TechCrunch |

- Last chance: Our bring a friend for free promotion on TechCrunch events ends tonight

- U.S. Energy Secretary Jennifer Granholm will speak at TC Sessions: Climate

- Amazon is killing its Alexa-connected Cloud Cam, will replace customers’ dead devices with a Blink Mini

- Faster ML models, crypto M&A, and what’s ahead for on-demand pricing

- Hannah Grey launches its $52M inaugural fund

- TechCrunch Live is going to Columbus, OH — June 1st!

- Bonfire Ventures secures $230M for two new funds targeting B2B software startups

- Onramp Funds accelerates e-commerce financing platform with $42M in equity, credit

- Railway snags $20M to streamline the process of deploying apps and services

- Data-sharing platform Vendia raises $30M Series B

- Seemplicity emerges from stealth with $32M to consolidate security notifications and speed up response times

- New York-based Digital Asset to help Japan’s financial giant SBI develop ‘smart yen’

- Temasek in talks to invest in Google-backed DotPe

| Last chance: Our bring a friend for free promotion on TechCrunch events ends tonight Posted: 31 May 2022 08:11 AM PDT Savings-savvy startuppers take note. Your chance to buy two attendee passes for the price of one — for three TechCrunch events — disappears tonight, May 31 at precisely 11:59 pm (PT). Whether you buy a single pass, split the cost and go with a friend, or buy in bulk to take your entire team, this is the time to do it — and save a tidy bundle. Heck, at this price, you can attend all three events and really expand your startup skills, knowledge and network. Here's the scoop on the three qualifying events, their dates and the links to go purchase your pass(es).

Note: The 2-for-1 pricing applies only to attendee tickets; it does not apply to demo or exhibiting packages. Why should you go to TechCrunch events? Two of your peers shared their reasons with us. "I'm never disappointed when I attend TechCrunch events. Whether from the smallest startup all the way up to a Google, I always find someone or something surprising that makes me say, "Oh, I didn't know about that." — Rachael Wilcox, creative producer, Volvo Cars. "TechCrunch does this thing of connecting total strangers to create a genuinely supportive community. We're all trying to do the same thing, which is bring our idea to life and make it a reality. I loved that unexpected benefit." — Jessica McLean, director of marketing and communications, Infinite-Compute. Here's just a sample of what we have planned at these three events. TC Sessions: Climate

The TC Summer Party

TechCrunch Disrupt 2022

Time is running out on this 2-for-1 promotion. Don't miss your chance for serious savings. Click on the links above and get ready to mine for opportunities at three TechCrunch events. Remember, the sale ends tonight, May 31 at 11:59 pm (PT). Go, click, save! Is your company interested in sponsoring or exhibiting at TC Sessions: Climate, TC's Annual Summer Party or TechCrunch Disrupt? Contact our sponsorship sales team by filling out this form. |

| U.S. Energy Secretary Jennifer Granholm will speak at TC Sessions: Climate Posted: 31 May 2022 08:00 AM PDT It's hard to believe that, despite a scientific consensus and mountains of verified evidence, climate change has become a global political football. And yet here we are. All the innovative climate tech in the world — both current and emerging — is not enough to turn the rising climate-crisis tide without one key ingredient: political will. Yet, the increasingly gridlocked nature of U.S. politics is holding back progress on emissions mitigation. It begs the question: How can we, as a nation, meaningfully move forward here at home — much less influence other major carbon polluters across the globe? This vital question is just one reason why we're excited to announce that the Secretary of the U.S. Department of Energy (DOE) Jennifer Granholm will join us on June 16 for our Online Day at TC Sessions: Climate & The Extreme Tech Challenge 2022 Global Finals. Granholm leads the DOE's effort to help achieve President Biden's goal of net-zero carbon emissions by 2050, which would, Granholm said in the Secretary’s Message to America, mean "cheap, abundant, clean power — made right here in the U.S." It's unlikely that Granholm, or any of our current politicians, will be in office come 2050. But, given the likelihood of yet another contentious presidential election in 2024, we're curious about what concrete measures Granholm plans to take over the next two — or possibly six — years to move us closer to that distant goal. In 2021, the DOE announced $2.1 million in public-private partnership awards related to advancing fusion energy. We'd like to hear more about the DOE's funding of public-private partnerships and what other projects may be in the pipeline. These are just some of the topics we'll discuss with Granholm, who became the second woman to lead the DOE on February 25, 2021. She was also the first woman elected Governor of Michigan, serving two terms from 2003 to 2011. Granholm led efforts to diversify Michigan’s economy, strengthen its auto industry, preserve manufacturing and add emerging sectors — such as clean energy — to the state’s economic portfolio. After serving as governor, Granholm joined the faculty of the University of California, Berkeley as a Distinguished Professor of Practice in the Goldman School of Public Policy, focusing on the intersection of law, clean energy, manufacturing, policy and industry. She also served as an advisor to the Clean Energy Program of the Pew Charitable Trusts. Don't miss this online fireside chat and the opportunity to hear directly from the Secretary of the U.S. Department of Energy, Jennifer Granholm, about the ongoing efforts to move the U.S closer to net-zero carbon emissions. TC Sessions: Climate takes place in person on June 14 at UC Berkley’s Zellerbach Hall, and this fireside chat takes place during our online day on June 16. Buy your ticket today.

|

| Posted: 31 May 2022 07:30 AM PDT Amazon is shutting down its smart home camera, the Cloud Cam, and its companion apps, the company informed customers via a recent email. Launched in 2017, the nearly five-year-old Cloud Cam was one of Amazon’s first entries into the area of Alexa-connected home security devices, arriving just ahead of the retailer’s acquisition of connected camera and doorbell maker, Blink, and soon thereafter, smart doorbell maker Ring. Now, Amazon says it’s now focusing its efforts on Ring and Blink, which is why it no longer intends to support Cloud Cam. “With your help over the last five years, Cloud Cam has served as a reliable indoor security camera and a hub for Amazon Key-compatible smart locks that work with Alexa,” the email to existing customers states. “As the number of Alexa smart home devices continues to grow, we are focusing efforts on Ring, Blink, and other technologies that make your home smarter and simplify your everyday routines.” The email goes on to inform customers that, starting on Dec. 2, 2022, they’ll no longer be able to use Cloud Cam or its associated apps. Until then, users will still be able to download their video recordings. But as of the shutdown date, all video history will be deleted and the service will no longer function. Fortunately for impacted customers, they won’t just be left with a useless device as a result of the shutdown, after having paid over $100 to purchase their Cloud Cam smart camera. Instead, Amazon is doing the right thing in this case by offering a replacement device for free. The company says it will provide Cloud Cam users with a complimentary Blink Mini and one-year Blink Subscription Plus Plan. The Blink Mini is an indoor security camera with 1080p HD video, 2.4 GHz Wifi connectivity, night vision, motion detection, two-way audio, and, like Cloud Cam, it works with Alexa devices. These specs are similar to Cloud Cam, which had also offered 1080p HD video, night vision, and two-way audio. However, Cloud Cam’s subscription plan differs from Blink’s. Today, Cloud Cam users can choose from three priced tiers of $6.99, $9.99, or $19.99 per month, based on how many cameras they have (3, 5, or 10) and how long they want to store video clips — either a week, two weeks or a month, respectively. Blink’s subscriptions, meanwhile, include a free tier without video history, or a $3/mo or $10/mo paid plan — Basic or Plus — each of which offers a 60-day unlimited video history. But only the Plus subscription allows for more than one camera. Amazon said it will send out a separate email ahead of Cloud Cam’s shutdown to inform customers how to claim their complimentary replacement device. In the meantime, Cloud Cam users can back up their videos from the “Recorded Clips” section in the app’s top-right menu. They’ll need to click on each video and then click the Download icon to save the video. They can also delete recordings from here or from Amazon’s “Manage Your Content and Devices” online hub.

|

| Faster ML models, crypto M&A, and what’s ahead for on-demand pricing Posted: 31 May 2022 07:06 AM PDT Hello and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines. It's Monday, which means that Alex and Grace were back as a team to cover the biggest, boldest and baddest technology news. We are once again back with your weekly kickoff! Here's what we got into:

Woo! Equity is live this Thursday, so come hang with us on Twitter Spaces or Hopin, yeah? Chat then! Equity drops every Monday at 7 a.m. PDT and Wednesday and Friday at 6 a.m. PDT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts. |

| Hannah Grey launches its $52M inaugural fund Posted: 31 May 2022 06:55 AM PDT Focusing on “Customer-centric founders redefining everyday experiences,” venture firm Hannah Grey told me it just closed its oversubscribed $51.6 million fund. The company’s thesis focuses on “studying macro-societal forcing functions and evolving human behavior to identify areas of opportunities.” The team told me it was planning to raise $25 million but found a lot more interest for its thesis, eventually closing more than twice that. The firm is backed by LPs such as Screendoor Partners, JPMorgan, Twitter, Carta, Stagwell Group, Insight Partners, Equity Alliance, and other foundations, fund of funds, family offices and strategic industry veterans. The firm is the brainchild of Kate Beardsley and Jessica Peltz-Zatulove. Beardsley was founding member of Lerer Hippeau and Upslope Ventures. Before that, she was an early Huffington Post employee and chief of staff to Martha Stewart. She’s been in VC since 2009. Peltz-Zatulove formerly ran the CVC of Stagwell Group and spent 10-plus years working with Fortune 500+ brands commercializing emerging technology. She’s been investing since 2014, and co-founded Women in VC, which has since scaled to over 4,000 women across 65 countries. The firm invests at the pre-seed and seed stage, writing checks ranging from $400,000 to $1 million. It leads a lot of the rounds it invests in. Hannah Grey is named for the firm’s partners’ oldest daughters — Raya Hannah and Gunnison Grey, now 4.5 and 5 years old, respectively. The firm uses its name as a touchstone. “[The name] is a constant reminder that we are investing in companies building for generational change,” Peltz-Zatulove told me. “The firm’s name is also a tribute to the human side of venture capital — which can be overlooked. We feel privileged to be long-term partners with our portfolio founders, empathizing and empowering them through the highs and lows of both everyday life and building businesses in the decades ahead.” The firm has hired its first full-time employee. To my surprise, that person wasn’t an associate or an admin person, but a marketing and branding expert in the form of Michael Miraflor: “The assumption is we probably hire an associate first. Jess and I have been doing the work, and are used to doing the work. We expect to continue to do all of the work in that capacity,” says Beardsley. “Tech talent is more available than it was in the early days, but there’s not an understanding of brand in the same way. That’s where we found a huge opportunity. Founders tell us that ‘we don’t care about technical talent: we have our team from this previous company. We care much more about this area; we don’t come from a marketing background, and we need to lean on your expertise to find the right hire.” With its focus on brand and marketing, Hannah Grey is positioning itself as a catalyst and amplifier for companies that need to make a big splash. It offers assistance with go-to-market and acquisition strategies, brand voice, visual identity, content strategy and the full gamut of brand guidance and monitoring. The firm has already made 13 investments out of its fund, leading four of them. Investments to date include money deployed into learning platform Subject, period care company August, web3 DAO company Upstr |

| TechCrunch Live is going to Columbus, OH — June 1st! Posted: 31 May 2022 06:38 AM PDT On June 1, 2022, the TechCrunch Live crew is hosting an extended TechCrunch Live episode with Columbus investors, founders and business leaders. There's even a pitch-off with Columbus-area startups. Register for the virtual event here for free! Why Columbus? Because it's quickly becoming a major startup scene in the Midwest, especially in the areas of healthcare and insurance. More than $3 billion has been injected into the city over the past 20 years, according to Crunchbase data. Investment into the city startups started picking up around 2017 and really peaked in 2021. That's when investment essentially doubled, going from $583 million in 2020 to just over $1 billion, with half of those dollars going into two companies: healthcare technology company Olive and autonomous robotics company Path Robotics. So far in 2022, $110 million has gone into Columbus startups. Olive is now valued at over $4 billion and is among other Columbus success stories like CoverMyMeds, a healthcare software company that was acquired by the McKesson Corp. in 2017 for $1.4 billion, which represents Central Ohio's first $1 billion exit. Root Insurance, which raised over $800 million since 2015, went public in 2020. Other notable raises include Forge Biologics' $120 million Series B round, which was thought to be Ohio's largest Series B to date. Forge plans to add 200 new jobs by 2023. We hope you can attend this event! Like every TechCrunch Live event, it's free to participate and attend. And like every TechCrunch Live event, it kicks off at 2:30 p.m. EDT/11:30 a.m. PDT, and this one happens on June 1, 2022. TechCrunch Live in Columbus!Columbus Unicorns with Olive and Drive Capital (3:00 p.m. EDT)

Raising startup capital (3:30 p.m. EDT) Ohio isn’t Silicon Valley, and yet there are numerous venture capital funds eager to write checks to early-stage founders. Join this session and hear from two investors on which industries are thriving in Columbus, and which sort of founders fit best in this scene.

Work for a startup in Columbus (4:00 p.m. EDT) Columbus, like many major American cities, is home to industry giants with hundreds of workers toiling away in cubicles. But startups are hiring! Hear from two local leaders on who’s hiring and what startups look for in new employees.

Pitch Competition (4:20 p.m. EDT) Judges

Found Live with Claire Coder, CEO of Aunt Flow (5:00 p.m. EDT) Aunt Flow is an innovative startup from Columbus, Ohio that supplies 23,000 bathrooms with essential feminine products. The company’s clients include Apple, Meta and more. Hear from the company’s CEO Claire Coder about the pains of raising capital in Ohio and scaling her company to 40 employees during this special Found Live podcast recording.

|

| Bonfire Ventures secures $230M for two new funds targeting B2B software startups Posted: 31 May 2022 06:30 AM PDT Bonfire Ventures, a Los Angeles venture capital firm, invests in seed-stage business-to-business software companies and aims to change the odds so that more than the average 33% of companies in this sector make it to Series A. The firm seems to have some good traction so far. It says over 85% of its portfolio companies raise follow-on funding — a collective $1.15 billion — and its first fund is "ranked as one of the top 5% of VC funds globally," while the second fund is in "the top 10% of their respective vintage years." Some of the companies getting follow-on funding include digital adoption company Spekit, led by CEO Melanie Fellay, which announced a $45 million Series B in January, consumer goods app company Aforza and e-commerce company Swell. Both managing directors Jim Andelman and Mark Mullen were leading their own venture capital firms in the early 2000s and often co-invested on startups and decided to combine forces as Bonfire Ventures. The third managing director, Brett Queener, joined in 2018 after a career at Salesforce and Siebel Systems. They secured $230 million in capital commitments for their two new funds, which include a third core seed fund of $168 million and a second opportunity fund flush with $63 million. The firm's leaders tell me they are "intentionally selective" in the number of startups they invest in under each fund, around 25 to 30, so they can give more specialized support to founders. Andelman and Queener spoke to me about the new funds, how the firm is working with startups and what they are telling their portfolio companies during this challenging investment environment. The following conversation was lightly edited for length and clarity. TechCrunch: How did you and Mark Mullen start working together? Andelman: The L.A. venture community was small for a long time, still relatively pretty small, and we all had small funds. We bumped into each other all the time and collaborated a lot more because we had independently developed the same investment focus in the same geography, same sector, same stage. We joined forces for a couple of reasons: One, we knew there was a great opportunity here for a bigger firm to play a bigger role in the ecosystem. We knew with a bigger team we could better support founders and the community. Two, we wanted to build something that outlasted us. It started as the two of us and now there are seven of us. What's your approach in investing in companies? Queener: We’re going to spend the next 10 years of our lives together with the people that we invest in, so we have to like them and they have to like us because the journey or any software company is long and has lots of ups and downs. Our approach is pretty hands-on, like a two-way partnership. We are looking for software companies with a strong narrative that we think can become iconic brands with products that buyers cannot live without. We also want a strong emotional connection to the company. Tell me about the traction from your previous funds. Queener: Both fund one and fund two are the top 5% or 10% in their vintage years, essentially when it started and how it performed. You can ask "How is that the case? Are we amazing pickers?" We’re not bad, but the companies also have to do well. In most seed-stage investment funds, they expect a 75% death rate. Less than 33% raise an A and only 50% raise any follow-on capital. Where that number for us is 85%.I think these results will probably be even better, compared to other venture capital firms, over the next five years. Why should companies add you to their cap tables? Andelman: We are very much a low-volume, high-conviction, high-support investor. We maintain the bandwidth to be responsive to founders and earn the role of first call when they have a question. That’s something you earn by being responsive, by being trusted and smart. That’s why we focus just on B2B software. The whole team’s entire careers have all been in and around the software. We have the time to dig in with the founders when they need us most. What do you make of the VC slowdown we are seeing? Andelman: The public cloud and software index, is down more than 50%. Meanwhile, the companies continue to grow. We have now come back down to a sort of historical norm or even a little lower. Things that were in the top quartile and trading at 20 times more revenue are now trading at seven-and-a-half times for revenue. So this is going to be a very challenging period for a lot of companies and a lot of VCs. I’m very grateful that my career has steered me, and then we steer the firm to focus on B2B software. Software companies have never been small, so I’m grateful that we are where we are in this climate. Businesses that are less capital efficient, that have less control over their expenses can’t really revert to a skinny model and are going to be the ones that take a much bigger challenge. Queener: The VC slowdown, to some extent, is the end of free money. Normally, we have a correction in tech every seven years. With the federal stimulus, the COVID response package and interest rates being low, valuations got way out of whack and what we’re seeing is a realization that that was untenable, and that profitability, efficiency and making money actually matters. Will all of this change your future approach to investing? Queener: Our approach is the same in that when we invest in companies, we don’t place too many bets. I think what will change is more around making sure you don’t invest too far ahead of what you see in front of you. Andelman: There are going to be some investments on the margin that made sense in November when capital was abundant and valuations were 100 times ARR that don’t make sense today. Every business is going to adjust its plan to some degree one way or the other. We’re fortunate that a lot of the really significant needle-movers across the funds are well capitalized. How are you advising your portfolio companies now? Andelman: We are giving similar advice to what I think a lot of VCs are, which is if you can defer your next fundraise by 12 or 24 months you should. The next 12 to 24 months are going to be very unpredictable, and there are always trade-offs between how much you invest in growth and how much you burn. There’s no one size fits all. We are going company by company engaging with each founding team to make sure that we are comfortable, collectively, with the investments that the businesses are making and giving those founders the best perspective and guidance. |

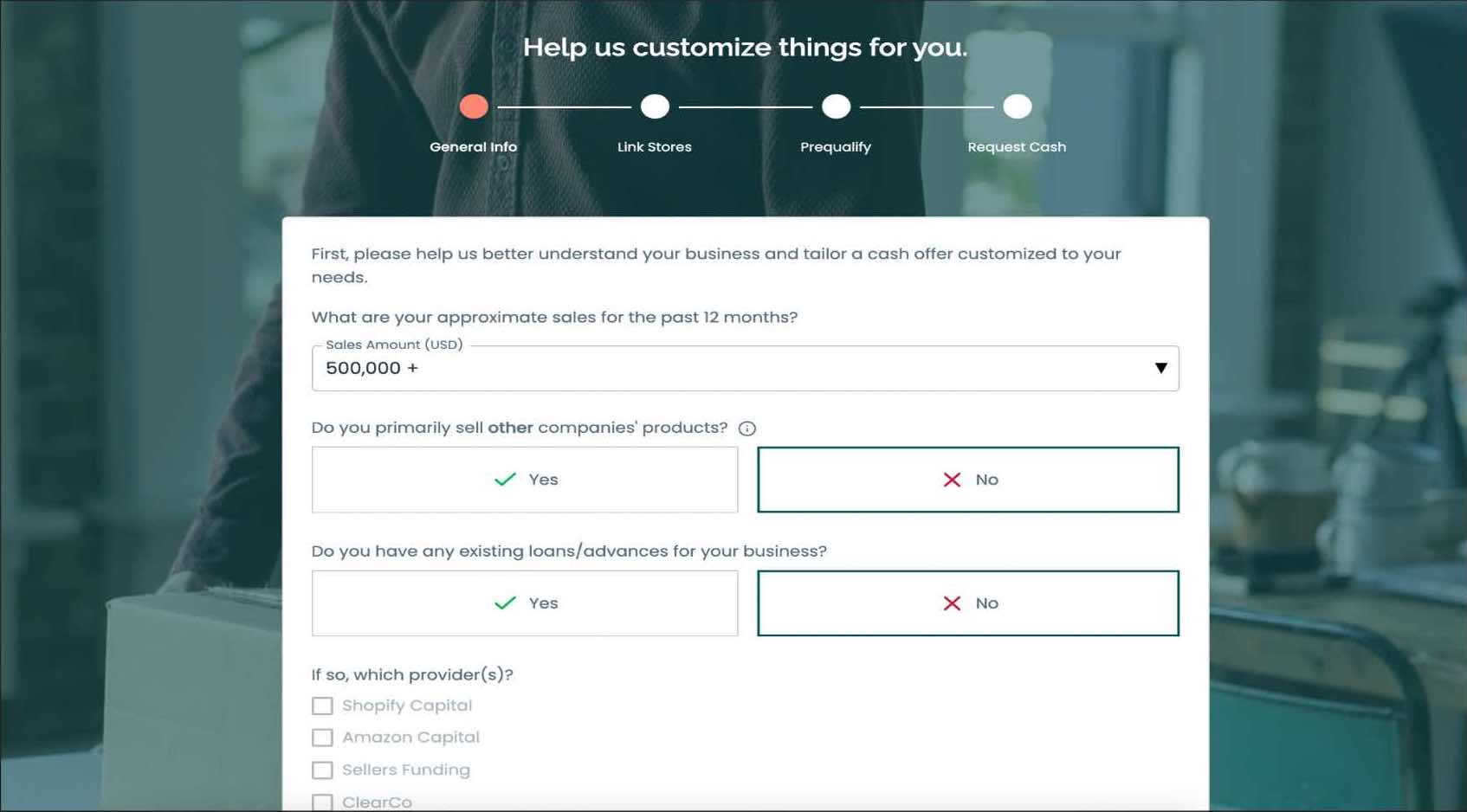

| Onramp Funds accelerates e-commerce financing platform with $42M in equity, credit Posted: 31 May 2022 06:05 AM PDT Onramp Funds, an Austin-based company providing financing to e-commerce sellers, secured $42 million in equity and credit to expand its working capital offering. CEO Eric Youngstrom founded the company in 2020 after a career at multicarrier shipping software company ShippingEasy. One of the problems with shipping at that time, back in 2012, was that you would have to log into each individual marketplace. For example, Amazon, eBay or Shopify, to see orders and figure out how to process them. What ShippingEasy did was bring that all together under one data management platform. When ShippingEasy was acquired by Stamps.com in 2016, Youngstrom shifted over to the new company and saw a new problem emerge — that smaller e-commerce merchants couldn't afford to ship an order because their credit cards were maxed out. "People just didn’t have the money necessary to complete the order," he told TechCrunch. "The money’s there — in three days it’ll be deposited into your account, but if you don’t get it going today, you’re going to lose the order. Amazon set the standard there." Youngstrom and his team tried solving the problem inside of Stamps.com, but couldn't find a good solution, so he decided to leave in 2020 and launch a product that could help merchants. The solution Onramp Funds came up with was a data-driven technology. The company doesn't just look at top-line sales, which Youngstrom believes differentiates his company from competitors but takes in historical sales data to build a sales forecast. Onramp then provides working capital from that data to resolve the shipping, fulfillment, advertising and inventory cost of goods so that merchants can take their own capital and redeploy it into their growing business. The company makes its revenue by charging a percentage of the sales, typically around 1%.  Onramp Funds web platform. Image Credits: Onramp Funds Providing working capital to small businesses is somewhat of a personal mission for Youngstrom, who grew up around business owners in a small town and related to the need to support local businesses. He also notes e-commerce sales in the U.S. are still under 20% of all retail sales, so there is over 80% of retail still ripe for e-commerce to grab more market share. "If we can help the small business owner, we can make the world a better place," he added. "If we get to help people succeed at their jobs, I think that’s wonderful." Meanwhile, Youngstrom declined to provide the breakdown on the $42 million equity versus credit line ratio. Luther King Capital Headwater Investments led the funding, which also included a group of high-net-worth individuals. Since officially launching the working capital offering nine months ago, Onramp is now working with hundreds of customers, some of whom have used the service multiple times. Revenue is growing 30% month over month. While the credit line will be used for financing small businesses, the equity portion will go to build out Onramp's customer acquisition engine and bring in additional staff in the areas of engineering, product, sales, marketing and client success. The company currently has 27 employees. The company is also providing more guidance to merchants when it comes to navigating the supply chain bottleneck that got worse during the global pandemic. "We’re building a really cool business that's finding great success and very early standards, and we plan to be here for the long haul to help these guys," Youngstrom added. |

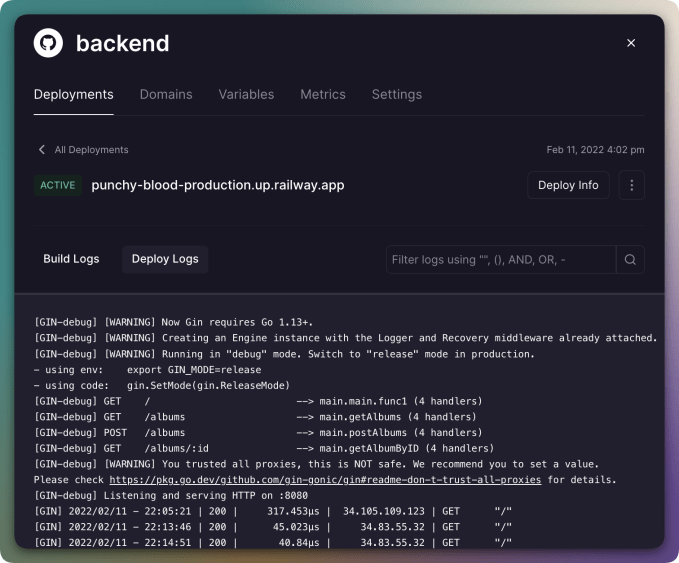

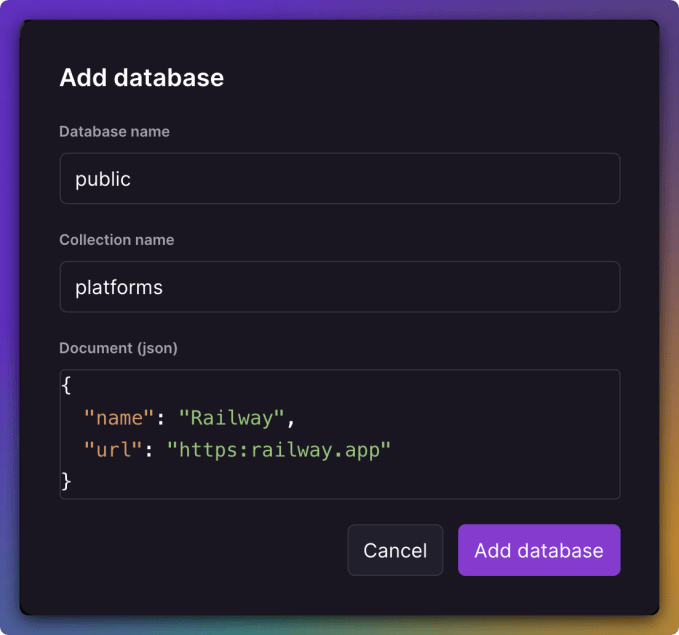

| Railway snags $20M to streamline the process of deploying apps and services Posted: 31 May 2022 06:00 AM PDT Railway, a startup building a software deployment platform tailored for engineers, today announced that it raised $20 million in a Series A round led by Redpoint Ventures and angel investors including Vercel CEO Guillermo Rauch and GitHub co-founder Tom Preston-Werner. The capital brings Railway’s total raised to $24 million, which founder and CEO Jake Cooper said is being put toward continuing to expand Railway’s product with a focus on enterprise customers. In a conversation with TechCrunch, Cooper said that he and Railway’s founding team was inspired to launch the platform by the dearth of support tools for deploying apps. Cooper was previously a software engineer at Wolfram Alpha, Bloomberg, and Uber before co-launching Railway in 2020. “When I was first learning to code, building software was a magical experience. Fast forward a decade later, and all current iteration of infrastructure tooling requires deep infrastructure knowledge … and a fleet of DevOps engineers to ship a simple app to production,” Cooper told TechCrunch via email. “In our minds, both users and companies alike will require better, more accessible tooling for their engineering teams to move quickly and build category defining products. Railway today allows engineers to … ‘automagically’ receive industry best practices for building and deploying apps.” Traditional app development might require drawing up architectural diagrams and weaving together services across public clouds like Amazon Web Services, Microsoft Azure, and Google Cloud Platform. In contrast, Cooper said, Railway provides a dashboard for building, deploying, and monitoring apps and services, either from a birds-eye view or down to the individual level.  Image Credits: Railway “In our mind, the number one challenge that the industry currently faces is ‘compute accessibility.’ Compute is one of the, if not the, most powerful tools available to people. Current iterations of cloud infrastructure tooling lock this experience behind complicated yaml or unintuitive dashboards,” Cooper said. “Railway is building an engine to unleash the full potential of compute and make it accessible to any user, anywhere in the world. We see ourselves as a ‘next-generation cloud’ that works with the user instead of against them.” Recently, Railway launched what it calls the “infinite shipping canvas,” which allows users to say what they want in natural language (e.g.,”Give me a PostgreSQL database,” “Deploy this GitHub repo”) and get a running version of that infrastructure. Railway keeps track of the services and configurations under the hood and redeploys them based on changes to the infrastructure. “Oftentimes with engineering organizations, it's not even a matter of ‘How expensive is it?’ but a matter of ‘How many quarters will it take?’ Time is the currency of engineering teams and leaders, and so when it comes to ‘Why should your CTO/VP/director care about this?,’ our answer is that Railway can cut your architectural implementation time from months to minutes,” Cooper said. “Railway as a lifecycle management engine that bridges the gap between development and production. In our ideal future, builders have time to focus on their core products without worrying about how to deploy them.” Railway’s traction is impressive to be sure. Cooper claimed that Railway has been used by over 50,000 developers, including AI-powered fire prevention service Fion Technologies, to launch more than 900,000 projects. User growth over the past year increased 30x and 90% in the last month alone. And while while Cooper didn’t reveal exact numbers, he said that revenue is growing anywhere between 20% to 50% month-over-month.  Image Credits: Railway “The platform now has over 1,000 people on the developer and teams plans, ranging from high-growth companies all the way to indie developer hobby projects,” Cooper continued. “The pandemic has been a massive accelerator for companies looking to adopt high leverage tooling to increase efficiency of managing their infrastructure. Collaboration and automation, things Railway excels at, are key and so things like preview environments, linking directly to cloud logs, and fully reproducible local experience using the command line are all things that have been massively helpful in selling our businesses value as orgs go cloud native … Railway is an incredibly powerful tool today, and we've only just scratched the surface of what we want to do.” San Francisco, California-based Railway has just eight people on its payroll. But with the funding, the company plans to grow the team to 12 to 15 members by the end of the year with an emphasis on technical roles. |

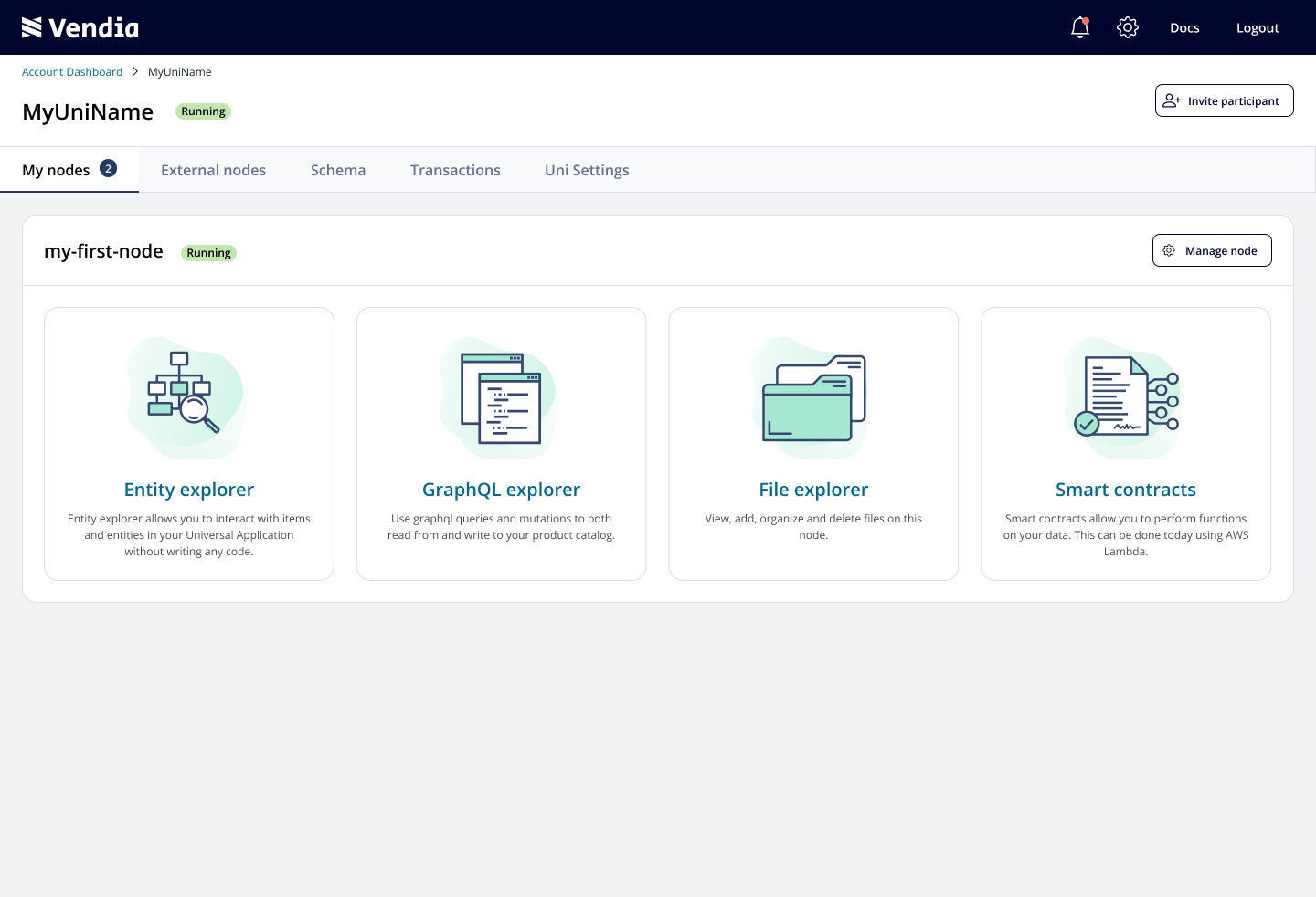

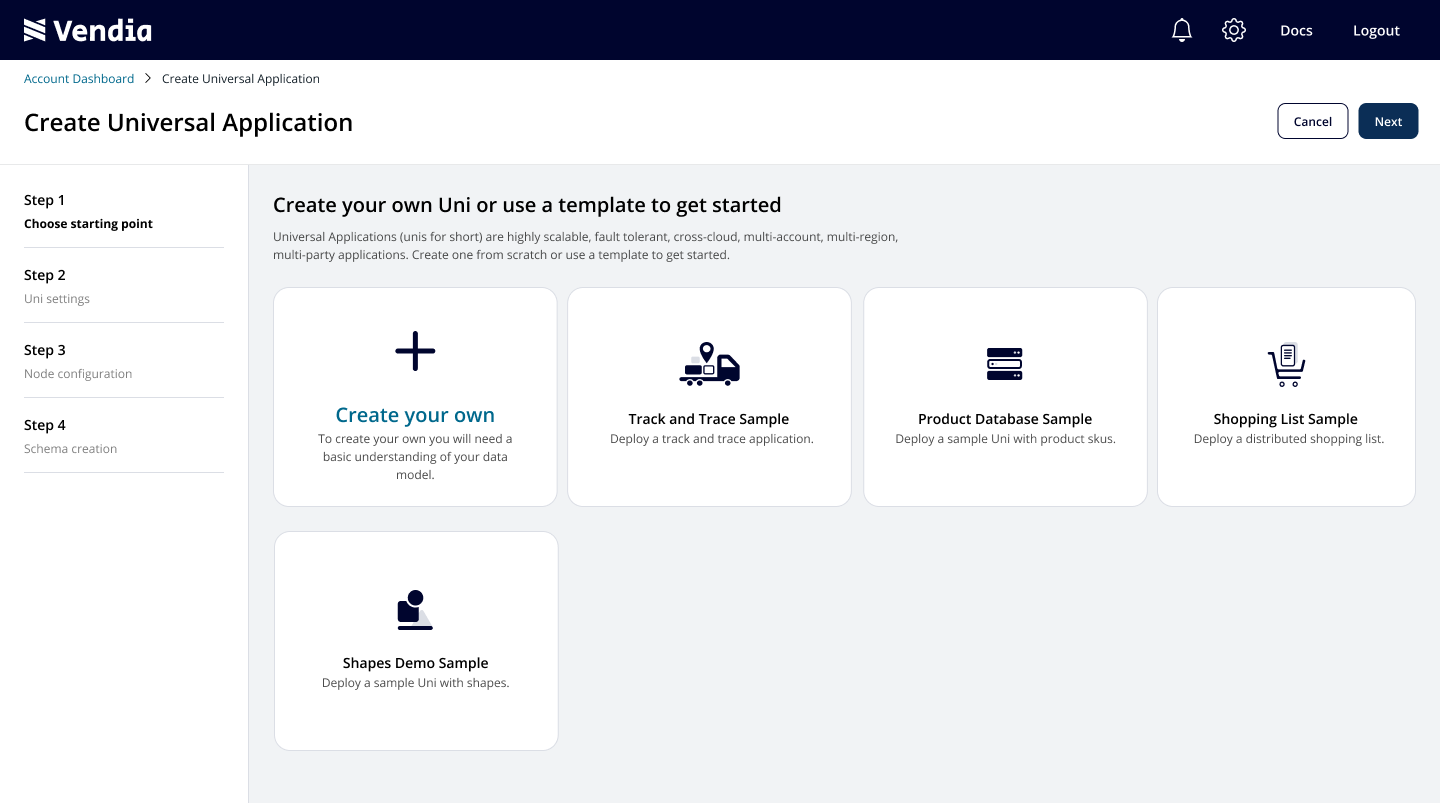

| Data-sharing platform Vendia raises $30M Series B Posted: 31 May 2022 06:00 AM PDT Vendia, a blockchain-based platform that makes it easier for businesses to share their code and data with partners across applications, platforms and clouds, today announced that it has raised a $30 million Series B round led by NewView Capital. Neotribe Ventures, Canvas Ventures, Sorenson Capital, Aspenwood Ventures and BMW iVentures also participated in this round, which brings the company’s total funding to $50 million. The company was founded by two AWS veterans: the inventor of AWS Lambda, Tim Wagner, and the former head of blockchain at AWS, Shruthi Rao. Since launching Vendia, the company added new customers like BMW, Aerotrax and Slalom, who use it to have a single source of truth for their multi-cloud data sharing with some of their partners. As Wagner noted, the company mostly focused on the financial services, travel and hospitality verticals so far, though with the new funding, it’ll likely look to expand to new verticals as well. Wagner also noted that the company recently launched a new product line around CRM data sharing and since the company is seeing a lot of traction around its file-sharing capabilities, it is also investing in that as well. Currently, Vendia supports AWS and the team recently launched Azure support as well. Support for the Google Cloud Platform is on the roadmap, in addition to the company’s ongoing work to allow its service to connect to an ever-growing number of services. The fact that it uses a blockchain to do so is somewhat secondary to this (and the company barely mentions it on its homepage), but it’s what allows the company to offer an immutable serverless ledger to its users to ensure data accuracy as well as provenance and traceability. Developers, meanwhile, won’t have to think about this blockchain part of the service as they only have to provide a JSON schema with the data model and Vendia will provide them with a GraphQL API to work with this data. “At the end of the day, our customers have real problems,” Wagner said. “They don’t have a blockchain problem — they’re trying to sell tickets, settle financial transactions, track supply chains. They’ve got real challenges.” Once the team starts talking to a potential customer’s IT teams, the discussion quickly focuses on blockchains, though, and as Wagner noted, that often includes teaching them about things like immutability and lineage tracing. But for Vendia, the focus is very much on selling a solution to its customers’ problems. “For most of our customers, their core problem is that they have partners and they have problems with sharing data with control, but they don’t want to invest a lot into IT and infrastructure for it,” Rao added and also noted that in today’s job market, even big companies don’t have a lot of IT people sitting around who can take on new projects like this. “Next-gen blockchains like Vendia represent a powerful way to solve age-old supply chain challenges,” said David Bettenhausen, CEO at Aerotrax Technologies. “When connecting partners across the aviation, aerospace and defense supply chain, trust in accurate and verifiable data is paramount. The ability to deliver this trust at scale – with top-notch security and real-time data sharing in a cost-effective way – has made Vendia a critical component within our technology stack. With Vendia, we’ve been able to reinvent our business model to accommodate a frictionless customer onboarding experience and significantly reduced sales cycles.” The Vendia team tells me that the company currently has about 100 employees and the plan is to use the new funding to double that by the end of the year. |

| Posted: 31 May 2022 04:59 AM PDT Cybersecurity continues to grow in complexity due to the ever-increasing threat landscape — more services in the cloud, more digital operations and more devices mean more attack surfaces and variations for malicious hackers to worm into networks, and thus more tools to fight this — and that is creating more work for operations teams tasked with responding to security threats. Today a startup called Seemplicity is emerging from stealth with $32 million in funding for a platform that it believes will help reduce that load. Funding for the Israel-based startup is coming in the form of a $6 million seed round and a $26 million Series A. Glilot Capital Partners, by way of its early growth fund Glilot+, is leading the Series A with new backers NTTVC and Atlantic Bridge and previous backers S Capital and Rain Capital also participating. S Capital led its seed round. Ravid Circus — Seemplicity’s CPO who co-founded the company with Yoran Sirkis (CEO) and Rotem Cohen Gadol (CTO) — said the company was choosing now to come out of stealth and launch publicly with news of its funding in part because the second round had recently closed, and in part because it’s racked up a decent number of customers already: 20 enterprises covering Fortune 500 and publicly-traded companies in various sectors (none of whom are willing to have their names disclosed yet). Seemplicity is a portmanteau of “see” and “simplicity”, and that is effectively what it is doing: helping DevOps and SecOps teams see a more complete picture of the state of an organization’s security, by simplifying how to view it. The problem is a pretty basic but thorny one: these days, DevOps teams are faced with a difficult task that in some ways is only getting harder. The number of breaches growing, according to both general and specific accounts; and that is translating to an ever-expanding range of tools targeting different aspects of security covering specific areas and use cases such as applications, SaaS, cloud and endpoint security. But while there has been a big evolution in security towards much more automation to handle a portion of the alerts that are generated by these different security apps, there are still a number of items that require human involvement to address and ultimately resolve. This in turn results in a huge shower of data that comes down on those DevOps teams that is hard to parse even before any action is taken. This is where a product like Seemplicity comes into the picture: it takes all of those alerts and orchestrates them, to figure out which are related, which can be bundled together, which are more urgent (because they are central to how something operates, or because it could signal a cascading problem, for example), and which can be fixed by fixing something else. By doing so, “We allow an organization to fix and remediate more effectively so that they are less in the business of firefighting,” Circus said. “The way to get to shorter times in security incidents is to remediate them faster.” The platform can be configured by organizations, but it also learns from how it is used, Circus said. This is an especially acute problem for larger organizations, the enterprises that Seemplicity is already serving and targeting for more business. Its customers typically have over 20,000 employees and might have as many as 15 or 20 DevOps and SecOps teams with multiple security programs and protocols already in place, so this is about channelling work more effectively across those organizations, as much as it is about identifying how best to tackle the trove of work. Given that teams are more distributed than ever these days, that’s also a reason for needing better tooling to manage how they work, and what they are working on. “In fact, I’d say that the main factor is not complexity but just the amount of remediation,” Circus said. Seemplicity is joining what appears to be a growing number of tools to help manage SecOps — Rezilion is another aiming to improve some of the busywork of SecOps teams; SeviceNow is also building more in this area; and something like Jira, already so ubiquitous in DevOps, might also be used to address this. But Circus said that it looks like Seemplicity is the only purpose-built tool today that aims to consolidate and prioritize notifications from security apps that address all of the different aspects of how a network operates, giving it a kind of moat (at least for now). The three founders come with a collectively long history in enterprise security, meaning that they understand the challenges first hand and have built this product to address those. "The ever-changing threat landscape of cybersecurity opens up organizations to more risks, necessitating the adoption of more security solutions. Ironically, the more cybersecurity tools a company uses, the less efficient its security team becomes at controlling and reducing risk," said Lior Litwak, Managing Partner of Glilot+, Glilot Capital's early growth fund, in a statement. "By streamlining the operational element of cybersecurity and building a dynamic, real-time bridge between security and remediation teams, Seemplicity enables organizations to both significantly improve their cyber risk posture and address their ever-increasing workloads." "From the get-go we knew we were dealing with strong founders who are leading subject matter experts. The vision they set out quickly translated into a platform that provides significant value to its customers, which over the past year has continued to grow," said Aya Peterburg, Managing Partner of S Capital. “CISOs are having to rethink their security automation and processes as they navigate challenges with access to talent and lead increasingly distributed teams," said Vab Goel, Founding Partner at NTTVC. "Seemplicity offers a unique, simple, and powerful automation platform that aligns the entire security organization around the highest impact actions.” |

| New York-based Digital Asset to help Japan’s financial giant SBI develop ‘smart yen’ Posted: 31 May 2022 03:07 AM PDT SBI Holdings, a Japanese securities and banking giant that launched a crypto-asset fund for retail investors last year, has been actively investing in the infrastructure that will allow it to roll out more crypto products. The firm has recently made a strategic investment in Digital Asset, a New York-based startup known for building enterprise blockchain solutions, it said in an announcement. As part of the deal, the pair are launching a joint venture this year to operate across East Asia, which includes Japan and South Korea. The undisclosed round adds to the $300 million in funding that Digital Asset has raised since its founding in 2014 from the likes of IBM and Goldman Sachs, which is tokenizing assets with help from the blockchain company. The objective of the partnership is to bring programmable money, or digital money that can be coded to act in a certain way based on predetermined conditions, into the Japanese market, said Digital Asset in a separate statement. The programmable money is tentatively called “smart yen” and will be using Daml, the smart contract language created by Digital Asset and known for playing a role in the Australian Securities Exchange’s distributed ledger technology (DLT) platform. The Hong Kong Stock Exchange is also a customer of Daml, which is expediating settlements for the bourse. Smart yen, according to Yoshitaka Kitao, president and representative director of SBI Holdings, will “make it possible to build a revolutionary, customer-oriented cash system by directly linking each individual customer loyalty program to deposits, and fully automating the process of providing loyalty through smart contracts.” The smart money system has to potential to create “additional opportunities for retail banks in Japan to develop innovative offerings, such as loyalty programs, vouchers, and other incentives to drive customer growth and retention,” reckoned Yuval Rooz, co-founder of Digital Asset who took the helm as CEO in 2019. Digital Asset is just one of a handful of investments the Japanese financial outfit has sealed to expand its crypto business. It made a key acquisition move in mid-May when it scooped up a controlling stake in the Japanese crypto exchange BITPoint. In late 2020, SBI bought UK-based crypto trading platform B2C2.

|

| Temasek in talks to invest in Google-backed DotPe Posted: 31 May 2022 12:26 AM PDT Google-backed DotPe, which helps businesses in India go online and sell digitally, is in advanced stages of talks to raise about $50 million in a new financing round, a source familiar with the matter told TechCrunch. Temasek, the Singapore state-owned investment firm, is finalizing deliberations to lead the investment in the Gurgaon-headquartered startup, the source said, requesting anonymity as the details are private. Terms of the investment could change and the deal may end up not materializing at all, the source cautioned. Temasek declined to comment, while DotPe did not respond to a request for comment. The two-year-old startup, which also counts PayU and Info Edge Ventures as its backers, also helps brick and mortar stores get visibility on Google Search. Restaurants, which are some of the customers of DotPe, use the startup’s offering to scan their inventories to make them digitally accessible via WhatsApp. These offerings puts DotPe chasing a similar set of audiences as other startups including Zomato, Swiggy and Dukaan. "DotPe provides a WhatsApp link which opens a restaurant menu and you can order directly and don't have to go to Zomato / Swiggy. DotPe works with small merchants across other categories –food delivery , apparel ecommerce, pharma," analysts at Bernstein wrote in a report last year. "DotPe doesn't do its own delivery but will work with delivery partners for last mile delivery." |

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment