TechCrunch |

- What most startup founders get wrong about financial projections

- LottieFiles raises Series B to make the animation format even more ubiquitous

- HOF Capital brings in $300M for second early-stage fund

- Prisma raises $40M for its open source ‘Rosetta stone’ for database languages

- Backed by Tiger Global and Sequoia India, Toplyne helps product-led growth teams tackle user conversion

- Sleuth wants to use AI to measure software developer productivity

- Point closes on $115M to give homeowners a way to cash out on equity in their homes

- Spotify becomes first music streamer to launch on Roblox

- Kevin raises $65M as it charges ahead on account-to-account payments over point-of-sale terminals

- Banking giant Truist acquires fintech startup Long Game in effort to reach younger demographic

- Hetz Ventures closes third fund of $123M to focus on DevOps tools, Open Source, Fintech and Cyber

- Cheq hopes an easy-to-use app for stablecoins will appeal to inflation-wracked countries

- Pangea to unlock diaspora remittances as funding source for African startups

- Traceable AI nabs $60M to secure app APIs using machine learning

- Andreessen Horowitz plans $500 million investment in Indian startups

- South Korea’s RECON Labs raises $4.4M to help shoppers visualize products by creating 3D models in AR

- Stellantis, Trudeau invest $2.8 billion to boost EV production in Canada

- LinearB wants to help development teams optimize their workflows

- Don’t miss the roundtable roundup at TC Sessions: Mobility 2022

- Daily Crunch: Google unveils new options for removing personal data from search results

| What most startup founders get wrong about financial projections Posted: 03 May 2022 05:08 AM PDT Financial projections are essential for any business, but in the case of tech startups, a financial model is one of the most important and overlooked tools available to a founder. Venture-backed startups work on risky, aggressive capital deployment, often operating at a loss for years as they pursue expansion and market dominance. This means that runway is a critical KPI that founders need to keep an eye on for every single financial decision. Aggressive spending should translate into aggressive growth: revenue might jump 20% or 30% month-over-month, which makes runway estimation an ever-moving target. Being able to expand the team a month earlier can make a tremendous difference in the long run, or cutting down expenses quickly can save the company from running out of money.

When milestones and deadlines are directly driven by your finances, you put yourself in a great position to iterate. However, few founders build themselves the tools to help make those decisions. We connect with hundreds of founders every month, and the most common mistakes we see include:

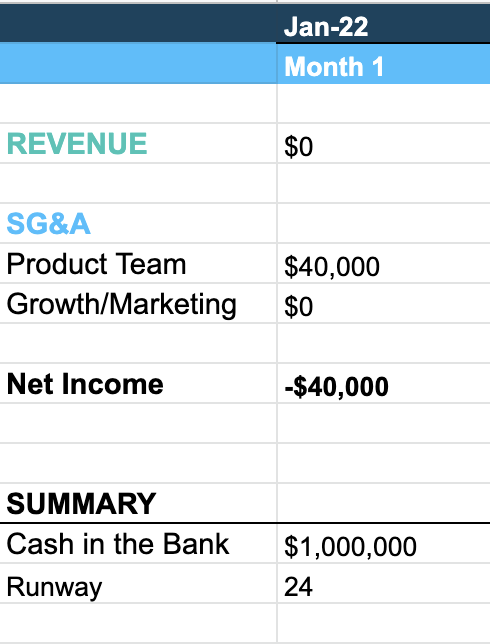

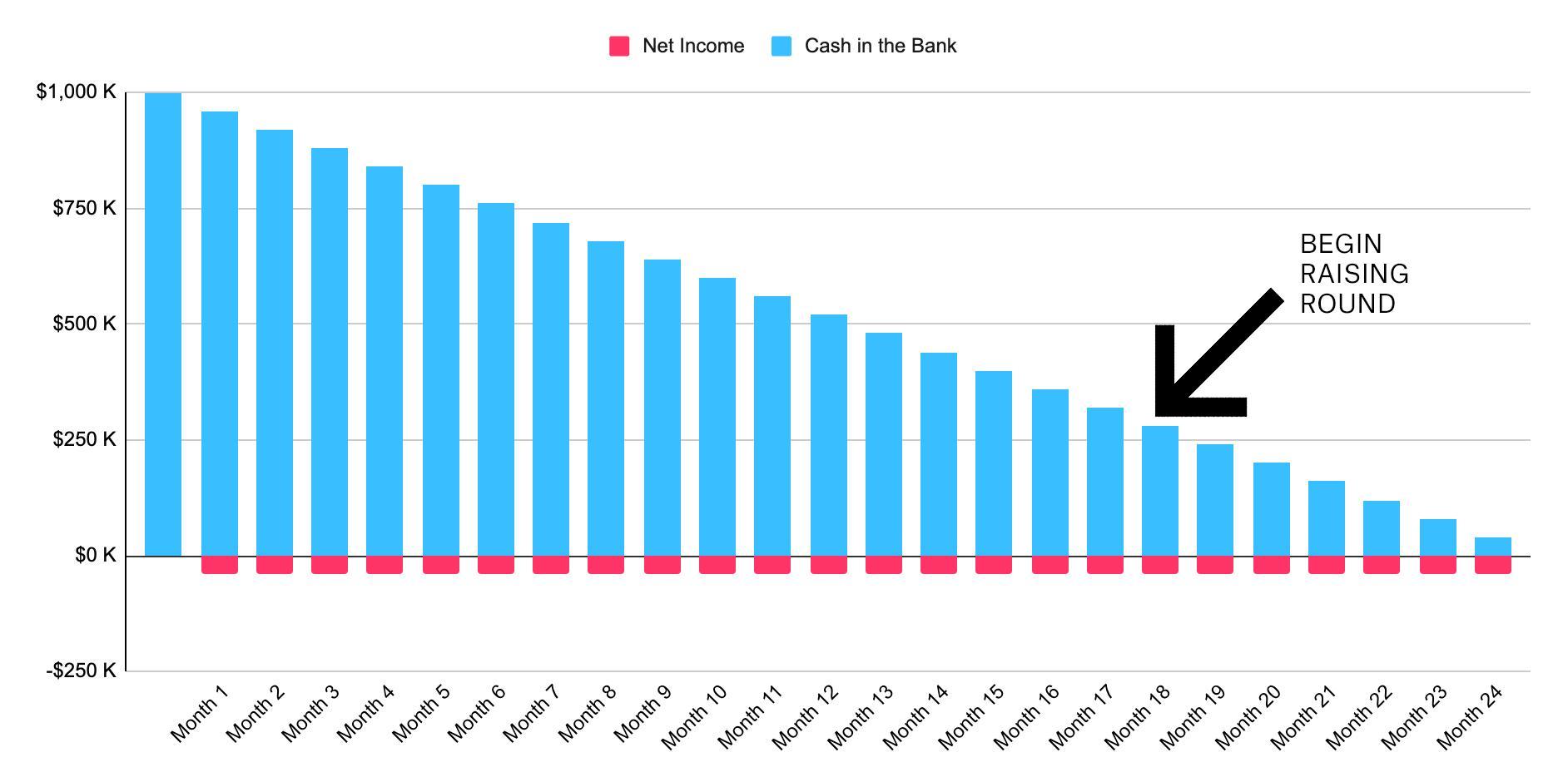

In the fast-paced world of startups, quick and educated decisions are critical. Take a look at this example scenario. A company is looking to raise a $1 million seed round to finish building and launching its product. It can set a burn rate target of $40,000/month so that the capital lasts roughly 24 months.  Image Credits: Jose Cayasso A safe cushion is to assume that new investor negotiations will take about six months, so by month 18, the company should be in a position to begin pitching to the next round of investors.  Image Credits: Jose Cayasso Where does the company need to be when it wants to raise money? How much of the product should be ready? How much revenue will it have? How many customers? How much will it cost to bring those customers? The founders need to make sure their capital deployment takes all of those variables into account. A miscalculation can translate into spending too little (and failing to launch the product on time), or spending too much (and not being able to close the next round before money runs out). The stakes are high. The problem is, in my experience, seed-stage founders are rarely thinking of these targets when they define how much money they want to raise, or how they want to spend it. Creating a model that you actually useThe most common problem I see is entrepreneurs think of the financial model as “homework,” so they prepare it to satisfy an investor request or to fill a slide in the pitch deck. At the pre-seed or seed stage, it's impossible for the model to predict revenue accurately. So for an early-stage company, the model should serve two main purposes:

|

| LottieFiles raises Series B to make the animation format even more ubiquitous Posted: 03 May 2022 05:05 AM PDT Lottie animations are everywhere. The JSON-based file format, first introduced as an open-source library by Airbnb engineers, can now be seen in the top 500 iOS and Android apps, said LottieFiles co-founder Kshitij Minglani. What LottieFiles does is streamline the process of turning animations made in software like Adobe After Effects into Lotties so they can be placed in apps. LottieFiles is now used by animation and motion designers at 150,000 companies, including Google, TikTok, Disney, Uber, Airbnb and Netflix. The startup announced today that it has raised $37 million in Series B funding led by Square Peg Capital, with participation from XYZ Venture Capital, GreatPoint Ventures and returning investors 500 Startups and Microsoft Venture Fund, M12. LottieFiles plans to use the funding to expand it product roadmap, hire for its engineering and R&D teams and develop a new workflow that will make shipping Lottie animations easier so designers can focus more on animations. LottieFiles also has the world's largest repository of free-to-use Lottie animations. LottieFiles was founded in 2017 by Minglani and Nattu Adnan. TechCrunch last covered the company when it announced a $9 million Series B in January 2021. LottieFiles has now raised about $47 million in total. Since its Series A, LottieFiles has grown from about 1 million users to 3.1 million. LottieFiles simplifies the workflow between creating an animation in software like Adobe After Effects, then shipping it to its final destination in an app. The startup currently has a plug-in for Adobe After Effects and other design software. Otherwise, Minglani told TechCrunch, the process is very complicated. LottieFiles allows designers to preview how their animation will look in the app and then ship it without hours of coding. "We are democratizing motion design the way Canva democratized design," said Minglani. "Before Canva, it was Photoshop, which needed hundreds of hours. We are doing the same thing to motion design industry." |

| HOF Capital brings in $300M for second early-stage fund Posted: 03 May 2022 05:02 AM PDT When you do something well once in venture capital, you want to keep repeating it, and HOF Capital plans to double down on its strategy of focusing on pre-seed through Series A, now with a brand new $300 million fund, its second institutional early-stage fund. Hisham Elhaddad, Onsi Sawiris and Fady Yacoub co-founded the venture capital firm in 2016 after emigrating to the U.S. from Egypt 11 years ago. Six years later, they have $1.2 billion in assets under management. They saw Silicon Valley as a "tight-knit circle of insiders that continually got access to the best opportunities," and wanted to build a firm that could essentially get in the trenches with its portfolio companies. "We're a young entrepreneurial team where almost every investment team member has a STEM background, so we speak the same language as the founders we partner with," Elhaddad told TechCrunch. "We truly roll up our sleeves and help with recruiting, strategy and anything else a founder needs while taking a back-seat from a management perspective and trusting them with leading their companies." Six years later, they have $1.2 billion in assets under management. During that time they also amassed a global investor base that now includes 240 enterprises and entrepreneurs. Elhaddad declined to go into details about who the limited partners were for this fund. Though the firm is industry agnostic, it does gravitate toward areas like fintech, deep learning-enabled software, computational biology, immersive computing, tech-enabled human enhancement and web3. Its portfolio contains companies like Epic Games, Yoco, Looped, Terra and Dapper Labs. The firm looks for entrepreneurs that have a deep understanding of market opportunities, are competitive — what Elhaddad referred to as "focused on building a defensible moat for their business" — and those that are "doing their life's work, not another stint on their resume and seek to create impactful generational companies." "We always try to imagine what the world will look like in 10 to 20 years, and how tech can create massive positive change," Elhaddad added. "That's how we land on the themes that we invest in today. It's beyond exciting to play a role in areas with unbounded potential for value creation." The new fund complements the firm's ability to follow on in multiple rounds through the lifecycle of the company, from pre-seed to pre-IPO or token listing, one of the things Elhaddad says makes HOF Capital unique. HOF Capital has made a number of investments already from Fund II, including HitPay (no-code fintech and e-commerce platform), Jambo (web3 super-app), Reframe (digital health app), Teiko Bio (machine learning-enabled precision medicine), Ghost Financial (cash-back credit card for restaurants) and Trace Finance (cryptocurrency-enabled financial products). |

| Prisma raises $40M for its open source ‘Rosetta stone’ for database languages Posted: 03 May 2022 05:01 AM PDT When it comes to building databases and other backend software development, different organizations and developers do not always speak the same language. Today a startup called Prisma that’s built a platform — based around a server-side library — that lets users write in the languages that are most intuitive to them, but lets that work carry across their organizations’ wider ecosystem of apps, is announcing $40 million in funding to continue expanding its business. Starting out focusing on GraphQL, today the company’s tech works — in the words of CEO Søren Bramer Schmidt (who co-founded the startup with Johannes Schickling in Berlin) — “the layer below that” and supports JavaScript and TypeScript languages, as well as databases in PostgreSQL, MySQL, SQLite, SQL Server, MongoDB and CockroachDB. Its open-source-based Prisma ORM, launched last year, now has more than 150,000 developers using it for Node.js and TypeScript projects, growing at an average rate of 10% every month. Schmidt said the plan is to increase investment in that open-source tool to bring on more users, with a view to building its first revenue-generating products. Those commercial tools, which Prisma describes simply for now as an “Application Data Platform”, should be getting launched later this year. It’s the traction that it’s had for the open-source tools and the plans for its first commercial steps that have attracted investors. Alimeter is leading this round, with Amplify Partners and Kleiner Perkins — a previous investor — also participating. It also, notably, has some founders backing it from other “companies in the ecosystem” that are a sign of how Prisma is finding its feet in that wider landscape of platforms and tools. They include the founders of Vercel, PlanetScale, GitHub and SourceGraph. (Small side note: Schmidt noted that one of the reasons that Kleiner Perkins led its seed round in 2018 was because it was hard to open doors with European backers as a startup that was pre-revenue. Back then the company also assumed it would eventually have to completely relocate to the U.S. to continue growing. Fast forward to today, and he acknowledges that a lot has evolved, and they are happily scaling as a business in Berlin.) Prisma positions itself as a kind of Rosetta Stone in the world of development — or in the metaphor of prisms, an object that lets one source of information be refracted into different parts. As Schmidt describes it, after a period of essentially only three languages, there was a proliferation of languages in programming and database development that emerged around 15 years ago, part of a larger wave of programming innovation. “But then the older, boring ones saw all the good ideas and those stated to get incorporated into them,” he said. For example, Javascript has become a much stronger language over the years. At the same time, though, database language proliferation has continued, he said, helped by the move to cloud computing and a preference for using specialized databases for particular purposes. “It’s much easier to host and operate a variety of databases,” he said. Larger tech organizations like Google and Twitter have invested a lot of money into tooling internally to work around this situation, producing “very good tools,” Schmidt said. But when it comes to an organization that is smaller, even a tech company, “they may have built something too but they won’t be able to continue to invest in it to keep it updated. They have sub-par tooling.” Or, nothing at all: “It’s a lot of learning, and it’s hard to be proficient,” he added. That is where Prisma tooling comes in: it essentially helps people remain compliant with various languages as they code, query and manage these databases in a more efficient way that speaks to how developers work today. Schmidt notes that the Google or Twitter approach — building internally — for the moment remains its biggest competition. This is a little ironic, since it was internal building to solve the exact same issue at a previous employer, Trustpilot, that led him to the idea of creating a product to solve the issue for everyone. “The way developers build applications is evolving,” said Jamin Ball, a partner at Alimeter, in a statement. “Prisma breaks down barriers between frontend and backend teams, and between data engineers, developers, and business analysts. The Prisma ORM is a product developers love, and an important step towards modernizing full stack development.” |

| Posted: 03 May 2022 05:00 AM PDT  Toplyne founders Ruchin Kulkarni, Rohit Khanna and Rishen Kapoor For product-led growth companies (PLG), the perennial question is: how do we get non-paying customers to subscribe? Then the second question is: how do we get paying customers to move to higher tiers? Toplyne wants to help by automating the process of identifying promising leads and figuring out what go-to market strategies will work best for each of them. Launched in June 2021, the startup's customers already include Canva, Grafana, Gather.Town and InVideo. The Bangalore-based startup announced today it has raised $15 million in Series A funding led by Tiger Global and Sequoia Capital India, with participation from returning investors Together Fund, Sequoia India's Surge program, and angel investors from Canva, Vercel and Zomminfo. Toplyne was founded by Ruchin Kulkarni, Rishen Kapoor and Rohit Khanna, who met while working as investment analysts at Sequoia India. During that time, Kulkarni told TechCrunch they discovered that many product-led growth companies were struggling with conversion rates, even if they had a relatively easy time getting free users. Their growth teams had a hard time not only identifying the best leads among thousands or even millions of users, but also what marketing strategies they should use. For example, Kapoor said a highly-engaged user may just need to be offered a discount on a paywall. But others might respond better to email marketing or contact from a salesperson. Toplyne integrates with a client's existing marketing software (including Amplitude, Mixpanel and Salesforce) and analyzes cohorts of users to show which ones have the lowest or highest potential conversion rates. For example, high engagement with an app, opening marketing emails and answering chatbot questions are all promising signals. This in turn helps growth teams plan their go-to-market strategies for each group. Toplyne analyzes which strategies are working best, or suggests other marketing channels, then helps growth teams see how effective each one is. The funding will be used to grow Toplyne's data science, engineering, product and design teams. The company is currently working on on its self-serve product and says it has a waiting list of more than 1,000 companies. In a statement, Naman Gupta, product-growth lead at Canva Pro and an angel investor in Toplyne, said, "Creating the infrastructure and plumbing to support growth experiments, followed by rapidly A/B testing and operationalizing the most repeatable growth strategies is a herculean task spanning several quarters. Toplyne helped us short-circuit this process to a few days." |

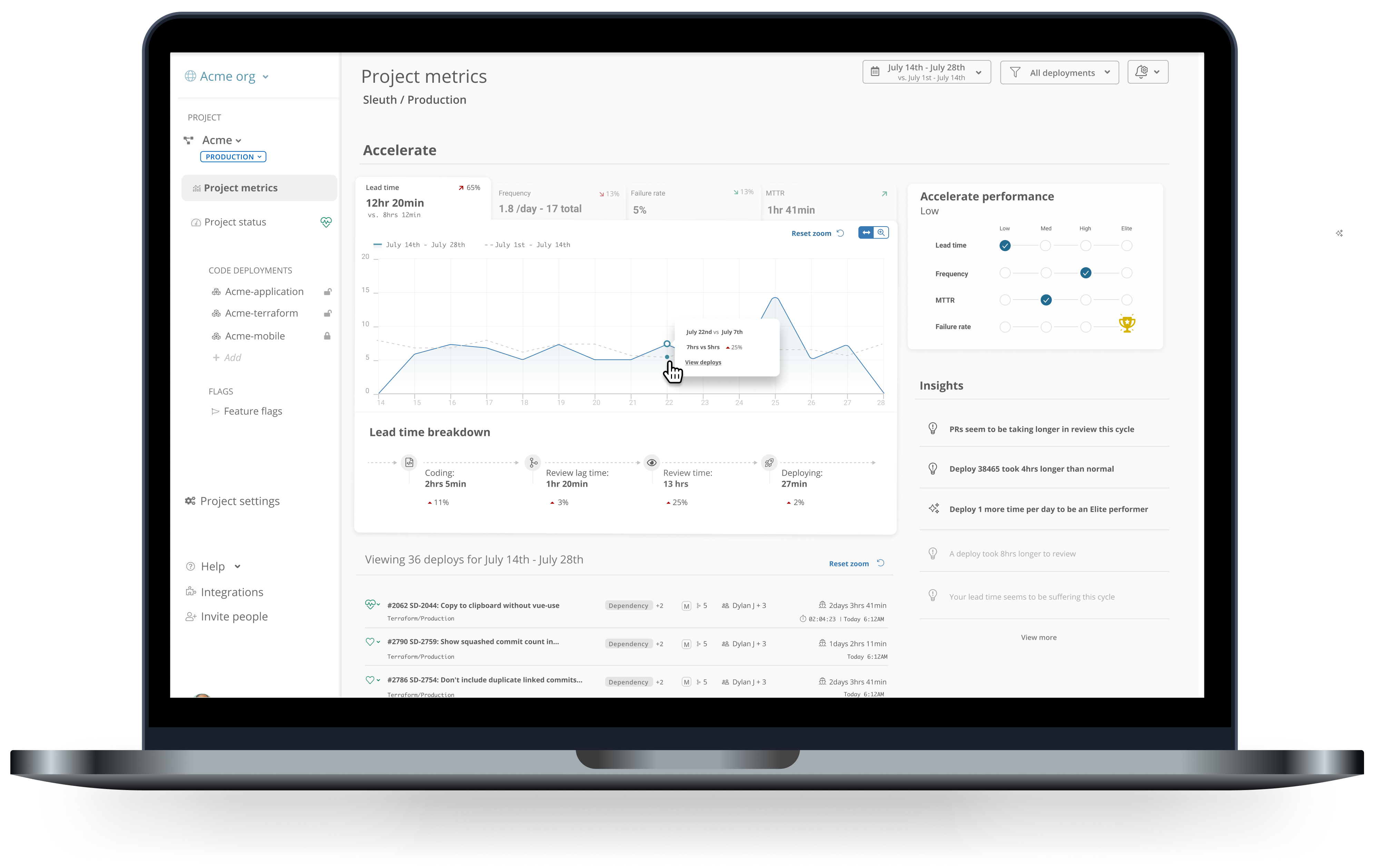

| Sleuth wants to use AI to measure software developer productivity Posted: 03 May 2022 05:00 AM PDT As knowledge workers including software engineers shifted to remote work during the pandemic, executives expressed a concern that productivity would suffer as a result. The evidence is mixed on this, but in the software industry particularly, remote work exacerbated many of the challenges that employees already faced. According to a 2021 Garden survey, the majority of developers found slow feedback loops during the software development process to be a source of frustration, second only to difficult communication between teams and functional groups. Seventy-five percent said the time they spend on specific tasks is time wasted, suggesting it could be put to more strategic use. In search of a solution to bolster developer productivity, three former Atlassian employees — Dylan Etkin, Michael Knighten and Don Brown — cofounded Sleuth, a tool that integrates with existing software development toolchains to provide insights to measure efficiency. Sleuth today announced that it raised $22 in Series A funding led by Felicis with participation from Menlo Ventures and CRV, which CEO Etkin says will be put toward product development and expanding Sleuth’s workforce (specifically the engineering and sales teams). “With the avalanche of remote work brought on by the pandemic the need for developers, managers and executives to understand and communicate about engineering efficiency has increased sharply,” Etkin told TechCrunch via email. “Developers, no longer in the same room, need a way to coordinate around deploys and a quick way to discover when a deploy has gone wrong. Managers need an unobtrusive way to proactively learn about bottlenecks affecting their teams. Executives need an unobtrusive way to understand the impact of their organization-wide initiatives and investments. Sleuth takes the burden of understanding and communicating engineering efficiency off-line and makes it digestible by all.” Etkin, Knighten and Brown were colleagues Atlassian, where they claim that they helped the company’s engineering organizations move from releasing software every nine months to releasing daily. Etkin was an architect on the Jira team before becoming the development manager at Bitbucket and StatusPage, while Knighten and Brown were a VP of product and an architect/team lead, respectively. While at Atlassian, which grew from 50 to over 5,000 employees in the time that Sleuth’s cofounders worked there, Etkin says it became “crystal clear” that many engineering teams lack a quantitative way of measuring efficiency — and that this gap could hold them back from growing and improving. “Measuring engineering efficiency is a known, large and growing problem that's now become solvable. Because every company is investing more heavily into software engineering, the need for visibility into engineering efficiency has intensified,” Etkin said. “However, measuring efficiency has historically been very challenging for a multitude of reasons, namely tooling complexity, lack of access to data and use of dubious proxy metrics that bred micromanagement and distrust.” Sleuth’s solution is DevOps Research and Assessment (DORA) metrics, an emerging standard used by developer teams to measure how long it takes to deploy code, the average time for a service to bounce back from failures, and the how often a team’s fixes lead to issues post-deployment. DORA arose from an academic research team at Google, which between 2013 and 2017 surveyed over 31,000 engineers on DevOps practices to identify the key differentiators between “low performers” and “elite performers.” Sleuth isn’t the only platform that uses DORA metrics to quantify productivity. LinearB, Jellyfish and Athenian are among the rival solutions that have adopted the DORA standard. But Etkin claims that its competitors don’t “fully or accurately” track these metrics. “Sleuth is unique … because we employ deployment tracking to model how engineers are shipping their work from concept through to launch,” he explained. “Accurately modeling exactly how engineers ship across their pre-production and production environments and how they interact with issue trackers, CI/CD, error trackers and metrics allows Sleuth to build a fully automated … view of a team’s DORA metrics and their engineering efficiency.” Sleuth uses AI to attempt to figure out a team’s baseline change failure rate (i.e., the percentage of changes that resulted in degraded services) and mean time to recovery — two of the four DORA metrics — from existing systems such as Datadog and Sentry. The platform can automatically determine when a metric is outside that baseline, Etkin says, and even automate steps in the development process to potentially improve on the metric. From Sleuth’s project dashboard, individual teams can track their DORA metrics. An organization-wide dashboard reveals trends across different projects and teams. “Customers just point Sleuth at at … error data and Sleuth lets engineers know when they’ve pushed these metrics into a failure range. Using AI to determine these values means engineers can focus on their work without needing to understand every metric in their system or what ‘normal’ looks like for each.”  Tracking DORA metrics with Sleuth. DORA metrics aren’t the end-all be-all, of course. They can be a hindrance when an organization’s focus on them becomes all-consuming. As Sagar Bhujbal, VP of technology at Macmillan Learning, told InfoWorld in a recent piece: “Developer productivity should not be measured by the number of errors, delayed delivery or incidents. It causes unneeded angst with development teams that are always under pressure to deliver more capabilities faster and better.” Etkin agrees, emphasizing that engineering managers need to avoid the temptation to micromanage. “Engineering is a creative endeavor, and engineers are more similar to artists than assembly line workers,” Etkin said. Engineering managers need to … track the right metrics [and] track them accurately [but also] give engineers the tools they need to improve on the metrics.” Sleuth customers vary from enterprises like Atlassian to startups including Launchdarkly, Puma, Matillion and Monte Carlo. Etkin says that the platform has tracked nearly a million deploys and undertaken over a million automated actions on behalf of developers. He declined to reveal revenue numbers when asked, but said that 12-employee Sleuth has grown 700% last year with a “very healthy” margin and cash flow. |

| Point closes on $115M to give homeowners a way to cash out on equity in their homes Posted: 03 May 2022 04:02 AM PDT Historically, homeowners could only tap into the equity of their homes by taking out a home equity loan or refinancing. But a new category of startups have emerged in recent years to give homeowners more options to cash in on their homes in exchange for a share of the future value of their homes. One such startup, Palo Alto-based Point, announced today that it has raised $115 million in Series C funding after a year of rapid growth. The company declined to reveal its valuation. Interestingly, the startup was founded by a trio that includes Alex Rampell, who is today a general partner at Andreessen Horowitz (a16z) and who also co-founded buy now, pay later giant Affirm. He teamed up with Eddie Lim and Eoin Matthews to start Point in 2015 prior to joining a16z. Rampell is on the company's board, but is not involved in the day-to-day operations of the company. So, what exactly does Point do? In an interview with TechCrunch, CEO Lim describes the startup as a marketplace that teams up homeowners with institutional investors. The company's flagship product, Home Equity Investment, is designed to allow homeowners to get cash in exchange for a certain percentage of future appreciation of their home. Point says that last year, it received over $1 billion in new capital commitments from real estate and mortgage-backed securities (MBS) investors. The way it works is that Point first evaluates the finances of applicants and makes a provisional offer. Point then values the home — often with an in-home appraisal — and updates the final offer. Once all closing conditions are met, Point says it will fund the investment within four business days. On average, the size of the Home Equity Investment (HEI) that Point makes is 15-20% of the home’s property value. Its average investment is around $100,000. And the average value of homes on its marketplace is around $700,000, according to Lim. The investors typically invest about 15-20% of a home's value. So if a home is worth around $1 million, they will put in $150,000 or $200,000. Homeowners, Lim said, use the cash to do a variety of things — such as conducting home renovations, starting a small business, funding a child's education or saving for retirement. "We have homes valued at $250,000 on our marketplace as well as multimillion-dollar homes, and everything in between," Lim said. "It can be a very compelling way to get cash." "The homeowner is not obligated to pay us back for 30 years," Lim told TechCrunch. "Of course, most folks have some kind of event or sell their home, or refinance, well before 30 years."  Image Credits: Point(opens in a new window) The executive likened the process to a venture capitalist backing a startup. "It's like [an investor] making a VC investment into the home," Lim said. "We invest in your home, and share in its future appreciation and upside." Since inception, Point has invested in more than 5,000 homes. While Point has been around for several years, Lim said it has seen "the vast majority of that" growth over the past year, according to Lim. Specifically, he said, Point's funding volume was up over 5x in the first quarter of 2022 compared to the first quarter of 2021. "We‘re kind of in a watershed moment for the U.S. housing market, and probably have been for a year or two now," Lim told TechCrunch, “where home equity has never been so abundant, and yet so inaccessible." Indeed, a recent report indicates that "Americans are sitting on $26 trillion of home equity." The company believes that the advantage to a homeowner of using Point, as opposed to taking out a home equity loan or refinancing, is that they have "no monthly payments, no income requirements and no need for perfect credit." Lim describes Point as an "asset-light fintech for home equity." "We don't own any assets and rather, connect homeowners to investors," he explains. "As a marketplace, we charge fees on both sides of the transaction. And we also charge asset management fees with the investor." Currently, the company operates in 16 states, including California, New York, Florida, Massachusetts, New Jersey, Washington, Colorado, Pennsylvania, Illinois, Maryland, Michigan, North Carolina, Arizona, Minnesota, Oregon and Virginia, as well as Washington, D.C. It plans to enter 11 additional states by year's end, including Ohio and Nevada.  Image Credits: Co-founders Eddie Lim and Eoin Matthews / Point The rise in mortgage interest rates have had a negative impact on startups in the digital mortgage space as the number of refinancings and new home purchases declines. But in this case, that may actually be serving as a tailwind for Point and companies like it, although Lim emphasizes that Point is not out to replace refinancings, for example. "People can still refinance and use Point," he told TechCrunch. Other companies in the space include HomePace, which just last week raised a $7 million Series A led by home builder Lennar's corporate venture arm, LENX. HomeTap raised more than $60 million in funding in December. Last October, Point announced a $146 million securitization. And in February, Unison completed a $443 million securitization. WestCap led Point's Series C, which also included participation from existing backers a16z, Ribbit Capital, mortgage REIT Redwood Trust, Atalaya Capital Management and DAG Ventures. New investors include Deer Park Road Management, The Palisades Group and Alpaca VC. The investment brings the startup's total raised to date to more than $170 million in equity capital. Point plans to use its new funds to scale its offering so it can "support more growth," as well as toward the launch of new products and expansion of its national presence. It also, naturally, wants to hire more "pointers," as Lim called the company's staff. Presently, the startup has 210 employees. "In many, many ways, we’re just getting started," Lim told TechCrunch, "in terms of how many homeowners are out there and how much equity is out there. We ultimately want to bring this to every homeowner in the United States." Laurence Tosi, founder and managing partner of WestCap, was actually an angel investor in the company before leading this round via the growth equity firm. He first backed the company in 2018. "WestCap is leading this round in Point because they have developed the best and most consumer friendly solution for consumers with the most flexibility and least financial burden," he told TechCrunch. "Point empowers homeowners to safely manage their wealth and invest in their future, even when unforeseen circumstances arise." Tosi — who is the former chief financial officer of both Airbnb and Blackstone — believes that Point’s offering stands out from competitors in that it works with regulators, has securitization capabilities and a "best-in-class investor base" while "offering investors above-market, risk-adjusted returns." For his part, Rampell — who led the company's seed and Series A rounds, and invested in its Series B as well — said in a statement that "the strength and depth of the team that Eddie Lim has brought together at Point and its innovative approach to providing financing to homeowners has been apparent." My weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox. |

| Spotify becomes first music streamer to launch on Roblox Posted: 03 May 2022 04:00 AM PDT Spotify announced today it will become the first music streaming brand to have an official presence within Roblox, with the launch of “Spotify Island,” a place where artists and fans will gather to play interactive quests, unlock exclusive content, and buy artist merchandise. The new Spotify Island destination in Roblox will actually consist of a central mainland surrounded by a collection of themed islands, which players can explore and interact with by walking, running, and jumping, and touching and picking up various objects. The worlds themselves feature a color palette centered around Spotify’s shades of greens, with oranges and purples mixed in. There’s also a musical play box in the top right corner of the world, which will feature a soundtrack powered by Soundtrap, one of Spotify’s audio creation tools. The music here can be played or paused, or players can skip tracks, the company says.  Image Credits: Spotify An in-game merch store, meanwhile, will feature a variety of exclusive Spotify merchandise that can be taken into other parts of Roblox, as well as special artist merchandise which will serve as an additional revenue stream for creators. Spotify says artists will be able to keep Spotify’s portion of those merch sales (less Roblox’s cut) and Spotify can help with the merch design, if need be. Initially, four free items can be unlocked by completing missions around Spotify Island, by doing things like playing sounds within the world’s crystal cave and on a trampoline, or collecting the musical notes sprinkled throughout the island.  Image Credits: Spotify There are also little hearts around Spotify Island that can be collected to unlock hidden easter eggs. For instance, one easter egg will change the island from daytime mode to nighttime for the individual player. They can then pick up the glow sticks on the ground to leave light trails behind them as they run around. A leaderboard will track the hearts collected by various island visitors. Spotify’s vision for the island is to turn Roblox players into creators themselves, the company says. At launch, it’s doing this by having players create sounds at its virtual beat-maker stations powered by Soundtrap, and by moving around a “stage” area where they can interact with items like a confetti cannon and bubbles, effectively becoming performers themselves. But in time, the company plans to expand on this experience it said without going into specific detail.  Image Credits: Spotify “The stage isn’t the typical artist broadcast to fan experience. We’re flipping the script and empowering players to be the creators and truly feel like they’re the artist performing,” noted Abby Stewart, Director of Business Development at Spotify. Spotify also says the island will continue to evolve with new worlds to explore focused on music and fandoms. The first of these will be K-Park, a custom-built experience designed as an homage to Kpop culture. The first two artists to activate in this space are Stray Kids and Sunmi. The latter will have Roblox merchandise available starting today, while Stray Kids’ merch will arrive in the weeks ahead. The launch of the Roblox world comes at a time when music has become an important competitive advantage for online gaming platforms as they position themselves as a future entry point to engage with the “metaverse.” Fortnite helped kick off the trend with its in-game Travis Scott concert in 2020, followed by its Ariana Grande concert last year, and its more recent collection of Coachella-themed items and music aimed to celebrate the festival on its platform. Roblox, meanwhile, also held its first virtual concert in 2020 when it hosted Lil Nas X in an online event space custom-designed with multiple stages inspired by the artist’s music. And last year, Roblox solidified its intentions to bring more artists into its online gaming worlds with the announcement of a partnership with Sony Music, aimed at helping artists reach fans within Roblox and make money. Spotify, which already hosts over 2.2 million gaming-related playlists, said it saw the potential to reach a younger generation of music fans with the launch of its game experience on Roblox. According to a Deloitte survey, it cited, more than 80% of people in the U.S. played games, and Gen Z gamers were averaging 11 to 13 hours per week engaging with their favorite titles.  Image Credits: Spotify “We want to meet this next generation of gamers where they are, while opening up new opportunities for fans and artists to engage in play,” said Alia Calhoun, Global Head of Partner Marketing, in a demo of the Roblox world to select press on Monday. While Spotify Island may be able to attract various fan bases who follow their favorite artist to the world to pick up some Roblox swag, the lack of any virtual concert news alongside the announcement is a bit of a letdown. That said, Spotify seems to have planned for concerts to arrive at some point given it’s built a stage with a big screen behind it. But when asked directly about its plans the company declined to share more than this. It only said Roblox users should “stay tuned” for special programming in the future. The new Spotify Island experience is live now in Roblox at Roblox.com/Spotify. On Spotify itself, there’s also a new playlist called Spotify Island on Roblox to stream. |

| Kevin raises $65M as it charges ahead on account-to-account payments over point-of-sale terminals Posted: 03 May 2022 03:39 AM PDT Payments remains a very fragmented business around the world: depending on where you’re buying or selling something (and whether you are selling online or offline) you will have different “standard” payment methods, currencies and settlement schemes and more. Today, a startup called Kevin that’s taking one piece of that puzzle — payments made from account to account, an alternative to payment card payments that bypasses those rails — and making it more easier and more ubiquitous to use through the development of whole new set of payments infrastructure that integrates directly with banks, is announcing a significant Series A of $65 million to double down on its business after some strong initial traction. It has already picked up 6,000 merchants in 12 markets in Europe, starting first with electronic point of sale, and more recently with an integration with physical POS terminals. Its plan is to be available as a payment option across some 35% of European electronic point of sale terminals by the end of this year, and then 85% the year after that, “same as any card scheme,” said CEO Tadas Tamosiunas in an interview. UK will be later this year but at the end of this year will be 35% of European EPOS terminals and then 85% next year same as card scheme. The round is being led by Accel, with Eurazeo and previous backers OTB Ventures, Speedinvest, OpenOcean, and Global Paytech Ventures also participating. Harry Stebbings of 20VC; Ilkka Paananen, CEO & Co-founder of Supercell; and Amitabh Jhawar, ex-CEO of VenmoVilnius are some of the individuals also investing in the round. Kevin has now raised $77 million and it is not disclosing its valuation. Lithuania-based Kevin was co-founded by Tamosiunas and Pavel Sokolovas (COO), who said in a joint interview that the plan will be to use the funding to continue building out its technology and to hire more people to break into more markets, starting first with covering all of Europe. Kevin is technically styled “kevin.” — including the full stop. Tamosiunas said that the choice was made for a few reasons: first “Kevin” as an everyman name, the idea being that this is a technical payments solution that will be useful for everyone; second the full stop to imply that it’s the first and last name you’ll need to know in the business; but third, as a conversation opener. “It gives us an opportunity to tell our story,” he said simply. That story is one that will be well known to merchants and others working in payments and commerce: every country has different payment systems at both the frontend and backend of the process. Account-to-account payments, which essentially debits money directly from the buyer and deposits it into the account of the seller, has long been one of those options, and often represents a much cheaper and direct alternative to card payments and the fees those incur, when someone isn’t already using cash. The problem is that much of pre-existing account-to-account payments infrastructure is very clunky, not built around APIs, and thus hard to expand and integrate into any new services, both those in physical stories as well as those that are “electronic point of sale”, which might be in a store but could just as easily be in, for example, an app to pay for time at a parking lot. “But account-to-account is a cheaper process and so we had a huge opportunity to solve that, especially in EPOS,” said Sokolovas. Years in the building, Kevin had a lot of naysayers initially, skeptical that APIs could be built to integrate with banks, which have traditionally been slow to embrace them and open up their services to others. There are exceptions, of course, such as the open banking efforts we’ve seen in the United Kingdom, but by and large it’s a fragmented and still-arcane area. “Now we are one and only company on the market that has a technical solution behind that.” There are now other companies catching on — for example the POS terminal giant Worldline is working on a solution to accept account-to-account payments, Tamosiunas said, but it will take years to build, he claimed. The bigger theme is that e-commerce remains a big and fast-growing area, but in the shift back to physical movement post-the peak of the Covid-19 pandemic, focus is also changing. “Everyone is looking how to improve sales offline, at the point of sale,” Tamosiunas added. The disruption that Kevin is going for here is not just that it’s opening and modernizing a process that has been around for years, but has been hard to use; but it’s also giving merchants, consumers and everyone else involved in any transaction a more direct way of enabling a particular payment. Being more direct means it’s also cheaper, which is also a significant part of the pitch: it means that anyone opting for this option can make better margins on transactions. Conversely, it’s also cutting a lot of the traditional players in the payments ecosystem out of the equation, another kind of disruption. That is what has caught the eye not just of investors but potential strategic partners and would-be acquirers of the startup. The founders wouldn’t go into detail about who has been knocking on their door but you could imagine other big players in payments tech old and new (including Stripe, Adyen, PayPal and maybe even the big credit card rail companies) might be among those interested in picking up this tech in a diversification play. For now, Kevin has declined even to work with them as strategic investors, in order to stay neutral and not tied to any specific platforms. “Tadas, Pavel and the Kevin team are powering the future of payments with their next generation payments infrastructure,” noted Luca Bocchio, a partner at Accel, in a statement. “Offering a fast, seamless payment experience, with reduced costs and increased authentication rates, the time for A2A payments is now and Kevin has already had impressive momentum with its offering. With the launch of its unique POS payments product, the opportunity ahead is huge and we're looking forward to partnering with the team on their journey." One interesting twist here will be whether and how Kevin and those like it will be integrated with mobile wallets. Today Kevin operates in services when a merchant has integrated its tech into their own point of sale, whether it’s physical or electronic and in an app. But Wallets like Apple Pay or Google Pay today only work with cards. Given how so many card transactions are now being supplanted by NFC-based payments using people’s phones, it could potentially limit how much Kevin can grow if it cannot also offer an alternative to consumers to pay this way. Coincidentally, Apple just yesterday was called out for anticompetitive practices by the EU over how it opens (or doesn’t as the case may be) its NFC-based wallet technology to other parties. That will be one to watch, and one that could have a big impact on how Kevin grows in future. |

| Banking giant Truist acquires fintech startup Long Game in effort to reach younger demographic Posted: 03 May 2022 03:01 AM PDT Truist — one of the nation’s largest financial institutions — has acquired Long Game, a 12-person fintech startup that has raised over $20 million in venture capital, executives have told TechCrunch exclusively. As of June 2021, Charlotte, N.C.-based Truist was the 10th largest bank, with $509 billion in assets. It was formed in 2019 as a merger between BB&T and SunTrust banks. Founded in 2015, Long Game has built a gamified finance mobile app that aims to help people "save, learn and engage" with their finances. Specifically, the San Francisco-based startup wants to drive bank customer engagement using prize-linked savings and casual gaming to motivate smart financial behaviors. Neither company disclosed what Truist paid for Long Game, or the company's revenues, saying only it was "growing year over year" Led by co-founder and CEO Lindsay Holden, Long Game has raised over $20 million in funding from investors such as Vestigo Ventures, Franklin Templeton, Thrive Capital, and Collaborative Fund. TechCrunch covered the startup's $6.6 million raise in 2017. "Over half of Americans have less than $500 in savings and so a lot of people, if something unexpected happens, it can be really detrimental to their financial lives," Holden told TechCrunch. "We wanted to approach that problem differently. And we thought a lot about behavioral economics and how people are motivated, and one of the things that we came across was a behavioral economics thing called prize-linked savings." Prize-linked savings, she said, is a concept of someone placing money in a savings vehicle for a chance to win money. "It's literally taking that lottery dynamic, where people are trying to win big and putting it towards something," Holden added, "Instead of buying a ticket and just throwing away that cash, you’re putting it into a savings account." Unsurprisingly, Long Game is targeted more to GenZers and millennials, Holden said, noting that former Zynga employees are staffers. "It's a true game, as we are really using game dynamics to drive financial literacy. Long Game uses best practices from the gaming industry to engage with users," she said. "There's a trivia aspect and clients get rewards for learning." Its main marketing channels thus far have been social media marketing and the use of game ad networks. For Truist, the opportunity to reach a coveted – and difficult to reach – younger demographic was appealing. Vanessa Vreeland, head of corporate Development at Truist Ventures – the bank's venture arm, told TechCrunch that while the acquisition of Long Game was not the bank's first fintech buy, it was perhaps the most "significant." "This one was one that just had a different feel to it," she said. "It didn't come with a balance sheet. It was our first fintech acquisition without a balance sheet.” Truist/SunTrust previously acquired online lender LightStream and Service Finance, a point-of-sale software provider. As part of this latest acquisition, Long Game's engineers, designers and executives will join Truist's Innovation team. "We view ourselves as a giant startup…and as we were looking to expand our offerings for our retail bank, we were looking for ways to not only acquire customers, but to deepen our relationship with them," Vreeland said. "…We thought 'what better way to really engage with our clientele and attract new clients from younger generations to Truist than by offering a really exciting gamified way to save and to engage with personal finances?’…Truist's app will be "integrated with the Long Game experience.” The bank plans to “relaunch” an enhanced version of the app “to make it available to over 15 million households," she added. Truist does have offices in San Francisco today, where it serves its wealth clients as well as its corporate and investment banking clients, "But we haven’t focused yet on building out technology or innovation teams out on the West Coast," Vreeland told TechCrunch. "We’re excited to put a critical mass of folks in our San Francisco office, and we will be continuing to augment Lindsay and her team with technology, product and design talent as we continue to build out Truist's capabilities to meet the technological demands of our clients." Truist came to be aware of Long Game through a few different channels, according to Vreeland. For one, Long Game participated in FIS's Fintech Accelerator Program. She also became acquainted with the company through personal networks. For her part, Holden said she was drawn to Truist's "intense focus" on the client, which she viewed similar to that of Long Game's. "We solely focus on the client experience of real financial progress – taking something that feels difficult and at times emotionally fraught and making it into something motivating, fun, and even magical," she added. "It is so great to be a part of a team who is embracing and investing in our dream to make the best consumer financial experience out there.”  Image Credits: Long Game co-founder and CEO Lindsay Holden/Long Game Meanwhile, the intersection between banks and fintech startups is happening more regularly, where the two are either partnering or competing or like in this case, one is getting acquired by the other. And many banks have come to realize that it makes more sense – financially and logistically – to acquire an established fintech than attempt to build out the technology themselves. "We are a very face-oriented organization. We spent quite a bit of time meeting with our clients. and so we know that our clients want to continue meeting with us in person but also want to work with us digitally," Vreeland said. "We want to maintain that balance of touch through all the digital channels that we pursue and so we were very excited about Long Game's ability to help us do that." As evidence of that increased digital focus, Truist earlier this year shuttered dozens of physical branches. Vreeland said she was also drawn to the fact that Long Game was led by a female CEO. "We were really excited to meet a female CEO – that was really important to us as we think about building a portfolio of products and services inside Truist that are really as diverse as the clients and communities that we serve," she added. My weekly fintech newsletter launched on May 1! Sign up here to get it in your inbox. |

| Hetz Ventures closes third fund of $123M to focus on DevOps tools, Open Source, Fintech and Cyber Posted: 03 May 2022 02:32 AM PDT Hetz Ventures, a seed-stage VC out of Israel launched in 2018, has closed its third fund of $123 million. The new (described as ‘over-subscribed’) fund, Hetz III, brings the firm's total assets under management to nearly $300M. Focusing on seed and pre-seed investments, Hetz has previously backed Granulate (acquired by Intel last month), Trigo, Retrain.ai, Blink Ops, and Velocity. In a statement Judah Taub, Managing Partner at Hetz Ventures said: "Raising this fund is a testament to our hands-on approach and our ability to provide our portfolio companies with value far beyond financial investment. The Israeli ecosystem is evolving and maturing, with entrepreneurs moving away from quick exits and rising to the challenge of building companies that stand the test of time." The Hetz fund focuses on DevOps & Dev Tools, Open Source Software, Enterprise/Data Software, Fintech and Cybersecurity. "With over $5BN having been already raised by Israeli companies in Q1 of 2022, it is clear that the record-breaking investments of 2021 were not a one-off. Competition to invest in the best companies in the ecosystem – especially at seed stage – has never been greater," added Pavel Livshiz, General Partner at Hetz Ventures. |

| Cheq hopes an easy-to-use app for stablecoins will appeal to inflation-wracked countries Posted: 03 May 2022 02:21 AM PDT People in the Global South are often subject to terrible fluctuations in their currencies, as well as hyperinflation. At the same time, many are unbanked, but still able to access a crypto wallet. A way for these populations to access more stable currencies would be by accessing Stable Coins which are pegged to the US dollar – but most crypto platforms are less thank user-friendly. This is the thinking behind Cheq, a fintech startup that enables cryptocurrency payments in a user-friendly app. It's now raised a $2 million pre-seed round led by London's Connect Ventures, alongside Semantic Ventures, firstminute Capital, and 30 angels including former leadership from Monzo, Revolut, and Tide. Cheq hopes now to establish itself as a viable option for taking payment with stablecoins that are pegged to the US dollar. And because it uses stable coins it also avoids intermediary fees and many approval requirements. Chris Butcher (no relation) was formerly co-founder and CTO of Portify, but also founded a side-project called Token Alerts in Latin America. From this experience, he learned that stablecoins were popular in the region as a way of staving off hyperinflation. Cheq says users connect a crypto wallet to the platform and then use the app as they would a modern neobank. Cheq can create payment links so customers can pay with crypto via these links. Cheq then collects names and addresses from the buyer and perform follow-on actions with other services for merchants to fulfil orders. Cheq is also aimed at SaaS companies wanting to add a crypto option alongside the existing fiat payment processor, such as events. It can be used with a wallet that supports payments on the Ethereum, Binance Smart Chain or Polygon chains. But does not offer Bitcoin as this is not pegged to the dollar, obviously. In a statement, Butcher said: "While cryptocurrency has its diehard fans, many people still find them complex and lacking tangible value in a day-to-day setting. We believe a crypto wallet has the potential to be an amazing business bank account, and stablecoins provide the means to trade across borders without the costs typical of card payments." Rory Stirling, General Partner at Connect Ventures commented: "Chris and his team have a unique perspective on building a web3 company, insisting that the mass market wants a clean and easy product that removes the complexity and confusion typical of the sector. I've been blown away by how quickly they've executed. In December 2021 Chris was pitching me an idea. By March they had built a stunning product and were processing tens of thousands of dollars every week." Cheq has competitors. Platforms like Coinbase commerce or Binance pay are creating similar offerings, but still run a fairly crypto-savvy interface. |

| Pangea to unlock diaspora remittances as funding source for African startups Posted: 03 May 2022 01:31 AM PDT Norway's Pangea Trust, through its equity crowdfunding platform Connect, is unlocking diaspora remittance inflows as funding source for early and growth-stage startups in Africa. Remittances to sub-Saharan Africa reached $45 billion last year, with Nigeria, Ghana, Kenya, Senegal and Zimbabwe leading the list of recipient countries. And as annual inflows grow, Pangea's country director and CEO for Kenya Anne Lawi told TechCrunch, diaspora remittances can be tapped to increase the amount of funding injected into startups. Startups in Africa raised nearly $5 billion in funding last year but the amount remains meager when compared to the rest of the world. "While the amount of funding invested in startups in Africa has grown over the years, it is still negligible compared to the need. And that is why we are working towards unlocking diaspora remittance as a source of funding," said Lawi. "And because we are also an accelerator, we have created and validated an approach that helps us identify investable businesses… we also have created structures that help angel investors invest in these businesses alongside VCs too," she said. However, a perspective-shift is required for this to happen and that is why Pangea, working in partnership with Swedish International Development Cooperative Agency and Kenya Diaspora Alliance, has since last year organized a series of events geared towards educating those in the diaspora on why startups are good investment options. After making the initial public call for its first cohort last year, Pangea vetted and onboarded nine startups that met several criteria, including high-growth potential, and long term goals aligned with the Sustainable Development Goals. The nine have equity investment needs of between $25,000 and $100,000. By the end of the fundraiser, Pangea will have connected the startups to $320,000 of diaspora funding, with an additional objective of raising $1 million from the same sources by the end of the year. Startups participating in the initial fundraising include Grow Agric, which connects farmers to working capital; Ai Care, a SaaS insurtech; Baridi, an off-grid solar preservation business addressing post-harvest loss problem; Damu sasa, a blood services information management system; Ambulex, which is taking emergency health care solutions to low income communities; Funke Science, an e-learning platform for science courses; Kiri EV, makers of electric scooters; Rabbii Teecha, which is offering one-on-one tuition service, and Benacare, a link to home nursing services. All the aforementioned startups are founded in Kenya, but others from Ethiopia and Somalia will be supported during the pilot phase, with plans to scale to five more countries including Rwanda, Tanzania and Zimbabwe over the next one year. |

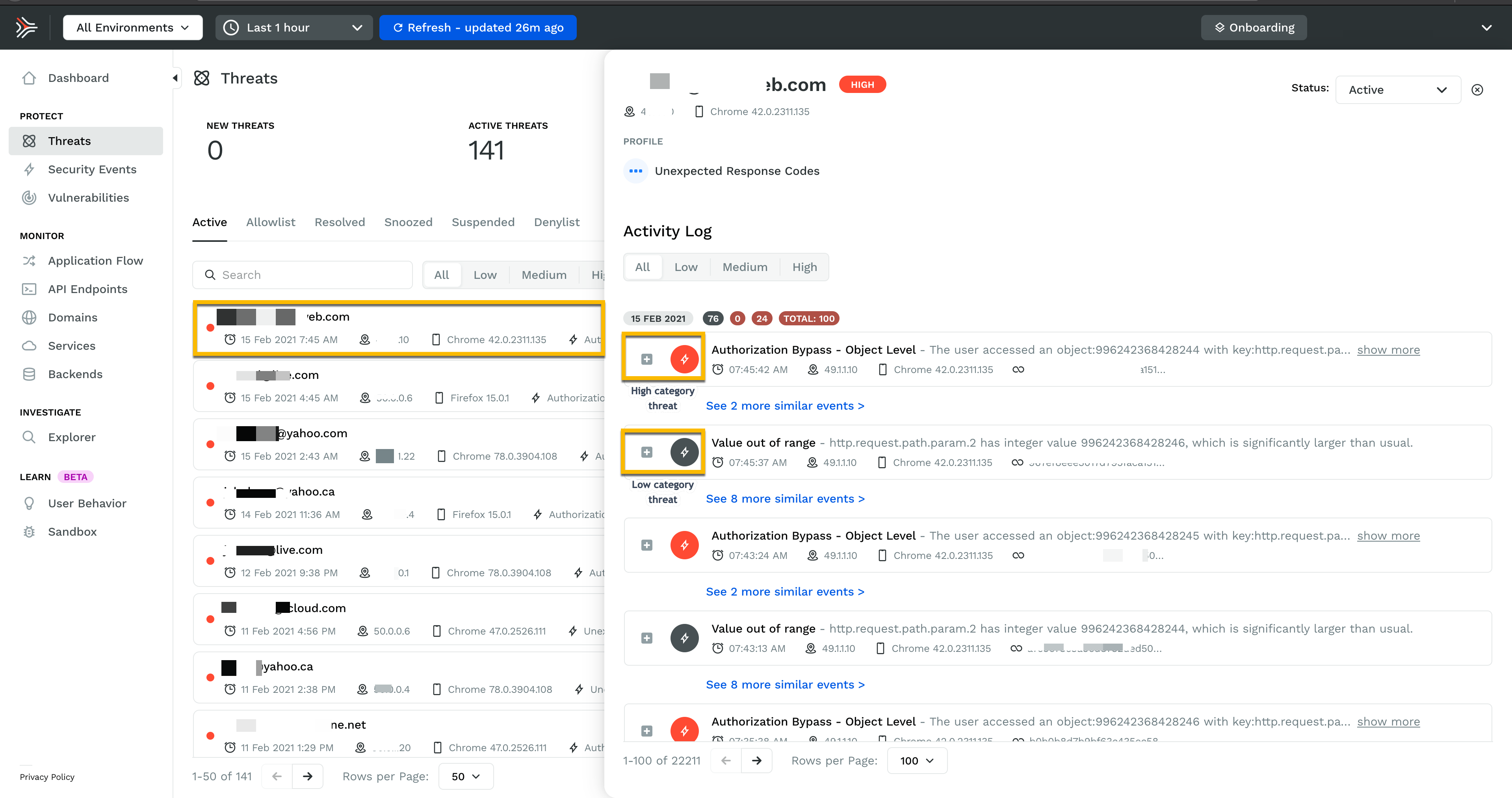

| Traceable AI nabs $60M to secure app APIs using machine learning Posted: 02 May 2022 09:00 PM PDT Traceable AI, a startup offering services designed to protect APIs from cyberattacks, today announced that it raised $60 million in a Series B round led by IVP with participation from BIG Labs, Unusual Ventures, Tiger Global Management, and several undisclosed angel investors. The new capital values the company at more than $450 million post-money, and CEO Jyoti Bansal — who’s also the cofounder of BIG Labs and Unusual Ventures — says that it’ll be put toward product development, recruitment, and customer acquisition. APIs, the interfaces that serve as the connections between computer programs, are used by countless organizations to conduct business. But because they can provide access to sensitive functions and data, APIs are an increasingly common target for malicious hackers. According to Salt Labs, the research division of Salt Security (which sells API cybersecurity products, granted), API attacks from March 2021 to March 2022 increased nearly 681%. Gartner predicts that 90% of web-enabled apps will have more attack surfaces exposed in APIs than user interfaces and that API abuses will become the top attack vector for most companies in 2022. Bansal saw the writing on the wall four years ago, he said, when he cofounded San Francisco-based Traceable with CTO Sanjay Nagaraj. Bansal is a serial entrepreneur, having cofounded app performance management company AppDynamics (which was acquired by Cisco for $3.7 billion) and Harness (which recently raised a $230 million Series D). Nagaraj, a Harness investor, has long been close within Bansal’s orbit, previously serving as the VP of software engineering at AppDynamics for seven years. “APIs are the glue that keeps modern applications and cloud services together. As businesses large and small migrate en masse from monolithic to highly distributed cloud-native applications, APIs are now a critical service component for digital business processes, transactions, and data flows,” Bansal told TechCrunch in an email interview. “However, sophisticated API-directed cyberthreats and vulnerabilities to sensitive data have also rapidly increased. Businesses need machine learning here. To have zero trust you need API clarity. You can no longer easily buy or hire security people, so you need to solve these vulnerabilities via technology.” Like several of its competitors, including Salt, Traceable uses AI to analyze data to learn normal app behavior and detect activity that deviates from the norm. Via a combination of “distributed tracing” and “context-based behavioral analytics,” the startup’s software — which works on-premises or in the cloud — can catalog APIs including “shadow” (e.g., undocumented) and “orphaned” (e.g., deprecated) APIs in real time, according to Bansal. Traceable describes distributed tracing as a technique involving the use of “agent modules” that collect diagnostic data from within production apps as code executes. Context-based behavioral analytics, meanwhile, refers to understanding the behavior of APIs, users, data, and code as it relates to an organization’s overall risk posture. “APIs often expose business logic that threat actors use to infiltrate applications and private data. Every line of code needs to be observed in order to properly secure modern cloud-native applications from next-generation attacks,” Bansal said. “Automated and unsupervised machine learning allows Traceable to go deeper and complete the API security requirement better than anyone. As its name suggests, Traceable traces end-to-end application activity from the user and session all the way through the application code.”  Traceable AI’s monitoring dashboard. Traceable provides a risk score based on “a calculation of likelihood and the possible impact of an attack,” using 70 different criteria (reportedly). The software also maps app topologies, data flows, and unique security events, including runtime details on APIs and data stores. The API security solutions market is quickly becoming crowded, with vendors including Cequence, 42Crunch, and Noname Security vying for customers. The growth correlates with the general rise in API usage — particularly in the enterprise. In twin reports, API marketplace RapidAPI found that 90.5% of developers expect to use more or the same number of APIs in 2022 compared to 2021 and that 98% of enterprise leaders believe APIs are a critical part of their digital transformation efforts. According to Crunchbase data, companies that describe themselves as securing APIs received $193.4 million in venture funding from late 2019 to June 2021, underlining the opportunity that investors see in the technology. Traceable has done quite well for itself despite the competition. Bansal says that the company has a number of paying customers, and — to spur further adoption — Traceable recently released its tracing technology in open source. Dubbed Hypertrace, it enables enterprises to monitor apps with technologies similar to those powering the Traceable platform. “The very nature of the pandemic fallout further helped accelerate digital transformation that was already under way. The creation and adoption of millions of microservices and APIs has been a core underlying enabler for the rapid growth of digital services,” Bansal said. “As different organizations have either created, adopted, or used millions of … APIs, it has greatly increased the attack surface vulnerable to API based attacks which cannot be detected or stopped by traditional security solutions. This problem requires a completely new approach to detect and stop these new attacks.” While Bansal declined to reveal annual recurring revenue when asked, Traceable’s total capital stands at $80 million — the bulk of which is going toward supporting product development and research, he said. “Businesses use Traceable’s rich forensic data and insights to easily analyze attack attempts and perform root cause analysis,” Bansal continued. “Traceable applies the power of machine learning and distributed tracing to understand the DNA of the application, how it is changing, and where there are anomalies in order to detect and block threats, making businesses more secure and resilient.” |

| Andreessen Horowitz plans $500 million investment in Indian startups Posted: 02 May 2022 06:15 PM PDT Andreessen Horowitz, which made its maiden India investment last year, is looking to get aggressive in the world's second largest internet market. The Silicon Valley-based venture capital firm has earmarked about $500 million to back Indian startups, a source familiar with the matter told TechCrunch. The firm, which led a funding round in the Bengaluru-based cryptocurrency exchange CoinSwitch Kuber last year, is also looking to hire for several investment roles in the country, people familiar with the matter said. A number of partners at the firm including Seema Amble and Sumeet Singh have engaged with several Indian startups in recent months, people familiar with the matter said, requesting anonymity as the matter is private. The firm — which in January said it had raised $9 billion for its venture, growth and bio funds — is exploring investment in an Indian startup that operates an opinion sharing platform at a valuation of about $250 million, one person said. It has also engaged with a Bengaluru-headquartered early-stage fintech, another person said. We are “starting to see them look more seriously,” said an investor at a top tier fund in India. He declined to be named. If the firm, which is colloquially called a16z, goes ahead with the plan, it would be the latest high-profile investor to become actively involved in India, home of 100 unicorns and where tech giants Google, Facebook and Amazon have collectively deployed at least $20 billion over the past decade. Andreessen Horowitz did not respond to a request for comment Friday. The firm has been exploring markets like India for years and has been open about the complexity of entering new regions. In a talk at Stanford Graduate School of Business six years ago, a16z co-founder and general partner Marc Andreessen (pictured above) said it was "extremely tempting" to back startups in emerging markets. But it was also challenging for a venture fund to expand to more countries, he explained. Venture capital is a "very hands-on process of understanding the people you're working with for both evaluating the company and work with the company." "If it continues to be a hands-on business like that then there is the problem of geographic remoteness, which is if I'm not present in another geography, do I really know those people to make the decisions. So what a bunch of firms have been trying to do is staff local teams. But then there's the fundamental problem that if the local team is really good, then they can easily leave and run their own firms. If they are bad, they stay working for me…which has its own issues." With valuations getting a broader correction in the private market (as well as public), now would be a good time for the firm to chase deals in the country. Scores of firms, including Bessemer Venture Partners, General Catalyst, Insight Partners, B Capital, Ribbit Capital, Dragoneer, D1 and James Murdoch’s Bodhi Tree (who previously invested in India through Lupa) have increased the pace of their investments in the world's second most populous nation in the past two years. Several of their peers/rivals, including Sequoia, Lightspeed and Accel that each have operated in India for over a decade have either raised new country-specific funds in recent months or are in the process of raising one. Lightspeed India Venture Partners is looking to raise over $500 million for its fourth India fund, TechCrunch reported last week. SoftBank, Alpha Wave Global and Tiger Global have also notably doubled down on India in recent quarters. SoftBank alone invested more than $3 billion in Indian startups last year and plans to invest up to $10 billion this year, it said. Tiger Global has helped mint nearly two dozen unicorns in India in the past 18 months. On the web3 front, scores of investors, including Coinbase Ventures, Sino Global, Hashed and FTX Ventures, have engaged with multiple startups in the country in recent weeks, according to people familiar with the matter. |

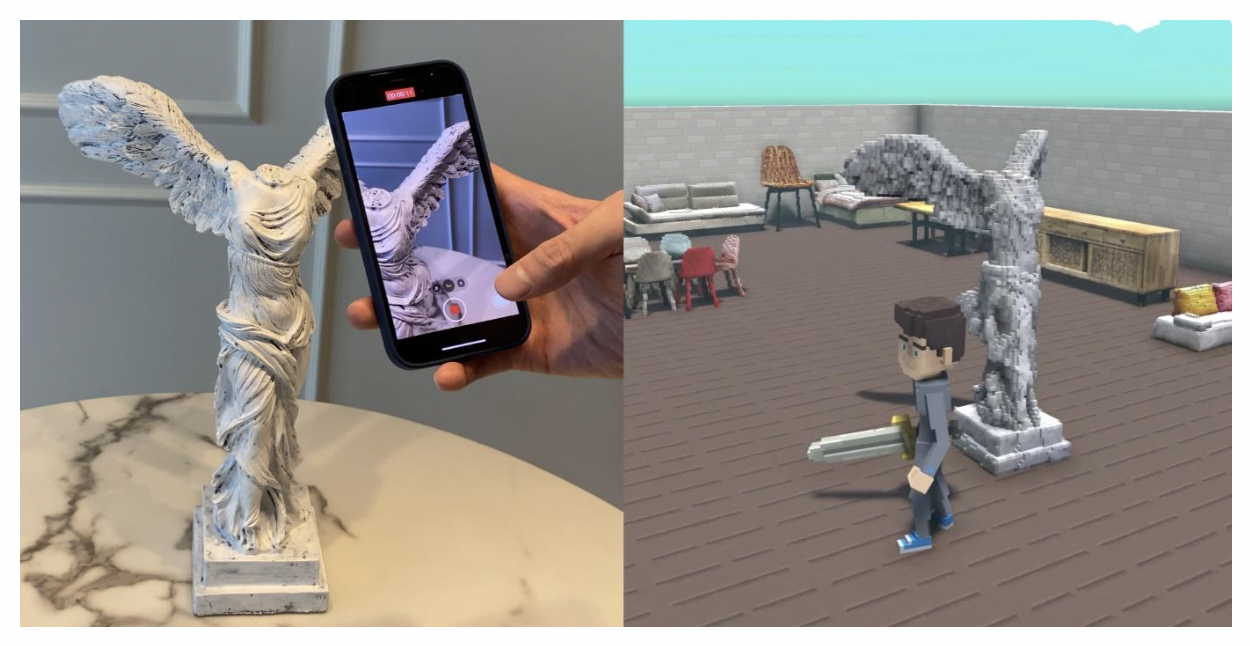

| Posted: 02 May 2022 05:00 PM PDT Augmented reality (AR) can help customers shopping online preview products before making a purchase, and is a growing area of investment for e-commerce businesses. According to a recent survey of 16,000 Snapchat users in 16 markets, 92% of Gen Zers want to use AR and VR for online shopping. Now, a South Korean augmented reality (AR) startup called RECON Labs, which enables e-commerce customers to create 3D models within a few hours by taking a short video of products via its platform PlicAR, has raised $4.4 million. The company will use its Series A funding to increase its headcount and enhance its platform PlicAR, which helps automatically turn a 2D image into a 3D view of its products without requiring any special skills in 3D modeling. RECON Labs CEO Seong-hoon Ban told TechCrunch that the firm works with a number of e-commerce marketplaces and retailers, including furniture companies that want to help their clients visualize products in 3D models in actual life-size in augmented reality. The company currently offers its service to more than 22 small and medium companies in South Korea, and is in discussion with potential customers in the fashion, toy and food sectors, Ban said. Retailers can save time and costs by using PlicAR without building their own 3D modeling platform, he added. RECON Labs claims it has more than 10,000 products that are 2D converted into 3D content. The platform will let users download, upload, view, sell and buy 3D assets through its web-based service in the future, like Sketchfab, which was acquired by Epic Games in 2021, Ban said.  Image Credits: RECON Labs The startup also recently partnered with The Sandbox, a San Francisco-based game company, to develop a tool that will allow users to create 3D characters and items. RECON Labs says it plans to roll out a 3D creator's app next year. It also aims to open an office in Silicon Valley for U.S. expansion in the fourth quarter of 2022. Its previous backers, including Kakao Ventures, Shinhan Capital, Lotte Ventures and Naver D2SF, participated in the latest round, bringing its total raised to $4.8 million since its inception in 2019. New investors Korea Investment Partners, Hanwha Techwin and Kakao Brain also joined in the round. "We will create a service that can easily and conveniently create and utilize 3D content as simple as anyone creating images or video content. Our vision is to grow to provide any types of 3D assets for AR and metaverse environments," said Ban. |

| Stellantis, Trudeau invest $2.8 billion to boost EV production in Canada Posted: 02 May 2022 04:51 PM PDT Stellantis will spend $2.8 billion (CAD $3.6 billion) to increase production of electric vehicles at two of its Canadian plants, the company said on Monday. The funding is a portion of the $35.5 billion Stellantis dedicated to electric vehicles and new software over the next year in its push to move away from internal combustion engines and be carbon net zero by 2038. Stellantis North America chief operating officer Mark Stewart, alongside Canadian Prime Minister Justin Trudeau, announced the overhaul of the Windsor and Brampton, Ontario facilities during an event at the automaker’s Automotive Research and Development Center in Windsor. About a third of the fresh funds will come from the Canadian government and the Ontario government, which plan to invest up to $410.7 million (CAD $529 million) and $398 million (CAD $513 million), respectively, alongside Stellantis, a signal that Canada is keen to support domestic production of EVs at a time when advancing climate change initiatives coincide with increasingly dire supply chain constraints. "Today's deal on made-in-Canada electric vehicles is yet another investment in our workers and in our future," said Prime Minister Trudeau at the event. "We're building a world-class Canadian auto industry, an innovative economy and a clean, strong future for everyone. This is what a healthy environment and a healthy economy looks like." The funding will add more than 650 engineering jobs to the Windsor R&D center, according to Stellantis. The company also said an additional 2,500 jobs will be created at the Stellantis-LG Energy Solution joint battery venture, which was announced in October last year. At the time, Stellantis said only that its new factory would be built in North America, but it’s now clear the automaker has its sights set on Ontario. Stellantis, which owns a range of vehicle brands, including Alfa Romeo, Fiat, Chrysler, Dodge, Jeep, Ram and Peugot, has not yet said which brands would be affected; however, it’s likely there will be continued work on the Chrysler Pacifica Hybrid and other Chrysler EVs, as well as some electrified Dodge cars. The Windsor factory currently produces the Pacifica, as well as the Chrysler Voyager and Grand Caravan, the latter for the Canadian market only. At CES this year, Stellantis said Chrysler, best known for its minivans and being a family-friendly brand, will become all-electric by 2028. At the same time, the automaker unveiled its Airflow Concept, an all-wheel-drive electric SUV. Meanwhile, the Brampton facility is home to the production of the Chrysler 300 and the Dodge Challenger and Charger, all three of which are on their way out. Dodge has said it plans to launch an electric muscle car, the eMuscle, in 2024. Retooling at Windsor is expected to begin in 2023, and retooling and modernization at Brampton in 2024, with production at the latter reesuming in 2025, complete with an “all-new, flexible architecture to support the company’s electrification plans,” the company said in a statement. Stellantis said it would announce at a later date which brands will be affected by the fresh funds. Regardless, we can expect the vehicles produced in those factories to feature the automaker’s new software technology, from which Stellantis has said it plans to generate $22.5 billion annually. All new Stellantis vehicles by 2024 will feature the automaker’s platforms, including the “STLA Brain,” a cloud-connected technology that allows for over the air software upgrades; the “SmartCockpit,” a platform built with Foxconn that delivers applications like navigation, voice assist, e-commerce marketplace and payment services; and “AutoDrive,” developed with BMW to deliver automated driving features. For those who want a high-tech hit now, Pacificas of this model year can upgrade to get an Amazon Fire TV to stream or download shows and movies or get information from Alexa, a partnership that will also hit millions of Stellantis vehicles by 2024. Through its 14 brands, Stellantis currently has 29 electrified models on sale globally. By the end of the decade, the automaker hopes to reach 75 BEVs globally, 25 of which will target the U.S. market. Recently, Stellantis revealed its first-ever fully electric Jeep SUV, which is expected to launch next year, as well as its new Ram 1500 BEV pickup, which is expected for 2024. |

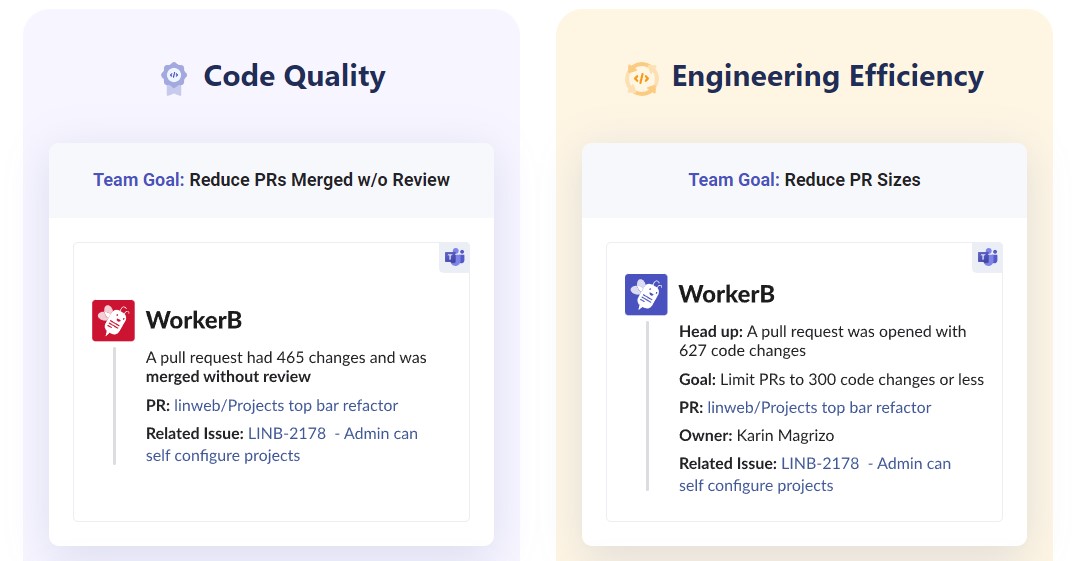

| LinearB wants to help development teams optimize their workflows Posted: 02 May 2022 03:16 PM PDT LinearB, a startup that helps engineering leaders optimize the workflow of their development teams, today announced that it has raised a $50 million Series B round led by Tribe Capital. New investor Salesforce Ventures, as well as existing investors Battery Ventures and 83North, also participated in this round, which brings the company’s total funding to $71 million. The company says it managed to grow its user base from 1,500 development teams in 2021 to over 5,000 today. It currently counts Bumble, BigID, Cloudinary, Unbabel and Drata among its users. One of LinearB’s most important promises is that it goes beyond simply giving engineering managers access to more dashboards about developer efficiency. Instead, LinearB wants to also provide them with more insights into how they can optimize the development workflow as well. It does so by integrating with a wide variety of existing DevOps tools to aggregate data about how teams work. It tracks metrics like cycle time, deployment frequency, mean time to restore when things go off the rails and change failure rates. That data is at the core of what LinearB does and provides something akin to a baseline for developer productivity in a given company. But from there, users can then also dig deeper to see where there are bottlenecks in their workflows or which team members may have a bit too much on their plate right now. In addition, LinearB then also helps teams set their own goals so they can track their own progress, and also helps them automate routine tasks like creating Jira tickets (because while it’s often at the core of what a development team does, nobody enjoys managing Jira tickets). This focus on providing value for everybody from the VP of Engineering down to the individual developer is also a core tenet of the service, LinearB CEO and co-founder Ori Keren told me. Both he and his co-founder Dan Lines previously worked as VPs of R&D and engineering — and that was the user persona they had in mind when they started building the service. Keren tells me they had some early success with that, but decided that in order to really provide the most value for their customers, they had to change course. “Our true philosophy is that improvement has to come from the bottom up,” he said. “You got to have the developers using that tool, you got to have team leaders, frontline managers. So really quickly, we identified that if we want to be a successful company — I wouldn’t say we pivoted, but we kind of adjusted quickly and said: when you onboard to the tool, it has to have something for every persona in the engineering organization: the developers, the team leaders and also for the engineering managers.” That’s something the team learned in early 2020 and with the COVID pandemic hitting just around this time, a lot of companies saw the need to accelerate their own projects around accelerating their development processes. And while developers may not care too much about tracking the cost of their projects and instead about cycle time, both draw from the same data. The company says its users are seeing deployment speeds increase by 64% during the first 120 days of using the project. "We're not just building a tool that helps dev teams, we're creating a community of engineering leaders that want to improve the way software development happens," said LinearB COO and co-founder Dan Lines. The company plans to use the new funding to expand across its own development teams but also to expand its go-to-market efforts. In terms of product, the team is doubling down on its workflow optimization tools, Keren said. “We’re going to invest a lot in developer workflow optimization,” he said. “We believe that developer productivity, if you want to be great at it, you have to be helping developers — these are the people who are doing the work.” |

| Don’t miss the roundtable roundup at TC Sessions: Mobility 2022 Posted: 02 May 2022 03:15 PM PDT TC Sessions: Mobility is quickly approaching. Join us on May 18-19 in San Mateo, California and online on May 20 for a deep dive featuring the best, brightest and most intriguing founders, engineers, investors, regulators and technologists dedicated to transforming the way we move people and packages around the globe. Pro Tip: Buy a General Admission pass now and save $200. We have two days of in-person programming waiting for you — just take a gander at the agenda. But we want to spotlight the topic-focused roundtable discussions. Why? These smaller gatherings will be led by topic experts and main stage speakers. They give attendees the chance to dig into an issue and engage in meaningful conversations that can lead to interesting opportunities. We've got some great ones on tap. Take a look for yourself.

May 18Building a Sustainable Mobile Ecosystem with Ritu Narayan, CEO and Founder, Zum

Pilotless Flight: How Close Are We to Fully Autonomous Airplanes? with Maxime Gariel, CTO, Xwing

Next Gen Mobility: Why Software Drives the Future of Vehicle Architecture with Joe Speed, VP of Product, Apex.AI

Zero-emission Aviation — A Roadmap for Hydrogen-powered Flight with Dr. Alex Ivanenko, Co-founder and CEO, HyPoint

Creating Ethical and Inclusive Solutions for Mobility Tech with Lisa Mae Brunson, Founder & Chief Visionary, Wonder Women Tech