TechCrunch |

- Researchers fear what a Musk acquisition might mean for Twitter research data

- What’s the deal with the one-click checkout space?

- James Murdoch firm invests $600 million in India’s Allen Career Institute

- Elon’s big week

- Felicis Ventures partners share the four pillars of scaling a SaaS startup

- These Android features will help protect your digital privacy

- Slice and dice it all you want, that’s a seed round

- This Week in Apps: Elon buys Twitter, Snap Summit recap and an App Store cleanup

- On putting toothpaste back into the tube

- Perceptron: AI mixes concrete, designs molecules, and thinks with space lasers

- Affirm’s CTO talks transparency and the tech that makes BNPL possible

- India seizes $725 million assets from Xiaomi unit over illegal remittances

- If the earliest investors keep going earlier, what will happen?

- USV quietly announces $625M in fresh funding for ‘both Web2 and Web3’ teams

- Daily Crunch: Musk’s Twitter purchase plan calls for new CEO, monetization strategies, job cuts

- Jack Dorsey says he’s against permanent Twitter bans, with an asterisk

- Why a bipartisan embrace of crypto might never touch Bitcoin

- Pitch deck pro tips from a leading Silicon Valley venture capitalist

- TechCrunch+ roundup: Finding product-market fit, pitch deck teardown, getting into YC

- DoorDash extends gas rewards program for delivery people on its platform through August

| Researchers fear what a Musk acquisition might mean for Twitter research data Posted: 01 May 2022 09:15 AM PDT Much has been written about Elon Musk’s bid to acquire Twitter, an effort which, despite substantial backing from Morgan Stanley and the approval of Twitter’s board, stands on unsure footing at present. Reporting and punditry have focused on the security implications of the proposed acquisition, as well as Musk’s potential approaches to content moderation and, on a related subject, his understanding of the concept of “free speech.” But another consequential aspect of the deal has received considerably less attention: how Twitter’s data access policy for research might change under a Musk regime. Twitter hasn’t always had a cozy relationship with researchers. However, in recent years, the social network has made strides in providing access to its archives at a time when rivals have taken the opposite step. In January 2021, Twitter claimed that academic researchers were one of the largest groups using its API. Some researchers are concerned that Musk doesn’t share the same commitment to open data access, particularly considering the vitriol he’s shown in the past toward reporting that paints his ventures (including Tesla) in an unflattering light. In 2018, Musk pledged to — but didn’t ultimately — build a website to rate the “core truth” of articles and journalists in response to reports on crashes involving Tesla cars, Tesla labor issues and his relationship with Wall Street. Mor Naaman, a professor of information science at Cornell Tech, envisions a future in which Musk becomes hostile toward researchers exposing Twitter’s “challenges and deficiencies.” “I am pessimistic that Twitter will continue to strive for accountability as a privately held company under Musk,” Naaman, who’s worked with Twitter data since 2009, told TechCrunch via email. “I do not believe research like we have done on [former President Donald Trump’s] Stop the Steal campaign — and the data we collected from Twitter and made available to other researchers, used in 12 different papers since last year — would be allowed to happen under Musk. Second, I cannot imagine internal teams that scrutinize the ethics and bias of the company's systems will continue to function well, let alone publish their findings publicly. “If they do continue to publish, these publications will have a much harder time overcoming the already existing suspicion around the corporate-friendly bias nature of platforms putting out their own research papers.” Among other promises, Musk has said that he plans to “defeat spam bots” on Twitter — seemingly alluding to the malicious accounts that parrot misinformation and perpetuate scams. But not all bots are harmful, Orestis Papakyriakopoulos, a postdoctoral researcher at the MIT Media Lab, pointed out to TechCrunch via email. |

| What’s the deal with the one-click checkout space? Posted: 01 May 2022 07:15 AM PDT Welcome to the inaugural edition of The Interchange! If you received this in your inbox, thank you for signing up and your vote of confidence. If you're reading this as a post on our site, sign up here so you can receive it directly in the future. Every week, I'll take a look at the hottest fintech news of the previous week. This will include everything from funding rounds to trends to an analysis of a particular space to hot takes on a particular company or phenomenon. There's a lot of fintech news out there and it's my job to stay on top of it — and make sense of it — so you can stay in the know. Let's goooo! Mary Ann One-click checkout startup Bolt made headlines this week for more reasons than one — and none of them were particularly good. Let's start from the beginning. On April 26, Bloomberg reported that Bolt was being sued by "its most prominent customer," Authentic Brands Group (ABG), which owns dozens of retail brands. ABG alleged that San Francisco-based Bolt failed to deliver technology that it promised and that it missed out on over $150 million in online sales during the company's integration with fashion retailer Forever 21. Oof. On top of that, ABG's complaint went on to say that Bolt had raised funding "at increasingly high valuations" by "consistently overstating" the nature of its integrations with the company's brands in an effort to make it seem like it had more customers than it actually did. For context, Bolt in January raised $355 million in a Series E financing that valued the company at $11 billion. As TC's Christine Hall wrote at the time, Bolt's one-click checkout product aims to give businesses the same technology Amazon has been known for since 1997, and at the same time, incorporate payments and fraud services meant to ensure transactions are real and payments can be accepted.  Image Credits: Bolt According to Bloomberg, Bolt reacted to the complaint by saying that ABG's claims were without merit, and "a transparent attempt" to renegotiate the terms of the companies' agreements. Then on April 28, Insider reported that it heard from unnamed sources that ABG's lawsuit was really an attempt by the firm to claim an ownership stake in the company. Apparently when ABG became a Bolt customer in October 2020, reported Insider, Bolt entered a deal to award the group stock warrants, which give the holder the right to buy shares at a specified price before a specified date — under certain conditions. According to Insider:

The plot thickens. Meanwhile, The Information reported on April 28 that Bolt is not as dissimilar as competitor Fast — which recently imploded after raising $120 million over time — as we all may have thought. If you recall, it was revealed that Fast had only generated $600,000 in revenue all of last year. According to The Information, Bolt's revenue growth has "dramatically" slowed due to competitive pressure the company is likely feeling from the likes of giants such as PayPal and Shopify, who have launched their own one-click checkout services for merchants. TechCrunch reached out to Bolt about all of the above but had not heard back at the time of writing. Bolt is no stranger to controversy. Its 27-year-old founder, Ryan Breslow, started the company after dropping out of Stanford. He stepped down as CEO in January, and is generally known for his very outspoken rants, such as this series of tweets and recent digs at the media. In an interview with TechCrunch's Connie Loizos that same month, he said the company had signed roughly 10 major deals in the second half of last year, with each being bigger "than any that Bolt has signed in the company's history previously." He went on to say that those exclusive partnerships would "generate billions in revenue" when rolled out, although he did say the process takes time given the "large technical lift" of some of these "large merchants and commerce platforms." Despite all the challenges that Bolt and Fast have faced, newer players continue to emerge in the space. TC's Mike Butcher last week reported on Volume, a new London-based checkout startup that closed a pre-seed round of $2.4 million led by firstminute Capital and joined by SeedX and Haatch Ventures. As Mike wrote, “Volume's take on this checkout market is — it says — about making the checkout process shorter and reducing associated fees. It does this by using the Variable Recurring Payment mandate and also employing biometric security to finalize the purchase.” A chat with Affirm’s CTO, Libor MichalekBNPL is not a new concept; it's just taken off in recent years and become far more mainstream (TechCrunch+ subscription required). Buy now, pay later lets people do exactly what its name suggests — buy something and pay for it later. The difference between BNPL and credit cards is that rather than charge the full amount of a purchase on a card, consumers can choose to pay for an item in installments. However, there are some that argue BNPL is just another form of debt, which could lead to a discussion on whether companies that enable it are doing it responsibly. In the case of Affirm, one of the space's largest players, co-founder Max Levchin (who also founded PayPal) has been vocal about what he describes as a "mission-based" approach. Ukraine-born Levchin started Affirm in January 2012. The fintech went public in 2021, and while it's trading considerably lower than its 52-week high (which stock isn't?), Affirm is today valued at nearly $9 billion, and its executives remain bullish on the company's future. I sat down with Libor Michalek, president of technology at Affirm, to understand just how the company differentiates itself from its plethora of competitors, what is unique about its technology and strategy and why he thinks using BNPL is much better than using a credit card to pay for purchases. You can read all about it here (TechCrunch+ subscription required).  Image Credits: Affirm Is Robinhood a takeover target?Robinhood this week announced it was laying off 9% of its staff, or an estimated 300 workers. This follows Better's move to cut some 1,200 or so people last week and Blend's lay off of 200 workers in the wake of a challenging mortgage environment (among other things in the former's case). In the case of Robinhood, the company has reported some positive news in recent months — it saw its value rise 25% in March following news that it was extending its equity trading hours toward a goal of supporting 24-hour-a-day activity — but there have also been myriad struggles at the former unicorn. The Financial Revolutionist shared last week a tweet from Ben Carlson of Ritholtz Wealth Management, who basically said that Robinhood appears ripe for an acquisition by Goldman Sachs or Fidelity. To quote FR:

Infrastructure boom continuesLast week, I reported on two different infrastructure companies that raised venture funding: Streamlined and Minka. Ex-Chime engineers Boris de Souza and Zhuo Huang founded Streamlined, an Oakland-based startup that emerged from stealth with a total of $4 million in funding. A lot of B2B payments tech is built on top of B2C tech, such as Stripe, that was engineered to handle consumer card transactions, according to de Souza. But Streamlined is different, he claims, in that it has "custom built" transaction infrastructure for B2B "from the ground up." The company also touts that its infrastructure is designed to allow for faster merchant payouts and to "dramatically simplify" reconciliation, which he believes is one of the company's biggest differentiators. Greylock and SignalFire led the company's seed round.  Image Credits: Minka Also, Bogota-based payments infrastructure startup Minka said it had secured $24 million in a funding round co-led by Tiger Global Management and Kaszek. In an interview, CEO and co-founder Domagoj Rozic described Minka as "an open network that aims to allow organizations such as banks and clearinghouses to 'publish' and move money in real time by exposing their 'closed, outdated core systems' to the web. "This in turn enables them to collect, send or exchange money in real time without the need for reconciliation and with almost no cost," Rozic told TechCrunch. These two rounds are proof that infrastructure is an area that is proving to be thus far resilient in the face of a global funding slowdown. Spend management — againFleet management company Motive has launched the Motive Card, marking the company's entry into the spend-management world, reported PYMNTS. "With fuel representing the second-largest operating cost for fleets, fuel discounts are more important than ever for driving profitability," Motive said in a news release issued on April 28. The company said the "zero fee" card — which it claims is the first corporate card "natively integrated" with a fleet-management platform — offers businesses substantial discounts at fuel providers, including Love's, TA, Petro Stopping Centers and TA Express, as well as savings on expenses such as tires and maintenance. "Motive is unifying the management of financial and physical operations in one integrated platform," Shoaib Makani, co-founder and CEO of Motive, said in a statement. But Motive is not the only player in the space. In February, TechCrunch reported on Coast, which aims to help companies control fuel and fleet spending with its expense management software, and its $27.5 million Series A financing co-led by Accel and Insight Partners. Founded in late 2020 by Daniel Simon, Coast describes itself as the "modern financial services platform for the future of transportation." It compares itself to the likes of Ramp, Brex or Airbase in that it has developed an expense management software platform for fleet operators and their employees. To that end, and like the aforementioned spend-management companies, Coast has created a commercial charge card designed for the businesses that operate vehicle fleets, such as trucking companies, plumbers, HVAC businesses or last-mile delivery companies. Meanwhile, Rain raised $6 million in seed funding to provide corporate credit cards for decentralized autonomous organizations (DAOs), reported The Block. Lightspeed Venture Partners led the round, which also included participation from Coinbase Ventures, Uniswap Labs and Terraform Labs. Founded by Farooq Malik and Charles Naut, the startup aims to tap into the growth of DAOs by providing them with a corporate card and expense management tools. Crypto, crypto and more cryptoLast week, I wrote about how teen-focused Copper raised a $29 million Series A led by Fiat Ventures. Since its launch last May, Copper has grown to have more than 800,000 users. That's up from 350,000 last October. While the company would not reveal its valuation or hard revenue figures, it did say that its revenue growth is in line with its user growth, which — as noted above — has more than doubled since October 2021. Seattle-based Copper offers features such as personalized debit cards, access to 50,000 ATMs and support for digital wallets like Apple Pay, Google Pay and Samsung Pay. And now, it wants to move into giving teens a way to invest "responsibly" in stocks, mutual funds and even crypto. Anita recently wrote about Step's efforts to also offer teens a way to invest in crypto. For more on the topic, listen to Alex Wilhelm and I riff about it on EquityPod here. Meanwhile, the biggest retirement plan provider in the United States, Fidelity, last week announced plans to offer individuals the opportunity to invest in bitcoin through their 401(k) retirement accounts later this year. With 20 million plan participants accounting for $2.7 trillion in assets, Fidelity just brought a somewhat controversial strategy into the mainstream. It's not surprising that Fidelity was the first tradfi asset management firm to stake out its territory in this space — the company has been ahead of its peers in launching digital asset products under the tenure of CEO Abigail Johnson. It launched its first crypto-related offering in 2018 when it began to hold digital assets in custody for institutional investors. The news marked a pivotal moment in the growing movement to expand access to alternative investments — a goal that can be seen as either laudable or risky, depending on whom you're asking. Anita digs in here (TechCrunch+ subscription required). Digital banking startup Cogni is joining the ranks of companies hopping on the crypto bandwagon. The mobile-based platform, founded in 2018 out of Barclays' accelerator program (which is operated by Techstars), launched with the intent to offer personalized banking products suited to the lifestyles of those in the 18-to-35 crowd, CEO and founder Archie Ravishankar told TechCrunch's Anita Ramaswamy. Now, Cogni has raised a $23 million funding round led by Hanwha Asset Management and CaplinFO with a new mandate — bringing Web 2.0 and web3 services together on one platform. Ondo, founded by two alums of Goldman Sachs' digital assets team, is capitalizing on crypto's capital markets by building what it calls a "decentralized investment bank." What that means is that Ondo acts as an intermediary between DAOs (decentralized autonomous organizations) that, like traditionally structured companies, need to raise money to fund their operations, and the investors who can provide them with that money. Last week, Ondo announced that it raised a $20 million Series A round, co-led by Pantera alongside Founders Fund. Coinbase Ventures, GoldenTree, Wintermute, Steel Perlot, Tiger Global and Flow Traders participated in the round as new strategic backers. More from Anita here. Fundings and other fintech newsI reported last week that PayPal is shuttering its San Francisco office as it evaluates its global office footprint. Multiple sources told me that the payments giant is closing its San Francisco office on 425 Market Street, which housed its Xoom business unit, by June 3. PayPal acquired Xoom, which is focused on online money transfer technology and services, in 2015. A person familiar with internal happenings at the company said the employees that worked out of that office will work virtually, with the ability to work from the company's headquarters office in San Jose. It is unclear how many employees are affected by the decision. Self Financial, an Austin-based fintech that aims to make credit and savings accessible to U.S. consumers, announced that in addition to Equifax and TransUnion, it now also reports rent payments to Experian. Self claims that the move makes it "the first and only direct-to-consumer company to report rent to all three major credit bureaus." The announcement follows Self's February acquisition of rent and utility data furnishing company RentTrack and its consumer division LevelCredit. I covered the startup's $50 million raise last September. Kard announced last week that it raised a $23 million Series A round led by new investor Tiger Global, with participation from other new backers Fin Capital and s12f. Underscore VC, which led Kard's seed round in 2020, also participated in the latest funding. Kard's rewards-as-a-service API streamlines the card issuance process for issuers, allowing them to create a customized rewards program tailored to their particular customer base by choosing from Kard's set of merchant partnerships. The startup plans to use its new capital to expand its merchant network and to launch new reward and loyalty-related products in the coming quarters. Anita Ramaswamy gives us the story here. Ben Franklin once famously said that in this world nothing can be said to be certain, except death and taxes. But that doesn't make dealing with either particularly natural and easy. Tech is rushing in to fill that gap, and last week a Berlin-based startup called Taxfix, which has built a popular mobile assistant to address the former of these, is announcing a big round of funding to fuel its growth. It closed a Series D of $220 million at a valuation of over $1 billion, money that the startup will be using both to build in more products to extend its touch points with customers beyond annual use around tax time, and to expand to new markets beyond its current footprint of Germany, Spain and Italy. Ingrid Lunden gives us all the details here. São Paulo-based UME, a fintech specialized in “buy now pay later,” has secured $10 million in funding, including $5.5 million in equity and $4.5 million in debt. Silicon Valley venture capital fund NFX and Brazilian VC firm Canary co-led the round. The startup plans to use the money to invest in a national expansion with the goal of allowing customers "to shop at any retailer in Brazil, whether physical or online." UME says what differentiates it from other players in the space is its proprietary deep neural network (“deep learning"). "Bringing high-end technology to analyze customers’ behavior in the retail space allows us to create underwriting models based on proprietary data that grants better credit to more people", said founding partner Marco Cristo. The company operates in the northern region of Brazil and has more than 70 retailers in its network, adding up to more than 350 stores. At the end of 2021, the startup had performed over 100,000 transactions and granted credit to more than 45,000 customers. QuotaPath — which has developed a commission-tracking solution for sales and revenue teams — raised a $41 million Series B led by Tribe Capital with participation from Insight Partners and others. The funding comes nine months after its $21.3 million Series A round. During that time, the startup says it has tripled its revenue and doubled its team. OneVest raised $5 million CAD in seed funding and the support of fintech-focused investors like Luge Capital and National Bank's NAventures to accelerate the growth of its wealth management offering. More here. Trust, a Los Angeles, Cakifornia-based "growth network" for emerging brands founded by a group of Snap alums, secured $30 million in debt and equity funding. That included $25 million in debt from Upper90 and $5 million in equity from existing and new investors, including Sapphire Sport and Michael Vaughan (Venmo's former COO). Christine Hall covered the startup's $9 million raise last August. Carbon Collective, an online investment advisor "100% focused" on solving climate change, announced an oversubscribed seed round at $2.2 million, featuring Powerhouse Ventures, HyperGuap and Elevation Ventures. Founded in 2020, Carbon Collective has a B2C robo investment offering, a B2B Green 401(k) and claims to have compiled "the most comprehensive list of climate solution stocks in its 2022 Climate Index. That's it for this week. Thanks so much for reading. If you enjoyed it, please share. Hope you enjoy the rest of your weekend! Cheers, Mary Ann |

| James Murdoch firm invests $600 million in India’s Allen Career Institute Posted: 01 May 2022 05:49 AM PDT Bodhi Tree is taking a $600 million stake in Allen Career Institute as James Murdoch and former Disney executive Uday Shankar’s investment platform expands its bet on India’s growing edtech market, they said Sunday. The duo said their investment in the 33-year-old education brand, which operates 138 classroom centers in 46 cities in India and Middle East, is strategic in nature. Allen — which helps prepare students looking to crack prestigious exams such as IIT JEE Mains & Advanced, NEET-UG, KVPY and the Olympiads — said it will work with Bodhi Tree to broaden its test-prep offering and “deliver at-scale positive impact for millions of students in test-prep and K12 segments, using technology as the core driver of value.” The deal values Kota-headquartered Allen at over $1 billion, a person familiar with the matter said, but TechCrunch could not determine the precise valuation. Allen runs one of the largest coaching institutes in India. The firm competes with Aakash, which Indian edtech giant Byju’s acquired last year for nearly $1 billion. Indian online platform Unacademy, last valued at $3.4 billion, explored acquiring Allen earlier, according to two people familiar with the matter. "Since its inception, Allen has focused on providing high quality education to students to help them achieve their highest potential and fulfil their career aspirations,” said Rajesh Maheshwari, founder of Allen, in a statement. “In the process, we have helped create hundreds of thousands of doctors and engineers, who contribute to building India and the society of today. Our partnership with Bodhi Tree is an essential ingredient in furthering our mission to significantly increase Allen’s reach and impact.” The investment in Allen is the second backing Bodhi Tree has announced this week. On Wednesday, the firm said it was investing $1.78 billion in Mukesh Ambani-backed television network Viacom18. "Education is a critical consumer need, driven by its deeply transformative impact on lives and livelihoods of consumers," Murdoch and Shankar said in a joint statement. "We believe that education is on the cusp of a technology led renaissance that will fundamentally alter how education is imparted and will increase its efficacy. Allen’s unrivaled success and scale provide the right foundation to build the digital education company of the future. We are excited to work with the Maheshwari family to build an outcomes-focused digital education company that delivers on the aspirations of millions of learners and parents in India and beyond." The duo — who through Lupa have invested in a number of Indian startups including short-video platform and news aggregator DailyHunt and edtech DoubtNut — announced Bodhi Tree, a $1.5 billion investment firm, in February this year. The firm, backed by the Gulf State's sovereign wealth fund Qatar Investment Authority, seeks to focus on investing in India and the broader Southeast Asia region. |

| Posted: 30 Apr 2022 01:00 PM PDT Hi! I’m Greg Kumparak. I’ll be heading up Week in Review for the foreseeable future, with your former host Lucas Matney diving into cryptoland with the launch of a newsletter and podcast called Chain Reaction. He’s not going too far, and I’m sure he’ll stop back in from time to time. If my name seems familiar, it might be because I took over Week in Review a few times while Lucas was AFK/touching grass/not staring at a screen. Or it could be because you’ve been reading TechCrunch for a long time. I’ve been around this place for over a decade; I’ve worn a lot of hats in that time. (Metaphorical hats. I’ve got a big ol’ head, most actual hats don’t fit right.) That’s all I’ll say about me, for now, because this isn’t the Greg in Review newsletter. But come say hi on Twitter. Tell me what you like most about Week in Review as it has existed so far. I don’t intend to change much about the format, but I’m always down to do more of what people like. the big thingLucas always started the newsletter off with the week’s “big thing”… and, well, the big thing this week was, inarguably, Elon Musk offering $44 billion to buy Twitter, and Twitter accepting. If you were looking at our list of most read posts for the week, you might think it was the only thing that happened in tech this week. No joke. I’m pretty sure just about everything that can be said about Elon, Twitter and the combination of Elon and Twitter… has been said. Hot takes, not-so-hot takes… all takes, of all temperatures, have already been taken. I’m a believer that if you have nothing smart to say, the smartest thing you can say is nothing. [ … pause for effect] Fortunately, I have plenty of smart friends that have said plenty of smart things! Ron was quick out of the gate with some thoughts on how Twitter has evolved since he joined in 2007, and where it could go from here. Natasha pointed out that, with a number of Twitter employees suddenly less happy and likely more rich, this could be the start of a whole new wave of startups. Devin questioned… well, everything about it. If you somehow find yourself saying “Wait, Elon’s buying Twitter?”, here’s our recap of the entire wild ride. other thingsBelieve it or not, other stuff happened this week! Like: PayPal confirmed it’s shutting down its SF office: Our own Mary Ann Azevedo broke the news that PayPal is parting ways with its SF office, with the company saying it’s evaluating its “global office footprint” based on how the pandemic has changed the way we work. It sounds like SF employees will be able to work virtually or commute down to the San Jose HQ. Snap built a selfie drone?: It’s adorable, but I’m having a hard time seeing how this becomes anything more than a goofy side project for the company. “Hold on friends, don’t take that selfie. Let me get out the drone. Hold on, let it boot up. One sec. Wait, no drones allowed here? It’s fine, we’ll be fast. I’m not killing the vibe! You are. Welp, battery is dead, gimme a minute.” Someone found a Pixel Watch: In news that throws me back to the wild gadget blogging days of 2010*, someone found what appears to be a prototype of a Google-made Pixel smartwatch sitting forgotten at a restaurant. Google’s big I/O event kicks off in just a few weeks, so I’d expect to hear more about this then. (* “Oh no, how was the iPhone 4/Gizmodo thing over a decade ago,” he says to himself as he crumbles to dust and blows away.) added thingsWe have a paywalled section of our site called TechCrunch+. It costs a few bucks a month and it’s full of very good stuff! From this week, for example: The 9 startups developing tomorrow’s batteries: From building smarter devices to battling climate change, we need better batteries if we want to keep moving forward. But what’s actually happening in the space? TechCrunch newcomer Tim De Chant kicked things off with a bang (zap?) with a deep dive on nine companies that have collectively raised over $4 billion in hopes of cracking the next era of battery tech. Plus he got a pun in the headline, which is a win in my book. YC’s Dalton Caldwell on how to get into YC: A few weeks back at our TechCrunch Early Stage event, Y Combinator’s Dalton Caldwell led a session on what he looks for when a startup applies. The session and the Q&A thereafter were full of actual, actionable insight from someone who knows more about the accelerator’s application process than perhaps anyone else, and in this post I’ve collected many of the bits that stood out to me most. Should you put any of your 401(k) into crypto? This week Fidelity announced that it will allow retirement account holders to invest up to 20% of their 401(k) into bitcoin. But should you? The excellent Anita Ramaswamy explores the risks and rewards. |

| Felicis Ventures partners share the four pillars of scaling a SaaS startup Posted: 30 Apr 2022 12:05 PM PDT For investors, one factor will almost always stand head and shoulders above the rest: Your TAM (total addressable market) needs to break at least $1 billion. But alongside a massive addressable market, investors are also looking to see that you have existing customers, even they’re few in number, who truly love your product. However, communicating the steps between your existing users (wedge) and your long-term potential as a company (TAM) can be incredibly tricky. At TechCrunch Early Stage this month, we sat down with Felicis Ventures partners Viviana Faga and Niki Pezeshki to talk about scaling, product-market fit, and why it’s crucial to be “10x better” than the incumbents. Product-market fitStartups must be able to demonstrate that they have users that love their product. But what does “love” really mean? Faga and Pezeshki believe that startups need a framework to measure their initial push into a niche audience. They suggest running a survey with your first cohort of users that asks how they would feel should the product no longer exist. Anything below the 50% threshold — in other words, one of every two users should be upset were this product to stop existing — isn’t good enough to move on to the next step. Even then, they warn, it’s important to stay focused on the niche you’re building for before moving on. Faga described a founder she’s currently working with who is building in the beauty space, and they’re interested in applying what they’re building to the CPG market. “We had to take a step back and say, ‘Let’s own beauty,'” she explained. “Let’s do that really well. Let’s repeat it. Let’s scale it. And then, that affords you the right to move into the CPG space, because what will happen is that the CPG space might take you in a totally different direction. You can eventually get there, but own beauty first. Do it really well. That gives you that graph that’s up and to the right and gets a lot of investors really excited.” While maintaining focus on your niche and working to hit that 50% threshold of users who couldn’t continue on without your product, start paying close attention to your Net Promoter Score (NPS). Using that, find the group of users that are rating your product a nine out of 10 and charge them for it. If your NPS drops down to two, you don’t have product-market fit. |

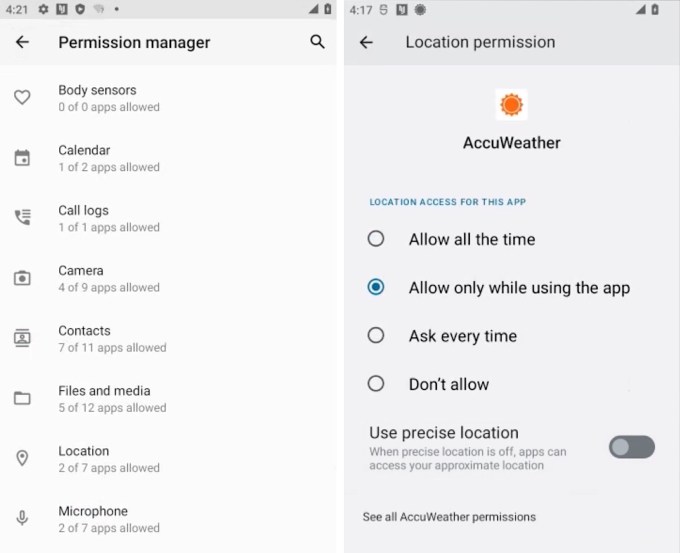

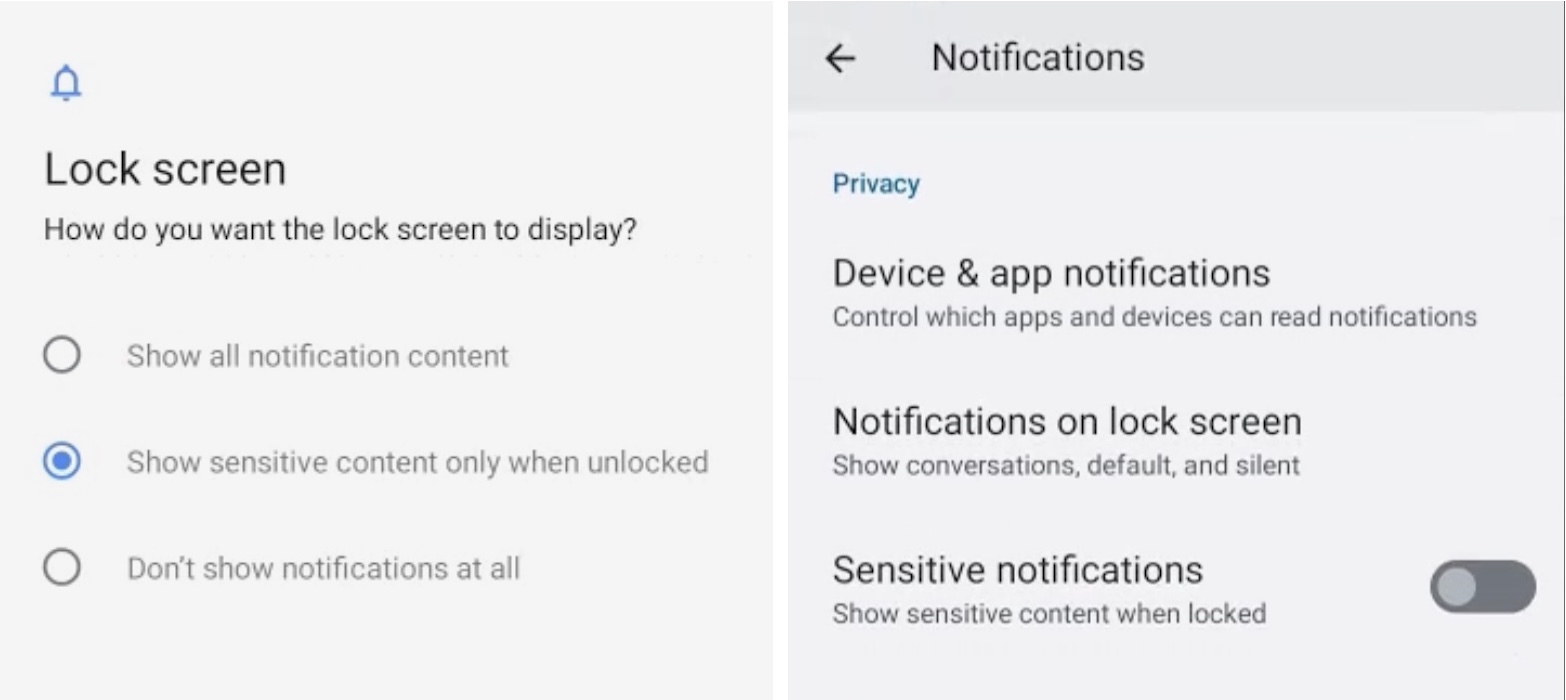

| These Android features will help protect your digital privacy Posted: 30 Apr 2022 12:00 PM PDT Android and privacy haven’t always been natural companions. Google still makes the bulk of its profits from its data-fueled advertising business that relies heavily on user information, much of it derived directly from Android users. Nowadays, Google gives its users more authority over how and when the search giant taps into Android-associated data by baking a number of security features and privacy protections into the software. Many of the basics you already know. Setting a strong PIN — or better yet, an alphanumeric passcode — to lock down your device is a great start, and making sure you keep your device up-to-date with the latest security patches. Plus, protecting your Google account with two-factor authentication can save you from even the most well-resourced hackers. What's more, a number of Android's built-in security features are switched on by default, such as verified boot, a feature that ensures that the device’s firmware hasn’t been tampered with by malware, and Google Play Protect, Android’s in-built app scanner, which protects against malicious apps like spyware and stalkerware. Here’s what else you need to consider. (Some settings may vary depending on your Android version.) How to protect your digital privacy on Android1. Uninstall unused appsIt's unlikely you're using all of the apps installed on your Android device. Not only can uninstalling your unused apps help to free up storage space on your device, it can also dramatically improve the security of your device, as these apps — though unused — can still run in the background, collect, and then share your personal data. Thankfully, getting rid of these so-called zombie apps is pretty straightforward. Simply head to the Google Play Store, tap Menu, and select My apps and games. From here, you can select the apps you want to get rid of and remove them from your device. 2. Check your Android app permissions You can allow, disallow, or adjust what permissions and access your apps have to your data. Image: TechCrunch Once you've got rid of unused apps, you should also do a privacy audit of those you use on a regular basis to ensure they only have access to the things they're supposed to. To do this, head to Settings, then Privacy and security, and then Permissions Manager. Here, you'll see exactly what data each app can access — be it location data or contacts — and have the option to limit. In the case of location data, later versions of Android let you limit its accuracy to allow you to still obtain nearby results but without revealing your precise location. 3. Hide sensitive notifications on your lock-screen You can limit your notifications and sensitive content from appearing on the lock screen. Image: TechCrunch By default, Android is set to show all of your notification content on your lock-screen, This means if your device falls into the wrong hands, they might see sensitive information — from private messages to two-factor codes — without having to enter your device’s PIN or passcode. Thankfully, you can choose to restrict how much information is displayed on your lock-screen. In Settings, head to Privacy and security and tap Notifications on lock screen. While, by default, it will be set to Show all sensitive content, there's the option to switch this to Show sensitive content only when unlocked — which will filter your notifications and only display those deemed as "not sensitive" on the lock-screen — or to Don't show notifications at all. 4. Browse the web with more privacyGoogle Chrome is the default browser on Android, and Google's Safe Browsing mode is switched on by default. A feature called Enhanced Safe Browsing substantially increases your protection against dangerous downloads and malicious websites but at the expense of collecting more data on your browsing activity, which some users may feel uncomfortable with — especially given Google already has enough of our data. You can switch it on by way of Chrome’s three-dot menu in the top right of the browser, then open Settings and head to Privacy and security and Safe browsing. From here you can switch on Enhanced browsing. There is another option: switch to an entirely different browser. There are several privacy-focused browsers available in Google Play that provide more protection than Google's default offering, from Brave to Firefox. You can also adjust your search engines to DuckDuckGo, a popular privacy-friendly search engine that doesn’t log search queries, and the Tor mobile browser, which anonymizes your browsing history and helps users circumvent censorship. Before you go, you should consider:

|

| Slice and dice it all you want, that’s a seed round Posted: 30 Apr 2022 11:43 AM PDT Welcome to Startups Weekly, a fresh human-first take on this week's startup news and trends. To get this in your inbox, subscribe here. There's a clash happening in the early-stage market. In one world, late-stage investors are reacting to tech stonk corrections by clamoring toward the early-stage investment world, forcing seed investors to go even earlier to defend ownership and potential returns. This trend was underscored by firms like Andreessen Horowitz launching a pre-seed program months after launching a $400 million seed fund. Even more, Techstars, an accelerator literally launched to help startups get off the ground, debuted a fund to back companies that are too early for its traditional programming. While all that is going on, early-stage investors are enduring a valuation correction and portfolio markdowns. Some are admitting that they're telling portfolio companies to refocus on cash conservation, profitability and discipline, not just growth. Let's pretend these two vastly different worlds are in the same universe: Early-stage investors are getting more disciplined and cash rich, but at the same time, the earliest investors are going earlier. Investors are pushing founders to be lean but also green, but at the same time, offering them $10,000 to take PTO for a week and try their hand at entrepreneurship. Growth, gross margin and burn are the new top priorities for CEOs, but at the same time, venture capitalists are clamoring to offer more funds, earlier, in newly invented subcategories of early-stage investment. It's a lot happening at once, and makes me worry about the race to the bottom — or race to the earliest stage — and its consequences. For more thoughts, read my TechCrunch+ piece: "If the earliest investors keep going earlier, what will happen?" In this newsletter, we'll talk about news that has to do with Elon Musk, and news that has nothing to do with Elon Musk. As always, you can support me by forwarding this newsletter to a friend, following me on Twitter or subscribing to my personal blog. Let's talk about Elon MuskAs I'm sure many of you know all too well, Elon Musk's $44 billion dollar bid for Twitter was accepted this week, marking a massive moment in tech history and a looming return to the private markets for a fundamental social media platform. We wrote up the entire timeline of Musk's acquisition, from tweet to close, but just know the saga is nowhere near done — the deal is yet to officially close. Here's why it's important: I mean, for once this format doesn't work because there's way too many angles for why Musk's buy of Twitter is important. Instead, I'll just bullet list some specific angles that TechCrunch dug into.

And finally, I'll just remind you all that Twitter, in its earnings this week, said that it has overcounted its users over the past 3 years. By 1.9 million accounts. Jeez. It's a bad look for Twitter, but also bad news for advertisers — a revenue stream that the platform is very dependent on. As Sarah Perez put it, "for a company as dependent on advertising revenues as Twitter currently is, it's a wonder why they would agree to a deal that puts a free speech absolutist in charge."  Image Credits: Bryce Durbin / TechCrunch Ok, now let's not talk about Elon Musk for the rest of the newsletterYes, we're at that point of the [insert high–profile news cycle] story. First, there are the leaks and scoops. Then there are the slightly hedged thought pieces. Then, there is the Major Confirmation. Then, there are the straight-up savage threads and op-eds, sprinkled with more leaks, more scoops and key details. And finally, the stories that want to provide brief respite from the aforementioned madness. Let's embrace this last stage! The deal of the week, that may have snuck under your radar, is that Robinhood is laying off 9% of full-time staff. Here's why it's important: Robinhood announced its layoffs just days before Q1 2022 earnings, and after its seen its value erode in the public markets. The move thus seems defensive, and the company's attempt at proving that it's en route to becoming a more efficient and growth-oriented financial institution. Also in fintech news, PayPal is shuttering its San Francisco office. Things are getting tense:

Image Credits: Orla (opens in a new window) / Getty Images Across the week

Seen on TechCrunch Does it smell like teen spirit, or teen bankruptcy? Airbnb commits to fully remote workplace: 'Live and work anywhere' AppDynamics founder's Midas touch strikes again as Harness valuation hits $3.7B Snap announces a mini drone called Pixy Seen on TechCrunch+ How to get into Y Combinator, according to YC's Dalton Caldwell Please don't YOLO your 401(k) into shitcoins Having some crypto in your 401(k) is neither irrational nor exuberant Why Latin America's freight-forwarding opportunity is still attracting capital Charged with billions in capital, meet the 9 startups developing tomorrow's batteries today Until next time, |

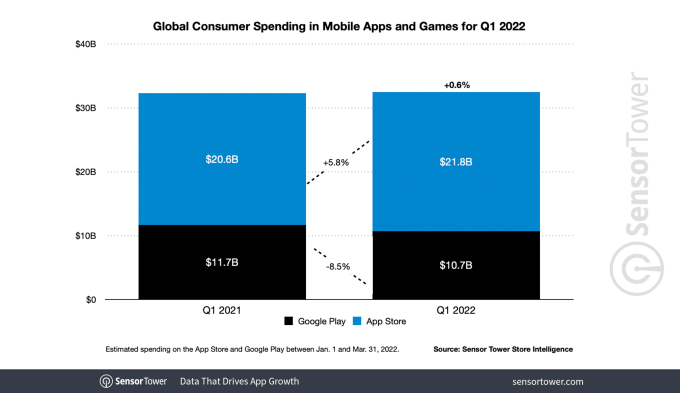

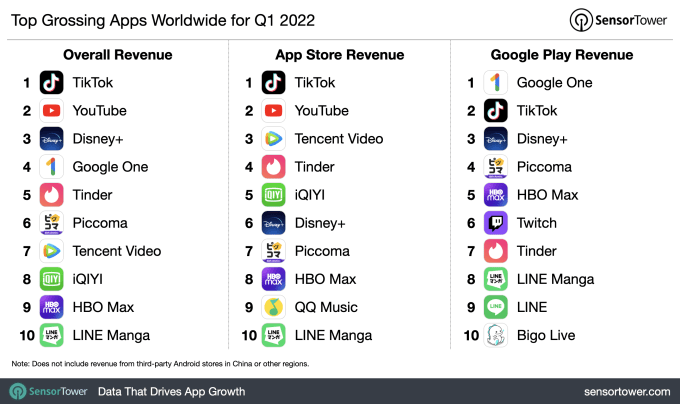

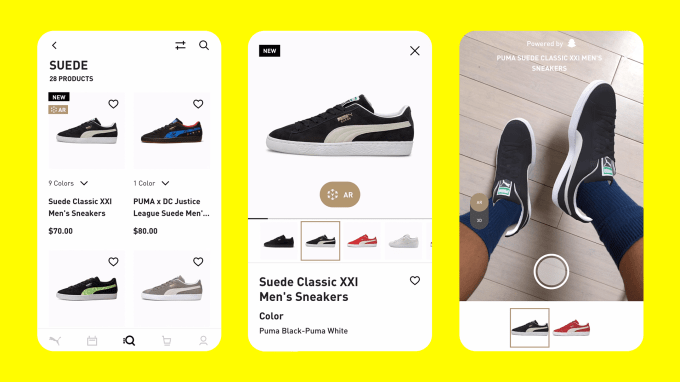

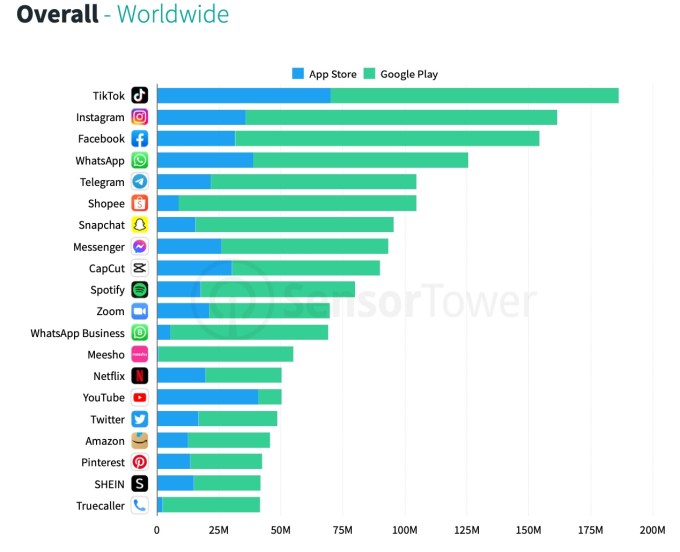

| This Week in Apps: Elon buys Twitter, Snap Summit recap and an App Store cleanup Posted: 30 Apr 2022 11:00 AM PDT Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. Global spending across iOS, Google Play and third-party Android app stores in China grew 19% in 2021 to reach $170 billion. Downloads of apps also grew by 5%, reaching 230 billion in 2021, and mobile ad spend grew 23% year over year to reach $295 billion. Today's consumers now spend more time in apps than ever before — even topping the time they spend watching TV, in some cases. The average American watches 3.1 hours of TV per day, for example, but in 2021, they spent 4.1 hours on their mobile device. And they're not even the world's heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed five hours per day in mobile apps in 2021. Apps aren't just a way to pass idle hours, either. They can grow to become huge businesses. In 2021, 233 apps and games generated over $100 million in consumer spend, and 13 topped $1 billion in revenue. This was up 20% from 2020, when 193 apps and games topped $100 million in annual consumer spend, and just eight apps topped $1 billion. This Week in Apps offers a way to keep up with this fast-moving industry in one place, with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps to try, too. Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters Top StoryA billionaire buys himself a social networkCan you believe it’s only been a week since Elon Musk announced he was buying Twitter for around $44 billion? It’s felt like years! A lot has happened since Elon Musk first signaled his interest in Twitter by snatching up Twitter shares, then later being offered a board seat, declining the seat, then deciding he’d rather just take the whole company. Initially, no one was quite sure how serious Musk’s offer was, but when he rounded up financing and detailed how he planned to pay for Twitter, the offer had to be given a lot more consideration. On April 25, Twitter accepted Musk’s offer, which includes a $1 billion termination fee on both sides. The deal is a go. There’s a lot of curiosity over why Musk wanted Twitter in the first place. But it’s likely a combination of a power user thinking they can fix the service and a desire to use the network for the market-moving power it’s been shown to have. Now everyone’s wondering what happens next. Twitter was never a great business in Wall Street’s eyes, so going private is not the worst choice for the company to make. But going private under a free speech absolutionist already has advertisers wary. If Twitter were to lighten its content moderation rules, it could allow more online abuse and hate speech to thrive. AdAge reported the immediate reaction from advertisers was one of anxiety and confusion. Brands began reaching out to agencies to help them understand and prepare, it said. One agency exec said advertisers are preparing to stop spending after Musk’s takeover if things go south. Looking to quell worries, Twitter emailed reassurances to advertisers, the FT reported. But brands know Twitter can’t make any promises about the nature of free speech on Twitter once Musk is in charge. Advertisers can pull out of Twitter if need be — there are a number of other social networks hungry for their dollars beyond Meta. Snap and TikTok, for instance, could benefit from a potential ad budget shift, as they also reach a younger demographic and have growing user bases. While Musk has ideas about how to grow Twitter’s revenues in other ways in the future, Twitter’s business today is advertising-dependent. To what extent Musk understands the nuances of that complication is less clear. But unless the billionaire wants to self-fund Twitter, he should probably give it some thought. Weekly NewsGlobal app store revenues remained flat in Q1Global consumer spending in apps saw relatively flat growth year-over-year, according to new data from Sensor Tower. The company found that worldwide app revenue growth from in-app purchases, premium apps and subscriptions grew just 0.6% from $32.3 billion in Q1 2021 to $32.5 billion in Q1 2022. However, when looked at individually, the App Store and Google Play saw different trends. Google’s Play Store lack of growth pulled the combined growth rate down, as it saw approximately $10.7 billion in consumer spending, down 8.5% year-over-year from $11.7 billion in Q1 2021. Meanwhile, Apple’s App Store revenue, which was double that of Google Play’s, grew 5.8% year-over-year from $20.6 billion to $21.8 billion.  Image Credits: Sensor Tower Top grossing apps in the quarter included TikTok (iOS) and Google One (Android), as well as streamers like YouTube, Disney+, Tencent Video, HBO Max, and others. Dating app Tinder was also the No. 5 top grossing app overall.  Image Credits: Sensor Tower Among app categories seeing increased usage in Q1, medical apps led the market with 102% year-over-year growth, followed by navigation (+24%), travel (+19%), business (+15%), shopping (+14%), finance (+13%) and education (+13%) Snap Summit RecapSnap held its Partner Summit this week, where the company announced a number of new features in areas like AR Shopping, 3D asset creation, AR development tools and more. It also announced a drone for taking photos, but that’s not really an app! Among the highlights:

Image Credits: Snap

Apps and earningsIt was a busy week for tech company earnings. Apple had a stellar quarter, with revenue increasing 9% to $97.3 billion, and quarterly profit growing 6% to $25 billion, but shares slipped on warnings of possible supply chain constraints impacting the business in the future. But the standout news for the app economy was the record revenue reported by Apple’s services division, which includes the App Store and other subscription-based business lines, like Apple TV+, Apple Music, cloud services and more. The company said services revenue grew 17% year over year to reach $19.8 billion and it now has 825 million paid subscriptions. That means services is now bigger than Apple’s Mac ($10.44 billion) and iPad ($7.65 billion) divisions combined. Other tech earnings of note this week included:

Platforms: Apple

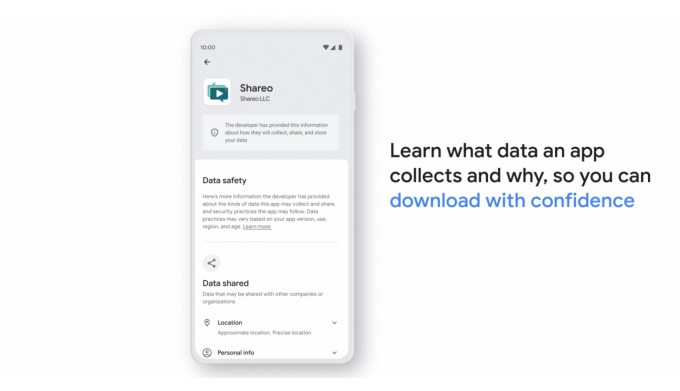

Platforms: Google

Image Credits: Google Augmented Reality

Fintech

Social

Image Credits: Sensor Tower

Streaming & Entertainment

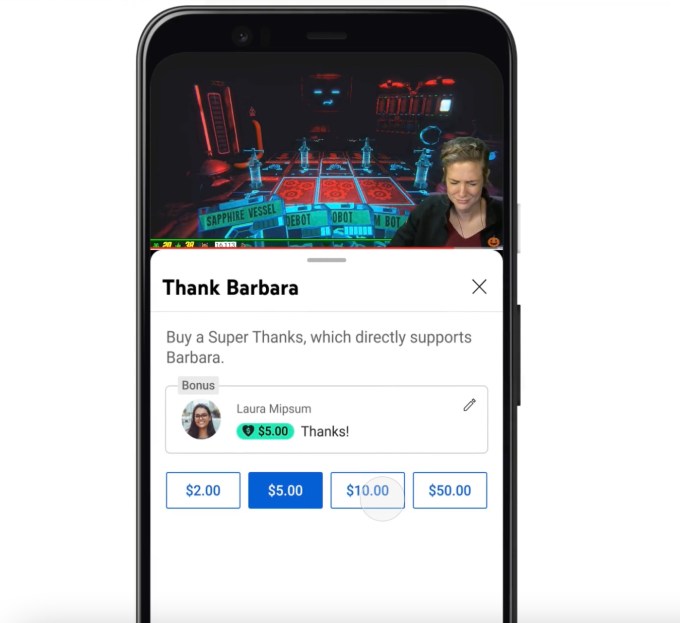

Image Credits: YouTube

Gaming

Health & Fitness

Government & Policy

Security & Privacy

Funding and M&A

|

| On putting toothpaste back into the tube Posted: 30 Apr 2022 10:31 AM PDT Welcome to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It's inspired by the daily TechCrunch+ column where it gets its name. Want it in your inbox every Saturday? Sign up here. Good news! We’re not talking about crypto, Elon Musk or SaaS multiples today. We’re also not talking IPOs, global venture capital trends or the like. Instead, we’re going to talk about putting toothpaste back in the tube. Sound fun? Let’s go. China’s technology industrySince the Ant IPO was pulled and the Chinese Communist Party executed off a flat-wild period of regulatory action in 2021, you have probably heard less about China’s technology. That’s because the companies that tended to make the biggest splash in foreign media were concerns like Alibaba, ByteDance and the like — tech companies that touched lots of individuals, including folks outside the country’s national borders. China’s government decided that such companies had too much influence, and thus needed to be cut down to size. This meant, variously, the decapitation of the for-profit edtech sector, social media regulation, the effective curtailment of foreign listings, punitive data reviews, video game limits along with a long pause in new titles, new rules regarding algorithms and more. After a period of comparative freedom to innovate, compete and, yes, at times act anticompetitively, China’s domestic tech industry entered 2022 in a very different state than it kicked off 2020. (This isn’t to discount the impacts of COVID-19 on Chinese tech companies; but the move toward remote work and the like was global, and for our purposes today we care more about the regulatory environments shifts in particular.) The result of the fusillade of regulatory action, a full nelson of top-down control, was probably about what you expected. Some recent headlines for flavor:

Those should paint a fair enough picture of market sentiment regarding the crackdown. In more monetary terms, the value of many Chinese tech companies fell sharply. After peaking at more than $300 per share in late 2020, Alibaba is worth less than $100 per share today. Didi, which got caught between the Chinese government and the American markets after its IPO, saw its shares peak at a penny over $18 per share. Today it’s worth less than $2 per share. Stories began to crop up about layoffs and other misery from Chinese tech companies. A few more headlines for context:

Given that this was pretty much what anyone with a pulse might have expected from the Chinese government throwing its absolute control around like gravity in a rollercoaster, pushing to remake one of its key economic engines by autocratic fiat in a short period of time, you are probably not surprised. And yet it appears that the Chinese government is, at least to some degree! How do we know that? Well, observe:

The context here is that while the rest of the world is largely figuring out a path out of COVID, China’s government is locking down hundreds of millions of its citizens as it chases an impossible goal of zero COVID-19 cases. (The government previously touted its success at keeping the pandemic at bay as evidence of its superiority; such a stance makes any retreat from the goal difficult.) The result of lockdowns and a sharply diminished local tech industry is, surprise, economic malaise. Not that the Chinese government intends to accept that. After indicating that besting American economic growth is a priority, debt-fueled infrastructure spending is back on the table, along with more real estate speculation, and, it appears, some softening of the rules deluge that its domestic tech market has been forced to endure without complaint. Good luck? Can the Chinese government put the tech toothpaste back in the tube? We’ll find out, but if I was an investor or founder I would not build inside the country. Sure, it’s a big market, but not one that you can count on. More when we get Q2 2022 Chinese venture capital data. |

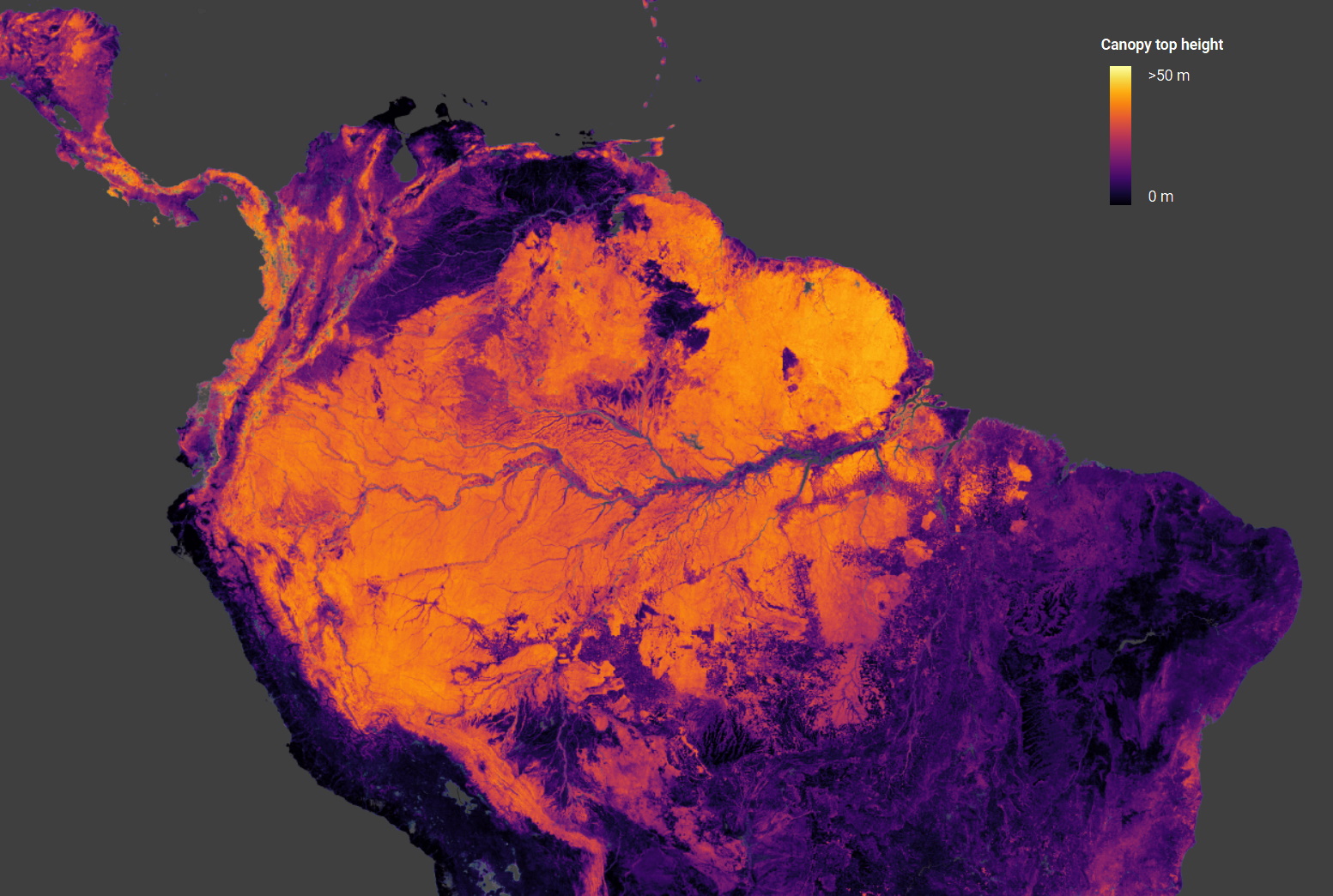

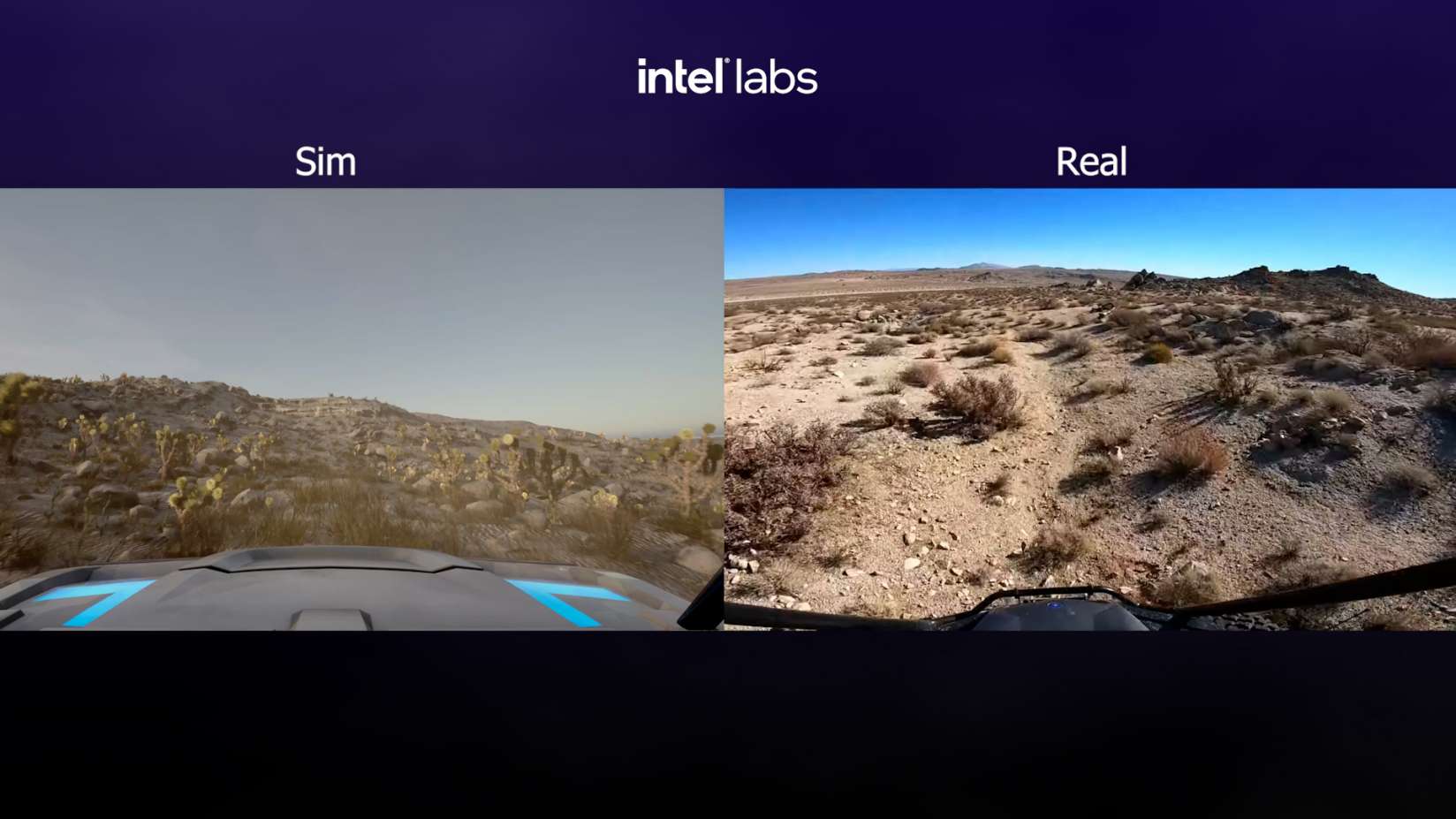

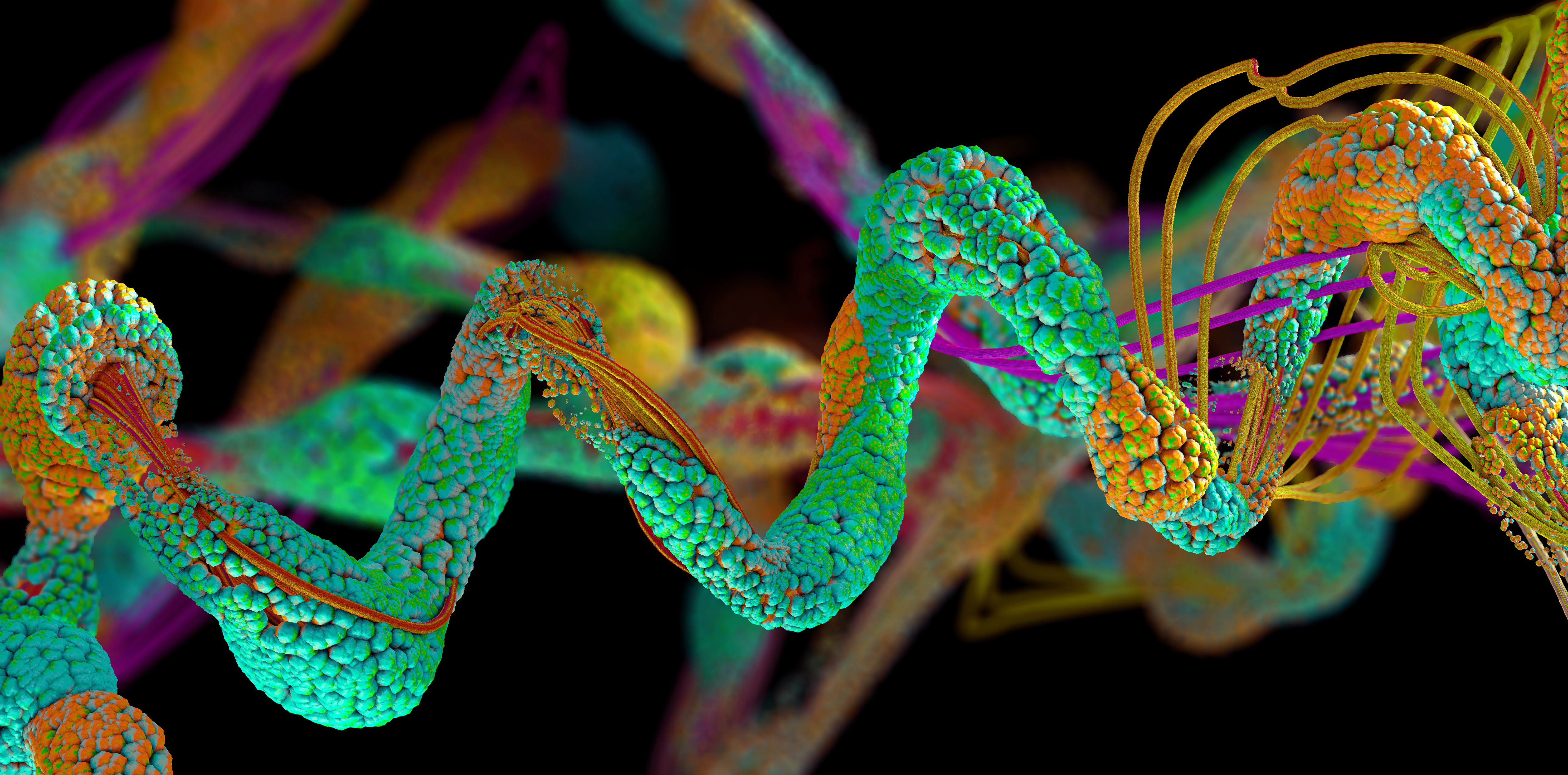

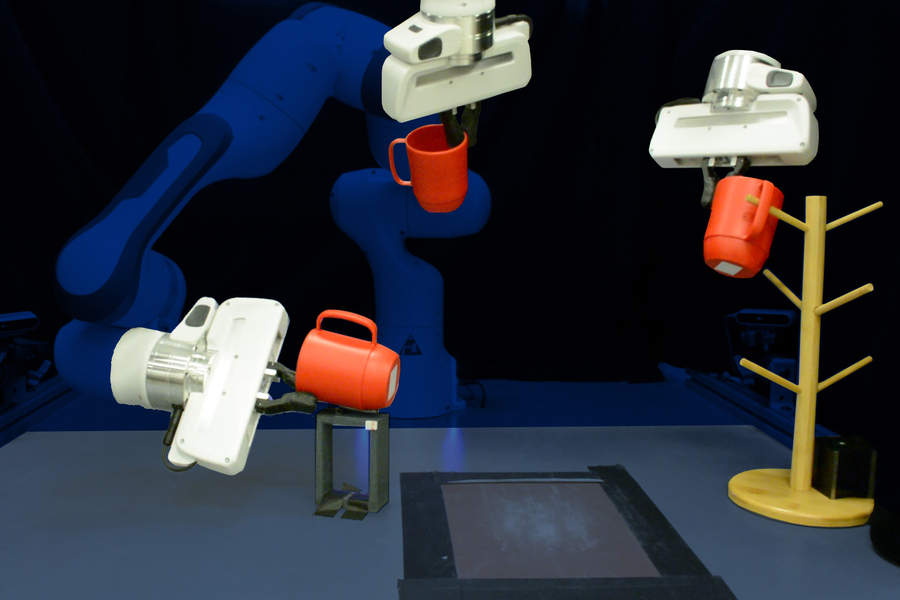

| Perceptron: AI mixes concrete, designs molecules, and thinks with space lasers Posted: 30 Apr 2022 08:05 AM PDT Welcome to Perceptron, TechCrunch’s weekly roundup of AI news and research from around the world. Machine learning is a key technology in practically every industry now, and there’s far too much happening for anyone to keep up with it all. This column aims to collect some of the most interesting recent discoveries and papers in the field of artificial intelligence — and explain why they matter. (Formerly known as Deep Science; check out previous editions here.) This week’s roundup starts with a pair of forward-thinking studies from Facebook/Meta. The first is a collaboration with the University of Illinois at Urbana-Champaign that aims at reducing the amount of emissions from concrete production. Concrete accounts for some 8 percent of carbon emissions, so even a small improvement could help us meet climate goals.  This is called “slump testing.” What the Meta/UIUC team did was train a model on over a thousand concrete formulas, which differed in proportions of sand, slag, ground glass, and other materials (you can see a sample chunk of more photogenic concrete up top). Finding the subtle trends in this dataset, it was able to output a number of newformulas optimizing for both strength and low emissions. The winning formula turned out to have 40 percent less emissions than the regional standard, and met… well, some of the strength requirements. It’s extremely promising, and follow-up studies in the field should move the ball again soon. The second Meta study has to do with changing how language models work. The company wants to work with neural imaging experts and other researchers to compare how language models compare to actual brain activity during similar tasks. In particular, they’re interested in the human capability of anticipating words far ahead of the current one while speaking or listening — like knowing a sentence will end in a certain way, or that there’s a “but” coming. AI models are getting very good, but they still mainly work by adding words one by one like Lego bricks, occasionally looking backwards to see if it makes sense. They’re just getting started but they already have some interesting results. Back on the materials tip, researchers at Oak Ridge National Lab are getting in on the AI formulation fun. Using a dataset of quantum chemistry calculations, whatever those are, the team created a neural network that could predict material properties — but then inverted it so that they could input properties and have it suggest materials. “Instead of taking a material and predicting its given properties, we wanted to choose the ideal properties for our purpose and work backward to design for those properties quickly and efficiently with a high degree of confidence. That's known as inverse design,” said ORNL’s Victor Fung. It seems to have worked — but you can check for yourself by running the code on Github.  Image Credits: ETHZ Concerned with physical predictions on an entirely different scale, this ETHZ project estimates the heights of tree canopies around the globe using data from ESA’s Copernicus Sentinel-2 satellites (for optical imagery) and NASA’s GEDI (orbital laser ranging). Combining the two in a convolutional neural network results in an accurate global map of tree heights up to 55 meters tall. Being able to do this kind of regular survey of biomass at a global scale is important for climate monitoring, as NASA’s Ralph Dubayah explains: “We simply do not know how tall trees are globally. We need good global maps of where trees are. Because whenever we cut down trees, we release carbon into the atmosphere, and we don't know how much carbon we are releasing.” You can easily browse the data in map form here. Also pertaining to landscapes is this DARPA project all about creating extremely large-scale simulated environments for virtual autonomous vehicles to traverse. They awarded the contract to Intel, though they might have saved some money by contacting the makers of the game Snowrunner, which basically does what DARPA wants for $30.  Image Credits: Intel The goal of RACER-Sim is to develop off-road AVs that already know what it’s like to rumble over a rocky desert and other harsh terrain. The 4-year program will focus first on creating the environments, building models in the simulator, then later on transferring the skills to physical robotic systems. In the domain of AI pharmaceuticals, which has about 500 different companies right now, MIT has a sane approach in a model that only suggests molecules that can actually be made. “Models often suggest new molecular structures that are difficult or impossible to produce in a laboratory. If a chemist can't actually make the molecule, its disease-fighting properties can't be tested.”  Looks cool, but can you make it without powdered unicorn horn? The MIT model “guarantees that molecules are composed of materials that can be purchased and that the chemical reactions that occur between those materials follow the laws of chemistry.” It kind of sounds like what Molecule.one does, but integrated into the discovery process. It certainly would be nice to know that the miracle drug your AI is proposing doesn’t require any fairy dust or other exotic matter. Another bit of work from MIT, the University of Washington, and others is about teaching robots to interact with everyday objects — something we all hope becomes commonplace in the next couple decades, since some of us don’t have dishwashers. The problem is that it’s very difficult to tell exactly how people interact with objects, since we can’t relay our data in high fidelity to train a model with. So there’s lots of data annotation and manual labeling involved. The new technique focuses on observing and inferring 3D geometry very closely so that it only takes a few examples of a person grasping an object for the system to learn how to do it itself. Normally it might take hundreds of examples or thousands of repetitions in a simulator, but this one needed just 10 human demonstrations per object in order to effectively manipulate that object.  Image Credits: MIT It achieved an 85 percent success rate with this minimal training, way better than the baseline model. It’s currently limited to a handful of categories but the researchers hope it can be generalized. Last up this week is some promising work from Deepmind on a multimodal “visual language model” that combines visual knowledge with linguistic knowledge so that ideas like “three cats sitting on a fence” have a sort of crossover representation between grammar and imagery. That’s the way our own minds work, after all. Flamingo, their new “general purpose” model, can do visual identification but also engage in dialogue, not because it’s two models in one but because it marries language and visual understanding together. As we’ve seen from other research organizations, this kind of multimodal approach produces good results but is still highly experimental and computationally intense. |

| Affirm’s CTO talks transparency and the tech that makes BNPL possible Posted: 30 Apr 2022 06:30 AM PDT BNPL is not a new concept; it's just taken off in recent years and become far more mainstream. Buy now, pay later lets people do exactly what its name suggests — buy something and pay for it later. The difference between BNPL and credit cards is that rather than charge the full amount of a purchase on a card, consumers can choose to pay for an item in installments. However, there are some that argue BNPL is just another form of debt, which could lead to a discussion on whether companies that enable it are doing it responsibly. In the case of Affirm, one of the space's largest players, co-founder Max Levchin (who also founded PayPal) has been vocal about what he describes as a "mission-based" approach. Ukraine-born Levchin started Affirm in January 2012. The fintech went public in 2021, and while it's trading considerably lower than its 52-week-high (which stock isn't?), Affirm is today valued at nearly $9 billion, and its executives remain bullish on the company's future. TechCrunch sat down with Libor Michalek, president of technology at Affirm, to understand just how the company differentiates itself from its plethora of competitors, what is unique about its technology and strategy, and why he thinks using BNPL is much better than using a credit card to pay for purchases. (Editor’s note: This interview has been edited for length and clarity.) TC: I grew up in the era of layaways, where you could pay in installments for an item but had to wait to take it home. So when I heard about BNPL, I was intrigued. In your view, what makes Affirm stand out?

We have this notion of a vertically integrated stack where we are able to handle the full touchpoint — that really gives us a lot of visibility into the customer, in the transaction, and that lets us underwrite accurately. Libor Michalek: Our main focus is doing right by the customer. And that really translates into this idea of aligning our interests with that of the customer. So if they get the unexpected or unwanted, then we share in the negative outcomes. The second pillar for us is building modern technology that enables us to do this. How do you deliver a financial product with no late fees, with no gimmicks and no deferred interest tricks? It’s really the ability to have access to real-time data, deliver it on the phone and do it at e-commerce sites in real time, and then bringing all that together to make real-time decisions and deliver those decisions clearly to the customer. Another advantage we have is the scale of our merchant network. We work with 170,000 merchants, which enhances our ability to provide access to à la carte credit wherever the customer might want it and need it. I recently learned that Affirm (and other BNPL players) do charge interest at times, but often at a lower rate than traditional credit card providers. Tell us more about how those decisions are made — how do you decide who is charged interest, and who isn't? For us, the most important and biggest difference is that unlike a credit card, the customer knows how much interest in dollars they’re going to pay for that purchase. There’s no way for them to pay more for that purchase, and they will know it upfront before they click. We’ll communicate it to them obviously, as an interest rate as we’re legally required to, but also in dollars and cents. A lot of times people get surprised when I tell them that a $1,000 purchase at 15% for a year actually translates to $83 because of the amortization schedules. A calculator on our website lets you play with all of those numbers. I think the transparency part is pretty key, because I feel like with credit cards, you do run that risk of — depending on how long it takes you to pay or what your minimum payments are — how much you pay in interest potentially ranging wildly. With us, it's a fixed amount that's communicated to the customer upfront. And even if they miss a payment, there are no late fees and nothing gets tacked on in any way that would ever result in a different outcome. In fact, if they pay early, the number can be lower, but it won’t ever exceed the figure we give them. How many people are usually able to use BNPL through Affirm without being charged interest? |

| India seizes $725 million assets from Xiaomi unit over illegal remittances Posted: 30 Apr 2022 05:38 AM PDT India’s anti-money laundering agency said on Saturday it has seized assets worth about $725 million from Xiaomi India for breaching the country’s foreign exchange laws in a major blow to the Chinese phone maker that commands the Indian smartphone market. The Indian Enforcement Directorate said it had seized bank accounts of Xiaomi India after finding that the company had remitted $725 million to three foreign-based entities “in the guise of royalty” payments. “Such huge amounts in the name of royalties were remitted on the instructions of their Chinese parent group entities,” it said. The amount remitted to “other two US-based unrelated entities” were also for the “ultimate benefit of the Xiaomi group entities,” the agency added. Xiaomi India former head, Manu Jain, was summoned by the directorate earlier this year for questioning over tax related compliances and company structure. The directorate, which has been investigating Xiaomi as well as several other Chinese firms since December, said Xiaomi has “provided misleading information to the banks while remitting the money abroad.” Xiaomi said in a statement today that it believes its royalties payments are legit as they were made for the “in-licensed technologies and IPs used in our India version products.” The company, which refreshed its smartphone, smart TV and tablet lineups with new models in India earlier this week, commanded 23% of the local smartphone market share in the quarter that ended in March this year, according to market research firm Counterpoint. The company has taken a hit in its popularity in recent years following India’s ban on Chinese apps over national security concerns. For optics measures, Xiaomi rebranded several of its shops in India two years ago with “Made in India” banners in a move that analysts said was the company’s attempt to distance itself from its Chinese parent firm. |

| If the earliest investors keep going earlier, what will happen? Posted: 30 Apr 2022 04:00 AM PDT There's a clash happening in the early-stage market. In one world, late-stage investors are reacting to tech stonk corrections by clamoring toward the early-stage investment world, forcing seed investors to go even earlier to defend ownership and potential returns. This trend was underscored by firms like Andreessen Horowitz launching a pre-seed program months after launching a $400 million seed fund. Even more, Techstars, an accelerator literally launched to help startups get off the ground, debuted a fund to back companies that are too early for its traditional programming. While all that is going on, early-stage investors are enduring a valuation correction and portfolio markdowns. Some are admitting that they're telling portfolio companies to refocus on cash conservation, profitability and discipline, not just growth. Let's pretend these two vastly different worlds are in the same universe: Early-stage investors are getting more disciplined and cash rich, but at the same time, the earliest investors are going earlier. Investors are pushing founders to be lean but also green, but at the same time, offering them $10,000 to take PTO for a week and try their hand at entrepreneurship. Growth, gross margin and burn are the new top priorities for CEOs, but at the same time, venture capitalists are clamoring to offer more funds, earlier, in newly invented subcategories of early-stage investment. The tension between these two worlds looks different depending on if you're a Stanford founder starting a SaaS company, or if you're a bootstrapped, first-time entrepreneur trying to disrupt agtech. Regardless, the growing spotlight, and discipline, on the early stage just makes me wonder one broad thing: What's left for early-stage investors to focus on? |

| USV quietly announces $625M in fresh funding for ‘both Web2 and Web3’ teams Posted: 29 Apr 2022 05:23 PM PDT Union Square Ventures (USV), the 19-year-old, New York-based venture firm, has raised $275 million for its eighth early-stage fund and $350 million for its fourth opportunity fund, the firm announced in a blog post yesterday. In sharing news of the two new vehicles, firm partner Andy Weissman and the firm’s general counsel, Samson Mesele, wrote that USV plans to “invest our new funds around the same thesis as our previous funds: we are looking for opportunities in the market that align with our Thesis 3.0.” (USV has written previously that this updated thesis centers on “trusted brands that broaden access to knowledge, capital, and well-being by leveraging networks, platforms, and protocols.) Relatedly, USV will continue to invest in “both Web2 and Web3 companies and projects,” the post states. Early last year, when Weissman announced in a similar blog post that USV had raised $250 million for its seventh core fund, he wrote explicitly that as in USV’s “last several funds,” the firm planned to invest roughly 30% of the capital in crypto-related investments and that it intended to hold tokens, and equity, in early-stage blockchain-related projects. One of these newer, related bets is Polygon, a platform for Ethereum scaling and infrastructure development. (USV, which waded into crypto ahead of most firms, was also an early investor in Coinbase and owned 8.2% of its Class B shares at the time of its direct offering last year.) Some of USV’s newer bets include Slope, an API developer that enables retailers to offer buy-now-pay-later services; a two-year-old, Egyptian electric mobility startup called Shift EV that aims to convert fuel-run vehicles into EVs using batteries that it designs and manufactures; Alife, a two-year-old, San Francisco-based startup that’s trying to improve the efficacy of IVF procedures through AI; and Gumball, a two-year-old, L.A.-based podcast ad marketplace founded by the podcast company Headgum. USV, which also closed its first climate fund last year with $162 million in capital commitments, has seen its share of exits over the years. Just last month, the three-year-old stock trading platform Public purchased Otis, a startup that allows individual investors to buy fractional ownership in alternative assets, including NFTs and sports memorabilia. Terms of the deal weren't disclosed, though Crunchbase data shows Otis had raised $16.5 million from investors, including from USV and Maveron. In addition to Coinbase, others of USV’s higher-profile bets have included Etsy and Twitter, companies of which USV owned more than 15% and at least 5%, respectively, at the time of their public offerings, per their S-1 filings. Indeed, USV cofounder Fred Wilson remains highly active on Twitter and tweeted earlier this month his belief that Twitter is “too important to be owned and controlled by a single person. The opposite should be happening. Twitter should be decentralized as a protocol that powers an ecosystem of communication products and services.” After Elon Musk’s bid to buy the company was accepted by its board early this week, Wilson softened his stance slightly in his newsletter, writing, “I continue to believe that a single person owning one of the most important communications protocols of the internet is a bad idea, but maybe it can be a bridge to something better." On SEC filings for the new funds, Wilson, Weissman, are listed as managing members, along with longtime managing director Albert Wenger, general partners Rebecca Kaden and Nick Grossman and both Mesele (who joined the outfit last year) and USV’s longtime finance manager, Kerri Rachlin, who has not been included in the firm’s SEC fund registrations previously. (USV says the two have “joined the USV partnership in connection with the 2022 Funds.”) John Buttrick, who joined USV in 2010 and was included in the SEC forms relating to the firm’s seventh flagship fund, is not listed. |

| Daily Crunch: Musk’s Twitter purchase plan calls for new CEO, monetization strategies, job cuts Posted: 29 Apr 2022 03:05 PM PDT To get a roundup of TechCrunch's biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here. Friday, more like Fri-yay! It's April 29, 2022, we're here with the latest headlines, but honestly our brains are mostly focused on all the hardcore fun we're going to have this weekend. Like doing laundry, napping, playing with our pets, reading a book for a while and sleeping in. I know, we're old and boring, deal with it. — Christine and Haje The TechCrunch Top 3

Startups and VCCivilian drone manufacturer DJI and the Ukrainian and Russian governments continue their spat. Most recently, DJI suspends sales in Ukraine and Russia in an apparent attempt to appear more neutral. We were particularly enthralled this morning by Jim Motavalli's feature article about bidirectional charging. In other words: If the power goes out, what does it take to power your house from your car's batteries? Johnny’s in the basement, mixin’ up the medicine, I'm on the pavement, reading news with wonderment:

Charged with billions in capital, meet the 9 startups developing tomorrow's batteries todayIn his first TechCrunch+ article, Senior Climate Writer Tim De Chant examined nine startups optimizing EV battery technology that have collectively raised just over $4 billion in the last 18 months. Improving tech like solid-state batteries, replacing specific chemical components and using hybrid chemistries are just a few of the techniques startups are deploying to unlock benefits like reducing weight while increasing range and safety. “But cars and trucks won't be the only thing touched by the battery revolution that'll occur over the next few years,” he writes. “Like many advances, better, lighter and longer-lasting batteries will drive changes in our lives that are both unexpected and welcome.” (TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.) Big Tech Inc.We're going on a bit of a roller coaster ride in terms of good news versus not, so keep your hands and legs inside the newsletter, and you'll be good.

|

| Jack Dorsey says he’s against permanent Twitter bans, with an asterisk Posted: 29 Apr 2022 03:00 PM PDT On Friday afternoon, former Twitter chief executive Jack Dorsey turned to the platform that he co-created to speak about its future, days after the company was bought for $44 billion by Elon Musk. In the vague thread, Dorsey said he doesn't believe in permanent bans, with the exception of illegal activity. "As I've said before, I don't believe any permanent ban (with the exception of illegal activity) is right, or should be possible. This is why we need a protocol that's resilient to the layers above," said Dorsey, who stepped down from his role at Twitter in November 2021 and currently works as the Block Head of Block. While Dorsey's thread didn't name names, there's a possibility that he's referring to some of Twitter's most controversial moments that have resurfaced amid Musk's purchase of Twitter — including the platform's choice to ban former President Donald J. Trump from the platform and the temporary ban of The New York Post after it published an article related to U.S. President Joe Biden's son Hunter's laptop. The social media giant’s chief legal officer Vijaya Gadde has recently been under attack online from trolls after Musk posted a meme about her. This storm in mind, Dorsey's words today shed a very soft, dim light on his stance about whether controversial figures, even those who spread misinformation, should be allowed on the platform. "Some things can be fixed immediately, and others require rethinking and reimplementing the entire system. It is important to me that we get critical feedback in all of its forms, but also important that we get the space and time to address it. All of that should be done publicly," Dorsey said in the same Twitter thread. Earlier this week, Dorsey said that "Elon is the singular solution I trust…I trust his mission to extend the light of consciousness." But, there's a tension there: If Dorsey believes in Musk, but Musk tweets memes at the cost of Twitter's executive team, is Twitter really on the trajectory to get more transparent? As Dorsey said, the company needs "space and time to address" some of its most critical feedback. Morale plays a role in the rebuilding. "What matters is how the service works and acts, and how quickly it learns and improves," Dorsey said in today's tweet storm. "My biggest failing was that quickness part. I'm confident that part at least is being addressed, and will be fixed." |