TechCrunch |

- Rock the Kasbosch? Bosch has a new, $295M VC fund

- Xiaomi appoints Alvin Tse as General Manager of India business

- Coinbase extends hiring freeze, rescinds some accepted offers

- Temasek’s Pavilion Capital backs South Korean AI chip maker Rebellions with $50M investment

- Cruise can finally charge for driverless robotaxi rides in San Francisco

- Social app IRL lays off 25% of team, says it has enough cash to last well into 2024

- Daily Crunch: To manage high-demand products, Amazon unveils invitation-based ordering system

- Insurtech Policygenius cuts 25% of staff, less than 3 months after raising $125M

- Mozilla brings free, offline translation to Firefox

| Rock the Kasbosch? Bosch has a new, $295M VC fund Posted: 03 Jun 2022 12:00 AM PDT Bosch’s venture arm just announced its fifth fund, saying it’s on the lookout for startups with the “potential to improve quality of life and conserve natural resources.” The new, $295 million (€250 million) investment vehicle ups the stakes from Bosch VC‘s prior fund by about $53 million, yet the German firm’s global focus on deep tech remains much the same. For Bosch VC, that nebulous category includes everything from autonomous vehicles to internet-of-things platforms. Climate tech is also on the firm’s radar—including solar, carbon capture and alternative fuels, managing director Ingo Ramesohl said in a call with TechCrunch. Typically, Bosch VC backs startups at the Series A or B stage, investing up to about $27 million apiece (€25 million). Compared to its German parent company, a 135-year-old conglomerate, Bosch VC is run by a relatively small team with 22 investment managers. That number is set to grow, according to Ramesohl, with the pending launch of a new U.S. office in Boston. The East Coast office is coming “very soon, basically next week,” added Ramesohl. It’ll exist alongside Bosch VC’s office in Sunnyvale, CA. As well as backing climate-tech startups, Bosch recently said it would drop around $3.5 billion to develop “climate-neutral” tech, including vehicle electrification, hydrogen electrolyzers, and heat pumps.

|

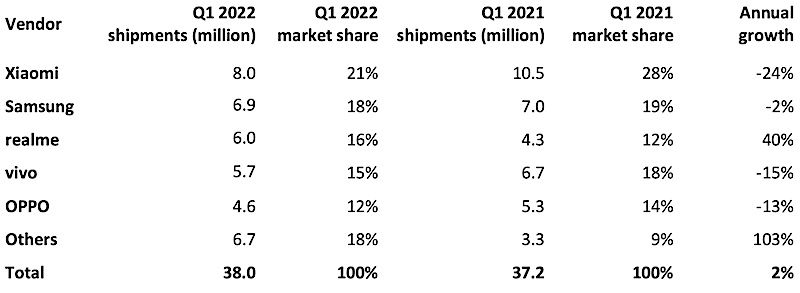

| Xiaomi appoints Alvin Tse as General Manager of India business Posted: 02 Jun 2022 11:37 PM PDT Xiaomi is elevating Alvin Tse, a veteran at the firm, as the General Manager for its India business as the Chinese technology group bolsters its efforts to fight increasing competition from rivals including Samsung and looks to smoothen its relationship with New Delhi. The appointment of Tse (pictured above), who until recently led Xiaomi’s Indonesia business, follows the transition of Manu Kumar Jain, the previous head of Xiaomi India, to a globe role as Group VP. India is Xiaomi’s largest international market. Under Jain's leadership Xiaomi grew from being yet another upstart to the largest smartphone maker in India, a position it has largely maintained for over three years. He left his India leadership position last year. Tse is no stranger to the India, either. He was instrumental in shaping Xiaomi’s strategy and execution in its early days, according to people familiar with the matter, and has over the years served multiple roles at the firm. Tse, who is also an angel investor in several Indian startups, was also one of the founding members at Poco, a sub-brand Xiaomi launched before spinning it out as an independent business. "Post his transition, Alvin will join hands with the Xiaomi India leadership team and support the company’s next phase of growth. Being a British national and true global citizen, Alvin has helped Xiaomi expand successfully into many global markets," the company said in a statement. Xiaomi also announced that Anuj Sharma, a former Motorola executive who has also previously worked at Xiaomi and moved to Poco over two years ago, is rejoining the Chinese giant as Chief Marketing Officer. "With their guidance, Xiaomi India will continue to stay true to its core philosophy of relentlessly building amazing products with honest prices such that everyone in the world can enjoy a better lifestyle through innovative technology," the company said. The rejig comes at a crucial time for Xiaomi. Even as it maintains the tentpole position in the Indian smartphone market, Samsung and Realme are increasingly closing the gap.  A look at India’s smartphone market. Data: Canalys Xiaomi is also confronting a strange debacle in India. In April this year, India's anti-money laundering agency seized assets worth about $725 million from Xiaomi India for what it said was a breach of the country's foreign exchange laws. The move has been put on hold pending a court decision. The agency also summoned Xiaomi executives including Jain for questioning earlier this year over tax compliance. Xiaomi, which has denied wrongdoing, later alleged that its executives faced threats of “physical violence” during the questioning, Reuters reported. The India Cellular and Electronics Association, a lobby group that represents Apple and many other tech giants, late last month called out Indian authorities for lacking understanding of how patents and royalty atop of them work, an element at the core of the dispute between Xiaomi and the anti-money laundering agency. Over the past four years, Xiaomi has aggressively expanded its presence in India, setting up its iconic stores and has partnered with scores of local retailers. It has also made deep inroads with phone manufacturers such as Foxconn to move much of its assembly work to India from China. But the firm is not immune to the geopolitical tension between India and China. India banned over 200 apps with links to China in 2020. Some of Xiaomi’s apps also got blacklisted in India and amid the scuffle between the two nuclear-armed neighboring nations, Xiaomi rebranded many stores in the country to position itself as an Indian firm. |

| Coinbase extends hiring freeze, rescinds some accepted offers Posted: 02 Jun 2022 05:09 PM PDT Coinbase announced today that it will extend its hiring freeze and revoke accepted offers from some candidates who haven’t started their roles yet. The third-largest crypto exchange by volume, Coinbase began to slow hiring two weeks ago, but this move is more drastic. “Adapting quickly and acting now will help us to successfully navigate this macro environment and emerge even stronger, enabling further healthy growth and innovation,” Chief People Officer L.J. Brock wrote in a company memo, shared publicly to Coinbase’s blog. Brock added that the hiring freeze will persist as long as the macroeconomic downturn continues, and that the freeze will also apply to backfills. However, any role that is necessary for security and compliance will still hire a replacement. “We will also rescind a number of outstanding offers for people who have not started yet. This is not a decision we make lightly, but is necessary to ensure we are only growing in the highest-priority areas,” the note continued. “All incoming hires will be advised of their updated offer status today by email.” People whose offers were rescinded will be eligible for Coinbase’s “generous severance philosophy,” on which the letter does not elaborate. But in late 2020, when CEO Brian Armstrong invited employees to resign if they were upset with the company’s “apolitical” mission, Coinbase’s severance packages supported employees for four to six months, depending on their length of employment, with six months of health coverage through COBRA. The company is also establishing a “talent hub” to offer impacted individuals additional support, like interview coaching and resume review. “We always knew crypto would be volatile, but that volatility alongside larger economic factors may test the company, and us personally, in new ways,” Brock wrote. “If we're flexible and resilient, and remain focused on the long term, Coinbase will come out stronger on the other side.” Heading into 2022, Coinbase planned to triple its headcount. But in its first quarter financial results, the company said that limiting headcount could be a way to manage costs. The company reported a $430 million loss, a bad omen for a crypto exchange that depends on trading activity for most of its revenue. The crypto platform Gemini, led by co-founders and twin brothers Cameron and Tyler Winklevoss, also announced today that it was curtailing its workforce. Gemini laid off 10% of its staff due to “turbulent market conditions that are likely to persist for some time.” Unfortunately, this turmoil extends far beyond the crypto space. In May alone, it’s estimated that 15,000 tech workers lost their jobs as companies try to cut costs during a challenging economic time. |

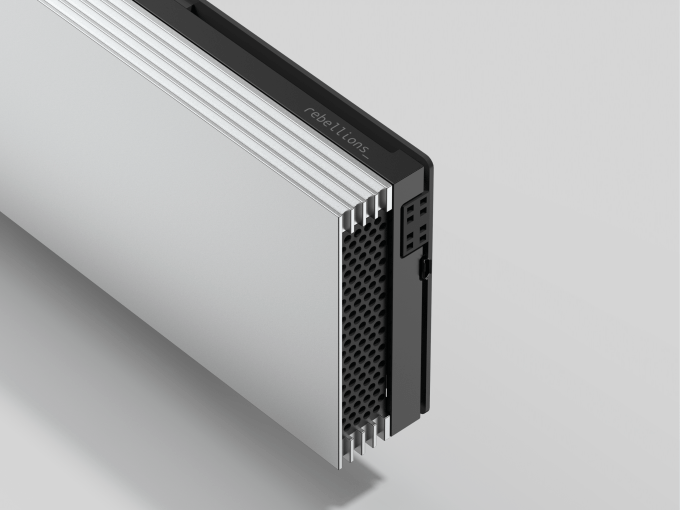

| Temasek’s Pavilion Capital backs South Korean AI chip maker Rebellions with $50M investment Posted: 02 Jun 2022 04:59 PM PDT Global venture capital firms are pouring money into the semiconductor startups developing the next generation of chips. Semiconductors, which have become a valued asset, are used in virtually almost every industry, including 5G networks, automation, the Internet of Things, financials, smart homes, smart cities, virtual reality (VR), augmented reality and self-driving cars. Sunghyun Park, a former quant developer at Morgan Stanley in New York, launched artificial intelligence semiconductor startup Rebellions with four co-founders to enter this red-hot industry in 2020. Today, the South Korea-based company that builds chips designed for artificial intelligence applications, announced it has raised a $50 million (62 billion KRW) Series A from investors, including Temasek's Pavilion Capital, Korean Development Bank, SV Investment, Mirae Asset Capital, Mirae Asset Ventures, IMM Investment, KB Investment and KT Investment. Its existing backers Kakao Ventures, GU Equity Partners and Seoul Techno Holdings also participated in the round, Park told TechCrunch. The Series A, which was oversubscribed — the firm initially targeted around $40 million — and wrapped up in less than three months, brings Rebellions' total funding raised to about $80 million (100 billion KRW) at an estimated valuation of $283 million (325 billion KRW), CEO of Rebellions Park said in an interview with TechCrunch. The startup will use the capital to mass-produce its second AI chip prototype, called ATOM, which will be used in enterprise servers, Park said. Additionally, the funding will be used to double its headcount to 100 employees, and set up an office in the U.S. by the end of this year, Park continued. Rebellions is in talks with potential customers to get its first AI Chip, called ION, into the market. The company’s ION customers could include global investment banks, and its second chip ATOM targets large companies in the cloud sector and data centers, Park added. It has lined up Taiwan Semiconductor Manufacturing Company (TSMC) to begin manufacturing the ION chips as early as next year. The company claims that its first chip ION, released in November 2021, improves trading speeds and reduces latencies and is two times faster than Intel Habana Labs' AI Chip Goya in terms of execution. That means Rebellions' ION enables faster data execution, so that lead orders can be processed more quickly and profitably than traders with slower execution speeds. High-frequency trading (HFT), or systematic trading, is an automated trading platform used by large investment banks, hedge funds and institutional investors to transact a large number of orders.  Image Credits: Rebellions’ AI chip ION Park had previously helped design a Starlink ASICs chip at SpaceX, and worked as an engineer at Intel Labs and Samsung Electronics. There are more than 50 AI chip makers in the world, including Samba Nova, Graphcore, Groq and Cerebras, looking to challenge AI processors from Nvidia, Intel and Qualcomm, according to Gartner analyst Alan Priestley. Intel acquired Israeli AI chipmaker Habana Labs for about $2 billion in 2019 while Qualcomm picked up Nuvia for approximately $1.4 billion in early 2021. The AI chip market is projected to be worth over $83.2 billion by 2027, up from $56 billion in 2018, per a 2019 report by Insight Partners. Venture capital funding for global chip startups more than tripled year over year in 2021, with $9.9 billion invested across 170 deals, per PitchBook. |

| Cruise can finally charge for driverless robotaxi rides in San Francisco Posted: 02 Jun 2022 04:42 PM PDT Cruise, the autonomous vehicle unit of General Motors, has finally been given the green light to start charging fares for its driverless robotaxi service in San Francisco. The California Public Utilities Commission (CPUC) voted Thursday to award Cruise with a driverless deployment permit, the final hurdle the company needed to jump to begin operating its autonomous ride-hail service commercially. Cruise will be operating its passenger service at a maximum speed of 30 miles per hour between the hours of 10 p.m. to 6 a.m. on select streets in San Francisco, adding another one and a half hours to its current service. The company will need additional state regulatory approval to charge members of the public for driverless rides in the rest of the city, according to a Cruise spokesperson. These preconditions come as part of Cruise’s “passenger safety plan” that limits the service to overnight hours and doesn’t include the city’s dense urban core, according to the CPUC’s draft resolution. “In the coming months, we’ll expand our operating domain, our hours of operation and our ability to charge members of the public for driverless rides until we have fared rides 24/7 across the entire city,” a spokesperson for Cruise told TechCrunch.  Screenshot of Cruise’s proposed autonomous ride-hail service in San Francisco per CPUC agenda. Image Credits: California Public Utilities Commission Cruise has been offering free driverless rides to San Franciscans in its autonomous Chevrolet Bolts between the hours of 10:30 p.m. to 5 a.m. since February. The company began testing its autonomous vehicles without a driver in the front seat in the city in 2020, and started giving passengers free test rides in June 2021. In October last year, Cruise received a driverless deployment permit from the California Department of Motor Vehicles, which meant it could begin charging for autonomous vehicle services, like delivery. Crucially, the limits of the DMV’s permit stop at charging for robotaxi rides. With this CPUC permit, Cruise is the only AV company in the city that can operate a commercial driverless ride-hailing service. Waymo, Cruise’s biggest competitor and the self-driving arm of Alphabet, also recently received a permit from the CPUC to charge for robotaxi, but only if a human safety operator is present during rides. Waymo has been offering a fully autonomous commercial ride-hail service in Chandler, a city southeast of Phoenix, since 2020, and recently expanded its driverless program in the city. While Cruise’s CPUC permit allows for a fleet of up to 30 all-electric autonomous vehicles, Cruise has not been shy about promoting its plans to scale rapidly in the near future. Last year, former CEO Dan Ammann laid out Cruise’s plans for growing its fleet of purpose-built Origin AVs to thousands, even tens of thousands, in the coming years. Last week, a group of San Francisco agencies — including the city’s municipal and county transportation authorities, the Bureau of Fire Prevention and Investigation, the Mayor’s Office on Disability and the SF Police Department — raised concerns about the lack of clarity within the CPUC’s draft resolution regarding limitations to Cruise scaling its fleet. The draft resolution stated that Cruise must submit an updated passenger safety plan in the form of a Tier 2 advice letter before modifying “any changes to the hours, geography, roadway type, speed range, or weather conditions in which Cruise intends to operate…” Notably, that language doesn’t oblige Cruise to have to appeal to the CPUC if it wants to increase its fleet size, a distinction which the SF stakeholders argue will “increase the negative impacts of driverless Cruise AV deployment” given Cruise’s “current approach to passenger loading,” another item of concern in the city’s comments on the draft resolution. “Cruise's current approach to passenger pickup and drop-off, stopping exclusively in the travel lane even when curb space is available, is below the level expected for human drivers,” the comments read, emphasizing the danger that an ever-growing fleet of AVs stopping in the travel lane could pose to vulnerable road users, like emergency responders, people with disabilities and older people and cyclists. As part of its comments, the city provided a list of recommendations for the CPUC to integrate into its final resolution, including:

“The [draft resolution] applies the same ‘wait and see’ approach that the Commission used in regulating Transportation Network Companies (TNCs),” read the comments. “That approach undermined San Francisco's climate goals, reduced transportation options for people who use wheelchairs, and significantly increased congestion and travel time delays on San Francisco streets used for robust public transit services. These outcomes are likely to be repeated unless the issues identified in these comments are addressed.” The CPUC’s decision to award Cruise with a deployment permit sets a precedent for how the state will continue to regulate commercial AV services in the future, so feedback from the public is crucial. And indeed some of the city’s recommendations did made it into the final draft language. For example, the deployment decision directs the Consumer Protection and Enforcement Division (CPED) of the CPUC to include whether or not a citation was issued in a collision or incident involving law enforcement in its categories of incidents for reporting. In addition, to support easier access, CPED conceded to post Cruise’s driverless deployment operational design domains on its website. However, the final language in the decision doesn’t require Cruise to necessarily submit an advice letter if it wants to add vehicles to its fleet, though it does commit Cruise to engaging with the CPED to discuss whether such a letter might be necessary in the future as changes to fleet size could materially affect the passenger safety plan. Which is not to say Cruise is at the risk of going unchecked. The company needs to get approval from the DMV before increasing fleet size, a Cruise spokesperson told TechCrunch. Finally, while the Commission encourages Cruise to provide wheelchair accessible vehicles and services for people with disabilities, the resolution doesn’t require it to run a commercial service. This article has been updated to include information on which of the city’s recommendations made it to the final deployment permit language. |

| Social app IRL lays off 25% of team, says it has enough cash to last well into 2024 Posted: 02 Jun 2022 03:31 PM PDT "We have all seen the state of the market," IRL CEO and co-founder Abraham Shafi wrote in a company-wide memo where the social app announced it would be dramatically cutting staff. Similar to dozens of startups over the past few weeks, IRL has just announced it’s laying off 25% of its team, or around 25 people, citing market dynamics. The cut comes around a year after the startup landed a $170 million SoftBank-led Series C and hit coveted unicorn status. What's different from recent layoffs, though, is the company's tone. "Courage is a decision, and we will choose courage," Shafi wrote in the memo, obtained by TechCrunch. "Whatever we are facing today can't be any worse than the uncertainty we met at the beginning of the COVID 19 pandemic." Regardless of the state of the pandemic, though, layoffs force workers into an unexpected period of precariousness, augmented by the impending loss of health insurance. Regarding the decision to cut staff, Shafi wrote that IRL has "more than enough cash to last well into 2024." Over the last year, the startup increased its head count by 3.5 times, but Shafi noted that WhatsApp was able to grow to 450 million users with a team of 55. This suggests that the workforce reduction was less about trying to reduce runway and more about right-sizing the team after a period of overhiring. “Becoming one of these iconic, impactful companies is akin to winning a gold medal in the Olympics. In fact, probably more challenging,” the CEO wrote. “Like the Olympics, we know most people don't want to be Olympians. In the same way, not everyone will want to walk the path we are walking. But for those that want to push their limits and find out what they are capable of, this culture is for you.” Throughout the memo, Shafi emphasizes the employees’ necessity to “adapt” and be “disciplined.” “I have been reflecting on Darwin's observation that the highest indicator of survival for any living organism is not brute force strength, but how quickly it can adapt to its changing environment,” Shafi wrote. “This company is a living organism, and our ability to adapt to our changing environment is of the utmost importance.” Going forward, IRL is focused on being an engineering-led organization, suggesting that the layoffs impacted other teams. An employee at IRL, who spoke to TechCrunch on the condition of anonymity, confirmed the layoffs and said that they "support the move and respect it." "It shows a SoftBank company is taking responsibility, usually SoftBank companies get criticized a lot," they said. "Financially, I know we're good because I heard we have around $100 million still in the bank…years and years of runway." The employee, who was not impacted by this layoff, said that the startup has a ton of new features, partnerships and prototypes in the works to create a more meaningful service in the future. IRL was founded in 2017 as a way to help users find real-world events, but when the pandemic hit, the platform pivoted to prioritize the discovery of online events. The company told TechCrunch at the time of its Series C that it had 20 million registered users, with 400% growth over a 15-month period. But some employees told The Information that they were skeptical of the accuracy of these numbers. It’s unclear if IRL’s user growth played a role in today’s layoffs, but it’s more likely a combination of factors, including also the current economic downturn that’s impacting the tech industry more broadly. Even as global lockdowns have eased, IRL remained dedicated to its new, digital-first strategy while also allocating money from its Series C to help bring back in-person events. At the same time, IRL also invested in its integration with TikTok and thought of itself as a potential "WeChat of the West." It later acquired the “digital nutrition” startup AeBeZe Labs with an eye on making its service a “healthier social app.” While the co-founder cites macroeconomic environment as reasoning to adapt, he also talked about how both individual economic hardship and recent tragedies like mass shootings could increase the demand for "humans' need to feel connection and intimacy," which is IRL's mission. "Now, our mission is not for the faint of heart. There will be naysayers, critics, hackers, spammers and so on, he continued. "We will succeed as long as we focus on what we know and what we can control. Not just for us but our users worldwide." Shafi confirmed the layoffs, and provided the following statement to TechCrunch:

You can read the memo he sent to staff, per sources, in its entirety below:

Sarah Perez contributed reporting to this piece. |

| Daily Crunch: To manage high-demand products, Amazon unveils invitation-based ordering system Posted: 02 Jun 2022 03:05 PM PDT To get a roundup of TechCrunch's biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here. Hello, and welcome to June 2, 2022. Where we are sitting, the sun is shining, the birds are singing and we are celebrating adding Becca Szkutak to the TechCrunch team. She'll be covering venture capital and startup news for our subscription service, TechCrunch+. You can find her very first story in the Top 3, below! — Haje and Christine The TechCrunch Top 3

Startups and VCYesterday was our City Spotlight: Columbus, Ohio, and it was awesome to see you all there! We were excited to watch the startup pitch-off and congratulate SureImpact on its win! They pick up a spot in TechCrunch's Startup Battlefield 200. Apropos events, we just announced the agenda for TC: Sessions Robotics, taking place on July 21, and it's going to be really bloody awesome. It's a virtual event, so you can attend from anywhere in the galaxy. Get your tickets, get involved! Moar news? We've got moar news:

What connects the stock market contraction to startup valuations? Image Credits: Matthias Kulka (opens in a new window) / Getty Images Without striking a gloomy note: it’s clear that winds are shifting in the tech industry. Layoffs are mounting, investors are urging their portfolio companies to hunker down and founders are doing everything but chanting spells to extend runways. “But are valuations really down?” asks Daniel Faloppa, founder of Equidam. “For all startups? If so, why, and what can we expect in the short and mid-term?” (TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.) Big Tech Inc.What does the fox say?: A Foxconn factory in Mexico was hit with ransomware, the company confirmed. While this is not the first time Foxconn has had this happen, a company spokesperson says the factory's operations are returning to normal, though they did not go into detail on whether any data was accessed. Meta's new features: The company's big news of the week is still that Sheryl Sandberg is leaving, but time marches on, and there are features that need to go out. In a move to provide some TikTok-like features, Meta rolled out some new Reels features to Facebook and extended the length of Reels on Instagram to 90 seconds. The Instagram one might be more exciting because more meme posters are doing Reels, which, in our opinion, makes it difficult to read them. The extra seconds might redeem them. In addition, Messenger is getting a dedicated "Calls" tab so you can make fewer clicks to communicate with your peeps. We have more to help exercise your eyes:

|

| Insurtech Policygenius cuts 25% of staff, less than 3 months after raising $125M Posted: 02 Jun 2022 02:36 PM PDT Policygenius, an insurtech that raised $125 million in a Series E round less than three months ago, has reportedly laid off about 25% of its staff. The number of employees affected is not confirmed but is believed to be around 170, according to multiple sources. One employee posted on LinkedIn today that he was among the 25% of staff that were let go. In a statement provided via email, Jennifer Fitzgerald, CEO and co-founder of Policygenius, did not confirm that number, saying:

At the time of its Series E in March, Policygenius — whose software essentially allows consumers to find and buy different insurance products online — said that its home and auto insurance business had "grown significantly," with new written premiums having increased "more than 6x from 2019 to 2021." In a press release, the company said: "Policygenius continues to be the only tech-enabled brokerage and distribution platform to have successfully scaled and diversified across life and home and auto insurance. The company will use the new capital to continue to invest in the growth of its core businesses of life, disability, home, and auto insurance, as well as new no-exam life insurance offerings and Policygenius Pro." Since its 2014 inception, Policygenius has raised over $250 million from investors such as KKR, Norwest Venture Partners and Revolution Ventures as well as strategic backers such as Brighthouse Financial, Global Atlantic Financial Group, iA Financial Group, Lincoln Financial and Pacific Life.  Jennifer Fitzgerald and Francois de Lame, co-founders of Policygenius. Image Credits: Policygenius While we can't speak specifically to Policygenius, it's been widely reported how poorly insurtech companies have fared in the public markets over the past year with Lemonade, Root and Hippo all trading significantly lower than their opening prices. For example, as my colleague Alex Wilhelm wrote in January, Lemonade, which sells rental insurance, went public in early July 2020. Root, which focuses on auto insurance, went out in October of the same year. Metromile, also in auto insurance, went public via a SPAC in February 2021. And, finally, Hippo, focused on home coverage, went public via a blank check company in August of last year. It was quite the run of liquidity for companies that racked up impressive venture backing in their early days. Since then, Metromile announced that it would sell itself to Lemonade after losing nearly all of its value; today, Metromile is worth around $1.12 per share, down from a 52-week high of $12.74 per share. Its peers also struggled. Lemonade has seen its value erode from $115.85 per share to $21.72 as of the time of writing. Root is worth $1.48 per share, down from a 52-week high of $14.70. Hippo is down to $1.42 per share from its 52-week high of $10.82. Alex and team have covered the carnage over the last few quarters. In January, Root also conducted a layoff that affected 330 people, citing pandemic challenges. |

| Mozilla brings free, offline translation to Firefox Posted: 02 Jun 2022 02:33 PM PDT Mozilla has added an official translation tool to Firefox that doesn’t rely on cloud processing to do its work, instead performing the machine learning–based process right on your own computer. It’s a huge step forward for a popular service tied strongly to giants like Google and Microsoft. The translation tool, called Firefox Translations, can be added to your browser here. It will need to download some resources the first time it translates a language, and presumably it may download improved models if needed, but the actual translation work is done by your computer, not in a data center a couple hundred miles away. This is important not because many people need to translate in their browsers while offline — like a screen door for a submarine, it’s not really a use case that makes sense — but because the goal is to reduce end reliance on cloud providers with ulterior motives for a task that no longer requires their resources. It’s the result of the E.U.-funded Project Bergamot, which saw Mozilla collaborating with several universities on a set of machine learning tools that would make offline translation possible. Normally this kind of work is done by GPU clusters in data centers, where large language models (gigabytes in size and with billions of parameters) would be deployed to translate a user’s query. But while the cloud-based tools of Google and Microsoft (not to mention DeepL and other upstart competitors) are accurate and (due to having near-unlimited computing power) quick, there’s a fundamental privacy and security risk to sending your data to a third party to be analyzed and sent back. For some this risk is acceptable, while others would prefer not to involve internet ad giants if they don’t have to. If I Google Translate the menu at the tapas place, will I start being targeted for sausage promotions? More importantly, if someone is translating immigration or medical papers with known device ID and location, will ICE come knocking? Doing it all offline makes sense for anyone at all worried about the privacy implications of using a cloud provider for translation, whatever the situation. I quickly tested out the translation quality and found it more than adequate. Here’s a piece of the front page of the Spanish language news outlet El País:  Image Credits: El País Pretty good! Of course, it translated El País as “The Paris” in the tab title, and there were plenty of other questionable phrasings (though it did translate every | as “Oh, it’s a good thing” — rather hilarious). But very little of that got in the way of understanding the gist. And ultimately that’s what most machine translation is meant to do: report basic meaning. For any kind of nuance or subtlety, even a large language model may not be able to replicate idiom, so an actual bilingual person is your best bet. The main limitation is probably a lack of languages. Google Translate supports over a hundred — Firefox Translations does an even dozen: Spanish, Bulgarian, Czech, Estonian, German, Icelandic, Italian, Norwegian Bokmal and Nynorsk, Persian, Portuguese and Russian. That leaves out quite a bit, but remember this is just the first release of a project by a nonprofit and a group of academics — not a marquee product from a multi-billion-dollar globe-spanning internet empire. In fact, the creators are actively soliciting help by exposing a training pipeline to let “enthusiasts” train new models. And they are also soliciting feedback to improve the existing models. This is a usable product, but not a finished one by a long shot! |

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment