TechCrunch |

- So, you want to democratize venture capital

- Crypto sure requires a lot of fiat

- The exit effect: 4 ways IPOs and acquisitions drive positive change across the global ecosystem

- This Week in Apps: Poparazzi hype, Instagram drops Likes, Epic trial adjourns

- 6 investors and founders forecast hockey-stick growth for Edinburgh’s startup scene

| So, you want to democratize venture capital Posted: 29 May 2021 11:00 AM PDT A venture capitalist once told me candidly that whenever you see the phrase “democratization” in tech marketing material, think of it as a red flag. Democracy, generally speaking, often comes with an ironic caveat: It disproportionately benefits white and male participants. Now, you know me well enough to know that I wouldn't start off your Saturday with this dreary of an introduction normally, but I think that that reality is why a new tool, championed by tech entrepreneurs Lolita and Josh Taub, could be on to something actually innovative. The Taubs have launched a GP-LP, or general partner and limited partner, matching tool to help underrepresented fund managers get access to the capital they need to start their fund. The match-making tool connects those looking to raise funds (GPs!) with check-writers (LPs!). The move comes on the heels of their founder-investor matching tool, which to date has generated over 1,000 introductions that they say have led to 27 checks totaling nearly $4 million in total capital. Yes, matching LPs to GPs is a relatively simple tech and concept. And this is a relatively simple experiment. But, it couldn't have existed five, and definitely 10, years ago. Zoom investing has changed the way that people meet and vet, and I think the GP-LP tool is a key data point in how emerging fund managers can bring optionality to their fundraising process. Speaking of fundraising:

The tool's explicit focus on only helping underrepresented folks — which it defines as anyone who doesn't fit the classic Silicon Valley mold like women, LGBTQ+ folks, non-Ivy grads (or people from non-elite employers) and non-wealthy individuals — is a layer of differentiation from many other tools out there. Products like the AngelList rolling fund are great, but public, ongoing fundraising still largely benefits those who have networks to tap into in the first place — just take a quick scroll to see who has one so far. Let me put it like this: We've gotten to a point in venture where there are an ample number of tools out there that help founders and investors leverage their community into checks. What's missing, though, are the tools that help the community-less, undernetworked and underestimated access those opportunities. While there still is LP hesitancy as emerging managers raise their second and third funds, this effort is a good step in the right direction. And I'll be tracking it to see how successfully it works. It's been a big week for Black and other underrepresented founders:

Moving on, the rest of this newsletter will focus on disaster tech, Airbnb and a healthcare communications S-1 filing. You can always find me on Twitter @nmasc_. Disaster tech is at an inflection point Image Credits: Hiroshi Watanabe (opens in a new window) / Getty Images Disaster tech, such as startups that use data to fight wildfires or analyze brainwaves to analyze PTSD after a traumatic event, is having a moment. Are you surprised? COVID-19 and the ongoing climate crisis have energized entrepreneurs to build proactive solutions that fight literal disaster. Our own Danny Crichton spent 12,000 words mapping out the landscape so you don't have to. Here's what to know: The Equity team boiled down those 12,000 words on disaster into a 20-minute episode focused on top takeaways and highlights. As Danny explains in the show: "Cataclysms are a growth industry." If you're more of a reader than a listener …

Airbnb's next trip Image Credits: Getty Images Since travel first shut down last March, all eyes have been on Airbnb, the travel and short-term rental company with global name recognition. Nearly a year ago, the company cited revenue declines and cut 1,900 jobs, roughly 25% of its workforce. Now, as digital nomadic lifestyles and long-term travel come back, it has a growth story worth sharing, too. Here's what to know: Airbnb CEO Brian Chesky sat down with our own Jordan Crook to talk about how his company is preparing for a faster, nimbler post-pandemic reality. Time will tell if Airbnb's stance pans out, but getting into the head of one of the co-founders of a business pummeled, then resurrected, by this pandemic can give founders some tactical tips on how to frame conflict and what's next.

When the future of living melds with future of work:

Around TCIf you haven’t heard, TC Sessions: Mobility 2021 is coming up June 9. The one-day virtual event is packed with the best and brightest minds working on — or investing in — the future of transportation. The docket is jammed with founders, investors and experts in micromobility, autonomous vehicles, electrification and air taxis. Among the growing list of speakers are Motional President Karl Iagnemma and Aurora co-founder and CEO Chris Urmson, who will team up to talk about technical problems that remain to be solved, the war over talent and the best business models and applications of autonomous vehicles. Other guests include Zoox co-founder and CTO Jesse Levinson, community organizer, transportation consultant and lawyer Tamika L. Butler, Remix co-founder and CEO Tiffany Chu and Revel co-founder and CEO Frank Reig. There's also Joby Aviation founder and CEO JoeBen Bevirt, investor and LinkedIn founder Reid Hoffman (whose special purpose acquisition company just merged with Joby) will talk about the future of flight — and SPACs. And to answer your next question, yes, you can still buy your tickets here. Across the weekSeen on TechCrunch

Seen on Extra Crunch

Ok, bet, N |

| Crypto sure requires a lot of fiat Posted: 29 May 2021 10:00 AM PDT Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It's broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday? Sign up here. Ready? Let's talk money, startups and spicy IPO rumors. Hello from Friday, I presume that you are currently enjoying the long weekend. In celebration for this week's Exchange letter we'll try something new by being brief. If you are tired of hearing about cryptocurrencies, I have bad news. They are not only not going away, but it appears that the financial cannon that have helped clear the fields for their general advance are reloading with even more financial ammunition. At least that's what Eric Newcomer is reporting in a post out this week aptly titled "a16z Crypto Fund Balloons to $2 Billion." This raises a few points. First! That there is enough LP demand to fund a crypto vehicle to the tune of $2 billion. Second! That there are enough hot crypto ideas out there worth sticking $2 billion into. I can entirely believe the former, but the latter stretches my brain a little. Not that there aren't great companies being built in the blockchain space; Coinbase's Q1 earnings indicate that you can make money with crypto. But it seems that the firms that have proven the most successful thus far are more a hybrid of the traditional banking world and the crypto space than entirely inhabitants of the latter. But as those ideas have been mined to increasing perfection, we should anticipate seeing money chase the more experimental crypto ideas. As I noted in the Daily Crunch yesterday, there's a lot of money already going into those markets:

This is where venture investing in crypto — and that mammoth a16z fund — gets interesting. Sure, crypto exchanges can make money. But what about the further reaches of the crypto economy? Can they build material revenues that the fiat world can understand and go public? (Do they even want to go public?) It's a pleasure to watch other people wager other people's money on ideas that may fail. Heads they lose, tails we win. Not bad! Twitter's subscription (and media?) momentTwitter's "Blue" subscription product is slowly dripping its way into the market. I'm going to buy it, whatever it is. But what I can't get out of my head is that Twitter is very well positioned to build a sort of creator nirvana. After all, Twitter is already where many writers, journalists and artists hang out. Where we already have a following. Why not help us weirdos leverage all the time we've spent on the platform? You can see how this could scale. Now that Twitter has bought startups Revue and Scroll, it could build a newsletter platform where Blue subscriber money is divvied up amongst writers for its platform. Or Twitter could buy Medium, as a friend suggested to me the other day. Medium has a huge subscriber base, which Twitter could merge into Blue and provide a sort of extra-social-network-network for writers and other creatives. Right? If I had a few billion dollars, a few thousand engineers and a dictate from shareholders to grow, I'd go hog-wild and do some crazy shit. Let's see what Twitter comes up with, but let's hope that they aren't making small plans. Closing, you can catch up on all we wrote on The Exchange during the week here. Have a truly lovely break, we all need one. |

| The exit effect: 4 ways IPOs and acquisitions drive positive change across the global ecosystem Posted: 29 May 2021 08:15 AM PDT For many VCs, the exit is the endgame; you cash in and move on. But as we know, the startup world is evolving, and that means the impact of investment is no longer limited to how much money is made. As investors, we're looking further into what each investment means to human beings, at interlinking our mission with our money. And yet, one of the events that generates the most momentum for long-term impact — the successful exit of a portfolio company — is not being harnessed. When leveraged properly, an exit can be the beginning of a firm's true impact, especially when we're talking about giving all founders equal opportunities and empowering the best ideas. The investment sphere is slowly shaking off its "America first" approach as foreign products take the world by storm and international businesses become the norm.

When leveraged properly, an exit can be the beginning of a firm's true impact, especially when we're talking about giving all founders equal opportunities and empowering the best ideas. Investors will be driving forces in enabling the highest-potential companies to build products that countries everywhere will benefit from — no matter where they were conceived. The way they play the game can transform the industry into one in which a founder from across the ocean has as much of a chance to change the world as one from next door. We know the basics of how to do this with cash: Investing in underrepresented founders is a necessary first step. But who's talking about the power of exits to change the playing field for diverse founders? We must consider the psychological motivation of seeing a huge buyout on other entrepreneurs, what that startup's ex-team members go on to build, and what the achievements of one citizen does for that nation's reputation. Last year, 41 venture-backed companies saw a billion-dollar exit, totaling over $100 billion, the highest numbers in a decade. We have an unprecedented amount of clout to do something with those power moves and four ways to turn them into a domino effect. 1. Competitor effectWhen a foreign entrepreneur raises money from U.S. firms and sells to a U.S. company, other immigrants see that. Regardless of how groundbreaking their product idea might be, immigrant Americans will always be more wary of putting their eggs into the entrepreneurship basket, at least as long as 93% of all VC money continues to be controlled by white men. This, despite research suggesting that immigrants contribute 40% more to innovation than local inventors. What these foreign entrepreneurs most need is confidence, role models and success stories proving other people who look like them have made it, especially when those founders are making waves in the same industry as them. So a big, well-publicized exit will create momentum in the industry for other foreign founders to give fuel to their venture and seek to take it to the next stage. Not only that, it will instill more self-assurance when it comes to fundraising, and investors will value that. I was inspired to write this column after Returnly, a fintech founded by a fellow immigrant from Spain based in San Francisco — which, for full transparency, I invested in as an angel investor, and then for Series B and C via my fund — was acquired for $300 million by Affirm. While there was undoubtedly a personal financial gain worth celebrating, the success of a foreign founder who persevered against the odds in such a competitive ecosystem as Silicon Valley, raised large rounds from U.S.-based investors, and was finally acquired by a U.S. company served as a moment of inspiration for other diverse founders around the world. We saw this in the amount of media attention it received in both business and mainstream press in Spain and the floods of connect requests and congratulations that followed on LinkedIn. The impact of an exit is greater when it shows foreign entrepreneurs that there are globally minded organizations helping startups like theirs get equal access to funding. That means having VC firms that spotlight international entrepreneurship and foster global expert networks. As investors, we can maximize the impact of our exits in the industry by highlighting the foreign origins of our founders in a big way when it comes to promoting the exit, including narrating the challenges and opportunities they encountered on their journey. We can use the victory to drive the point home to our fellow investors that diverse and international entrepreneurship is an undervalued gem. We can personally take the win to boost our brand as one that empowers foreign entrepreneurs in that niche, attracting more to seek funding with us in a positive reinforcement cycle. 2. Wealth effectThe windfall from a big exit puts all previous investors in a privileged position, and it's unlikely that money will sit around for long. They'll look to reinvest in other high-potential companies — probably ones that look a lot like the one that was just sold. But in addition to those investors multiplying the positive impact in their own portfolio, they will rally other investors to behave in a similar way. Each exit — good or bad — sets a precedent for that niche and that type of company. Other investors will follow suit if they sense that one of their peers is onto a cash cow. Because foreign and ethnic minority founders are still underrepresented in startup funding, it makes this field less competitive while harboring huge potential. VCs who have an eye out for unique opportunities will spot when an investor has made a hefty profit from an unconventional startup, especially if they continue to invest in others in that same field. To help this along, angels and VCs who've been behind a recent exit and are reinvesting in similar founders should publicize those knock-on investments, explaining how their previous success motivated them to support similar ventures. They can also be vocal within their network about their decision to raise up certain entrepreneurs because they've seen it works. Returnly's founder recently offered to put some of his earnings back into our fund, enabling more foreign entrepreneurs like himself to access capital. If as investors we foster meaningful relationships with our funders and truly care about empowering diverse entrepreneurs, we'll see more of that wealth circle back into our mission. 3. Team effectThe PayPal Mafia is a set of former PayPal executives and employees — such as Elon Musk, a South African, and Peter Thiel, a German American — who have gone on to seriously disrupt not one but multiple industries across tech. Among the companies they've founded are YouTube, LinkedIn, Yelp and Tesla, and they've even been named U.S. ambassadors. That's just one company. Imagine what other diverse and driven teams can do with the influx of cash and inspiration that comes with a big exit. There will be a ripple effect of team members eager to start out on their own who feel empowered by the success of someone who believed in them. Their ventures will be more likely to "pass it on" when it comes to giving equal opportunities to people regardless of origin and will generate more jobs for people with their mission. Take Thiel, who has to date backed over 40 companies in Europe alone. As VCs, we can capitalize on this team effect by keeping our eye on any spinoff ventures that arise and supporting them when possible (with experience and contacts, if not with capital). But beyond this, you can also consider encouraging these people to join the investment sphere, maybe even within your firm. Many successful startup founders and executives go on to become investors — the PayPal Mafia has contributed to some of the most notorious funds out there today. The origin story of these former team members will make them more prone to supporting underrepresented founders they can get behind. In turn, new entrepreneurs will draw more value from their personal experiences. 4. Reputation effectAlthough Returnly is headquartered in San Francisco, its founder is Spanish and many of its employees were based in Spain. That means that the impact of Returnly's exit will be felt on the other side of the Atlantic as well as among co-nationals in the United States. The same is true of other notable sales, like AlienVault, which was founded in Spain and had multiple offices there. AlienVault was acquired by U.S. telecommunications giant AT&T for $900 million. Or IPOs — earlier this month, the Spanish-origin payments company Flywire filed for an IPO that could value the company at $3 billion. One startup's success boosts the reputation of its entire team, and with it other founders and talent with their same country of origin, background, education and drive. It follows that investors and other stakeholders will be more inclined to back opportunities among founders from the same home country if it says something about the mission, expertise and culture they bring to their startup. At the same time, growing startups will be more interested in hiring the talent of evidently successful teams. That doesn't just mean hiring more foreign experts in the United States, but seeking to outsource farther afield. We're already becoming far more comfortable with remote teams, and it's more capital-efficient for one half of the team to be working while the other half sleeps. But founders will always gravitate more to countries where local talent and innovation is already seen to be thriving. Open up that conversation with your portfolio companies. VCs have the power to change an industry forever, to connect startup ecosystems across continents and to see startups expand worldwide. But this is about staying relevant as an investor as much as it's about ensuring this next stage in the startup world is a positive one. Investors who don't recognize that the future of startups is global and diverse in nature won't be in sync with the best opportunities — and won't be selected by the best founders. Rather than trying to play catchup, help build that ecosystem. |

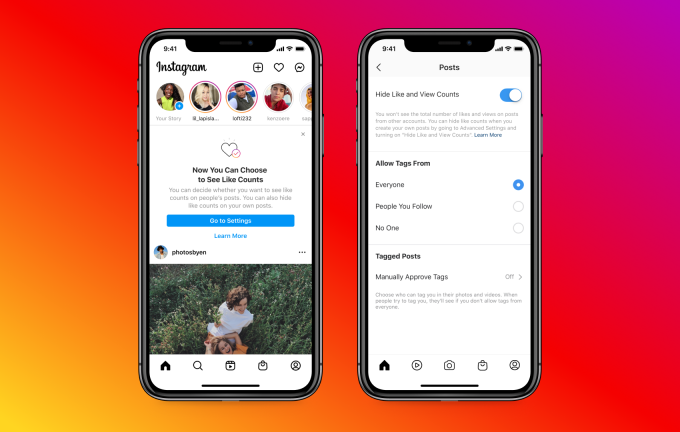

| This Week in Apps: Poparazzi hype, Instagram drops Likes, Epic trial adjourns Posted: 29 May 2021 07:45 AM PDT Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices. Apps aren't just a way to pass idle hours — they're also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that's up 27% year-over-year. This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters Top StoriesFacebook and Instagram apps will let you hide the “Like” counts Image Credits: Instagram Facebook this week will begin to publicly roll out the option to hide Likes on posts across both Facebook and Instagram, following earlier tests beginning in 2019. The project, which puts the decision about Likes in the hands of the company's global user base, had been in development for years, but was deprioritized due to the COVID-19 pandemic and the response work required on Facebook's part. When the company tested how people felt about Like counts, it got pushback from both sides — some wanted to see this information and others felt it was leading to a negative, competitive experience. The company decided to split the difference and put the decision in its users’ hands. Via new settings, users can choose to disable Like counts on the posts they make and those that appear when they browse the social apps’ feeds. The decision, however, indicates not one of user empowerment, but rather one representative of a company that’s so large (and intent on remaining the largest), it declines to have its own point of view on controversial matters for fear of causing a mass exit. You can see this in other areas of the business as well, like how it wanted to downplay its responsibility with regard to the misinformation it recirculated by leaving it to fact-checkers to handle, or how it offloaded hard decisions about takedowns to an advisory board. While it’s one thing to not want to piss off a large number of users, turning every toggle and setting into a user choice is just another way at shrugging off responsibility while claiming that something has been done. Poparazzi hypes and growth hacks to the top Image Credits: Poparazzi Meanwhile, a new app with its own point of view has made it to the top. Recently launched anti-selfie app Poparazzi sees itself as a referendum on the Instagram age of performative and self-obsessed social media. The app turns the “tag your friends in photos” feature from Instagram into a standalone, excellently marketed and growth-hacked app experience. Your Poparazzi profile can only be added to by your friends, which makes the app feel more authentic as it captures casual, unpolished moments, not those you’ve rehearsed and filtered to perfection. But the viral app favors giving up some user privacy protections for network effects, which could potentially be harmful. In the end, it also overlooks why people use social media today: self-expression. Posting pictures to other profiles doesn’t fulfill that desire. That means the app either become an additive experience to be used alongside your existing preferred social app, or one that’s risking a bet on a future where people are actually less self-involved. We can only hope. Apple-Epic trial officially adjourns Image credit: Andrew Harrer/Bloomberg via Getty Images As the Apple-Epic App Store antitrust trial adjourns, the judge seemed leaning more to Epic’s point of view on specific matters, including the 30% cut Apple takes and its decision to ban companies from telling their customers where they could get a better deal on an in-app purchase. (Tim Cook taking the stand only to claim ignorance of certain key aspects of the App Store business didn’t help matters, either.) At its core, the case is about whether or not Apple is a monopoly and could set the tone for later lawsuits and government regulation. Epic believes Apple has a monopoly over distribution to the iPhone, but Apple argued there were plenty of other places for a company like Epic to sell its games — including those that Epic pays a cut to without complaint, like Microsoft and Sony. Epic, meanwhile, argued that its metaverse is more than just a game, it’s a social place to hang out. The judge pointed out both Epic’s plain-as-day ulterior motives (hint: $$$$), but also the extent to which mobile games — games that make up the lion’s share of App Store revenue — seem to be subsidizing the platform for others. That includes apps where Apple doesn’t take a cut of IAPs. Still, for the judge to rule for Epic, she would have to find that Apple leveraged its market power as a monopoly. And that means Apple has to actually have a monopoly in the first place. But does it? There are other places to buy apps (Google’s Android devices, e.g.) and games, like console platforms. Epic wants the definition of a monopoly here narrowed to the market for apps on Apple devices, and that may not work. Though the trial has adjourned, a decision will still be months out, so don’t worry about prepping your in-app credit card forms and PayPal buttons yet. Weekly NewsPlatforms: Apple Image Credits: Apple Apple released its agenda for WWDC 2021, which will still be virtual. The keynote address will air June 7 at 10 AM PDT, followed by the Platform State of the Union at 2 PM PDT. The schedule also includes the Apple Design Awards on June 10 at 2 PM PDT. Plus, there will be more than 200 sessions and labs, as well as special activities and events. New this year is “Pavilions,” which will better organize event sessions, labs and activities around a given topic. With iOS 14.6’s public launch, Apple released Apple Card Family and Apple Podcast subscriptions, Spatial Audio and lossless audio for Apple Music, added enhanced support for AirTags (you can now add emails for lost AirTags), and made Shortcuts actions run faster on both iPhone and iPad, among other features. Apple’s watchOS 7.5 update brings the ECG app and its irregular heart rhythm notification features to more countries, as well as support for Apple Card Family, Podcast subscriptions, and more. Apple’s new M1-powered iPad Pro can download entire iPadOS updates over cellular, a support document confirms. That means more devices will likely have new OS updates sooner than before. Apple updated age ratings setting in App Store Connect. The Gambling and Contests setting is now split into two settings, allowing app developers to indicate these content types separately. They're also indicated separately on the App Store. If your setting was previously yes or no, it will remain across both content types now if you don’t make any adjustments. App Annie analyzed the top Apple SDKs by iOS installs globally following the release of iOS 14.5. The top six were all in the tools and utilities categories, indicting many developers are looking for SDKs to add functionality to create better user experiences. ATT opt-in update. According to new data form AppsFlyer, there were 78M instances were users saw an ATT prompt and allowed tracking. The advertiser side opt-in rates remain consistent at 35%-40%. In addition, spend in iOS apps increased 20% since ATT was enforced. Android budgets, by comparison, remained mostly the same (+2%). Apple pulled an app from the App Store that forced users to leave a good review. The scammy app was yet another that developer Kosta Eleftheriou highlighted as an example of Apple dropping the ball on App Store fraud protection, user safety and security.

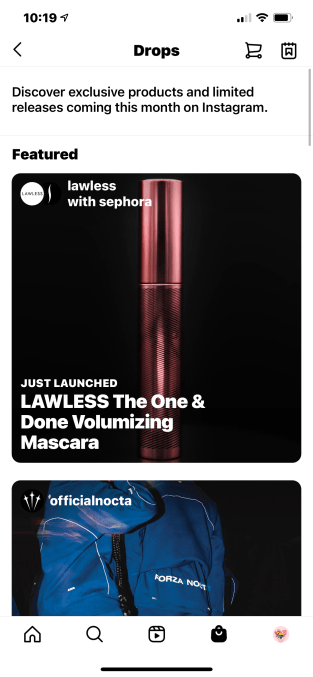

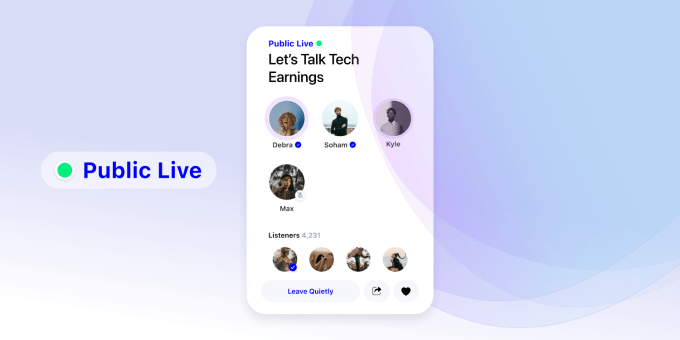

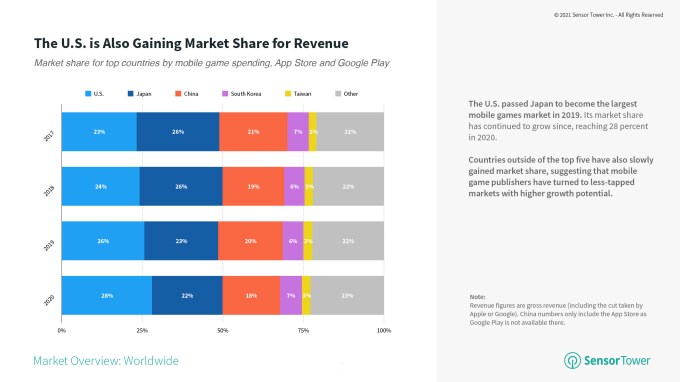

Platforms: Google Image Credits: Emojigraph Emojigraph took a deep dive into the new emoji in the Android 12 beta and its more than 389 updated designs. The games teams at Google announced the return of the Google for Games Developer Summit 2021 on July 12th-13th. The event will feature experts from Google who will speak about new game solutions, best practices, connecting with players and scaling your games business. The event is free and open to all game developers. E-commerce + Food deliveryInstagram adds a new section called Drops in its Shopping tab that will feature current and upcoming drops — a newer type of online flash sale where sellers create buzz in advance and often only have limited quantities available for a short period of time. Users can browse drops and be notified about those of interest to them, then check out in the app at time of purchase.  Image Credits: screenshot of Drops on Instagram Amazon’s ad revenue is now 2.4x as large as Snap, Twitter, Roku and Pinterest combined, and is growing 1.7x more quickly, a report from Loop Capital (via CNBC) found. Amazon’s “Other” unit, which is mostly its ads business, grew revenue 77% YoY to reach more than $6.9 billion in the quarter. Amazon is shutting down its Prime Now fast delivery app, and will instead integrate the faster, two-hour grocery and household essentials delivery service into its main app. Instacart rolls out a speedier Priority Delivery service in select markets. For smaller, less complex orders, Instacart may be able to deliver within 30 minutes for a small upcharge, it says. The app will show the faster delivery option with a lightning bolt icon. Despite restaurants’ re-opening, DoorDash was the No. 1 food and drink app in April 2021 in the U.S., App Annie noted, and received 2.1 million new downloads, a continuation of their No. 1 ranking in Q1 2021 by downloads in the U.S.  Image Credits: App Annie FintechPayPal expands its crypto plans. The company recently announced its PayPal and Venmo app users would be able to buy, hold and sell Bitcoin and other cryptocurrencies using the apps, but now it’s adding support for third-party wallets. That means users will soon be able to send Bitcoin to each other and to other platforms. Square’s app revealed the company’s plans to offer checking and savings accounts in a future version. Code in the iOS app showed the accounts would integrate with Square’s debit card for businesses and would have no monthly service fees or overdraft fees. Robinhood rival Public is launching its own Clubhouse-like audio programming feature in its app. Public Live, as it’s being called, won’t be a free-for-all, but will instead be moderated chats from paid hosts who will speak about financial-focused topics, like earnings. At launch, users can’t ask questions or go onstage, but can react with emoji instead.  Image Credits: Public SocialInstagram added new Insights to its TikTok rival, Reels, as well as Instagram Live. The tools previously focused on public metrics, like views, likes or comments. Now, creators can see more detailed metrics, like Accounts Reached, Saves and Shares for their Reels, as well as Peak Concurrent Viewers for Live videos. Instagram is exploring new ideas, including subscriptions, NFTs and a creator fund that’s similar to what YouTube and Snap are offering, reports The Information. ByteDance’s video editor CapCut, a companion app to TikTok, rocketed to the top of the U.S. App Store and Google Play. The app allows users to access an array of features, like stickers and effects, that they can use to create videos that are published to TikTok and elsewhere. The app has increased advertising on TikTok but was benefitting from a viral trend where TikTok users used CapCut to make 3D Photos. ByteDance rival Kuaishou, which makes the second most popular short-form video app after ByteDance’s Douyin (the Chinese version of TikTok), saw its shares tumble after livestreaming sales fell 20% — almost three times faster than a year earlier. TikTok’s hugely popular text-to-speech voice has been changed. The voice actor involved had sued the company saying she never agreed to having her voice recordings appear in the app like this — her recordings were only authorized for translations. The new voice TikTok has now added is more upbeat, which doesn’t work as well in some videos where the point was to use a monotone. PhotosGoogle Photos’ free unlimited storage tier is going away. Conveniently, the company rolled out a new feature that lets you now save photos from Gmail messages directly to Google Photos. DatingTinder announced it will be using an AI algorithm to scan private messages and then compare those against messages that had previously been flagged by users for inappropriate language. If the scan determines the message may be inappropriate, the app will show users a prompt that asks them to reconsider before hitting Send. The Biden administration is working with dating app makers to add new features that will encourage users to get vaccinated. The apps will let users promote their vaccination status and locate a nearby vaccination site, among other things. Tinder, OkCupid, Hinge, BLK, Chispa, Plenty of Fish and Badoo will be working on these efforts. MessagingIndia’s government said WhatsApp’s lawsuit challenging the new local IT ruling was a “clear act of defiance.” WhatsApp says it’s fighting rules that would allow people’s private messages to become traceable by the government authorities, and would open the app to mass surveillance. Streaming & EntertainmentSiriusXM partnered with TikTok on a range of new initiatives. The music company will launch a TikTok channel on SiriusXM across all platforms (including mobile), will roll out hosted TikTok playlists on Pandora’s app and will stream re-airings of Pandora LIVE events on TikTok. Clubhouse rolled out payments to all iOS users, allowing anyone to send monetary support to favorite creators. Android will soon follow. The company also this week poached a longtime Google engineer, Justin Uberti, who had been an engineering lead for Google Stadia’s cloud gaming service and led the team that made the Stadia for iOS’ web app. Apple delayed the launch of Apple Podcast Subscriptions until June and made some tweaks to the revamped Podcasts app, following user feedback with iOS 14.6. GamingVerizon began offering customers free Apple Arcade or Google Play Pass subscriptions for up to a year as part of a new promotion. The length of the deal will depend on your mobile plan. Netflix is expanding its gaming efforts, The Information reported. The streamer has been approaching gaming industry vets about joining the company. Netflix already launches a Stranger Things game from a third-party developer, which is available across several platforms, including mobile. The U.S. share of consumer spending in mobile gaming reached an all-time high of 28% last year, reports Sensor Tower. That’s higher than Japan (22%) and China (18%, excluding third-party Android app stores).  Image Credits: Sensor Tower Health & FitnessA thinly sourced report indicates Apple may be planning to sherlock MyFitnessPal in an upcoming version of iOS. Reportedly, iOS 15’s Health app may include a food tracking feature that would allow users to log food items they consume to get nutritional details and calorie tracking data. Productivity + UtilitiesNavigation app Waze gets a new CEO. The company named former Hotwire president and Carvana board member Neha Parikh as its CEO, replacing Noam Bardin, who stepped down in April after 12 years at Google. ReadingAmazon rolled out a new feature in India that allows consumers to read magazine articles inside its shopping app. The quietly launched "Featured Articles" appeared on its shopping app and website, offering feature articles, commentary and analysis on a wide range of topics, including politics, governance, entertainment, sports, business, finance, health, fitness, books and food. Government & PolicyThe Cyberspace Administration of China (CAC) ordered 105 apps to stop improperly collecting and using people’s personal data. Among the apps listed are Microsoft’s LinkedIn and Bing, Chinese TikTok Douyin, video sharing app Kuaishou, music streaming service Kugou and apps from local search engines Sogou and Baidu. Funding and M&A

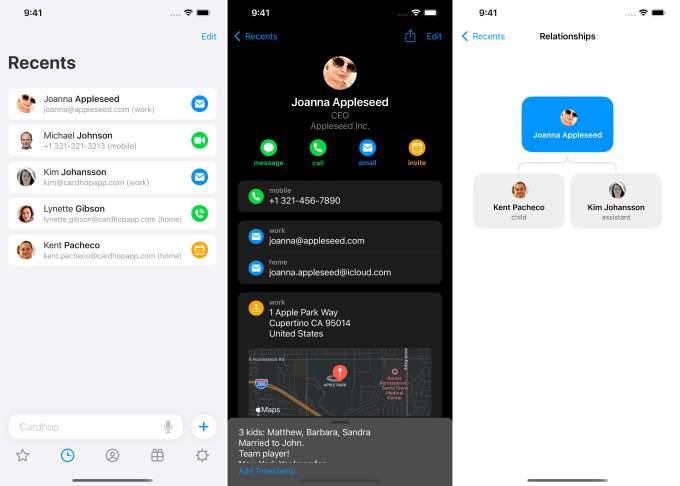

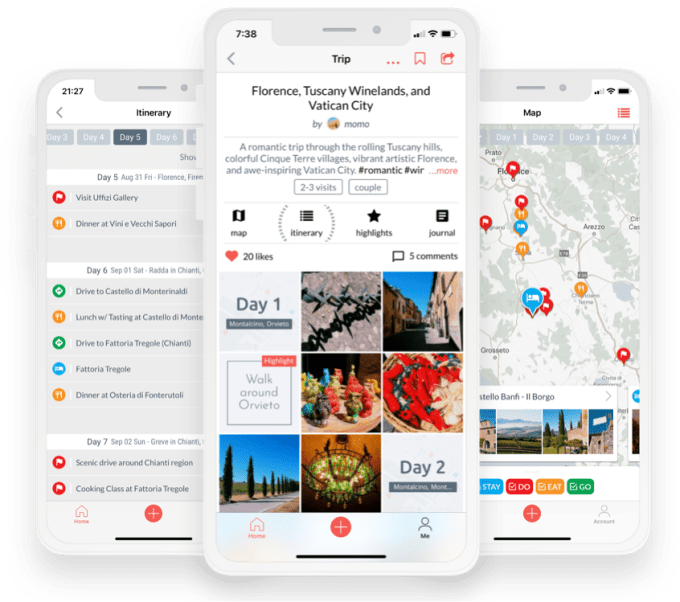

This Week’s DownloadsCardhop Image Credits: Flexibits Flexibits, the company behind the popular productivity app Fantastical, updated its contacts management app Cardhop for Mac and iOS. This second major update to Cardhop brings several new features, including business card scanning, iOS widgets for your favorite Cardhop actions, organizational charts and family trees, and improved integrations with Fantastical. For example, you can now create an event with everyone in a Cardhop group. The updated app and premium version of Fantastical is being bundled in a single Flexibits Premium subscription ($4.99/mo or $39.99/yr), but a free version with fewer features is also available. Hoptale Image Credits: Hoptale Recently launched from public beta, Hoptale is ready to kick off the post-Covid summer travel season with its travel journal and discovery app. The startup uses smart technology to organize trip plans and your photos, and users metadata to create trips as well as “hops” within your trips — meaning the individual stops you made during trips at different locations. This creates a travel journal of sorts where you itinerary, points of interest, map and, optionally, your own commentary are organized for you. You can also share trips publicly with the Hoptale community or privately with friends and family. That could make it easier for sharing your favorite recommendations with someone who wants to know what to do and see from a place you’ve already visited. The beta version had hundreds of users who cataloged thousands of trips, and the app is now open to the wider public. Poparazzi Image Credits: Poparazzi Well, you have to see what all the hype is about, right? The new social app for iOS and Android offers Instagram-like photo profiles with one big difference: you can’t post pictures yourself. Instead, the app only allows users to post photos to their friends’ profiles, arguing against the self-absorbed nature of today’s social media. After a lot of pre-launch hype on TikTok, the app shot to the top of the App Store at launch where it sits poised to be the viral trendy app of the post-COVID summer. Reading Recommendations

Tweets |

| 6 investors and founders forecast hockey-stick growth for Edinburgh’s startup scene Posted: 28 May 2021 11:56 PM PDT Scotland is slowly but surely drawing attention in the UK’s startup space. In 2020, Scottish startups collectively raised £345 million, according to Tech Nation, and with nearly 2,500 startups, it has the highest number of budding tech companies outside London. Venture capital fundraises are also consistently on the rise every year. Scotland’s capital Edinburgh boasts a beautiful, hilly landscape, a robust education system and good access to grant funding, public and private investment. It’s also one of the top financial centers in the U.K., making it a great place to begin a business. So to find out what the startup scene in Edinburgh looks like, we spoke to six founders, executives and investors. The city’s tech ecosystem appears to have a robust space for machine learning, artificial intelligence, biomedicine, fintech, travel tech, oil, renewables, e-commerce, gaming, health tech, deep tech, space tech and insurtech. Use discount code SCOTLANDSURVEY to save 25% off an annual or two-year Extra Crunch membership. However, the city’s tech scene is apparently lackluster when it comes to legal tech, blockchain and consumer-facing technology. Breakout companies that were founded in Edinburgh include Skyscanner and FanDuel. Notable among the current crop are Desana, Continuum Industries, Parsley Box, Current Health, Boundary, Zumo, Appointedd, Criton, Mallzee, TravelNest, TVSquared, Care Sourcer, Stampede, For-Sight, Vistalworks, Reath, InfraCost, Speech Graphics and Cyan Forensics. The Edinburgh business-angel community appears to be quite strong, but it seems local founders find it difficult to get London-based investors to take an interest. Scottish investors are said to be “pretty conservative and risk-adverse” with some notable exceptions. We surveyed:

Wendy Lamin, managing director, HoloxicaWhich sectors is your tech ecosystem strong in? What are you most excited by? What does it lack? What are the tech investors like in Edinburgh? What's their focus? With the shift to remote working, do you think people will stay in Edinburgh or will they move out? Will others move in? Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)? Where do you think the city's tech scene will be in five years? Andrew Noble, partner, Par EquityWhich sectors is your tech ecosystem strong in? What are you most excited by? What does it lack? Which are the most interesting startups in Edinburgh? What are the tech investors like in Edinburgh? What's their focus? With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in? Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)? Where do you think the city's tech scene will be in five years? Danae Shell, co-founder and CEO, VallaWhich sectors is your tech ecosystem strong in? What are you most excited by? What does it lack? Which are the most interesting startups in Edinburgh? What are the tech investors like in Edinburgh? What's their focus? With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in? Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)? Where do you think the city's tech scene will be in five years? Allan Nelson, co-founder and CEO, For-SightWhich sectors is your tech ecosystem strong in? What are you most excited by? What does it lack? Which are the most interesting startups in Edinburgh? What are the tech investors like in Edinburgh? What's their focus? With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in? Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)? Where do you think the city's tech scene will be in five years? Lysimachos Zografos, founder, ParkureWhich sectors is your tech ecosystem strong in? What are you most excited by? What does it lack? Which are the most interesting startups in Edinburgh? What are the tech investors like in Edinburgh? What's their focus? With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in? Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)? Where do you think the city's tech scene will be in five years? Bertie Wilson, co-founder, "Stealth mode"Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack? Which are the most interesting startups in Edinburgh? What are the tech investors like in Edinburgh? What's their focus? With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in? Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)? Where do you think the city's tech scene will be in five years? |

| You are subscribed to email updates from TechCrunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

RevenueCat

RevenueCat  Investing app Acorns

Investing app Acorns

No comments:

Post a Comment