TechCrunch |

- Post-pandemic, used car startup platforms are booming — and the latest is Spotawheel

- Raising monster rounds for self-driving mobility startups on TechCrunch Live

- Dat Bike is the creator of Vietnam’s first domestic electric motorbike

- Sumutasu secures $10M to digitize Japan’s real estate market

- Daily Crunch: US dangles reward up to $10M for info on 6 elite Russian military hackers

- WhatsApp follows Google in giving cash-back rewards to win payments users in India

- Meta says Reels now makes up over 20% of the time users spend on Instagram

- Meta says its metaverse biz lost another $3B… but the 2030s will be ‘exciting’

- Elon Musk wins $13B suit over Solar City deal Tesla shareholders called a ‘bailout’

- Dear Sophie: When should I sponsor engineers for green cards?

- Ford earnings weighed down by Rivian stake

- HBO Max app just had one of its best quarters to date, but app performance still has room to improve

| Post-pandemic, used car startup platforms are booming — and the latest is Spotawheel Posted: 27 Apr 2022 07:00 PM PDT Used-car digital platforms have been proliferating across the world for a handful of significant reasons, but most of those are related to our recent pandemic. Among those reasons is the rapid digitization of the used car industry, as startups have flooded the market with easier-to-use platforms that the older e-commerce-style ones lacked. The other is that – with the pandemic straining supply chains for micro-chips, essential in new cars – the premium on used cars market has skyrocketed, even as the supply of new cars has been constricted. Among the platforms to have arisen in the last couple of years is Autohero which has jumped on the used car market. The ‘used car boom’ is now spreading across Central & Eastern Europe with the news that Spotawheel, the CEE-focused used-car platform had raised a €100M in equity and asset-backed debt, he said: “Athens-based VentureFriends led the equity round, with participation from Adevinta Ventures, UNIQA Ventures, Rockaway Ventures, Velocity Partners, FJ Labs, Collective Spark and, others. The debt side of the round was led by an unnamed UK-based credit fund together with some equally unnamed institutional investors. The credit fund subscribed to the equity round as well. "We are very excited to further support Spotawheel in its quest to expand internationally while upgrading its Europe-wide data-driven inventory sourcing .T, said George Dimopoulos, Partner at VentureFriends. The company says it expects to add more staff and scale up Germany operations while establishing teams throughout Western Europe. |

| Raising monster rounds for self-driving mobility startups on TechCrunch Live Posted: 27 Apr 2022 06:33 PM PDT Raquel Urtasun founded Waabi in 2021 after spending nearly three years as Uber’s R&D head of Advanced Technology Group (ATG). Waabi’s mission is to develop an AI-first approach to speed up the commercial deployment of autonomous vehicles, starting with long-haul trucks. To do so, her company raised an $83.5 million Series A with Khosla Venture’s Sven Strohband leading the round. Both will speak to Urtasun’s unique (and commanding) perspective, and what allowed the company to raise the massive Series A. This event opens on May 11 at 11:30 am PT / 2:30 pm ET with networking and pitch practice submissions. The interview begins at 12 pm PT followed by the TCL Pitch Practice at 12:30 pm PT. Register here for free. TechCrunch Live records weekly on Wednesday at 11:30 am PT / 2:30 pm ET. Join us! Click here to register for free and gain access to Waabi’s pitch deck, enter the pitch practice session and access the livestream where you can ask the speakers questions |

| Dat Bike is the creator of Vietnam’s first domestic electric motorbike Posted: 27 Apr 2022 06:00 PM PDT  Dat Bike founder and CEO Son Nguyen Dat Bike is on a journey to reduce the amount of gasoline used in Vietnam. The startup makes electric motorbikes with key components that it designs and produces domestically to reduce costs and improve performance. Today, Dat Bike announced it has raised a $5.3 million Series A led by Jungle Ventures, with participation from Wavemaker Partners. Both are returning investors. Jungle Ventures led Dat Bike's seed round a year ago, when TechCrunch first profiled the company. The latest funding brings Dat Bike's total to $10 million raised since it was founded in 2019 by Son Nguyen. Dat Bike is recognized by the Vietnam Ministry of Transportation as the first domestically-made electric bike. Nguyen said that Dat Bike uses vertical integration instead of relying on third-party, imported electric drivetrains and parts because that keeps costs down while improving quality. Most of the parts on Dat Bike's vehicles are designed by the company and 80% of its suppliers are located in Vietnam. It also uses a direct-to-consumer distribution model, pushing prices down lower. Part of the funding will be invested in its technology. Nguyen explained that the three most important parts of an electric bike are its battery, motor and controller. Right now, Dat Bike owns technology for its battery packaging and controller. With its new capital, it will be able to invest in its engine technology. Nguyen added that the company will also upgrade its mobile app, adding new features and shortening the feedback loop on its error reporting feature. One major thing the company had to address was consumer concerns about the performance of e-bikes compared to their gasoline counterparts. The company says its first product line, the Weaver, displayed three times the performance (5 kW versus 1.5 kW) and two times the range of (100 km vs 50 km) of most competing electric bikes. Dat Bike's second model, the Weaver 200, was launched last year with higher performance, or a range of 200 km and 6 kW power. It also reduced charging time from 1 hour for 100 km to 2.5 hours for its full 200 km charge. "We aim to develop a new product every year and research for faster charging," Nguyen said. Dat Bike currently has two stores in Ho Chi Minh City and Hanoi, and its bikes can be ordered online, too. Part of the funding will be used to expand its offline-to-online model into more large cities, including Thai Nguyen, Bac Ninh, Hai Phong, Hai Duong, Ha Long, Vinh, Quy Nhon, Nha Trang, Danang, Can Tho and Vung Tau. |

| Sumutasu secures $10M to digitize Japan’s real estate market Posted: 27 Apr 2022 05:08 PM PDT Sumutasu, a Tokyo-based proptech startup that offers a direct online real estate purchase service, has secured $8.2 million in equity and $1.6 million in debt. The company has raised a total of $16 million since its 2018 inception. Takahiro Sumi (CEO) and Tomoya Ito (COO) co-founded Sumutasu four years ago to streamline the buying and selling of residential real estate. In Japan, where the real estate market is fragmented, homeowners have faced uncertain selling prices riddled with brokerage fees and an average selling period of between four and eight months, Ito said. Those factors have led to a low percentage of existing homes in circulation in Japan — around 15% compared to the 80% typically seen in countries like the U.S. and the U.K., per the 2020 report of the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). Sumutasu says its platform enables users to access a fair house valuation in an hour. Sumutasu has adopted an iBuyer model — meaning it buys houses directly from homeowners, renovates them at scale, then resells them to buyers. While the U.S. and Europe have a more competitive iBuyer market with Opendoor, Zillow, Offerpad and Redfin, Japan has a nascent iBuyer industry, according to the company. “The business model is similar in the way that it is an arbitrage model where the difference between the purchase price and the sales price is the profit,” Ito told TechCrunch. “The difference is that we purchase from the seller at a discount from the market price. The reason we are able to purchase at a discount is that we offer sellers the value of being able to sell at their own time and hassle-free.” Additionally, unlike the iBuyers that charge service fees, Sumutasu does not charge a commission or processing fee because the transaction is conducted directly with the seller — without an agent in between, Ito said in an interview. When purchasing an existing house in Japan, brokerage fees usually amount to about 3% of the property price, Ito added. The Japanese real estate tech startup operates its service in Tokyo but plans to take it to more areas like Osaka and Nagoya. With the latest funding, the company plans to continue to buy more houses, and launch its mortgage brokering service next year, aiming to increase sales five-fold compared to 2021. It also intends to expand its headcount. Sumutasu has purchased approximately 100 properties and currently maintains 30 property listings due to smooth progression of sales, Ito told TechCrunch. The company is partnered with more than 20 banks and remodeling companies. Existing backer World Innovation Lab (WiL) and new investor Mobile Internet Capital co-led the Series B, with participation from other new investors Mercuria Investment, Carta Ventures and Kiraboshi Capital. Japan Finance Corporation led the debt financing. "Despite the iBuyer business having a huge potential in terms of the market size, we haven't seen this business model in Japan for a long time due to it being financially intensive," said partner of World Innovation Lab Toshimichi Namba. "We are confident that they [Sumutasu] can leverage this less competitive landscape to further fuel their growth." The company has a team of 30 people. |

| Daily Crunch: US dangles reward up to $10M for info on 6 elite Russian military hackers Posted: 27 Apr 2022 03:40 PM PDT To get a roundup of TechCrunch's biggest and most important stories delivered to your inbox every day at 3 p.m. PT, subscribe here. It's April 27, 2022, and here's a thing we didn't see coming: May. What the hell happened to this month, this year? As the summer equinox draws closer, the weather warms up and the days get longer, we long drinks with tiny rainbow umbrellas in them. If you're reading this in the Southern Hemisphere: Sorry for our summery optimism. Please enjoy some hot chocolate and fuzzy socks as we take a dip in the pool. – Christine and Haje The TechCrunch Top 3

Startups and VCIt's fundraising season for venture funds, apparently! MassMutual Ventures closed a $300 million fund to back Asian and European startups. Lightspeed India Partners announced a half-billion-dollar fund. Crypto-focused Dragonfly Capital officially announced its third fund, weighing in at $650 million. A little less aspiration, a little more traction, please:

How to get into Y Combinator, according to YC's Dalton Caldwell Image Credits: Third Eye Images (opens in a new window) / Getty Images In a conversation with Editor Greg Kumparak at TechCrunch Early Stage, YC managing director and group partner Dalton Caldwell spoke about the application process founders must navigate before they’re accepted to one of the world’s top accelerators. "The first thing I look at when I read an application is the team. What I'm looking for is technical excellence on the team," said Caldwell. “Our teams that rely on trying to hire outsourced engineers or consultants or whatever to build their product tend to move much slower than folks with a technical founder,” he added. “They tend to get ripped off.” (TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.) Big Tech Inc.Robinhood announced plans to lay off 9% of its staff just before the investing and trading service was poised to come out with its earnings. We'll have to see what happens Thursday — and whether that sheds light on the situation. In earnings talk, Spotify's stats told us what we already assumed: that the controversy around having a Joe Rogan podcast did little to sway subscriber numbers, which grew 15%. Yesterday, we prepared you for the General Motors earnings, and today, we are able to share that GM has some big ambitions and some serious cash to put behind it. Stay tuned for Ford. Meanwhile, Alphabet's earnings showed some mixed results — Google doing well, YouTube not so much, though the number of channels making $10,000 in revenue grew 40%. Not bad. Salesforce updated its low-code workflow tool, Salesforce Flow, which Ron described as "a bold attempt to pull together all of the pieces in the Salesforce arsenal in a more coherent fashion, using a popular tool that has been around since 2019 to do the job." Twitter news continues, from what happened at the company's all-hands meeting to Devin's opinion piece to how much Elon Musk and Twitter will have to pay each other should the deal fizzle. Follower counts on high-profile accounts fluctuated all over the place, with Twitter saying the undulations were mostly organic. Alex and Amanda came together to chat about all things Elon Musk and Twitter for the latest Equity podcast. We also have the skinny on Musk's attempt to end an SEC settlement regarding Tesla tweets. Here are some others we think you might like:

|

| WhatsApp follows Google in giving cash-back rewards to win payments users in India Posted: 27 Apr 2022 03:34 PM PDT WhatsApp, the most popular smartphone app in India, is employing one of the most popular strategies that has proven to drive users in the world’s second largest market to a service: cash-back. The Meta-owned instant messaging service is running a campaign as part of which it is giving away about 11 Indian rupees, or 14 cents, up to three times to users if they send money to three different people on the app, according to users and an official company support page. The reward comes at a time when WhatsApp is attempting to expand the reach of its mobile payments service in India. Even as WhatsApp began exploring mobile payments in India as early as 2017, regulatory pushback has prevented the popular app from aggressively expanding its payments service. WhatsApp got some relief earlier this month when the National Payments Corporation of India, the payments body that oversees the popular payments protocol UPI, which WhatsApp is using, permitted the messaging firm to extend the payments service to 100 million users, up from 40 million earlier. WhatsApp, which began testing the cash-back rewards in India as early as November of last year (if not earlier), is extending the perk to users who have been using the app for at least 30 days and have registered for payments on WhatsApp by adding their bank account details. WhatsApp Business users are not eligible. “We're introducing a cashback promotion for selected WhatsApp users. If you become eligible for the promotion, you might see a banner within the app, or a gift icon when you're sending money to an eligible receiver,” the company says on the support page.  Image Credits: TechCrunch WhatsApp is not the first service to offer cash-back rewards in hopes of courting users. Google also offered users in India about 65 cents for making their first payments transaction when it launched Tez (since rebranded to Google Pay) in 2017, and has since offered as much as $40 to $50 to users to drive engagement and retention. Local giants Paytm and MobiKwik have also delivered cash-back to users for years in the country, and continue to offer similar perks for certain features on the app. The cash-back should help WhatsApp accelerate its efforts to make inroads in India’s mobile payments market, which is currently dominated by Google and Walmart-backed PhonePe. WhatsApp says on the support page that it won’t be offering cash-back for QR code payments, or money sent on collect requests. Users sending payments to users with UPI ID on other apps will also not be eligible. In a statement, a WhatsApp spokesperson said: “We are running a campaign offering cashback incentives in a phased manner to our users as a way to unlock the potential of payments on WhatsApp. Offering safe, secure and easy-to-use digital payments is an important part of scaling India's digital economy, and we'll continue to drive awareness of payments on WhatsApp as part of our broader efforts to bring the next 500 million Indians onto the digital payments ecosystem.” |

| Meta says Reels now makes up over 20% of the time users spend on Instagram Posted: 27 Apr 2022 03:23 PM PDT Meta announced during its Q1 2022 earnings call that Reels, its short-form video feature and TikTok rival, now makes up more than 20% of the time that people spend on Instagram. The company also noted that video, overall, makes up 50% of the time that users spend on Facebook. Although Meta didn’t specify how much of that time is made up by Reels, it noted that Reels are performing well on Facebook as well. Meta CEO Mark Zuckerberg said during the call that although its short-form video product doesn’t monetize as well as Stories currently do, the company is optimistic about improving this in the future. Zuckerberg pointed toward the company’s experience with Stories, which at first wasn’t monetizing as well as the main Instagram feed but had improved over time. Meta expects to see a similar experience with monetizing Reels over time, but notes that it’s going to be a multiyear journey and that the company is still in the early days of ads in Reels. Zuckerberg outlined that since starting Facebook 18 years ago, the company has seen multiple shifts in the media types that people use and that short-form video is only the latest iteration and is growing quickly. He outlined that while Meta is seeing an increase in short-form video, it’s also seeing a major shift in the advancement of AI recommendations driving more of its feeds, for both posts and Reels. He elaborated that feeds are going from being exclusively curated by users’ social circles to being recommended by AI. “Being able to accurately recommend content from the whole universe that you don’t follow directly unlocks a large amount of interesting and useful videos and posts that you might have otherwise missed,” Zuckerberg stated. “The AI that we’re building is not just a recommendation system for short-form video, but a discovery engine that can show you all of the most interesting content that people have shared across our systems.” TikTok’s powerful recommendation algorithm is one of the reasons behind its immense popularity, which is why it makes sense for Meta to focus on enhancing its own recommendation systems to get people to interact with Reels more, and in turn, be better aligned to compete with TikTok. Meta’s comments on Reels monetization come a day after Google revealed that it has started testing ads in YouTube Shorts. Google CEO Sundar Pichai also announced that YouTube Shorts, the platform's TikTok clone, is generating 30 billion views per day, which is four times more than last year. Meta and YouTube’s short-form video efforts are a direct response to the success of TikTok, which has proven to be one of the world's fastest-growing social media platforms, according to recent data. Meta has been looking to enhance Reels over the past few months and has largely adopted several of TikTok’s features over time, including a Duet-like tool called Remix, to help it compete with the platform. As for Meta’s quarterly earnings overall, Facebook boasts 1.96 billion DAUs, up from 1.92 billion last quarter. In addition, Meta's Reality Labs operated at a loss of $2.96 billion in Q1 alone, and last year, Reality Labs lost over $10 billion. |

| Meta says its metaverse biz lost another $3B… but the 2030s will be ‘exciting’ Posted: 27 Apr 2022 03:10 PM PDT Do you hear that? It’s the sound of every Meta executive breathing a deep sigh of relief, because unlike last quarter, Facebook’s daily active users (DAUs) are up… a little. For the second time since its rebrand from Facebook, Meta has reported its quarterly earnings. Last time, the Facebook platform reported its first decline in DAUs in its 18-year history, but now, Facebook boasts 1.96 billion DAUs, up from 1.92 billion last quarter. Of course, Meta's family of apps — Facebook, Instagram, WhatsApp, Messenger — isn't the star of the show. As CEO Mark Zuckerberg explained, the revenue from these apps is helping to fund Meta's projects in virtual reality, which he is betting will become the company's crown jewel in the future. Was this worth renaming the company for? In Q1 alone, Meta's Reality Labs operated at a loss of $2.96 billion, and last year, Reality Labs lost over $10 billion. "It's not going to be until those products really hit the market and scale in a meaningful way, and this market ends up being big, that this will be a big revenue or profit contributor to the business," said Zuckerberg. "This is laying the groundwork for what I expect to be a very exciting 2030." Horizon Worlds, Meta's social VR app, started rolling out creator monetization features late in the quarter, but those in-app purchases won't move the needle much if the platform doesn't significantly woo more users. Soon, Meta will roll out a web version of Horizon Worlds, welcoming people who don't have $300 to drop on a VR headset. Zuckerberg said that Horizon is the “centerpiece” of the company’s strategy to develop the metaverse. "I recognize it's expensive to build this. It's something that's never been built before," Zuckerberg said. He conceded that because of these investments, Meta's overall profitability won't grow in 2022, especially since ad revenue hasn't grown as fast as expected. Like its competitors at Snapchat and YouTube, Meta also cited a downward trend in ad revenue due to the Russian war on Ukraine (Facebook is now banned in Russia). Overall, Meta's quarterly revenue rose by 7%, missing analysts' 7.8% expectation. The combination of increased DAUs and lower-than-expected ad revenue can be explained by the fact that Meta's apps are growing in regions like the Asia-Pacific region, where ads cost less, rather than the U.S. and Europe. Meta's most promising money-maker from Reality Labs are the headsets themselves. The Meta Quest 2 had a big bump in sales during the holiday season, and the company is already looking toward releasing its newest headset later this year, codenamed "Project Cambria." Zuckerberg said that the new, premium headset will be "focused on work use cases and eventually replacing your laptop or work setup." Meta is also building eye-tracking and face-tracking so that when you're socializing in VR, people will be able to perceive your real-life facial expressions. He added that we can expect more news on the headset in the months ahead. Back on its family of apps, Meta faces competition from TikTok as it aims to overtake the platform as the leader in short-form video. But Zuckerberg reported that his company’s investment in its TikTok clone Reels is working, noting Reels makes up 20% of the time that users spend on Instagram. Plus, video accounts for 50% of the time that users spend on Facebook. “I’m just trying to lead the company in a way where we’re positioning ourselves as the premier company for building the future of social interaction and the metaverse,” Zuckerberg said. “If you care about those things, I think we’re getting the best people to come work here.” |

| Elon Musk wins $13B suit over Solar City deal Tesla shareholders called a ‘bailout’ Posted: 27 Apr 2022 03:07 PM PDT A Delaware judge has sided with Elon Musk in a hefty lawsuit brought by Tesla shareholders, which accused the executive of coercing the electric vehicle company’s board into buying SolarCity back in 2016. Seeking as much as $13 billion in damages, the shareholders alleged that Tesla’s $2.6 billion, all-stock SolarCity deal amounted to “a rescue from financial distress, a bailout, orchestrated by Elon Musk,” per a January statement from the plaintiff’s attorney, Randy Baron. While the court found that Musk “was more involved in the process than a conflicted fiduciary should be,” it ultimately ruled in favor of the “technoking” on all counts. Shareholders still have the option to file an appeal. At the time of the deal, Musk’s connections to Solar City ran deep. The unprofitable solar energy firm was co-founded and co-led by Musk’s first cousins, Lyndon and Peter Rive, and Musk was Solar City’s largest shareholder and chairman. “[The] Tesla Board meaningfully vetted the Acquisition, and Elon did not stand in its way,” read the opinion by Vice Chancellor Joseph Slights. “Equally if not more important, the preponderance of the evidence reveals that Tesla paid a fair price — SolarCity was, at a minimum, worth what Tesla paid for it,” Slights added. The verdict is a clear win for Musk, but the court declined to force the shareholders to cover his legal fees. Slights concluded that the Tesla boss and Twitter suitor “likely could have avoided” the case in the first place, “had he simply followed the ground rules of good corporate governance in conflict transactions.” |

| Dear Sophie: When should I sponsor engineers for green cards? Posted: 27 Apr 2022 02:47 PM PDT Here’s another edition of "Dear Sophie," the advice column that answers immigration-related questions about working at technology companies. "Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams," says Sophie Alcorn, a Silicon Valley immigration attorney. "Whether you're in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column." TechCrunch+ members receive access to weekly "Dear Sophie" columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off. Dear Sophie, The engineers that we're trying to recruit are increasingly requesting that we sponsor them for green cards. I don't have an HR background, but I've been assigned HR duties at our startup. Can you give me a rundown of the green cards that are available? Is it possible to sponsor someone for a green card without them getting an H-1B or other visa first? Which green card is the fastest? — Targeting Talent Dear Targeting, With the ongoing and intensifying competition for tech talent in the wake of the Great Resignation, I find myself addressing questions like yours quite frequently. That's no surprise: Turnover in tech last year was remarkably higher than in health care, according to the Harvard Business Review. Resignations within the tech industry increased 4.5% last year compared to the previous year, while in health care, resignations increased 3.6%. As you explore this process, consider looking at green cards and other immigration support not only as a way to recruit candidates and retain employees, but as an opportunity to shape your company culture. Now is the time to present your company as one that values innovation, diversity, creativity, inclusivity and the security and well-being of your employees. This will ultimately bring resilience to your company. Let's get into it. Which green card is the fastest?Of all the employment-based green cards, the EB-1A extraordinary ability green card is the quickest option. This option requires significant proof of accomplishment in your field — which can be a challenge for some (more details below). The EB-1A is the fastest for two main reasons: It currently allows for Premium Processing, where you can pay $2,500 extra and the government will adjudicate the petition in 15 calendar days, and, for people subject to the India/China-green card backlogs, the EB-1 First Preference green card category always has the most movement and availability. Good news for green card processing: U.S. Citizenship and Immigration Services just announced that it will be adding premium processing to more categories. This fiscal year, it will be adding a Premium Processing option to both the EB-1C Multinational Manager and Executive green card category as well as the EB-2 National Interest Waiver green card category. In the coming months, USCIS will launch this option: You will be able to pay an additional $2,500, and USCIS will promise to adjudicate your I-140 petition in EB-1C or EB-2NIW in 45 (not 15!) days.  Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window) |

| Ford earnings weighed down by Rivian stake Posted: 27 Apr 2022 01:50 PM PDT Ford reported Wednesday a multibillion dollar loss in the first-quarter due to a massive write-off on the value of its stake in Rivian. Shares still rose in after-hours trading as investors focused more on Ford's fundamentals — including beating analysts' estimates on revenue and adjusted earnings — and not its Rivian holding. Ford generated $34.5 billion in revenue in the first quarter of 2022. That beat analysts' expectations of $31.2 billion worth of revenue, albeit falling from its year-ago result of $36.2 billion. That Ford managed to beat revenue expectations but still lost so much money might surprise you. Investors were not shocked, with Ford reporting adjusted profits within a penny per share of estimates. Still, the car company lost $3.1 billion in GAAP terms in Q1, largely due to a write-off of the value of its stake in Rivian, an electric car company that has had a tumultuous life on the public markets. Ford told investors that its quarterly net loss was "primarily attributable to a mark-to-market loss of $5.4 billion on the company's investment in Rivian." If the scale of the Rivian-induced hit to profitability surprises you, recall that the EV company's stock crested at $179.47 per share according to Yahoo Finance data, before suffering from a decline to $31.22 today at the close of regular trading. In simpler terms, the value of Ford's stake in Rivian fell by more than half from $10.6 billion at the end of 2021 to just $5.1 billion as of the quarter ended March 31. Rivian's stock has shed another double-digit percentage of its worth since that date, indicating that Ford could take another paper loss in the second quarter. Ford would not comment on Rivian further when questioned by investors during Wednesday’s earnings call. Past the company's accounting-induced net loss, Ford earned $2.3 billion worth of adjusted EBIT (earnings before interest and taxes) according to its earnings report. EVs and supply chainWhile the supply chain issues spurred by the pandemic have created numerous headaches for nearly every industry attempting to reach production goals, in at least Ford’s case, it might have inspired a strategy of vertical integration that could weather future storms. During Wednesday’s earnings call, the automaker expressed a positive outlook for 2022 backed by its efforts the past few years to secure battery and EV manufacturing in-house and serious demand in its EV lineup. CEO Jim Farley even openly sent a message out to metal and mining industry that Ford is looking for good deals on lithium and nickel and will invest capital to move processes from overseas to North America. Positive outlook notwithstanding, Ford said it shipped 970,000 vehicles in the first quarter, down 9% from a year ago as a continuing global shortage of semiconductors held down the automaker's January and February production and shipments. In fact, the automaker has about 53,000 vehicles completed and sitting around waiting for the installation of certain components affected by the semiconductor supply shortage, according to John Lawler, Ford’s chief financial officer. Ford did cite "significantly improved" manufacturing rates during March, signals that the second quarter and full year numbers could improve. The company also exceeded its previous record of electrified vehicle sales year to date with an increase of about 38%, according to its March U.S. sales report. The automaker attributed its recent manufacturing success as the result of hard work with suppliers at every level of the value chain to break constraints, as well as expediting freight to pull ahead of available supply. At the same time, the company says it has taken design actions over the past year to alleviate potential constraints which are coming online now and in the second half of the year, along with deals with wafer and chip suppliers that Ford expects to come online at the back end of the year. The company entered the second quarter with what Ford CEO Jim Farley called an "extremely healthy" order bank, and says it is on track to scale high-demand EVs to 600,000 units by the end of next year and expects production to go ahead as scheduled for E-Transit vans in the U.S. and Europe, as well as the F-150 Lightning pickup in the U.S. Ford's EV ambitions are largely tied up in the success of the F-150 Lightning pickup truck, which went into production this week. The automaker said it has 200,000 reservations for the F-150, which has prompted the company to double its planned annual production to 150,000 vehicles in 2023. GuidanceLooking ahead, Ford reaffirmed its 2022 guidance of positive adjusted EBIT of $11.5 billion to $12.5 billion, alongside "adjusted free cash flow" of $5.5 billion to $6.5 billon; Ford closed the quarter with cash and equivalents worth $29 billion and reported $45 billion in total liquidity inclusive of its Rivian stake. While Ford's unit volume dipped in Q1 compared to the year-ago period, the company expects "vehicle wholesale volumes [to increase] 10% to 15% from 2021" by the end of the year. That unit volume figure includes a stated assumption of there being more chips available in the market by the back half of 2022. The high demand for Ford’s new EVs might help the automaker achieve its goal for the year of significantly higher profits in North America and collective profitability worldwide, but Ford executives were realistic about inflationary pressures being unlikely to ease anytime soon. Ford is baking $4 billion worth of higher commodity costs in its estimates, along with what the company described as "inflationary effects on a range of other expenses." Once again, cost cutting and finding production efficiencies took center stage in the company’s strategy to reach production goals. That should help meet demand as the company gears up for the second half of the year, when Ford sees volumes improving based on better availability of supply, according to Doug Field, Ford’s chief officer of EVs and digital systems. “Our opportunity is really around our costs and our Blue business,” said Field. (Ford Blue is the automaker’s legacy internal combustion engine business, which was established as a separate entity from Ford Model e, the automaker’s EV business, last quarter.) “In terms of investing we need to invest in a fully networked advanced electric architecture. We need to invest in Level 2 and Level 3 autonomy. We need to invest in a new portfolio and in changing our industrial system over to these electric digital products. We need to invest in our OS software that supports all of that. And we believe very strongly, we need to invest in Level 4 autonomy. Our Ford Plus plan is so specific about where to invest that at this point in time our real work that we need to do is to get after these inefficiencies and improve the productivity of our base business.” This story has been updated to reflect new information from the earnings call. |

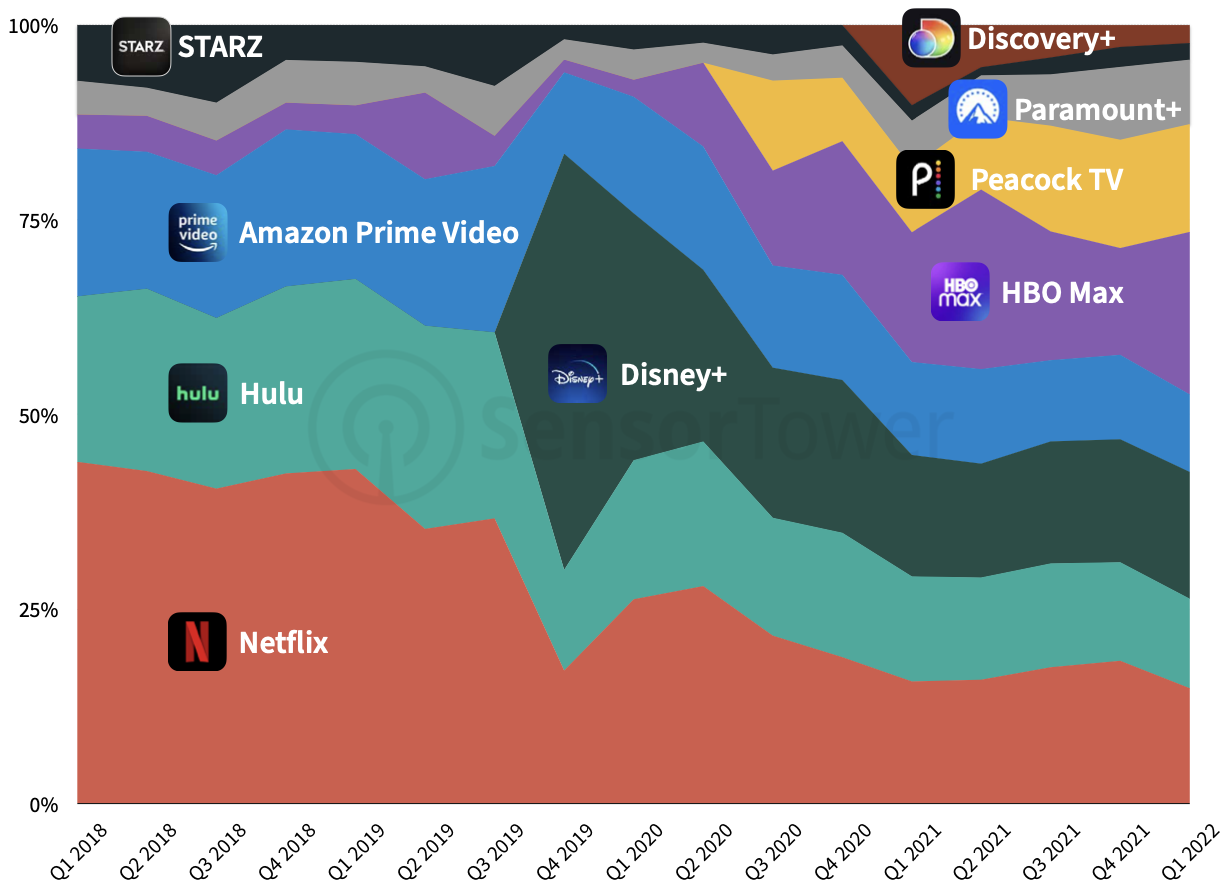

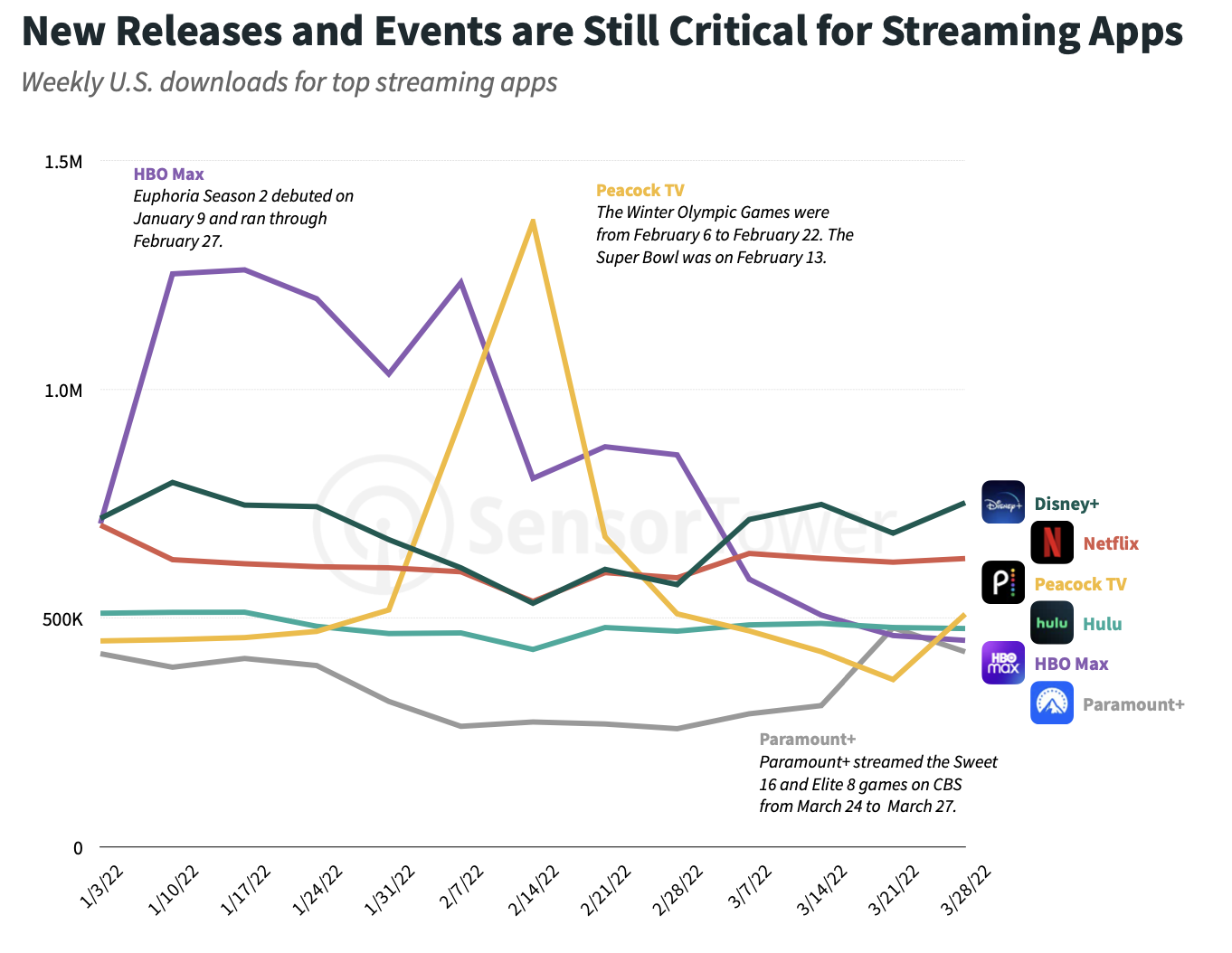

| HBO Max app just had one of its best quarters to date, but app performance still has room to improve Posted: 27 Apr 2022 01:31 PM PDT Sensor Tower's "Q1 2022: Store Intelligence Data Digest" report saw HBO Max as a top contender for the most downloaded apps in the U.S. Not only did the app make the top five list, but it also had the second-best month overall in the month of January. In addition, HBO Max had the best quarter on the U.S. App Store for any SVOD (subscription video on demand) app since Disney+ launched in late 2019, passing Netflix for only the second time. In recent years, there has been a continuous rise in video streaming downloads as more consumers value watching content on the go. The top six apps had more than 10% U.S. download market share in Q1 2022, with HBO Max in the lead (21%), Disney+ (17%) and Netflix (15%). Meanwhile, Peacock, Hulu and Amazon Prime Video had at least 10%. Additionally, HBO has had success adding new users since its launch in 2020. Its U.S. MAU (monthly active users) market share rose from 4.5% in Q2 2020 to 10% in Q1 2022. While Netflix, Hulu and Amazon Prime Video were the top three video streaming apps in the U.S. from Q1 2018 through Q3 2019, with 80% of combined downloads, by Q1 2022, the three streaming apps combined for only 37% of downloads. All in all, improved content offerings have resulted in a sustained upward trend in monthly users. In Q1 2022, events such as HBO Max's season two of "Euphoria," along with major U.S. sporting events such as the Super Bowl (Peacock TV) and March Madness (Paramount+) all contributed to a boost in adoption, giving these streaming services a competitive edge. The flaws of HBO Max’s app platform and plans for improvementMore and more consumers are turning to their mobile devices to stream their content, so it's no surprise that HBO Max's app got the attention of subscribers. However, users are frustrated with the platform and have complained for years about its performance. If the user interface is flawed, no amount of valuable content is worth dealing with outages and errors. On the App Store, the app has a 2.8 rating, with many reviewers complaining that the app is "super buggy," slow and poorly designed. Google Play users were a little nicer, giving the app a 3.7. However, most still complained about an "unfriendly" interface and constant buffering. HBO Max is notorious for having unstable app performance. Its platform overall has had many issues, and not only were there outages last year in June and December, but there have also been crashes like the finale of "Mare of Easttown," and more recently, "Euphoria" season two and "The Batman" were both down. Sarah Lyons, head of HBO Max's Product Experience, told Protocol that at launch, the company willingly released an imperfect app because the team figured it could get a facelift once the app garnered more success. "We've been changing out the engine of the plane while we're flying the plane," she said. The original app was based on the old HBO Go and HBO Now mobile and TV apps. HBO Go was only meant for cable subscribers, so it lacked a strong discovery function like its competitors, Netflix and Disney+. Earlier this month, WarnerMedia finally got around to fixing its Apple TV app and promised it would be rolling out upgrades such as enhanced stability, a more simplified sign-in process and other new features. It previously improved the app experience for Roku, PlayStation, Android TV, LG and Vizio. The desktop version also got a new shuffle button in March. According to Lyons, crashes of the HBO Max Roku app have decreased by 90%, and load times on Android TV decreased by 50%. She also told Protocol that Fire TV and Xbox apps would also be improved after the relaunches of the mobile and web experience. The platform will get a decent makeover as the team plans to improve in-app discovery, among other changes. Warner Bros. Discovery now has plans to merge the two streaming services, HBO Max and Discovery+, into a single app. While Discovery+ has a lower U.S. download market share than HBO Max in Q1 2022, its app rankings on the App Store and Google Play are significantly higher at 4.9 and 4.7, respectively. While this obviously isn't an overall comparison, since reviews and rankings are only from a low number of users (less than one million), it is something to note. |

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment