TechCrunch |

- Ayoken raises $1.4M to grow its NFT marketplace for creatives

- Betastore gets $2.5M to solve stock-outs, financing challenges for informal retailers in West and Central Africa

- Berlin-based B2B BNPL platform Mondu raises $43M Series A led by Valar in the US

- Indonesia’s Astro raises $60M to work on 15-minute grocery delivery

- India withdraws warning on biometric ID sharing following online uproar

- Why web3 companies get hacked so often, according to crypto VC Grace Isford

- Should Oracle or Alphabet buy VMWare instead of Broadcom?

- Finix goes head-to-head with Stripe

- How Box escaped the SaaS growth trap

- EV SPACs are facing a new regulatory speed bump

- Hydrogen startup ZeroAvia has a zero-emission vision, but its next plane is a hybrid

- Samsung reportedly cutting smartphone production by 30M

- The week Jack stepped back

- This Week in Apps: Mobile gaming’s market share hit, web3 app growth, Niantic’s new AR tools

- Footnotes on Sequoia’s startup memo

- The TechCrunch Podcast: Why do people keep giving Adam Neumann money?

- Cannabis, sex tech and psychedelics startups deserve more than stigma

- Why Convoy’s Dan Lewis expects digital freight to go mainstream within the year

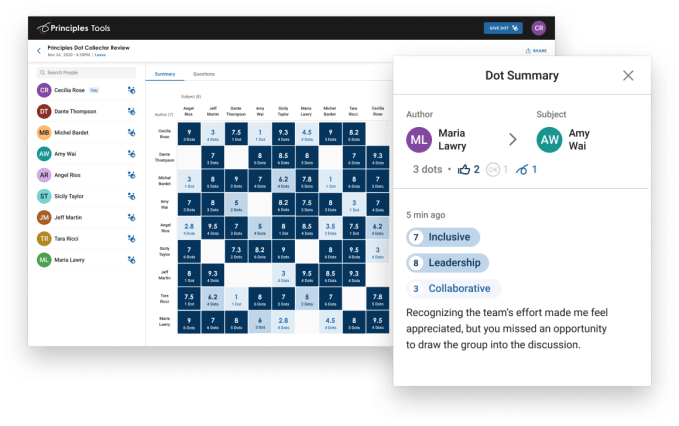

- Coinbase is testing a real-time employee feedback system. It sounds rough.

- Sequoia is the latest VC firm telling you to take the downturn seriously

| Ayoken raises $1.4M to grow its NFT marketplace for creatives Posted: 30 May 2022 01:00 AM PDT Ayoken, an NFT marketplace for creatives, has raised $1.4 million pre-seed funding to enable users grow their revenue streams through digital collectibles. The startup's marketplace, Ayokenlabs, will feature digital collectibles from musicians, sports brands and influencers from all-over the world. Ayoken founder and CEO, Joshua King, told TechCrunch that the marketplace is a bridge between fans and artists, and gives supporters a sense of ownership in the success of their idols. Through the NFT marketplace, he said, fans will have access to tokens such as behind-the-scenes videos and album art. NFT holders will also get other perks like access to unreleased music and exclusive live events by the creatives. "Through VIP passes, fans will get the ability to actually livestream music by these artists before it arrives on Spotify, YouTube or Apple Music. Fans will get discounts for future events too," said King, who has 14 years' experience in strategy, growth and innovation consultancy, and entrepreneurship. His career includes helping scale AZA (Bitpesa), a Nairobi-based platform that leverages bitcoin to facilitate cross-border remittances, and where he first got introduced to crypto and blockchain technology. King said Ayoken will over the next few months release NFTs of some major African artists, and others across the world. The London-headquartered startup has already partnered with Ghanaian afrobeats artist KiDi (Dennis Nana Dwamena) for his first NFT drop on the first day of June. King said the cross-chain marketplace (although currently built on Avalanche blockchain) allows crypto and card payments, but plans to add mobile money – as the startup makes it easier for people in emerging markets like Africa to trade with ease. King said they are negotiating partnerships with a number of telcos in the continent to make this a reality. "We are reducing friction points for the users by letting people use their cards instead of having to use crypto to buy, we are working on partnerships with telcos that will allow people to use mobile money to make the payment in future too. Nothing comes close to what we are doing and that is why we are able to sign some of the biggest names in the creative industry," he said. Users will get token (Ayo) rewards when they buy the NFTs or refer people, which they can redeem later for an NFT. King said, unlike other NFT marketplaces, they have distribution partners including YouTubers, influencers, newsletters, crypto exchanges, and telecoms to promote NFT drops – allowing the creatives to tap a wider audience, and not just their fanbase. "What this means is that celebrities do not have to rely on their social media following to drive transactions. They get instant access to millions of people all around the world at the touch of a button. And our approach is so different to any other NFC marketplace on the planet. we also have a marketing agency to help these creatives succeed in their first NFT drops," said King. "They (distribution partners) will get a revenue share based on any transactions generated on their social media promotions". Using the funds raised from the investors, among them Founders Factory Africa, Texas-based Kon Ventures, Europe-based venture capital collective Crypto League, Ghana-based R9C Ventures and Maximus Ventures, Ayoken plans to sign a number of exclusive deals with artists and partnerships with telcos, besides growing its team and secondary marketplaces. "A majority of the funding will go into buying exclusive licenses and into building our tech team, that is the developers and engineers by fourfold," he said. |

| Posted: 30 May 2022 12:00 AM PDT About 80% of household retail in sub-Saharan Africa is delivered through informal channels, which perennially face several challenges like stockouts, leading to an instability in earnings, and a lack of attractiveness to financiers. These challenges befall millions of micro-retailers across the continent, and Betastore, a B2B retail marketplace for informal retailers, is working to resolve in Nigeria, Ivory Coast and Senegal. The Betastore marketplace enables informal traders to source fast moving consumer goods (FMCGs) directly from manufacturers or distributors – which keeps the prices of the products competitive by eliminating interactions with sales agents. It also works with logistics partners to ensure the delivery of goods within 24 hours. The Nigeria-based startup plans to provide these services beyond its current three markets by expanding to Ghana, the Democratic Republic of Congo and Cameroon by the end of this year, after closing $2.5 million in pre-series A funding from 500 Global, VestedWorld, and Loyal VC. Betastore has to date raised $3 million in funding. "What is really important for us is to be able to continue to scale by leveraging our asset-light model. We plan to enter new markets before the end of the year and to expand to 100 cities across Nigeria, Ivory Coast and Senegal. We are also planning to reinforce our technology and leadership teams, and to bring in new products and to improve existing ones," said Betastore CEO, Steve Dakayi-Kamga, who co-founded the startup with Leo-Armel Tchoudjang mid 2020. The asset-light model means Betastore does not have any capital and labor intensive assets like warehouses or its own fleet of vehicles for delivery. Dakayi-Kamga said that this has helped the startup to optimize its technology to ensure that retailers source goods from the closest distributors. On average, a retailer using Betastore makes 4.4 orders per month. "Our technology enables retailers to order on demand, access a variety of products and solves logistics headaches for them too. With Betastore, they don't have to close their shops to go get goods from distributors stores or the market, and do not have to lose close to half of the margins in in the logistics," said Dakayi-Kamga, who previously worked for Jumia, where he led the e-commerce platform's logistics, warehousing and marketplace fulfillment department. The B2B ecommerce platform is set to introduce financing in July, a launch that follows a pilot program involving 200 retailers that the startup carried out last year. The BNPL financing strategy, Tchoudjang says, will be based on retailers' sales and will go a long way in helping them to grow the value of their shopping baskets, and ultimately their businesses. The startup plans to charge an interest based on product margins. Betastore is currently integrating its technology into a network of financing partners including fintechs and banks. "The mandate of some of the partners we have on board is to support the economy by financing small businesses, but are not able to lend to them because they do not have the data to inform decisions. We have the visibility of what is happening in this sector, and have data they can use to extend financing," said Tchoudjang, who previously held executive and leadership roles within the IFC-backed AccessHolding AG network in Africa. He has also helped multinationals rollout fintech and microfinance products for emerging markets in the past. Retailers use the Betastore wallet to repay loans, deposit money for their operations, and to send, receive and save money. "The wallet helps them separate their business money from their own money, and it is directly connected to the whole banking system, meaning that retailers can receive and send money to any bank, and load cash with any agency banking platform," said Tchoudjang. Since launch, the startup claims to have grown its customer base and revenues by 10 and 12 times, respectively. The startup anticipates greater growth especially after entering more countries and rolling out its buy now pay later (BNPL) product, as it taps the retail market in sub-Saharan, which was valued at $380 billion in 2021, contributing 20-50% of the region’s GDP on average. "We want to simplify access to goods and services for the retailers and for the end consumer because we see the merchant as an agent able to make access to goods and services easier. We started out in Nigeria, and we are expanding within Francophone Africa on our way to being a pan African player," said Dakayi-Kamga. Amit Bhatti, the principal at 500 Global while commenting on the latest funding round said, "We believe Betastore's talented team is creating market efficiencies that have the potential to boost the growth of Africa's retailers. With Betastore, merchants can get greater transparency into wholesaler inventories and price points." |

| Berlin-based B2B BNPL platform Mondu raises $43M Series A led by Valar in the US Posted: 29 May 2022 11:30 PM PDT Given the likely global recession, small businesses are reaching for new kinds of financing. Thus, the Buy Now Pay Later business model is now expanding into this B2B world at a rate of knots. Playter has raised backing to do this, as has Hokodo, Billie and Tranch, to name a few other players. But in Germany, B2B Payments company Mondu has emerged as a significant entrant to the market. Mondu has now raised a $43M Series A round led by US-based venture capital fund Valar Ventures, and will use the funding to expand into more European countries later this year. Previous investors Cherry Ventures, FinTech Collective, and tech entrepreneurs and senior executives from Klarna, Zalando, and SumUp, also participated. The company has now raised $57M to date. Mondu's BNPL for B2B solutions for merchants and marketplaces offers the main payment B2B payment options and flexible payment terms. Malte Huffmann, Co-Founder and Co-CEO of Mondu, said in a statement: "The concept of BNPL isn't new in the B2B world; offline business trade has enjoyed it for decades. But as more companies increasingly move to digital, the need for BNPL for B2B online will grow immensely. We are on the verge of a “digitalization boom”, and Mondu wants to be part of that revolution and drive innovation within the B2B payments space." Philipp Povel, Co-Founder and Co-CEO of Mondu, said there is a "$200Bn opportunity just in Europe and the US, which is bigger than the global consumer BNPL market." Since October 2021, Mondu has signed merchant customers across industries such as beauty, cleaning and manufacturing. One example is Ionto Comed, a manufacturer in the beauty sector that supplies salons. Andrew McCormack, Founding Partner of Valar Ventures, commented: "BNPL for B2B sits at the intersection of three huge markets that are all in transition. The B2B payments market is immense, and its transition to digital has been accelerated over the past couple of years. The B2B eCommerce market is larger than B2C but is underserved by current offerings, and supply chain financing is a growing need, particularly for SMBs." Mondu will have to expand quickly. Berlin-based Billie has raised €138.2M so far, and Tranch in the UK has raised $5.6M. |

| Indonesia’s Astro raises $60M to work on 15-minute grocery delivery Posted: 29 May 2022 07:00 PM PDT Indonesia’s sprawling archipelago has long been a headache for logistics companies, but there’s no lack of brave challengers. Jarkata-based Astro, which provides 15-minute grocery delivery, has recently closed a $60 million Series B financing round, lifting its total funding to $90 million since the business launched just nine months ago. The Series B round was led by Accel, Citius and Tiger Global, with participation from existing investors AC Ventures, Global Founders Capital, Lightspeed and Sequoia Capital India. The company declined to disclose its post-money valuation. The speed at which Astro is attracting investment goes to show the need for hefty upfront investment in the grocery delivery race, which is about establishing a logistics infrastructure quickly and locking in loyal customers ahead of rivals. Founded by Tokopedia veteran Vincent Tjendra, Astro plans to spend its funding proceeds on user acquisition, product development, and hiring more staff to add to its current team of 200. As in many countries around the world, on-demand delivery got a boost during the COVID-19 pandemic in Indonesia. But e-grocery penetration in the country remains low and is estimated to be just 0.5% by 2022, compared to China’s 6% and South Korea’s 34% in 2020. That means there’s a huge opportunity for companies like Astro that are trying to prove the convenience of online grocery ordering over brick-and-mortar visits. The e-grocery delivery market in Indonesia is projected to reach $6 billion by 2025. Astro offers 15-minute delivery within a range of 2-3km through its network of rented “dark stores,” which are distribution hubs set up for online shopping only. The company has opted for a cash-intensive model, as it owns the entire user journey going from inventory sourcing, supply chain, mid-mile, to last-mile delivery. The benefit of this heavyweight approach is that it gets to monitor the quality of customer experience. Astro currently operates in around 50 locations across Greater Jakarta, an area with 30 million residents, through a fleet of about 1,000 delivery drivers. Revenues grew more than 10x over the past few months and downloads hit 1 million, the company said. The startup is competing with incumbents like Sayurbox, HappyFresh, and TaniHub to win over users. Its customers range from working professionals to young parents at home “who seek convenience,” said Tjendra. Grocery delivery is notoriously cash-burning, but Tjendra reckoned margins will improve as the business scales. The company’s main source of revenue is the gross margin it earned from the goods sold and delivery fees customers pay. A large chunk of the business’s costs comes from delivery, which the founder believed “will come down over time as we deploy for hubs and subsequently reduce the delivery distance areas.” |

| India withdraws warning on biometric ID sharing following online uproar Posted: 29 May 2022 06:04 PM PDT India has withdrawn a warning that asked users to not share photocopies of their national biometric ID following a widespread uproar from users on social media, many of whom pointed that this is the first time they were hearing about such a possibility. A regional office of UIDAI, the body that oversees the national biometric ID system Aadhaar, warned users on Friday that "unlicensed private entities" such as hotels and theatre halls are "not permitted to collect or keep copies of Aadhaar," a 12-digit unique number that ties an individual's fingerprints and retina scan, and people should avoid sharing photocopies of their Aadhaar to prevent misuse. The warning prompted an immediate and wide backlash from individuals. "I might have stayed in almost 100 hotels who kept a copy of my Aadhaar! Now this," an individual tweeted, summing up the dilemma of tens of millions of people in the country, if not more. About 1.33 billion people in India, or roughly the nation's entire population, have enrolled in Aadhaar, an ID system that was unveiled about 13 years ago, according to government's official figures. This scale of adoption makes Aadhaar the world’s largest biometric identity system. Though Aadhaar has been touted as one of the world's most sophisticated ID systems, critics have expressed concerns over the way its use case has been extended and made mandatory across several daily life services despite New Delhi marketing Aadhaar as a "voluntary" ID system. On Sunday afternoon, India's Ministry of Electronics and IT downplayed the warning following the backlash, saying the original advisory was issued by the Bengaluru Regional Office of UIDAI in the context of spreading awareness about the potential “misuse” of a “photoshopped Aadhaar card.” “However, in view of the possibility of the misinterpretation of the press release, the same stands withdrawn with immediate effect,” it added. “UIDAI issued Aadhaar card holders are only advised to exercise normal prudence in using and sharing their UIDAI Aadhaar numbers. Aadhaar Identity Authentication ecosystem has provided adequate features for protecting and safeguarding the identity and privacy of the Aadhaar holder.” |

| Why web3 companies get hacked so often, according to crypto VC Grace Isford Posted: 29 May 2022 10:00 AM PDT On the Chain Reaction podcast this week, Lux Capital’s newest investor, Grace Isford, joined us to talk about the opaque but crucial world of web3 infrastructure. At Lux, Isford invests in the companies working behind the scenes to make sure crypto exchanges are secure and reliable enough to avoid being hacked. Before joining Lux this February, Isford was an investor at Canvas Ventures focused on enterprise software and fintech. A data infrastructure investment she worked on at Canvas revealed to her the opportunity in the web3 space for companies to “share data immutably at scale,” motivating her pivot to crypto, she said. “That led me down the rabbit hole, and then I ended up investing myself personally,” Isford said. “I got into yield farming, which coincided with my move to New York, where many of my friends are also in the crypto and VC ecosystem.” Isford says her investing approach in web3 is rooted in what she calls her “circle of competence,” or the area where she can be competitive compared to others in the space. “NFT investing is quite different than DeFi investing, which is quite different than crypto data infrastructure investing, and I would argue that any person who says they invest in web three shouldn’t invest in all of that — they should probably choose their sweet spot in their core competency,” Isford said. Isford’s own “circle of competence,” based on her prior experience, is in enterprise and fintech infrastructure, so we asked her what she thinks some of the biggest challenges are for web3 infrastructure providers. Compared to web2, Isford said, web3 lacks enterprise-level security solutions. Alchemy and Infura are the only two major node service providers in the industry, meaning that most of crypto is reliant on two infrastructure providers to manage their data. “There seems to be a new security hack reported every week [in web3],” Isford said, citing the recent Metamask and Ethereum dApp outage that originated from Infura and February’s Wormhole bridge hack. While a number of startups are working on developing security solutions, Isford said, the tech is “still quite nascent” when it comes to developer tools, data infrastructure monitoring, and storage. Another major challenge is managing fraud and downside risk, Isford added. “I think [that issue] is really keeping a lot of folks out of the crypto world right now [because they’re] afraid of losing all their money if they venture too deeply into crypto,” Isford said. Isford is optimistic that through the massive inflows of investment into web3 startups in the past year, companies will be able to build more reliable solutions. “I think TRM Labs, Chainalysis, and several other companies in this space have 10x potential in terms of compliance and monitoring because you just do not have that yet at scale in the same way that we’ve kind of created these sophisticated AML systems on the financial infrastructure side in the web2 world,” Isford said, referring to traditional financial institutions’ anti-money laundering technology. Better fraud and risk management systems are a precursor to more institutional money flowing into crypto, Isford said. As companies like Fidelity, Goldman Sachs, and JP Morgan continue to make strides into crypto, the market will mature she added. “I think one of the biggest opportunities in crypto right now is still security, if you can build more reliable smart contracts at scale … but you can’t have a reliable system if it’s not secure, right? And you can’t run a system securely if you don’t know who’s within that system, so I think security is probably one of the most important pieces from a prioritization standpoint,” Isford said. |

| Should Oracle or Alphabet buy VMWare instead of Broadcom? Posted: 29 May 2022 09:00 AM PDT As expected, the Broadcom-VMware deal is a go. The chip giant intends to snap up the virtualization software company for $61 billion in cash and stock, along with taking on $8 billion in VMware debt. It's not an inexpensive transaction, but thanks to a “go-shop” provision that gives VMware 40 days to “solicit, receive, evaluate and potentially enter negotiations with parties that offer alternative proposals,” there's market speculation that another bidder could enter the fray. After chewing through analyst notes on the deal, Ron and Alex wound up on opposite sides regarding whether a higher price or another bidder would make sense. Ron's view is that the company's value is higher than its recent financial results may imply, while Alex feels the company is not sufficiently performative to deserve a higher price. TechCrunch+ is having a Memorial Day sale. You can save 50% on annual subscriptions for a limited time. We've long speculated who might buy VMware, and after Dell spun out the company, TechCrunch listed Amazon, Alphabet, Oracle, Microsoft and IBM as potential acquirers. The fact that we did not foresee Broadcom as a potential suitor underscores our view that we don't fully grok if it's the correct buyer for VMware. So let's talk about the pros and cons of the matter, ask what VMware is worth, and how it may have value over and above its recent quarterly results. Ron is taking point! Ron's take:With $61 billion on the table, it's hard to imagine anyone paying more, and research firm Bernstein agrees with the perspective. Before we put the idea to bed, though, it's worth taking a moment to think about the value of VMware. VMware's value goes beyond what its balance sheet or its profit and loss statement tells us at the moment. While the company might not have had a perfect first quarter, it has a particular set of skills that could fit nicely with any of the big cloud infrastructure providers. In fact, cloud infrastructure-as-a-service exists today only because the early crew at VMware figured out virtualization at scale in the early 2000s. Until then, people used servers, and if a server was underutilized, well, too bad. Virtualization lets you divide a computer into multiple virtual machines, paving the way for cloud computing as we know it today. While cloud computing has changed some since its early days, virtualization remains a core tenet of the market. Imagine for a moment if one of the three or four cloud vendors — think Amazon, Microsoft, Google or even IBM (although this deal is a bit rich for its blood) — brought VMware into its fold. VMware brings more to the table than virtualization, of course. Over the years, it has gained various capabilities by acquiring companies like Heptio, a containerization startup launched by Craig McLuckie and Joe Beda, two of the people who helped create Kubernetes. |

| Finix goes head-to-head with Stripe Posted: 29 May 2022 07:16 AM PDT Welcome to The Interchange, a take on this week's fintech news and trends. To get this in your inbox, subscribe here. We've all been keeping up with the recent drama of Stripe vs. Plaid. Rather than rehash all that here, I'll point you to some of our recent articles on the topic and just summarize: The two fintech startups have recently grown (much) more competitive. If things weren't turbulent enough, another startup has very publicly emerged as a formidable competitor to Stripe: Finix. Now, Finix is not coming out of nowhere. The SaaS startup — which started out in early 2020 by selling its payments tech to other businesses — raised a $35 million Series B led by Sequoia. In an unusual twist, Sequoia just 1 month later walked away from the deal in which it reportedly wrote the self-described payments infrastructure company a $21 million check. As TC's Connie Loizos reported at the time, Finix told employees that soon after issuing its check, Sequoia concluded that Finix competes too directly with Stripe, the payments company that represented one of Sequoia's biggest private holdings and that in turn counted Sequoia as one of its biggest outside investors. Fast-forward to last week. Finix announced that it was becoming a payments facilitator, in addition to enabling other companies to facilitate payments. This move puts it in direct competition with Stripe, something that CEO and co-founder Richie Serna is not shy about admitting. In an interview this past week, Serna elaborated by noting that Finix indeed started out to build software that gave any software company a way to become their own payment facilitator. "We were building technology that would take a three-year in-house build by dozens of engineers, with tens of millions of dollars of technical R&D and investment, and taking that down to a number of months by getting developer-friendly APIs to start monetizing their payments," he said. "That was our biggest core offering. What we've done now is become the payments facilitator ourselves, so that we can not only provide the payments, but also all the back office requirements and compliance certifications, so that our customers can get up and running in a matter of days, rather than months." He says the move gives Finix the ability to work with companies and software platforms who have $0 in processing volume all the way up to companies with billions of dollars in processing volume. "This allows these customers to get a better product experience and faster speed to market, and allows us to take on those non-technical aspects of rolling out and monetizing, and getting payments," Serna added. You see, historically, companies needed to hit a certain volume threshold before Finix could work with them. But now, according to Serna, they can start working with them in their earliest states. "Customers can start working with us from day one, use finance APIs, and when they’re ready to take on more of that ownership and more of that responsibility around risk, underwriting and compliance operations, they can graduate and become their own payment facilitator," he said, "since we’re still using the exact same APIs." Finix has also entered what the executive described as the "card present," or in-person, payments space. This means that it is able to provide software for many types of businesses to accept credit card payments. "If you think about a software provider for restaurants, they’re going to need a different set of devices than the device provider for gyms, or food trucks," Serna said. "And so that’s something that we uniquely offer and bring to the market." So, in case you haven't figured it out, Stripe did have reason to be concerned because Finix indeed is directly competing with it. So how are they different? According to Serna, the answer lies in the fact that Finix has built "an open system and open architecture that is modular and configurable." Stripe, on the other hand, he said, "continues to double down on that vendor lock in so it can continue to close their system and architecture." "We think about it very similar to iOS," Serna told TechCrunch. "We think about ourselves much more like Android…And I think we’re just going to continue to see those characteristics magnified as we continue to build our products and build our companies." With just over 150 employees, Finix is powering over 12,000 merchants in the U.S. with its APIs today. It has raised about $100 million in funding from investors such as American Express Ventures, Bain Capital Ventures, Homebrew, Inspired Capital, Lightspeed Venture Partners and Visa. Meanwhile, in a recent Forbes article, Stripe co-founder John Collison told Alex Konrad, reportedly with a shrug: "We will compete with a bunch of companies, and we'll partner with a bunch. Everyone just needs to be a grownup and well-behaved about it." In that same article, sources told Alex that Stripe saw gross revenue of about $12 billion in 2021, up 60% year-over-year. It also reportedly posted net revenue of about $2.5 billion. Weekly NewsSpeaking of Stripe, Ingrid Lunden reported on May 24 that the company debuted its App Marketplace, a new offering where Stripe will provide access to both third-party apps and scripts created by app publishers, users and Stripe itself, that incorporate those apps with Stripe. It potentially represents its biggest leap yet away from payments. Swedish payment giant Klarna reportedly cut 10% of its workforce, or 700 jobs, this past week. The move came just after the Wall Street Journal reported that the company was going to cut its valuation in order to raise fresh capital. One-click checkout startup Bolt is believed to have laid off as many as 240 employees across go-to-market, sales and recruiting roles. Earlier reports had cited that 100 workers would be impacted, but as details emerged, it appeared to be more. In mid-February, founder Ryan Breslow made headlines after announcing on Twitter that Bolt was offering every employee the chance to borrow money from the company to exercise their stock options. Now, it's unclear what happens to the people who were laid off and borrowed money from the company. The company told Bloomberg that the number of affected workers that took out loans is in “the single digits.” But not all fintechs are laying off. Fidel API says it "is rapidly growing" after its $65 million Series B announcement and is hiring for more than 60 roles across its engineering, sales and customer-experience teams. The fintech says it has doubled in size over the past 6 months and intends to double again before year's end. Peggy Mangot has left her role as operating partner at PayPal Ventures to serve as the new head of fintech partnerships for JPMorgan Chase Commercial Banking. At PayPal Ventures, Mangot helped lead investments globally across fintech, commerce, infrastructure and crypto. Both large and small companies are retaining their crypto optimism despite the recent market correction in the developing technology space. Mass adoption of blockchain technology and digital assets is going to happen sooner rather than later, according to Mastercard's VP of new product development and innovation, Harold Bossé. Read more here. Fundings and M&ASeen on TechCrunch Founder alleges that YC-backed fintech startup is 'copy-and-pasting' its business Revenue-based financing platform Bloom secures $377M Series A led by Credo and Fortress Viola Credit closes $700M fund to provide asset-based lending to fintech startups Roofstock founder closes on $90M fund to back early-stage proptech startups Zip lines up $43M at a $1.2B valuation for its growing 'concierge for procurement' Nowports streamlines LatAm's shipping to deliver a $1.1B valuation Indian fintech Jar eyes $50 million investment And elsewhere That's it for this week! If you're reading from the U.S., hope you enjoy the rest of your long weekend, and for everyone else, have a great day and week ahead. And to borrow from my brilliant friend and colleague, Natasha Mascarenhas, you can support me by forwarding this newsletter to a friend or following me on Twitter. |

| How Box escaped the SaaS growth trap Posted: 29 May 2022 07:00 AM PDT Enterprise productivity company Box reported results earlier this week for the first quarter of its fiscal 2023, the three-month period ending April 30. Box managed to beat revenue expectations, though it missed on adjusted per-share profit. Shares of the company initially lost modest ground. You might read the above paragraph and wonder why we're digging into a SaaS company that had a quarter that appeared to be somewhat mixed in results terms and largely neutral from an investor perspective. The reason is that Box is accelerating out of a period in which external investors took aim at its leadership over complaints about flagging growth; the company managed to fend off activist investor demands and is now reaping the results of the work it did while out of favor with Wall Street. Box’s revenue expansion decelerated to single-digit percentage points. Since Box went through the activist wringer, we've seen other public software companies with similar growth rates come under external pressure. This is what we're calling the SaaS growth trap — a time when a company's revenue expansion has slowed, but its profitability has not sufficiently scaled to keep investors content with its performance. TechCrunch+ is having a Memorial Day sale. You can save 50% on annual subscriptions for a limited time. Public software companies in the trap have to find a way to ignite growth without torching profitability. It's akin to the position that many startups find themselves in today, with growth expectations staying high as private-market investors are simultaneously less interested in high-burn models. Startups have to keep the growth coming while also paying double attention to their cost structure. It's a hard path to navigate. Box managed it, though it took time. The company's $238 million worth of Q1'F23 revenue was up 18% compared to its year-ago period, a growth rate that bested the 17% it managed in the quarter prior, and the 14%, 12% and 10% growth rates it reported in the quarters stretching back to the first quarter of its fiscal 2022. Notice the upward trajectory — it’s important. So how did Box manage to get out of the growth trap while also growing its gross margins, operating income and net profit in its most recent quarter? Let's talk about it. It's a lesson for public companies, yes, but also one that startups will want to understand as they navigate a more complex and demanding investment market for early-stage technology shares. |

| EV SPACs are facing a new regulatory speed bump Posted: 29 May 2022 07:00 AM PDT It's been a bumpy road for the electric vehicle startups that rushed to go public over the past two years by merging with a publicly traded shell company. Now, the SEC's broadest attempt to crackdown on these so-called reverse mergers could put a few speed bumps on the road to becoming — and maintaining — a SPAC. The U.S. Securities and Exchange Commission will conclude Tuesday a 60-day public comment period on a number of proposed guidelines for SPACs, specifically around disclosures, marketing practices and third-party oversight. If approved, the barrier of entry to becoming a SPAC will rise, putting it on par with the regulatory burden placed on companies that pursue the more traditional IPO path. The rules will "help ensure that investors in these vehicles get protections similar to those when investing in traditional initial public offerings," SEC Chairman Gary Gensler said when the proposal was first released back in March. The rules, if approved, will also strengthen protections for current investors, as well as prevent SPACs from using "overly optimistic language or over-promise future results" to appeal to potential investors. “Ultimately, I think it's important to consider the economic drivers of SPACs,” Gensler said in March. “Functionally, the SPAC target IPO is being used as an alternative means to conduct an IPO." The detailsThe most significant change to the proposed guidelines requires aligning the financial statements required for SPACs with those of traditional IPOs, a major step toward creating more transparency. This includes more disclosure across several areas. The guidelines also call for gatekeepers such as auditors, lawyers, and underwriters to be held responsible for their work, including assuming liability for the registration statements SPACs must file ahead of a target IPO. Gensler said the changes "provide an essential function to police fraud and ensure the accuracy of disclosure to investors." While the proposal winds through the approval process, some players in market have pressed the pause button. For instance, Goldman Sachs halted its dealmaking in May as it waits to see how the new regulations will affect dealmaking, especially if the SEC revokes the so-called safe harbor protection that until now has allowed SPACs to make bullish projections. Credit Suisse and Citigroup have voiced alarm, too. "I could say I think I’m gonna make a bajillion dollars in 2025, but here are all the reasons why I might not," said Ramey Layne, a capital markets and M&A attorney at Vinson and Elkins. "If you say that there’s a safe harbor, then you can’t be sued for that if it proves to be wrong." The SEC’s proposed regulations are "a very big step in the right direction," said Stanford Law School professor Michael Klausner, especially if SPACs are required to "disclose the extent to which their shareholders' equity is diluted at the time of the merger." The SEC expects to finalize new guidelines during the second half of 2022. Meanwhile, of the roughly 600 SPACs currently searching for a company to acquire, some deals have ground to a halt or been scrapped, according to SPAC Research. The catalystAllowing pre-revenue startups to take a shortcut to an IPO before selling a single vehicle has led to trouble on numerous fronts. Regulations today are so lax that commercial EV maker Electric Last Mile Solutions has gone without an auditor for the last three and a half months. The manufacturer, which went public in June 2021 through a $1.4 billion merger with Forum Merger III, said Friday in an SEC filing that it is in danger of running out of cash in June, one month sooner than projected, if it doesn’t find funding. Electric Last Mile Solutions is also at risk of being delisted if it doesn't file its delayed 2021 annual report and Q1 2022 financial report. The company blamed the delay on an acrimonious split with its accounting firm, BDO. The public spat over who had helped the EV maker's leadership architect a scheme to buy discounted shares pre-merger – a move that led to the resignations of both the company's CEO and chairman in February – sparked an SEC investigation into the company in March. That news sent shares tumbling below $1 and compelled the company to lay off nearly a quarter of its workforce to cut costs, and pull its guidance for the remainder of 2022. Now the SPAC is at risk of being delisted from the Nasdaq if it doesn’t submit a plan by Tuesday to comply with regulations. Other examples of this laissez faire approach abound in the SPAC world. Canoo, Faraday Future, Lordstown Motors and Nikola are just a few of the SPACs that have run into trouble. Faraday Future also faced a Nasdaq delisting, but managed to file its 2021 annual report and 2022 first quarter financial results this month. While the earnings reports staved off the delisting, they also showed a company burning through cash with little to no prospects of revenue in the near term. The company reported an operating loss of $149 million for the first quarter of 2022, compared with $19 million for the same period a year ago. The widening loss is due to "a significant increase in headcount and employee related expenses, and an increase in professional services primarily related to the special committee investigation," the company said in a statement. Net loss increased to $153 million for the three months ended March 31, 2022, compared with a $76 million loss for the first quarter of 2021. Faraday Future also continues to have trouble getting its fantastical, 1,050-horsepower FF 91 into production. The flashy sedan can travel from 0 to 60 mph in 2.39 seconds and travel more than 300 miles on a single battery charge, the automaker said. The company recorded 401 pre-orders for the FF 91 as of March 31 and plans to launch the car during the third quarter of 2022, CEO Carsten Breitfeld said in a call with investors on Monday. The $1,500 pre-orders are fully-refundable non-binding deposits, and pricing will be announced closer to launch. "Keep in mind that the FF 91 is not a high-volume car," Breitfeld said, adding that the automaker plans to ramp up eventually to 6,000 to 8,000 units a year. About 80% of the equipment Faraday needs to build the FF 91 is at its factory in Hanford, California, and the rest is on track to be delivered. The automaker said it has funding to cover its current production run but will need more money to produce its second model, an FF 81 sedan for the mass market, and smart last-mile delivery vehicle called the FF 71. Faraday also said it signed a lease on its first store, in Beverly Hills, California, and secured a dealer license to sell its cars nationwide online. |

| Hydrogen startup ZeroAvia has a zero-emission vision, but its next plane is a hybrid Posted: 28 May 2022 02:05 PM PDT ZeroAvia has raised $115 million from United Airlines, Alaska Airlines, British Airways and Amazon on a promise to fly a zero-emission hydrogen fuel cell regional passenger plane as soon as next year. Now the startup has set itself a slightly less high-flying goal: building a hybrid aircraft. This new experimental plane, which is under construction in California, is a 19-seat Dornier 228 that will have "a hybrid engine configuration that incorporates both the company’s hydrogen-electric powertrain and a conventional engine," according to a recent press release. ZeroAvia declined to tell TechCrunch why it had altered its plans. A hybrid system could reassure regulators that the Dornier can fly safely for tests, while the company continues to develop the world's largest aviation hydrogen fuel cells. The decision to build a hybrid plane follows a previously unreported statement from the UK's Air Accident Investigation Branch (AAIB) into the April 2021 crash of the moonshot project that caught the attention of investors: a smaller fuel-cell and battery-powered prototype near Cranfield Airport. The AAIB found that the crash near Cranfield airport occurred after the five-seater Piper Malibu lost power when its battery was turned off, leaving the electrical motors powered by the hydrogen fuel cell. The subsequent forced landing severely damaged the plane, although its pilot and passenger escaped injury. TechCrunch revealed last year that the Piper Malibu relied heavily on batteries, using them throughout what ZeroAvia called an historic first flight of the Malibu in September 2020. The company's only other flying prototype, another Piper Malibu, was damaged during the installation of a hydrogen fuel tank at ZeroAvia's U.S. base in Hollister, California in 2019, and has not flown since. Following the crash at Cranfield, ZeroAvia relocated its UK operation to Kemble airfield in Gloucestershire, which provided financial incentives to the startup. ZeroAvia now has two Dornier 228 aircraft, one at Kemble and one at Hollister. ZeroAvia previously said it would power the Dorniers using a newly developed 600kW hydrogen fuel cell. ZeroAvia has received over £14 million ($17 million) in grants from the UK government to build its aircraft there, as part of a flagship "Jet Zero" net zero carbon aviation pledge by 2050. The crash of its smaller prototype ended any chance of ZeroAvia fulfilling a commitment to fly that specific aircraft 300 miles using hydrogen. ZeroAvia received £1.6 million ($2.02 million) to go towards that goal. ZeroAvia's latest £8.3 million project in the UK, HyFlyer II, promises to operate a similar 300-mile zero-carbon flight by February next year, powered by the 600kW fuel cell. It is unclear whether the Kemble Dornier will now also be a hybrid. ZeroAvia declined to answer detailed questions about its progress, and spokesperson Sarah Malpeli told TechCrunch that the company could not comment on the Cranfield crash until the final AAIB report is published later this summer. The UK funding body, the Aerospace Technology Institute (ATI), provided this statement: "The ATI does not comment on the progress of live projects due to commercial confidentiality. We continue to work closely with ZeroAvia and look forward to the contribution of HyFlyer and HyFlyer II to the understanding and development of zero-carbon emission aircraft technologies in the UK." The construction of a hybrid aircraft with a conventional engine is a big change for the company, as ZeroAvia has always called its systems zero emission. As recently as last week, ZeroAvia's CEO Val Miftakhov told a U.S. House Transportation subcommittee that even a hybrid powertrain using batteries was "too incremental." Other companies however, including Airbus, are pursuing hybrid solutions for hydrogen aviation. There are many challenges to developing a purely hydrogen-powered aircraft, ranging from the storage of fuel, to cooling the system so that it does not overheat during flight. The most advanced hydrogen fuel cell aircraft to date is likely the H2Fly. This four-seat experimental aircraft completed a 124-kilometer flight last month between Stuttgart and Friedrichshafen, at an altitude of over 7,300 feet. Earlier this year, ZeroAvia released a video showing a "complete propulsion system" mounted on a "HyperTruck" ground vehicle and powering a propeller. That configuration had two fuel cells and a number of batteries, and is likely around one third the size of the system needed for the Dornier to take off. It did not include a conventional engine. The company's ultimate aim is to build a fuel cell capable of generating between 2,000 and 5,000kW (2 to 5MW). Earlier this year, ZeroAvia received a $350,000 economic development grant from the state of Washington to start work there on a 76-seat De Havilland Dash-8 Q400 aircraft from Alaska Airlines. The company hasn't always been successful in landing public money though. ZeroAvia is suing the U.S. government, in a previously unreported case filed at the U.S. Federal Claims court. Most filings in the case are sealed, but it appears to relate to a failed bid by ZeroAvia for a federal contract. Fuel cell futureIn the immediate aftermath of the crash, ZeroAvia's path still seemed solely focused on fuel cells. For instance, the company spent over 23 million Swedish kroner (about $2.2 million) on fuel cells since the accident, according to press releases from PowerCell Sweden AB, the manufacturer of the fuel cell used in the aircraft that crashed. This likely equates to between 10 and 13 100kW fuel cells. ZeroAvia is also evaluating a fuel cell from New York start-up Hyzon. ZeroAvia does not have an operational aircraft powered by hydrogen. However, the company continues to forge new commercial partnerships and promise evermore ambitious projects and timelines. Miftakhov, who is at the World Economic Forum in Davos this week, posted a blog that claims the UK-based Dornier plane is "on the verge of flying" and would go into service in 2024. ZeroAvia claimed this week that the larger Dash would fly by 2026, and announced new plans to convert a regional jet to hydrogen fuel-cell operation "as early as the late 2020s." |

| Samsung reportedly cutting smartphone production by 30M Posted: 28 May 2022 02:01 PM PDT All is not well in smartphone land. The industry was headed for a slowdown well before SARS-CoV-2 entered the picture. The glory days of expanding markets and bi-annual upgrades are seemingly at an end, and things have only been exacerbated by two years of financial hardships and supply chain constraints. For all these reasons, it's not surprising that manufacturers are pulling back on manufacturing. A new report from South Korea's Maeil Business News has the world's leading smartphone maker ramping production down by 30 million units for 2022. The news comes as sales are further hampered by the conflict in Ukraine. In March, the company followed fellow tech giants Microsoft and Apple by suspending sales in Russia. Apple, too, has been feeling the pain. Recent Bloomberg reports noted that the iPhone maker is throttling plans to manufacture an additional 20 million phones in 2022. Instead, its numbers are reportedly going to remain flat from 2021. Those reports follow several quarters of iPhone sales that had managed to buck many of the industry's macro trends, but the company might be coming back down to Earth, even with the imminent arrival of the iPhone 14. It’s a perfect storm of industry and global factors that have gotten us to this place. It's not panic time for the larger manufactures — they'll almost certainly come out of the dip unscathed. But there are broader questions that remain about the industry going forward. Biggest of all is whether this is a lull following a decade of explosive smartphones sales, or whether not even the arrival of new technologies like foldable screens will kickstart a return to the mobile golden age. Samsung declined to comment on the reports. |

| Posted: 28 May 2022 01:16 PM PDT Hey all. Welcome back to Week in Review, the newsletter where we recap some of the top stories to cross TC’s front page over the last 7 days. The most read story on our site this week was about Flowcarbon — a new company and “blockchain-based redemption story” (as Anita put it) launched by WeWork founder Adam Neumann. The goal, writes Anita, is to “sell tokenized carbon credits to companies looking to reduce their carbon footprint,” to which the only response I can think of is that Jennifer Lawrence “ok” gif. Why is it on the blockchain? What’s a “Goddess Nature Token”? Find out in Anita’s post here, then listen to Lucas and Anita go deep on the topic on this week’s Chain Reaction podcast. other stuffHere are some of the other most read TC stories from this week: Jack Dorsey steps down from Twitter's board: For the first time since its founding in 2006, co-founder Jack Dorsey is no longer officially involved in the operation of Twitter. Late last year, he stepped away from the CEO role but remained on the company’s board of directors. As of May 25, he has exited the board as well. Broadcom will buy VMware for a massive $61B: After a few days of rumors, Broadcom announced its plans to acquire VMware for a wild $61 billion. Ron’s got all the details of the deal — and as for why the chipmaker would drop that much on the virtualization company? Ron and Alex have you covered there, too. Take-Two buys Zynga: The parent company behind games like Grand Theft Auto and BioShock now owns the company behind games like FarmVille and Words With Friends. We’ve known for a while that this was in the works, but the $12.7 billion deal was all finalized this week. More tech layoffs: Another week of companies announcing or confirming layoffs — including cuts at Klarna, PayPal and grocery delivery companies Getir and Gorillas. Google’s answer to DALL-E: Just last month, OpenAI showed off “DALL-E 2” — its AI model capable of taking a text prompt like “Shiba Inu wearing a beret” and generating an entirely new image from it. Now Google says they’ve got their own algorithm that’s even better — but, outside of comparison images Google provides (which, naturally, include more Shiba Inu in hats), we’ll have to take the company’s word for it. Citing “potential risks of misuse,” Google isn’t currently releasing any code or public demos.  Image Credits: Google Research added thingsWe have a paywalled section of our site called TechCrunch+. It only costs a few bucks a month and it's full of very good stuff! From this week, for example: Know your potential investor’s thesis: Got a solid business and a polished pitch deck, but still getting turned down by investors? “A lot of the time, it doesn't matter how good your company is,” writes Haje. “What matters is whether it matches up with your investor's investment thesis.” U.S. cannabis investors on why they’re planting seeds now: Recreational cannabis use is slowly becoming legal in more and more states — but it’s still illegal at a federal level, which deeply complicates things when it’s the core of your business. Anna Heim checked in with four U.S. cannabis investors for their thoughts on the state of the industry, and what’s keeping it from really catching fire. It's not business as usual (and investors are admitting it): After Y Combinator’s memo suggesting founders “plan for the worst” in the months ahead, investors are echoing that sentiment in memos of their own. Natasha Mascarenhas takes a look at memos from Reach Capital, Lightspeed ventures and more. |

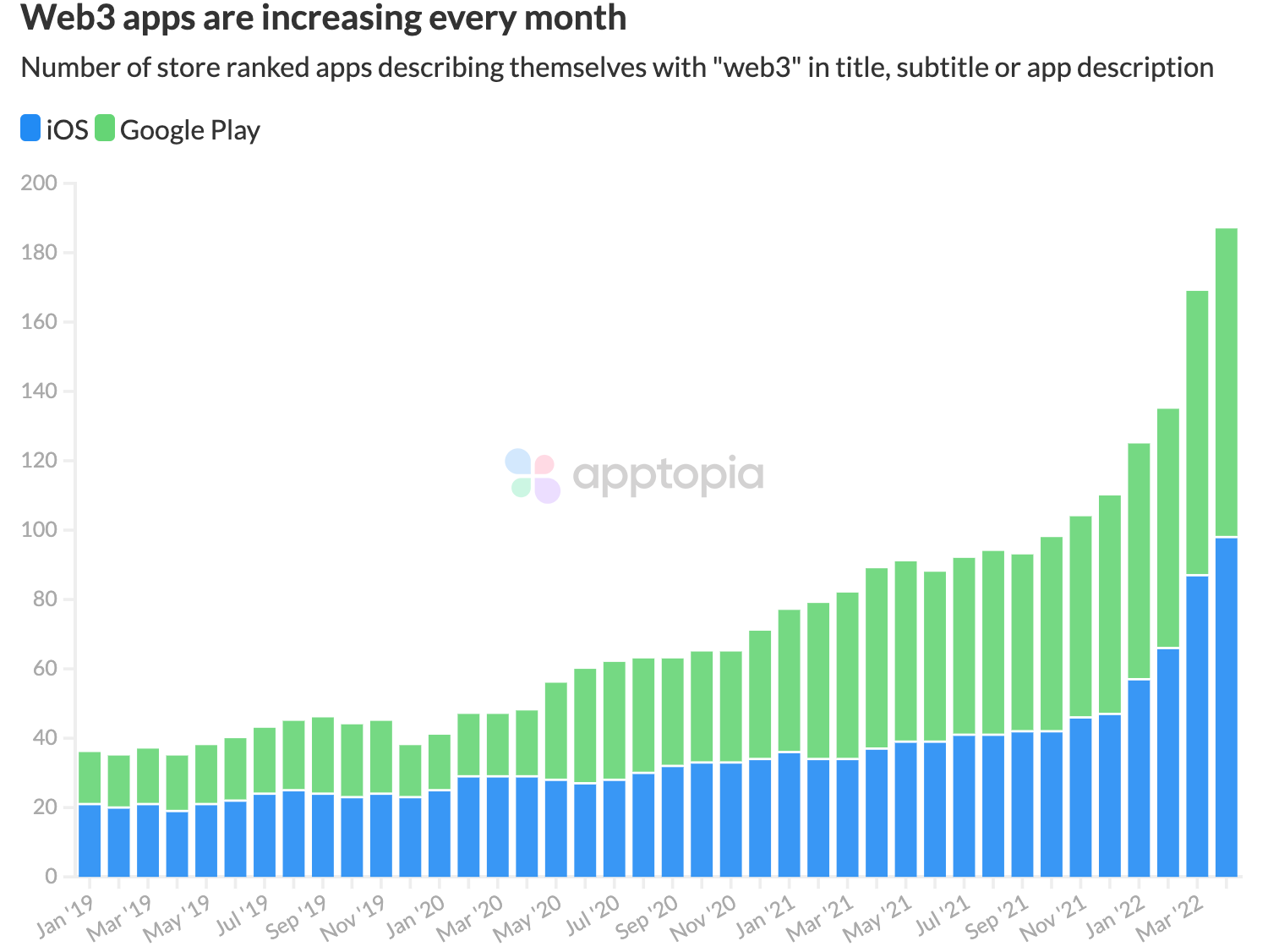

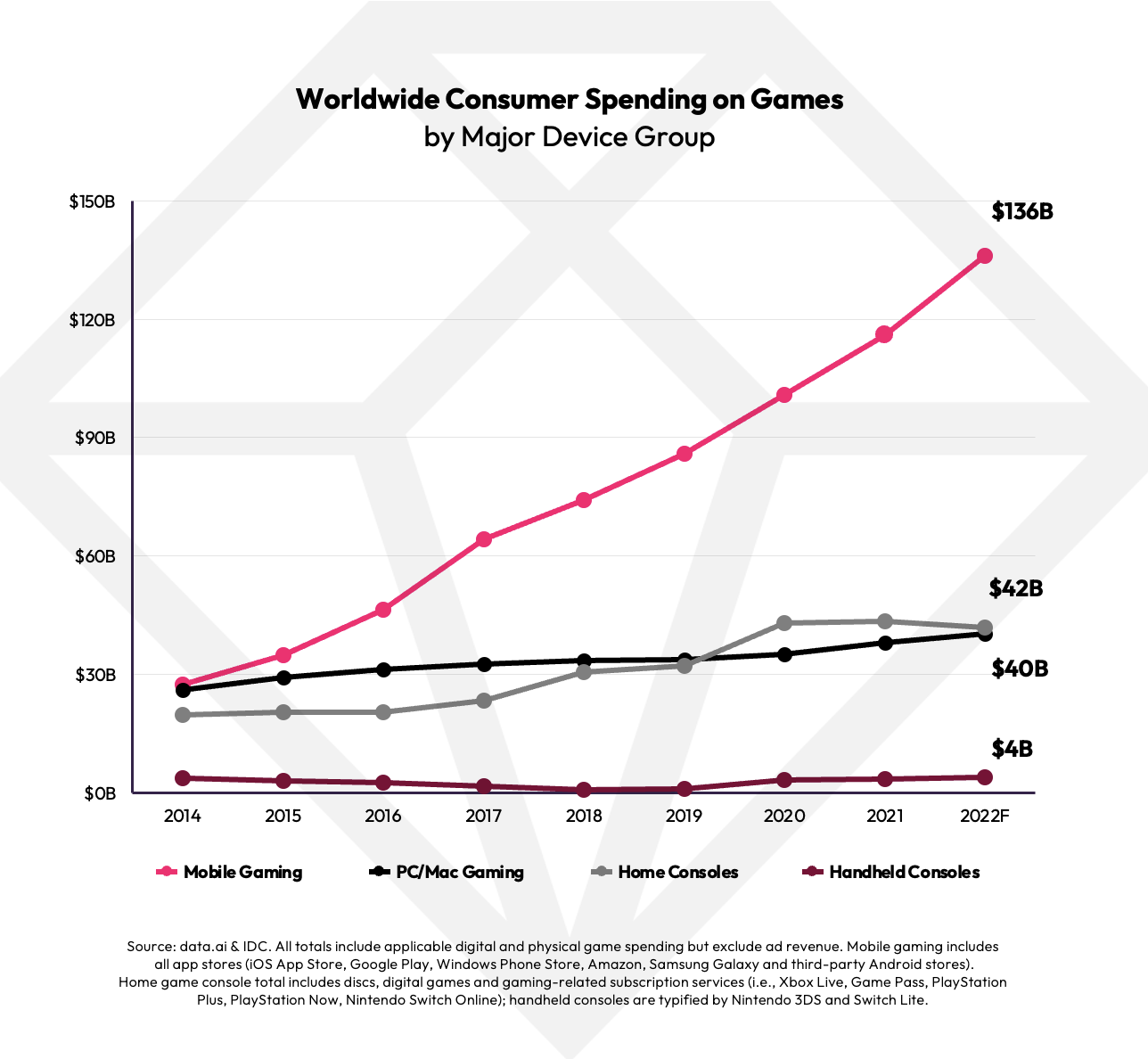

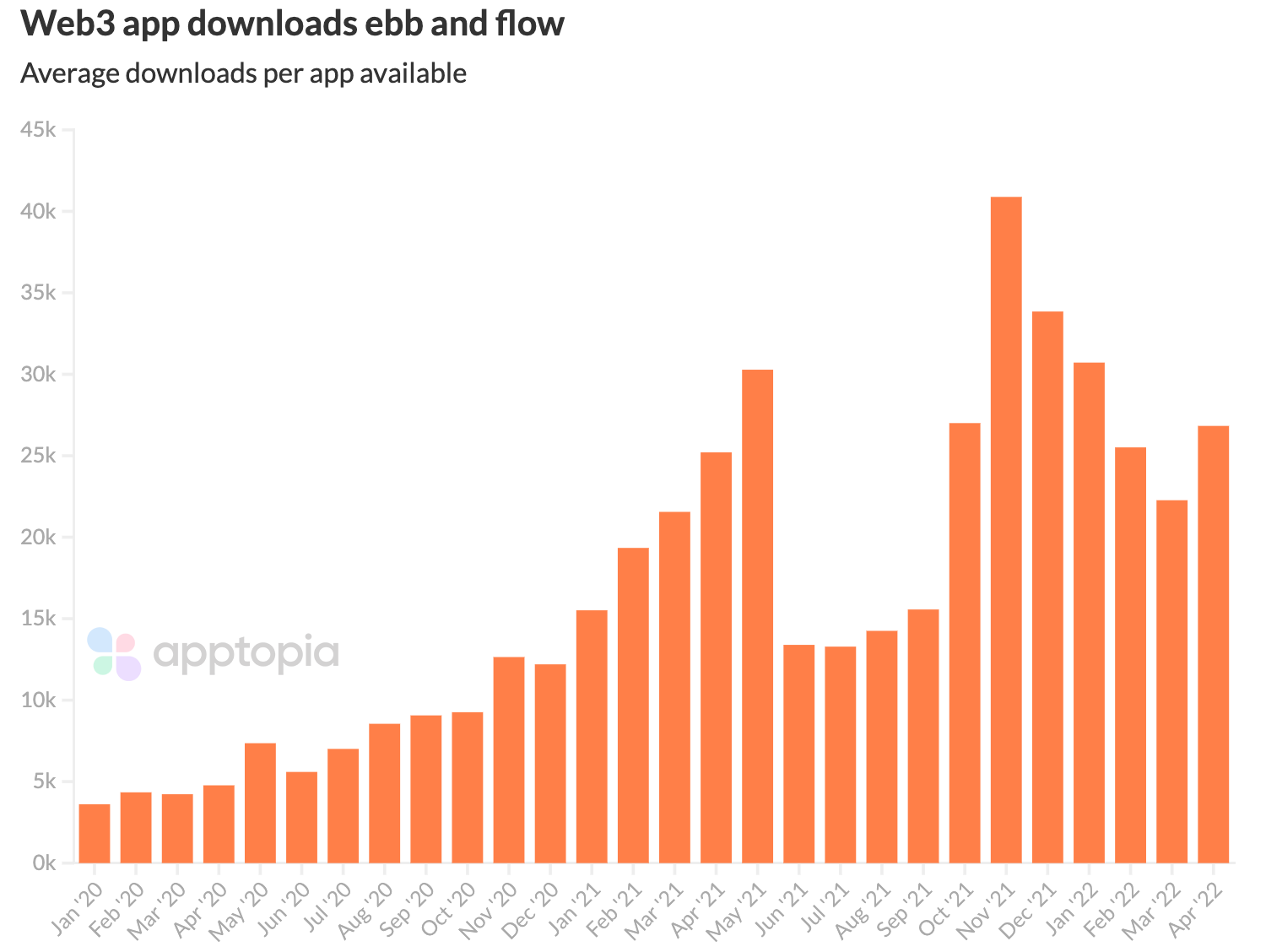

| This Week in Apps: Mobile gaming’s market share hit, web3 app growth, Niantic’s new AR tools Posted: 28 May 2022 11:15 AM PDT Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. Global spending across iOS, Google Play and third-party Android app stores in China grew 19% in 2021 to reach $170 billion. Downloads of apps also grew by 5%, reaching 230 billion in 2021, and mobile ad spend grew 23% year over year to reach $295 billion. Today's consumers now spend more time in apps than ever before — even topping the time they spend watching TV, in some cases. The average American watches 3.1 hours of TV per day, for example, but in 2021, they spent 4.1 hours on their mobile device. And they're not even the world's heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed five hours per day in mobile apps in 2021. Apps aren't just a way to pass idle hours, either. They can grow to become huge businesses. In 2021, 233 apps and games generated over $100 million in consumer spend, and 13 topped $1 billion in revenue. This was up 20% from 2020, when 193 apps and games topped $100 million in annual consumer spend, and just eight apps topped $1 billion. This Week in Apps offers a way to keep up with this fast-moving industry in one place, with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps to try, too. Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters Top StoriesWeb3 apps are growing Image Credits: Apptopia A report from Apptopia has found the number of mobile applications describing themselves as “web3” apps has continued to grow from 2020 through 2022. So far this year, the number of web3 apps available for download is growing nearly 5x faster compared with 2021, and year-to-date, the number of apps available for download is up by 88%. The firm analyzed data across the App Store and Google play, looking for any apps with “web3” in the title, subtitle or app description. Many of these apps — around 46% — were those in the finance space. This has to do with the large number of mobile wallets, NFT apps and the like now crowding the app stores. Much smaller percentages were found in apps in the social, tools/utilities, business and gaming categories. However, despite the growth in the availability of web3 apps, the number of downloads the apps are seeing seems to ebb and flow, Apptopia noted. In addition, it found that NFT marketplace apps OpenSea and Veve were down 90%+ off their highs, and the top 50 crypto apps have seen downloads fall 64% since November. Meanwhile, web3 apps seeing growth currently include the circular economy app Twig and running app STEPN, which lets users collect NFTs by running outdoors.

Never-ending Twitter deal dramaIn what’s becoming a regular occurrence, it was another tumultuous week for the deal that would see Elon Musk acquire Twitter. This week, Musk decided to put up more of his own money for Twitter — just days after it looked like the tech exec was trying to get out of the deal by alleging Twitter lied about the percentage of bots on the platform. In a filing, Musk said his personal financial commitment was now $33.5 billion, up from $27.25 billion. The Telsa and SpaceX exec had previously said he would execute a margin loan of $12.5 billion against his other holdings, like his Tesla shares. But Tesla shares had seen a sharp decline after news of Musk’s acquisition plans for Twitter back in April, potentially prompting this move. If you’re sick of all the deal shenanigans, you’re not alone. A group of Twitter shareholders has now sued Musk, alleging he manipulated Twitter stock for his own benefit throughout the course of buying the company. The suit says Musk’s complaint about the percentage of bots on the platform was likely an attempt to drive down the price of the deal. It also cites issues with how he claimed the deal was “on hold,” when there was no such mechanism in place to stop the deal from proceeding; and it points out that Musk delayed filing a disclosure when his stake in the company exceeded 5%, allowing him to buy shares at a discount, in violation of securities law. While a select group of Twitter investors is behind the lawsuit, it’s open to any shareholders who are looking to receive financial compensation from the Twitter chaos the deal has caused. Musk’s move to buy Twitter is certainly shaking things up. This week former Twitter CEO Jack Dorsey exited the board of directors. And, at Wednesday's shareholder meeting, the board voted to oust board member — and Musk ally — Egon Durban, CEO of private equity firm Silver Lake. Durban has backed Musk’s companies, including SolarCity, before it was acquired by Tesla. The FT pointed out that the two biggest shareholder advisers, Institutional Shareholder Services and Glass Lewis, cited concerns with Durban serving on too many other boards. (The FT said he was on seven this year, but a Twitter SEC filing said it was six.) Twitter then rejected Durban’s resignation, two days after shareholders had blocked his re-election. The company said that Durban likely failed to receive shareholder support because of his director role on so many other boards (six), but Durban had agreed to reduce the number to five by May 25, 2023. Also during the shareholder meeting, Twitter CEO Parag Agrawal faced a number of questions about the deal, what it means for free speech on Twitter, content moderation and other issues. But Twitter declined to answer questions about the deal and said work at Twitter was continuing as usual. (Which hardly seems true, given the string of firings and exec departures following Dorsey’s exit and Musk’s takeover attempt!). Twitter’s troubles also extended beyond the acquisition, as this week Twitter also agreed to pay a $150 million fine as part of its settlement with regulators over user data privacy. The FTC and Department of Justice said that between May 2013 and September 2019, Twitter asked users for personal information — including phone numbers and emails — to secure their accounts, but then used that information to target users with ads. More than 140 million Twitter users were impacted, the FTC said. Weekly NewsPlatforms: Apple Image Credits: Apple

Platforms: Google

E-commerce

Augmented Reality Image Credits: Niantic

Image Credits: Snap Fintech

Social Image Credits: TikTok

Image Credits: Snapchat screenshot via Watchful

Image Credits: Instagram

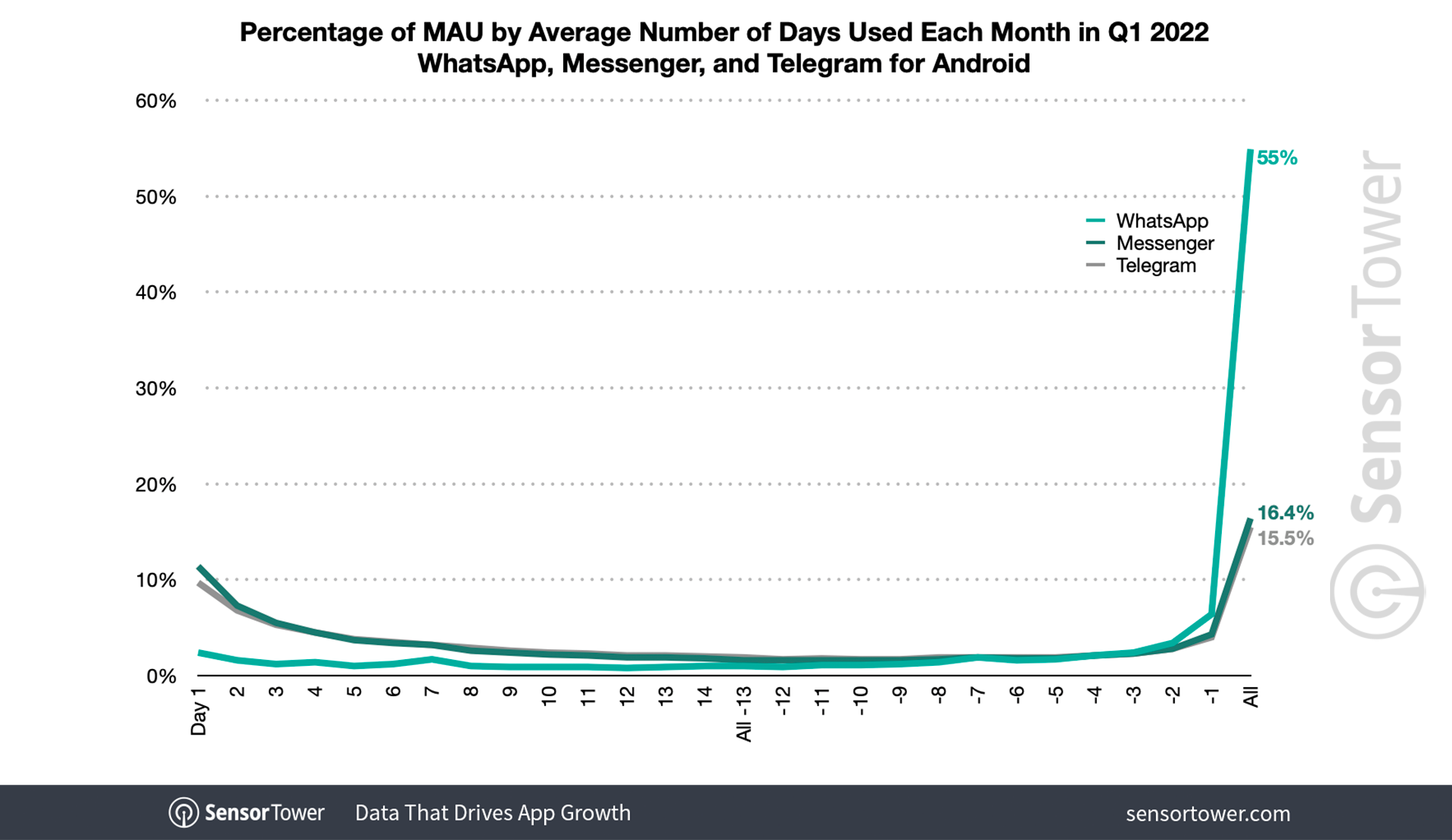

Messaging Image Credits: Sensor Tower

Photos

Dating

Image Credits: Bumble screenshot via Watchful Streaming & Entertainment

Gaming Image Credits: data.ai

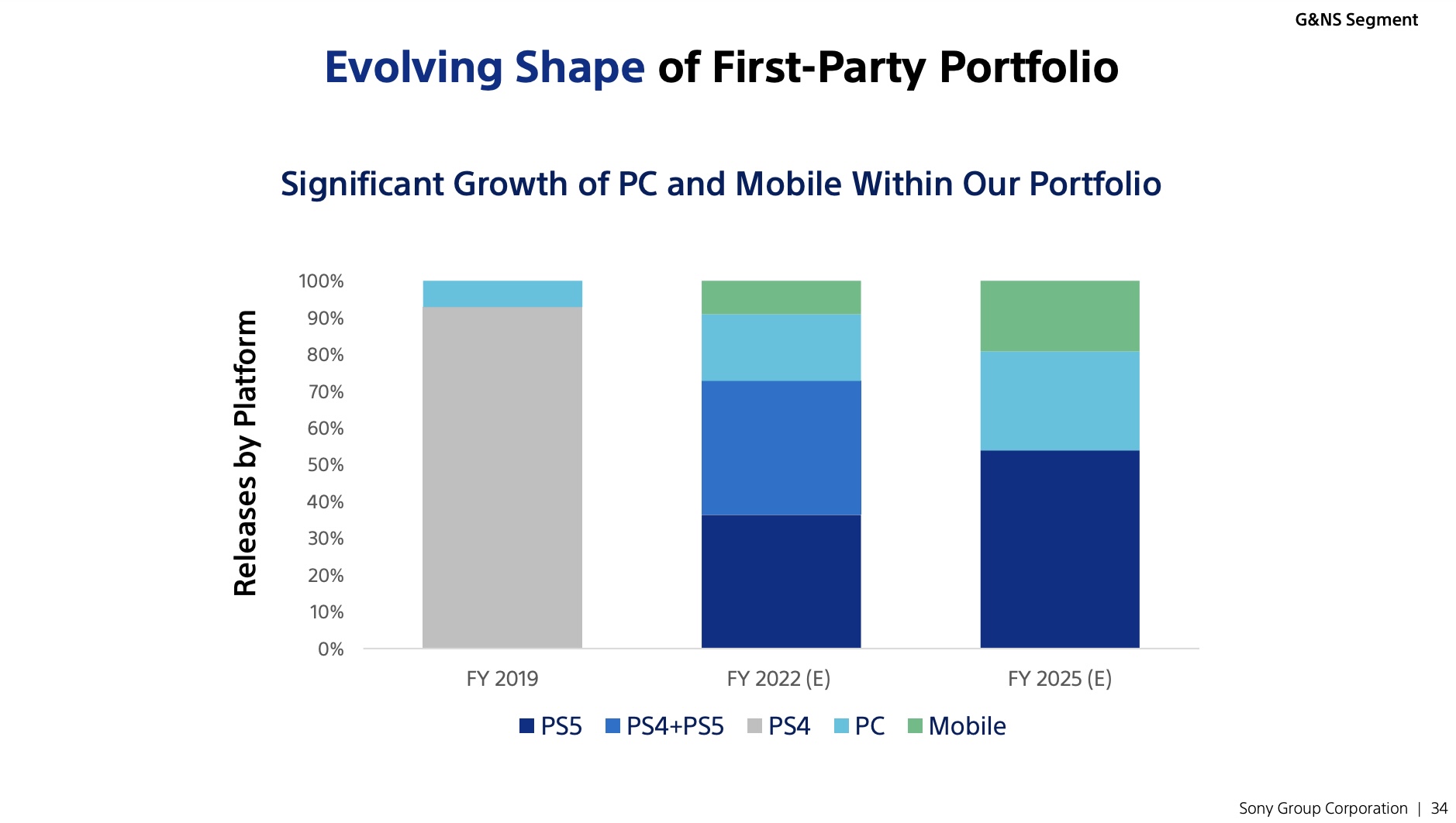

Image Credits: Sony (opens in a new window) Utilities

Government, policy and… antitrust lawsuits

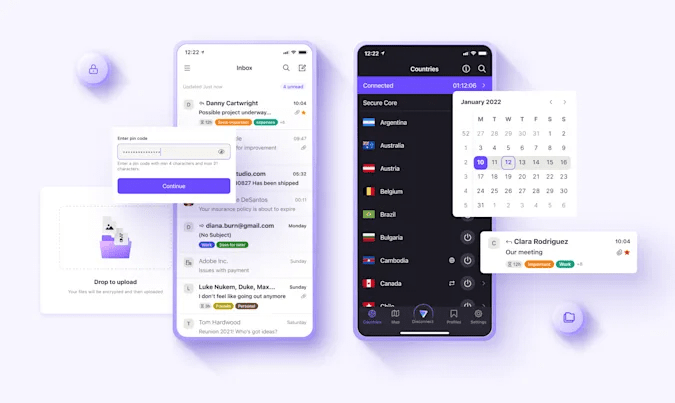

Security & Privacy Image Credits: Proton

Funding and M&A

|

| Footnotes on Sequoia’s startup memo Posted: 28 May 2022 11:02 AM PDT Welcome to Startups Weekly, a fresh human-first take on this week's startup news and trends. To get this in your inbox, subscribe here. Sequoia takes things seriously. The storied venture firm is known to react to macro-economic events with grand memos aimed at portfolio companies, and sometimes the entrepreneurship scene at large. Most recently, Sequoia created a 52-slide deck, first reported by The Information, titled Adapting to Endure; the document reads like a follow-up course to its infamously ill-timed "Coronavirus: The Black Swan of 2020" memo of March 2020. The firm is not always right in its prognostications — which is maybe why it stuck to internal musings instead of a Medium post this time — but it does do a service in providing a snapshot of how one of the most weathered, and successful, firms of all time thinks about a looming downturn. "Our intention in gathering today is not to be a beacon of gloom," the deck reads. "But we also believe that winning in the years ahead is going to depend on making hard, decisive choices confronting uncomfortable challenges that may have been masked during the exuberance and distortions of free capital over the past two years." Sequoia's advice largely followed the same script that other venture firms have been using: extend runway, focus on sustainable growth and recognize that an economic recovery may be a ways away. There were, however, some tidbits that stood out, such as a subtweet I'm guessing is for Tiger Global and a precise explanation of how founders should define fluff these days. For my full take on this topic, read my TechCrunch+ column, "Sequoia is the latest VC firm that wants you to take the downturn seriously." In the rest of this newsletter, we'll bring in a founder's perspective on this moment in tech, a pitch deck teardown and a deal that may have flown under your radar this week. As always, you can support me by forwarding this newsletter to a friend or following me on Twitter or subscribing to my blog. Let's have a Heart to HeartOn Equity this week, Heart to Heart CEO Josh Ogundu joined us to talk about his perspective on the market for early-stage founders. Ogundu told us what he's rethinking, the importance of honesty and what to do before considering a layoff. It's not too often that we have guests on the show, so when we do, you know it's going to be a good one. Here’s why it’s important: So much of the advice, as this newsletter’s intro shows, has come from investors. Yet, founders are the ones living the change and making the hard decisions, so consider this episode an overdue reality check.  Image Credits: Bryce Durbin/TechCrunch Pitch Deck TeardownOur own Haje Jan Kamps has started a weekly series in which he reviews a startup’s pitch deck in the shape of a witty column. Most recently, he reviewed Lumigo’s Series A pitch deck that helped the startup land a $29 million round. Here’s why it’s important, in his words: “I’ve been coaching startups for a long time, and the No. 1 challenge we always run into is that there’s no shortage of advice for how to do a good pitch deck (hell, I wrote a book about it), but the thing that’s always been missing is a good library of actual, real pitch decks that were successful in raising money. When I rejoined TechCrunch and started talking to founders about fundraising rounds, I realized this might be my chance. In this week’s teardown, we talk about what worked about the deck and where the company could have made further improvements. This is info that isn’t available anywhere else, and it’s been such a fun project so far!”

Deal of the weekIt certainly feels like layoff announcements are the new funding round stories, but I do think it's helpful to balance the doom and gloom with some growth-focused news. And no, I'm not just talking about new crypto funds. This week, Planet FWD announced that it has secured $10 million so the consumer products industry can track carbon emissions. No biggie. Here's why it's important via reporter Christine Hall: “Time is of the essence in reducing emissions, with [CEO Julia Collins] noting that there are less than 100 months left to reach the 2030 global goal of cutting at least 40% of greenhouse gas emissions from 1990 levels. Household consumption of things like food, which impacts land, energy and water, account for 60% of global emissions, she added.”

Image Credits: Peter Dazeley (opens in a new window) / Getty Images Across the week

Seen on TechCrunch Report: Substack, the highly hyped newsletter platform, has ditched plans for a Series C 4 investors discuss the US cannabis market's prospects in Q3 2022 Manish Maheshwari, former Twitter India head, leaves new startup Founder alleges that YC-backed fintech startup is 'copy-and-pasting' its business Everything you wanted to know about Elon Musk and Twitter (but didn't want to ask) Seen on TechCrunch+ Questions arise on Y Combinator's role in startup correction Sequoia's Jess Lee explains how VCs think about their deals Perhaps faster delivery times were a poor choice from a unit-economics perspective Dear Sophie: Does International Entrepreneur Parole have any advantages over an O-1 visa? Can recurring revenue financing drive growth in a turbulent market? Until next time, |

| The TechCrunch Podcast: Why do people keep giving Adam Neumann money? Posted: 28 May 2022 10:56 AM PDT Welcome to the second episode of The TechCrunch Podcast, our weekly news show bringing you all the top stories in tech. This week, we sat down with TC writers Natasha Mascarenhas, Anita Ramaswamy and Devin Coldewey to talk about the continued, troubling trend of layoffs in tech; Adam Neumann’s new crypto carbon credit startup (?!); and the one-upmanship among AI image generation technologies happening between OpenAI and Google. Listen below, and subscribe in iTunes or Spotify to get new episodes delivered weekly on Saturdays! Articles from the episode:

Other news from the week:

Extras:

|

| Cannabis, sex tech and psychedelics startups deserve more than stigma Posted: 28 May 2022 10:01 AM PDT Welcome to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It's inspired by the daily TechCrunch+ column where it gets its name. Want it in your inbox every Saturday? Sign up here. Cannabis, sex tech and psychedelics are often lumped together under the “vice” category — a characterization that prevents many VCs from investing in these spaces. But does that make sense? Let’s explore. — Anna It’s (not) a sinIsn’t cannabis actually similar to coffee, wine and spirits? That’s the argument Emily Paxhia made on a Twitter Space hosted by TechCrunch+ earlier this week to discuss our latest U.S. cannabis investor survey. A managing director at cannabis-focused hedge fund Poseidon Asset Management, Paxhia argued that marijuana-derived products have a lot more to do with wellness than with the “sin” category they often fall under. “Sin clause” and “vice clause” are terms that venture capitalists use to refer to their inability to invest in certain business categories, from porn and gambling to alcohol and tobacco. When I explored fundraising strategies for sex tech startups earlier this year, I found out that this veto typically comes from the fund’s limited partners, or LPs. It is understandable why investors wouldn’t want to put their money in certain types of businesses, let alone be known for doing so. But there’s a fine line between moral stances and stigma. “I don’t identify with the word ‘vice’ at all,” Andrea Barrica told me. Barrica is the founder of O.School, which she describes as a media platform for sexual wellness. “Wellness” is a popular term in both the sex tech and cannabis industries — because it makes them more palatable, sure, but also because it truly reflects the impact that entrepreneurs are hoping to have. It is worth keeping in mind that cannabis isn’t just about providing a recreational high. In Europe, we heard from investors, it is medical cannabis that has most of the momentum. It is the perspective of health benefits that drives many entrepreneurs, who deserve better than cheap laughs. Similarly, a deep dive into psychedelics taught me that this is about much more than drugs and fun. With investors sometimes getting into this space after personal journeys with depression or burnout, and founders hoping to make a dent on the global mental health crisis, easy jokes quickly feel out of place. Missing outThe vice clause applies only to certain types of investors, which is also problematic. The fund that is handling your pension might pass on cannabis investments, but many family offices aren’t. This means that returns from these potentially lucrative bets will be concentrated in the hands of the already-wealthy. Some fund managers are also investing as individuals, Paxhia said — and it’s them who will get the upside. Meanwhile, fiduciaries are missing out on the returns and the impact they could have, for arbitrary reasons. After all, what’s legal is not always moral, and vice versa. The most glaring paradox is that the tobacco, nicotine and alcohol industries are actually keeping close tabs on cannabis and whether consumption might shift. Would the shift be a net negative for society? Perhaps not. As for psychedelics, there’s research ongoing to use nonhallucinogenic derivatives to treat opioid addiction. With overdose deaths involving fentanyl and methamphetamine surging in the U.S., is this vice? I don’t think so. Do you? |

| Why Convoy’s Dan Lewis expects digital freight to go mainstream within the year Posted: 28 May 2022 09:30 AM PDT Dan Lewis, co-founder and CEO of digital freight company Convoy, didn't start his company because he had a deep and abiding passion for trucking. At least, not at first. The executive has a background in strategy and management consulting that progressed into a career in product development for top tech companies like Google and Amazon. But when he was struck by the urge to start a company, he researched the money-attracting industries of the world, and then, using AngelList, saw how many companies were trying to disrupt those industries. His search yielded thousands of companies that were working on industries ranging from telecommunications and fashion to video games and food. Billions of dollars were going into trucking each year but fewer than 30 startups showed an interest in the field. “I saw a massive opportunity and few people going after it,” Lewis told TechCrunch. TechCrunch+ is having a Memorial Day sale. You can save 50% on annual subscriptions for a limited time. Lewis and Grant Goodale co-founded Convoy in 2015, and since then, have brought on a series of high-profile investors. A couple of years after Convoy was founded, in a pivotal turn of events, the company secured its Series B from YC Combinator's Continuity Fund, a fund that was usually geared toward earlier-stage companies. More recently, Convoy secured a $260 million Series E, led by Baillie Gifford and T. Rowe Price, that brought the company's valuation up to $3.8 billion. To date, the company has raised almost $1 billion to scale its platform, which connects the fragmented network of shippers, carriers and brokers across the United States.

Speed is a big feature of building a startup, and it's also a big feature of not getting diluted, because you can show immense progress and then raise at a higher valuation based on that. Dan Lewis, co-founder and CEO of Convoy We sat down with Lewis to talk about the importance of being customer-obsessed when starting a company, why compensation packages in the early days can help you avoid diluting your company too much in future fundraises, and how to set boundaries on the compromises you'll make as a founder. The following interview, which has been edited for brevity and clarity, is part of an ongoing series that focuses on founders in the transportation sector. TC: YC’s investment in your Series B was notable because Convoy at the time was outside the Continuity Fund’s range of portfolio companies. What do you think made Convoy stand out? Lewis: The YC culture is a really curious one, so they didn't feel like they needed to stay in a particular lane, especially with the Continuity Fund, which was geared toward early growth-stage companies. When we met, I think the breakthrough was just the unique story. People don't usually realize how fragmented, how large, how offline the trucking industry is. So YC viewed this as a major disruptive play. We were excited to work with them because they’re an incubator and accelerator, so their whole system is designed around helping founders succeed. They had so many unique programs that helped us be successful and grow that I had never seen from other investors at the time. You mentioned that a good way to decide on a direction for a startup was to compare industries where there’s lots of money against companies that are trying to disrupt those industries. Is that still a good method? I think it is a really good method. It would be interesting to pull a list of industries and find out how much money is spent in those industries, and then see how many companies are going after those industries. AngelList is a great resource to find the newest, most innovative companies that are going after these spaces. Before I ever started the company, I wrote this article in Quora that went viral and was published by Forbes. It was an answer to the question: How to come up with a startup idea. I wrote this really extensive theory, basically a playbook. So when I was going to start my own company, I was like, I should eat my own dog food. I went back and used my own process, and I can now say it's credible because it works. |