Squared Away Blog |

| The Many Facets of Retirement Inequality Posted: 30 Jun 2022 06:06 AM PDT Retirement inequality is a thread running through several articles that have appeared here this year. One blog that was particularly popular with our readers distinguishes retirees who have enough wealth to maintain the same spending levels throughout retirement from those who will, over time, have to cut back and reduce their standard of living. The research behind the article – "Health and Wealth Drive Retirees' Spending" – makes clear that wealth is just one component of a satisfying lifestyle. Even retirees who can afford to maintain their living standard may not be healthy enough to enjoy their money to the fullest. The retirees who have both – health and wealth – are best equipped to maintain their pre-retirement lifestyle. Homeownership also marks a dividing line between the haves and have-nots. A home is one of retirees' largest sources of wealth. Although most are hesitant to withdraw home equity, the ones who have equity and tap it to pay medical bills see large, positive health benefits, according to "Using Home Equity Improves Retirees' Health.” Pensions are another dividing line. "Retirees with Pensions Slower to Spend 401(k)s" shows the value of having guaranteed income from defined benefit pensions, which are all but extinct outside the public sector. Retirees with pensions are less reliant on their 401(k)s. The evidence: the researchers found they don't deplete their savings as rapidly as retirees who lack pensions. The downside of not having a pension, they said, is "more risk that they will outlive their savings." So, how can retirees' lives be enhanced? Get more workers to save for the future. In the article "Viewing Retirement Saving as a Fresh Start," researchers tested various ways to increase the resolve to save. Workers were more likely to sign up for a 401(k) or increase the 401(k) contributions deducted from their paychecks if they were presented with the idea of doing so on their birthday or the first day of spring. The prospect of a fresh start on an important date proved to be persuasive. In "Workers: Social Security Info is Eye-Opening," working-age adults said they learned crucial information when they looked up the government's estimates of their Social Security benefits. One 31-year-old, upon seeing his estimate for the first time, realized that it is "not quite nearly enough to survive on." And that's why workers need to start saving early. The majority of adults have never logged on to Social Security's website – and they should. Other popular blogs in the first half of 2022 included:

Some of the research studies reported herein were derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof. |

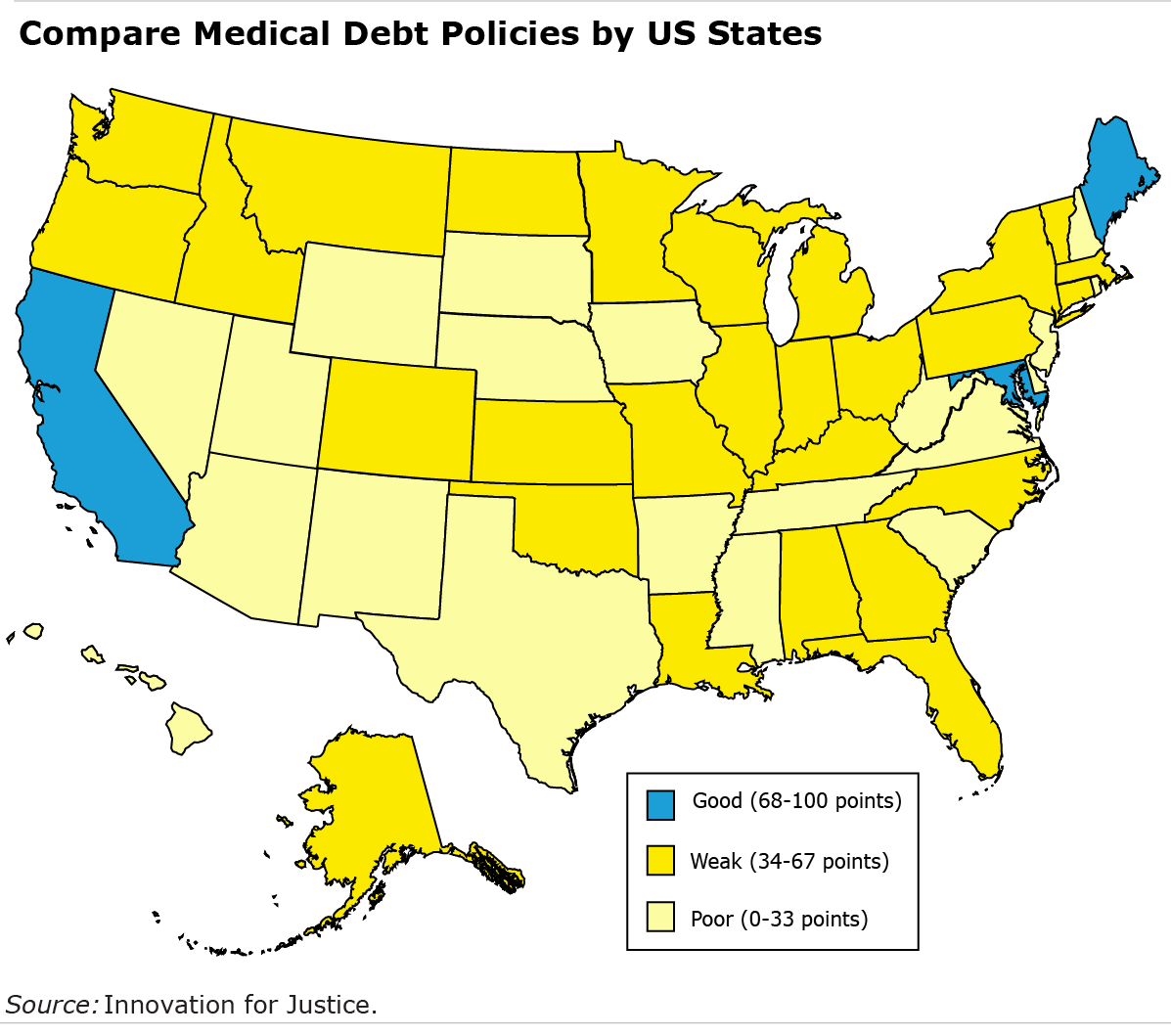

| Limiting Medical Debt: a 50-State Ranking Posted: 28 Jun 2022 06:04 AM PDT Lawmakers in Maryland, California and Maine have made the most effort to prevent residents from drowning in medical debt. Texas, South Carolina and Tennessee do the least. This is the assessment of an organization known as Innovation for Justice, a team of researchers at the University of Arizona and the University of Utah. They ranked the 50 states on whether they have taken myriad steps to minimize medical debt. These legislative measures range from restrictions on the healthcare industry's billing and collection practices to how debt claims are handled in the courts. Medical debt is the single largest category of consumer debt, and the Kaiser Family Foundation estimates that 100 million Americans are behind on paying their medical or dental expenses – and a quarter of them owe more then $5,000. This project would be important at any time and is even more so during a pandemic when many people have incurred medical debt for COVID. Some of that debt is even for bills the federal government would've paid on behalf of the uninsured cashiers, drivers, retail workers, restaurant servers and cooks who were on the front lines in the worst days of the pandemic. Putting the state rankings into a national perspective, the consumer protections to prevent the accumulation of debt are not exactly impressive. Only three of the 50 states qualify as having good protections. The researchers ranked another 27 states as weak and 20 as poor.

Last but not least, Maryland expanded its Medicaid program, as encouraged by the Affordable Care Act, to extend subsidized or free health insurance to more of its low-income workers. Medical debt has been reduced in the states that expanded their coverage. The lowest-ranked states – Texas, South Carolina and Tennessee – are among the states that have not expanded Medicaid. Visit the medical debt scorecard to see what your state is – or isn't – doing. Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You'll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College. |

| You are subscribed to email updates from Squared Away Blog. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Maryland, which sits at the top of the medical debt scorecard, satisfies most of the researchers' criteria for debt reduction. State lawmakers have limited residents' debt by mandating that patients be screened for health insurance or government health benefits. The state also regulates hospital billing practices, instructing them to offer a payment plan before sending a patient's bill to collections and requiring that bills itemize every charge, every payment, and whether charity care has been provided to the patient.

Maryland, which sits at the top of the medical debt scorecard, satisfies most of the researchers' criteria for debt reduction. State lawmakers have limited residents' debt by mandating that patients be screened for health insurance or government health benefits. The state also regulates hospital billing practices, instructing them to offer a payment plan before sending a patient's bill to collections and requiring that bills itemize every charge, every payment, and whether charity care has been provided to the patient.

No comments:

Post a Comment