited smart contracts guarantee timely distribution of vesting tokens and save significant time and resources spent building your own solution.” ArdaWhat it says it does: “A single API for fintechs to embed DeFi products on their platform. This allows them to acquire more customers, retain these customers and increase revenue & engagement, all in a custodial, secure, & compliant way.” OnScaleWhat it says it does: “OnScale is business bank for high-earning Creators that automates income budgeting, cash flow management, tax write offs and invoicing. We help creators automate financial tasks, save money and time.” BlocknomWhat it says it does: “We make crypto investing safe and easy for consumer and businesses through DeFi yielding. Our product is plain simple. People can deposit and withdraw in 3 clicks. Right after deposit, they might earn competitive interest with no hidden fees. The interest is obtained from DeFi protocols.”  Image Credits: Bloom BloomWhat it says it does: “Bloom offers students and young professionals in East Africa US Dollar banking. By saving in USD or digital dollars, and spending as they go in local currencies, they won’t be subject to inflation.” Take a look at some more of our Y Combinator Demo Day coverage. |

| Everything you need to know about YC Winter 2022 Demo Day, part 1 Posted: 29 Mar 2022 05:35 PM PDT The TechCrunch team spent today covering the first day of Y Combinator’s Winter 2022 Demo Day, which featured half of the 394 companies that plan to virtually present. Since the overall batch is bigger than ever before – with 414 companies in total – we decided to divide, conquer and create a slew of YC Demo Day trend pieces for you to parse through the cohort. It’s not all inclusive – you can check out Y Combinator’s blog for a list at your own leisure – but instead we aimed to provide signal amid the noise, and shout out out some of our favorite companies within this season’s batch as well. Before you check out all of our coverage from Day 1, there are some broader statistics and notes about the cohort to note. The fully virtual cohort, YC’s 34th Demo Day to date, was the first group to receive Y Combinator’s new standard deal. The deal, announced in January, is a $500,000 investment across two checks for the same equity stake as before, 7%. Other firsts for the 2022 YC Demo Day batch include country representation from New Zealand, Sudan, Uganda and Costa Rica. Despite growing its check size, geography focus and the overall size of the batch, YC’s Demo Day mostly fell on diversity. About 10% of founders in this cohort identify as women, down from 12% the batch prior. About 6% of founders in this cohort identify as Black, slightly up from 4% from the year prior, and 12% identify as LatinX, down from 15% the year prior. Big thank you to our team – Mary Ann, Kate, Connie, Lucas, Devin, Alex, Alyssa, Amanda, Anna, Bryce, Greg, Henry and Tage – for the team work. Okay! Without any further ado, here’s what we got into today: TC’s YC Demo Day Favorites, part 1The TechCrunch staff spends lots of time diving into the technologies that startups are building, the sectors they are focused on, and the parts of the world they hope to serve. As a result, each of us has a distinct perspective covering YC Demo Day. Out of the hundreds of companies we saw today, which stood out the most to TechCrunch staffers? Read on here! India Startups at YC Demo DayMore than 191 companies in India have been funded through YC accelerator with nearly half of those companies accepted in the last 12 months. This year’s batch of YC Demo Day companies plan to tackle a diverse range of challenges within tech, but appear concentrated mostly within the financial services sector. Think 'buy now, pay later' pitches, savings-focused neobanks and, of course, bitcoin bets. It's a contrast from prior showings, in which most of India's YC startups fell into the B2B services category. Here’s the full list of the startups based out of India in the Winter 2022 batch. Fintech YC Demo Day batchThere are 35 fintech companies this year at YC Demo Day, just over double the amount of the 2021 winter batch and up from 18 in the summer program, according to the organization's directory. We’ve listed each startup presented with thoughts about the broader problem each is trying to solve. What you'll notice about this year's cohort is the prevalence of companies from Nigeria, Indonesia and Argentina. Here’s the list of fintech startups presented at YC Demo Day 2022. Africa Startups at YC Demo DayThe U.S. has the most representation at YC Demo Day W2022. India, with 32 startups, is the second-largest demographic represented in this new batch, while Nigeria is third, having delivered a total of 18 startups. This is the first time an African country is appearing in the top three. Africa as a whole has 24 startups in this new batch, a record besting S21's 15. Read the list, in alphabetical order, on the batch of African startups at YC W22 here. Competitive startups in the same YC batchYC seems to be actively leaning into startups that are roughly the same age, operating in the same countries and targeting exactly the same opportunity with nearly identical business models. While similar types of companies within a class had grown inescapable as YC's class sizes have ballooned, a kind of sameness is more apparent than ever with it latest batch of 400 startups. In fact, it's beginning to look like the plan here is to back as many nascent rival teams as possible — then let them duke it out. We’ve rounded up some of the startups that seem to us to overlap within this YC Demo Day W22 batch. Read our coverage here.

|

| AR glasses maker Nreal nabs $200M funding in 12 months Posted: 29 Mar 2022 04:30 PM PDT China’s augmented reality startup Nreal is on a roll. The company, which hopes to bring AR to the masses by making bright-color, lightweight smart glasses, has just received $60 million in a Series C extension round, bringing its total funding in the last 12 months to a handsome $200 million. The new investment is led by Alibaba, which has historically been a more hands-on but less active corporate investor than its archrival Tencent. The Chinese e-commerce giant has a reputation for acquiring controlling stakes in startups that can potentially be a complementary piece to its giant retail ecosystem. Alibaba’s investment in Nreal, however, is purely financial. In theory, the two could have generated strategic synergies. One could easily imagine Alibaba hooking Nreal up with its gaming and video streaming units, or even having it develop smart glasses for its millions of food delivery riders — who recently began wearing voice-controlled helmets. But with the onset of China’s antitrust crackdown, the country’s tech behemoths have no doubt become more cautious with any investment that can be perceived as encouraging unfair competition. Plus, Nreal, which was founded by Magic Leap veteran Chi Xu, already has a club of notable partners. Some of its strategic investors are Chinese electric vehicle upstart Nio, short video app Kuaishou — TikTok’s nemesis in China and Baidu-backed video streaming platform iQIYI. Qualcomm is not an investor but supplies cutting-edge Snapdragon processors to the hardware maker and works closely with it to build a developer ecosystem. Nreal is also backed by renowned institutional investors, including Sequoia China, Jack Ma’s Yunfeng Capital, Xiaomi founder Lei Jun’s Shunwei Capital, as well as private equity giants Hillhouse, CPE and CICC Capital. Despite being China-based, Nreal hasn’t targeted its home market but has instead first tested the consumer appetite in six overseas countries, including Japan and the U.S. The smart glasses maker has relied on partnering with local carriers to tout its devices. In the U.S., for example, Verizon is helping to sell Nreal’s mixed reality glasses Light, which has a relatively affordable price tag of $600 and can be plugged into a 5G-compatible Android device. With the proceeds from its latest round, Nreal will finally make a foray into China this year. The funding will also be spent on R&D and growing its ecosystem of content and apps, which will be critical to user adoption. |

| Our favorite startups from YC’s Winter 2022 Demo Day, Part 1 Posted: 29 Mar 2022 04:16 PM PDT Day one of Y Combinator’s Demo Day confab for the Winter 2022 batch is over. We shook up our coverage this year, divvying things up by sector and geography. Our goal was to avoid a huge list, the sort that we compiled in years past. TechCrunch has notes on the ever-growing contingent of companies from Africa, Indian startups, international fintech and even a discussion on intra-startup competition at the accelerator. But one thing we’re not changing with our Y Combinator coverage is collecting favorites. Naturally, this is just our opinion. Our staff spends lots of time diving into the technologies that startups are building, the sectors they are focused on and the parts of the world they hope to serve. As a result, each of us has a distinct perspective. So, our favorites often stem from areas we know best and what we are currently fascinated by. Out of the hundreds of companies we saw today, which stood out the most to TechCrunch staffers? Read on! Our favorite startups from YC Winter 2022, day oneThe following list is in no particular order. Companies’ websites and authors’ Twitter profiles are linked. Alex Wilhelm: Discz Music

|

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment